Supreme Info About Profit And Loss Sheet Explained Horizontal Analysis Of Cash Flow Statement

The result is either your final profit (if.

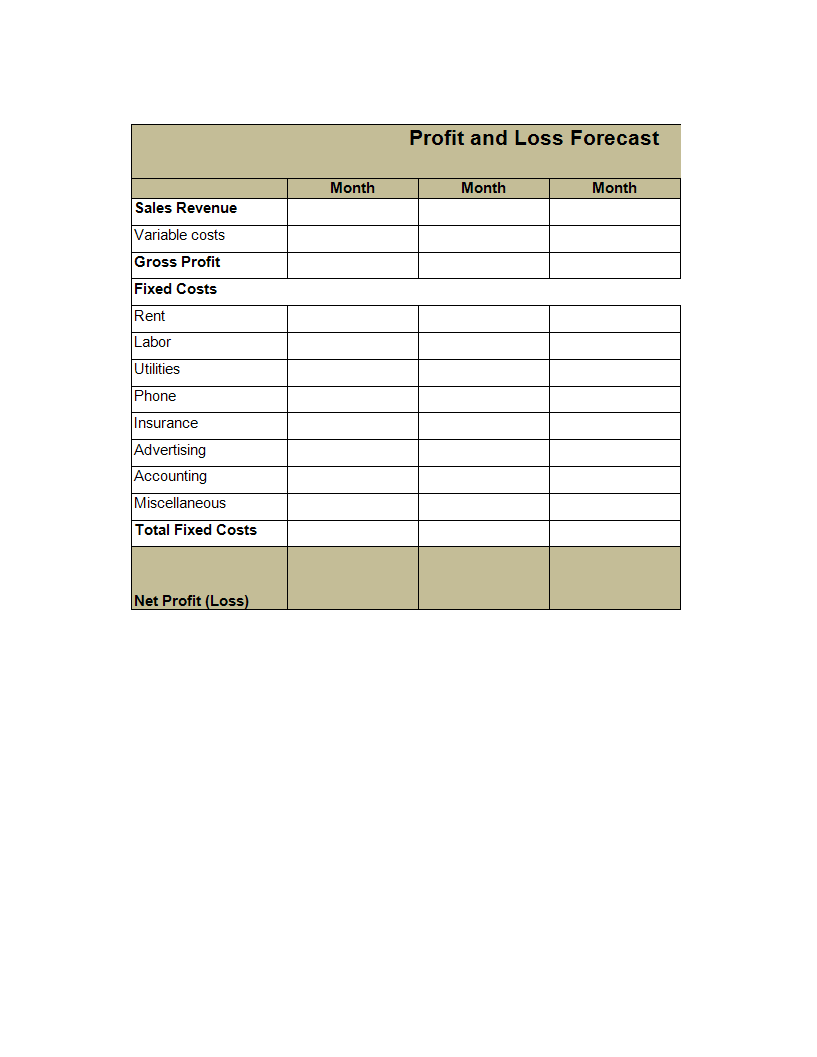

Profit and loss sheet explained. The cash method is a simple way to account for cash received or cash paid. The outcome is either your final profit or loss. Profit and loss account.

