Ideal Tips About Layout Of Income Statement Audited Financial Statements Construction Company

This document gauges the financial performance of a business in terms of profits or losses for the accounting period.

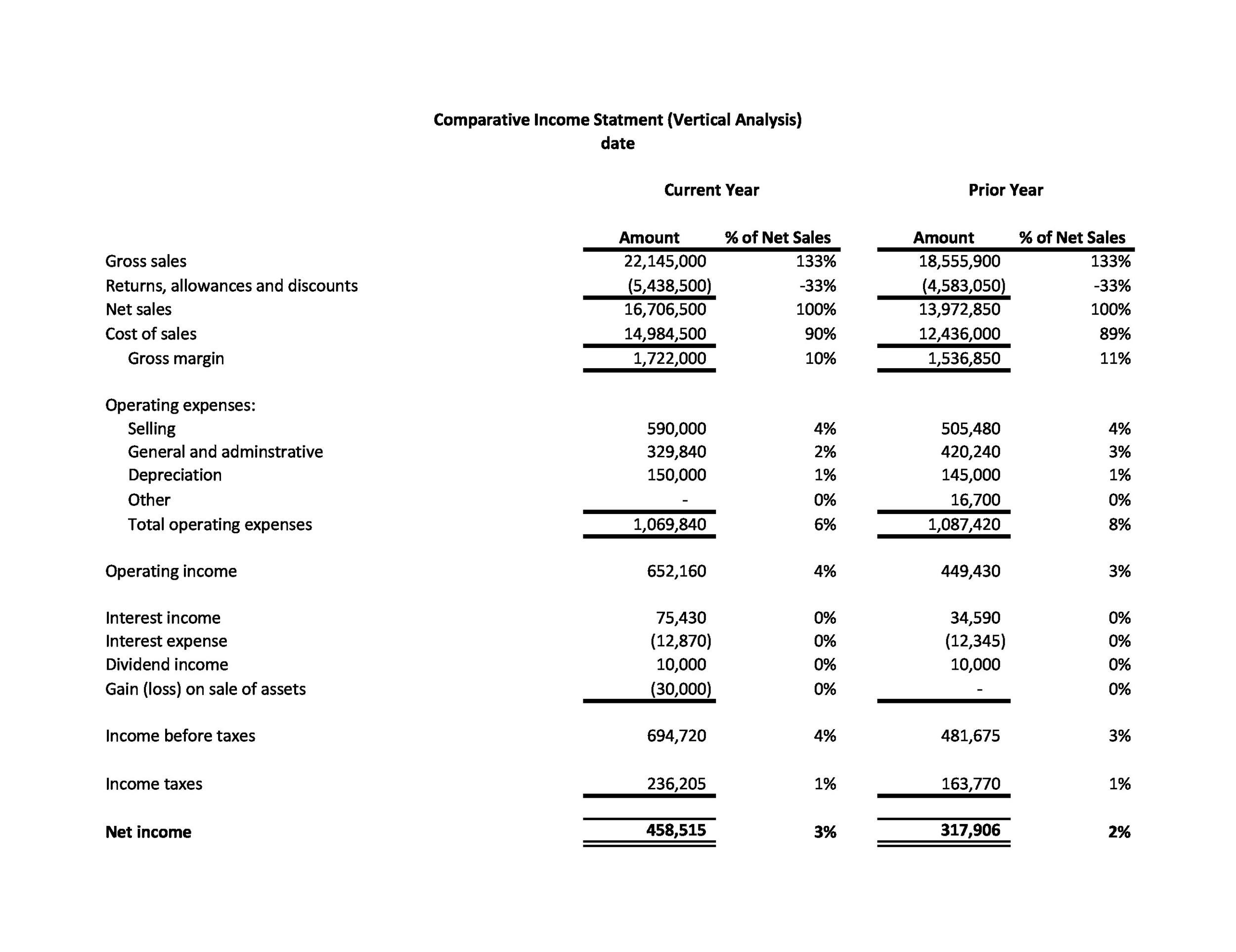

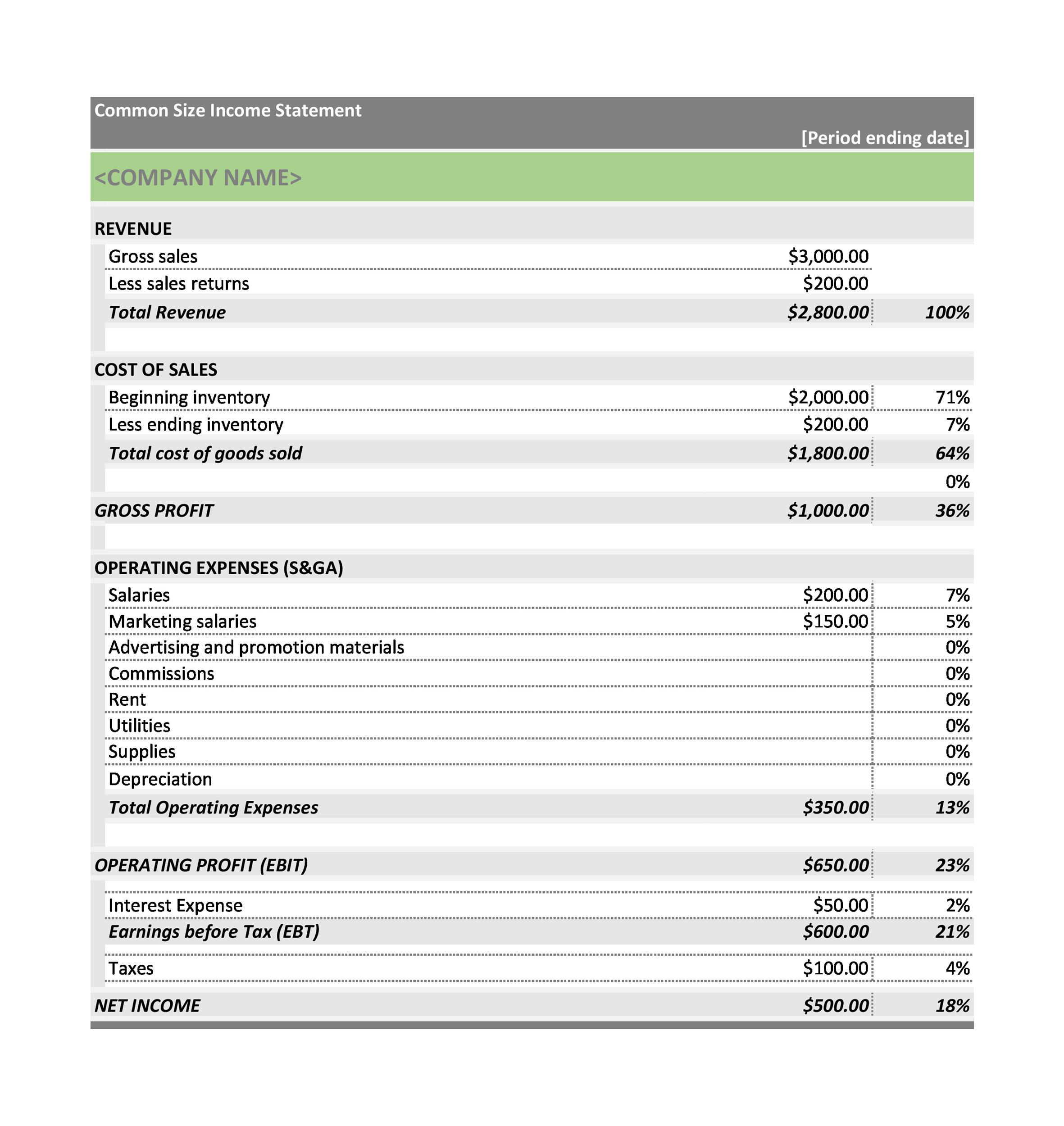

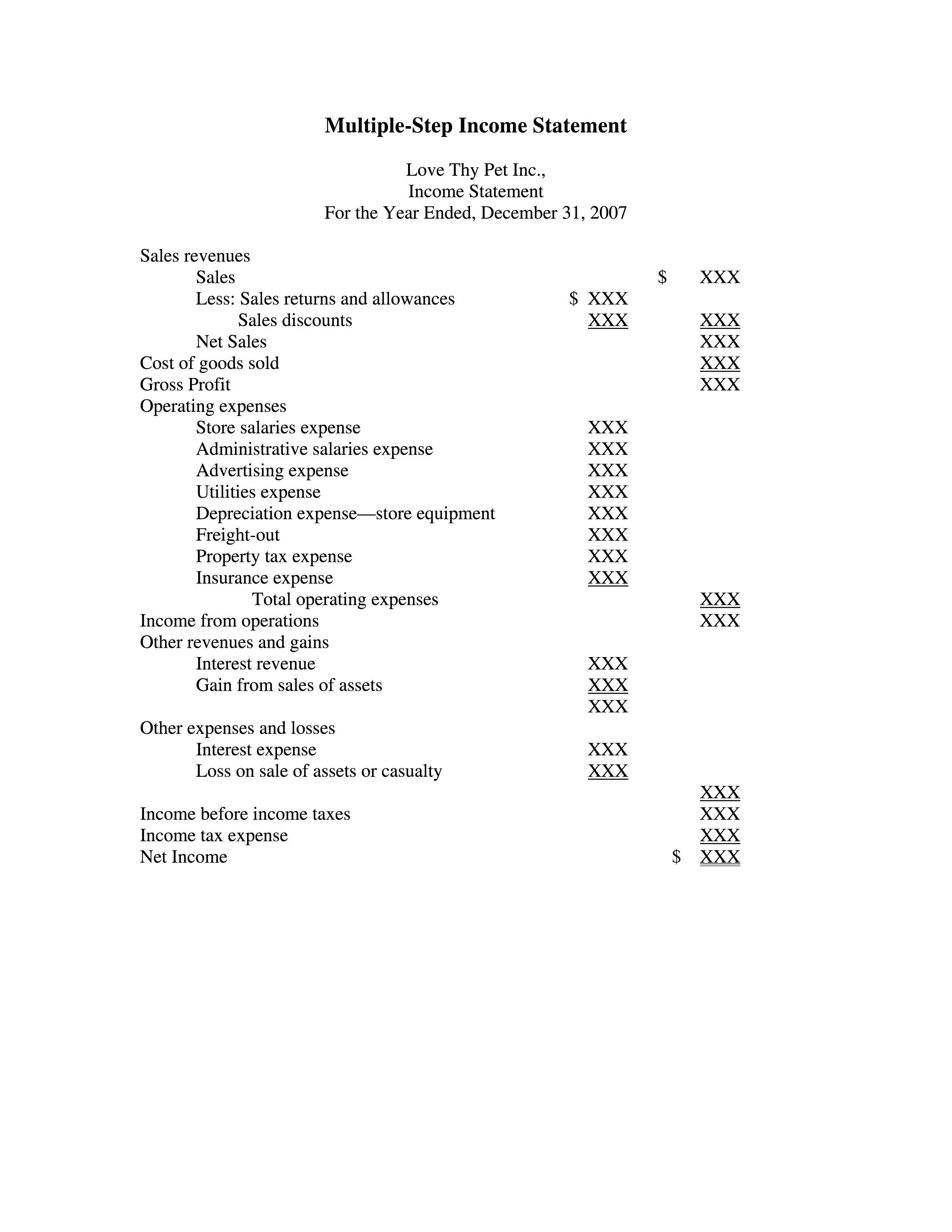

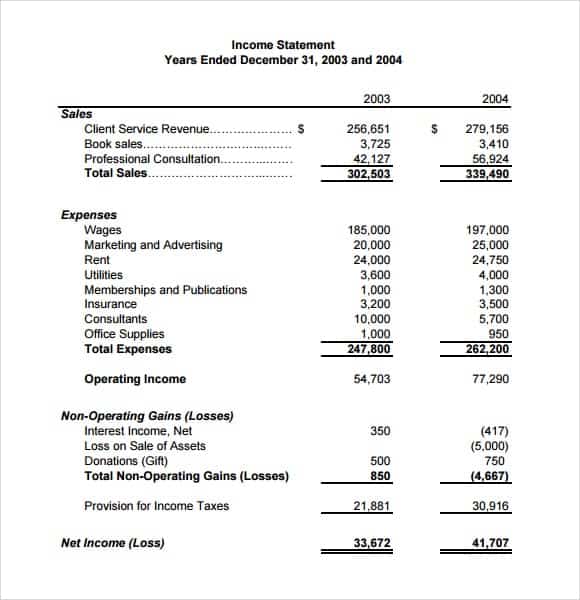

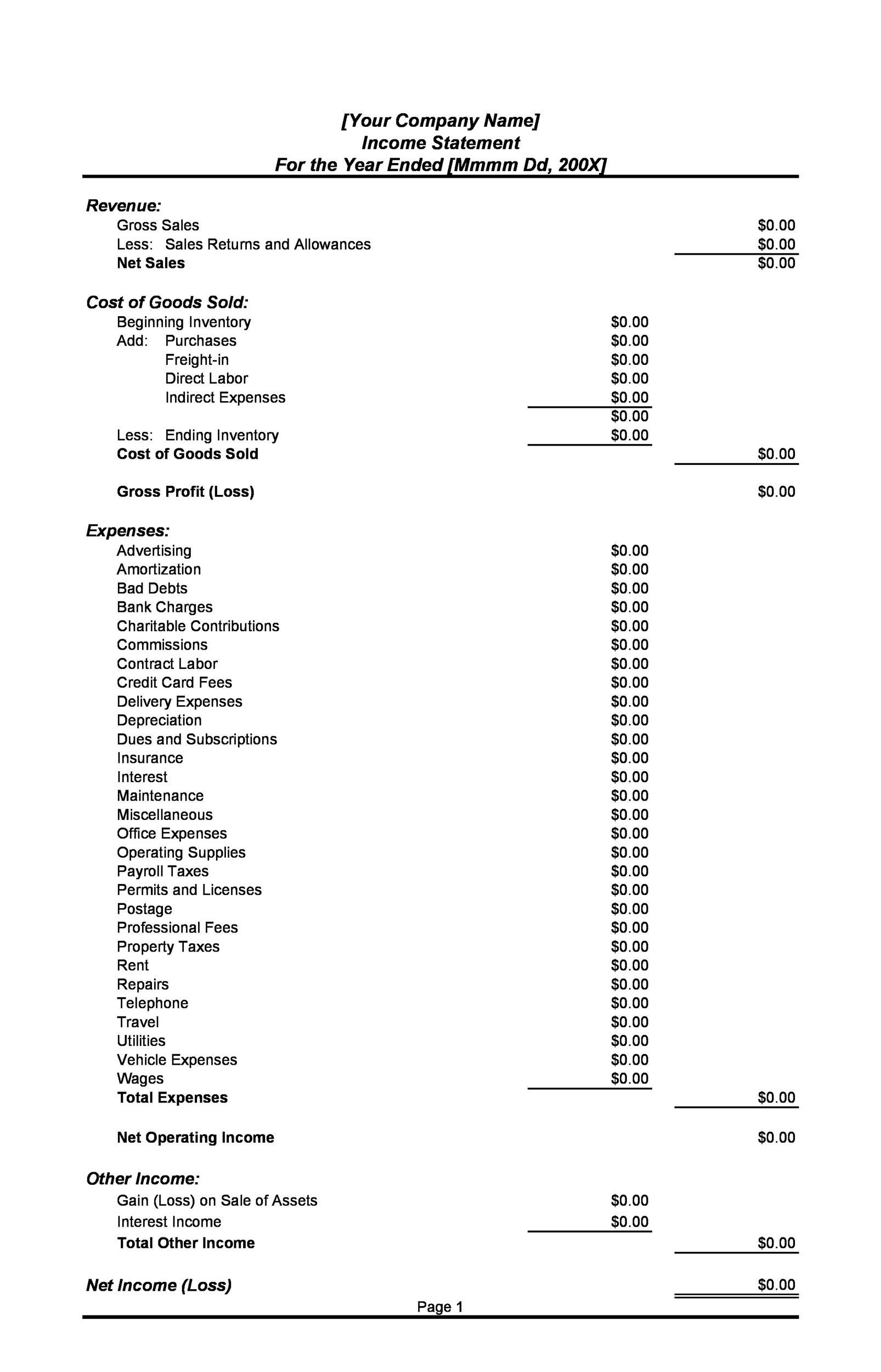

