Awe-Inspiring Examples Of Tips About Income Statement For Merchandising Business Sample Multi Step

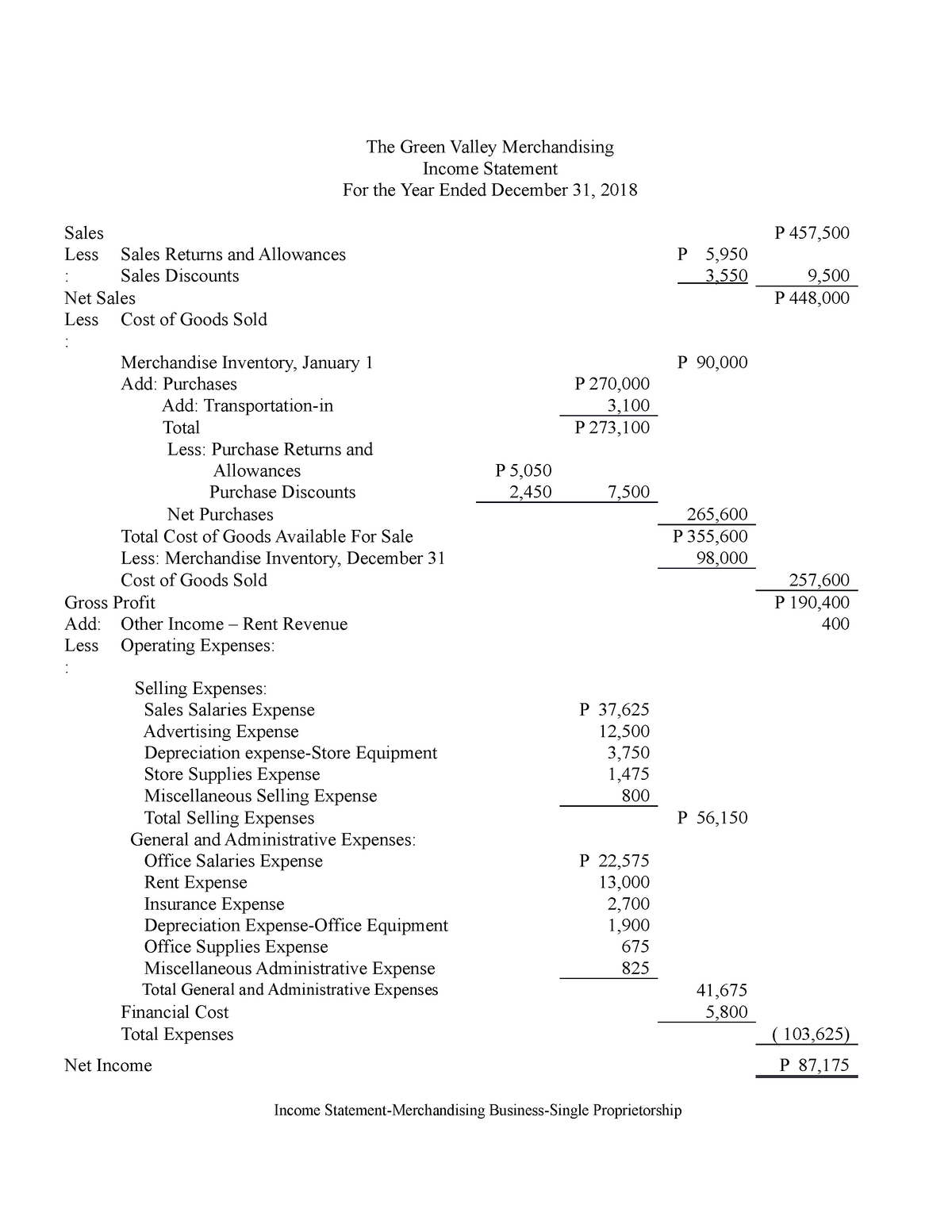

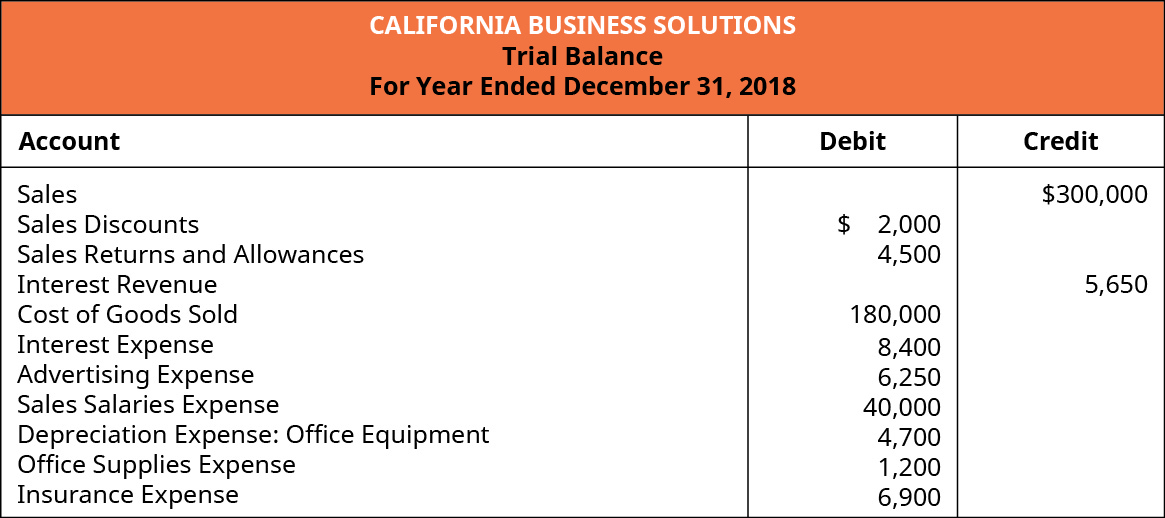