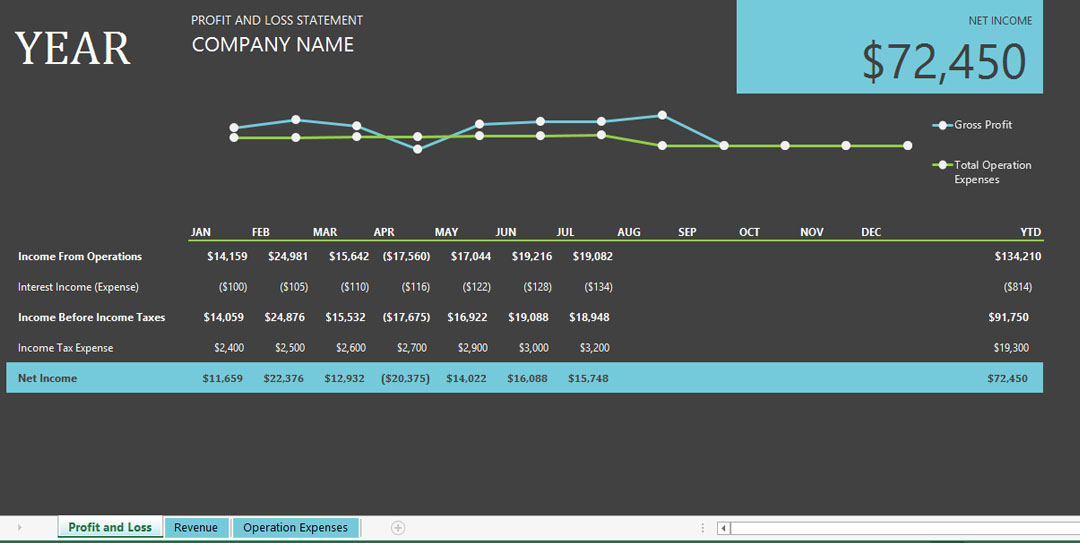

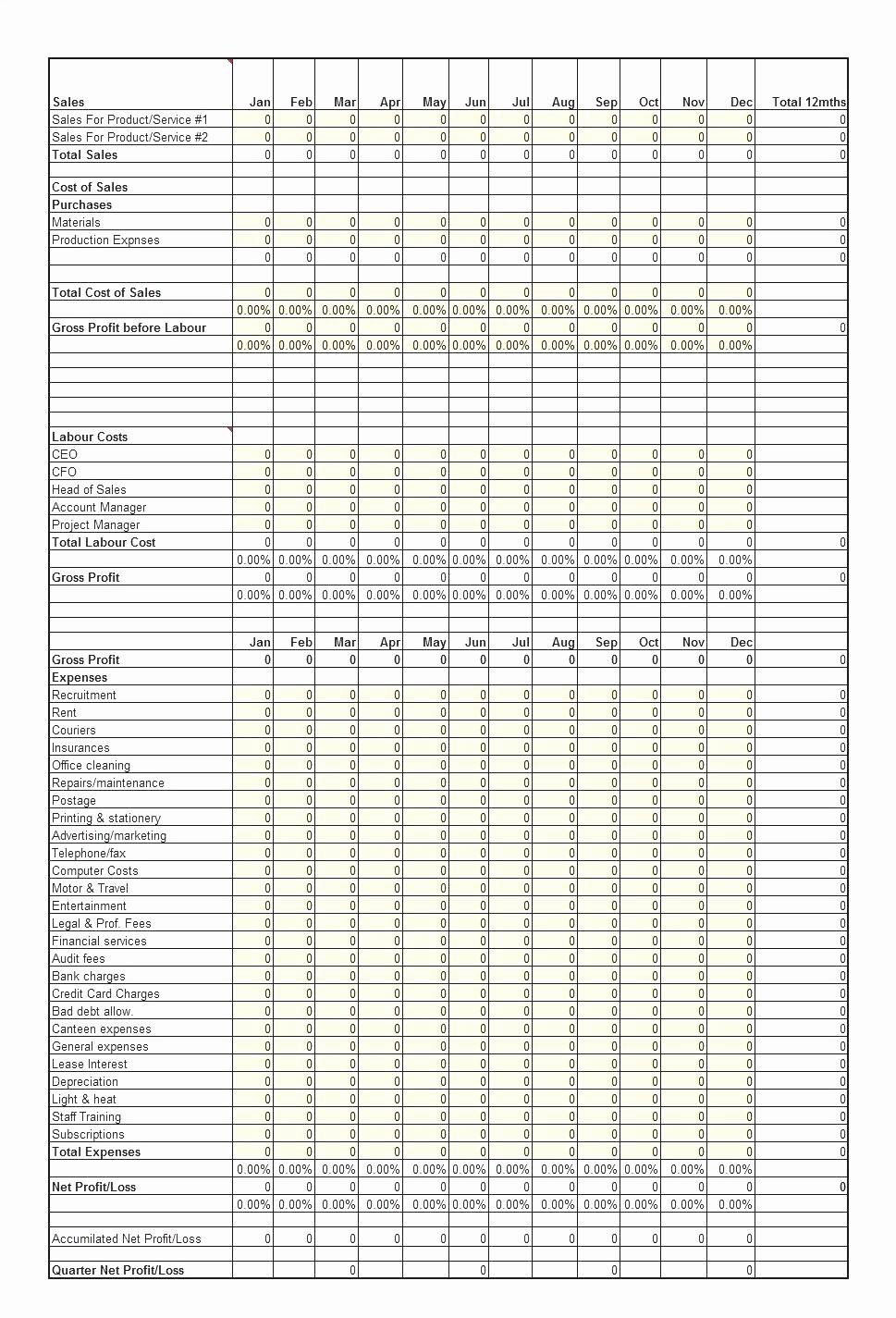

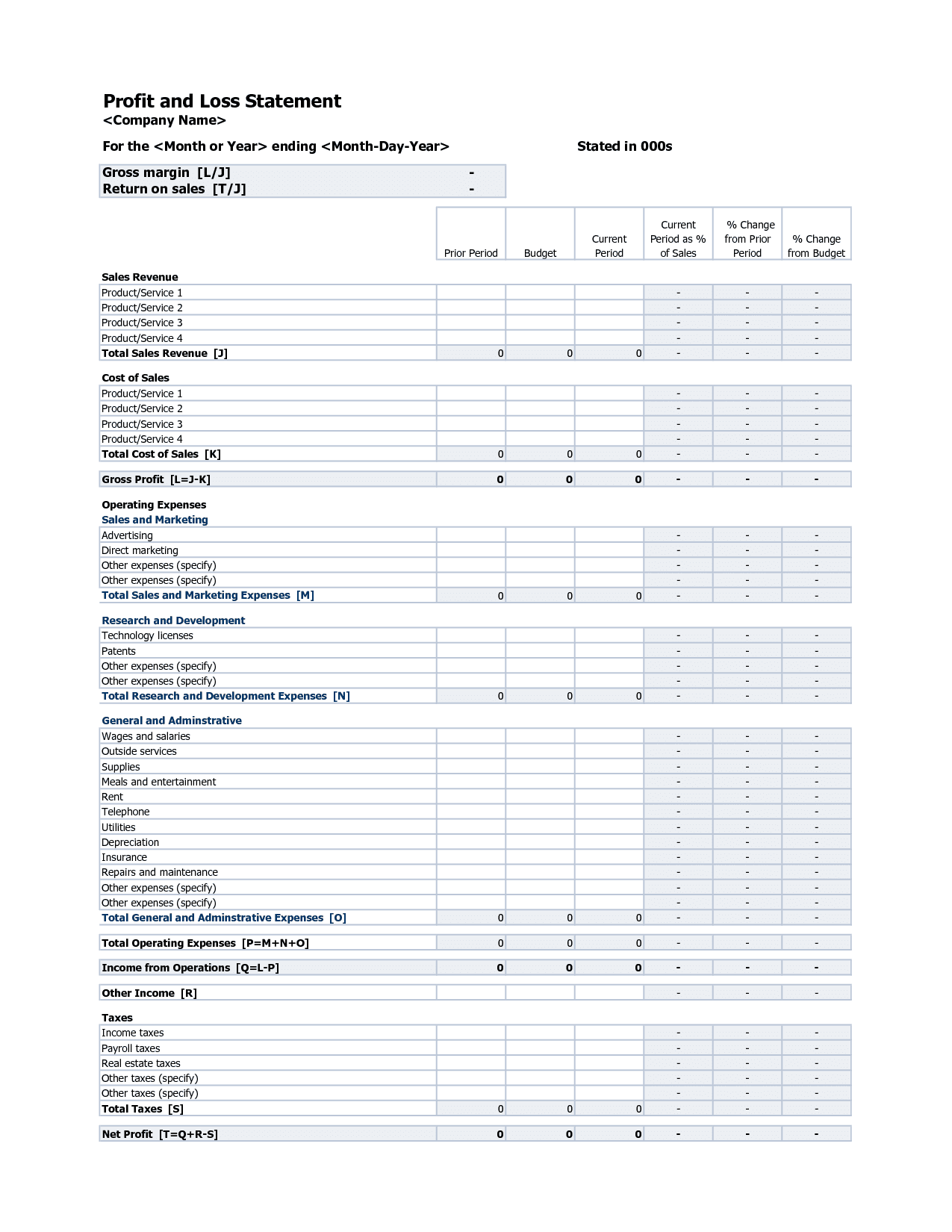

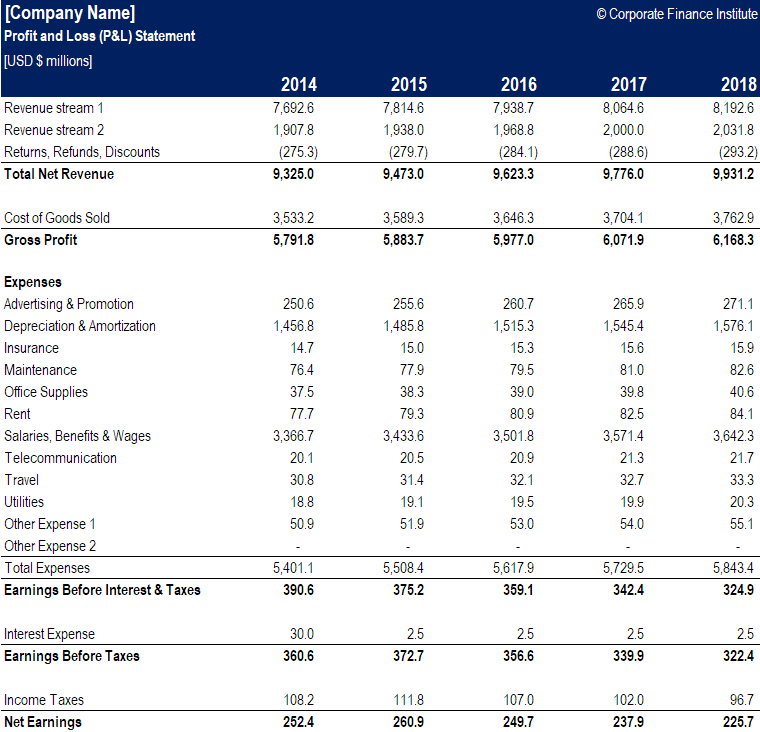

