Stunning Tips About Expenses On The Balance Sheet 3 Year Projection Business Plan

Elena cardone is organizing this fundraiser.

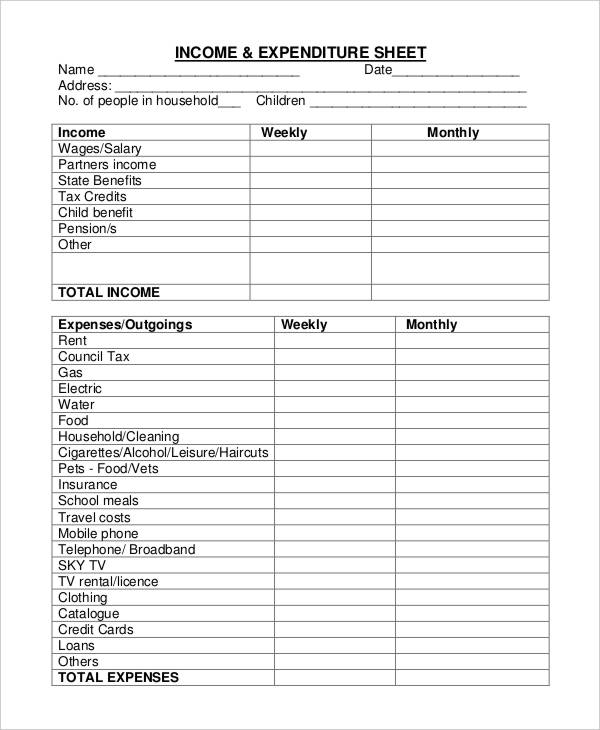

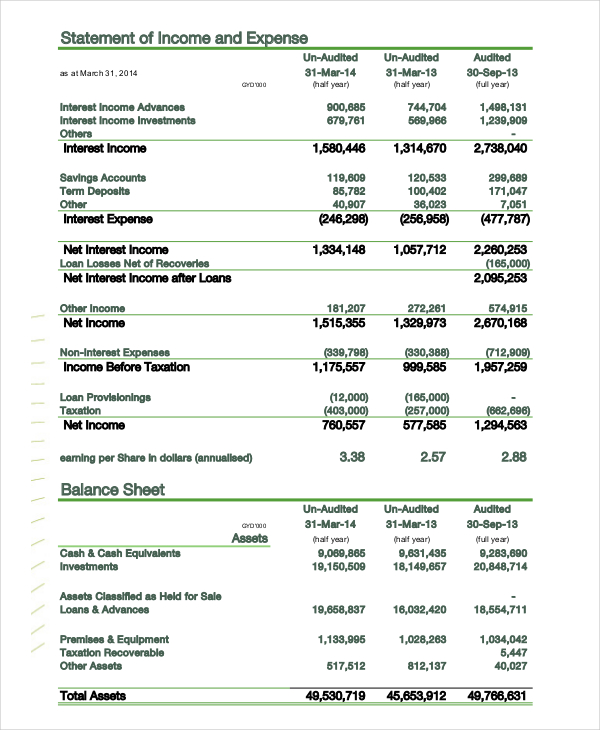

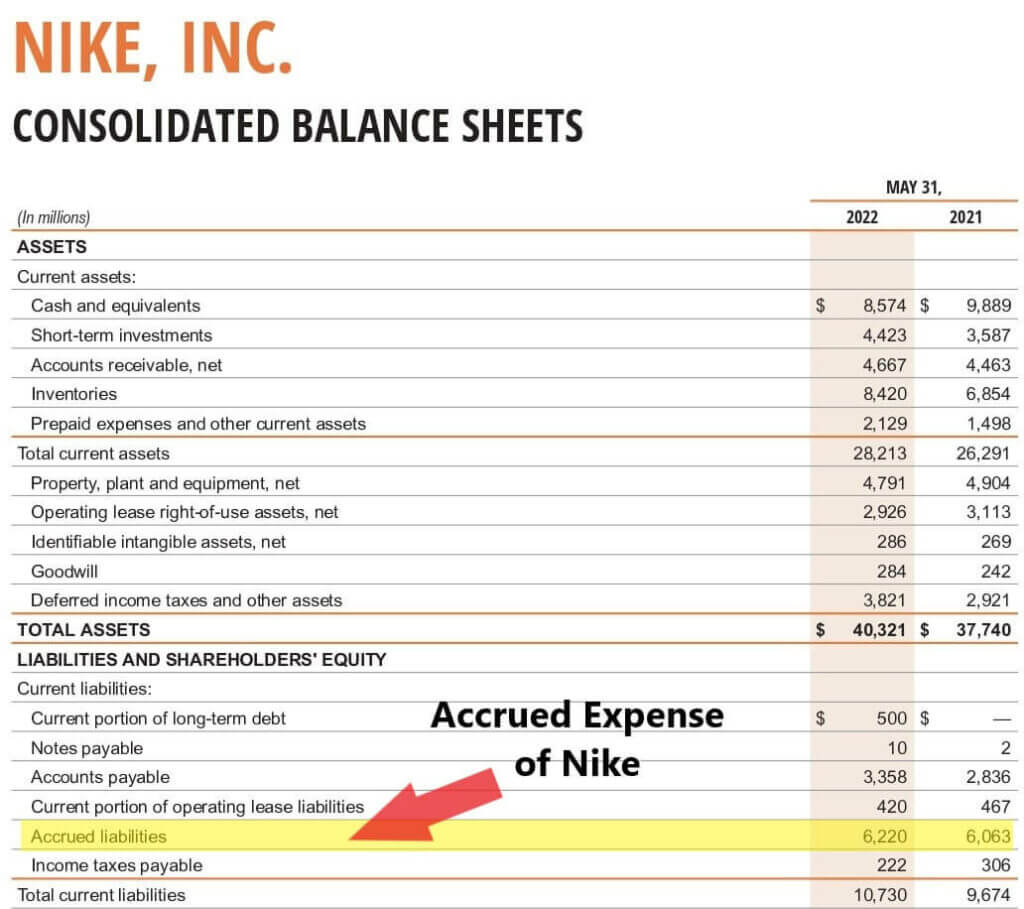

Expenses on the balance sheet. On the current liabilities section of the balance sheet, a line item that frequently appears is “accrued expenses,” also known as accrued liabilities. Prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset. When a business incurs an expense, this reduces the amount of profit reported on the income statement.