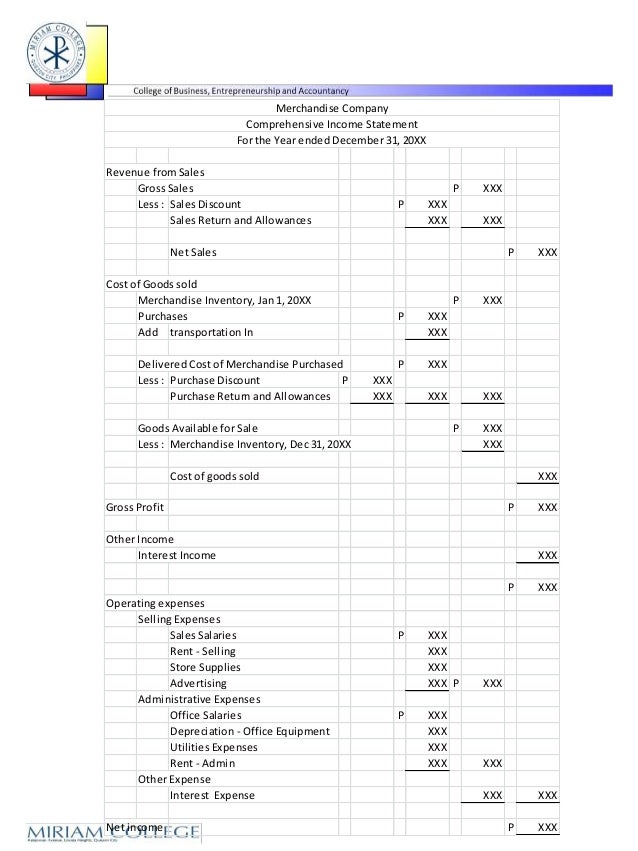

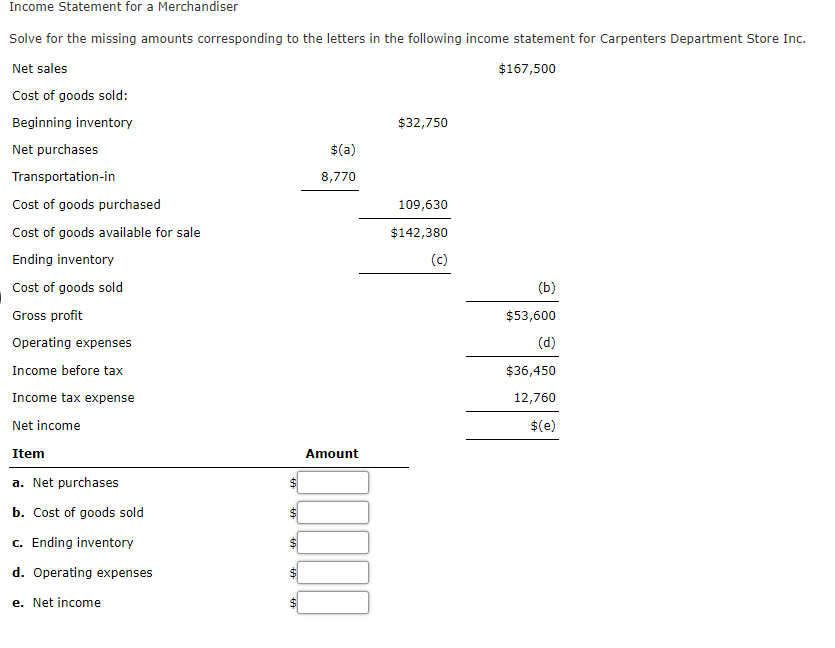

Income statement examples for service, merchandising and manufacturing businesses.

