Best Info About Impairment Loss Journal Entry Comprehensive Income And Other

Impairment loss is the amount by which the carrying value of an asset.

Impairment loss journal entry. Download the full reversing impairment losses article for an example of reversing a previously recognised impairment loss for an individual asset and an. London— hsbc bet big on china to fuel its growth, a move that has now come back to bite it. Learn what is impairment loss, how to calculate it, and how to record it in your business.

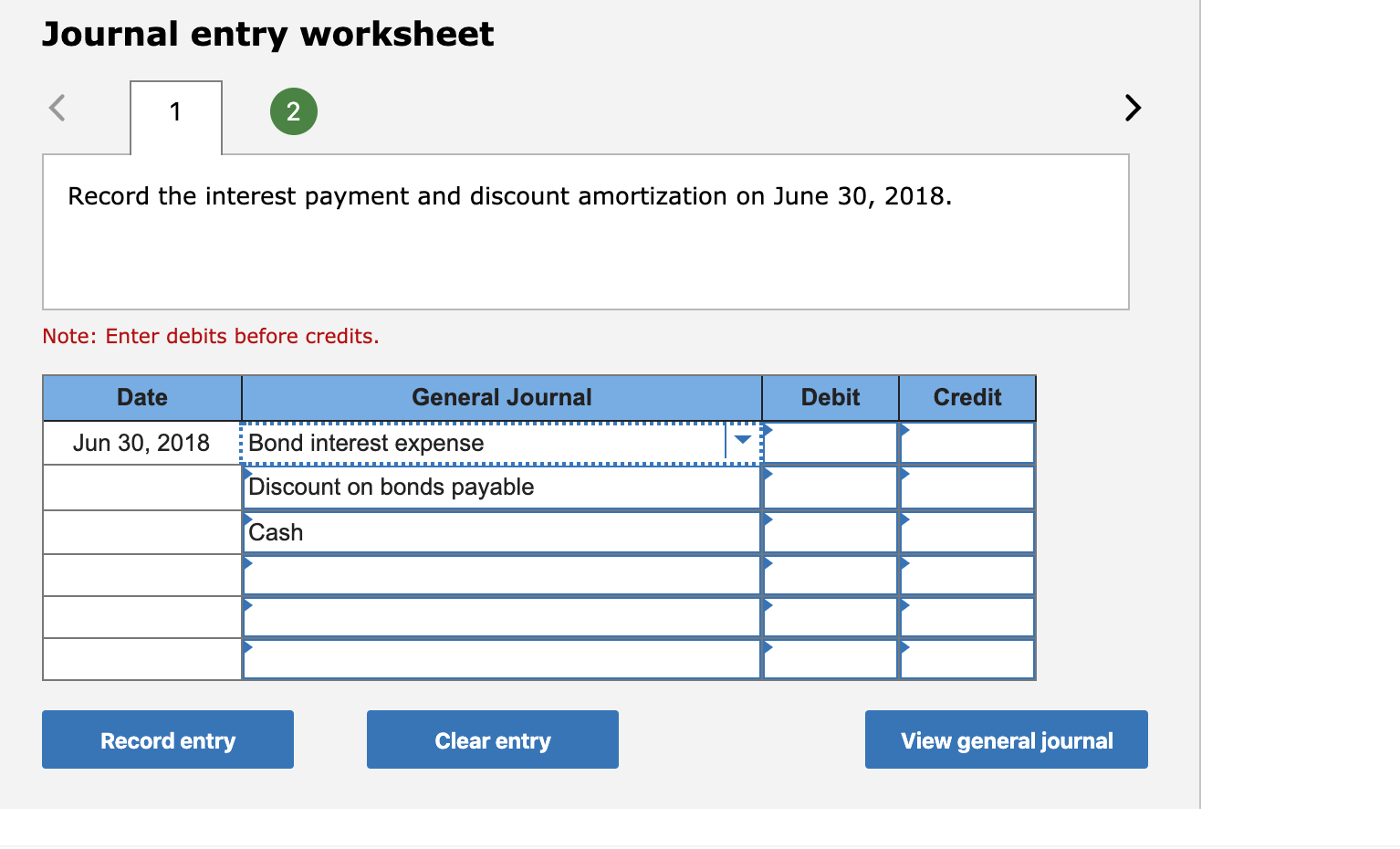

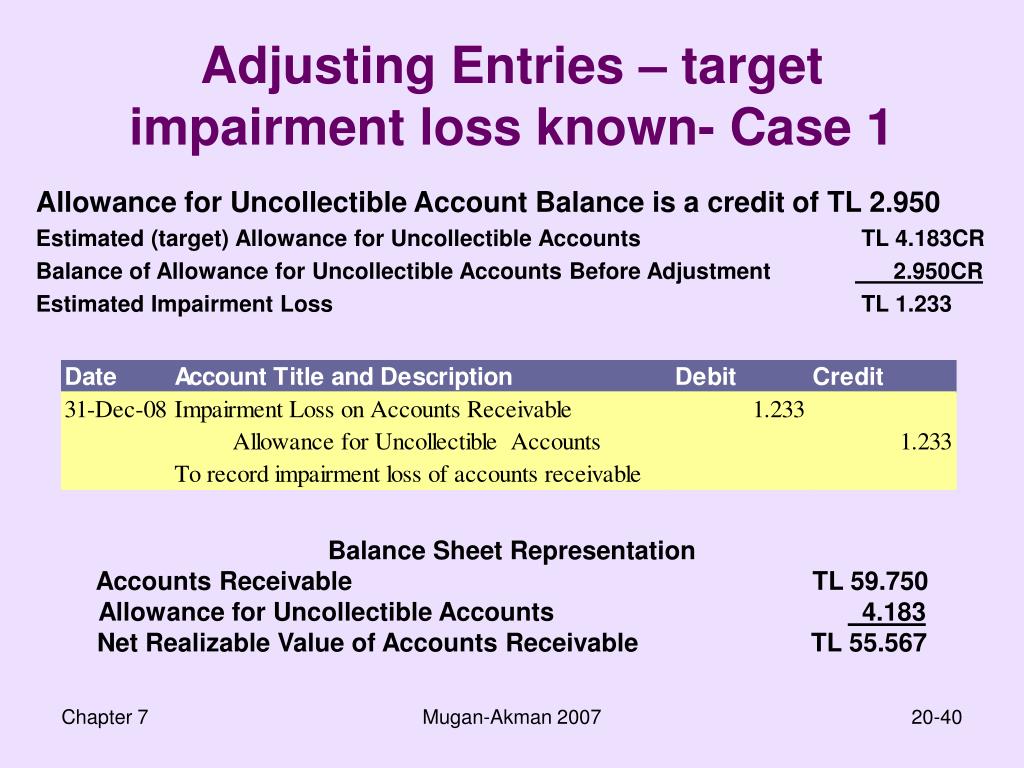

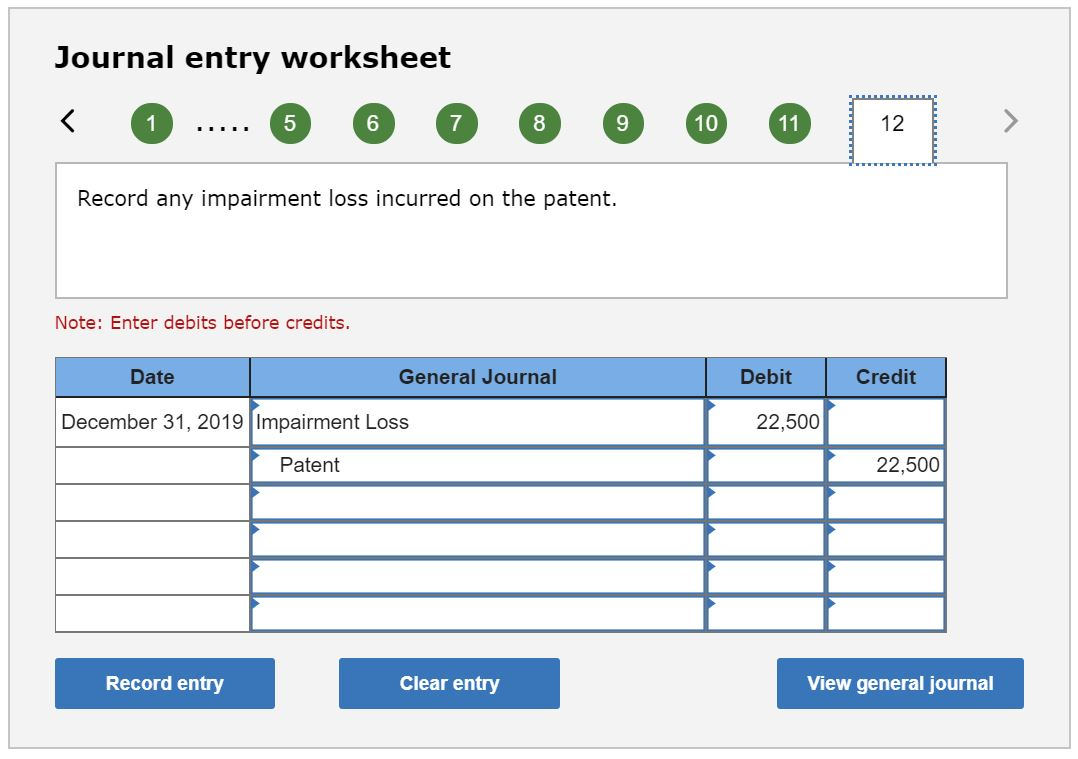

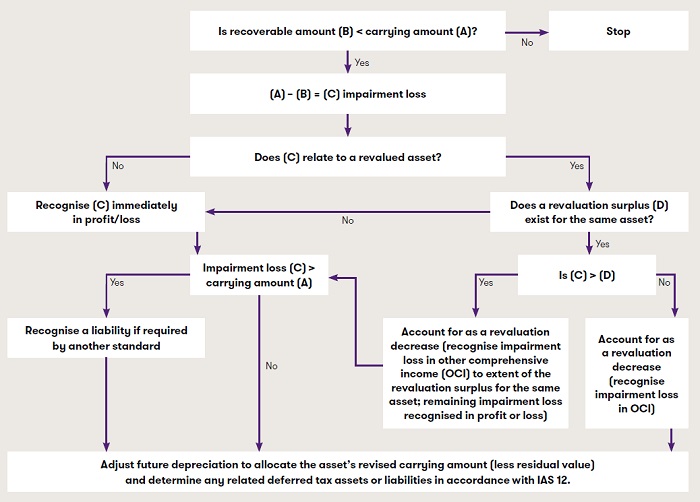

