Unique Tips About Company Balance Sheet Acquisition Example Tangible Equity

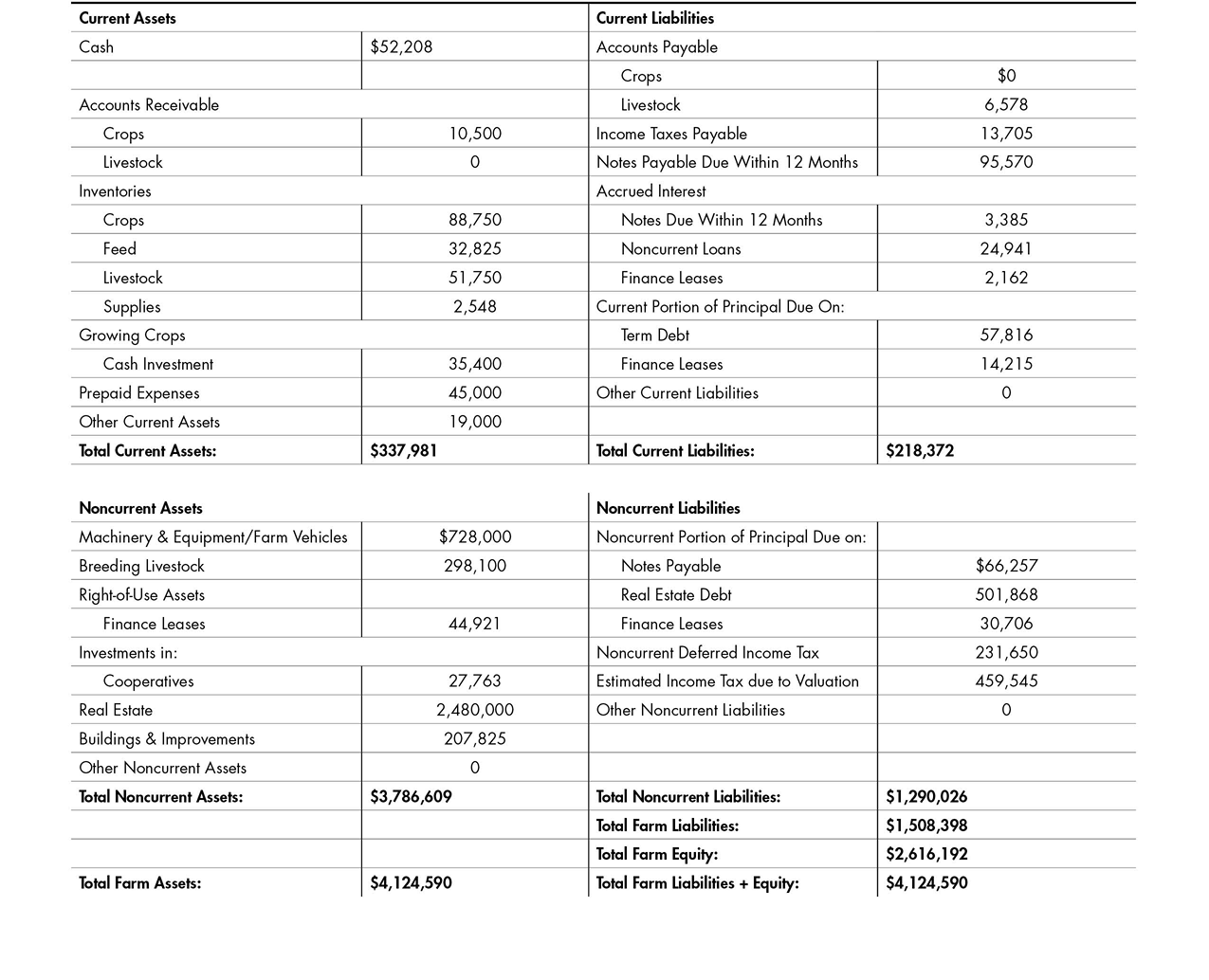

These parts form the accounting equation that states that the assets of a.

