First Class Tips About Cvp Income Statement Format Treasury Shares Balance Sheet

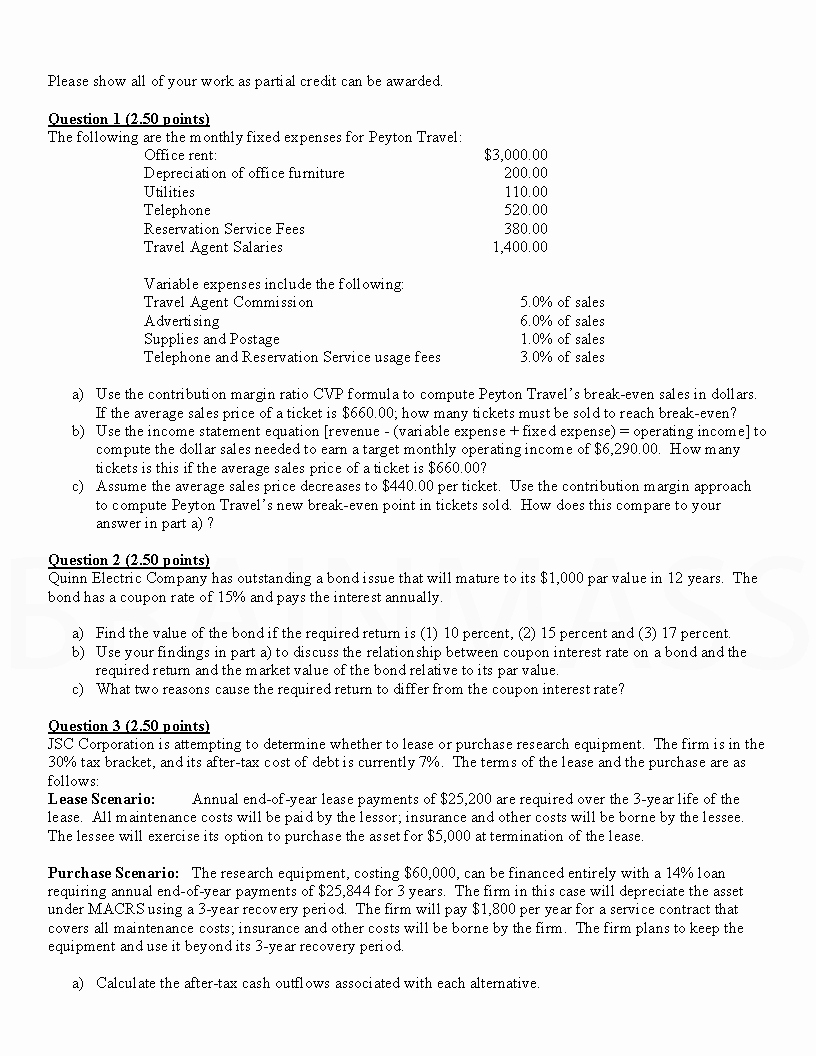

