Fun Tips About Different Types Of Balance Sheet What To Include In An Income Statement

There aren't different balance sheets for different business types.

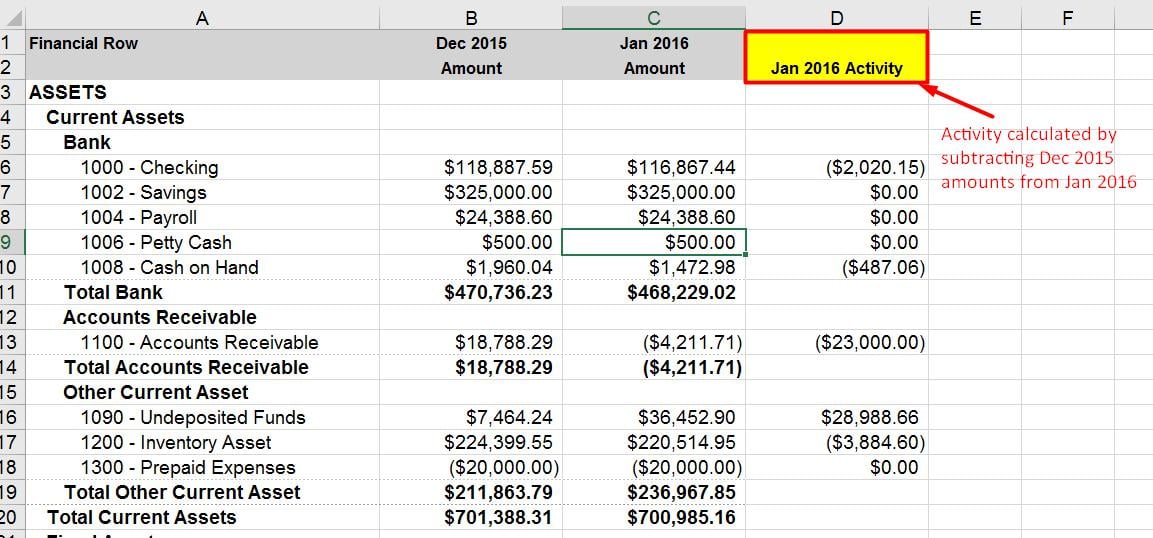

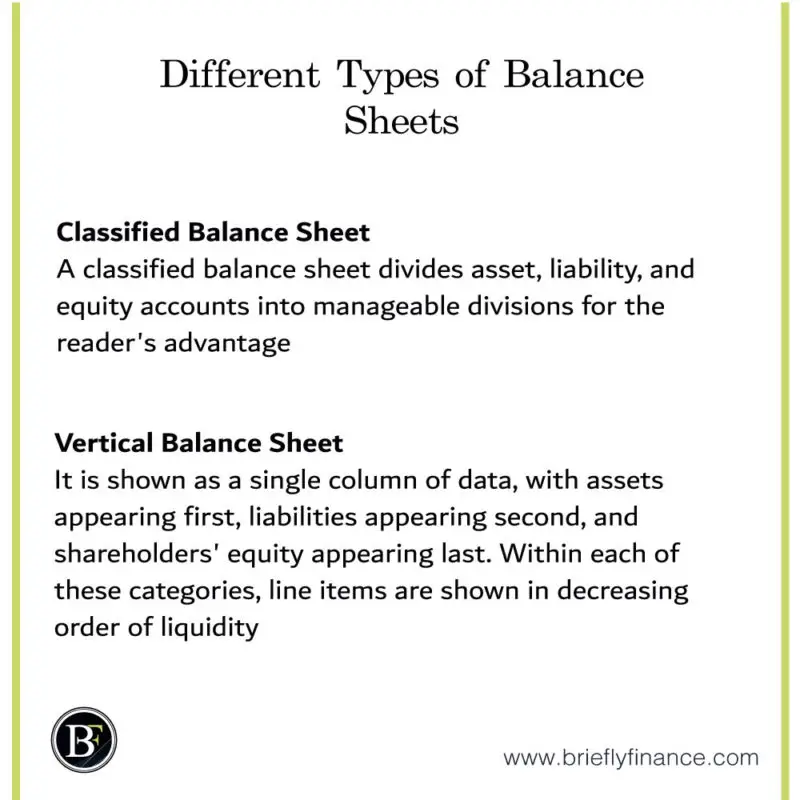

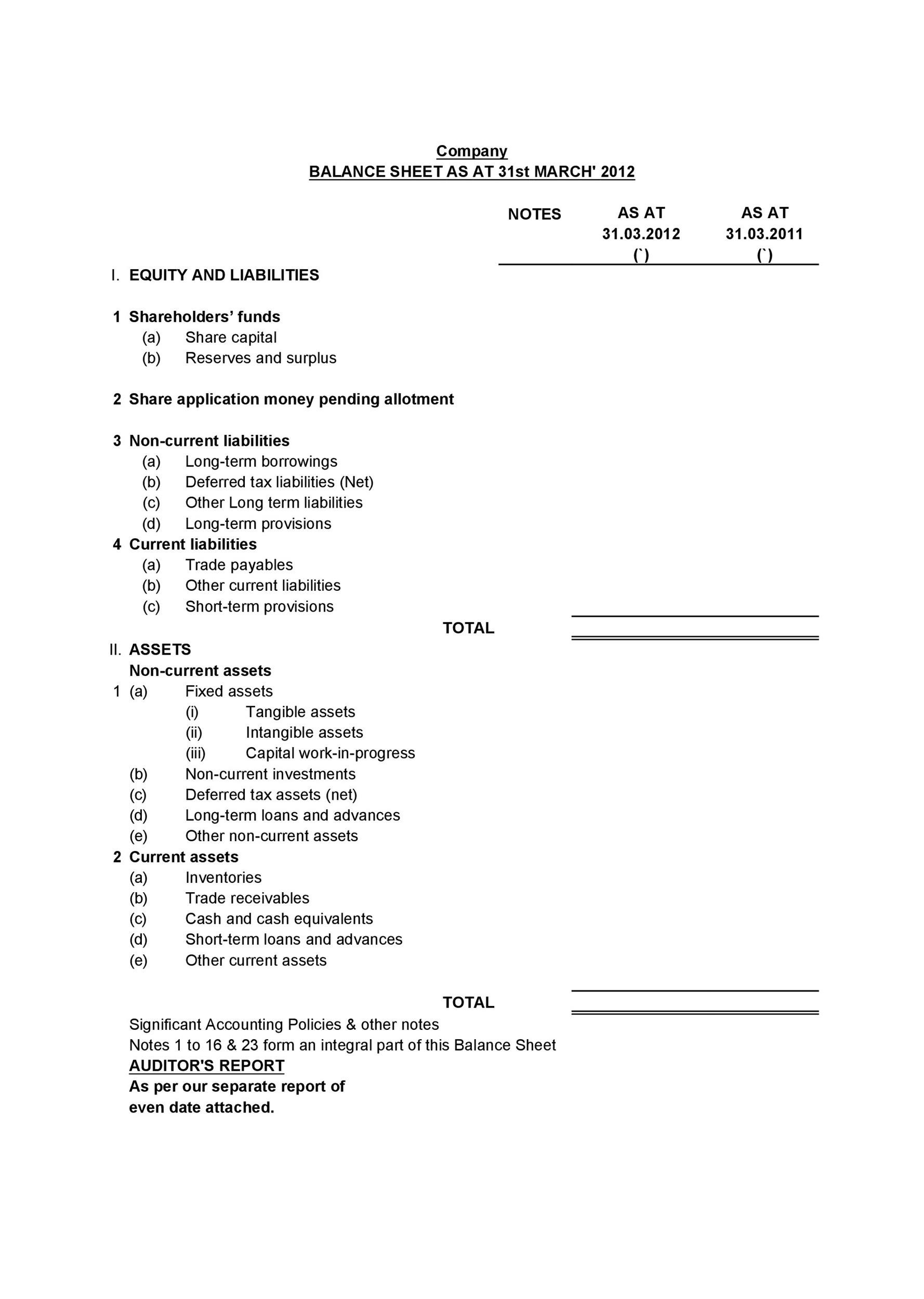

