Best Info About Comprehensive Income Tax How To Look At A Companys Financial Statements

A business income tax return is a crucial document.

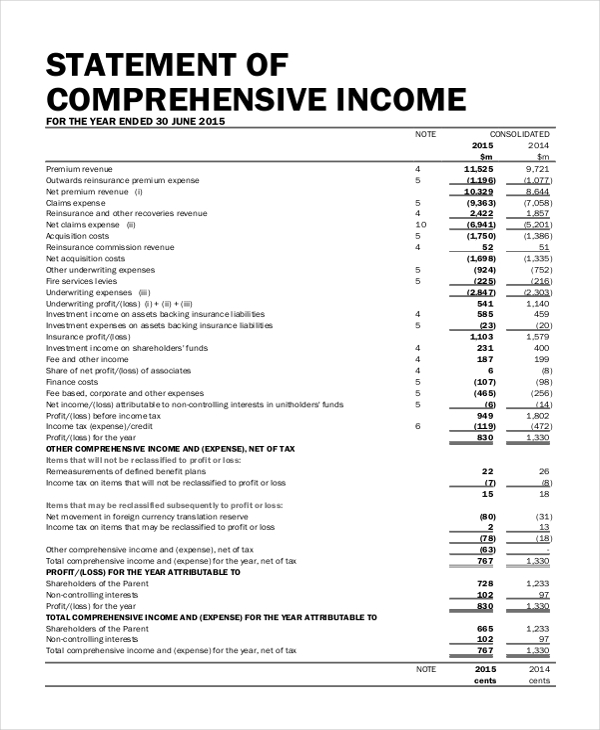

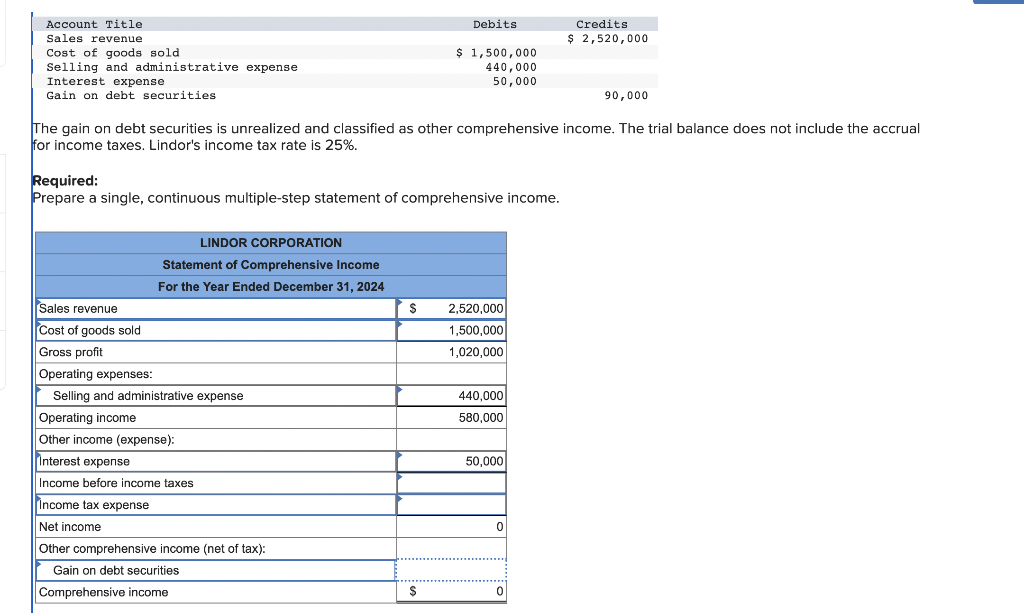

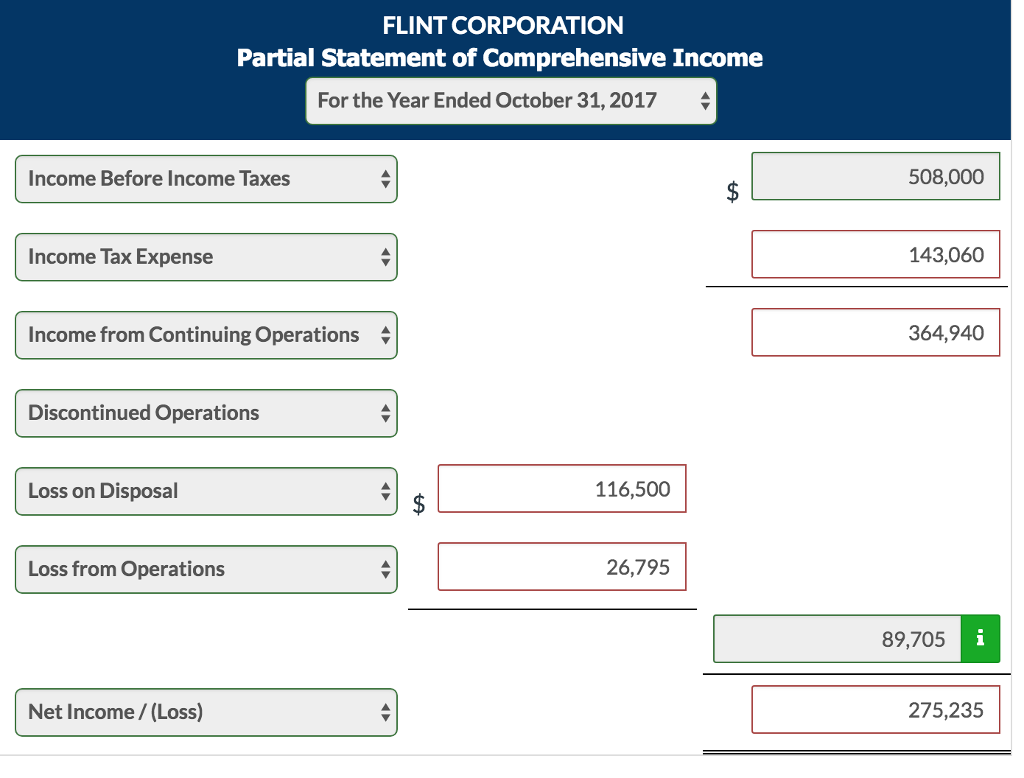

Comprehensive income tax. Comprehensive income is defined by the financial accounting standards board, or fasb, as “the change in equity [net assets] of a business enterprise during a. These amounts are shown without. Base of the proposed tax would include capital.