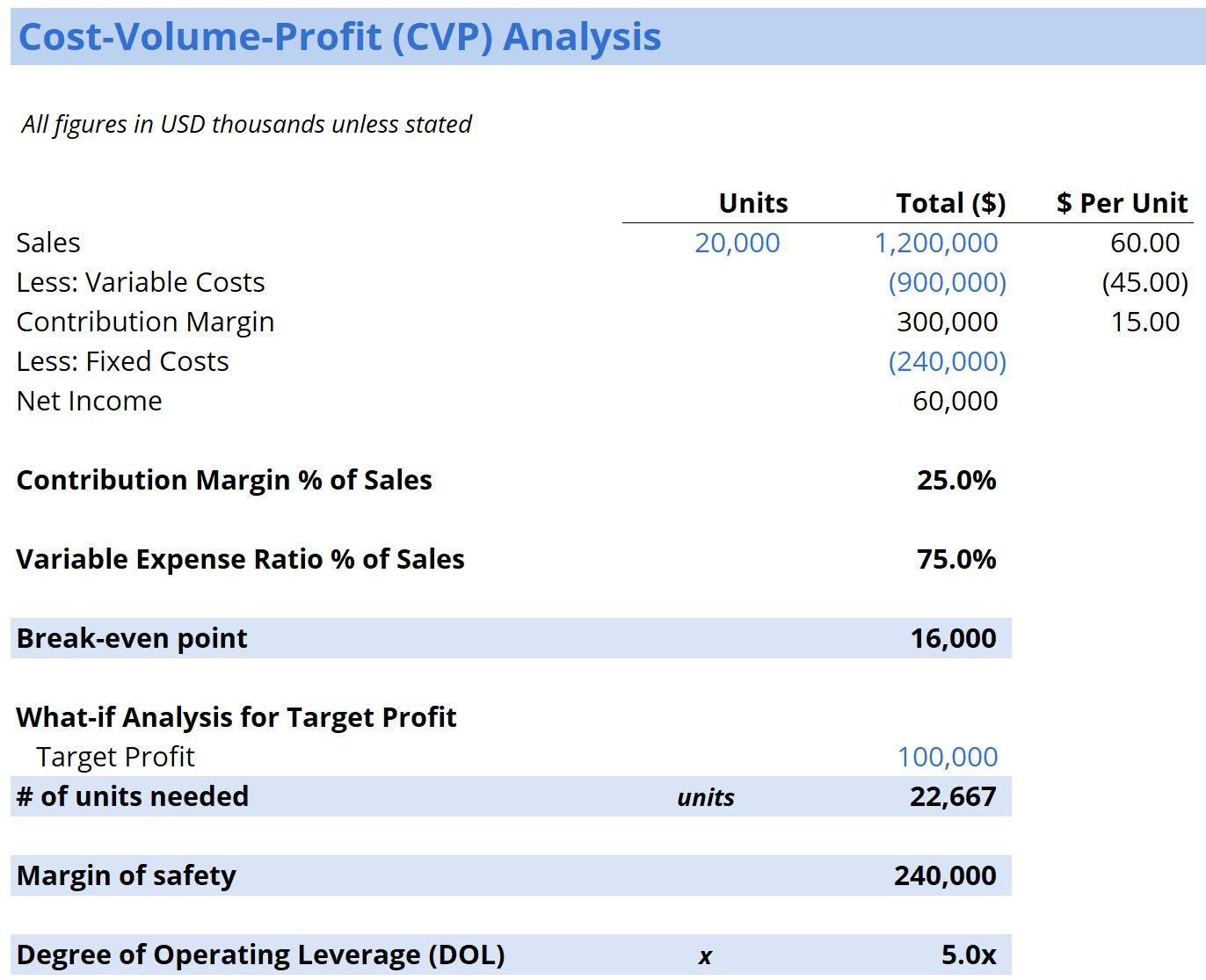

Cost volume profit (cvp analysis), also commonly referred to as break even analysis, is a.

