Ace Info About Blank Financial Statement Example Of A Small Business Balance Sheet Apple Income And

Basics of small business balance sheets.

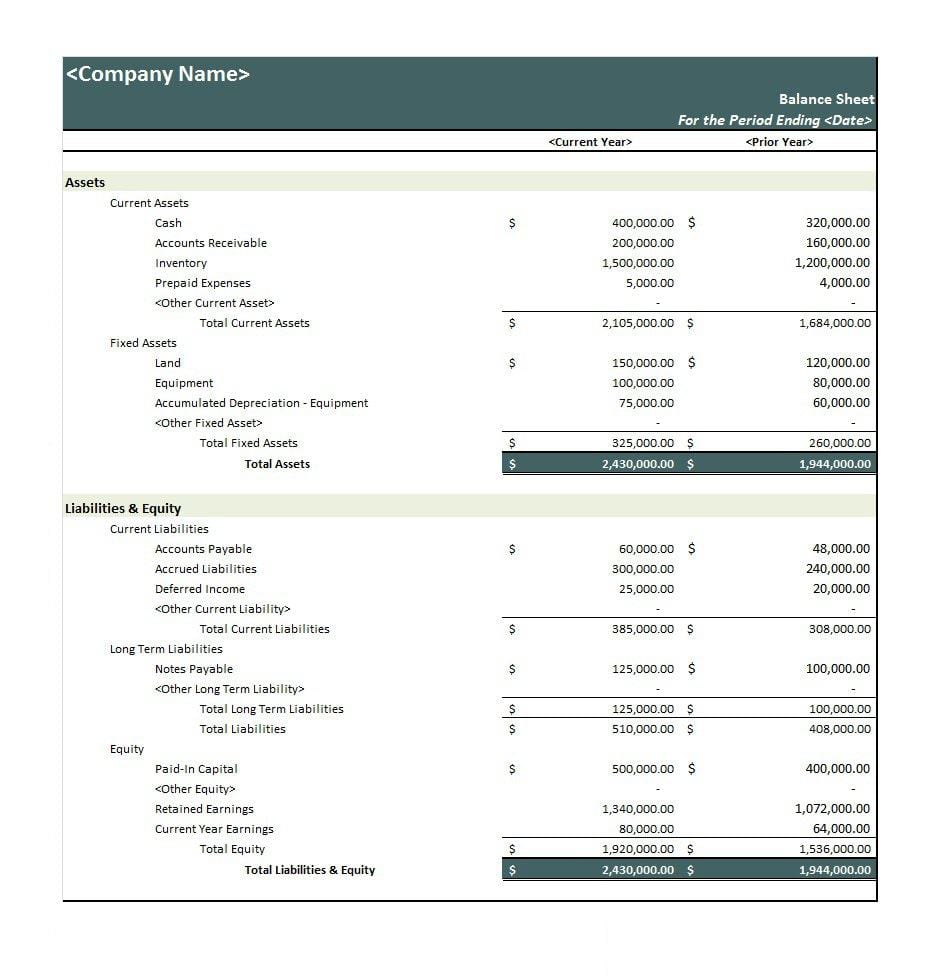

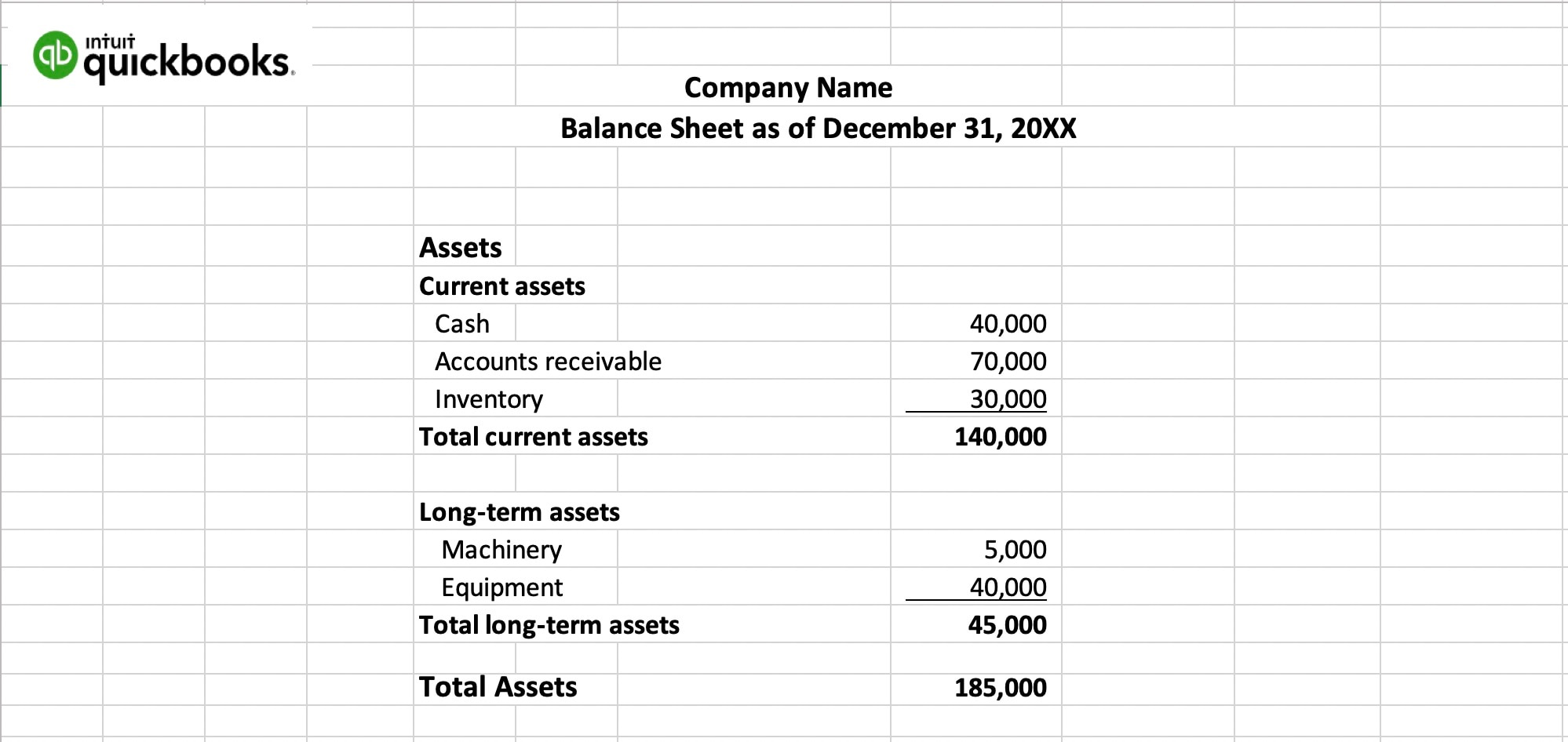

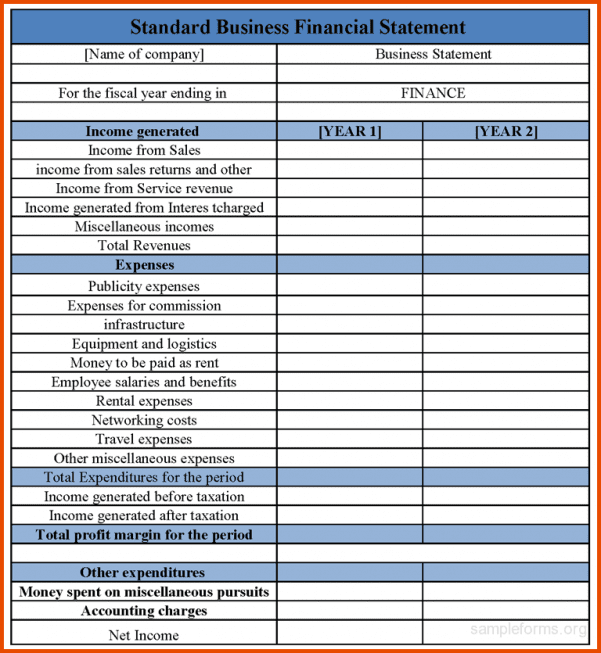

Blank financial statement example of a small business balance sheet. Examples of assets include: A company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Add up all your gains then deduct your losses.

Office equipment (computers, machinery, etc.) inventory real estate commercial vehicles cash accounts receivable investments note that if you lease equipment, you won’t be able to list it as either an asset or a liability. An unbalanced balance sheet can have serious implications, including: Add up the income tax for the reporting period and the interest incurred for debt during that time.