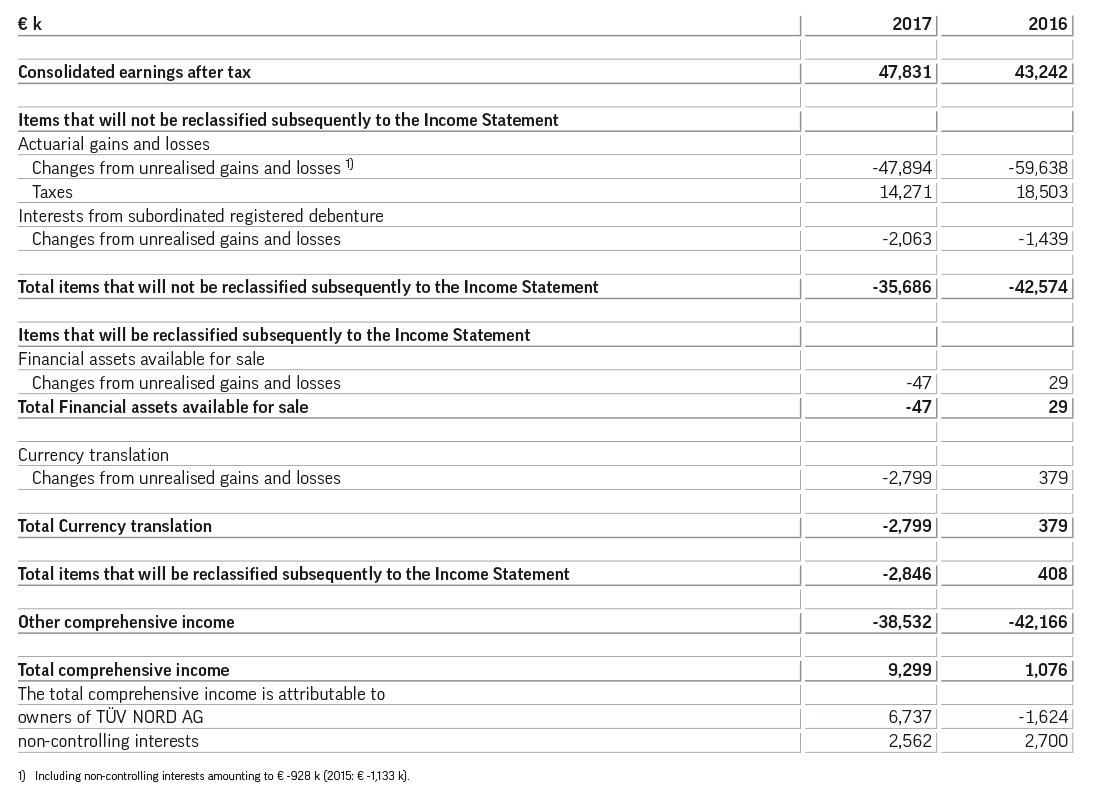

Other comprehensive income is shown on a company’s balance sheet. You can also consider sending an email to. Total other comprehensive (loss) gain, net of tax:

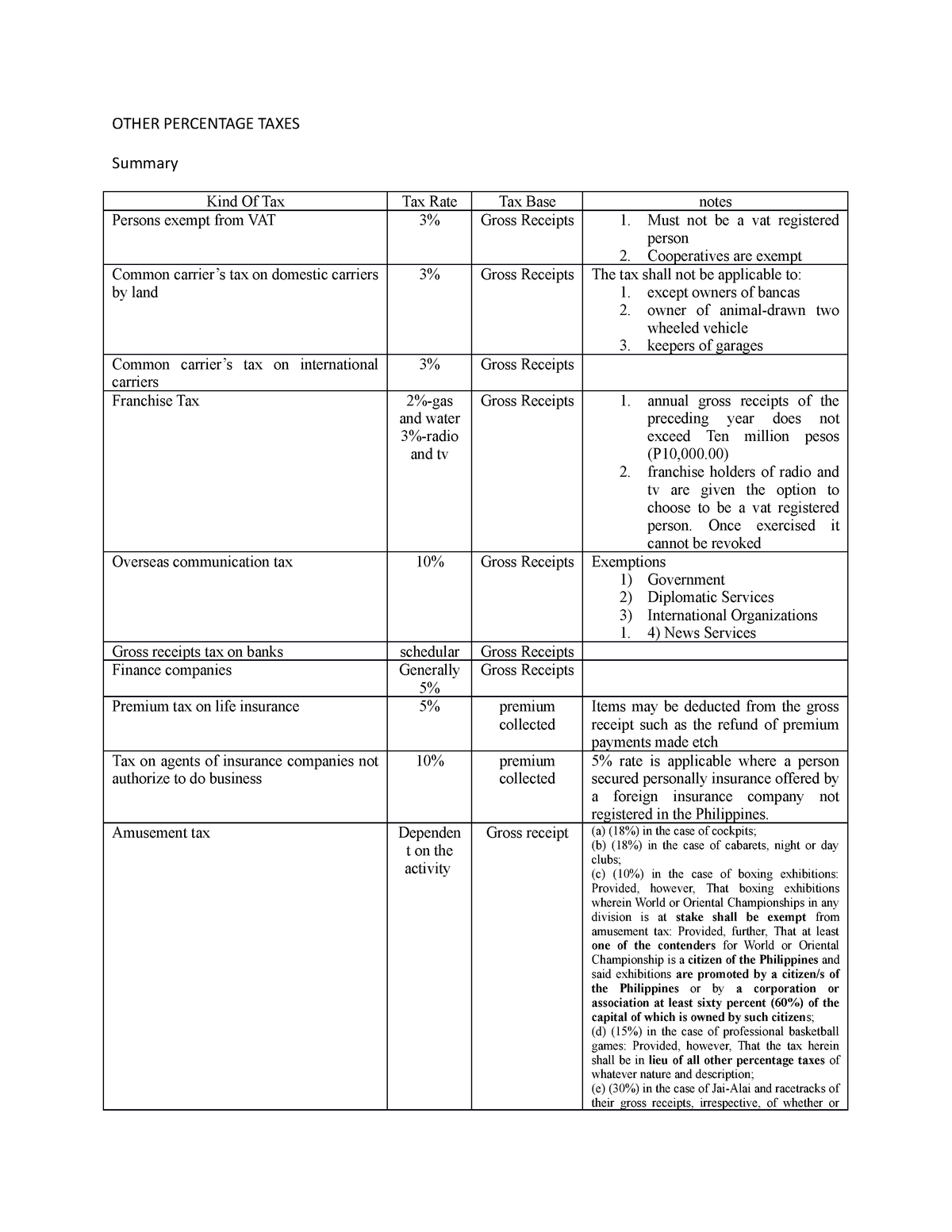

Personal income tax rates comprehensive income tax rates for residents, calculation of iit on annual comprehensive income is based on progressive tax rates (. A comprehensive guide to filing business income tax returns.

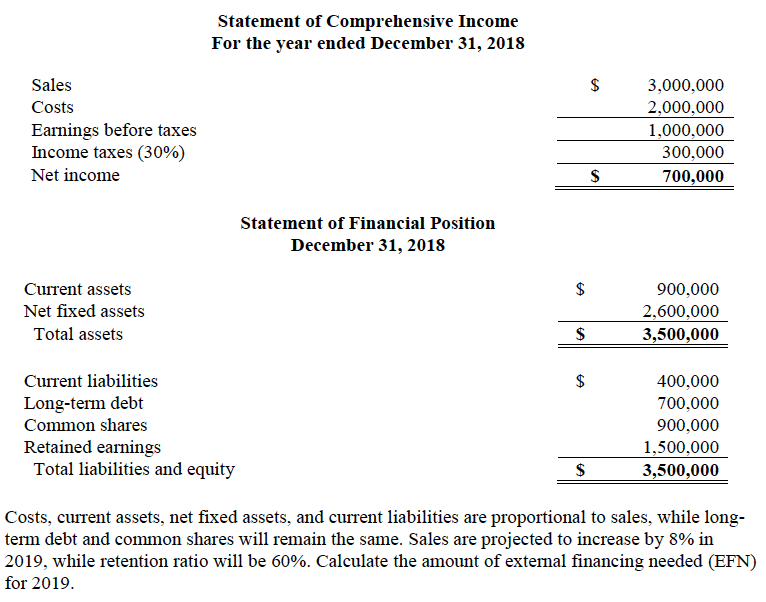

Comprehensive income tax published on by null. The purpose of income tax is to pay for public services and government obligations and toprovide goods for the public. The statement of financial accounting standards no.