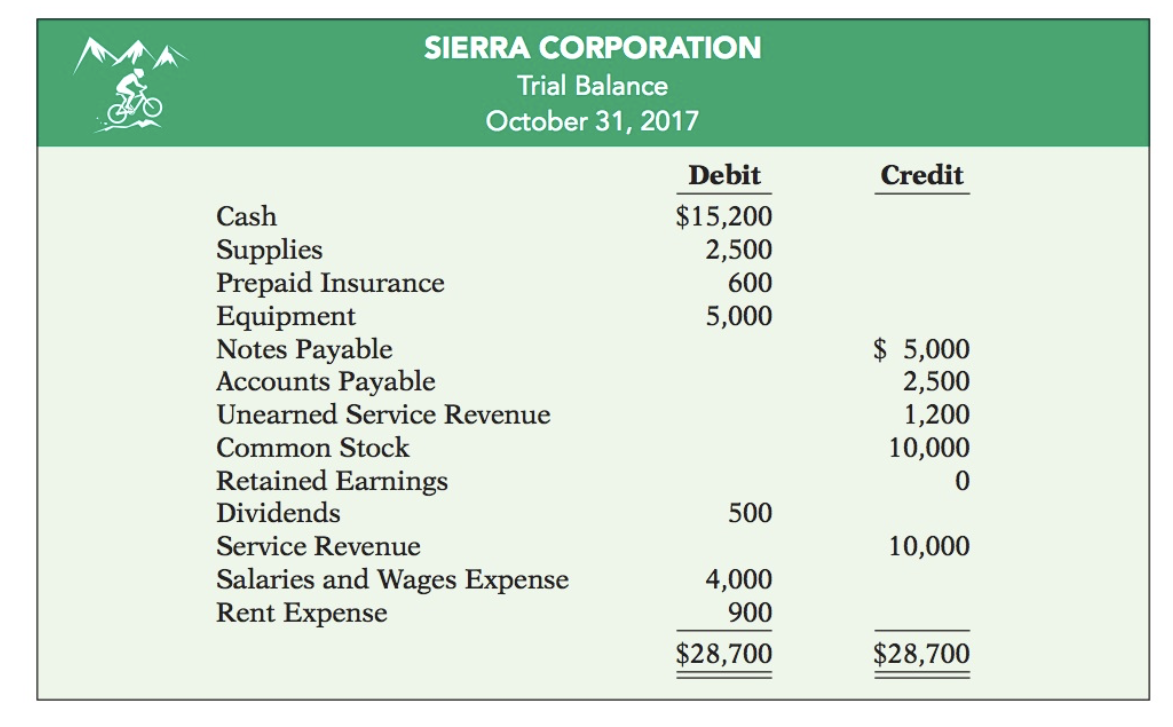

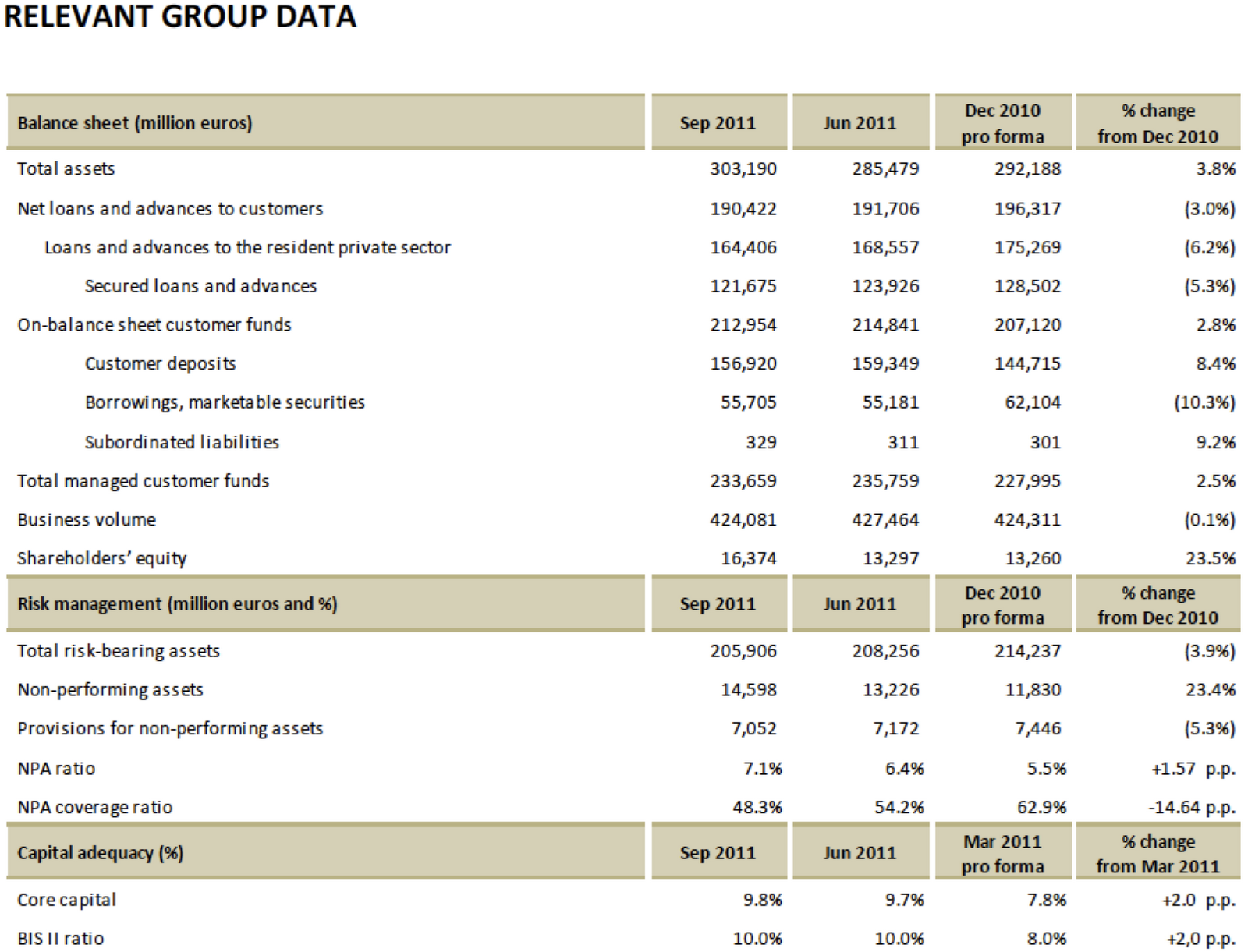

A balance sheet covers a company’s assets as defined. Depreciation expense has a direct impact on the balance sheet through the following components: That’s where this guide comes in.

2023 — these faqs update question 9 to provide that a united states military service member who is a wrongfully incarcerated individual and who receives back pay following the reversal of a court martial conviction may not exclude the payments under section 139f if the. Option one is straight to the profit and loss statement, effectively bypassing the balance sheet. Examples of expenses on the balance sheet.

