Wonderful Tips About Interest Expense In Profit And Loss Statement Cma Final Corporate Financial Reporting

The outcome is either your final profit or loss.

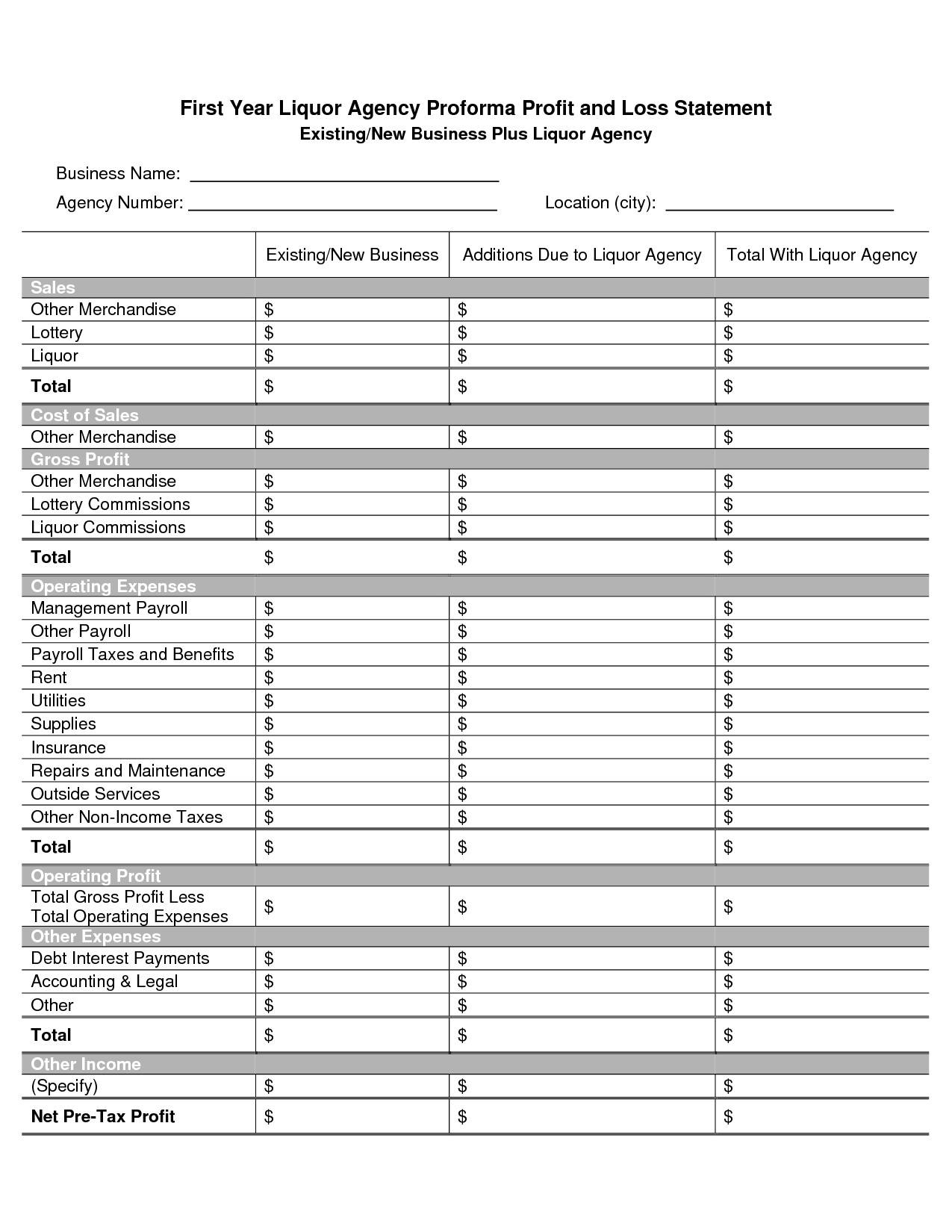

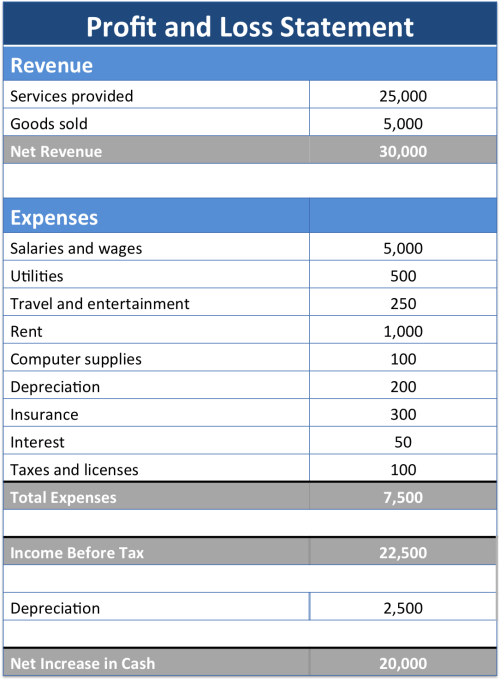

Interest expense in profit and loss statement. Key takeaways a p&l statement explains the income and expenses that lead to a company’s profits (or losses). This step is repeated for the month of november and december. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

