Beautiful Info About Creating A Balance Sheet Business Plan Financial Projections

Some fed officials said at the january meeting that amid uncertainty over how much liquidity the financial system needs, slowing the.

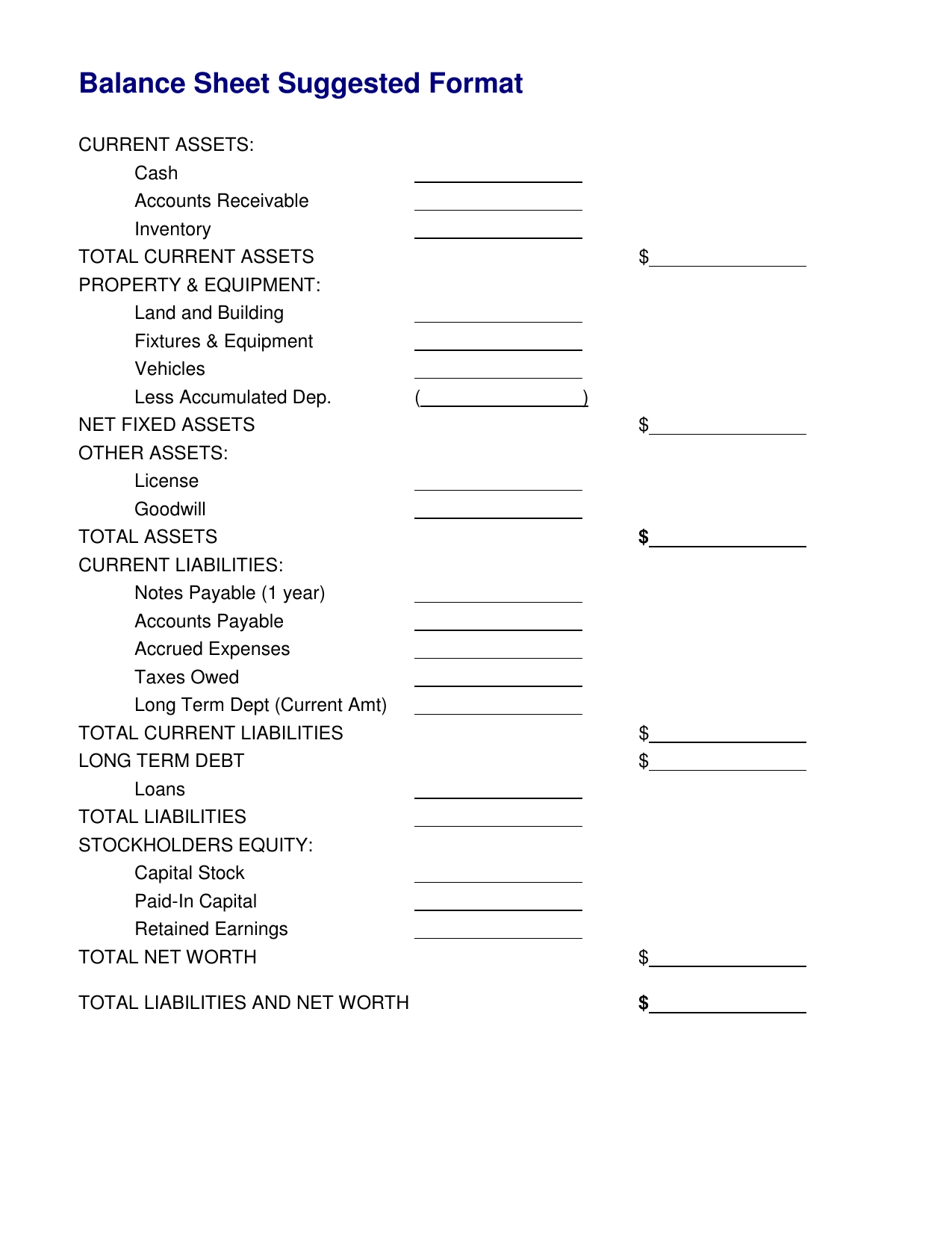

