Formidable Tips About Dividend Equalisation Fund In Balance Sheet Net Cash Provided By Operating Activities

General reserves are not kept aside for any particular purpose but for strengthening financial position of the company.

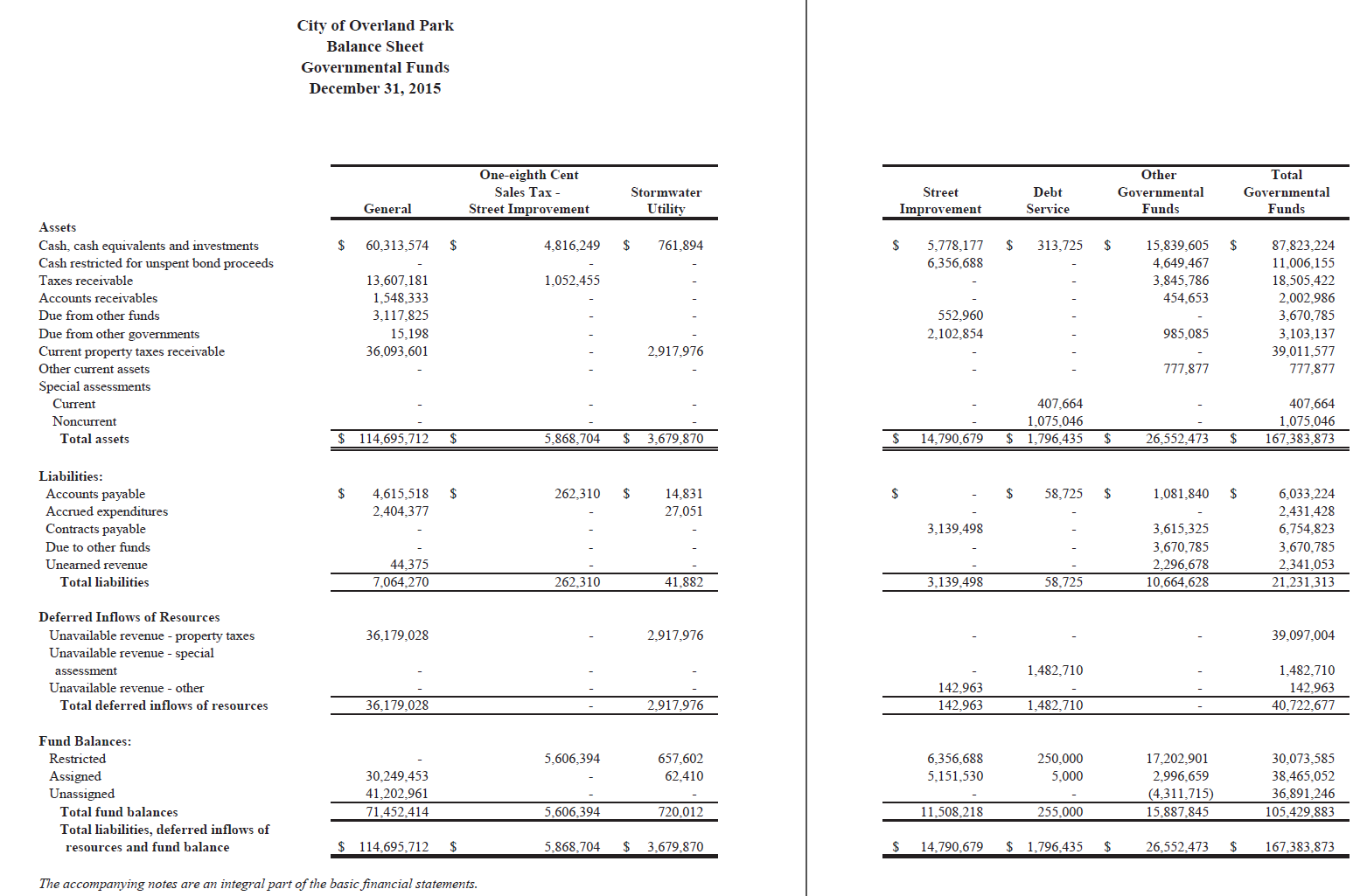

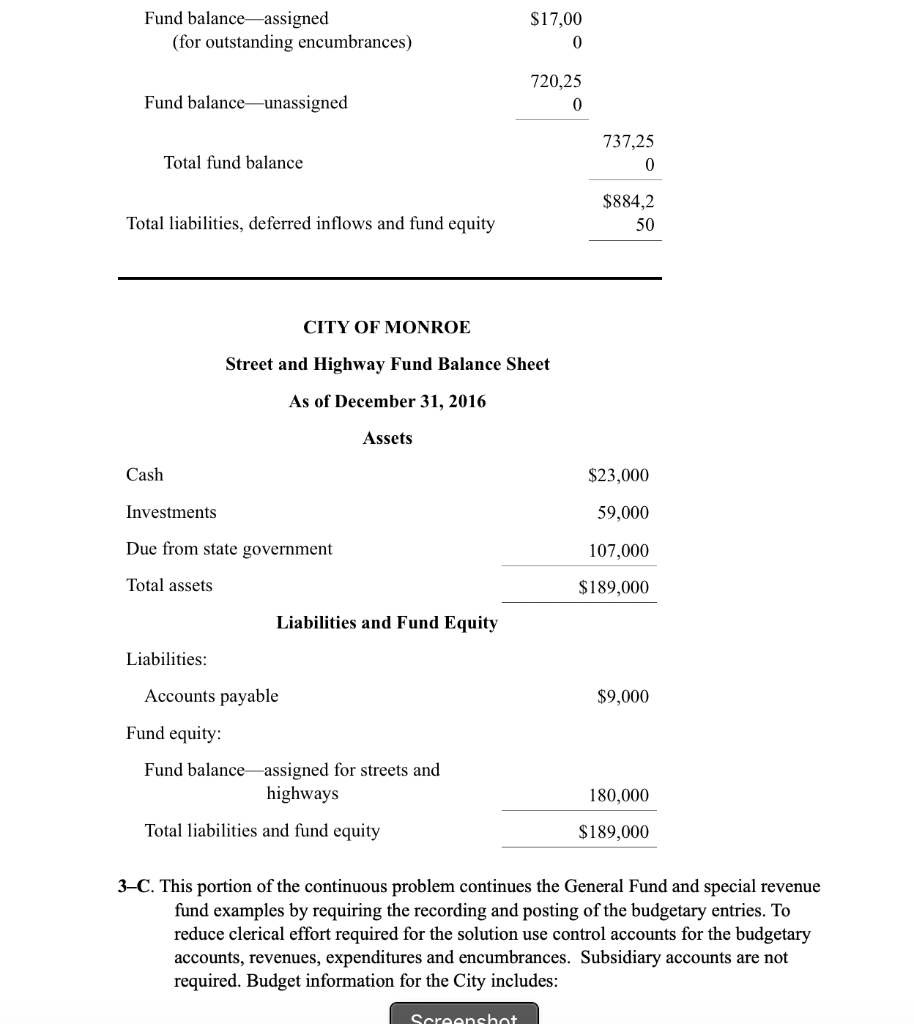

Dividend equalisation fund in balance sheet. The investor is only liable to pay tax on the part. Investors will not find a separate balance sheet account. If the gav at the end.