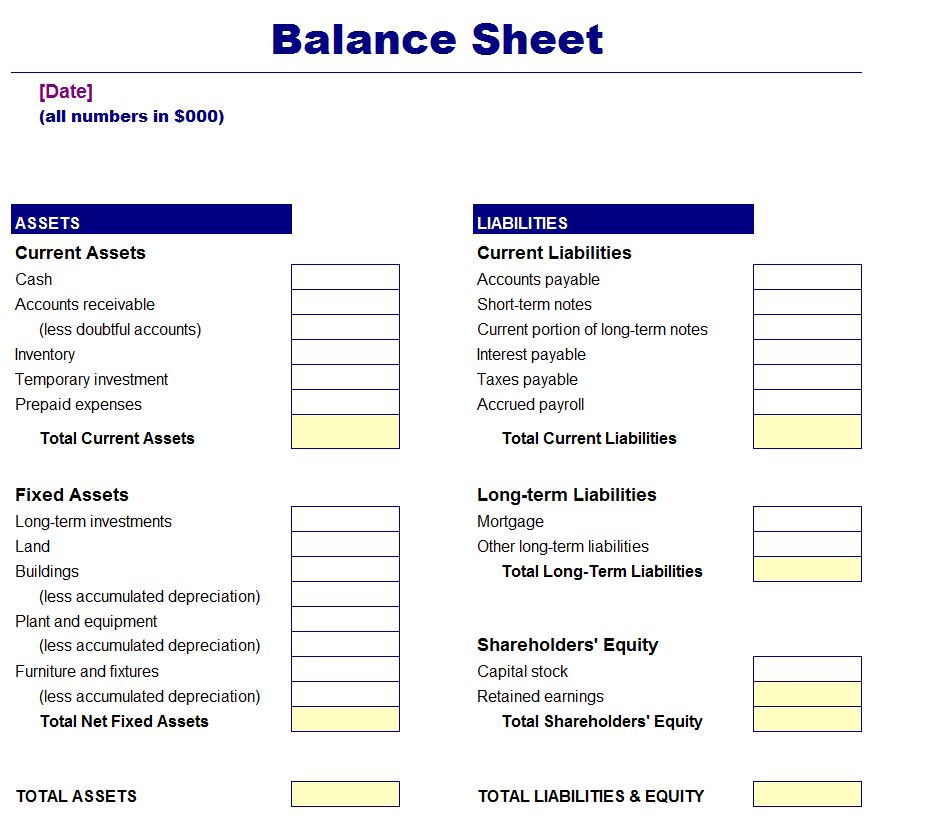

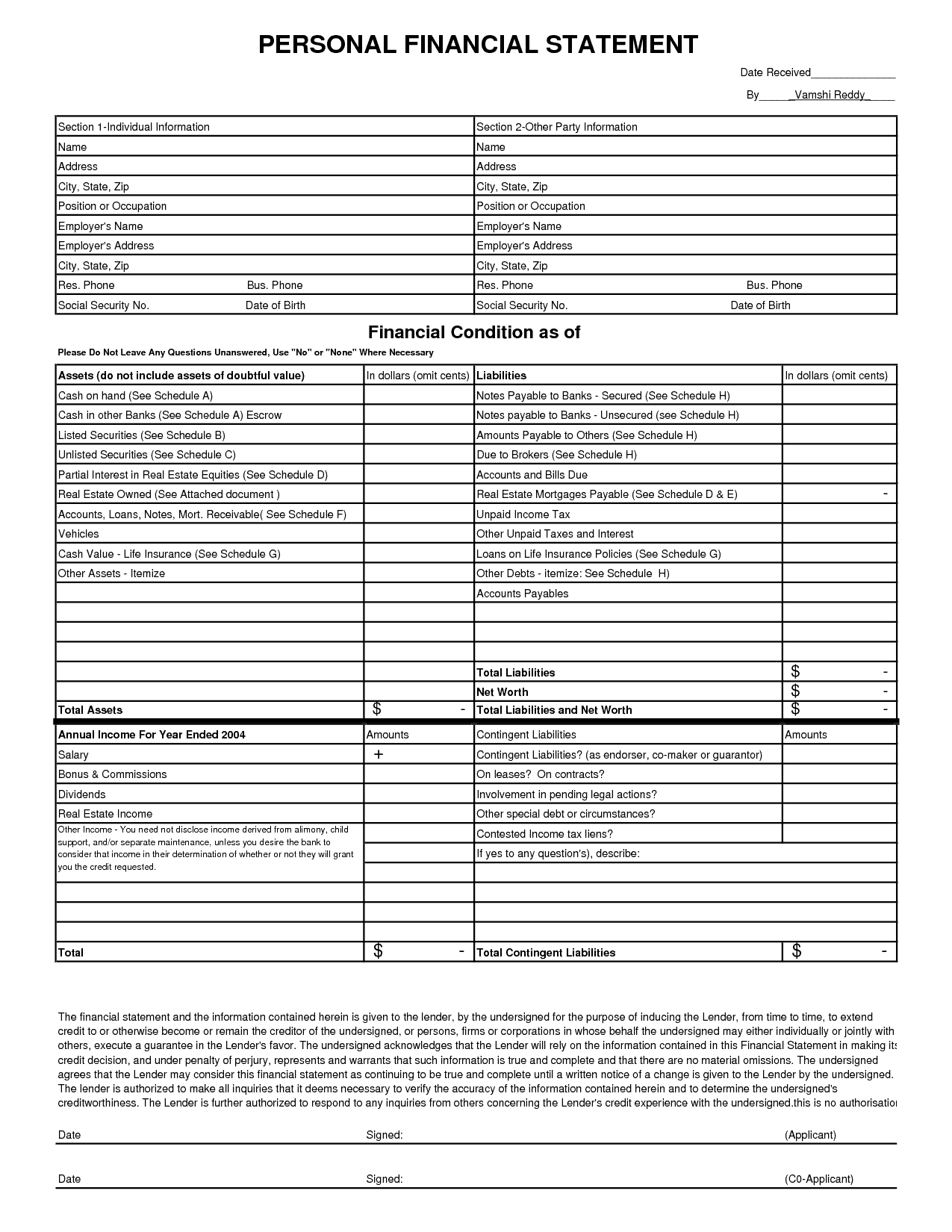

A balance sheet is a key financial statement that represents a company's financial status at any given point in time, capturing the company's assets, liabilities, and equity in a single document. A blank balance sheet, or a sample balance sheet template with example text to guide you through the process. The simple formula is assets = liabilities + equity.