Eighteen of nato’s 31 members are expected to spend at least 2% of their gdp on defense this year, the treaty organization’s leader said on wednesday. In accounting, these payments or prepaid expenses are recorded as assets on the balance sheet. Over time, prepaid expenses are expensed onto the income statement.

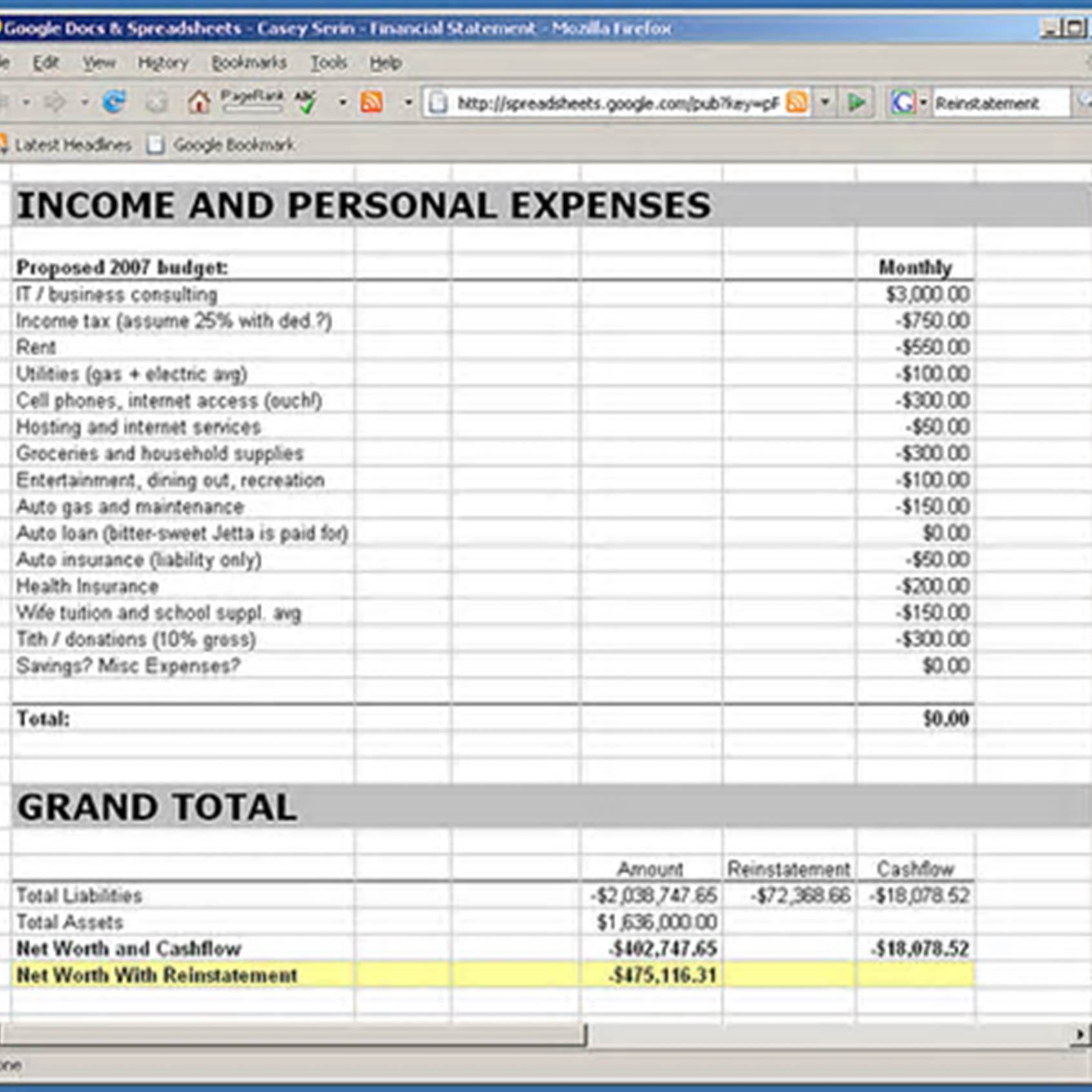

February 22, 2022 balance sheets can help you see the big picture: The format of the date is: Total costs or expenses were $12.39 billion.