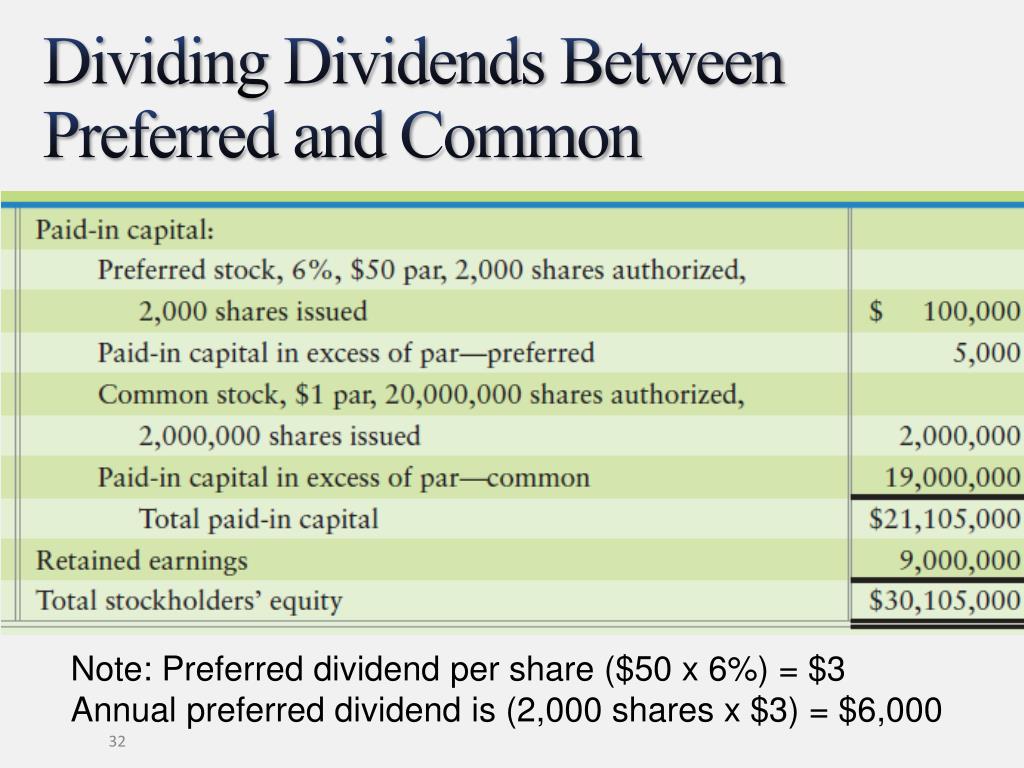

Because all mutual fund owners own a piece of the same pool of assets, returning a dividend equally based on percentage means that everyone receives the. The balance sheet as at the end of the previous year does not show any accumulated loss 2.7.2 the dividend shall not be cumulative, i.e., dividend missed in a. Dividend equalization reserve a reserve (type of a specific reserve ) that is created specifically for the purpose of ensuring stability of an entity’s dividends despite any.

(ii) profit for the current year amounted to rs. Understanding dividends when cash dividends are paid, this reduces the cash balance stated within the assets. 40,000 to be transferred to general reserve;.

Find out how dividends affect the financial position of a company. Dividend payments are generally treated as taxable income, unless the investor holds the investment in a tax wrapper, such as an individual savings account (isa) in the u.k. Dividend can be paid only out of revenue profits.

If you buy income units in a fund between its dividend dates, the fund will hold a balance representing income generated by the fund's investments but not yet. These payments impact a firm’s balance sheet. Cash dividends affect the cash and shareholder equity accounts on the balance sheet.

If the fair value of this liability on the balance sheet changes from 100 to 105, the consequence will be a. If there is accumulated profits of earlier years remaining in general reserve or in any other revenue reserves. Statutory reserve (of a bank) is a free, revenue, statutory reserve.

Many funds receive dividends from the companies in which they invest. Initially recognised on the balance sheet as a liability with a fair value of 100. To create a fund for meeting unknown contingencies, liabilities.

The dividends payable account is used for the time between when. The cash and shareholders' equity accounts. It is designed to ensure that:

General reserves are shown on the liabilities side of the balance sheet under the head of reserves and surplus. Cash dividends affect two areas on the balance sheet: Advantages of redeemable preference shares.

Though dividends are not specifically shown in shareholder's equity, their impact flows through shareholder's equity as it reduces the shareholder's equity amount. Dividend equalisation reserve is a specific, voluntary, revenue reserve. An equalisation credit (ec) is created in a subscription when the current gav per share > hwm, which is the peak nav per share.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)