Nice Tips About Prepare Consolidated Balance Sheet Bechtel Financial Statements 2019

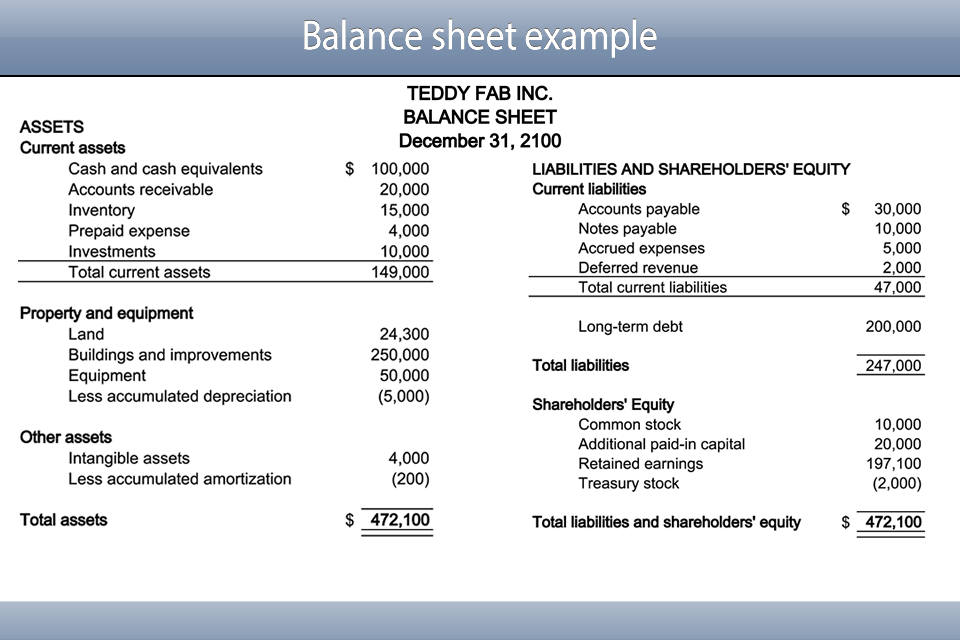

The two sides must always be equal.

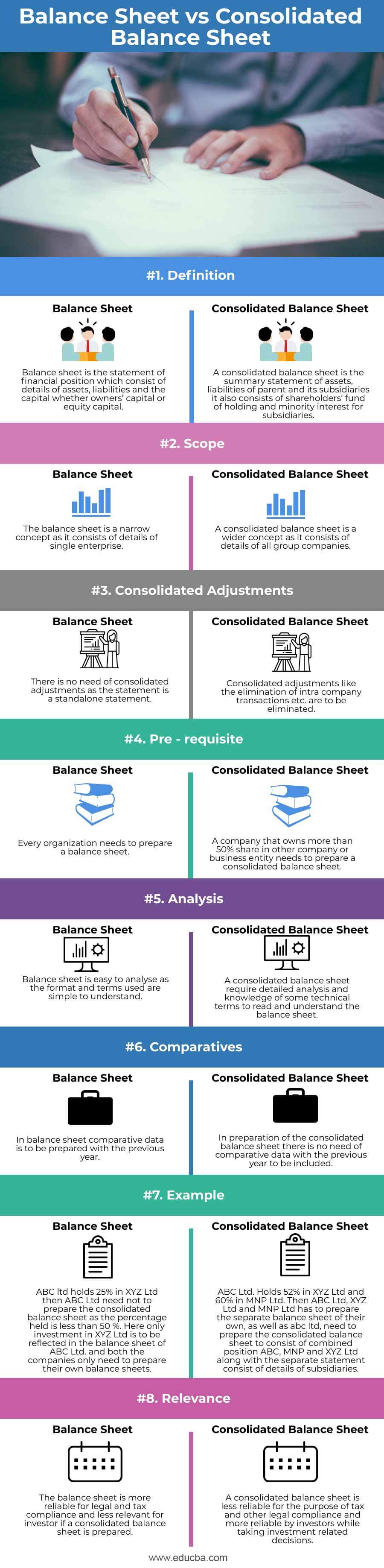

Prepare consolidated balance sheet. Based on provisional unaudited data. What is balance sheet, how to prepare balance sheet, components of balance sheet, format of balance sheet, common size balance sheet. A consolidated balance sheet allows any interested party to glance over the entire organisation's financial situation quickly.

