Brilliant Strategies Of Tips About Debt To Equity Ratio Means Disney Income Statement 2019

She takes a gander at the.

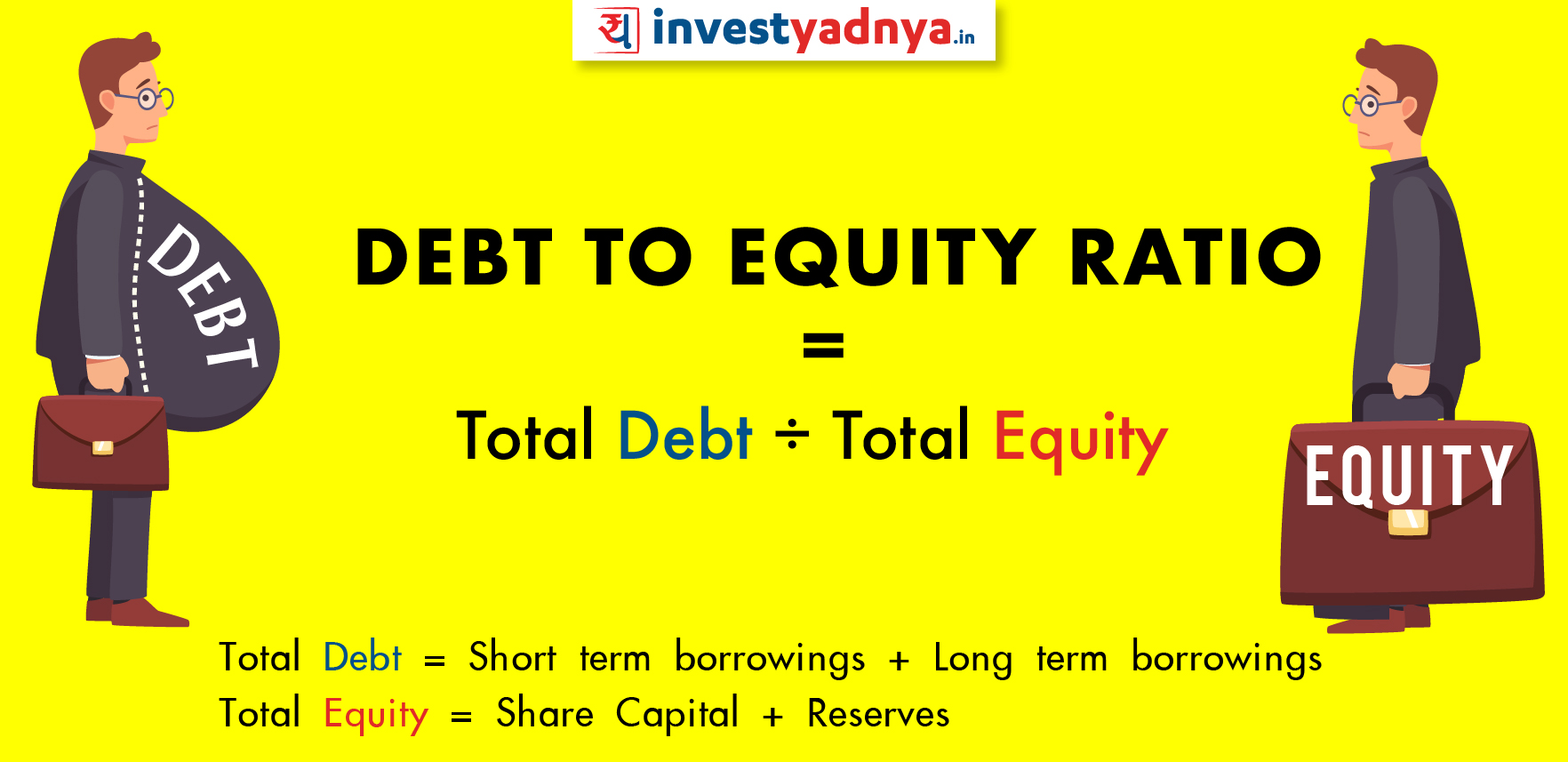

Debt to equity ratio means. Debt to equity ratio (der) = total utang / ekuitas. Dikutip dari laman accurate.id, begini cara menghitung debt to equity ratio yang memerlukan rumus tersendiri. Page couldn't load • instagram.

