Awesome Info About Non Cash Investing And Financing Activities Corporate Balance Sheet Template How To Read A For Dummies

What is the balance sheet?

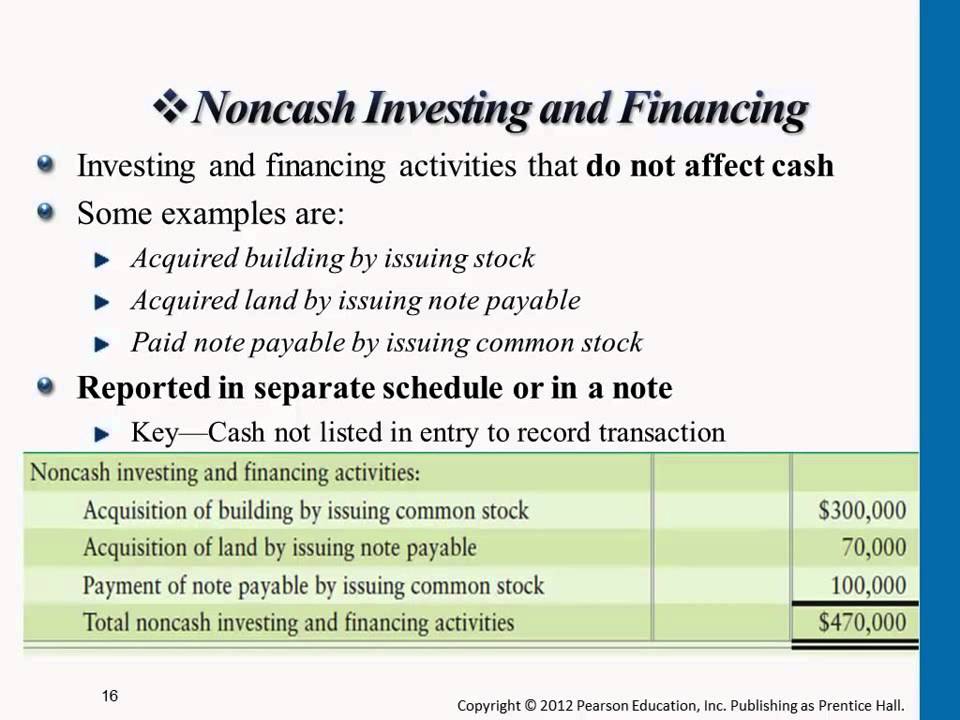

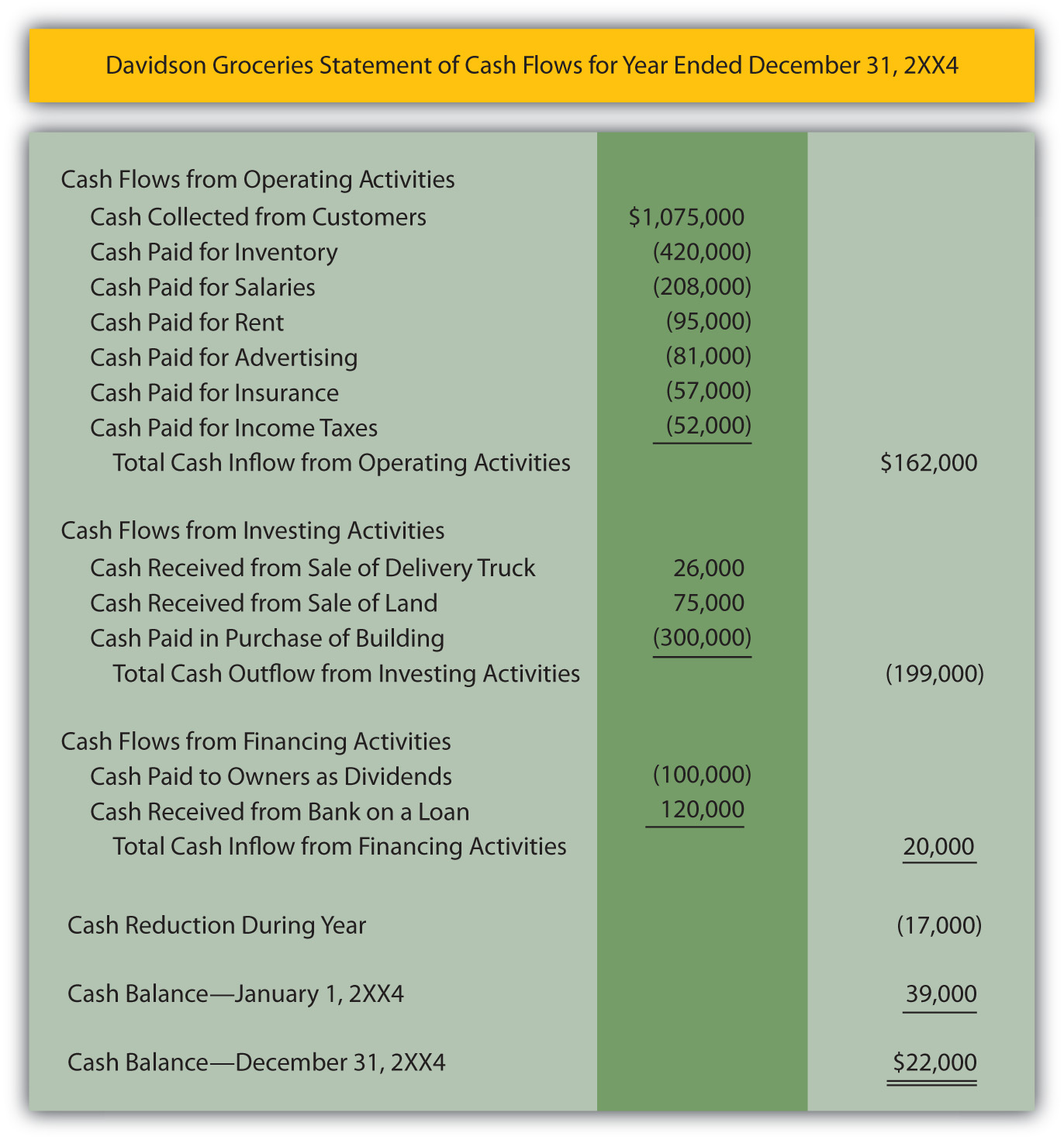

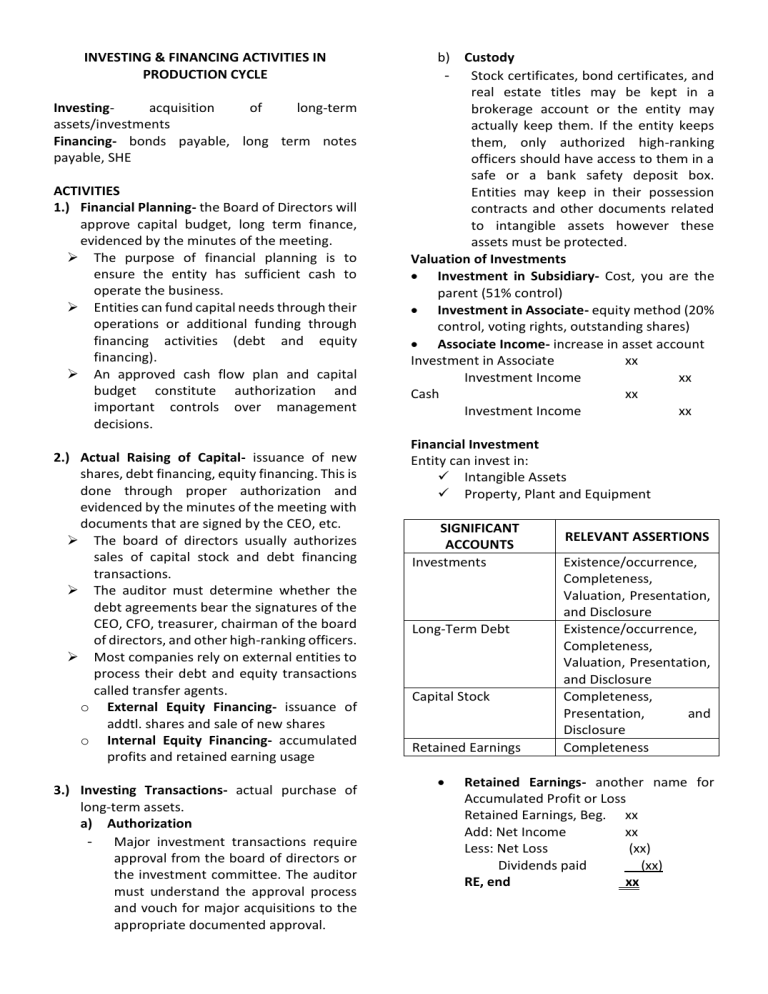

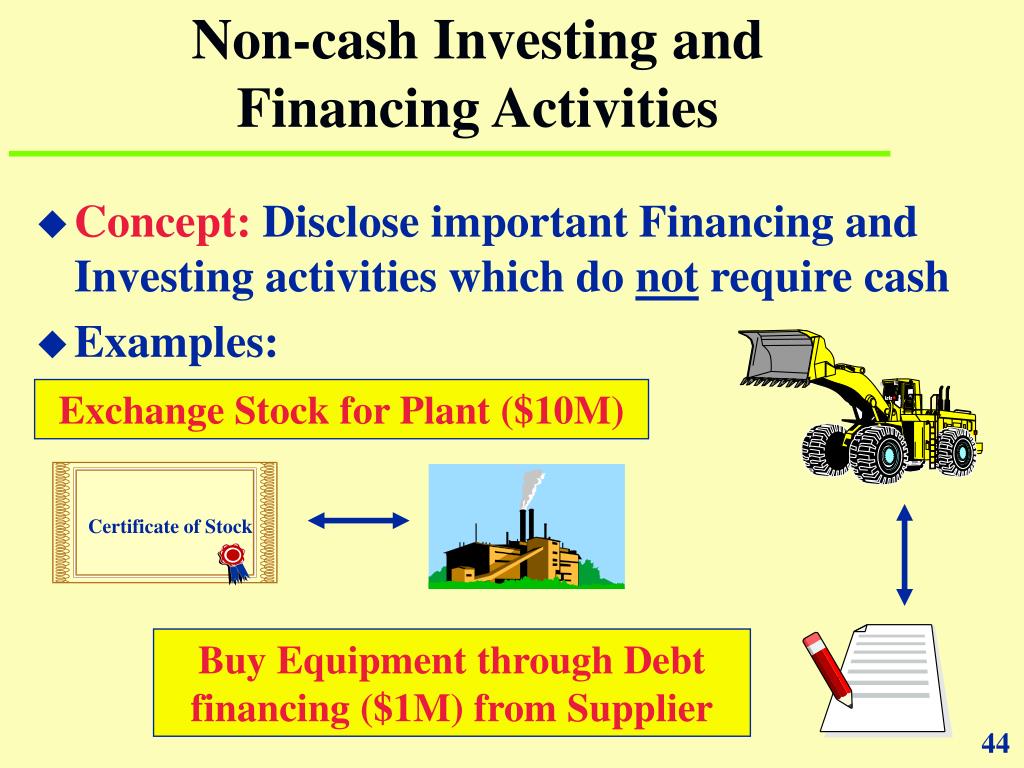

Non cash investing and financing activities corporate balance sheet template. Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity. Noncash investing and financing activities investing and financing activities that do not involve cash are not reported in the cash flow statement since there is no cash flow involved. In order to prepare a cash flow statement, we need to understand which items on our income statement and balance sheet may not involve the transfer of cash, thus will.

Cash and cash equivalents are those items on the balance sheet that are liquid assets. The company’s policy is to report noncash investing and financing activities in a separate statement, after the presentation of the statement of cash flows. Initial balance sheet.

Reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows interest and dividends taxes on income 17 18 21 22 25 These activities are therefore not reported on the cash flow statement. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period.

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Begin with net income from the income statement. Fixed assets are shown net of accumulated depreciation on the balance sheet.

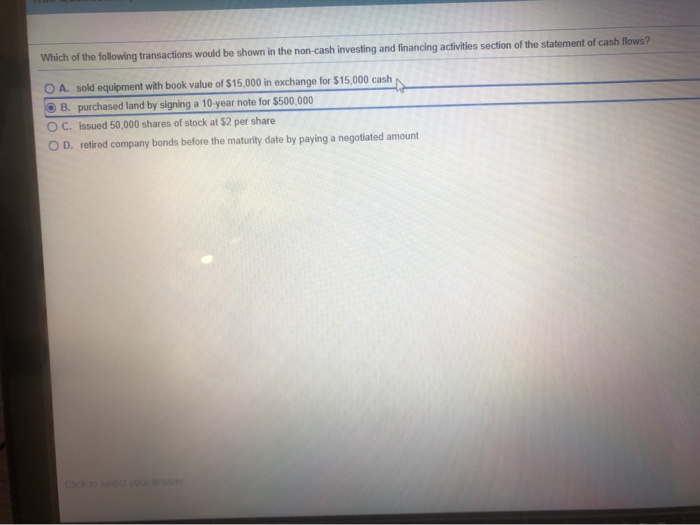

Now let me switch to our 2024 financial outlook. Chapter 5 — noncash investing and financing activities. This noncash investing and financing transaction was inadvertently included in both the financing section as a source of cash, and the investing section as a use of cash.

In addition to activities that generate cash flows (operating, investing, and financing), companies also engage in investing and financing activities that do not generate any cash flows. (9) purchases a patent on a machine process for $90,000 cash. Typically, investments are securities held for more than a year.

Add back noncash expenses, such as depreciation, amortization, and depletion. (8) issues a check for $1,800 for 3 months rent in advance for office space.

The balance sheet displays the company’s total assets and how the assets are. If an investment will be sold sooner, it belongs under “cash” on the balance sheet, and is then called a “marketable security.” We also expect to minimize the combined net cash outflow from investing and financing activities, by shifting to more efficient funding and capital structures, supported by our recent strong funding execution and stabilizing asset performance.

Download cfi’s free excel template and start practicing today. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. Analysis and income statement presentation.

Why is the cash flow statement important? Discover how disclosures occur, how to report them, and why it's essential to become familiar with them. Business owners can use it to evaluate performance and.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)