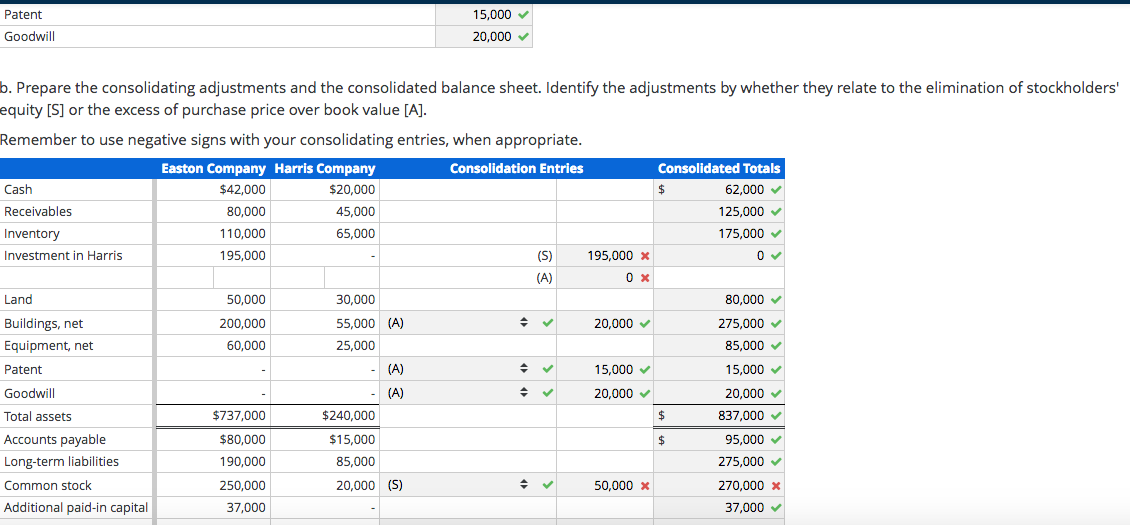

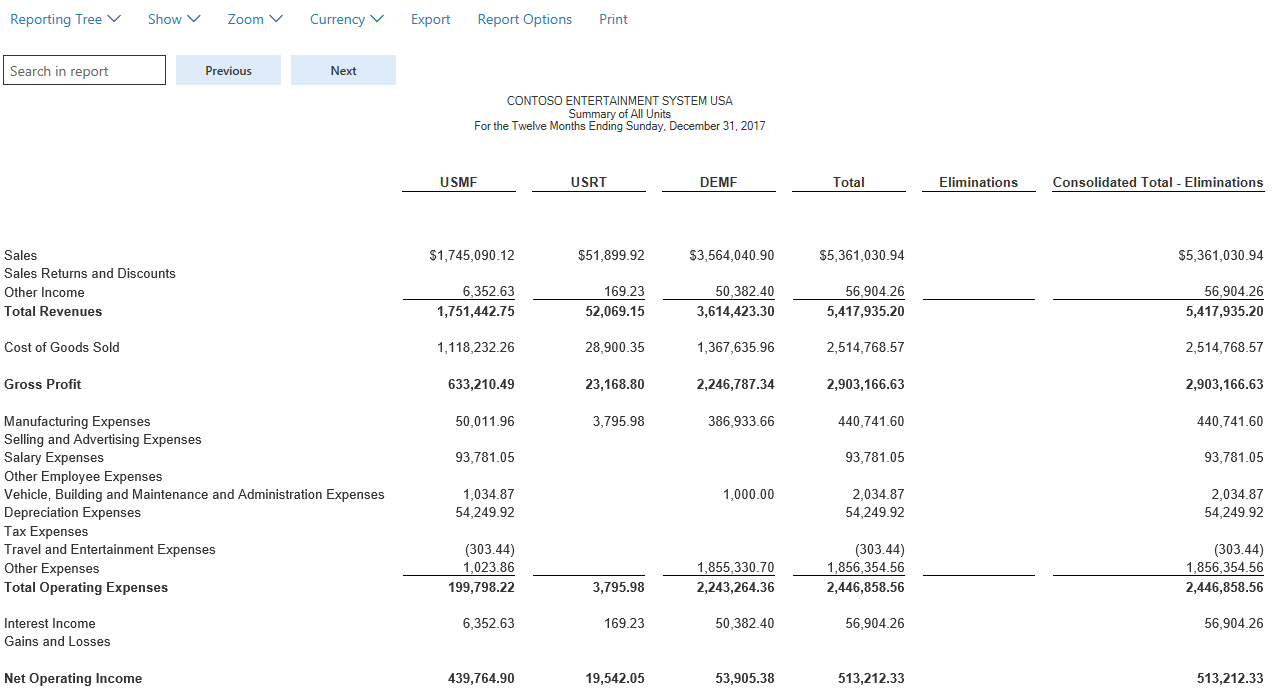

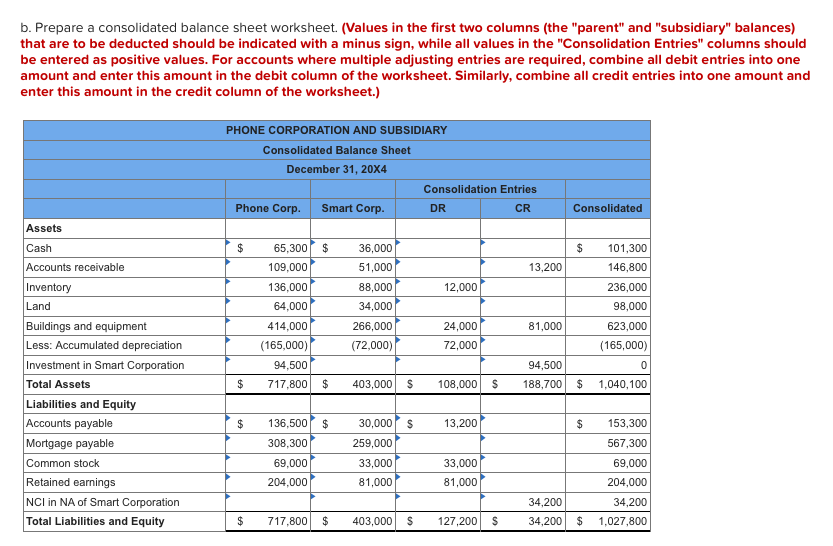

The terms ‘group’, ‘parent’, and ‘subsidiary’ are used in this context to refer to the. Consolidation worksheet is a tool used to prepare consolidated financial statements of a parent and its subsidiaries. These reports consist of consolidated income statements, consolidated balance sheets, and consolidated cash flow statements.