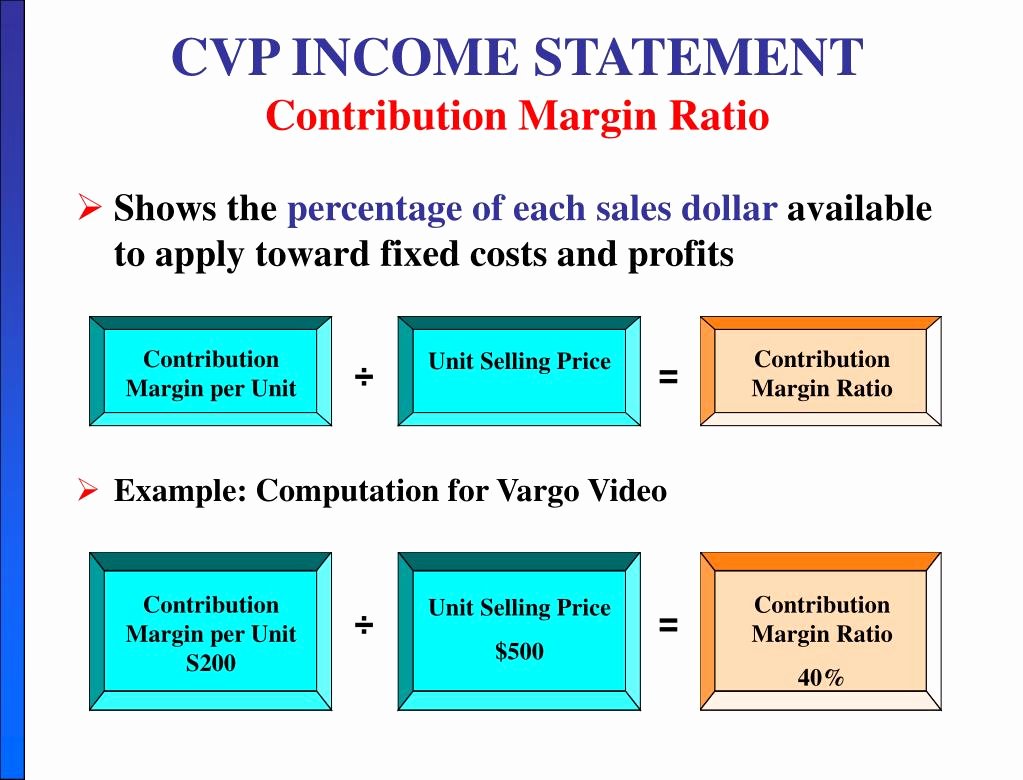

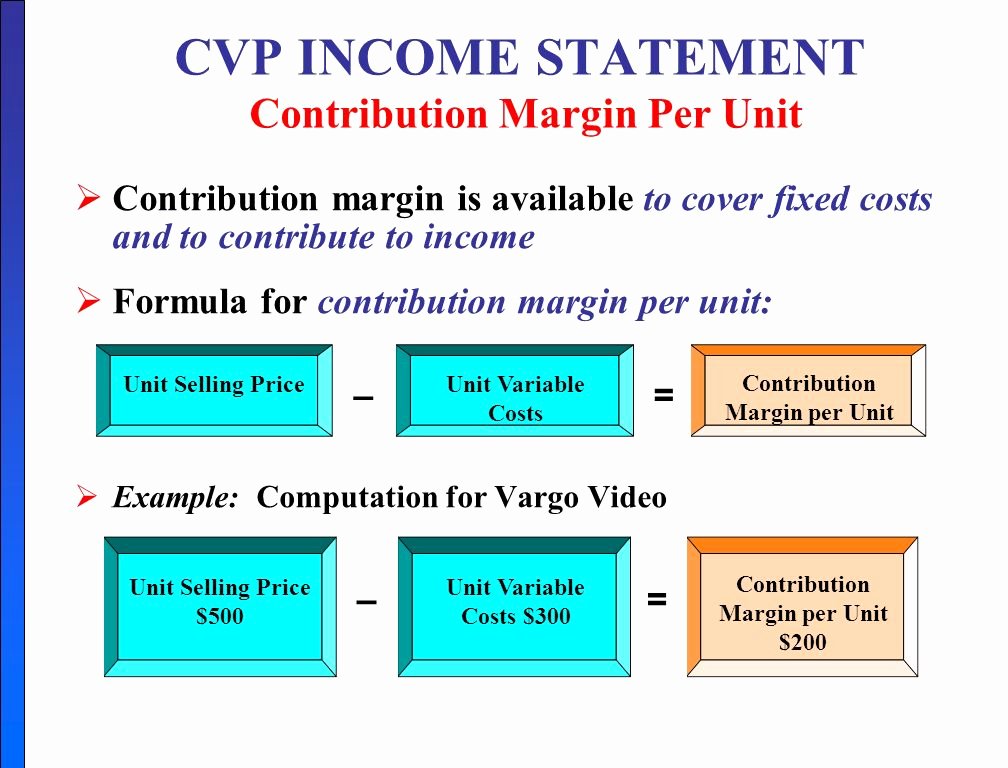

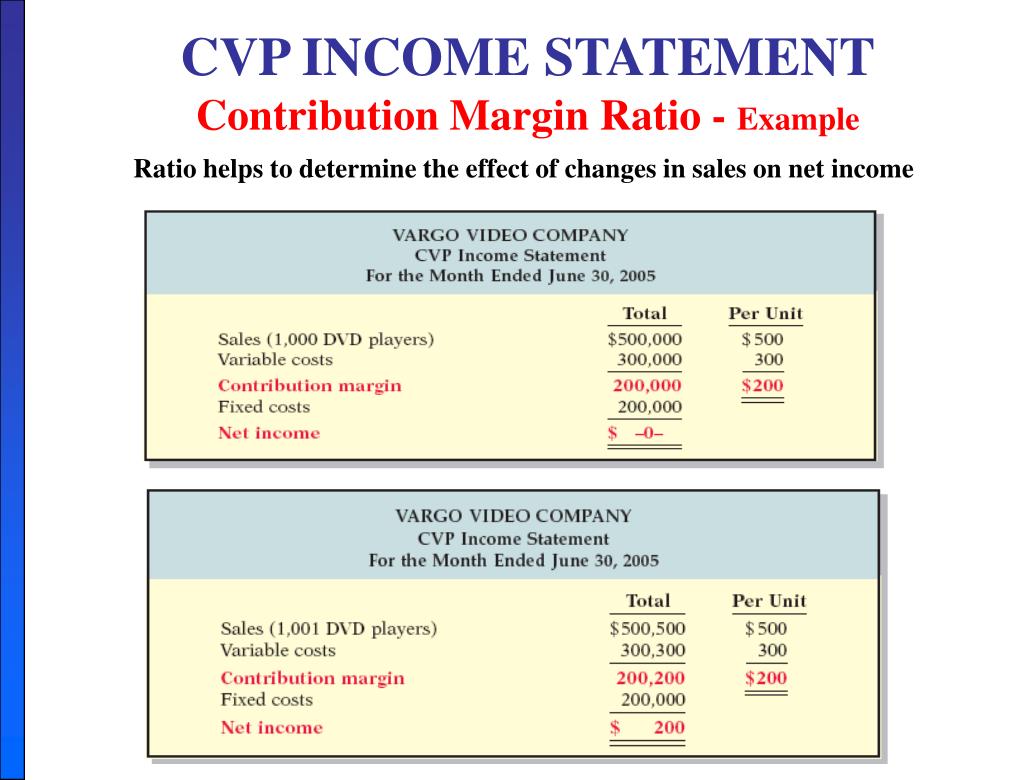

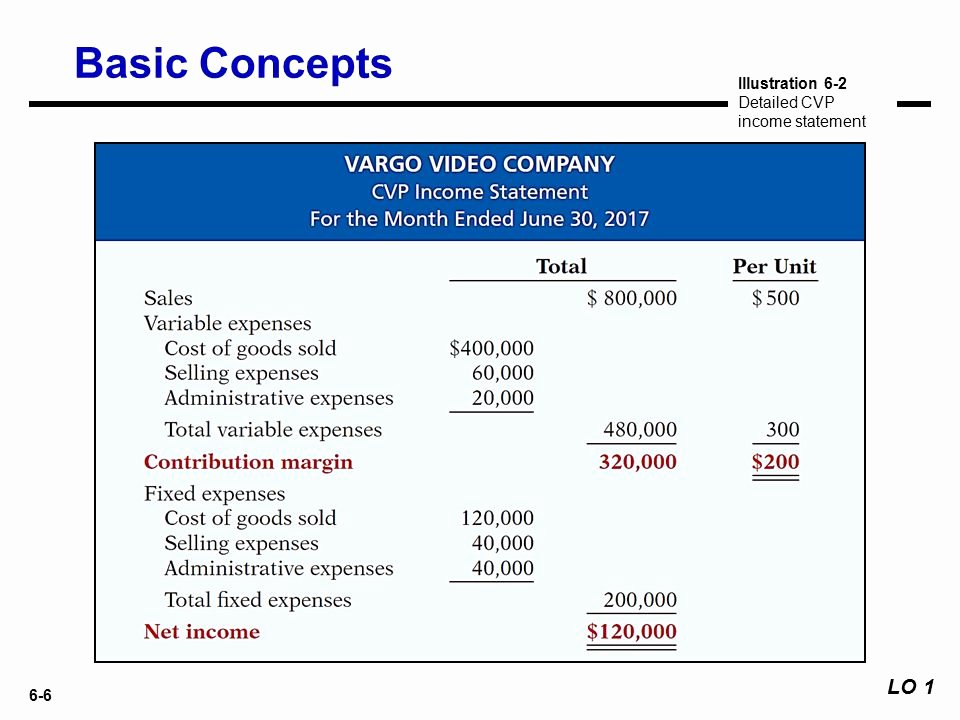

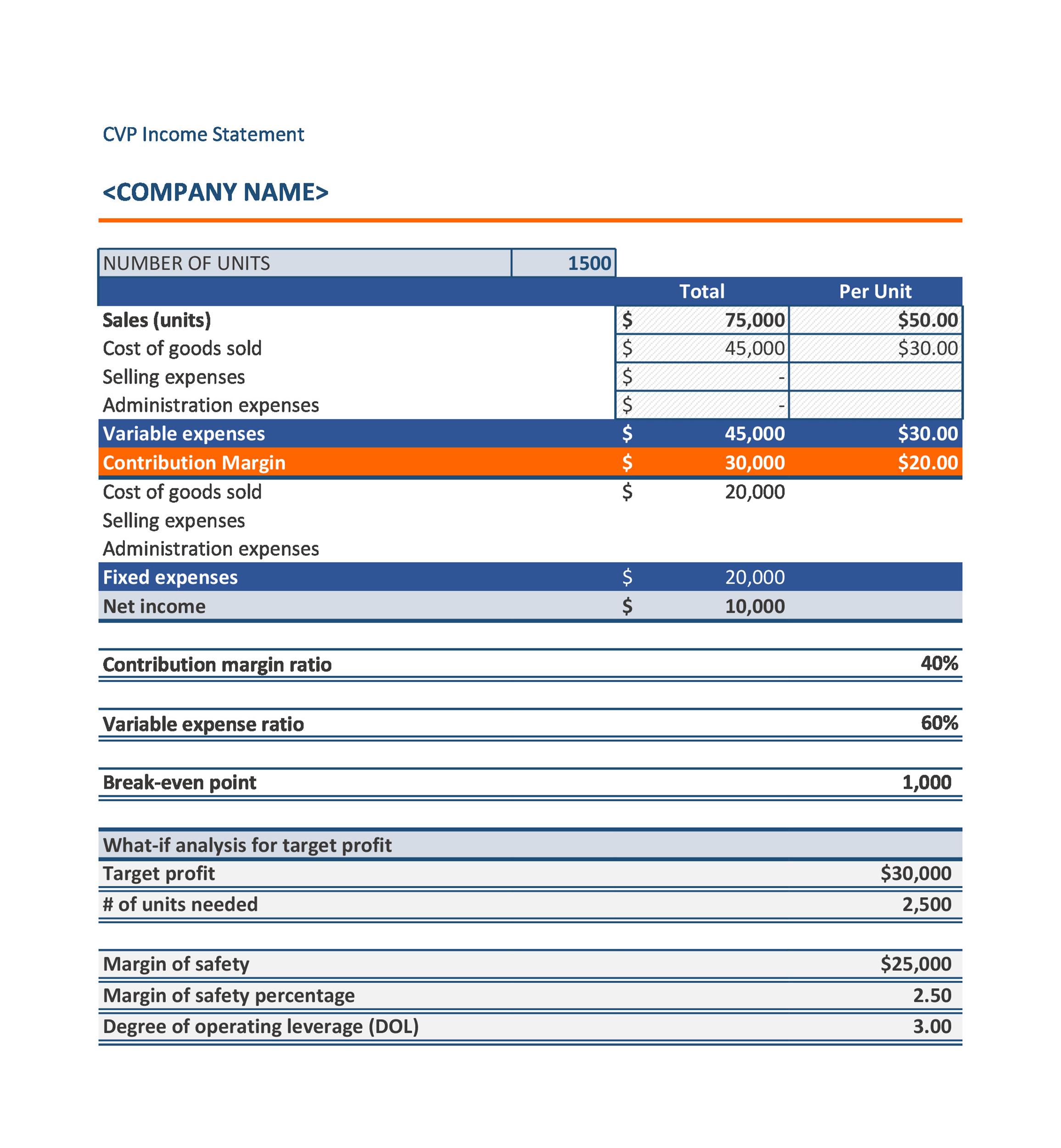

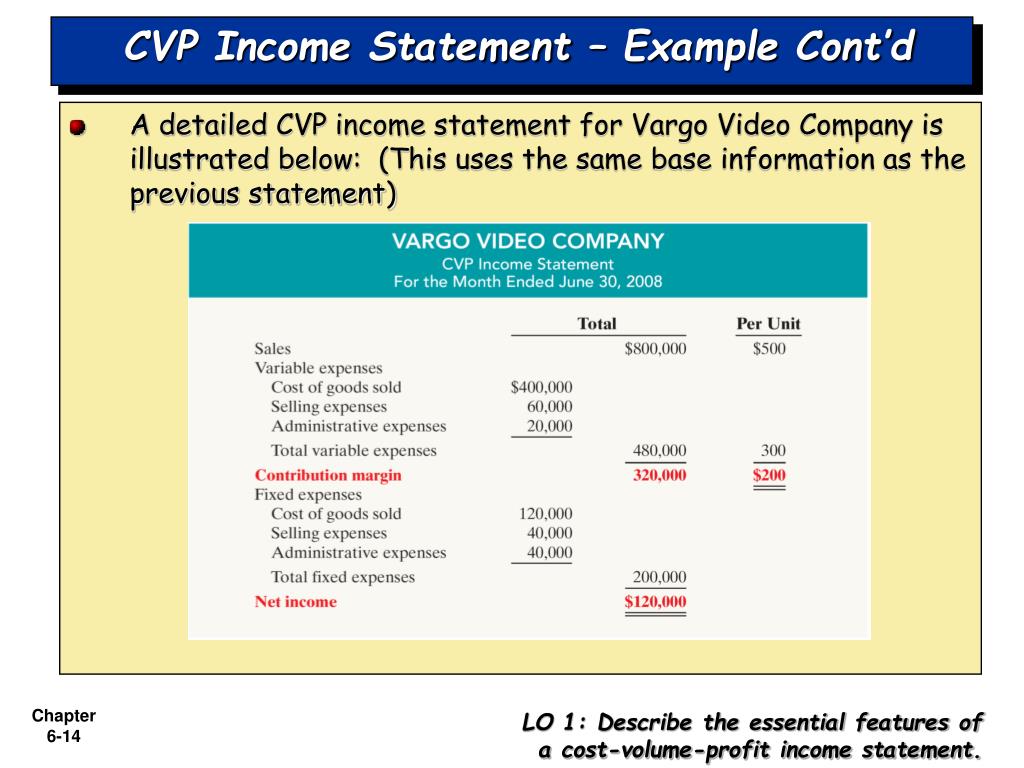

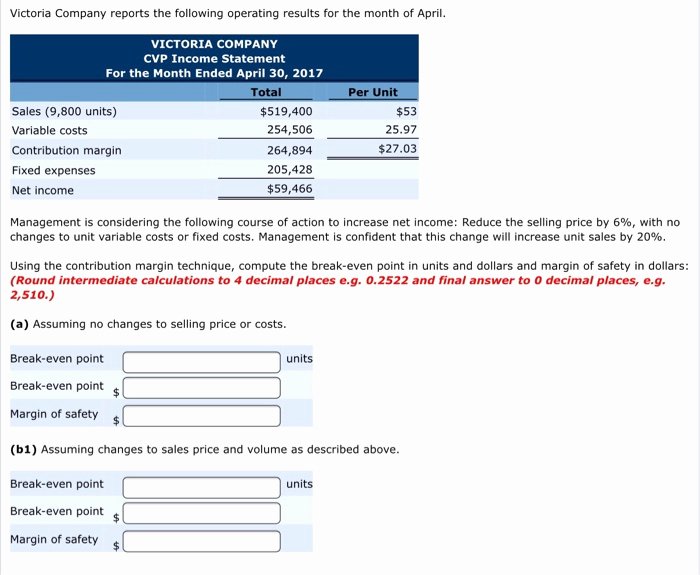

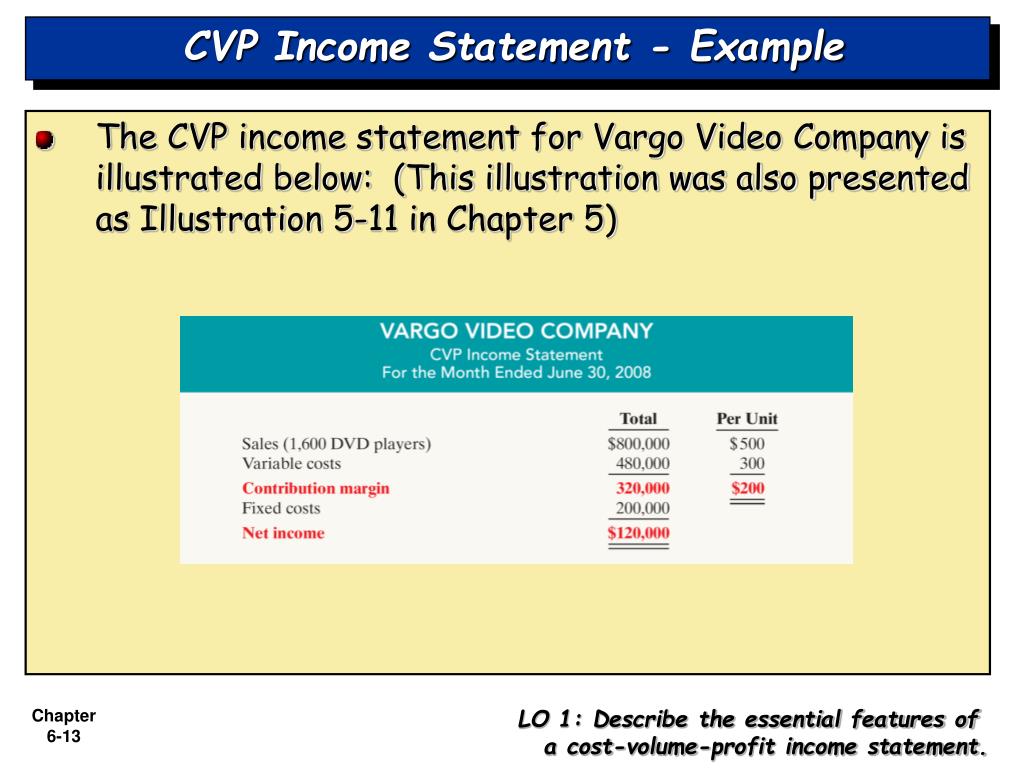

Cvp income statement format. Cost volume profit (cvp) analysis is a managerial accounting technique used to determine how changes