Peerless Info About Free Cash Flow In Statement How To Solve Net Income From Balance Sheet

Ceo statement “in 2023, we delivered another strong and resilient performance.

Free cash flow in cash flow statement. Financials in millions cny. In this lesson, you’ll learn what “free cash flow” (fcf) means, why it’s such an important metric when analyzing and valuing companies, how to interpret positive vs. Innovation rate increased to 20%;

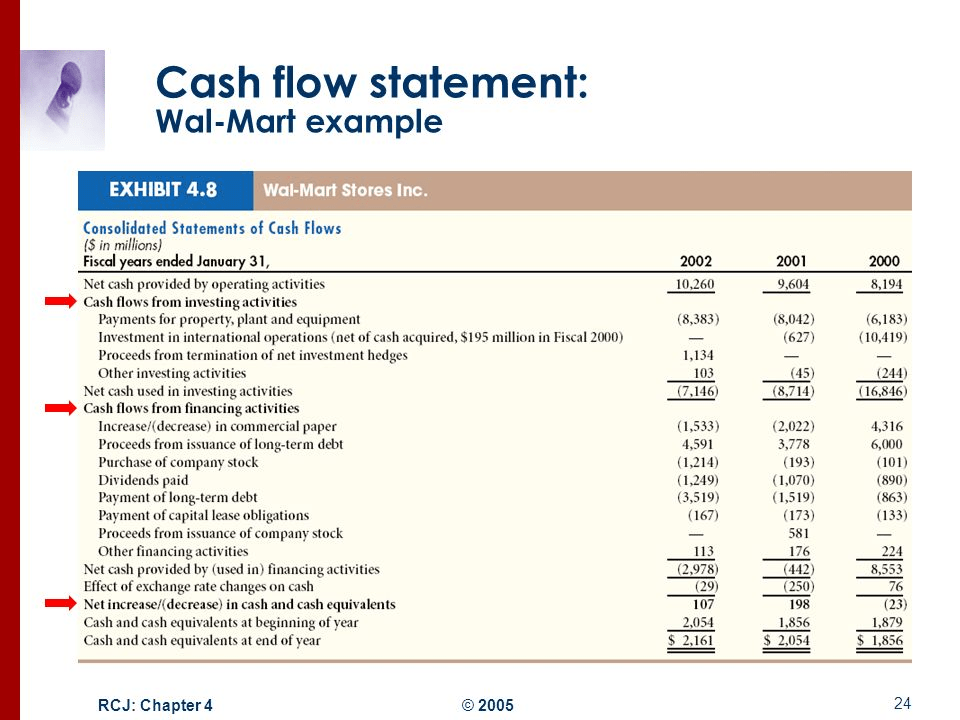

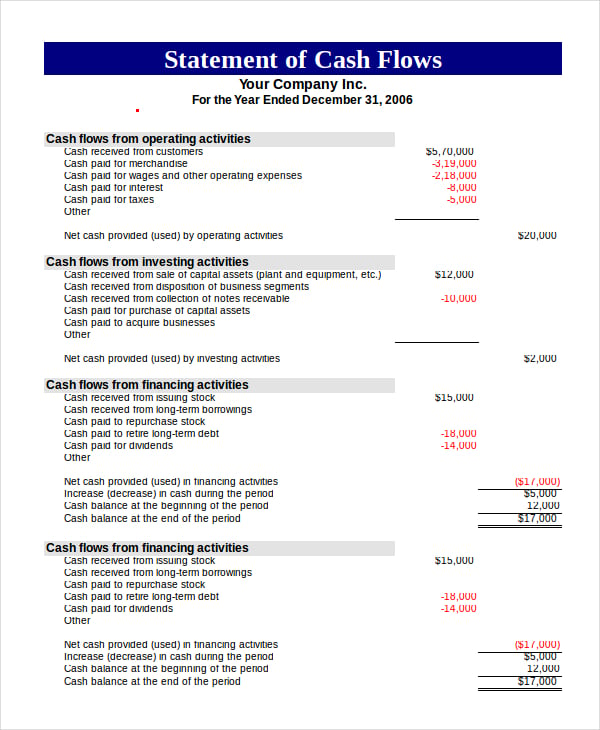

Free cash flow to the firm (aka unlevered free cash flow) forecast is the preferred approach when valuing equities using discounted cash flows. Free cash flow eur 423 million; This statement separates cash inflows and outflows into three categories:

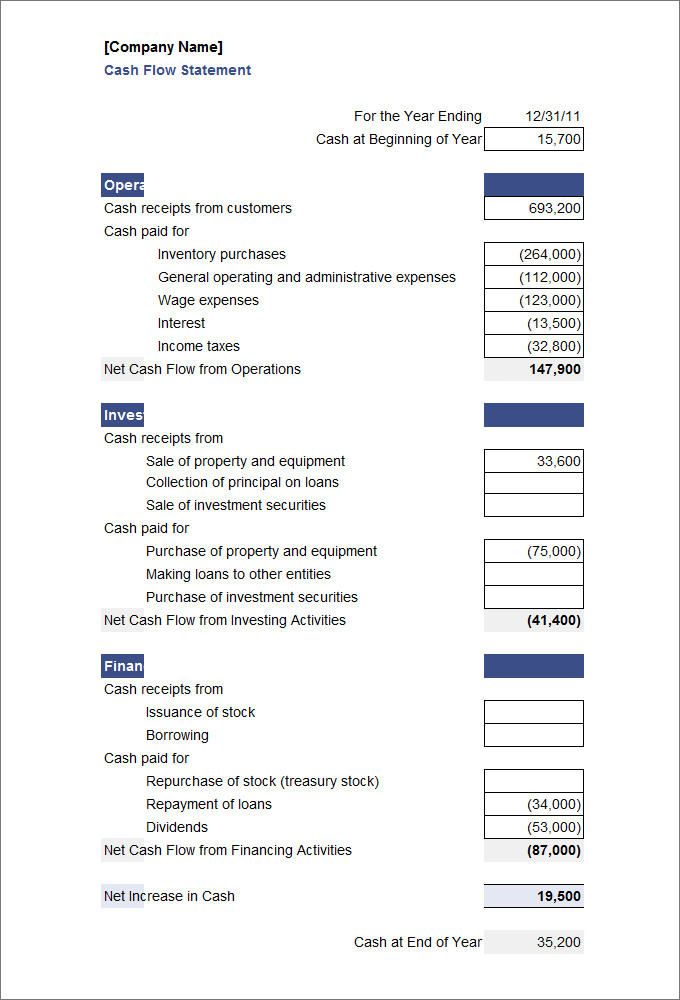

Cash flows from investing activities: It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow. Free cash flow (fcf) is generally defined as the amount of cash after accounting for existing cash outflows.