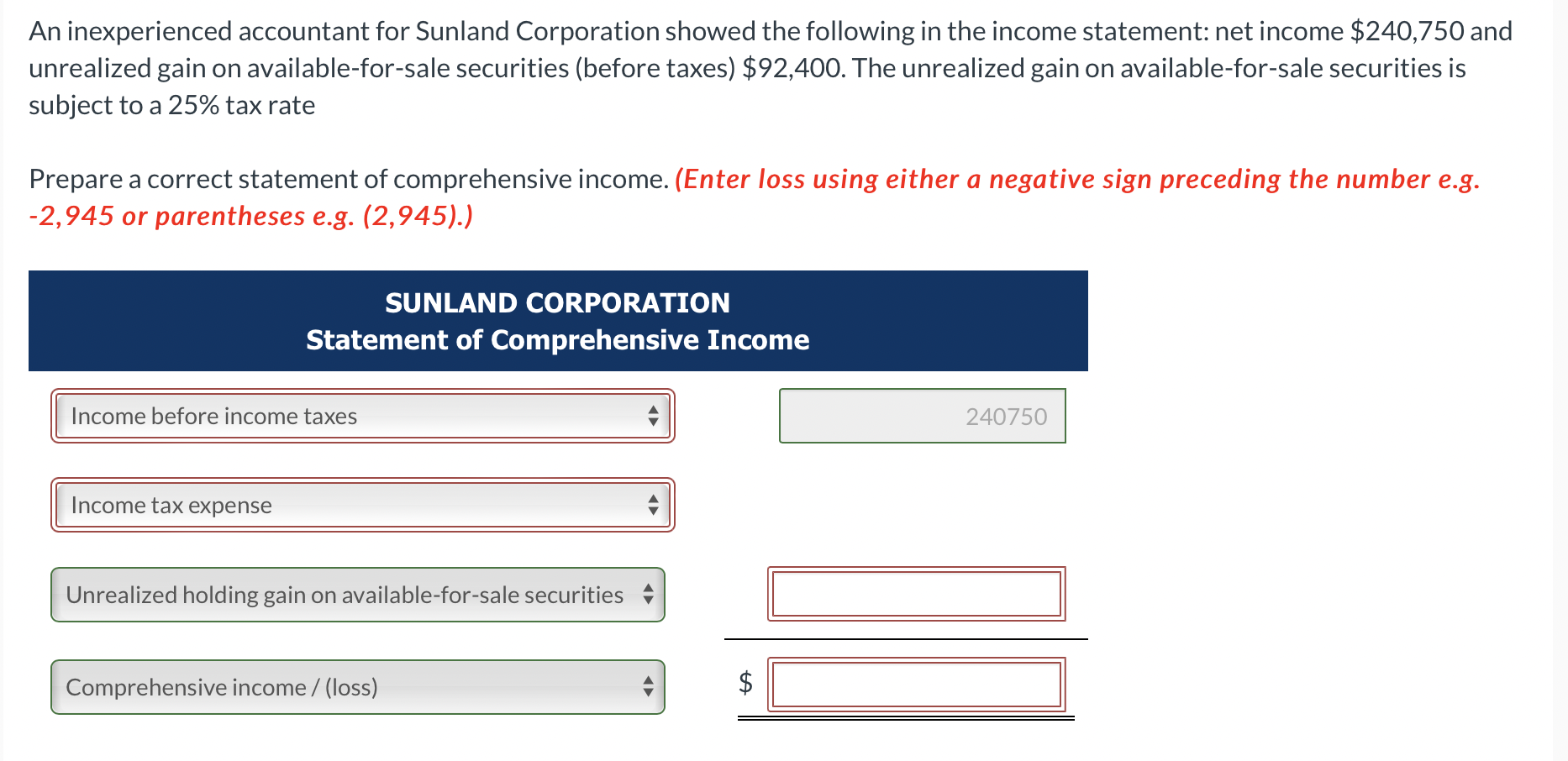

A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which. Once the bank details are updated, the refund will be issued again through a bank transfer, instead of a physical cheque. The formula for calculating comprehensive income is rather simple.

Unrealized income can be unrealized gains or losses on, for example, hedge/derivative financial instruments and foreign. For example, in january of 2022, an. An income tax for which the tax base consists not only of income but also of capital gains as well as other.

This would free the statement of profit or loss and other comprehensive income from the need to formally to classify gains and losses between sopl and oci. Mends a comprehensive income tax for canada, complete with. Details for practically all the problems raised by bittker.