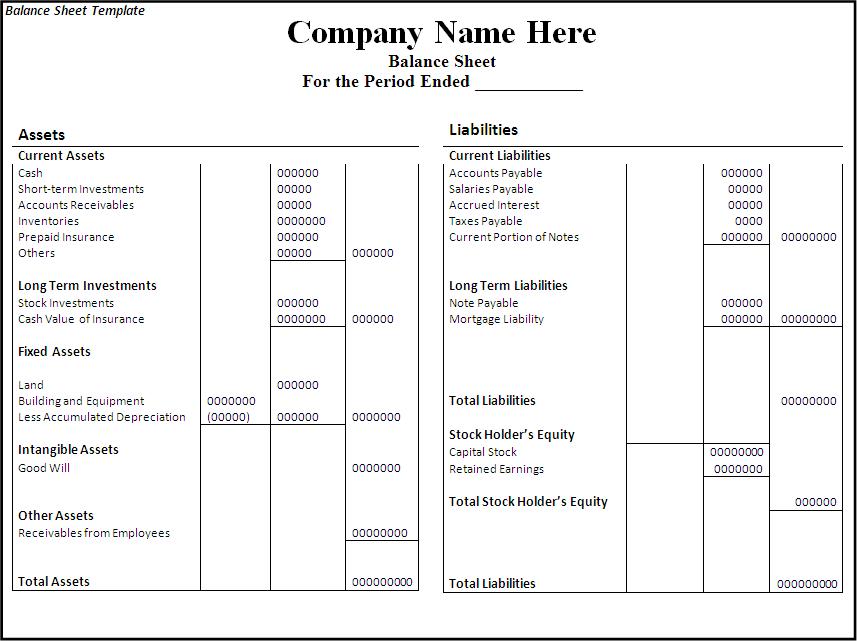

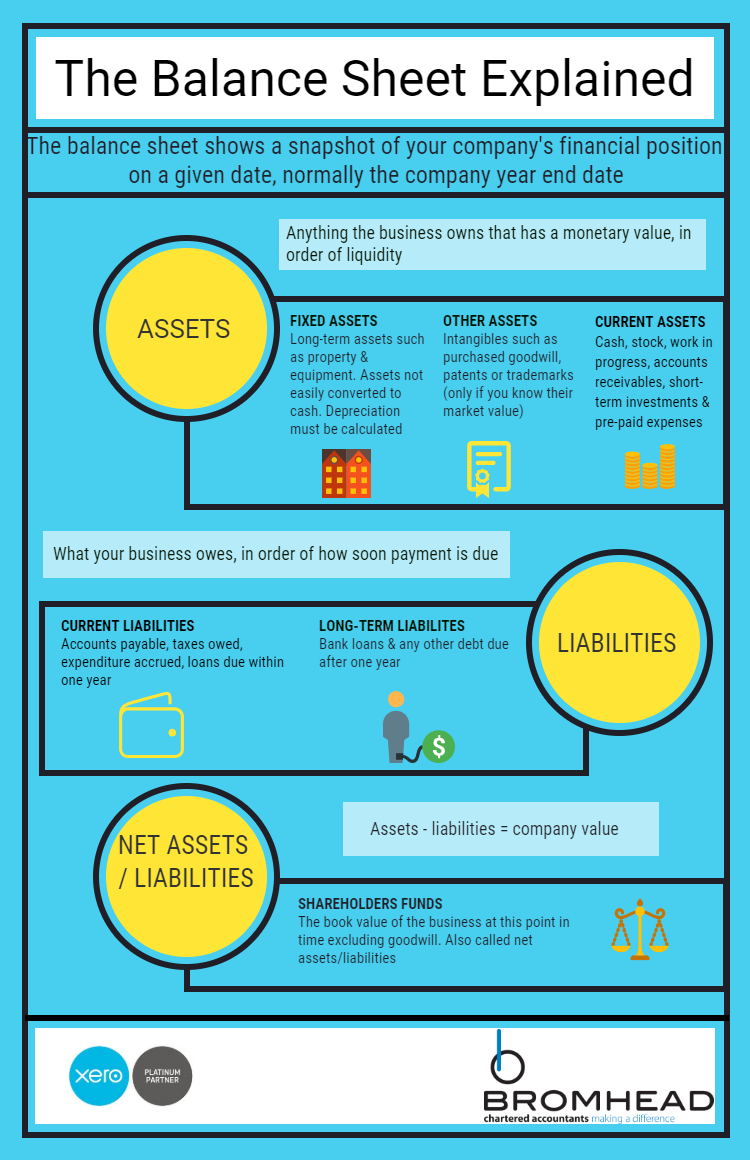

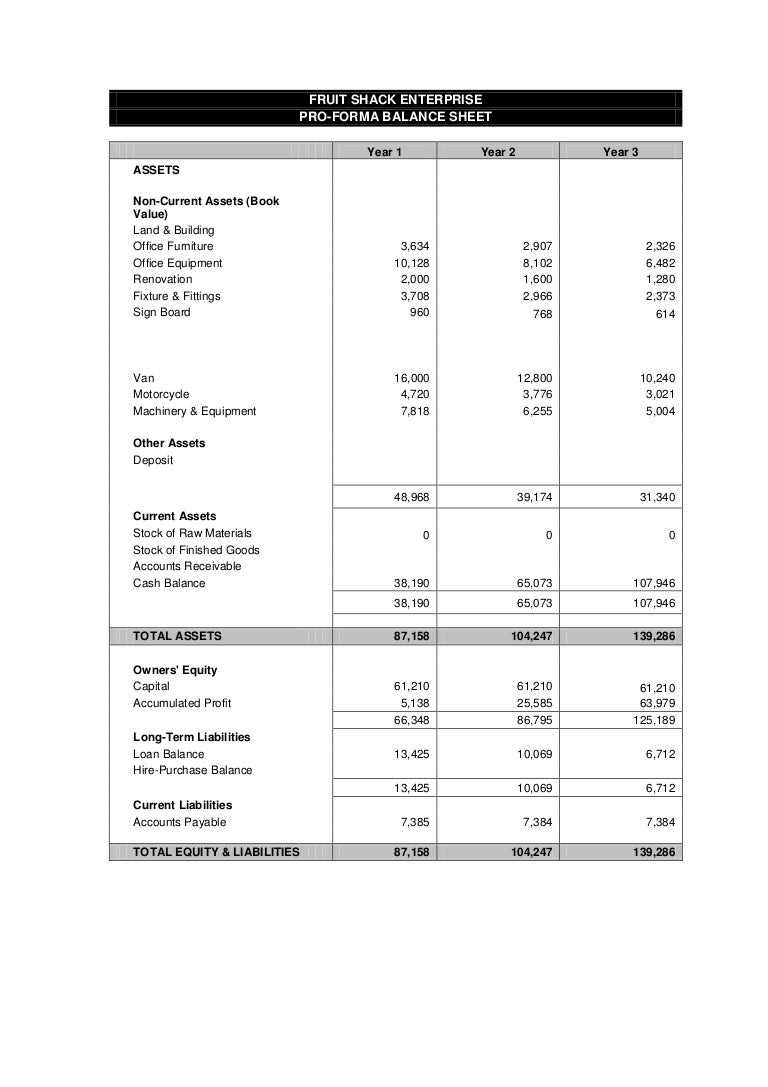