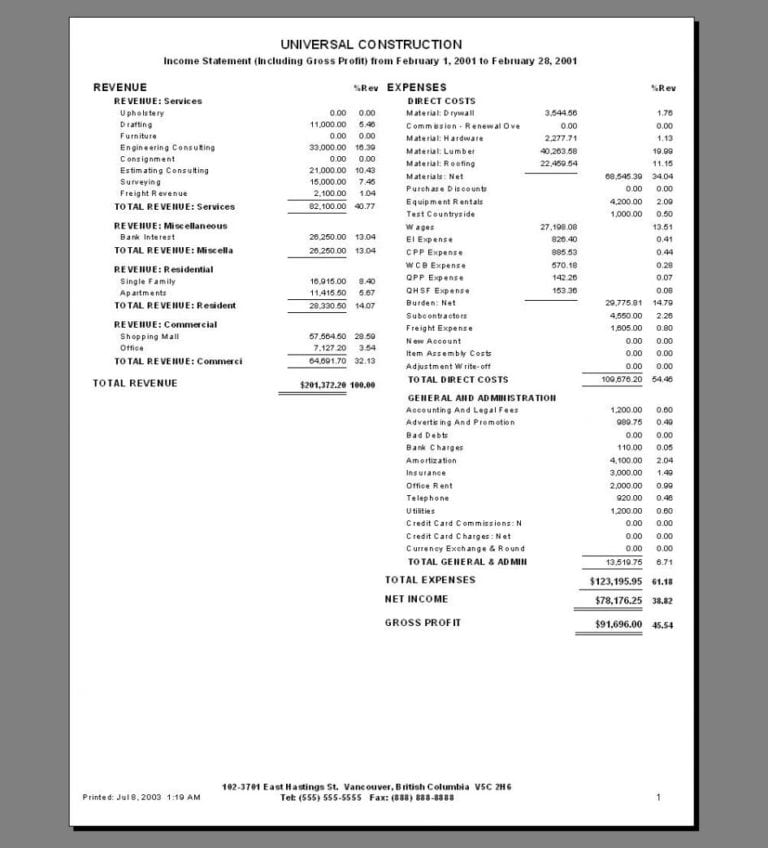

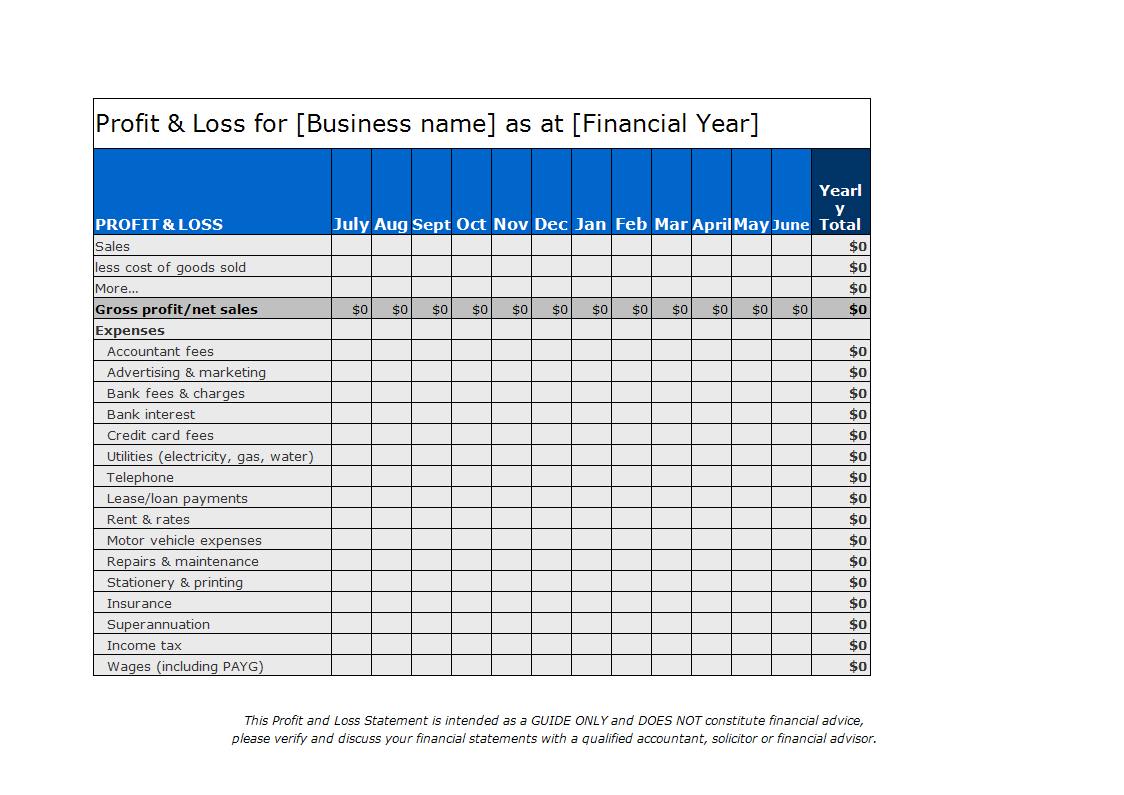

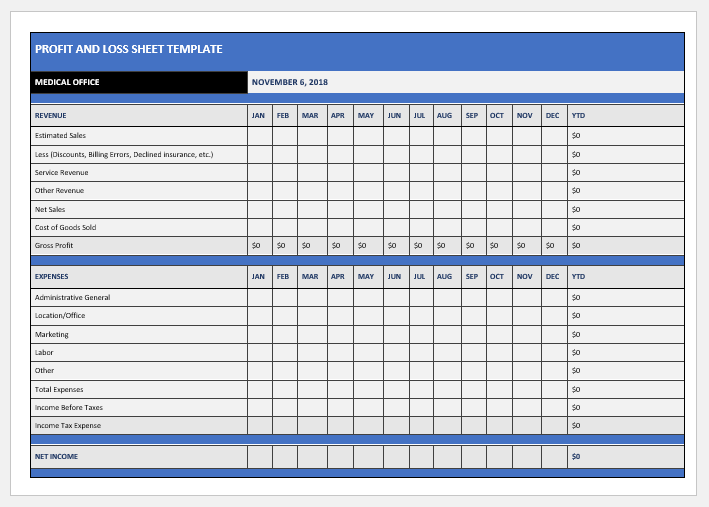

In fact, experts consider a profit and loss statement one of the most common financial documents in any sector and business plan. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually.

This summary provides a net income (or bottom line) for a reporting period. It shows your revenue, minus expenses and losses. What we’re referring to is the profit and loss statement (p&l), which gives you insight into how well your business is doing.