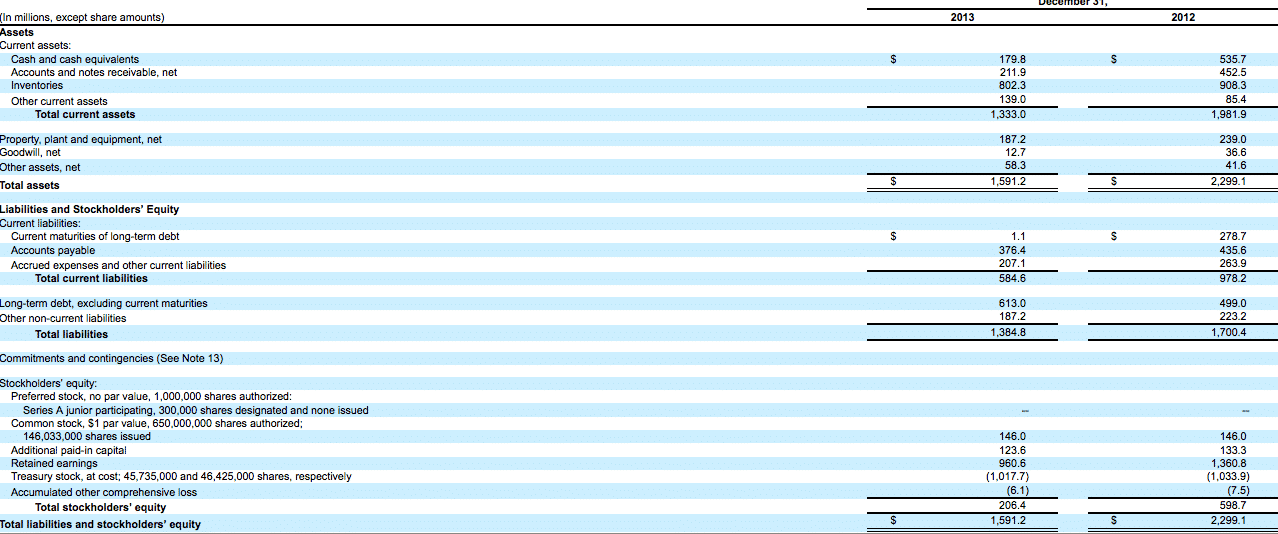

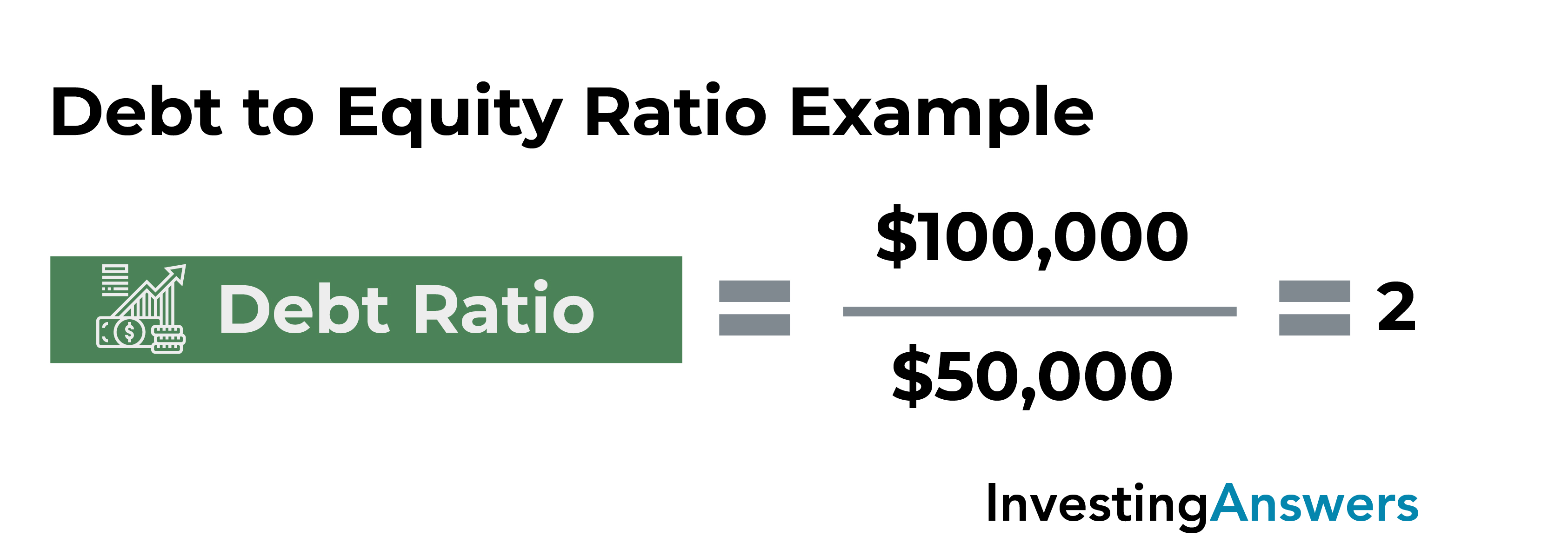

Even though shareholder’s equity should be stated on a book value basis, you can. $500,000 / $250,000 = 2. Here, all the liabilities that a.

Debt to equity ratio = total liabilities. This means that for every dollar of equity, company a has two dollars of debt. Utang atau yang disebut dengan liabilitas