Ace Info About The Basic Financial Statements Include Cpa Audit Report

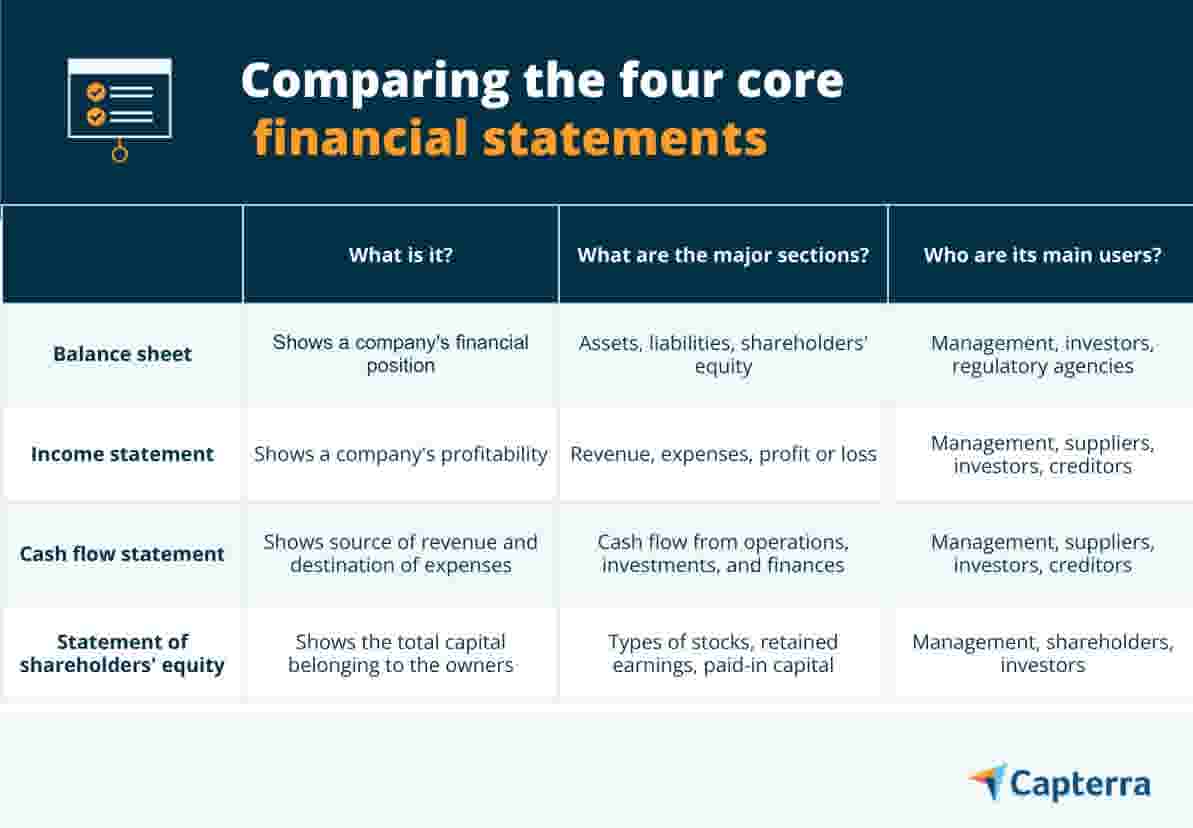

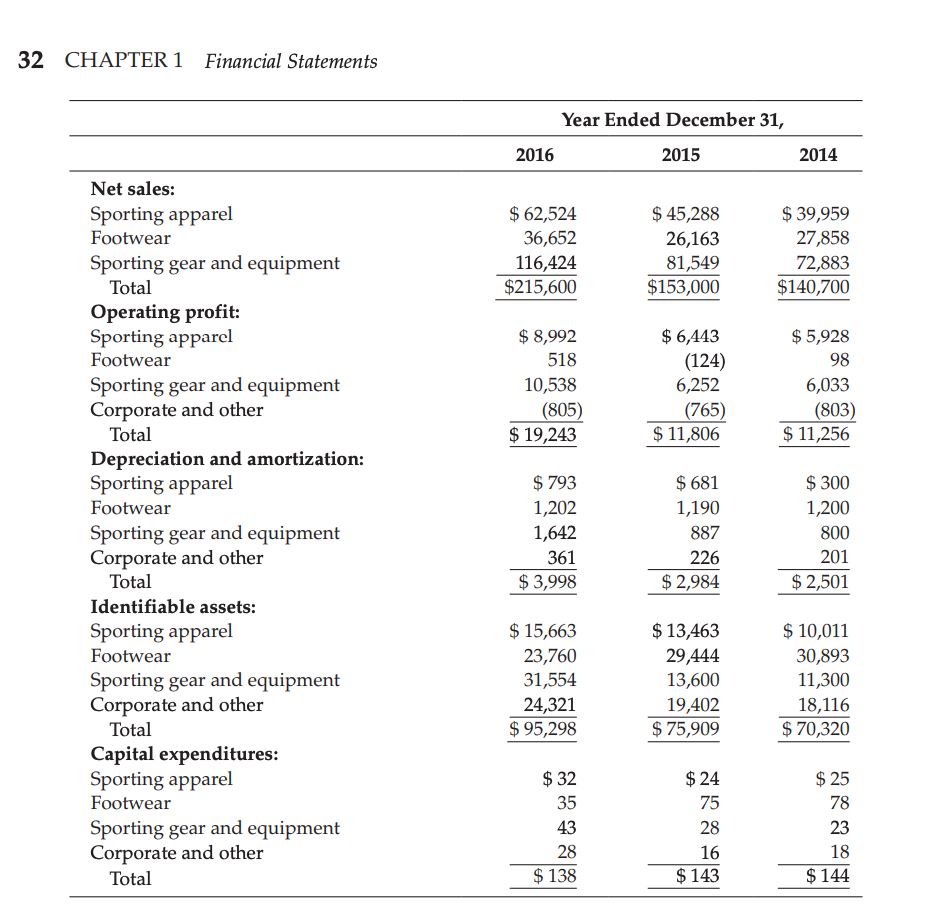

The basic financial statements of an enterprise include the 1) balance sheet (or statement of financial position), 2) income statement, 3) cash