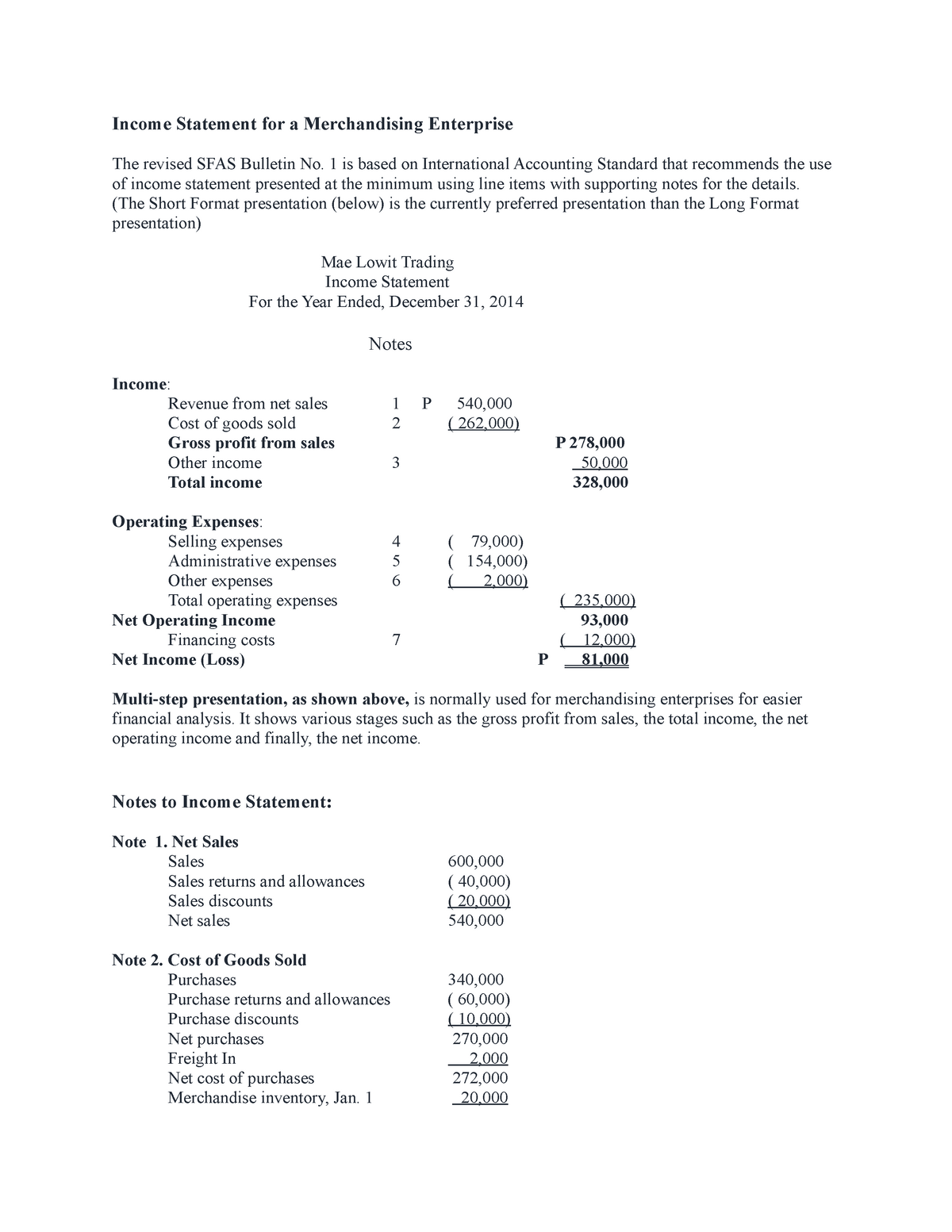

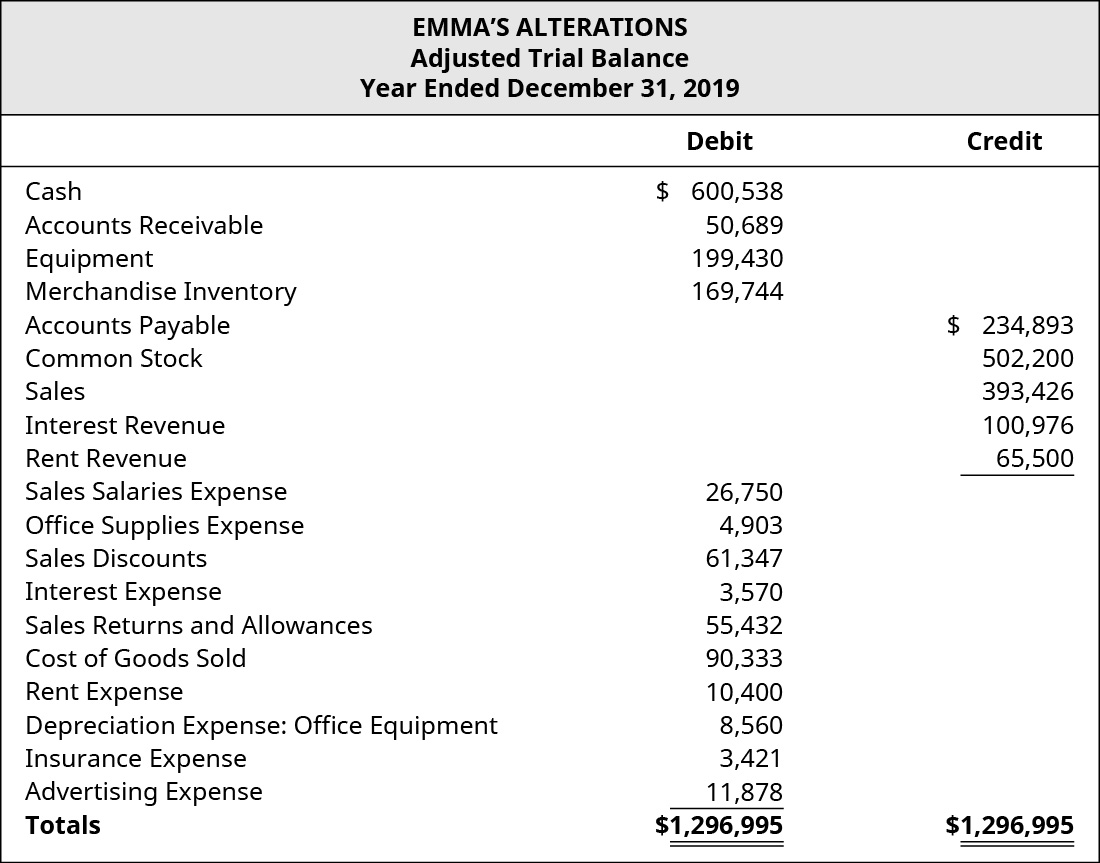

Income statement for merchandising business. Learn how they look like and see their differences and similarities. A merchandising company engages in the sale of tangible goods to consumers. The presentation format for many of these statements is left up to the business.