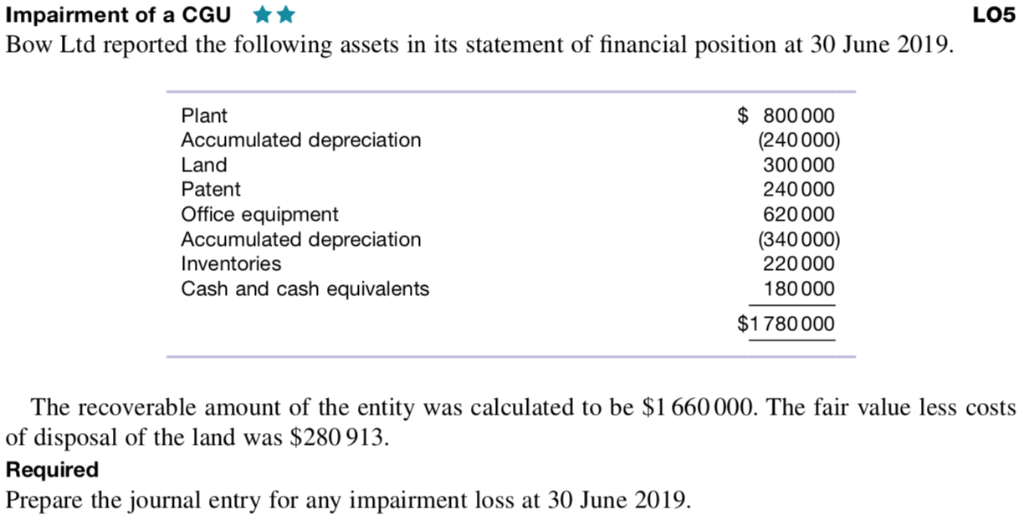

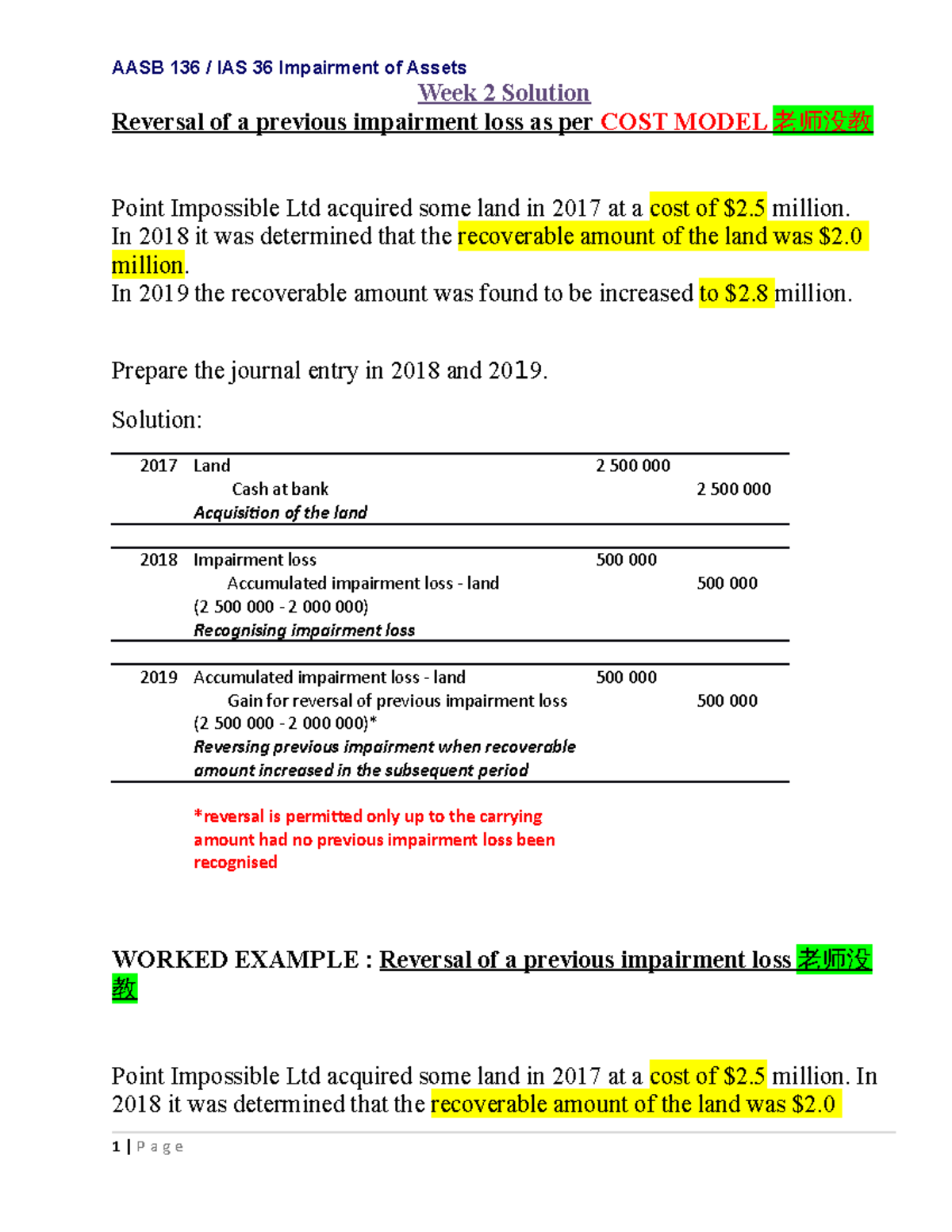

Learn how to record the journal entry for impairment loss, the deduction of assets value when the market value falls below the carrying amount on balance sheet. An impairment loss is recognised immediately in profit or loss (or in comprehensive income if it is a revaluation