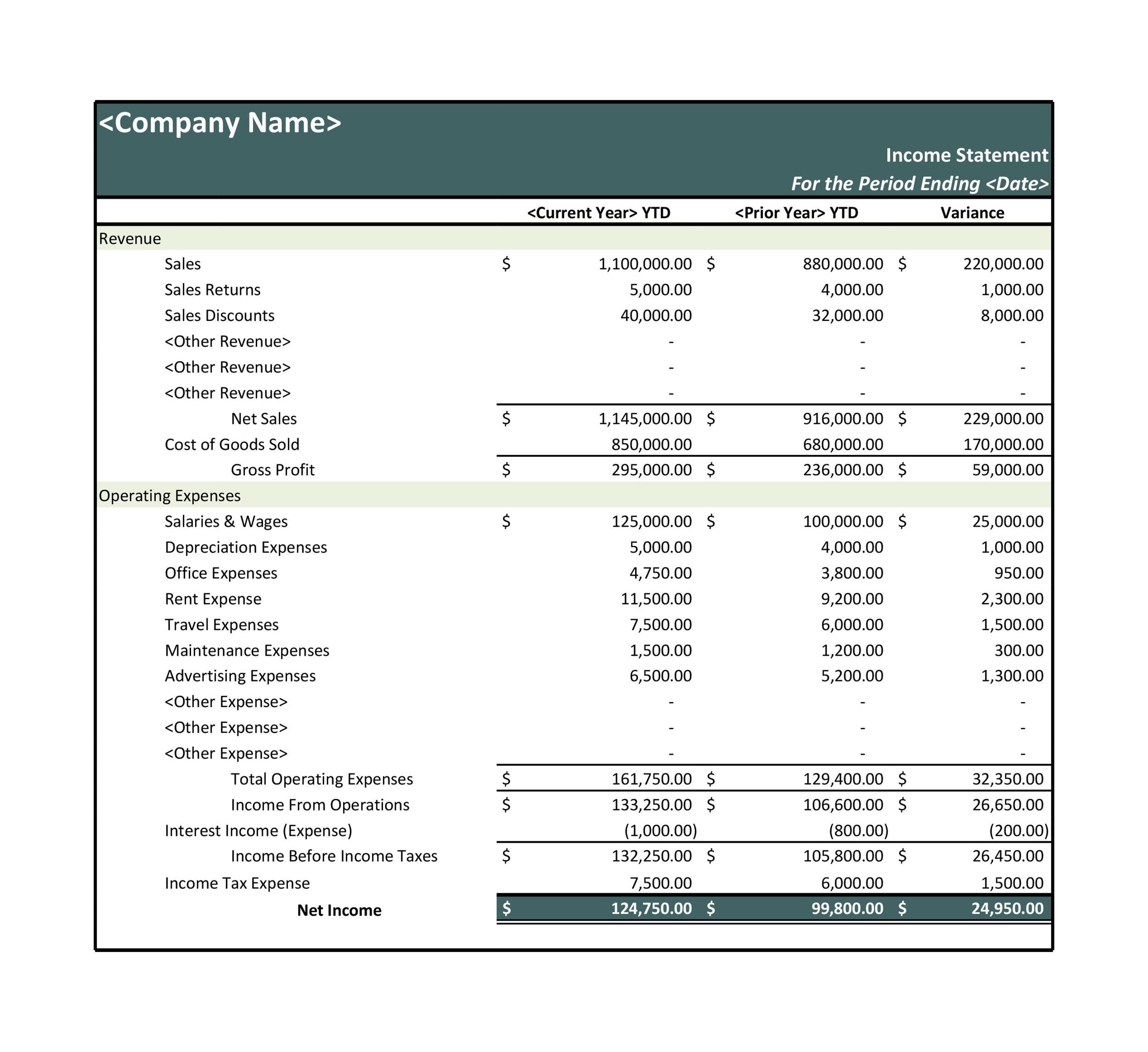

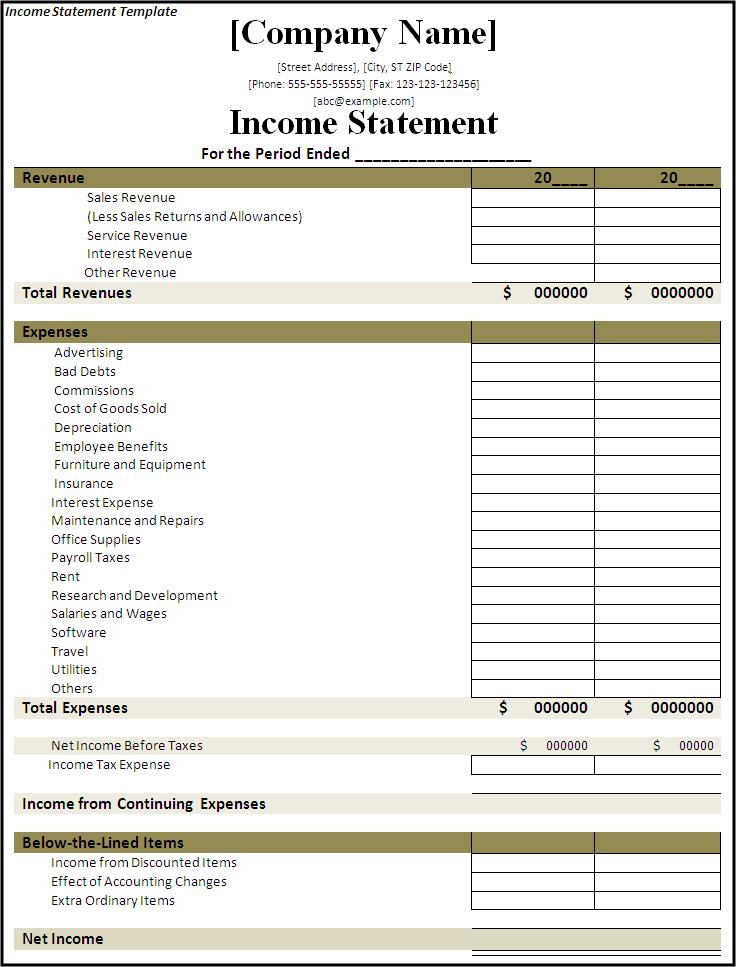

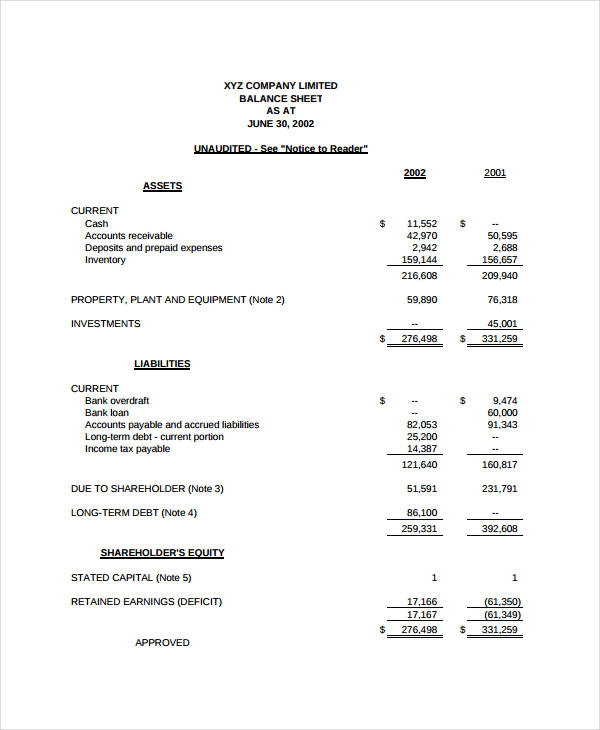

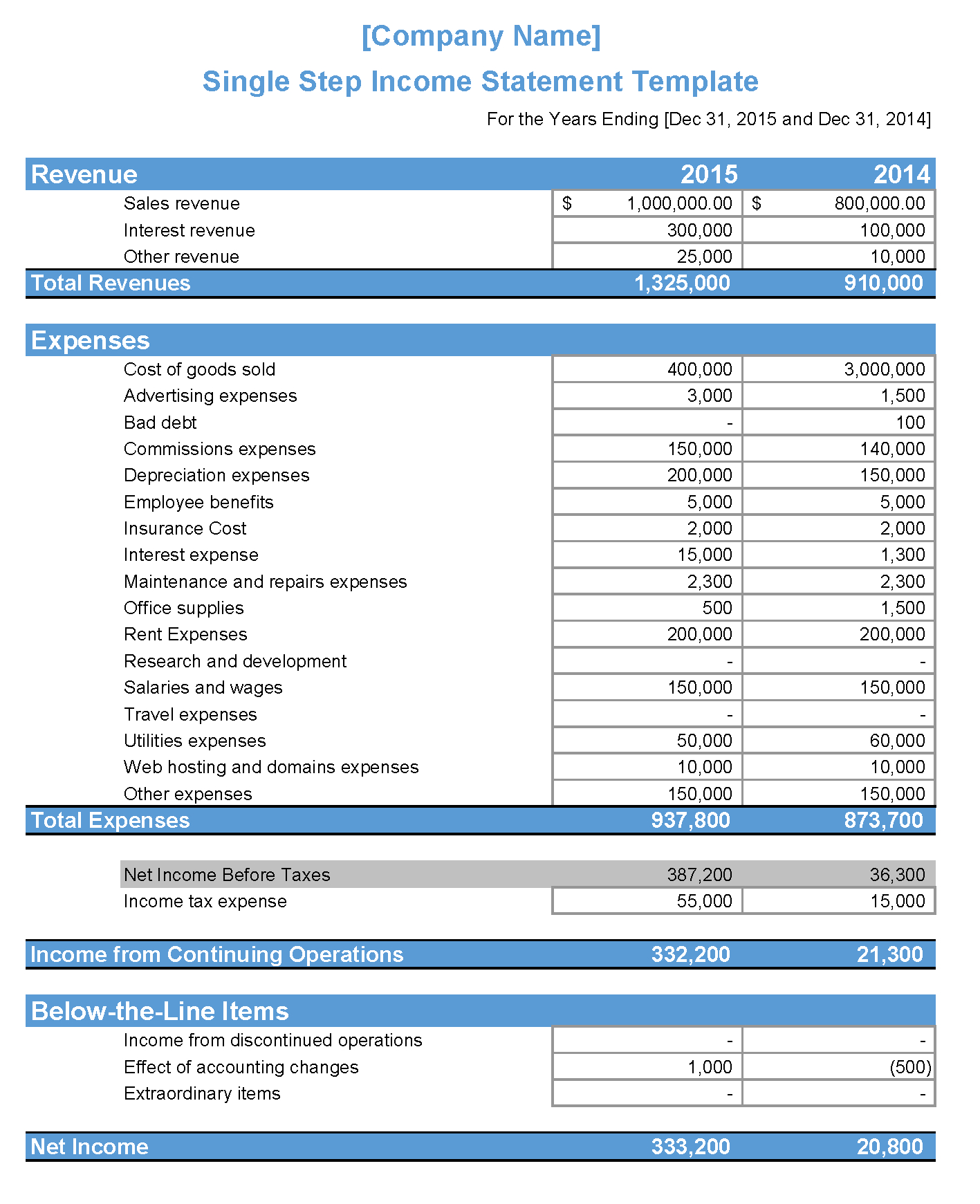

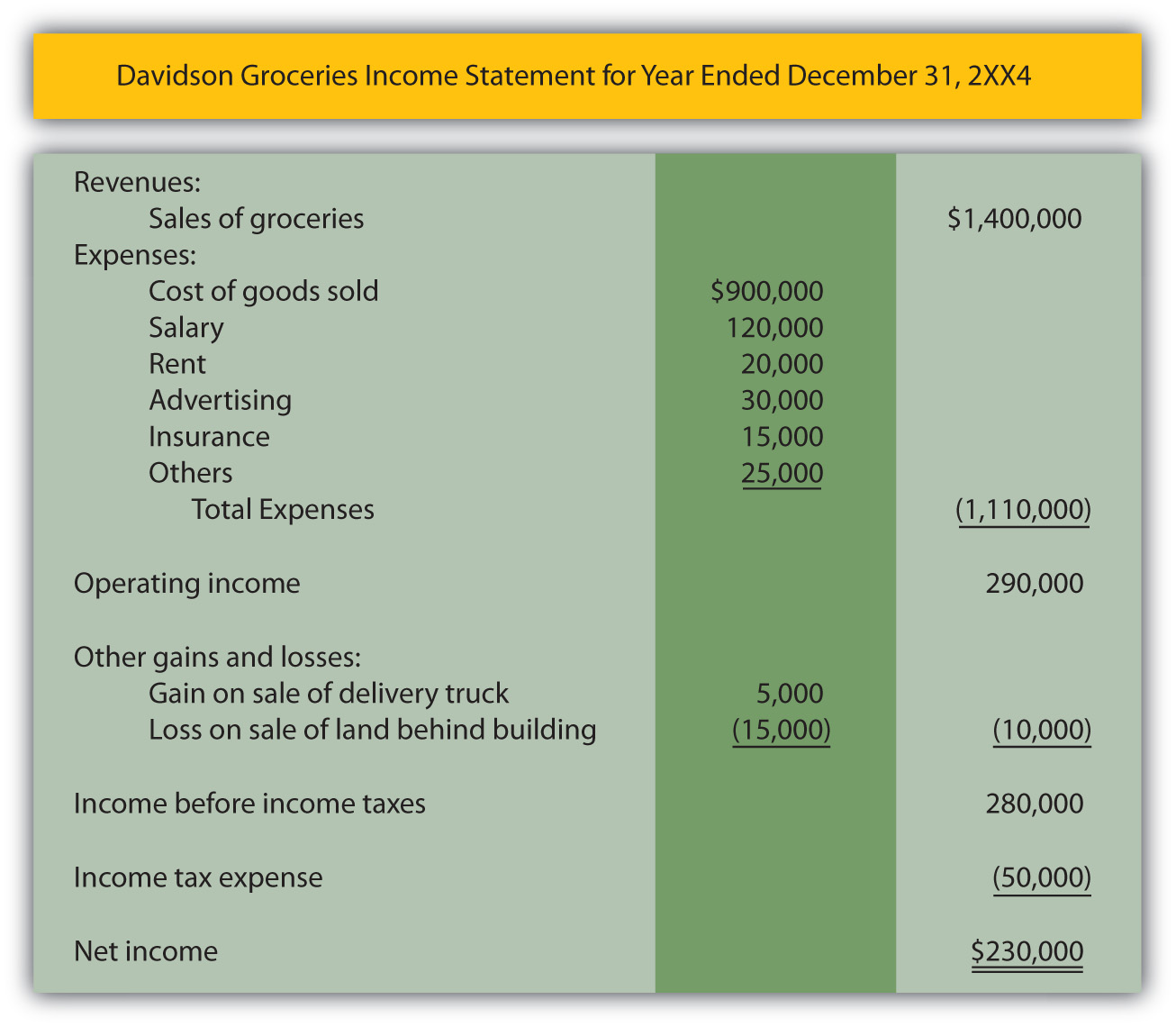

Layout of income statement. Income statement, also known as profit & loss account, is a report of income, expenses and the resulting profit or loss earned during an accounting period. The income statement is also known as a profit and loss statement, statement of operation, statement of financial result or income, or earnings statement. The difference between the two is in the way a statement is read and the comparisons you can make from each type of analysis.

Importance of an income statement. [income statement layout] the income statement always begins with revenue. To be eligible, the applicant:

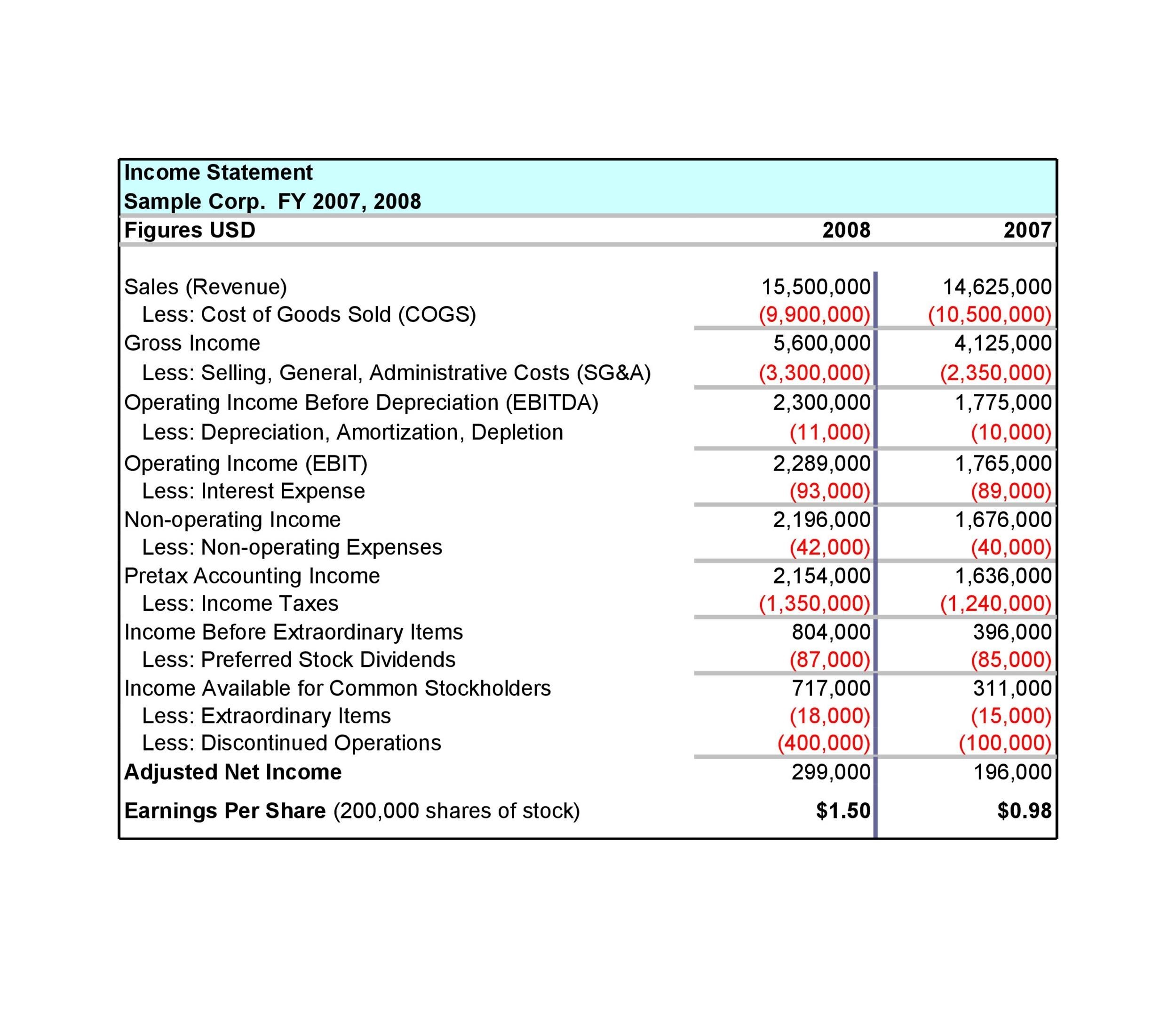

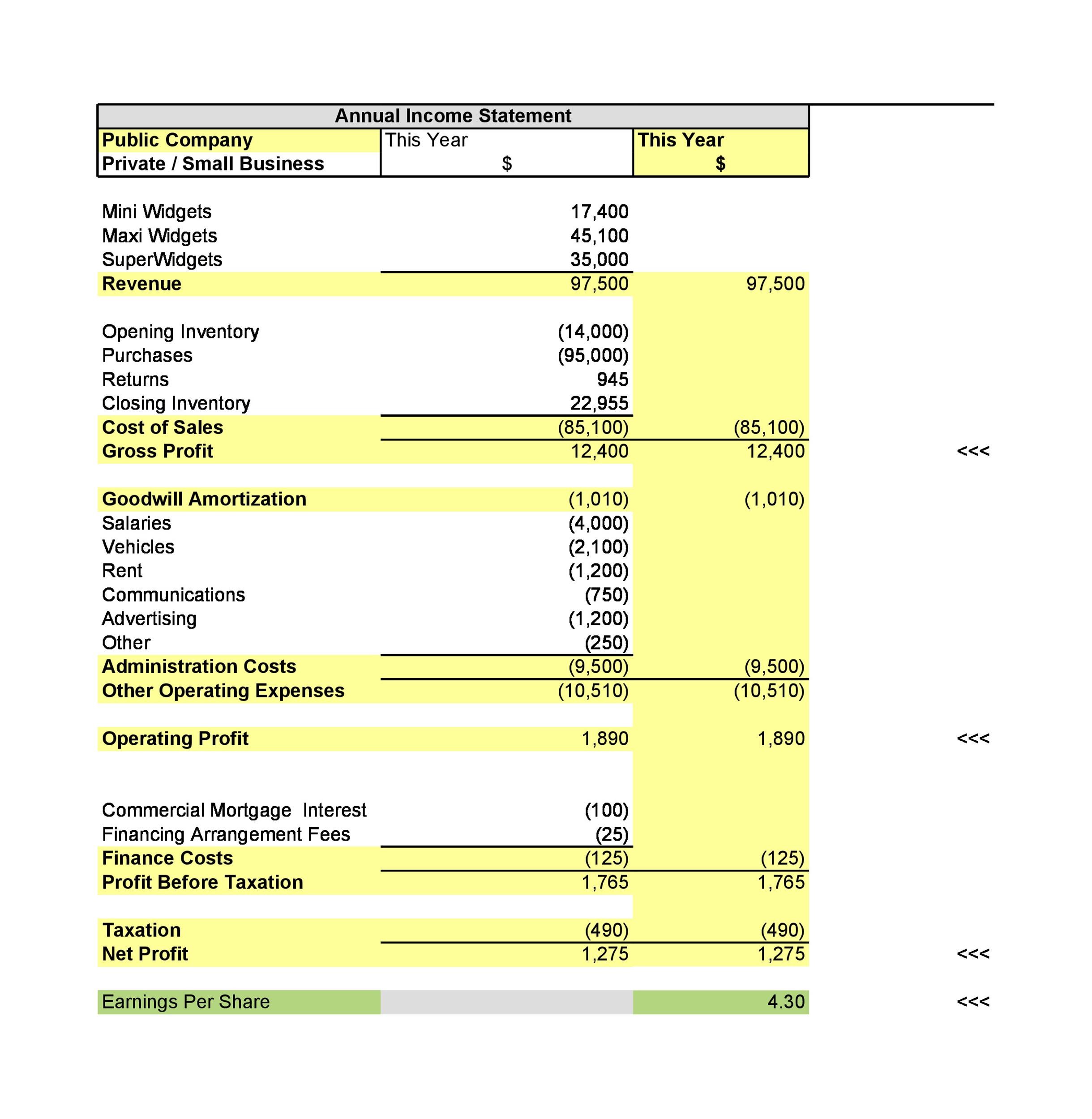

The income statement (also called a profit and loss statement) summarizes a business’ revenues and operating expenses over a time period to calculate the net income for the period. In such a stressful economic environment, the last thing anyone. Income statement analysis.