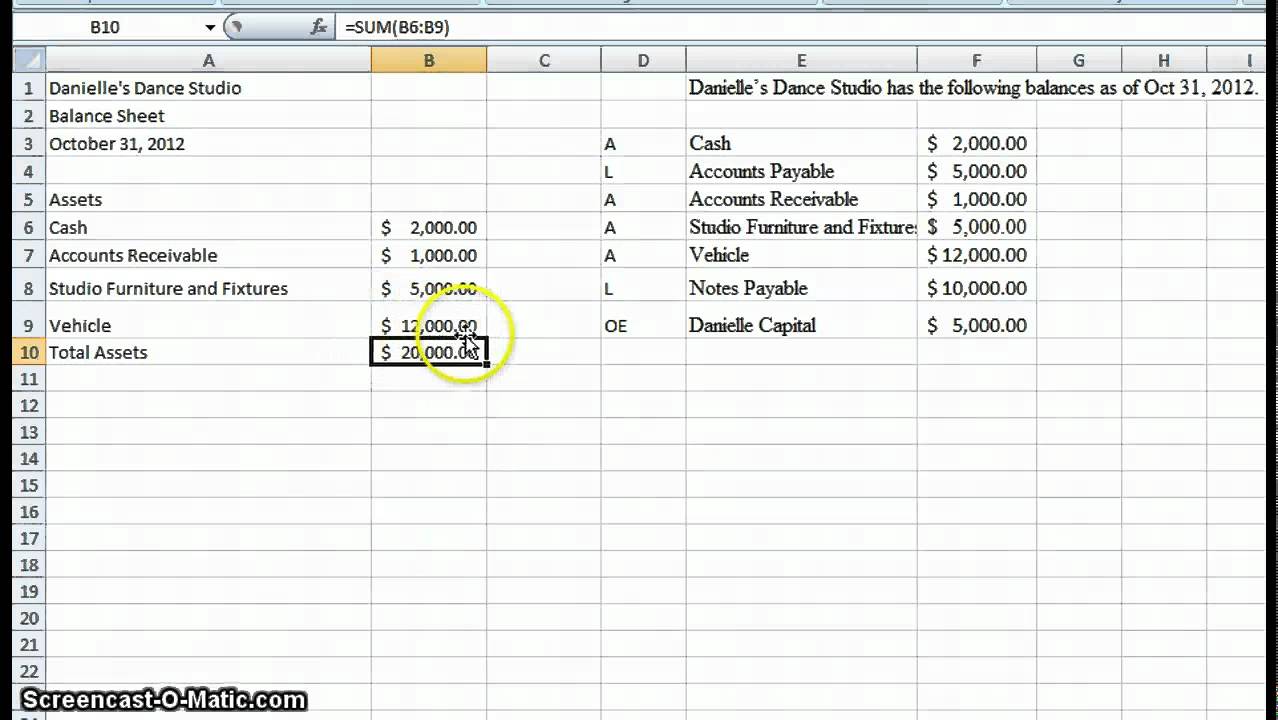

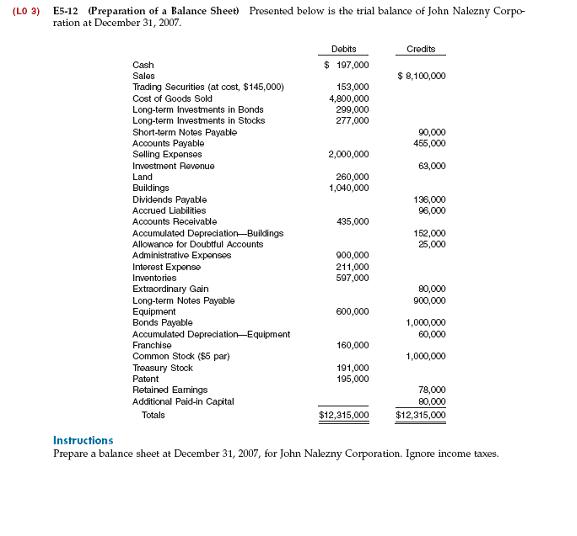

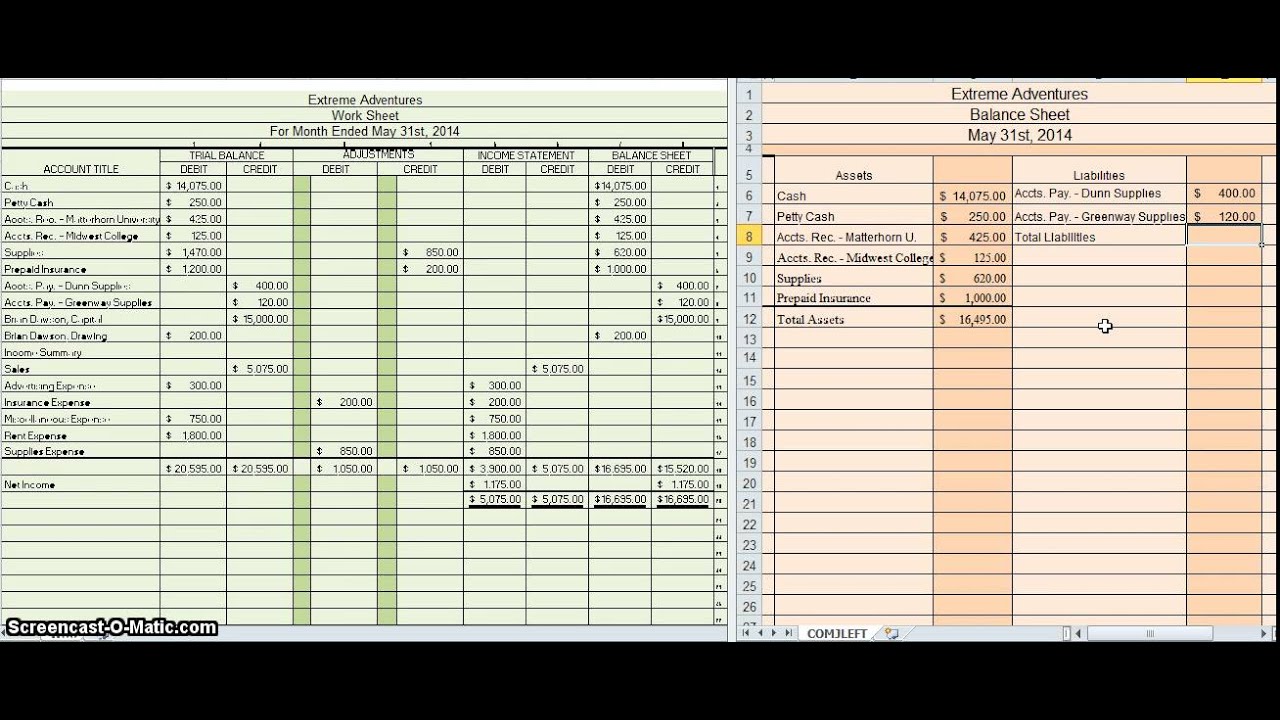

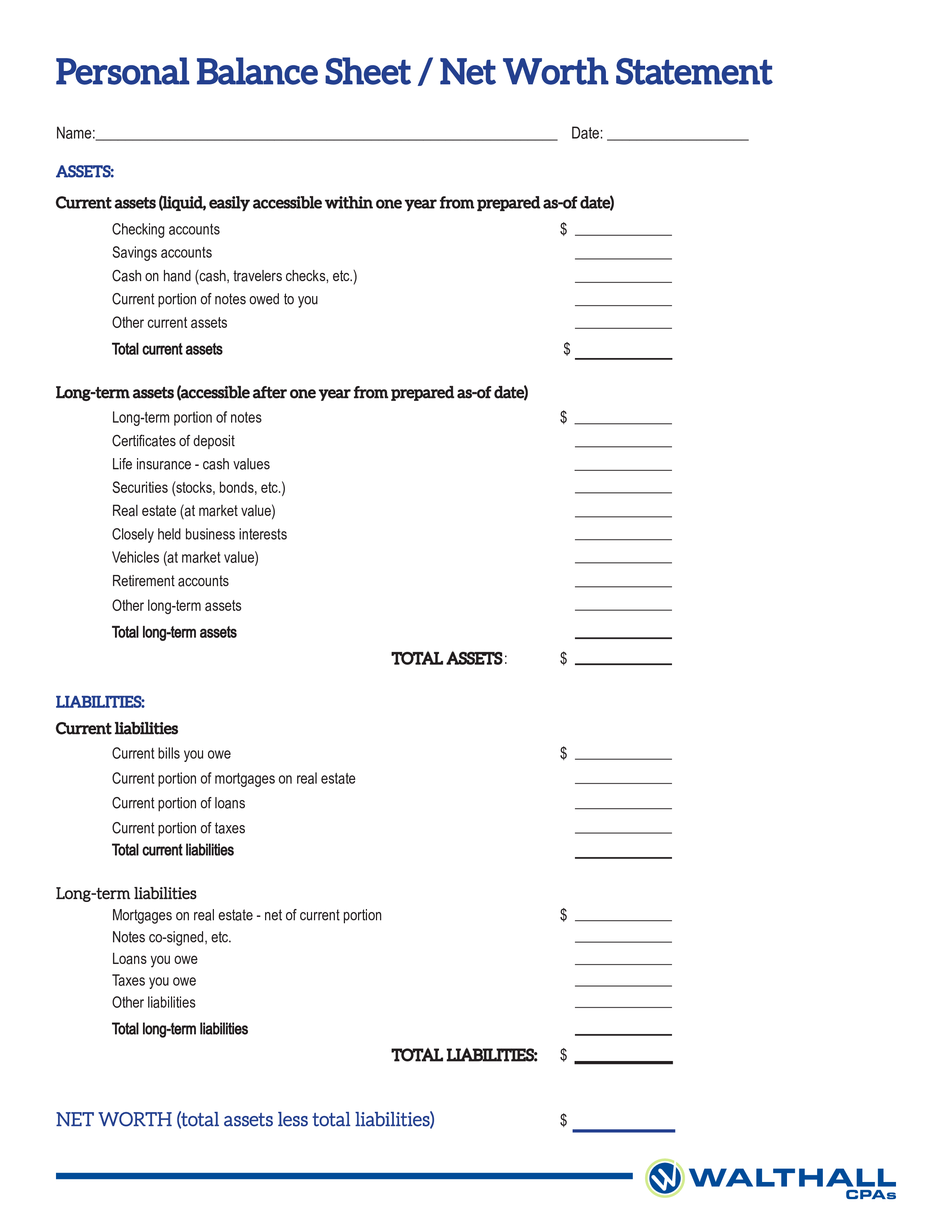

Creating a balance sheet. Whether you’re a business owner or an accountant, you