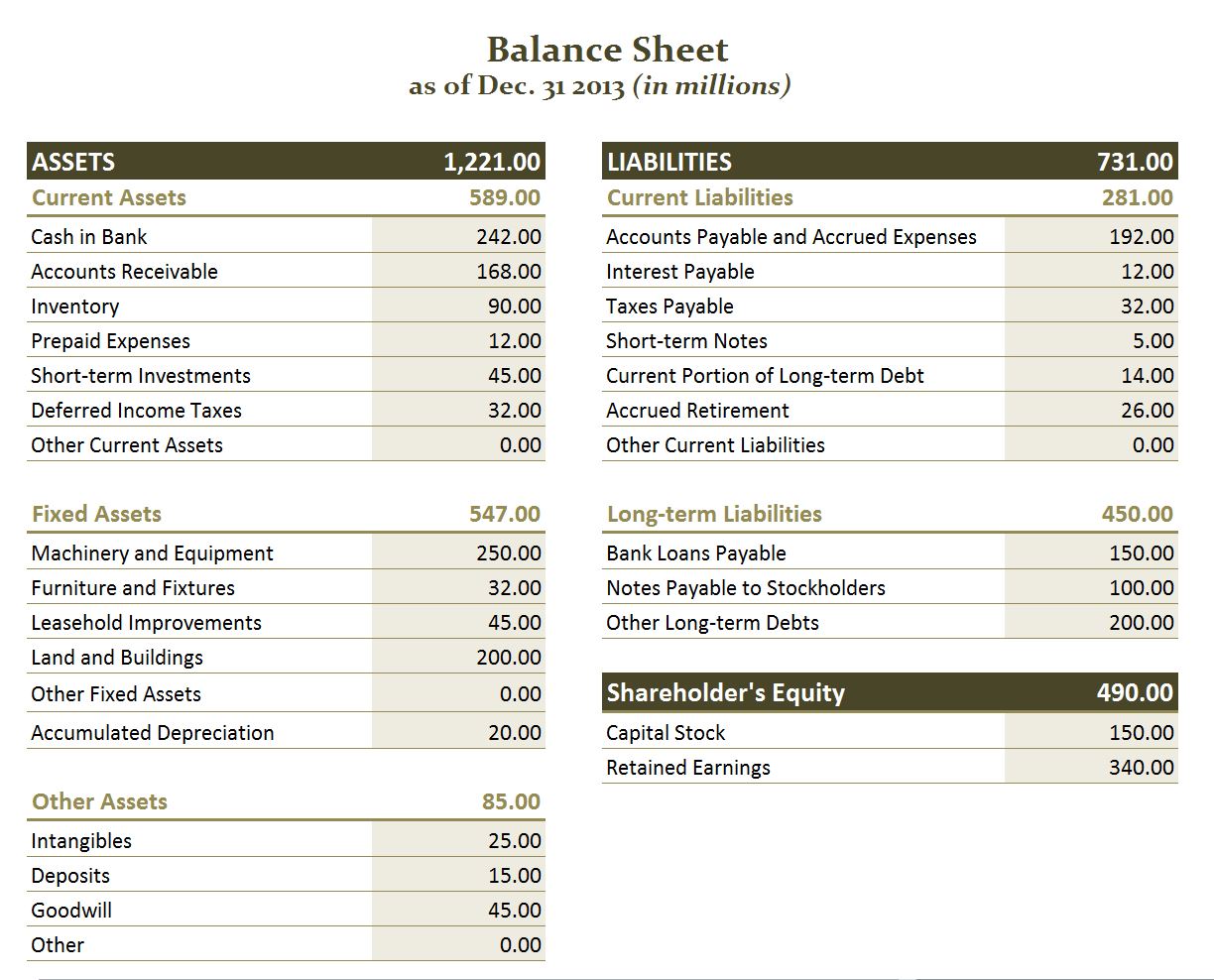

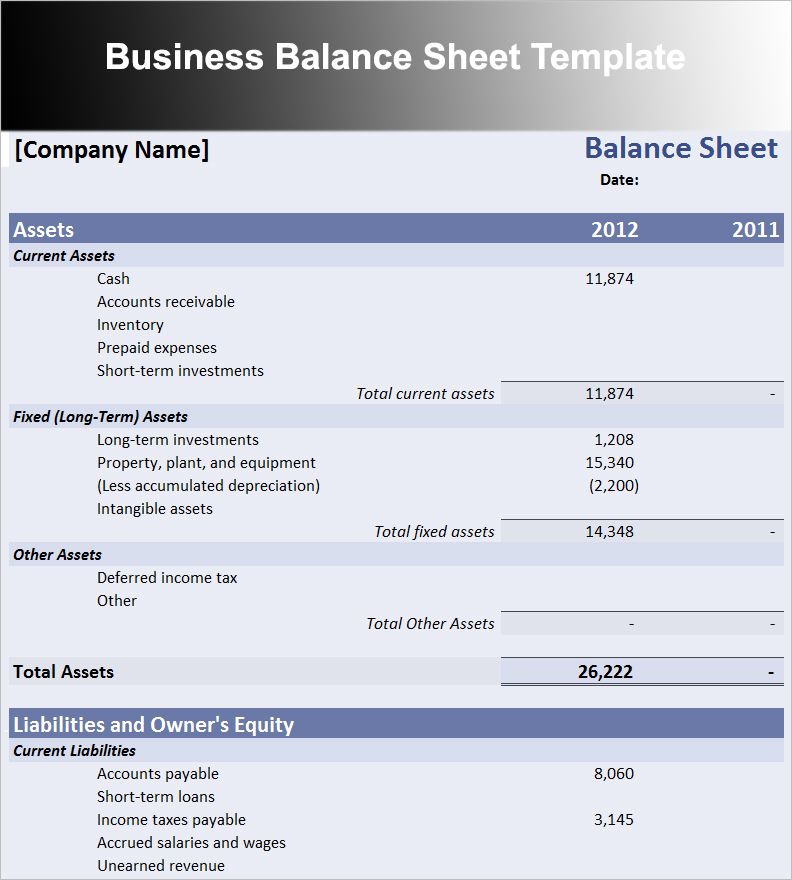