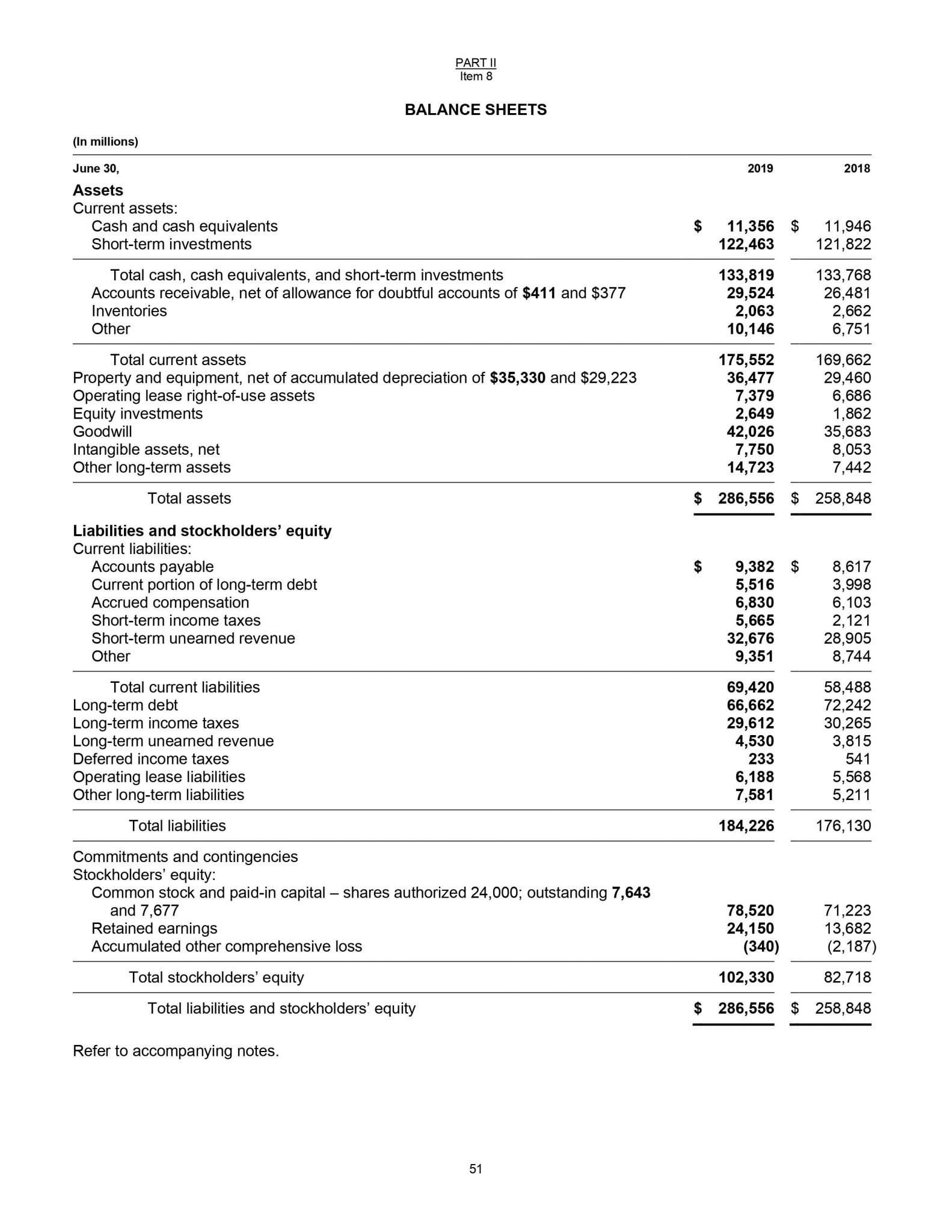

Different types of balance sheet. While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. There are several balance sheet formats available. The more common are the classified, common size, comparative, horizontal, and vertical balance sheets.

