Top Notch Tips About Balance Sheet For Income Tax Return Main Sections On A Statement Of Cash Flows

2023 — following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the internal.

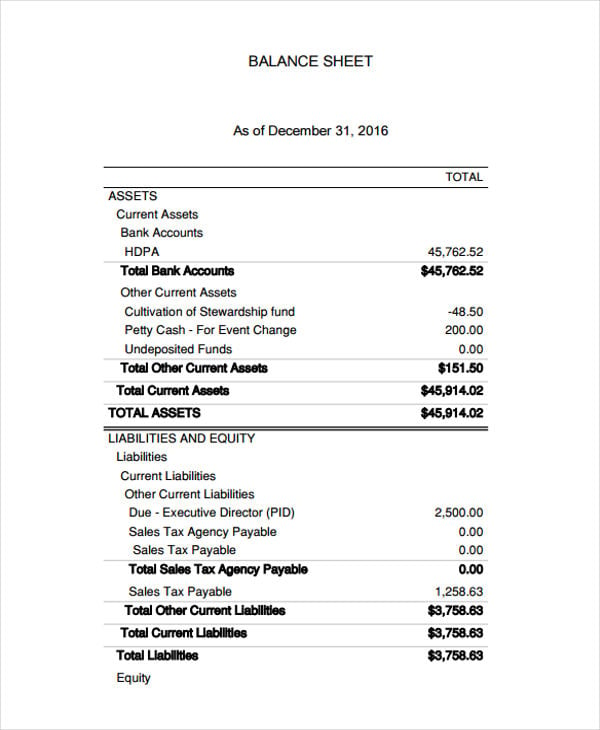

Balance sheet for income tax return. For example, if a business’ tax for the coming tax period is recognized to be $1,500, then the. Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the. Download free, printable, and customizable balance sheet templates in excel, adobe pdf, and google sheets formats.