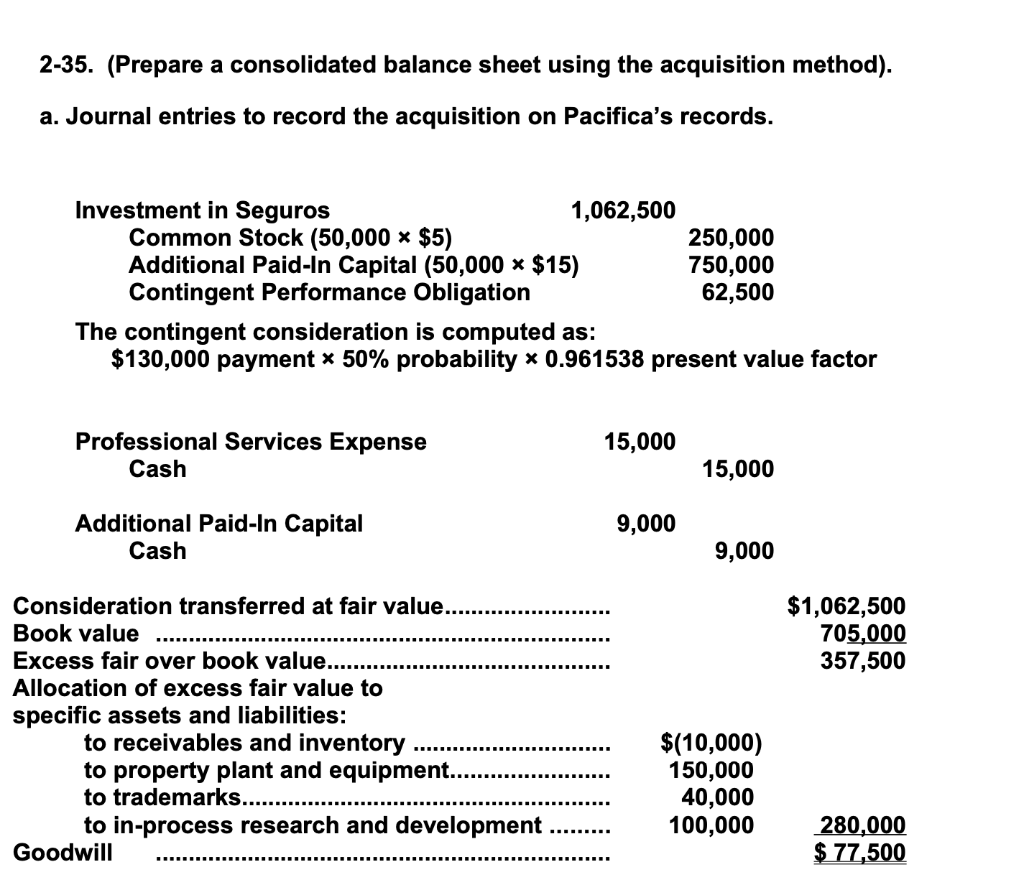

The presentation of a consolidated group may require certain adjustments for transactions occurring between the reporting entity and its subsidiaries. For an organization to be considered the parent company of another, it must hold at least 51% of the latter's total shares or have control over the composition of. Consolidate financial statements by creating a balance sheet that reflects a sum of net worth, assets and liabilities.