This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. The income statement focuses on four key items: An income statement compares company revenue against expenses to determine the net income of the business.

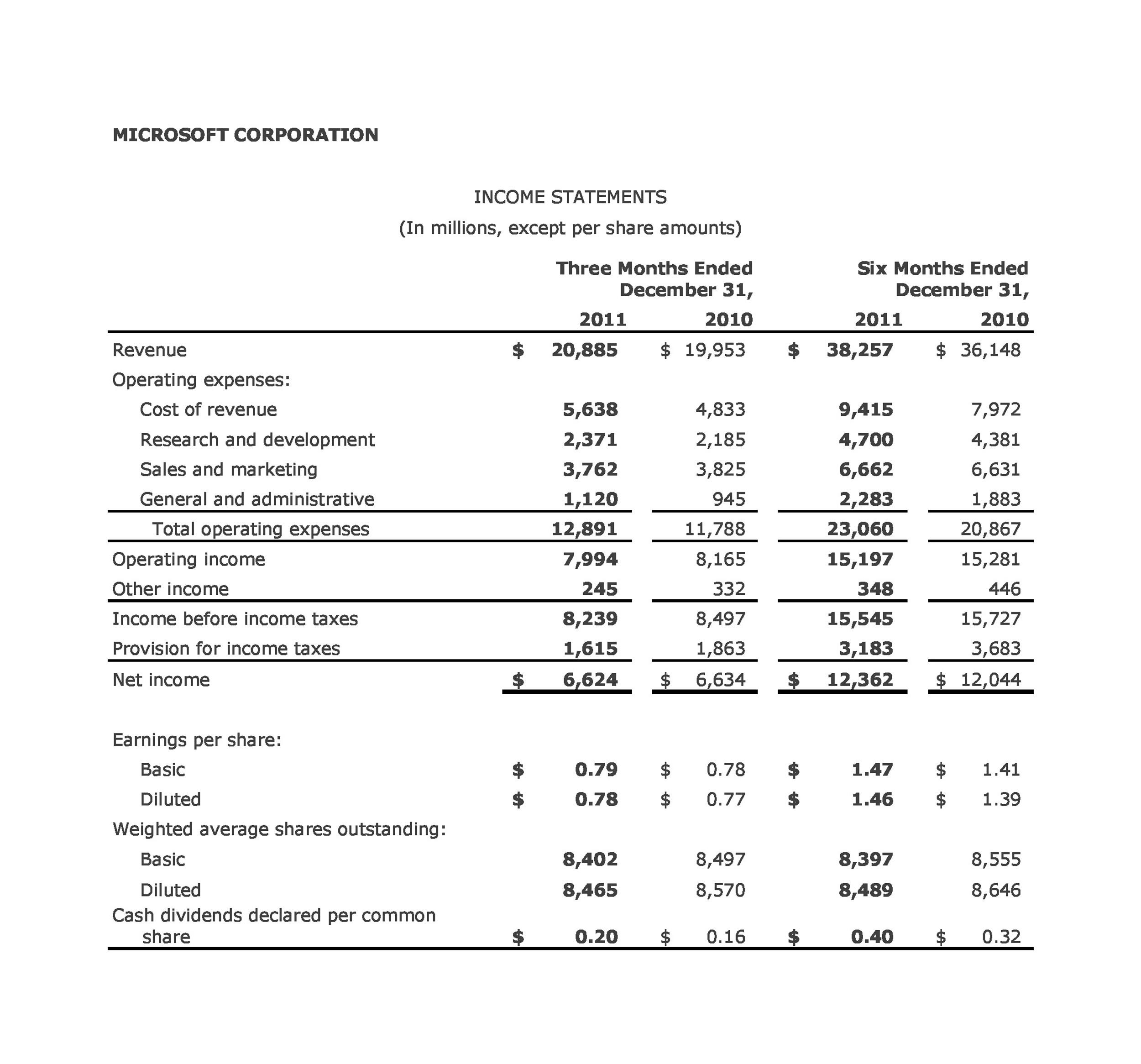

This is also described as sales or turnover, and it is the aggregate value of the company’s services and/or goods sold to. For example, the income statement of a large corporation with sales of $8,349,792,354.78 will report $8,349.8 and a notation such as (in millions, except earnings per share). What is the projected income statement?

Filed a new brunswick tax return. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. Had $3,000 or more in family working income for that taxation year.

You will need to file a return for the 2024 tax year: It’s always at the top. This stands in direct contrast to net income / net loss, which is known as “bottom line”.

The single step income statement formula is: Revenue is always the first line on the report. Revenue, expenses, gains, and losses.

Let's take a look at how each would look like. An income statement is a financial report that summarizes the revenues and expenses of a business. The income statement follows a specific format.

There are two methods commonly used to read and analyze an organization’s financial documents: Subtract operating expenses from business income to see your net profit or loss. This article has been a guide to what is income statement formats.