flow statement, and 4) statement of changes.

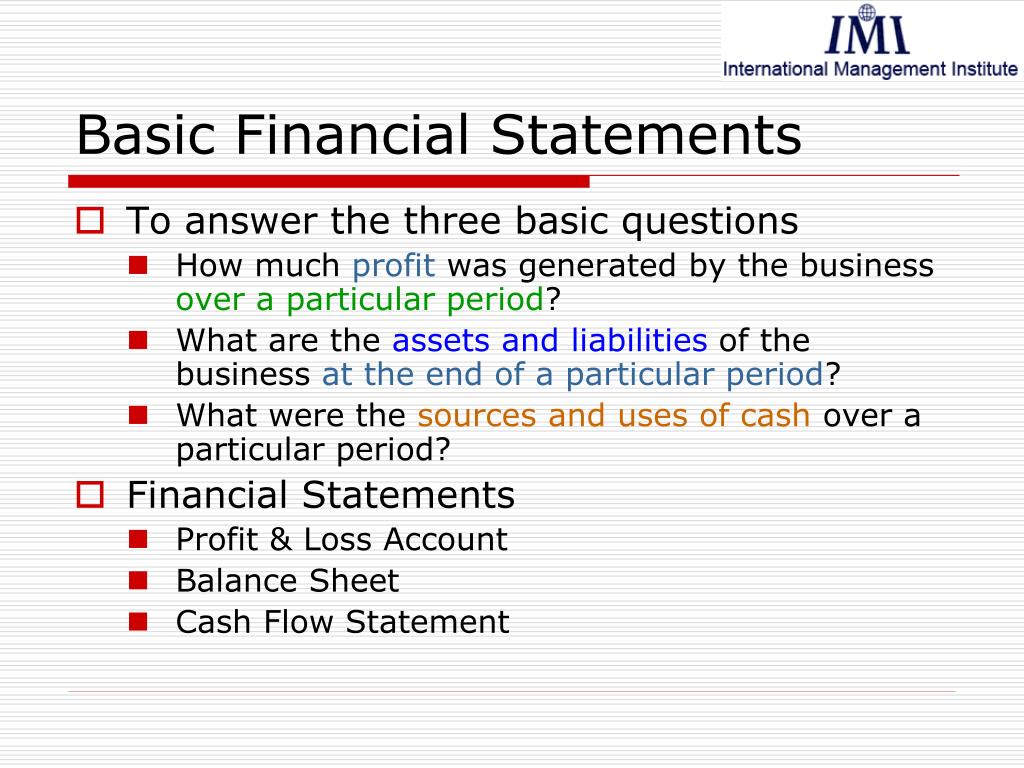

The basic financial statements include. The four basic statements summarize the financial activities of the business. Identify the basic financial statements: These are good questions and they deserve an answer.