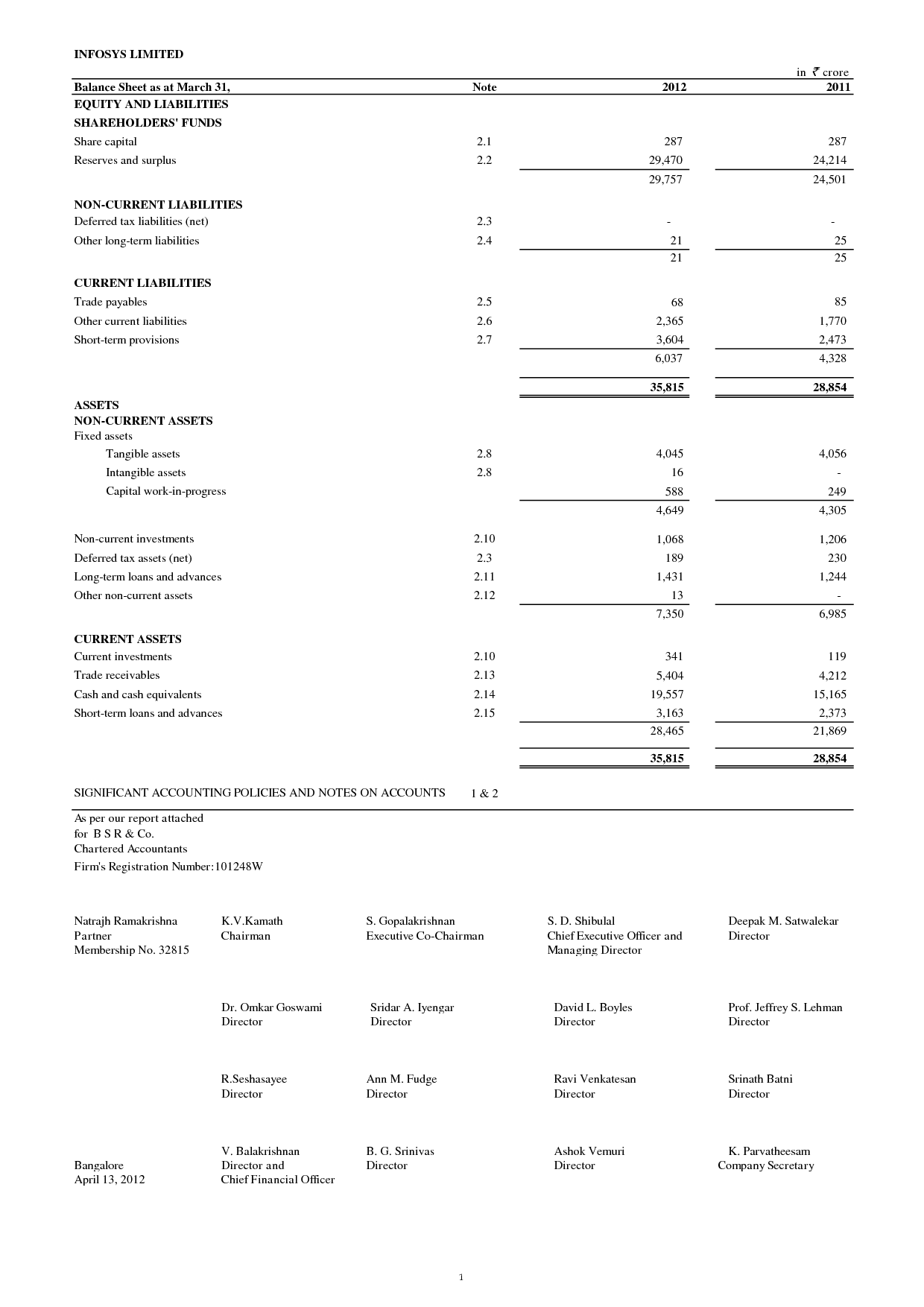

A balance sheet is a declaration that details a company's assets, liabilities, and equity as of a certain time. Key differences between profit and loss statement vs balance sheet. If your business owns more than it owes, then the balance sheet total will be a positive figure.