adalah kewajiban yang harus dibayar perusahaan secara tunai.

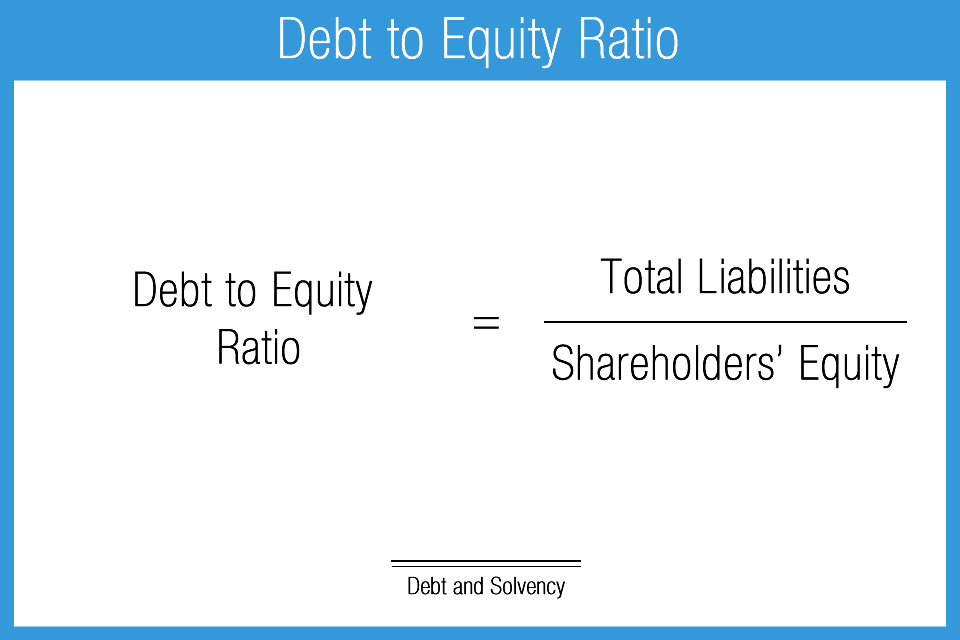

A d/e ratio greater than 1 indicates that a company has more debt than equity. Jennifer is an angel investor who has narrowed down to two the number of immersive art venues she wants to invest in. A debt to income ratio less than 1 indicates that a company has more equity than debt.