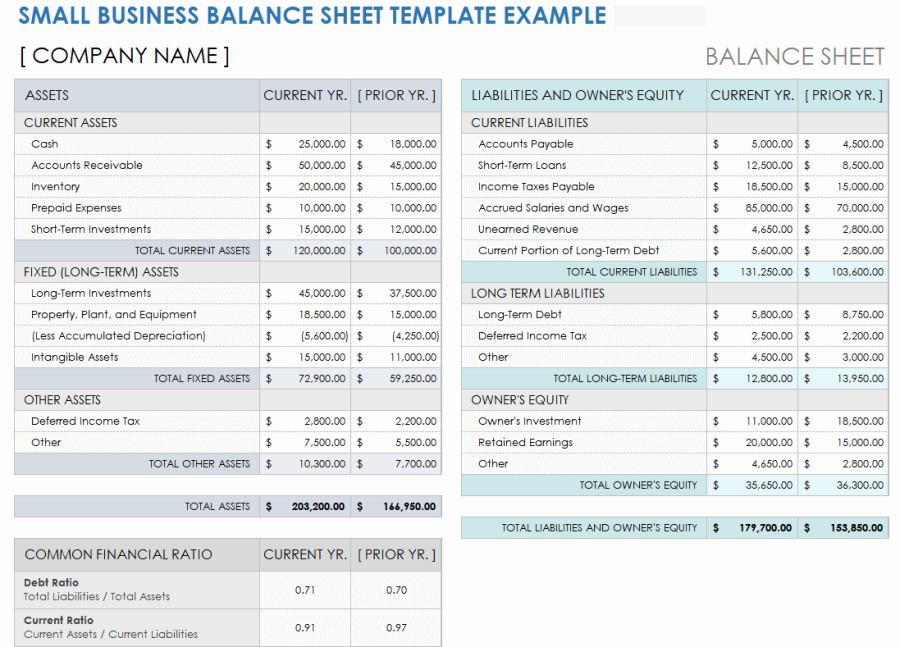

Download one of these free small business balance sheet templates to help ensure that your small business is on track financially. Retained earnings = net income since inception of your business. Maintaining a balanced balance sheet is crucial for the financial health of a small business.