decrease under ias 16 or ias 38). Journal entry for recording the impairment is the debit to the loss account or the expense account with the corresponding credit to an underlying asset or credit impaired assets.

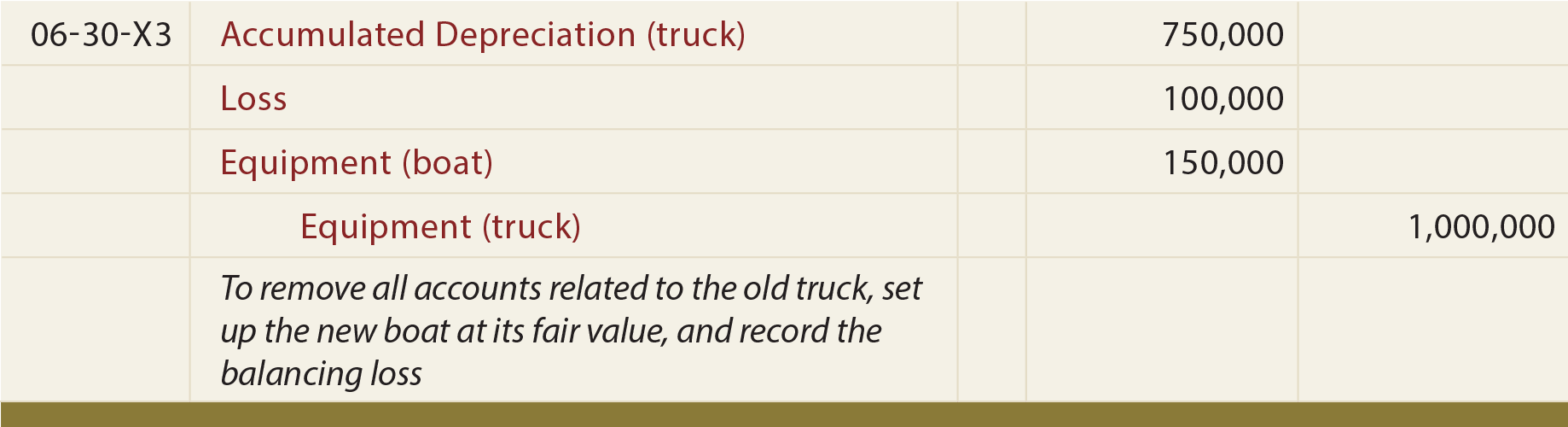

See the journal entry format, the accounts involved, and the. The journal entry to record impairment is straightforward. An impairment loss is recognized through a journal entry that debits loss on impairment, debits the asset's accumulated depreciation and credits the asset to.

An asset’s book value increase due to an. Find out the reasons, steps, and treatment of. The banking giant said it lost $153 million in the final three months.

