Awe-Inspiring Examples Of Tips About Trial Balance Order Of Accounts Ongc Debt Equity Ratio

The reason or logic behind the above rule is to.

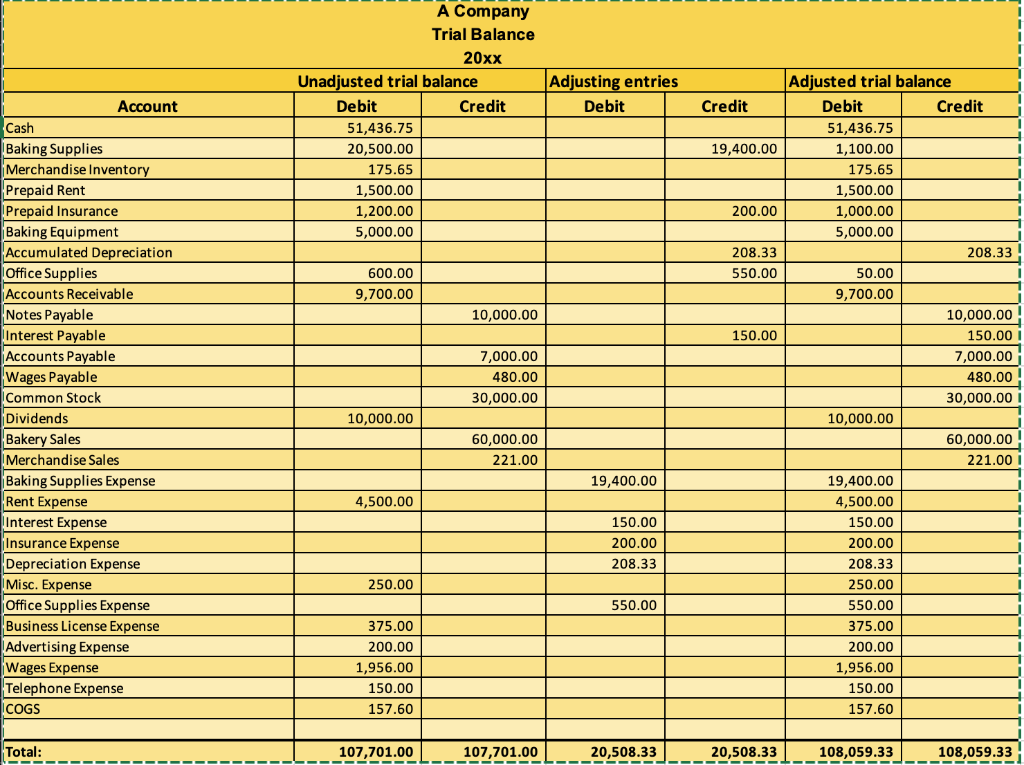

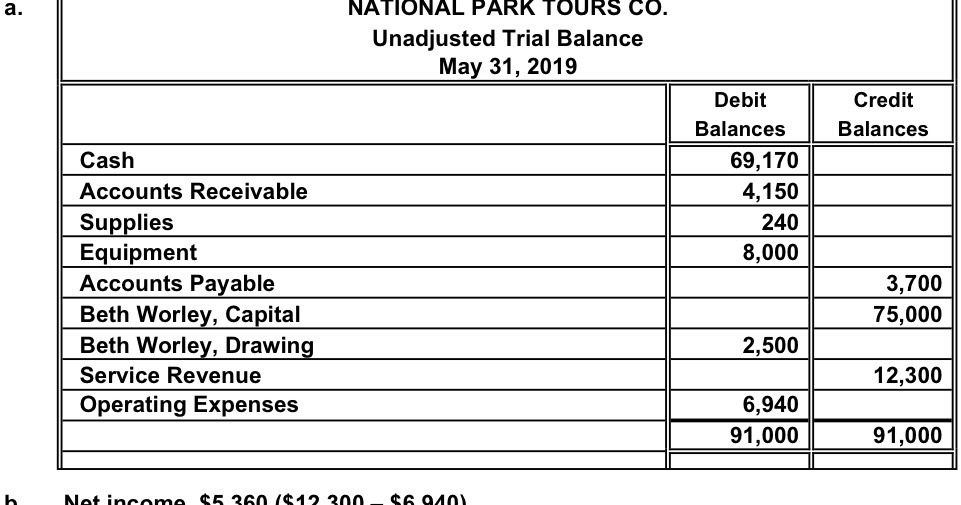

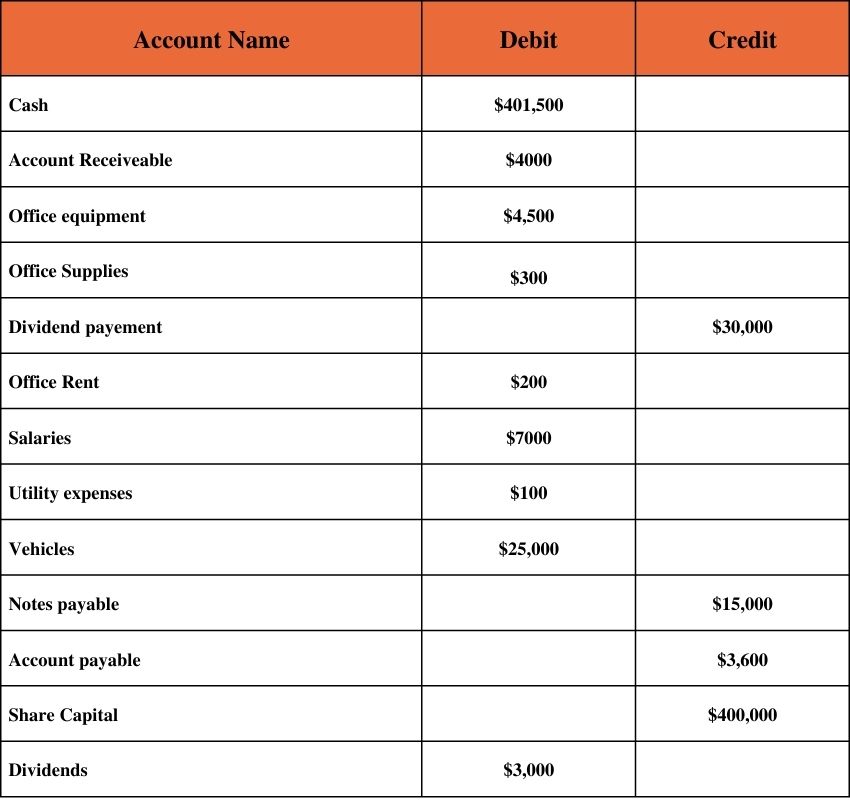

Trial balance order of accounts. Steps for preparing a trial balance list. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. From this information, the company will begin constructing each of.

Liabilities & incomes shall have a credit balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances. An overview of the balances in each account.

The result is a report that shows the total debit or credit balance for each. For instance, sometimes a company numbers its accounts in sequence starting with 1, 2, and so on. The trial balance is the next step in the accounting cycle.

The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. A trial balance is a listing of all accounts (in this order:

The role of a trial balance in accounting is to help accountants detect some errors when total debits don’t equal total. Trial balance is a useful accounting tool for the accounting process of listing ledger accounts along with their respective credit or debit accounts. Assets & expenses shall have a debit balance.

