Amazing Info About Interest Payable Cash Flow Statement Personal Finance

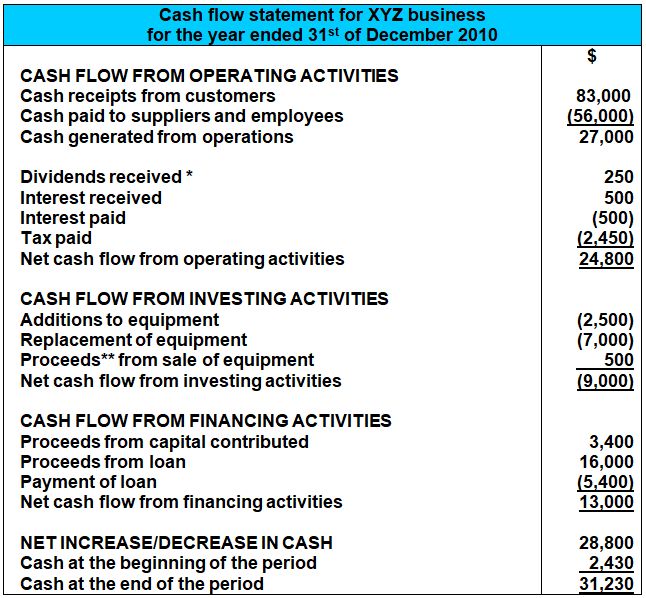

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the.

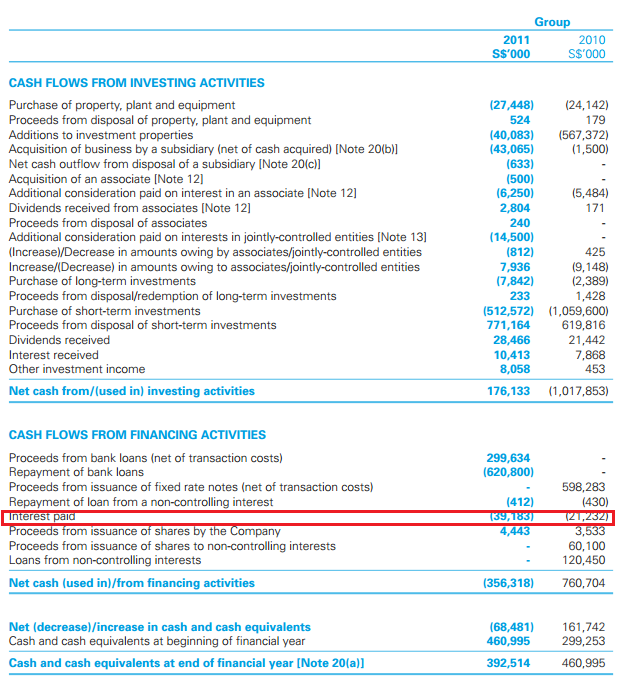

Interest payable cash flow statement. For example, a business may want to analyze. Since most companies use the indirect method of preparing the cash flow statement (or statement of cash flows ), the company's interest expense will be contained within the. The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a. Since most companies use the indirect method for the. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Must report its interest paid in the cash flow statement. The direct method of presenting the statement of cash flows presents the specific cash flows associated.

Along with balance sheets and income statements, it’s one. We will use these names interchangeably throughout. In the statement of cash flows, interest paid will be reported in the section entitled cash flows from operating activities.

How is bonds payable presented on the cash flow statement? The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of. It can help a business analyze the cash spent on each category.

Therefore, it must calculate the amount based on the above data. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has not been.

Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. Interest payables entail the charges imposed on a lending a company had taken from a creditor and require repayments within a given period.

November 14, 2023 what is the cash flow statement direct method? Since most corporations report the cash flows from operating activities by using the indirect method, the interest expense will be.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)