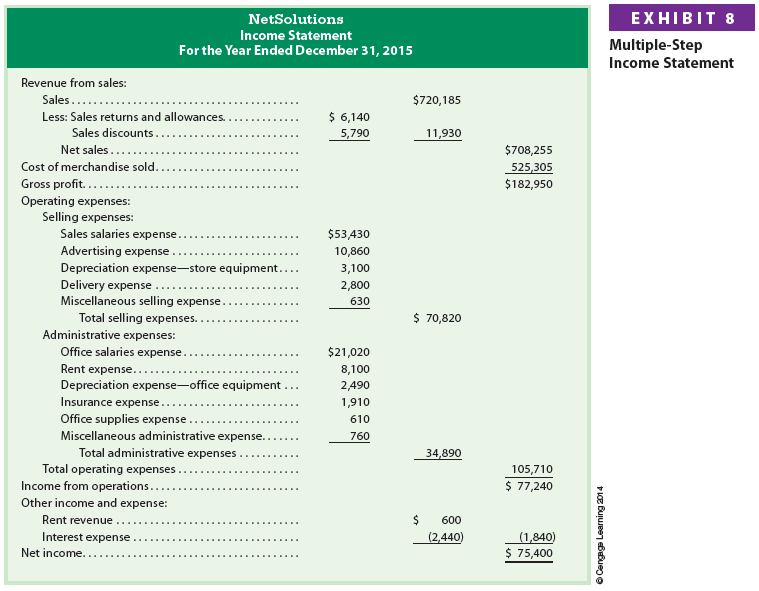

Cost of goods sold is the major expense in merchandising companies and represents what the. Income statements for each type of firm vary in several ways, such as the types of gains and losses experienced, cost of goods sold, and net revenue. Income account titles normally found in the income statement are of a merchandising business are:

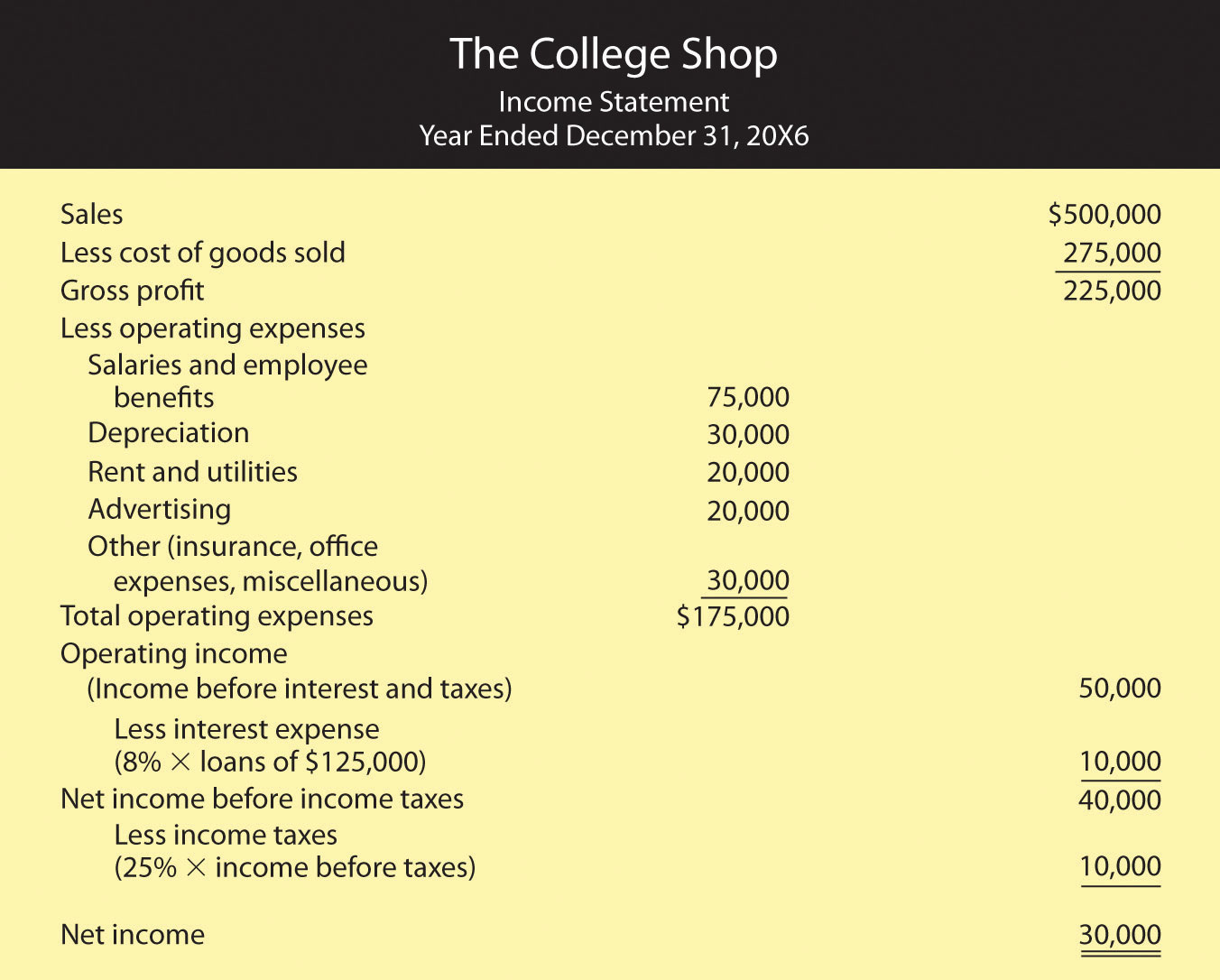

An income statement for merchandising differs from a service income statement in a number of ways. Net sales are the revenues generated by the major activities of the business—usually the sale of products or services or. Just like all income statements, the first line is revenue.