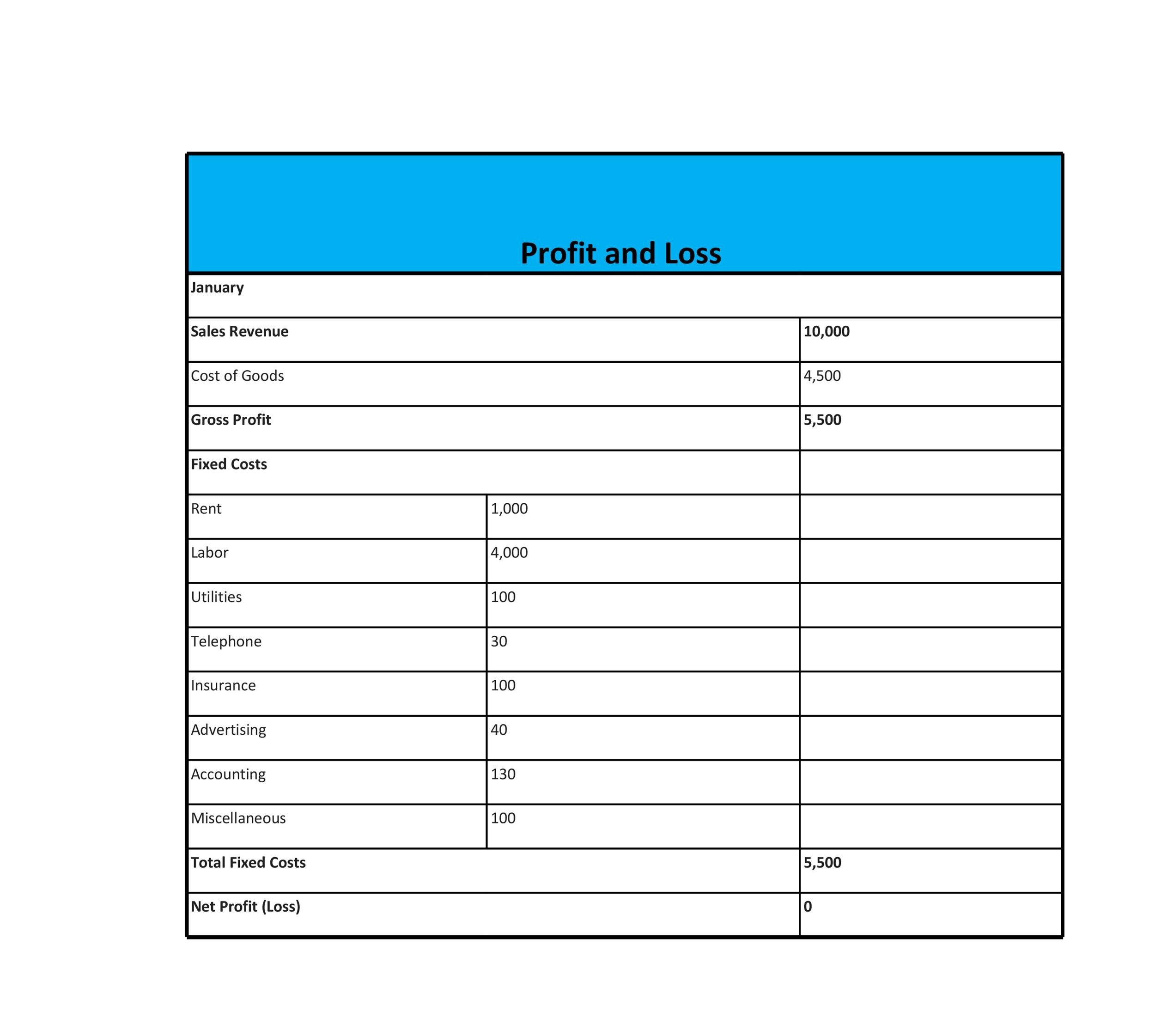

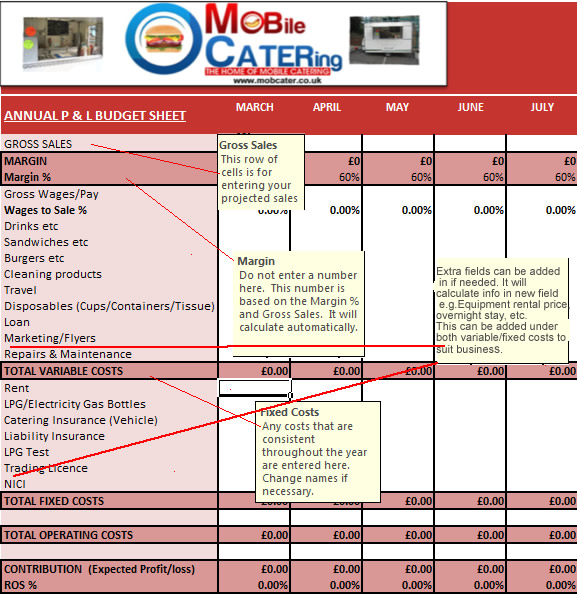

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. This will include daily running costs or overheads, such as renting a workshop or office space, and direct costs, such as buying materials. The total of the bottom half of the balance sheet will equal the top half.

Your p&l statement shows your revenue, minus expenses and losses. If you use estimated costs, you need to label them clearly. There are several key differences between the p&l and balance sheet, particularly the information presented and what it means.

It's a similar concept to creating a cash flow forecast, though the timescales can differ. In other words, from what your goods cost you, take away what you managed to sell them for. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

A p&l statement provides information about whether a company can. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Here is an example of a typical balance sheet for a small limited company:

What is the purpose of a profit and loss account? What is a profit and loss statement? A tax preparer may use a detailed business profit and loss statement for the entire year to create a tax return at the end of the fiscal year for a company.

The 'income statement', or 'profit and loss statement' (p&l) is one of the three major financial statements, along with the balance sheet and the statement of cash flows. A profit and loss account displays the company's earnings and outlays expenses within a fiscal year. On that basic level, profit and loss is derived from taking your costs away from your sales.