can follow these steps to make a basic balance sheet: August 25, 2022 a balance sheet gives you an overview of your business’ financial standing. A personal balance sheet can help you identify areas to pay down debt.

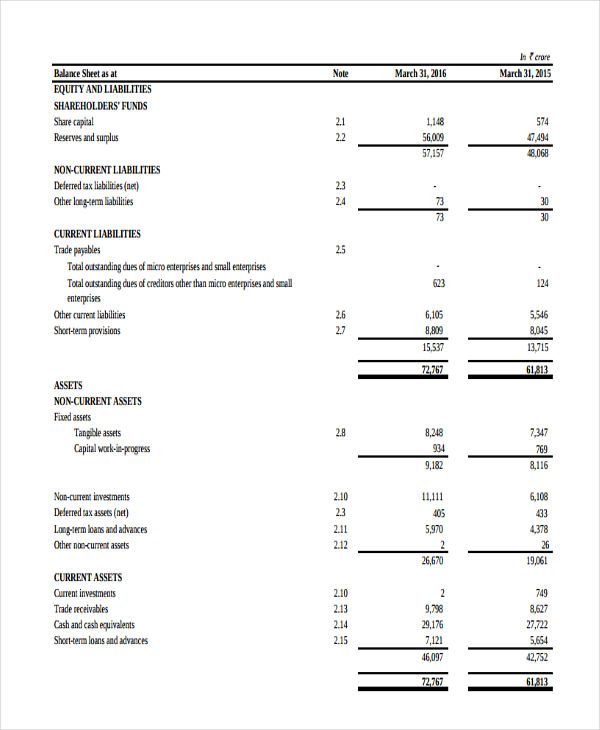

Balance sheet template profit & loss statement template financial projection template and more! A balance sheet includes a summary of a business’s assets, liabilities, and capital. It is allowing up to $95 billion in treasury and mortgage bonds to.