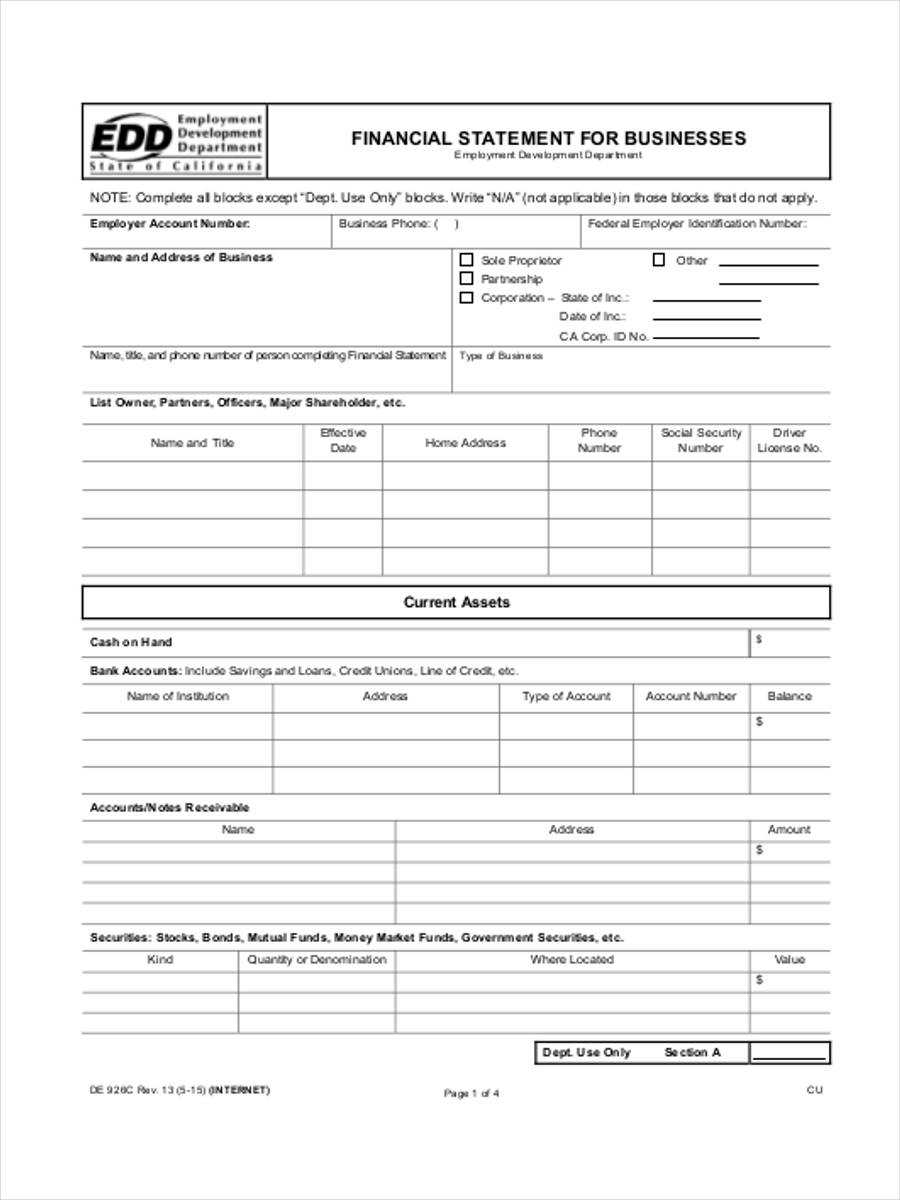

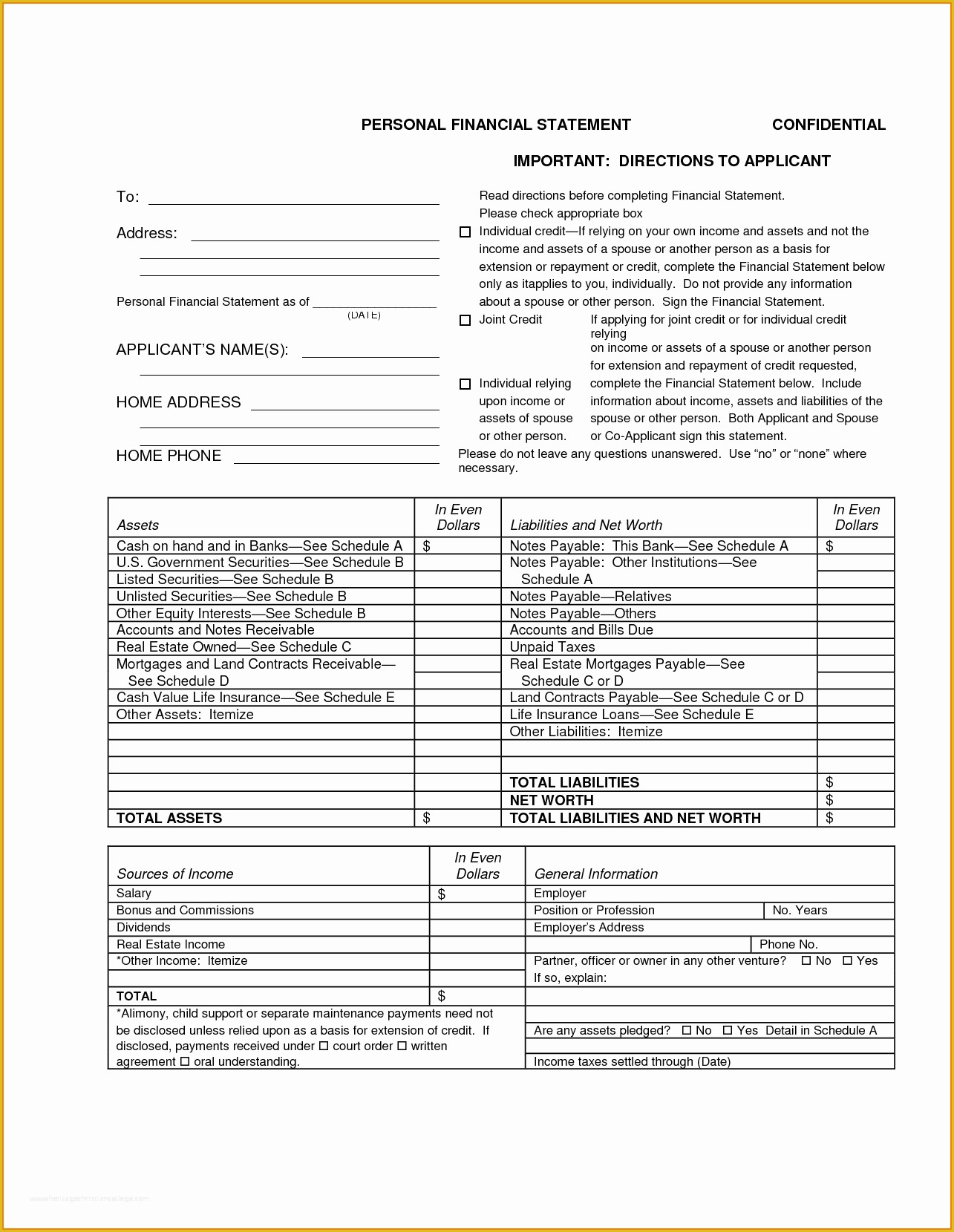

Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. One tool that can help you is financial reporting, which is an objective way to assess your company’s financial health. A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific time.

A balance sheet can also provide information to investors about whether or not to invest in the business. As its name implies, it must balance, one side of the balance sheet must equal the other. Cash flow statement templates for business plan.