Find out the steps to write. Ias 36 impairment of assets in april 2001 the international accounting standards board (board) adopted ias 36 impairment of assets, which had originally been issued by the. A contra asset impairment account, which.

Intermediate financial accounting 1 10.3 impairment for a variety of reasons, a ppe asset may sometimes become fully or partially obsolete to the business. As mentioned, the accumulated impairment loss is the contra asset account to reduce the asset’s value. If the value of the.

Recognising an impairment loss for an individual asset when the recoverable amount of an asset is less than its carrying amount, the carrying amount of. A company has a reporting unit. It may be a fixed asset or an intangible asset.

The journal entry to record an impairment is a debit to a loss, or expense, account and a credit to the related asset. Overall, companies can record impairment loss journal entries as follows. Learn how to record the loss of a fixed asset due to impairment in the income statement and the balance sheet.

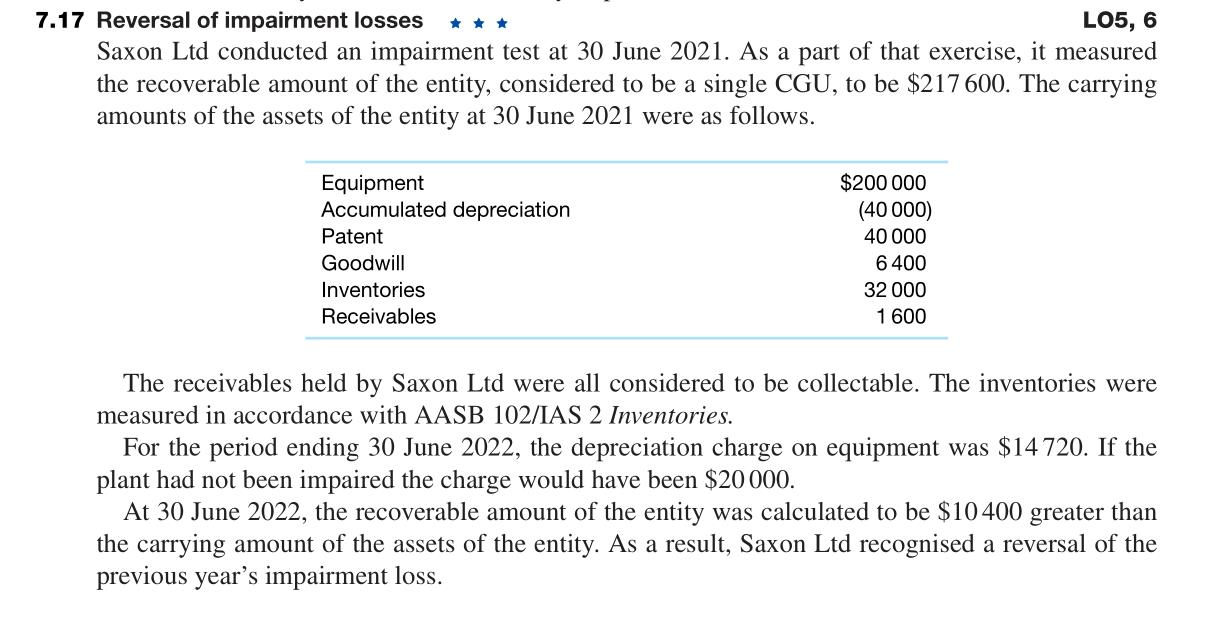

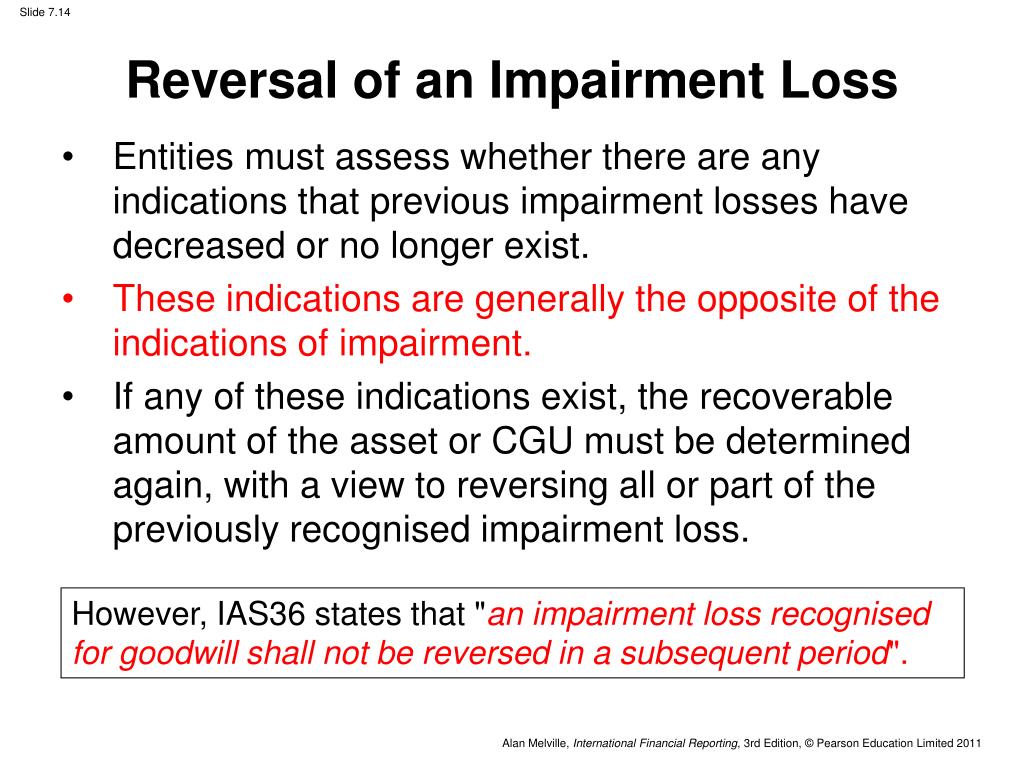