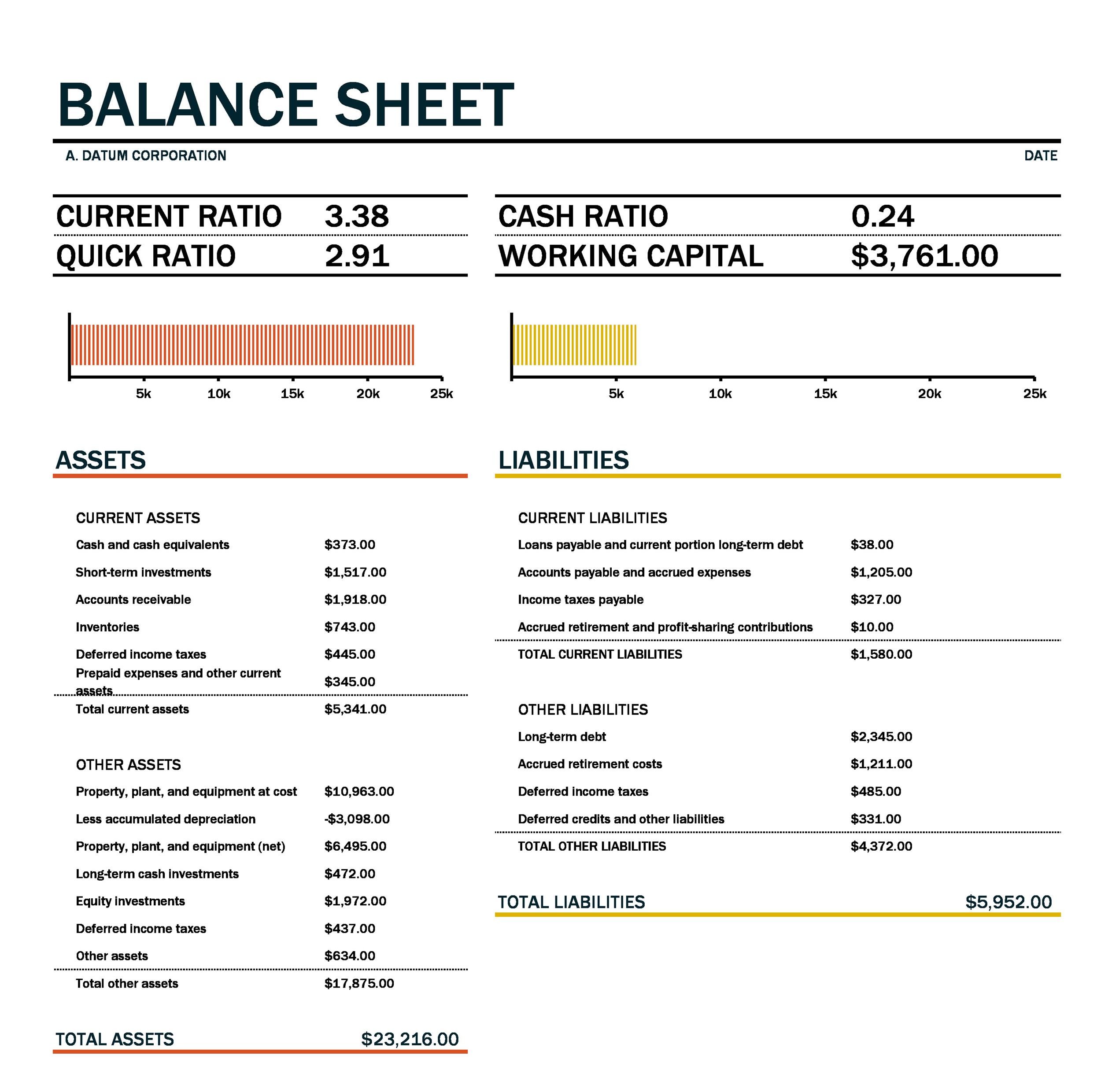

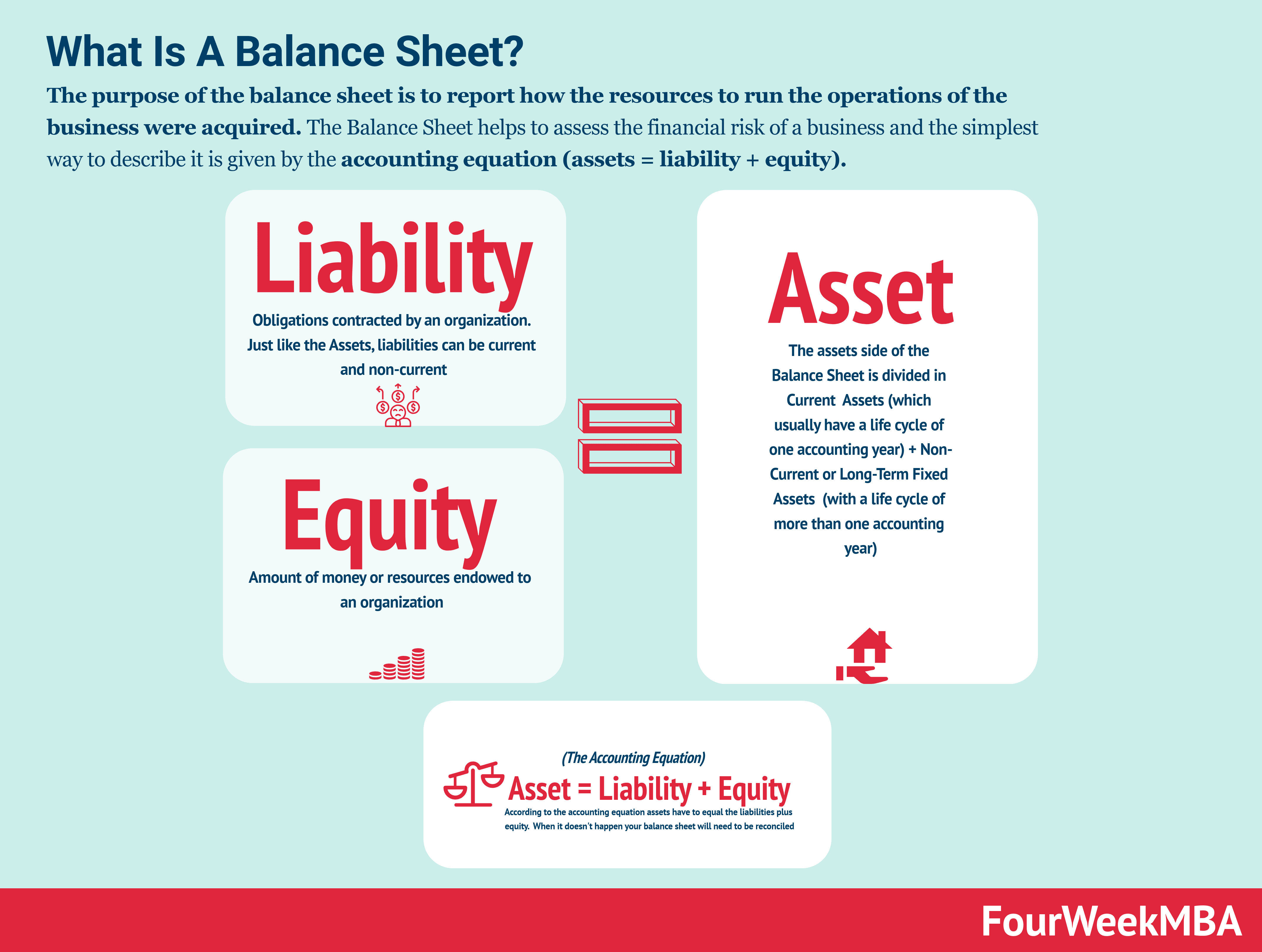

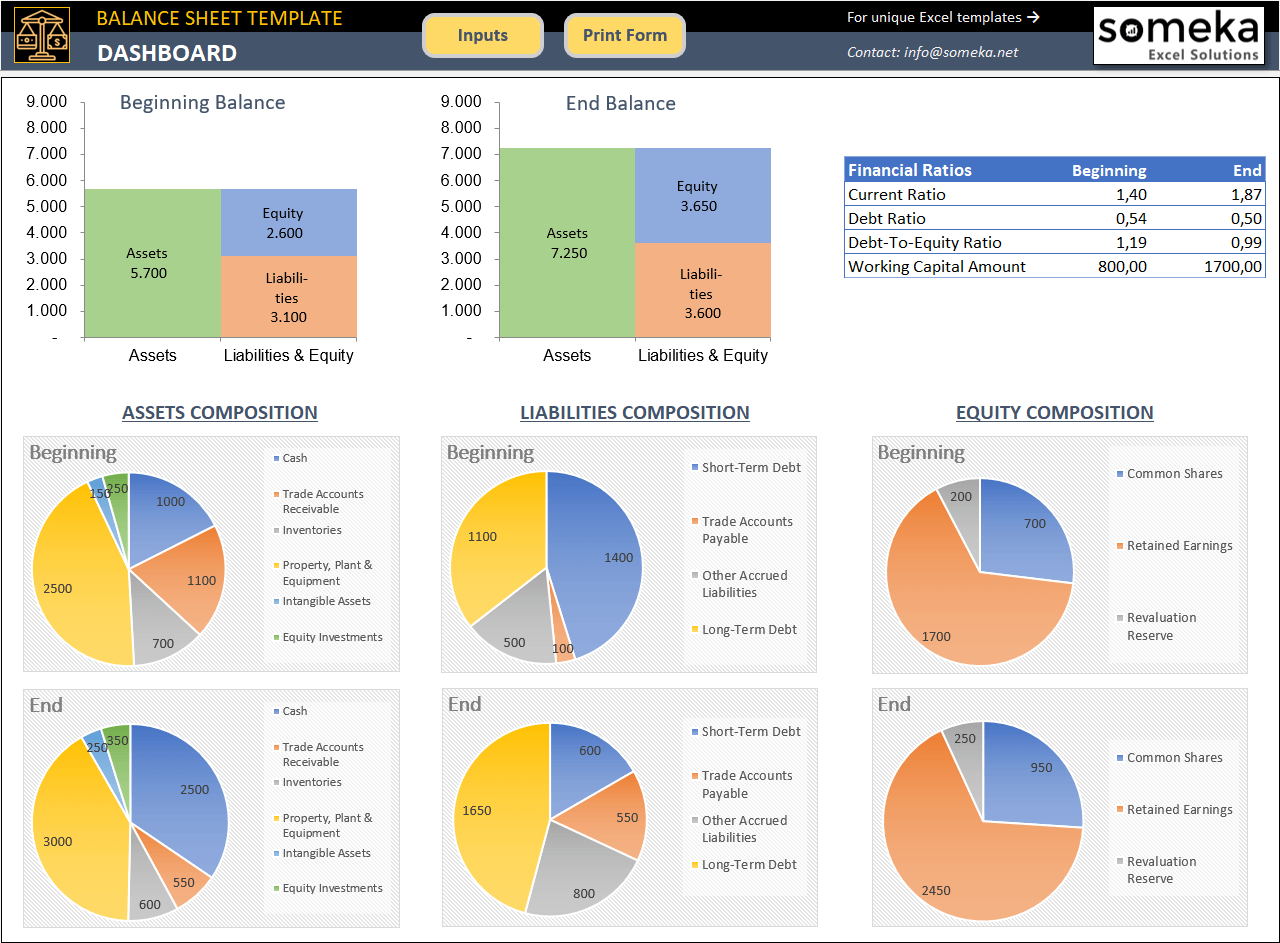

The report can be used by business owners, investors, creditors, and shareholders. How to create a balance sheet. A balance sheet is one of the financial statements of a business that shows its financial position.