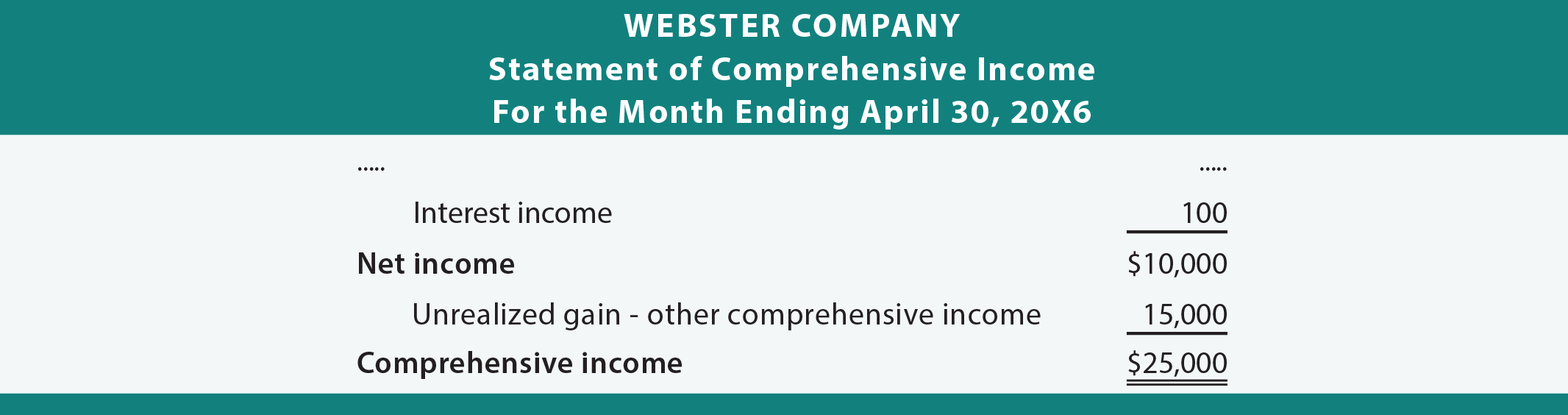

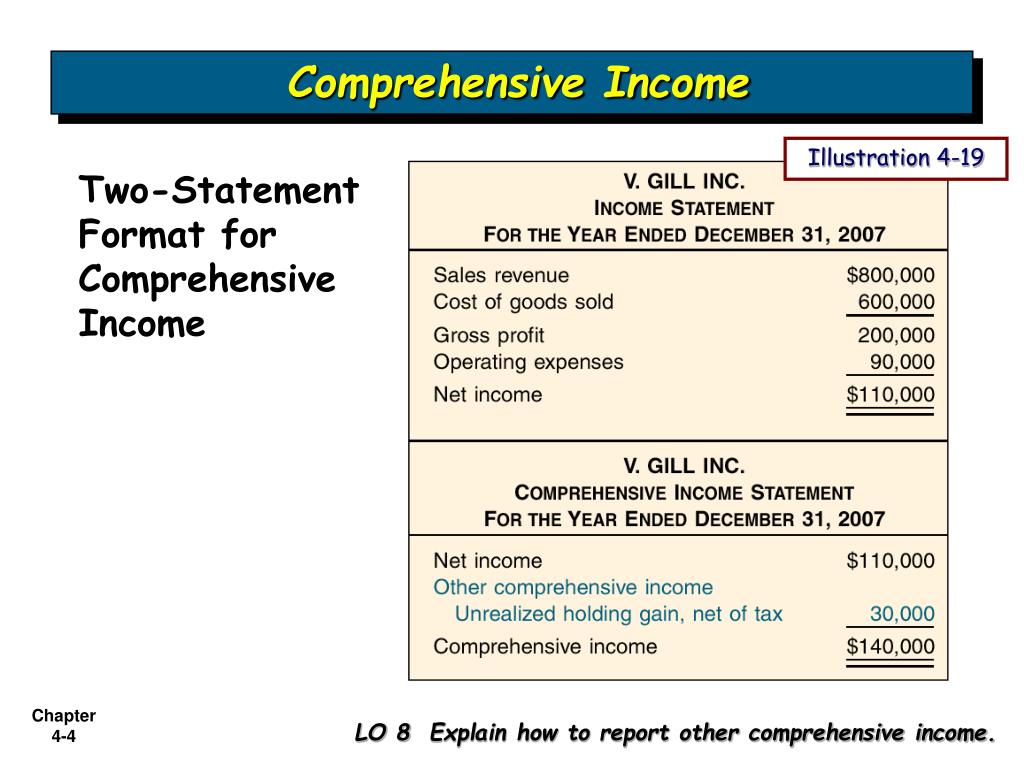

It's the sum total of oci plus your net income. With a hefty state budget surplus, iowa republicans are looking to speed up a series of income tax cuts that will take iowans to a 3.9% flat tax by 2026. In a general equilibrium framework, we develop a model of income taxation spanning several types of incomes with multidimensional taxpayer heterogeneity.

The prize money is considered part of your income tax expense, but it can't be categorized as regular income. It is similar to retained earnings, which is impacted by net income, except it includes those items that. For example, personal income taxes help.

A taxpayer who derives income from both comprehensive income and business operation income sources could claim personal standard deduction of up to rmb60,000 per. Comprehensive tax allocation is an analysis that companies use to identify discrepancies between their accounting for business purposes and their accounting for. 3, “announcement on relevant matters relating to the 2022 annual individual.