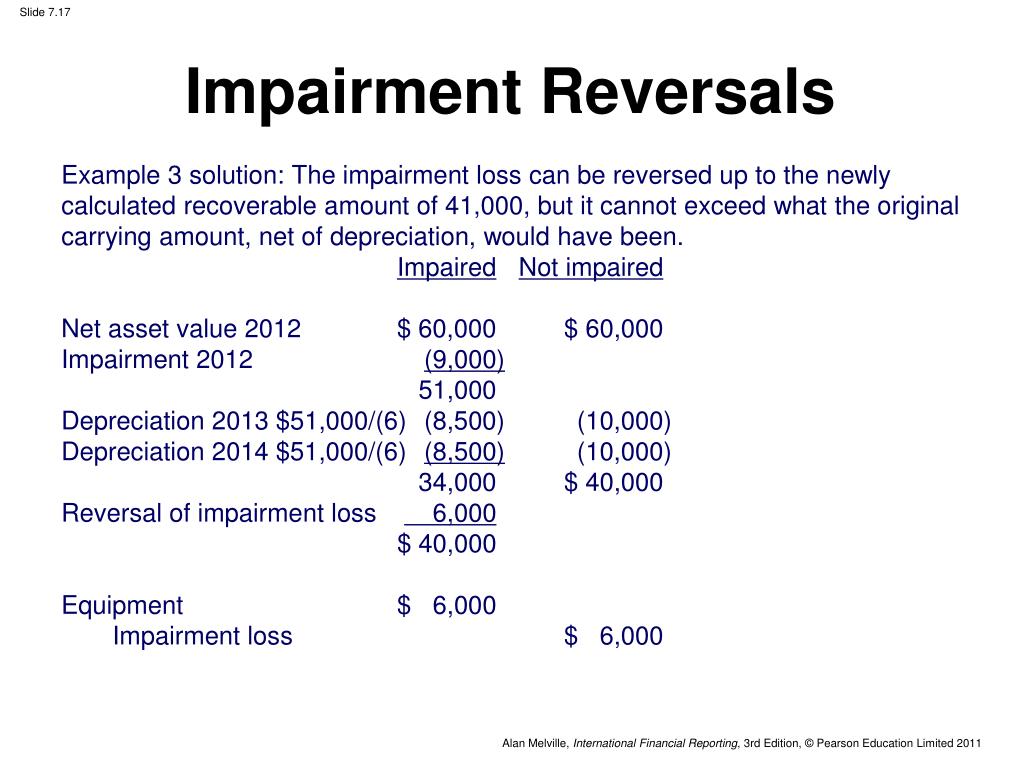

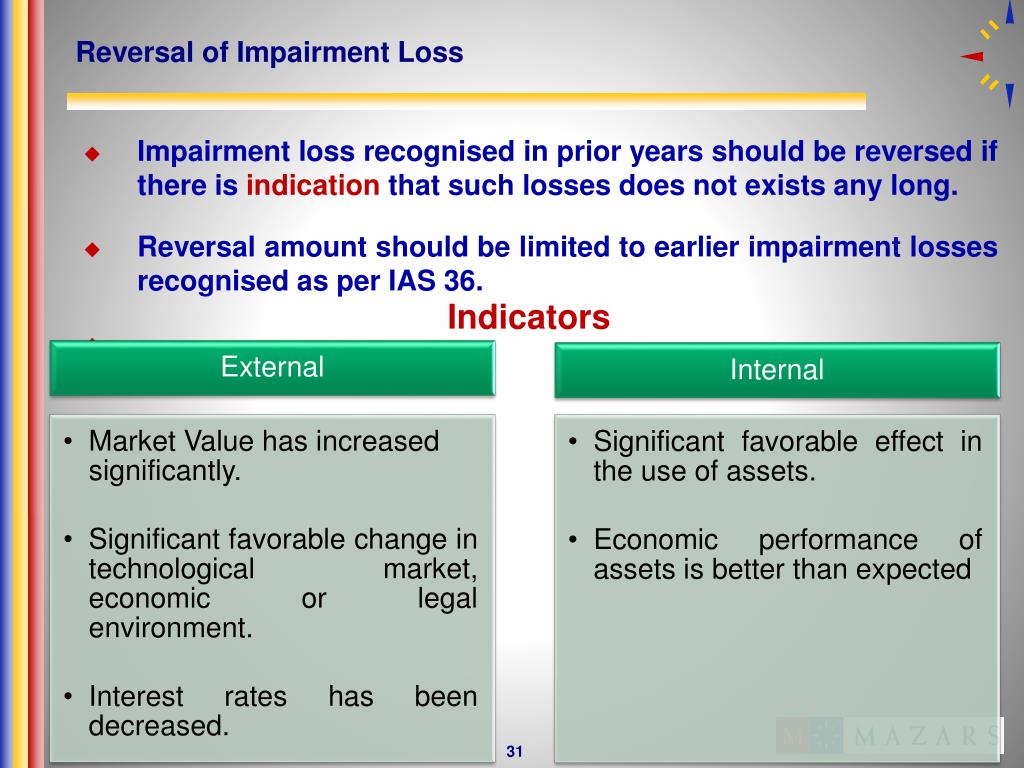

Reversing an impairment loss. Learn how to calculate an impairment loss when the value of a fixed asset drastically falls below its carrying cost or recoverable amount. This account holds all the impairment losses for.

In accounting, impairment is a permanent reduction in the value of a company asset. However, before recording the impairment loss, a company must first determine the recoverable value of the. Learn how to record an impairment loss journal entry when an asset is impaired or has lost its value.