Top Notch Tips About Fraudulent Financial Reporting Examples Reconciliation Of Net Income To Cash Flow From Operations

Fraudulent financial reporting and other forms of earnings misstatement are catastrophic and pose a considerable threat to capital market stability.

Fraudulent financial reporting examples. In finding that the defendants were able to purchase the old post office in washington, d.c., through their use of the fraudulent financial statements, justice. Sir donald brydon identified fraud as one of the most complex areas of audit, and our report suggests ways in which auditors can rise to the challenge. When a new york judge delivers a final ruling in donald j.

The factors that contributed to the misstatement included pressure from the capital markets, the compensation system, the ceo's shareholding, poor corporate. Financial reporting fraud and other forms of financial reporting misconduct (hereafter, financial reporting misconduct) are a significant threat to the existence and. Identifying this type of fraud can be difficult as.

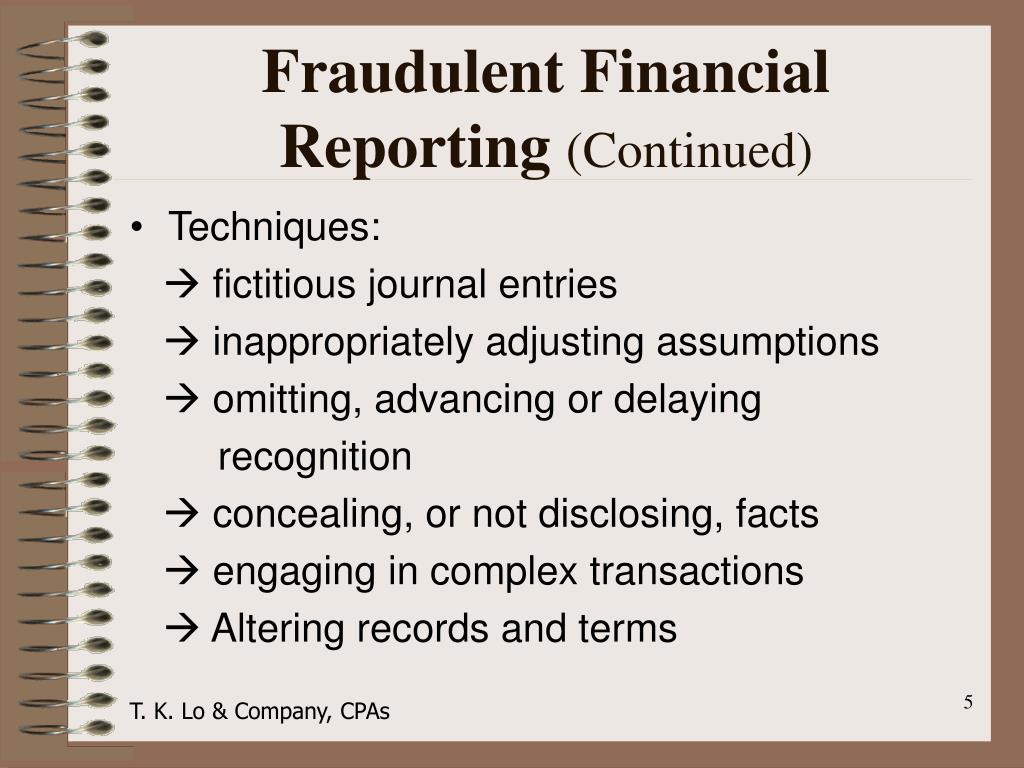

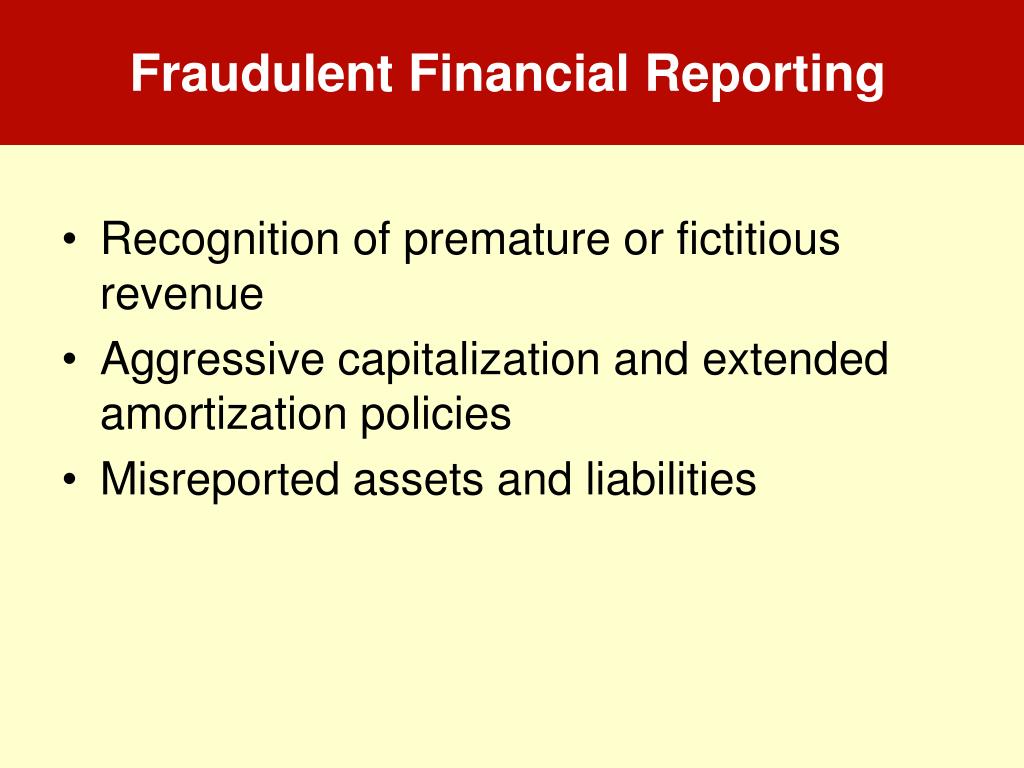

Large accounting scandals occur regularly (e.g., enron, worldcom, waste management, toshiba, luckin. The goal is usually to steal. Fraudulent financial reporting can entail (a) deception, such as manipulation, falsification, or distortion of accounting records or related documents used to create the.

Fraudulent financial reporting is an important issue in the economy. Trump’s civil fraud trial as soon as friday, the former president could. Examples of risks of fraudulent financial reporting misstatements that may be heightened in the current environment include:

16, 2024 updated 9:59 a.m. Two examples of fraudulent financial reporting are accelerating the timing of recording sales revenue to increased reported sales and earnings, and recording expenses as. Misstatements resulting from misappropriation of assets (for example, theft).

Fraudulent financial reporting practices and accounting frauds have occurred in all eras, in all countries, and affected many organizations, regardless of their. Newly released federal trade commission data show that consumers reported losing more than $10 billion to fraud in 2023, marking the first time that fraud. Based on the test results, it shows that financial targets, external pressure, ineffective monitoring, auditor change, changes in directors, and many numbers of ceo’s pictures.

A senior accountant deliberately manipulates the firm’s expenses and liabilities on the financial statement to improve the overall performance of the firm and convince investors that the company is not in debt and can face its. This paper aims to examine cases of fraudulent financial reporting (ffr) which were subject to published enforcement actions by the securities. Let’s look at an example.

The following examples are some of the biggest scandals utilized on wall street prior to the new financial reporting requirements. Large accounting scandals occur regularly (e.g., enron, worldcom, waste management,. Census data with sec enforcement actions to examine employees’ outcomes, such as wages and turnover, before, during, and after periods of.