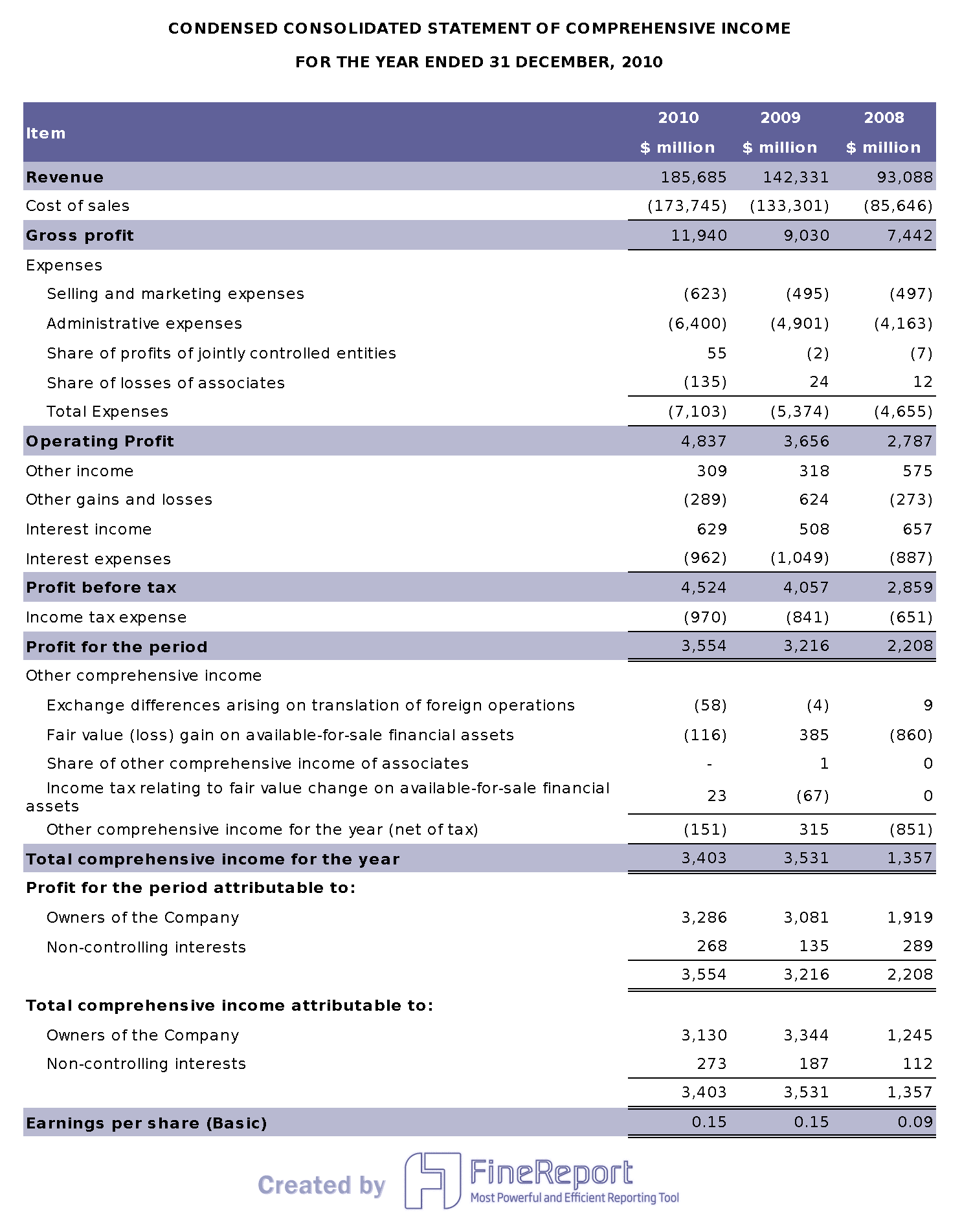

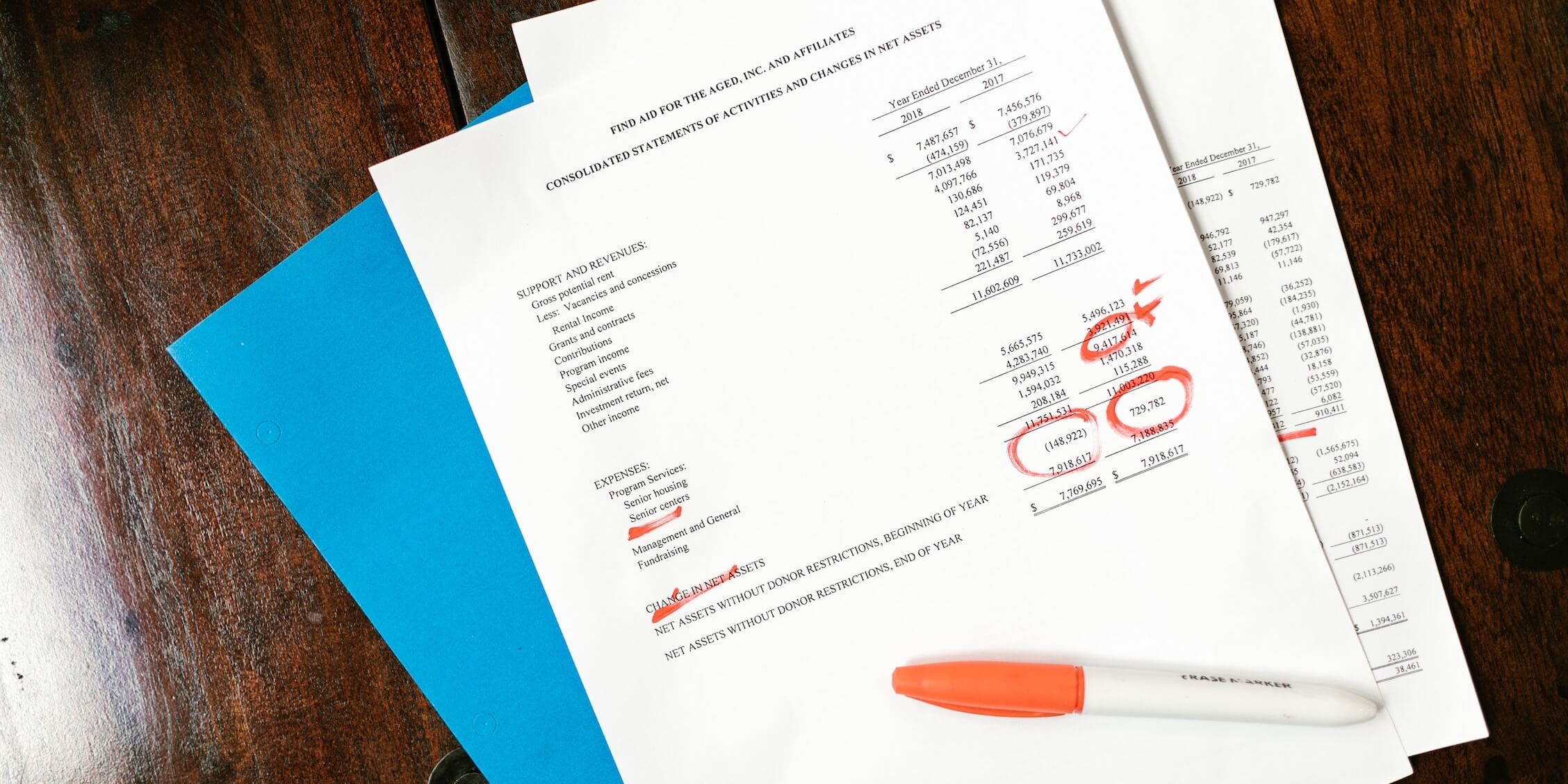

At the top, the statement breaks the company's revenue down by source—for most businesses, that means the sales of goods, services, or both. They show you the money. These principles require a company to create and maintain three main financial statements:

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. What are the financial statements? Financial statements to use the financial statements used in investment analysis are the balance sheet, the income statement, and the cash flow statement with additional analysis of a.

What does it tell us? Income statement an income statement, also known as a profit and loss (p&l) statement, shows you your business’s profits and losses over a certain period of time. Each of the financial statements provides important financial information for both internal and external stakeholders of a company.

The four basic financial statements that businesses and organizations use to track profits, expenses and other financial information work together to form a complete picture of a company's financial health. You can use an income statement to look at your profits and losses on a weekly, monthly, quarterly, or annual basis. Financial statements are records that reflect how a company has performed financially in a fiscal year.

The basic financial statements include all of the following except: Recognize key elements in every financial statement, including assets, liabilities, revenues, expenses, change in net assets, change in. Balance sheet, income statement, and cash flow statements.

There are four main financial statements. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three statements together show the assets and liabilities of a.

They show you where a company’s money came from, where it went, and where it is now. This opens the window for decision making and strategic planning, as well. The income statement, statement of retained earnings, balance sheet, and statement of cash flows, among other financial information, can be analyzed.

The income statement illustrates the profitability of a company under accrual accounting rules. The revenue section ends by. The balance sheet, the income statement, and the cash flow statement.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. And (4) statements of shareholders’ equity. Revenue and profit.

:max_bytes(150000):strip_icc()/exxonIS09-30-2018-5c5dc83c46e0fb00017dd129.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)