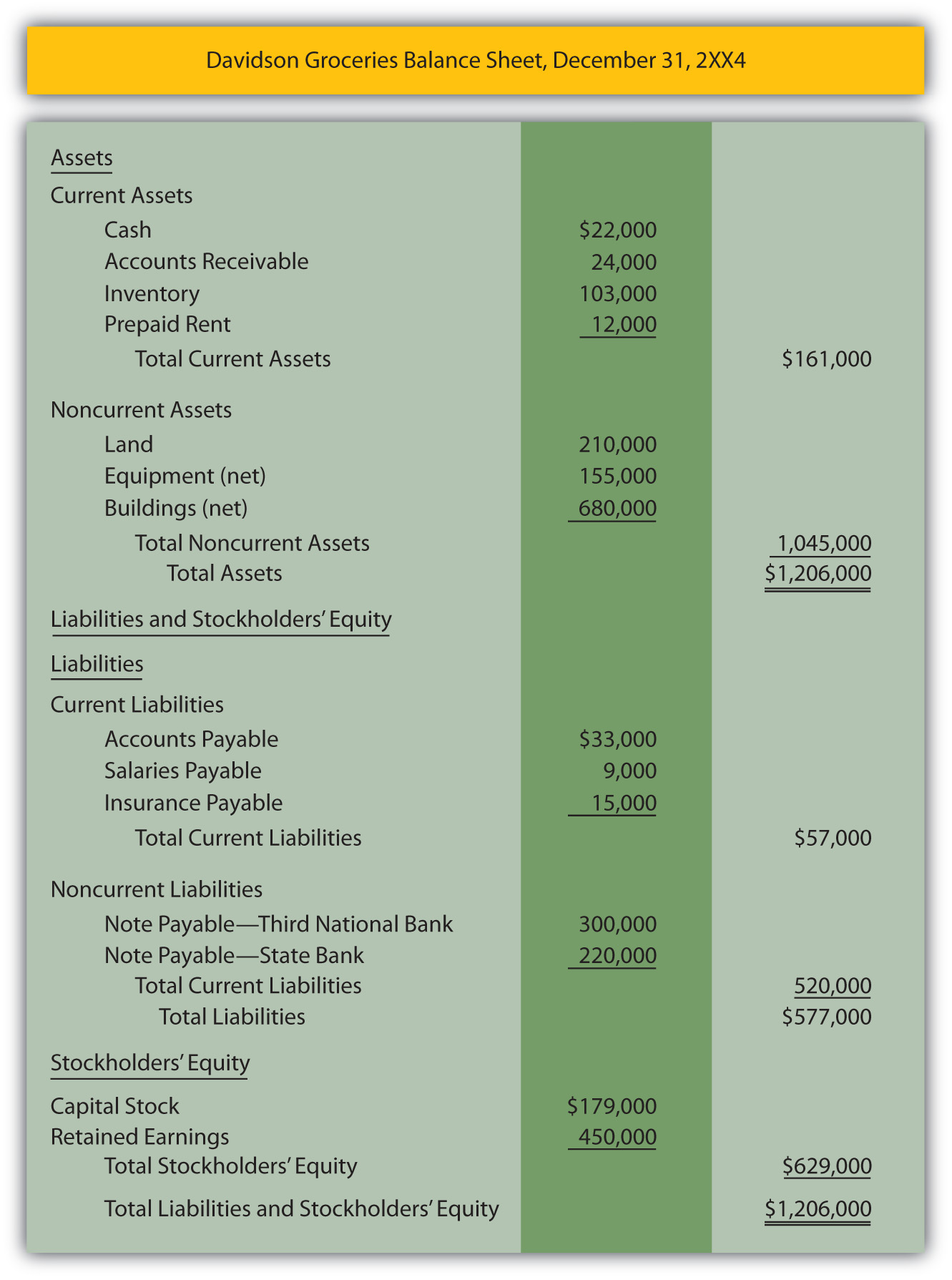

A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. A balance sheet provides a summary of a business at a given point in time. The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity.

Expenses on the balance sheet are not typically reported individually but rather indirectly reflected through their impact on various financial statement categories. These rules disallow a deduction for the portion of the employer's wage or salary expense that equals the total credit for the tax year. The net worth of your small business, how much money you have, and where it’s kept.

Accumulated depreciation, as discussed earlier, is a contra asset account that reduces the value of the related asset. They are shown on a company’s monthly income statement to determine the company’s net income. Accrued expenses can encompass a variety of costs, including salaries, interest expenses, rent, utilities, and vendor invoices.

The three components of the equation will now be described in further detail in the following sections. Sales, general and administrative expenses; An expense is a cost that has been used up, expired, or is directly related to the earning of revenues.

Most of a company's expenses fall into the following categories: This decrease in the carrying value of the asset is reflected on the balance sheet, reducing the total. Assets = liabilities + shareholders’ equity.