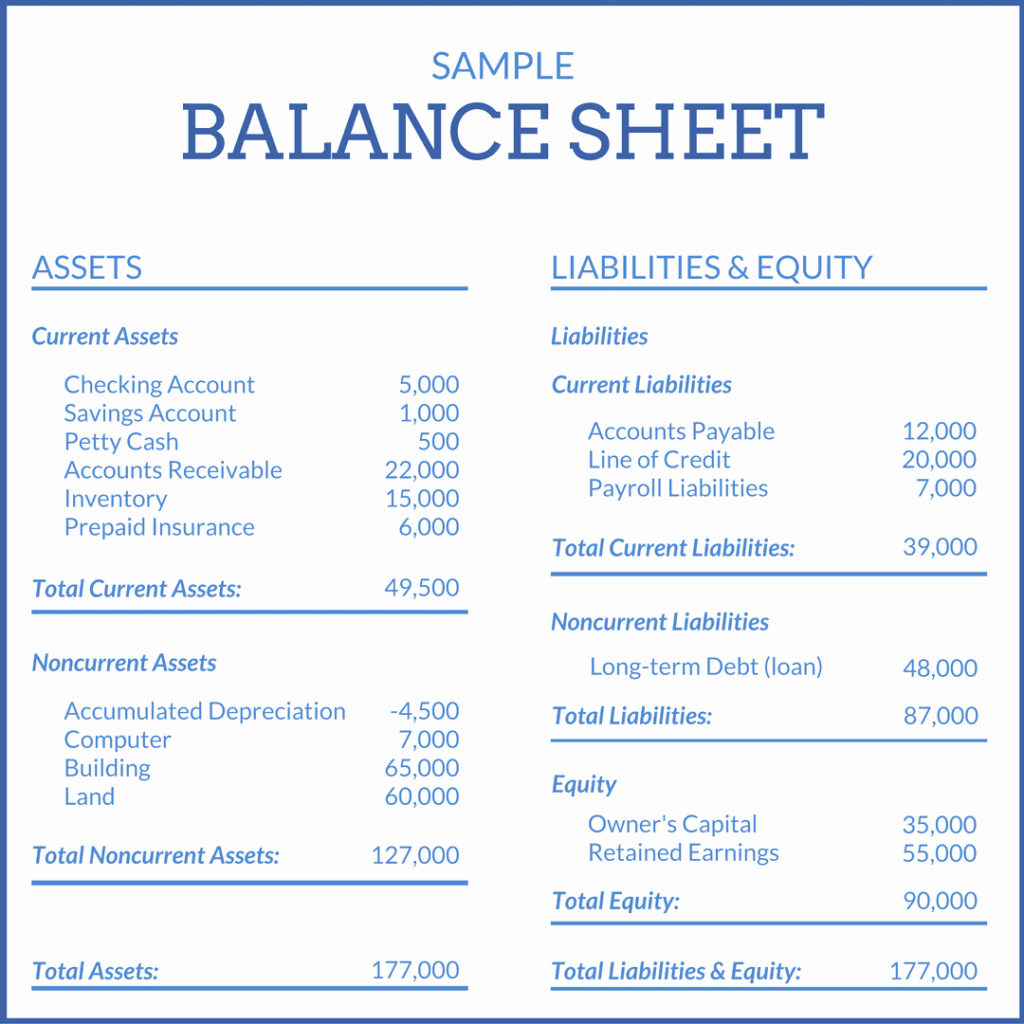

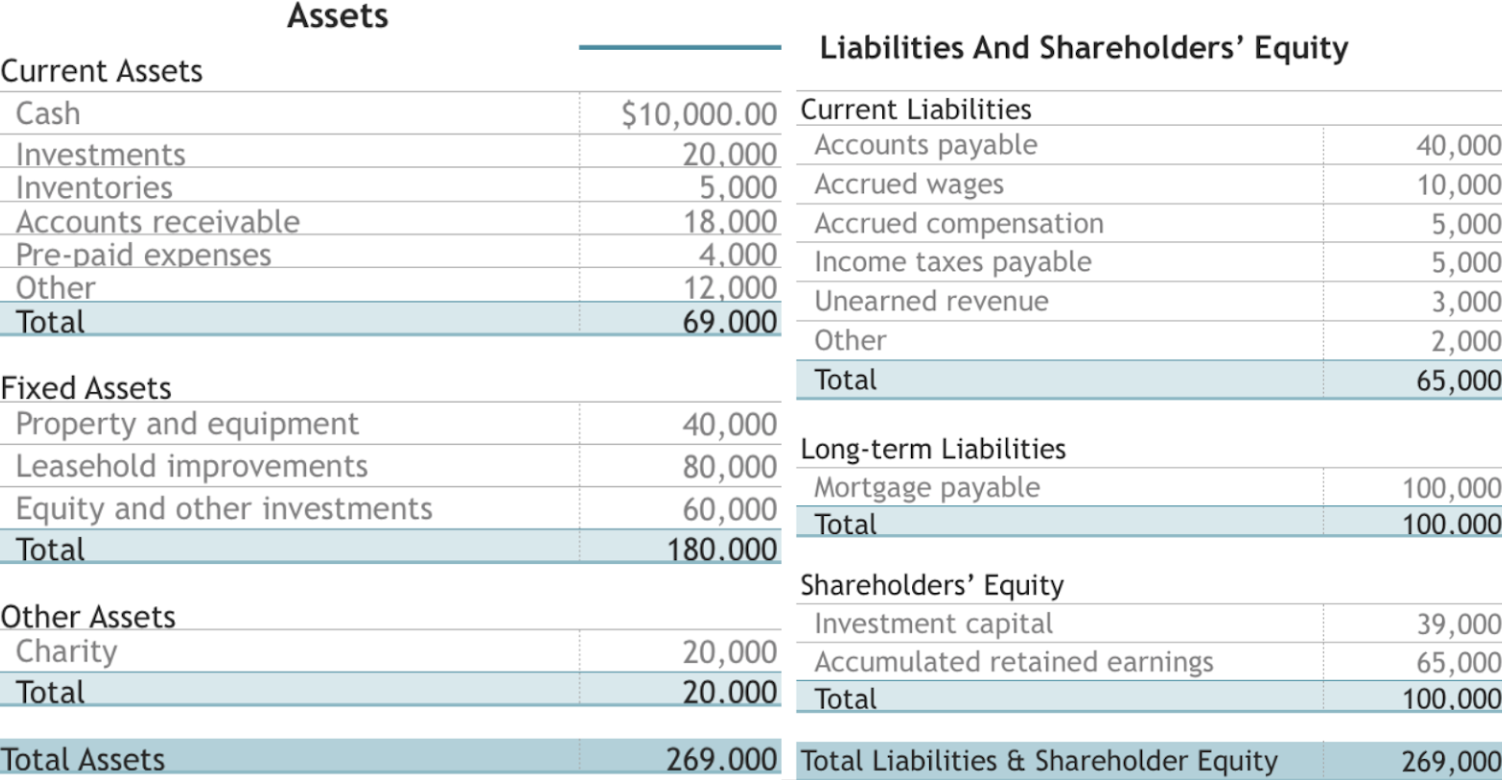

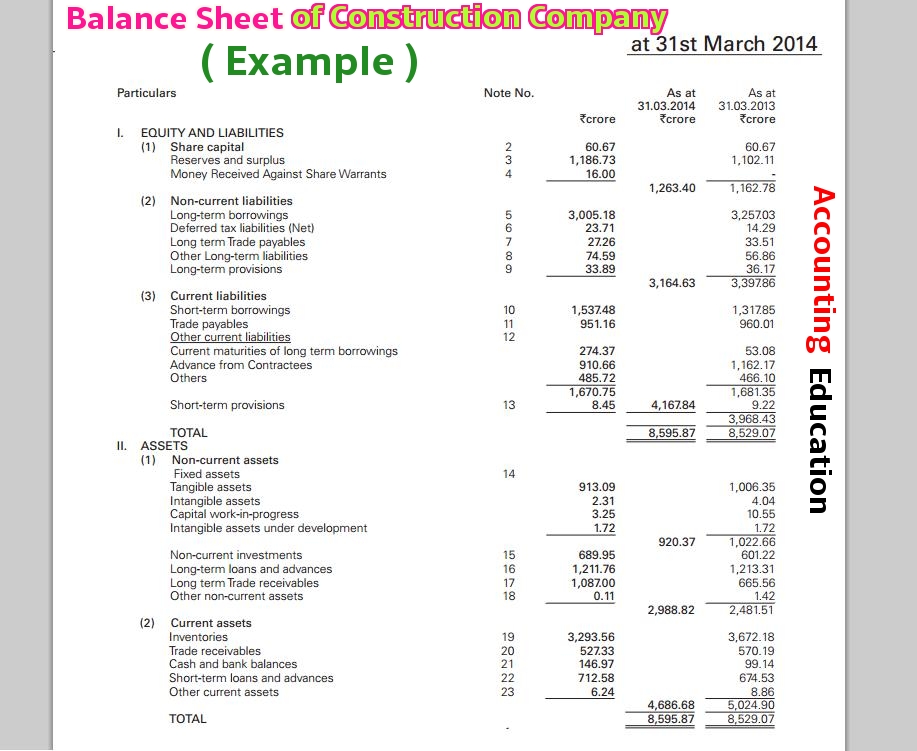

Company balance sheet acquisition balance sheet example. The format of the date is: The key steps in applying the acquisition method are summarised below: Example of a balance sheet.