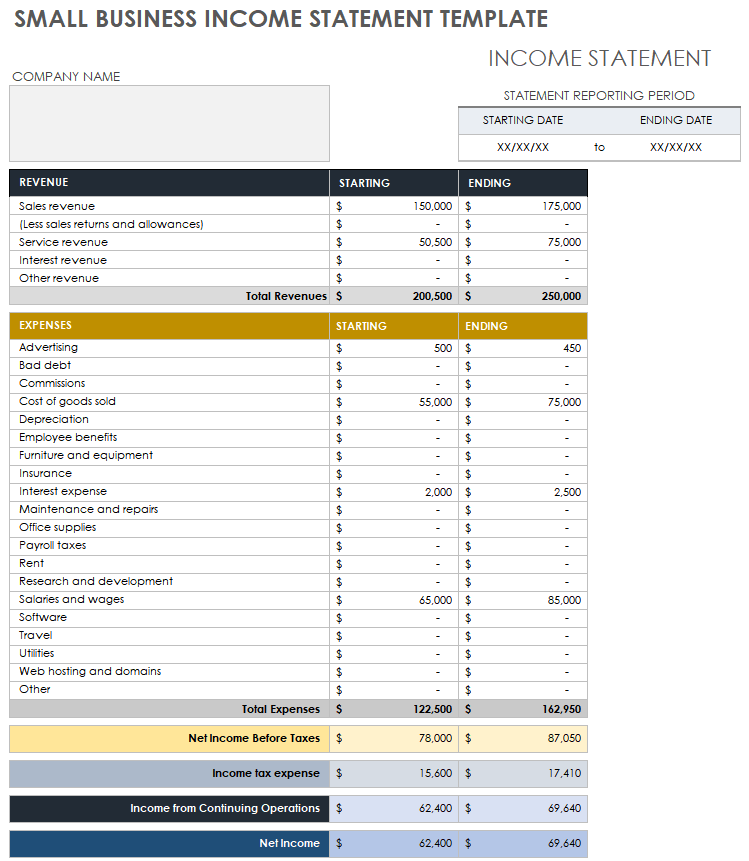

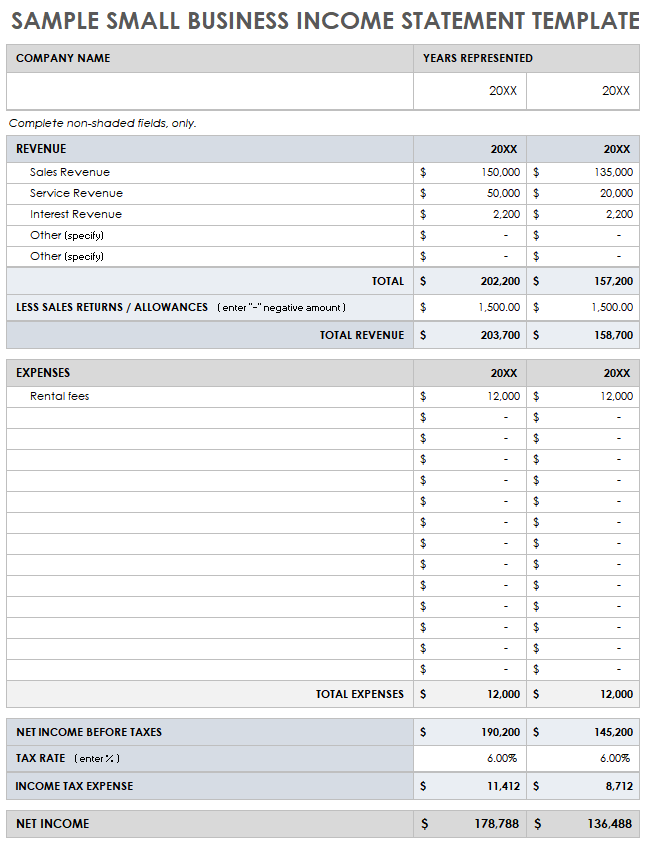

Hub reports february 20, 2024 by examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. Lenders and investors use balance sheets to evaluate a company's financial health. Enter your assets, liabilities, and owner’s equity to determine common financial ratios.

Download the sample template for additional guidance, or fill out the blank version to provide a financial statement to investors or executives. Securing the financial condition of a business considerably clean, and rising should be one of the vision statements of a company. You also need to clearly state on your balance sheet whether your figures are gst inclusive or exclusive.

You can download two versions of this template: Accounting financial statements: Use this tool to track and anticipate your small business’s finances.

Two of the most popular ratios used to analyze a small business. It can be used in estate, legal, and tax matters. A guide for small business owners april 26, 2022 understanding your company’s financial position is integral to its success.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)