Stunning Tips About Income Statement Of Sole Proprietorship The Summary Account Is Used To

The easiest and cheapest way to start a business.

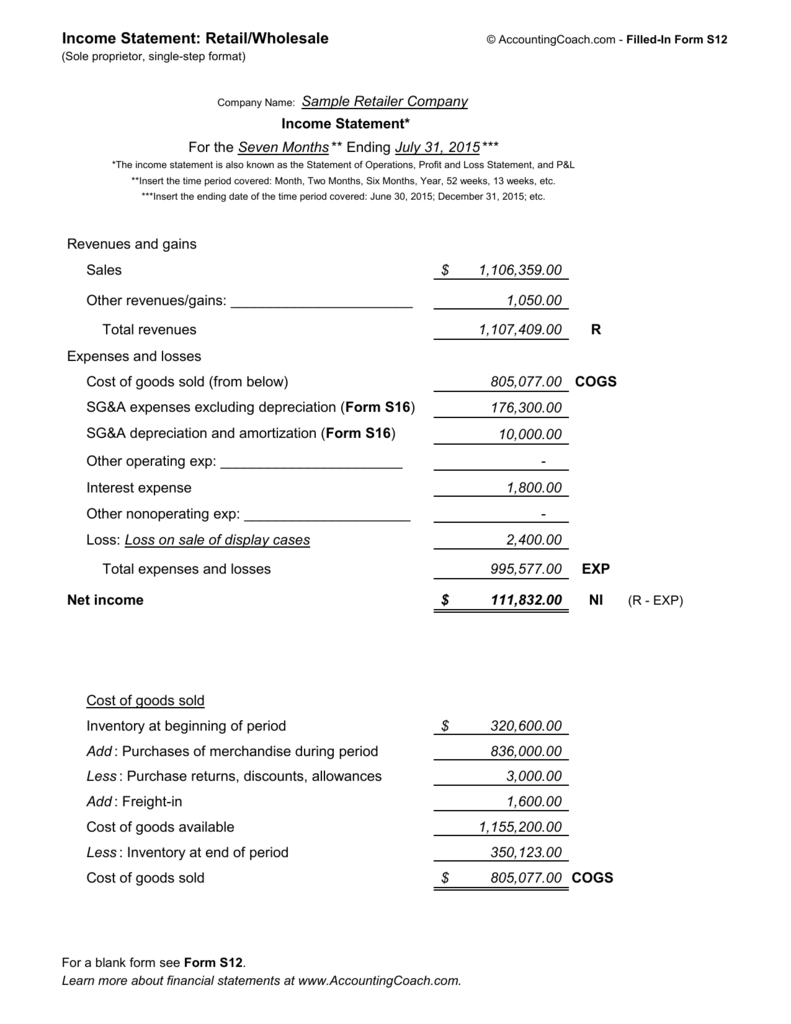

Income statement of sole proprietorship. Compared to other business forms, there is very little paperwork a. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. The most common expenses are preprinted to save you time.

Let’s prepare the income statement so we can inform how cheesy chuck’s performed for the month of june (remember, an income statement is for a period of time). All amounts are assumed and simplified for illustration purposes. A statement of owner's equity (soe) shows the owner's capital at the start of the period, the changes that affect capital, and the resulting capital at the end of the period.

One difference is that the income statement of a proprietorship does not include income taxes expense (since its profits are included in. The statement of owner’s equity, which is the second financial statement created by accountants, is a statement that shows how the equity (or value) of the organization has changed over time. Choices—sole proprietorship, partnership, or corporation.

Our unique financial statement format for sole proprietorships in excel consists of automated reports including an income statement, balance sheet, cash flow statement, statement of changes in equity and the notes to the financial statements. This simple small business income statement template calculates your total revenue and expenses, including advising, equipment, and employee benefits, to determine your net income. In a sole proprietorship, most of the revenue and expenditure sums on your cash flow projection will transfer directly to your personal tax form and provide the basis for your income tax.

There is no separate tax return for the business, since there is no separate business entity. As the owner of a sole proprietorship, you are liable for all of the business’s debts. It is also known as statement of changes in owner's equity.

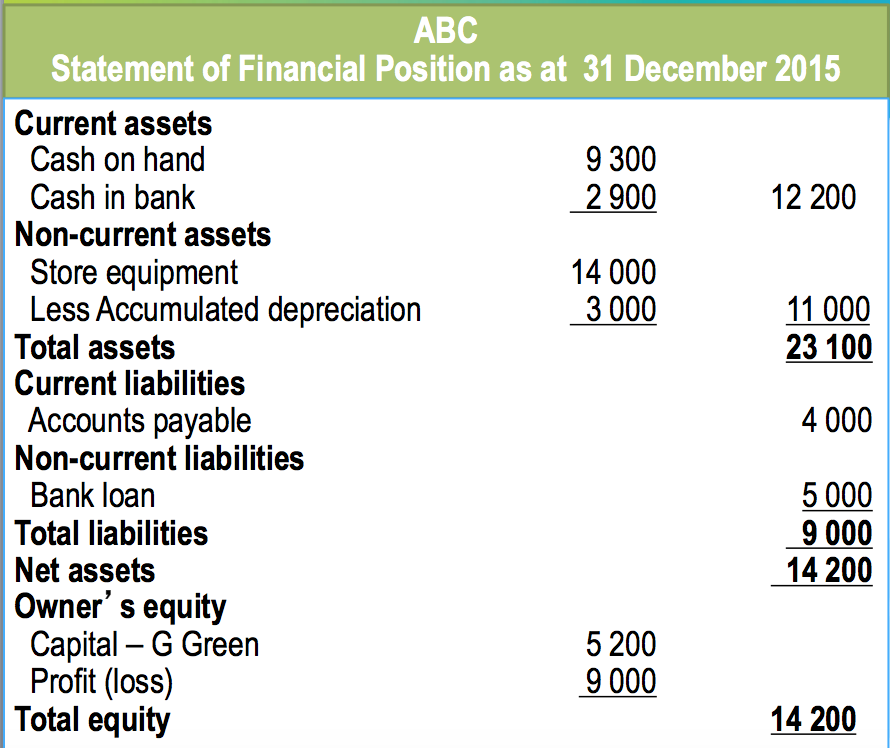

An income statement, also called a profit and loss statement, lists a business’s revenues, expenses and overall profit or loss for a specific period of time. The following are sample balance sheet (statement of financial position), income statement, and statement of changes in owner’s equity for an individual or sole proprietorship business. In this article, we will explore the importance of an income statement for a sole proprietorship and the different methods of producing and presenting them.

A profit and loss statement provides information about how much your company has earned during a specific period such as a month or a year. We've named the company carter printing services. As the sole owner of the business, you’re personally responsible for any liabilities or lawsuits.

The average cost for professional liability insurance for sole proprietors is $61 per month and workers compensation costs an average of $45 per month. And creditors can attempt to acquire your assets if you are unable to meet your liabilities. The statement of financial performance, also known as the income statement or trading account, reports the results of earnings activities for a specific time period, such as a month, quarter.

An income statement reports the following line items: Revenue generated from the sale of goods and services cost of goods sold: The tax reporting for a sole proprietorship flows through the owner's personal tax return, with a separate form used to itemize the major classes of revenues and expenses incurred by the business.

These sample financial statements are actually the ones we have discussed and prepared in our previous accounting discussions. Sole proprietorship you might choose the sole proprietorship form for your outdoor guide service. It’s a summary of what the company owns.