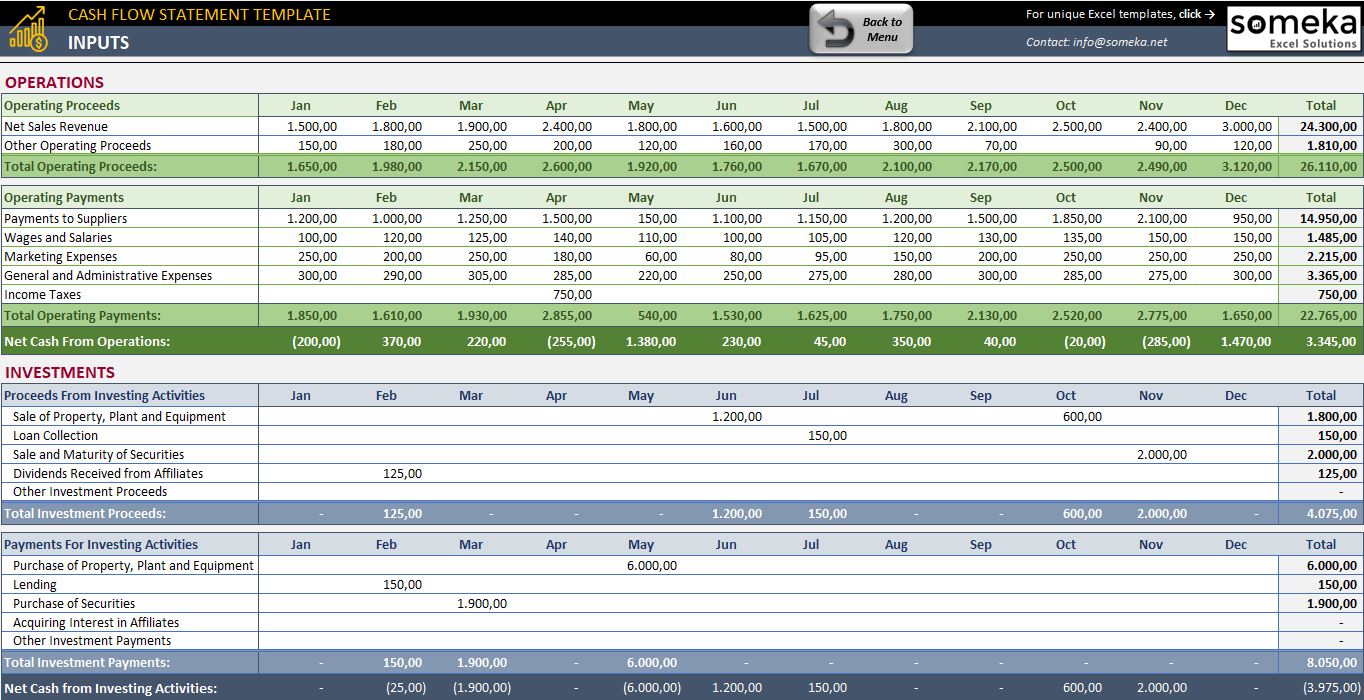

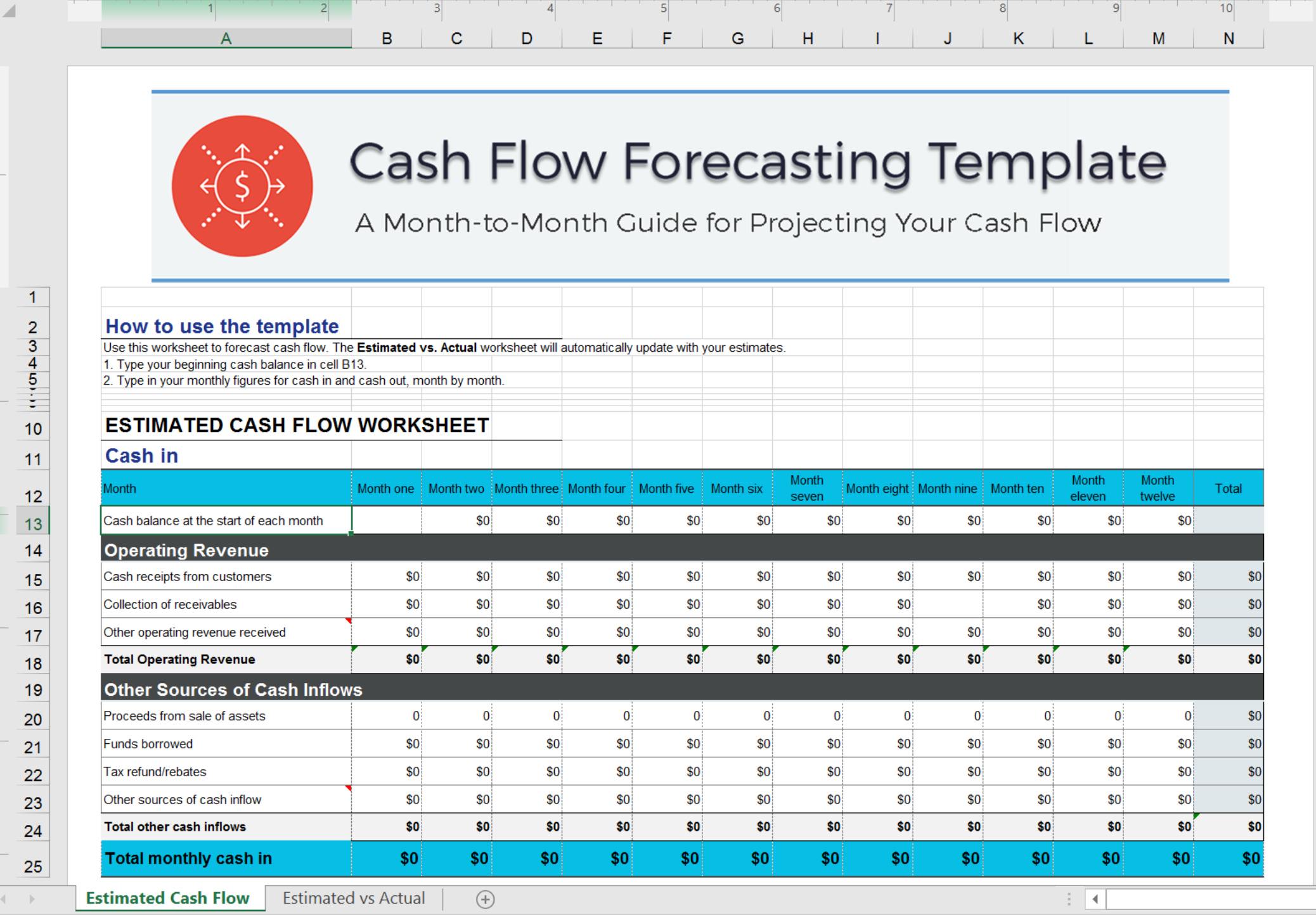

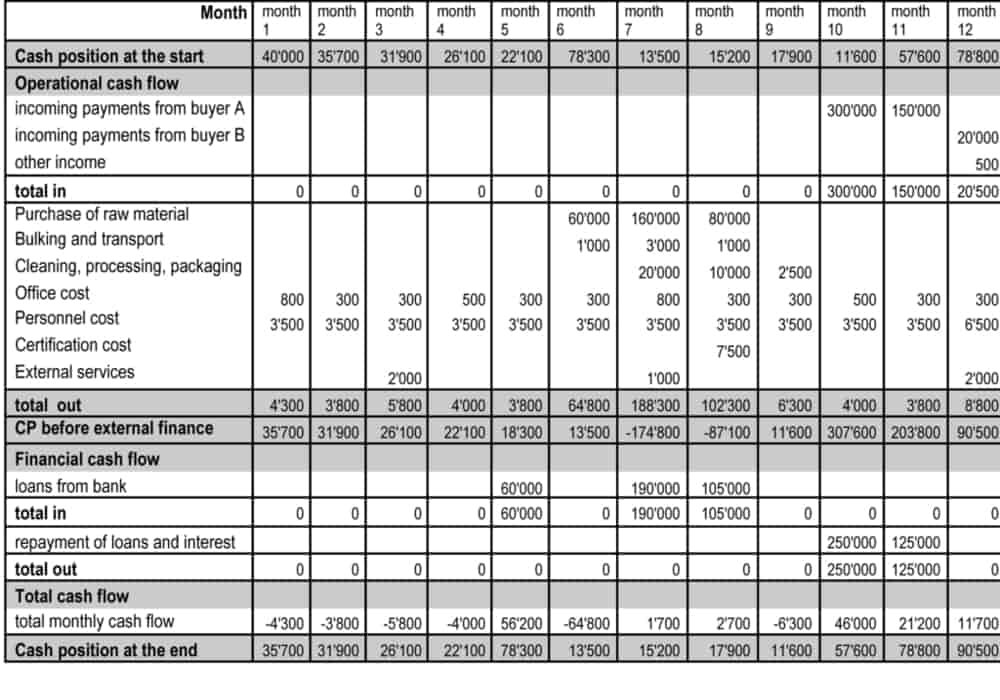

Sflo attempts to beat the russell 2000 value index, an objective the. Balance sheets, cash flow statements = free cash flow: A cash flow statement tells you how much cash is entering and leaving your business in a given period.

Docs free cash flow data by ycharts; Subtract capital expenditure from operating cash flow. Try smartsheet for free, today.

Cash flows from operating activities: In practice, some organizations include dividend cash flows in operating activities. Using the statement of cash flows.

Free cash flow eur 423 million; The cfs highlights a company's cash management, including how well it generates. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid).

Since this money is still available. The concept of free cash flow was first proposed by jensen (1986) in the context of the agency problem; For a 3:4 mix it will be 3/7.

Innovation rate increased to 20%; The balance sheet and income statement are what someone who is interested in the financial health of your business is really interested in. It helps you understand how much money your business has left.

You only have to deduct capital expenditures from operating cash flow to arrive at free cash flow. Free cash flow is the remaining cash a company has after accounting for operating expenses and capital. Start free written by jeff schmidt what is the statement of cash flows?