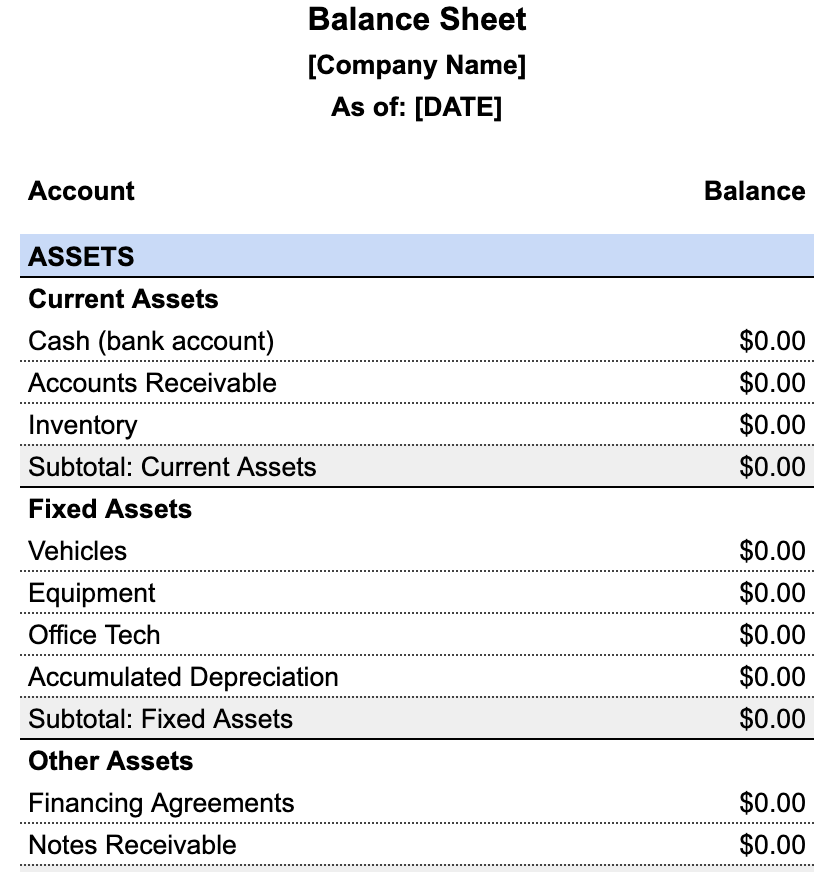

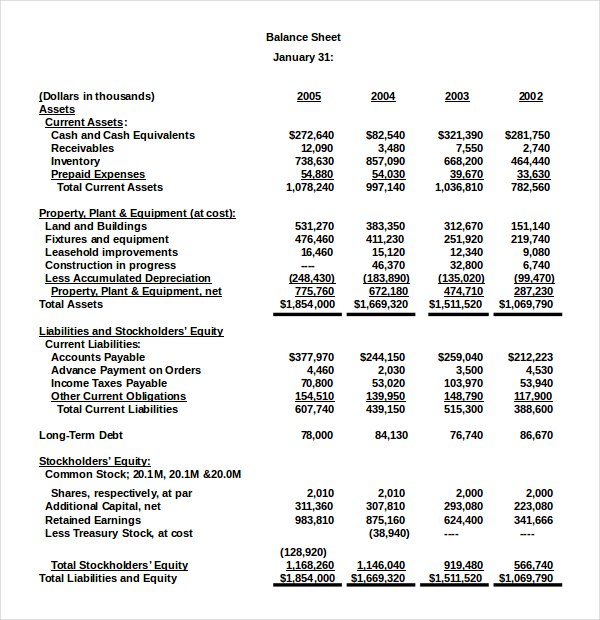

Assets, liabilities and owners’ equity are the three main parts of the balance sheet. I am so confused by the combined balance sheet after an acquisition. 16+ company balance sheet examples & templates.

By accurately adjusting the target company balance sheet for the items described the calculations for the purchase price adjustment are made simple. Aquisition of part of the stock Like paying control premium and stuff.