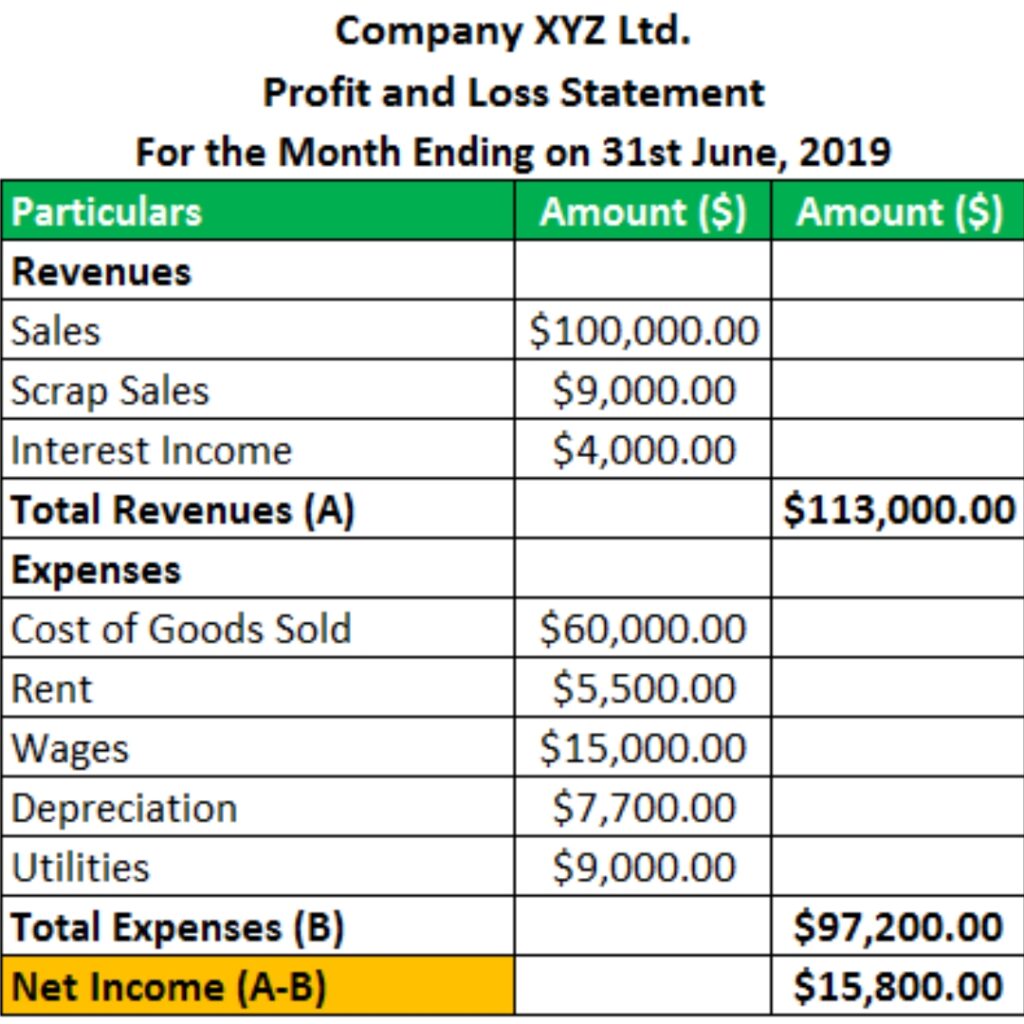

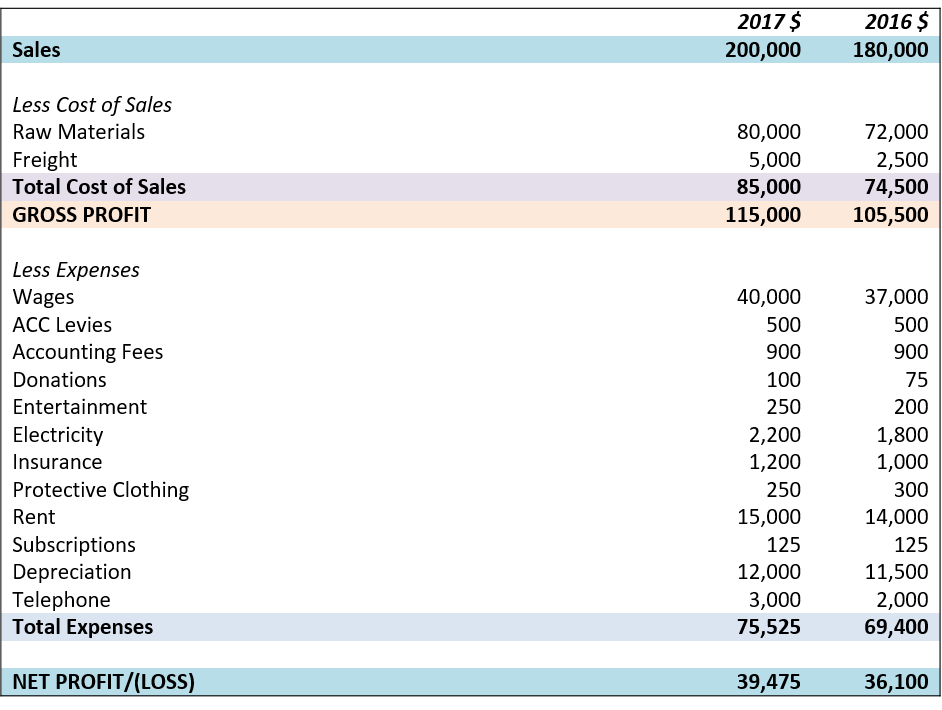

Profit and loss statement template (p&l) suppose we’re creating a simple profit and loss statement (p&l) for a company with the following financial data. A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

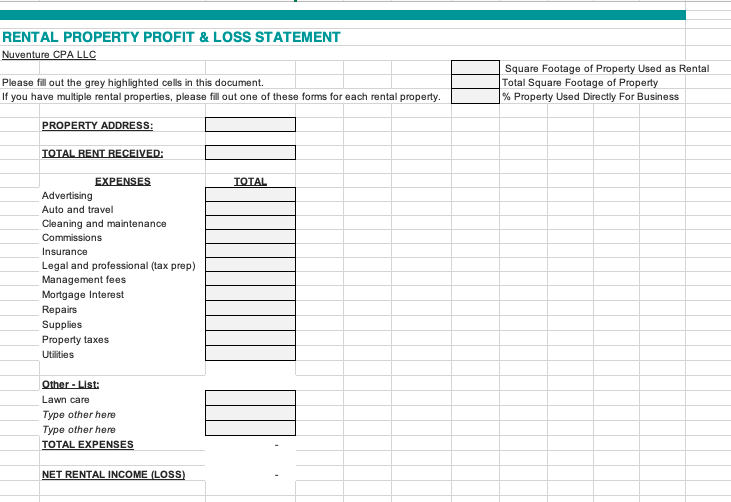

A profit and loss (p&l) statement, also known as an income statement or statement of earnings, is a vital financial document that provides insights into a company’s financial performance during a specific period. You usually complete a profit and loss statement every month, quarter or year. That decision is based on guideline (eu) 2016/2249 of the ecb of 3 november 2016 on the legal framework for accounting and.

It tells you how much profit you're making, or how much you’re losing. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. The profit & loss statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a business during a specific period, usually a quarter or year.

All the indirect expenses and incomes, including the gross profit/loss, are reported in the profit & loss statement to arrive at the net profit or loss. Make a journal entry for the end of the month, october 31st. Net income is the profit that remains after all expenses and costs, such as taxes.

Businesses take out loans to add inventory, buy property or equipment or pay bills. A profit and loss statement includes a business’s total revenue, expenses, gains, and losses, arriving at net income for a specific accounting period. What is a profit and loss statement?

Interest expense is the cost that the company has to pay if they borrow funds for the purpose of growth, expansion, and meet the operational cost of the business. Interest expense is the total amount a business accumulates (accrues) in interest on its loans. Revenue for 2023 was $15.5 billion and net income attributable to fluor was $139 million, or $0.54 per diluted share.

It represents interest payable on any. The p&l report is one of a business’s most important accounting tools, as it provides important insights into business operations. Flr) announced financial results for its year ended december 31, 2023.

Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or. The loan interest payment is the figure paid to the creditor by the business in loan repayment while the profit and loss statement shows details of the company's earnings and price incurred in their operations. A p&l statement provides information about whether a company can.

An income statement might use the cash basis or the accrual basis. How to read the interest figures. An income statement is another name for a profit and loss statement (p&l).

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Yearly-Profit-Loss-Statement-Template-TemplateLab-790x1101.jpg)