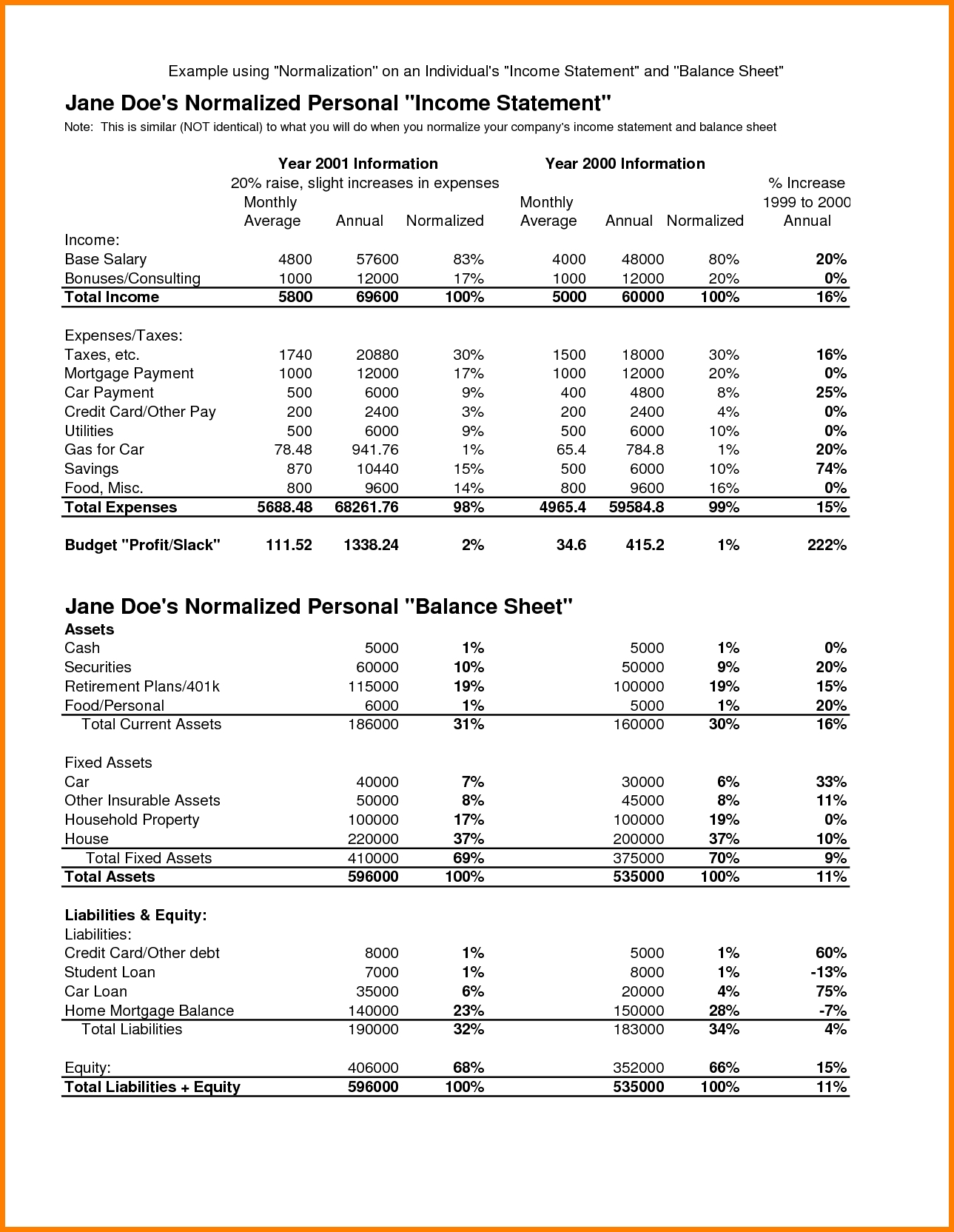

P&l account takes revenues into account for a specific period. First, a company’s income tax accounting should be in line with its operating. What is the difference between a balance sheet and an income statement?

It remains on the balance sheet because, probably the tax period is still to come. Total business income (before deductions) is less than $250,000, and your business isn't. Details of incomes and expenses can also be derived using the bank statement to prepare financial statements such as balance sheet and p&l account.

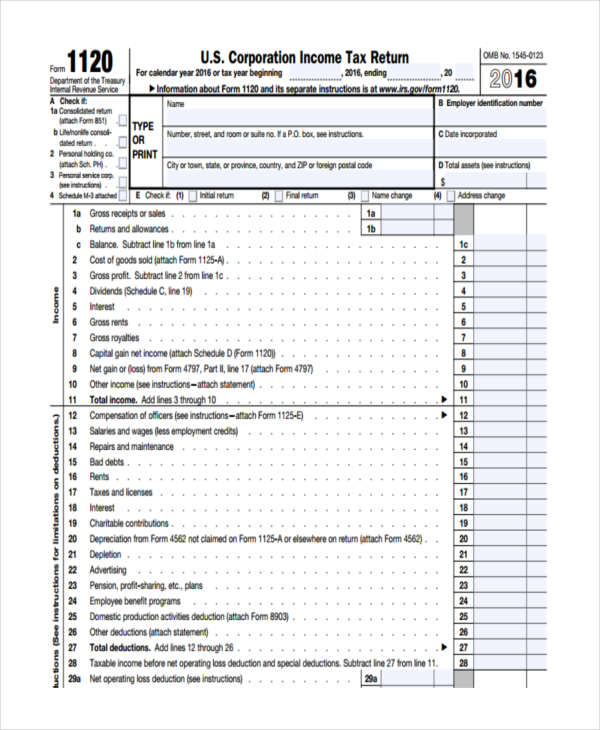

The schedule c has line items. When is the last date to file itr? The three main objectives in accounting for income taxes are:

You can skip the balance sheet section if all of the following are true: Balance sheet of the business or profession as on 31st march of the fy in respect of the proprietary. However, if you missed filing within the due date, you.

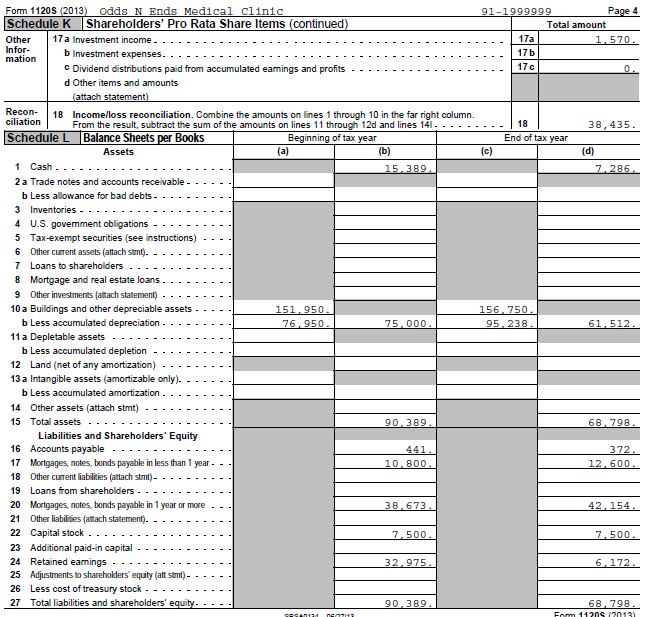

The income statement, also referred to as a profit and loss statement, statement of incomes and losses, or report of earnings, tells you or your investors: When it comes to completing the company tax return , the financial statements, which consist primarily of a balance sheet and income statement, become. Balance sheet as on 31st day of march:

Plus, find tips for using a balance sheet.