Aapl) the balance sheet of the global consumer electronics and software company, apple (aapl), for the fiscal year ending 2021 is shown below. Sample balance sheet example: Ifrs 3 establishes the accounting and reporting requirements (known as ‘the acquisition method’) for the acquirer in a business combination.

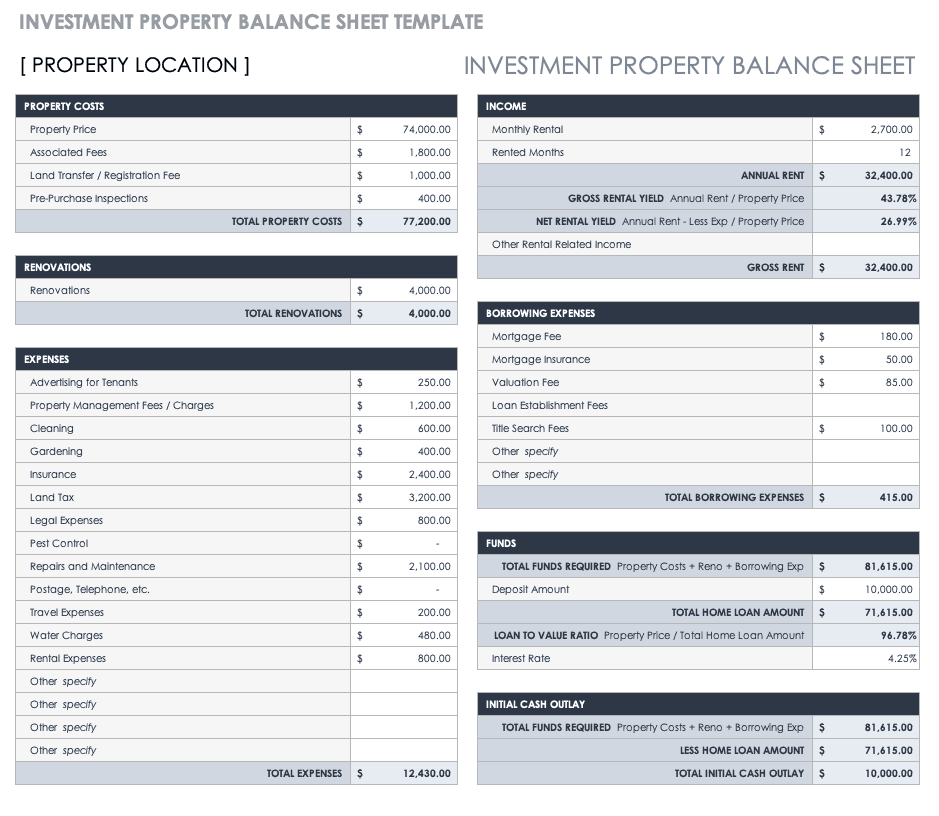

Once you have these figures totaled you can subtract all uses to arrive at seller proceeds. A loan is recognised on the balance sheet when the entity becomes party to a loan agreement. A company balance sheet is the key to both financial structuring and accounting and shows the company’s total assets, and how these assets were acquired.