To find the d/e ratio, we divide total liabilities by shareholder’s equity: The ideal debt to equity ratio is 1:1. Company a has total liabilities of $500,000 and shareholder’s equity of $250,000.

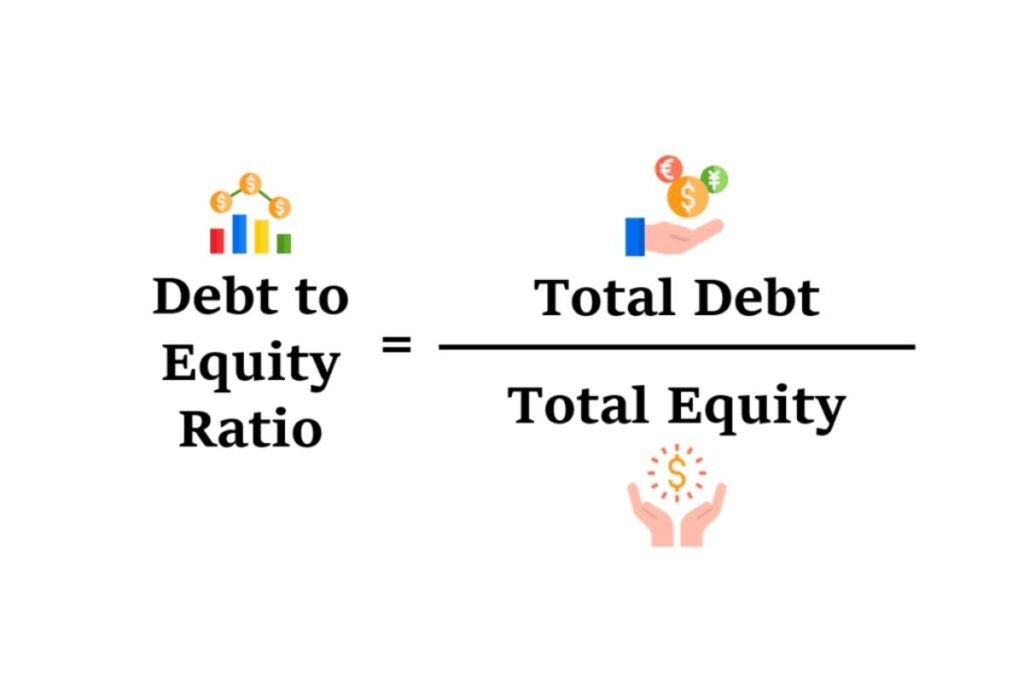

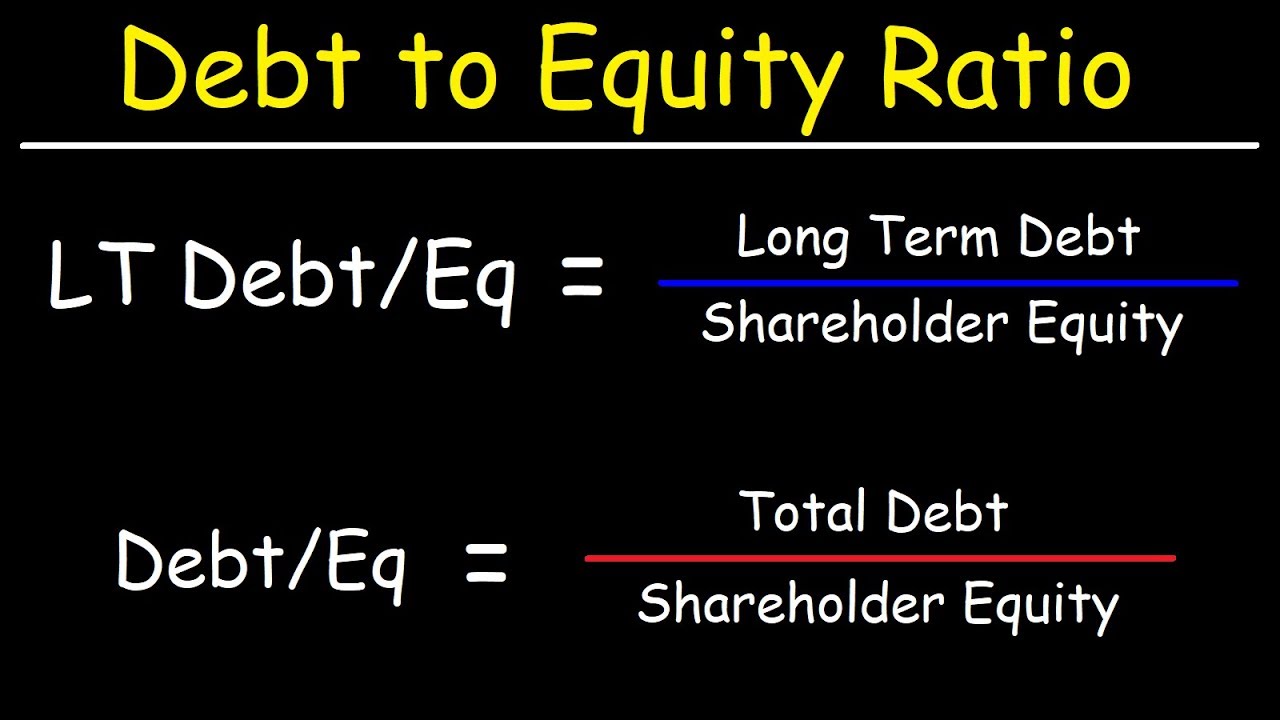

The d/e ratio is considered to be a gearing ratio, a financial ratio that compares the owner's equity or capital to. How to calculate debt to equity ratio (d/e)? What does the debt to equity ratio mean?

Debt to equity ratio formula & example. The de ratio of spicejet is. There's an issue and the page could not be loaded.