in sales volume, variable costs, fixed costs, and/or selling price per unit. Find out the key calculations, such as. The cvp income statement are a statement for inboard use that classed costs as rigid or variable and reports contribution margin in the bodies of the statement.

Enter your name and email in the form below and download the free template now! These relationships are important enough to operating managers that some businesses prepare income statements in a way that highlights cvp issues. Cost volume profit (cvp) analysis is a managerial accounting technique used to determine how changes in sales volume, variable costs, fixed costs, and/or selling.

A traditional income statement uses absorption or full costing, where both variable and fixed manufacturing costs are included when calculating the cost of goods. It looks at the impact of changes in production costs and sales on operating profits. Lo1 identify the purposes of cost volume profit analysis.

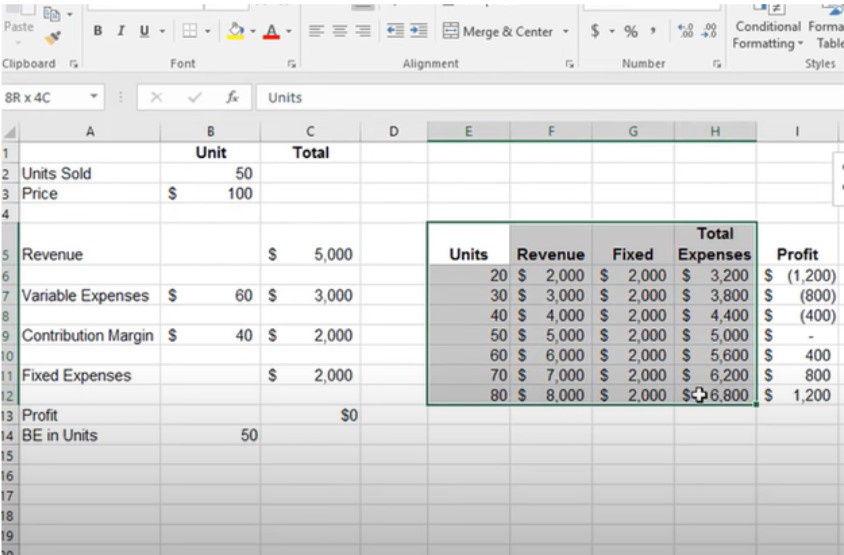

Learning objectives lo lo1 explain the purposes and advantages of segmented income reporting lo2 prepare a segmented income statement lo3 compute contribution. Learn how to use cvp analysis to determine how changes in costs and volume affect a company's operating income and net income. Racing developed contribution margin income statements at 300, 400, and 500margin income statements at 300, 400, and 500 units sold.

Cost volume profit (cvp) analysis helps managers make many important decisions such as what products and services to offer, what prices to charge, what marketing strategy to. Lo2 explain how the contribution margin income statement is used for cost volume profit analysis. A contribution margin income statement follows a similar concept but uses a different format by separating fixed and variable costs.