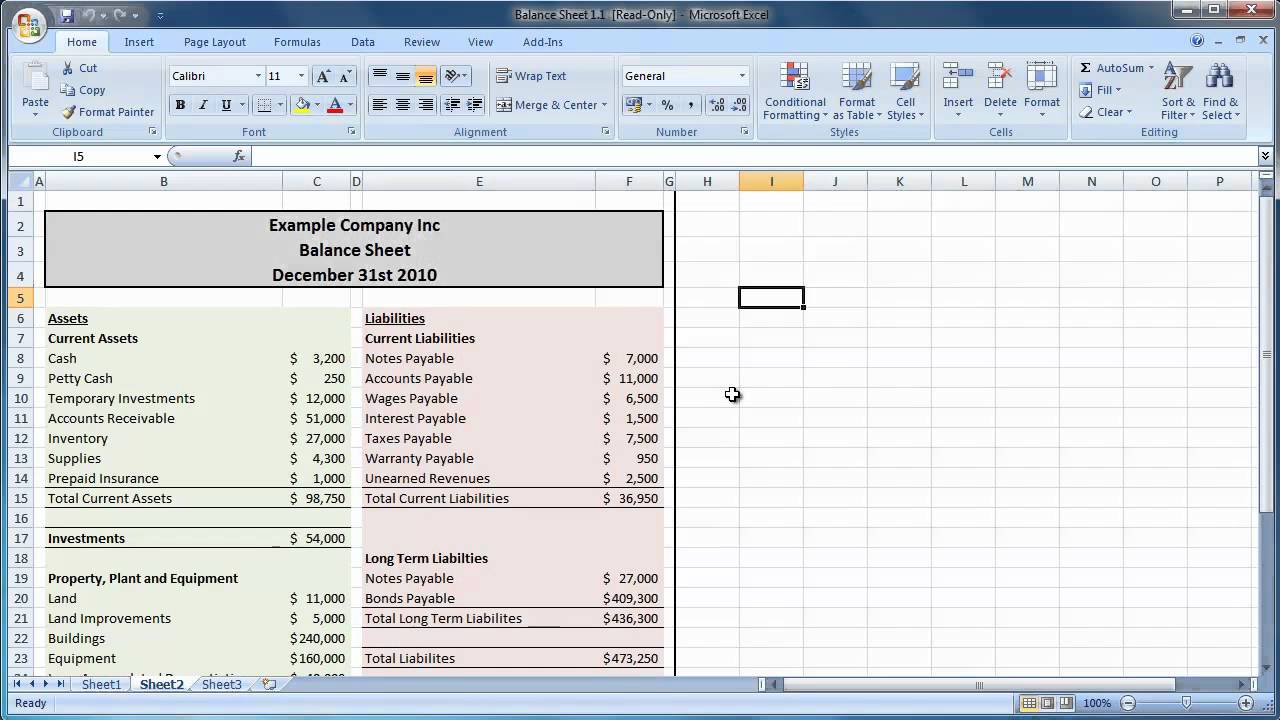

Liabilities, which are the company's debts; Pick a date and list your assets. It can also be referred to as a statement of net worth or a statement of financial position.

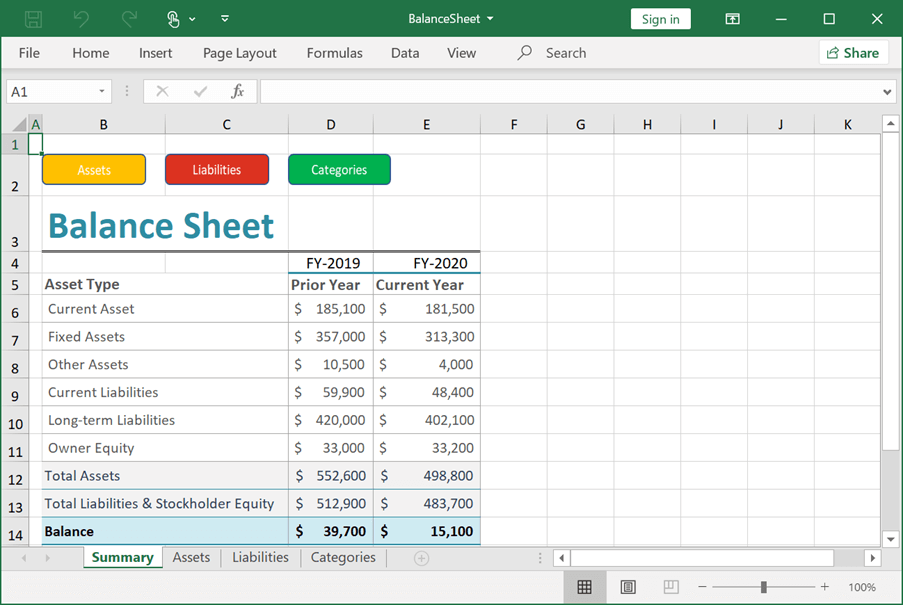

Here are the basic steps to building a balance sheet: A company’s balance sheet is used to determine financial data for a company for a specific date. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date.

The balance sheet is one of the three core financial statements that. 1 use the basic accounting equation to make a balance sheets. Key takeaways a balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Updated february 3, 2023 balance sheets are fundamental financial documents for both accounting and financial modeling within an organization. The fed has been reducing the size of its holdings since 2022. The first thing to make any financial statement is determining the data you want to look at.

A business can prepare the balance sheet in several ways, but. Using these valuable reports, a company's management and leadership team can understand the company's financial health, predict growth trends and perform many other tasks. Creating a balance sheet is an important step to understanding your financial situation and helping to improve it.

This financial statement provides insight into your company’s financial health by detailing your assets, liabilities, and shareholders’ equity. At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader. The latest balance sheet data shows that intel had liabilities of us$28.1b due within a year, and liabilities of us$53.6b falling due after that.

Vertical balance sheets list financial information from top to bottom. Calculate total assets and total liabilities. Often, the reporting date will be the final day of the accounting period.