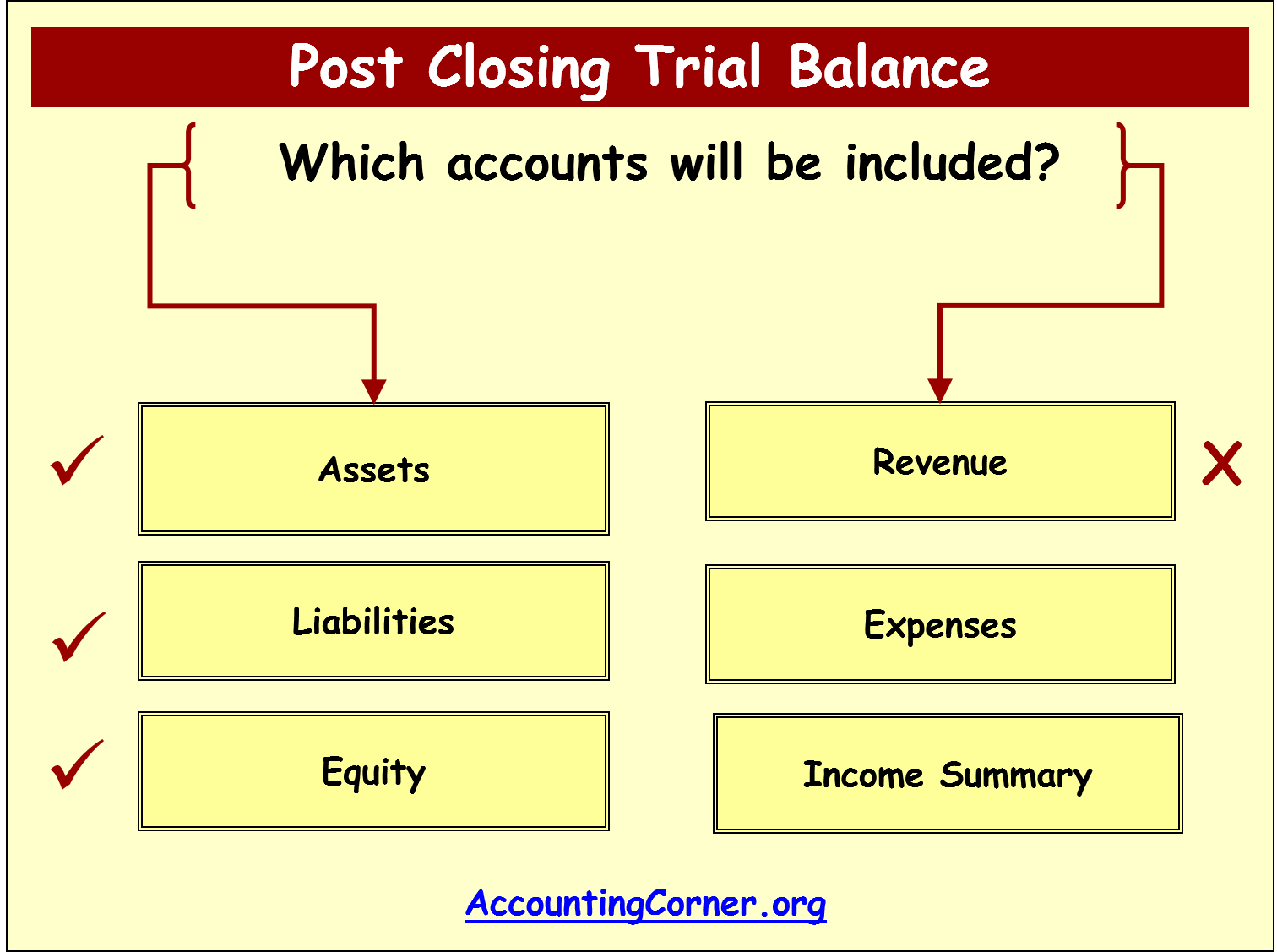

If the trial balance is unbalanced, mistakes may be present and must be considered and fixed. The purpose of doing this. A trial balance is a summarization of all journal entries made, aggregated by account.

It is the first step in the end of the accounting period process. To prepare the financial statements, a company will look at the adjusted trial balance for account information. It is called a trial balance because the.

Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements. Bookkeepers and accountants use this. Its purpose is to test the equality between total debits and total credits.

Asset, liability, equity, revenue, expense) with the ending account balance. What’s the role of a trial balance in accounting? Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

It is used to identify debits and credits entries, make adjusting. On the trial balance the accounts. The important idea is that companies use some numbering system.