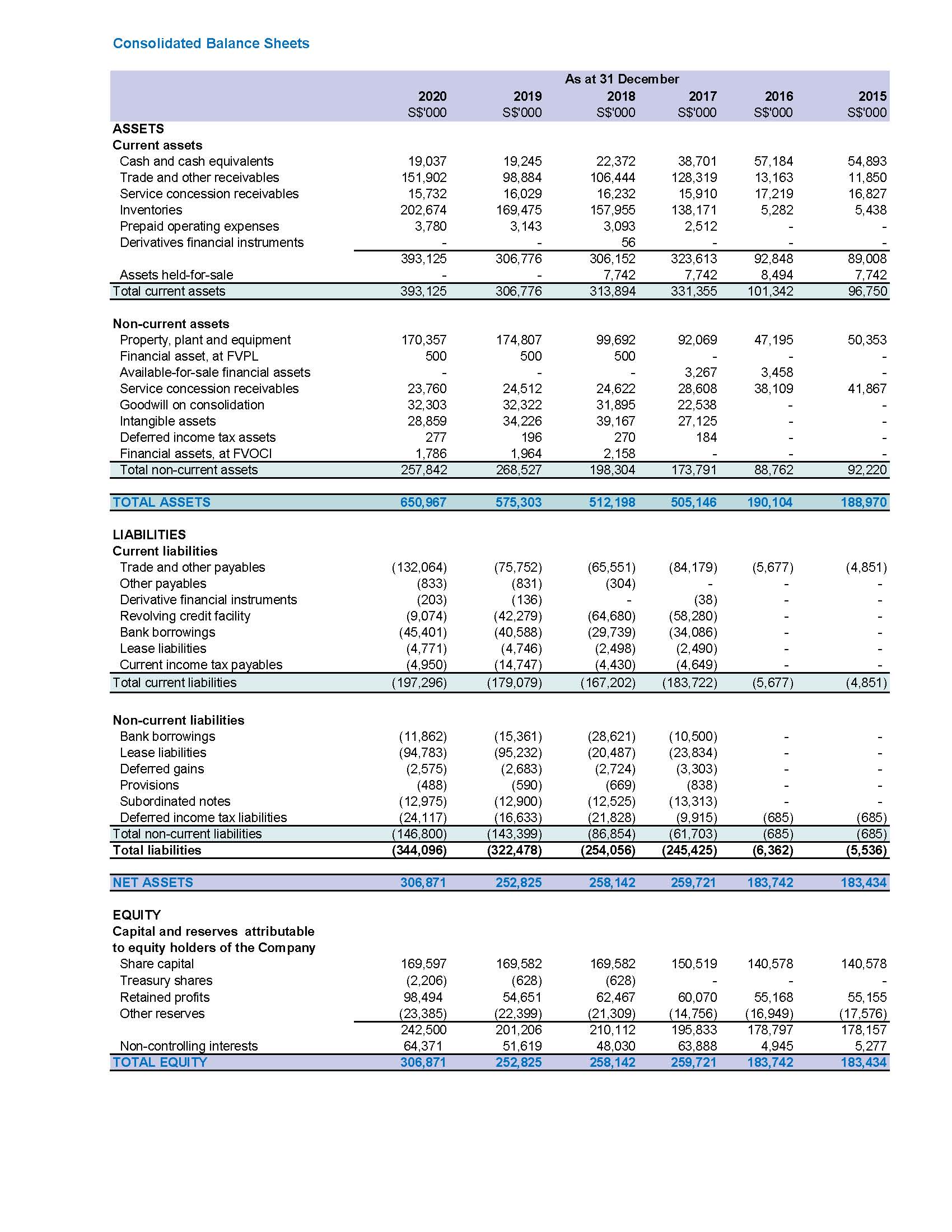

Ig.d.2.1 for example, if the purchased loan is subsequently measured at amortised cost, then the purchaser recognises the loan at its trade date fair value. Notice that we have added all the assets and liabilities of both a inc. This balance sheet compares the financial position of the company as of.

Why would an acquirer be willing to pay $100 million for a company whose balance sheet tells us it’s only worth $50 million? Goodwill is almost always positive—and can Bigco wants to buy littleco, which has a book value (assets, net of liabilities) of $50 million.

The image below is an example of a comparative balance sheet of apple, inc. The acquisition method. With an asterisk.when companies announce acquisitions, the executives throw around a number called goodwill, which is the difference between the price paid and the value of the company’s net assets on its balance sheet.

Purchase acquisition accounting is a method of reporting the purchase of a company on the balance. I knew it creates goodwill but i thought it was because purchase price is usually bigger than the value of company. Here is how the consolidated balance sheet of a inc.

Buys all the equity of b inc. It also shows the owners’ or shareholders’ equity in the company, which is equal to the difference between its assets and liabilities. When dealing with partnership accounts, a sole proprietorship or partnership firm may be converted into a firm to derive advantages from improving efficiency and avoiding competition.