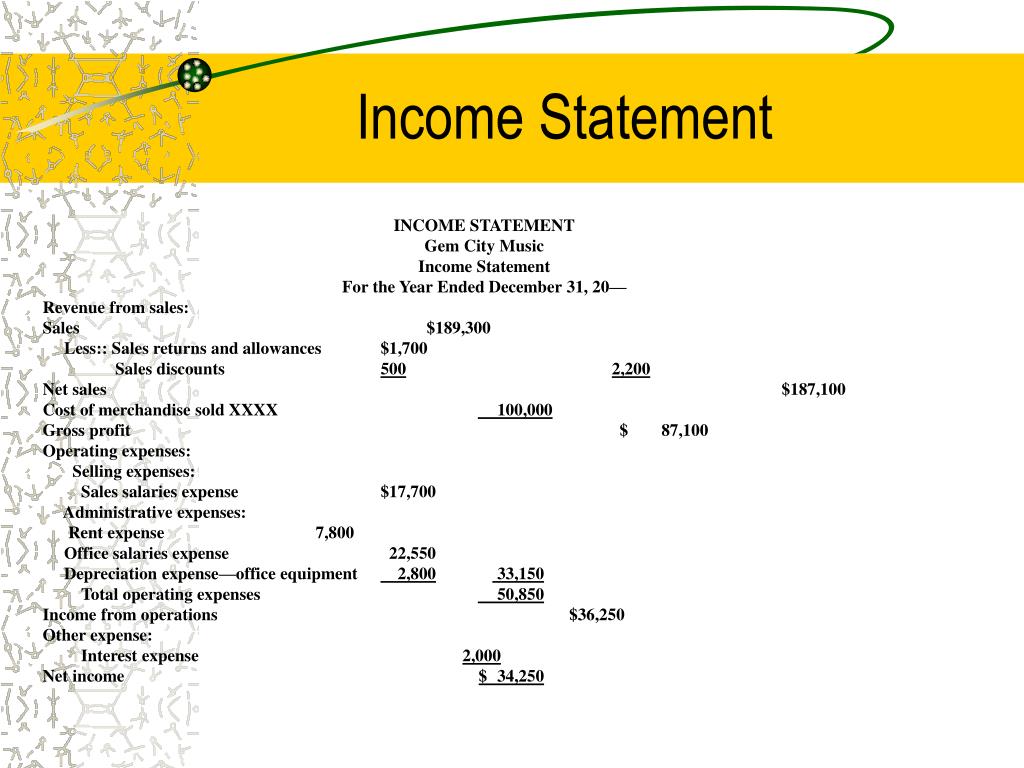

The balance sheet of the merchandising business expands its assets section to include merchandise inventory and sometimes estimated returns inventory. Music world income statement for the year ended june 30,20x3 | revenues | | | net sales | | $1,172,000 | interest income | | 7,500 | gain on sale of equipment | | 1,500 | total revenues | | 1,181,000 | expenses | | A merchandising income statement highlights cost of goods sold by showing the difference between sales revenue and cost of goods sold called gross profit or gross margin.

The company may choose to split out sales discounts, refunds and returns from total sales to derive net sales revenues. Add up the income tax for the reporting period and the interest incurred for debt during that time. Merchandise inventory is the merchandise purchased to be sold to consumers.

Expenses for a merchandising company must be broken down into select costs (cost of goods sold) and period fee (selling and. These largely relate to inventory items and the cost of goods sold, as well as provision for. Net sales are the revenues generated by the major activities of the business—usually the sale of products or services or.

Merchandising companies sell commodity but do not making them. Gross profit is also known as gross margin from sales. Completing the accounting cycle (part 3) | preparing the income statement learn the basics of preparing income statement for merchandising business.

This amount is the profit left after “paying for” the merchandise that was sold to the customer. A single‐step income statement for a merchandising company lists net sales under revenues and the cost of goods sold under expenses. Accounting financial statements for a merchandising business posted on 01/07/2021 by admin although merchandising transactions affect the balance sheet in reporting inventory, they primarily affect the income statement.

Rather, they provide services to customers or clients who value their innovation and expertise. Preparing the income statement. Add up all your gains then deduct your losses.

These businesses incur costs, such as labor and materials, to present and ultimately sell products. There are two ways of adjusting the merchandise inventory account: Therefore, these companies will having fees of goods sold but the calculation is much easier than for a manufacturing company.