A consolidated balance sheet presents the financial position of an affiliated group of companies. A consolidation model is constructed by combining the financial results of multiple business units into one single model. It is vital to track expenditures and profits separately as if each subsidiary were its own business.

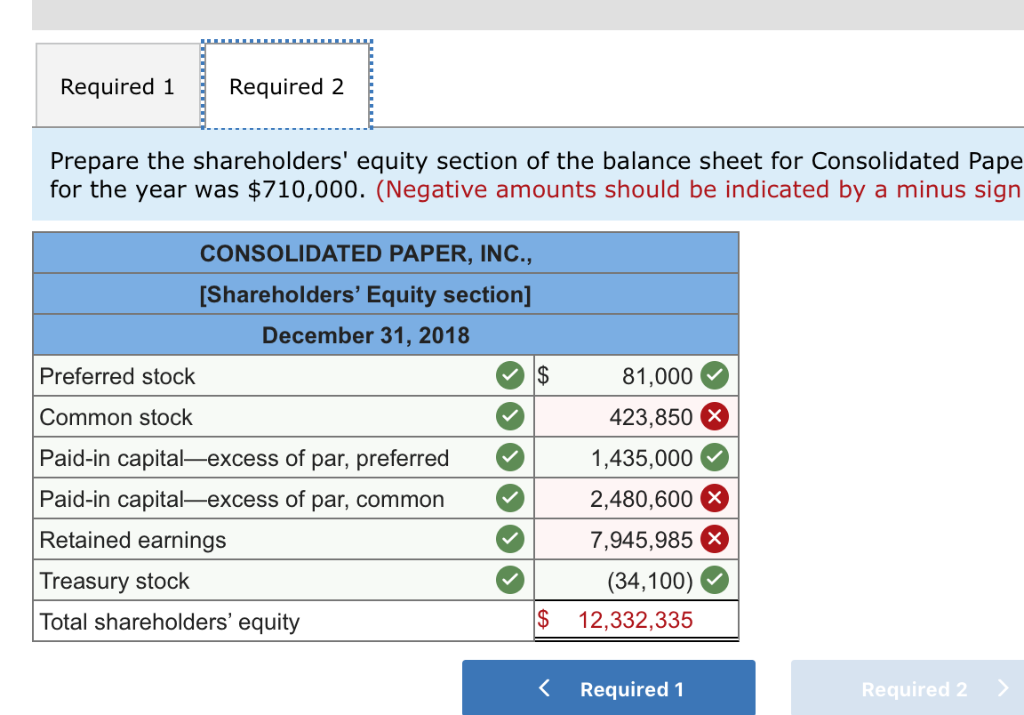

Create a consolidated balance sheet. The consolidated balance sheet includes the assets, liabilities, and equity of the parent. Consolidated balance sheets are a quick and easy way to examine the financial situation of an entire group of companies and are usually prepared at the end of the financial year.

Assets = liabilities + shareholders’ equity the equation above includes three broad buckets, or categories, of value which must be accounted for: It is in the way both are prepared. Balance sheet data use the period end conversion rate and income statement data use the average exchange rate during the financial period.

A business combination takes the form of either a statutory merger or a statutory. In the consolidation process, while adding accounts and activities together, go through any accounts that give hints to intercompany transactions since these need to be eliminated to avoid double accounting. How to prepare a consolidated balance sheet by danielle smyth published on 11 jun 2018 if you run a business that has both a parent company and subsidiaries, you understand how complicated the financials can become.

Consolidated financial statements are often referred to as ‘group accounts’. This brief article looks at how to prepare a consolidated statement of financial position. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee.

This is done by simply adding together the separate values from the balance sheets of the parent company and the subsidiaries. Format and example of a consolidated balance sheet. Rather, companies with shares in other companies (subsidiaries) prepare a consolidated balance sheet.

Requirement to prepare section 399(2) of the companies act 2006 states that if, at the end of the year, a company is a parent company, the directors must prepare group accounts for the year as well as individual accounts unless the company is exempt from the requirement. The result is a balance sheet that shows the assets, liabilities, and equity of. How do businesses prepare a consolidated balance sheet?