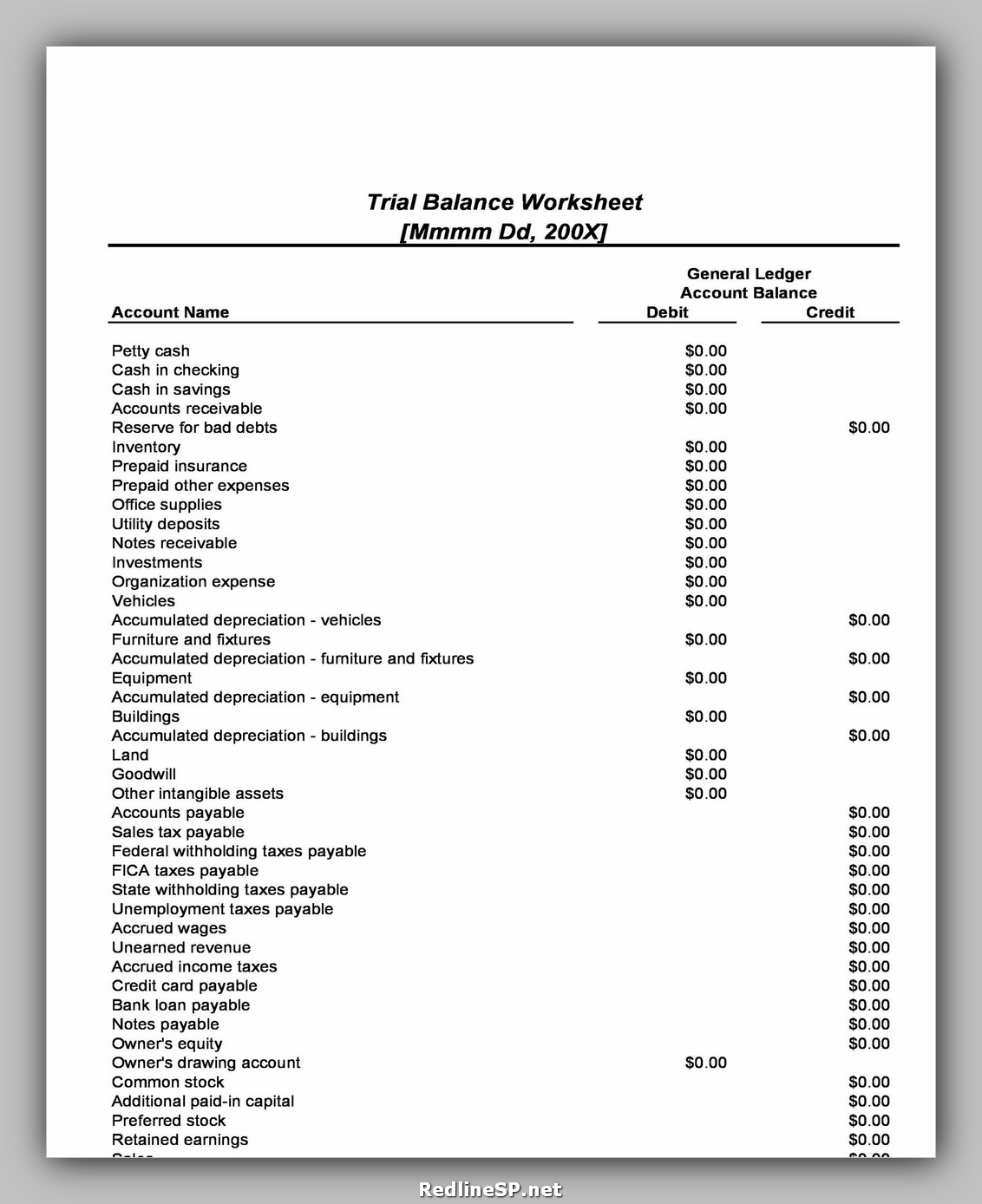

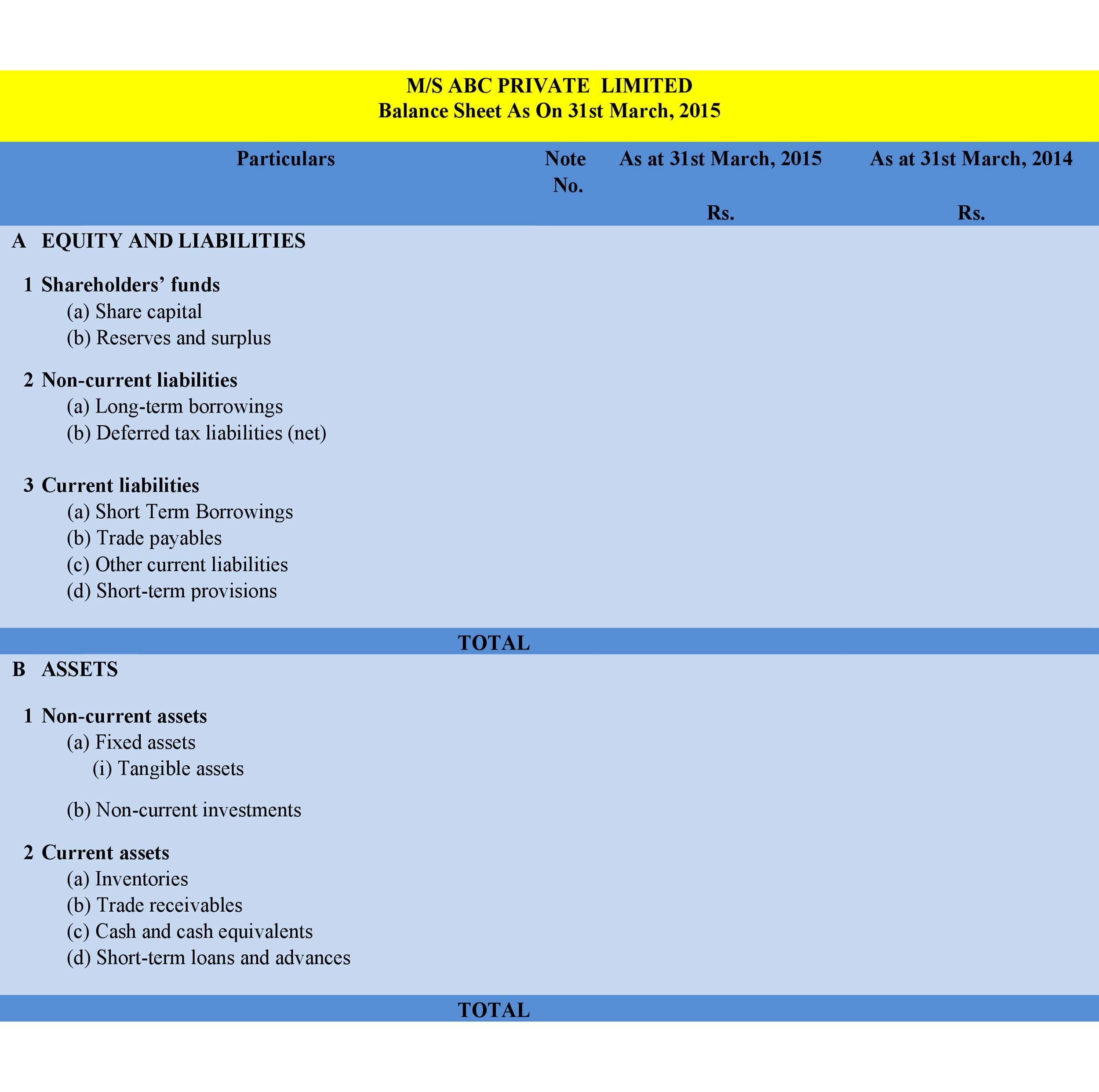

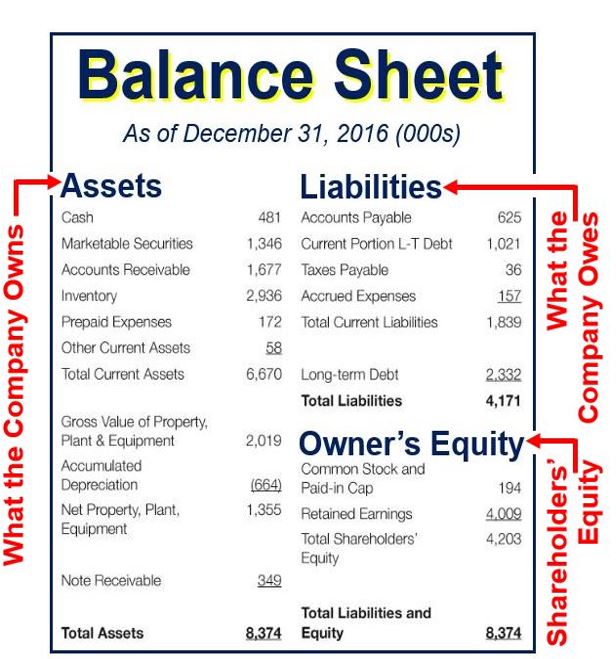

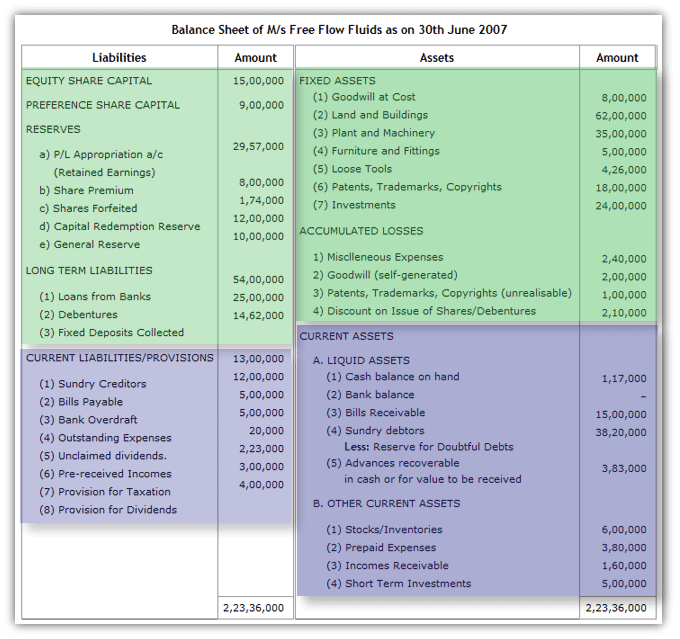

Assets represent all things of value that belong to the company. A company's balance sheet is comprised of assets, liabilities, and equity. The balance sheet is a statement that shows the financial position of the business.

For instance, when you sell inventory and receive payment, this is documented in the cash account. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. A typical balance sheet contains three core components:

Assets represent things of value that a company owns and has in its possession, or something that will be received and. Keeping the balance sheet balanced. Assets, liabilities, and shareholder equity.

Each of these sections is briefly discussed below: The prime aim of this is to monitor whether the business has enough cash and assets to survive in operations and whether the level of debt is low so that it does not face any future financial hurdles. Each of the financial statements provides important financial information for both internal and external stakeholders of a company.

The three financial statements are: Balance sheets include assets, liabilities, and shareholders' equity. As a small business, you may have placed security deposits.

This includes liquid assets such as cash or cash equivalents, as well as incoming payments via accounts receivable or prepaid expenses that will produce more company. Assets = liabilities + equity. The different types of balance sheet ratios are as follows:

The 3 types of core financial statements are: Assets are what the company owns, while liabilities are what the company owes. Correctly identifying and classifying the types of assets is critical to the survival of a company, specifically its solvency and associated risks.

In balance sheet, assets having similar characteristics are grouped together. 2 types of balance sheet are; Learn what a balance sheet should include and how to create your own.

The two key types are the classified balance sheet and vertical balance sheet which we will discuss below: This is the cash you receive during regular transactions at your business. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)