A de ratio of more than 2 is risky. A higher debt to equity ratio indicates that the company has taken on more debt relative to its equity, which can increase the risk of default if the company experiences financial difficulties.

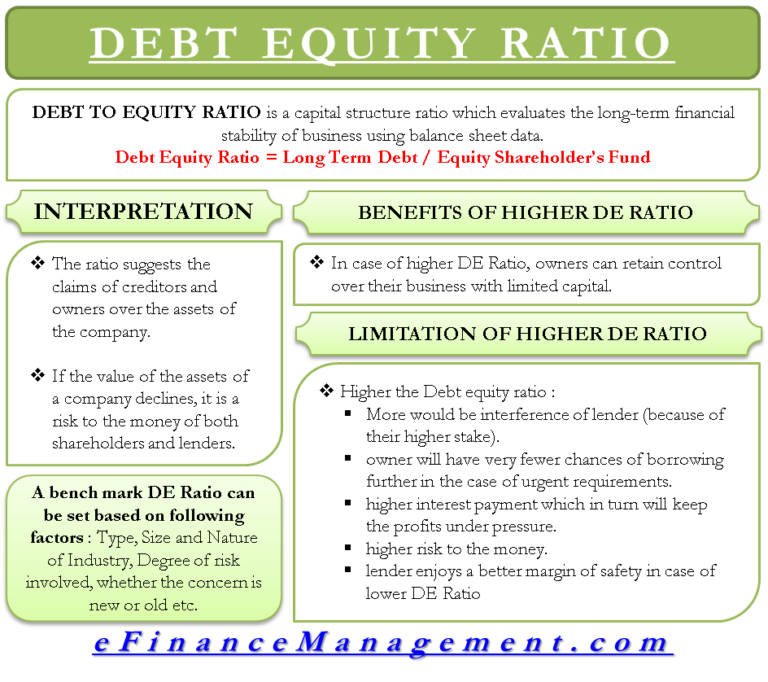

The debt to equity ratio (d/e) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account. This ratio measures how much debt a business has compared to its equity. To calculate it, you divide the company's total liabilities by total shareholder equity, like so:

In other words, it’s used to assess the extent that the company relies on. It is calculated by dividing the total liabilities. Companies with de ratio of less than 1 are relatively safer.

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)