One Of The Best Info About Income Tax Expense In Profit And Loss Statement Depreciation On Equipment Is $800 For The Accounting Period

It is a financial statement reflecting the outcome of business activities of an organisation.

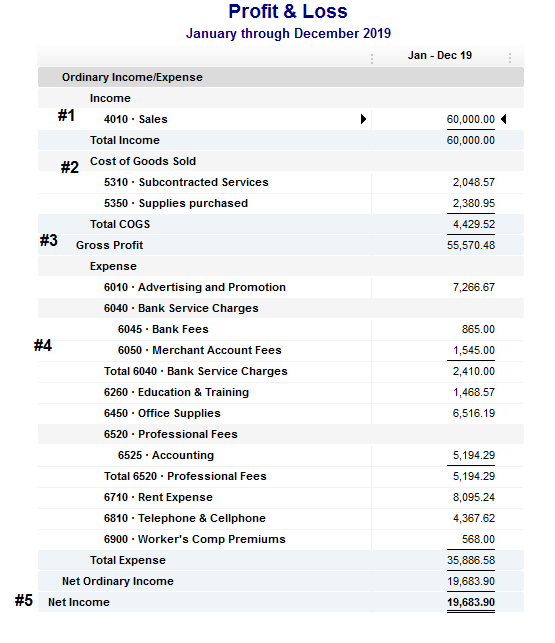

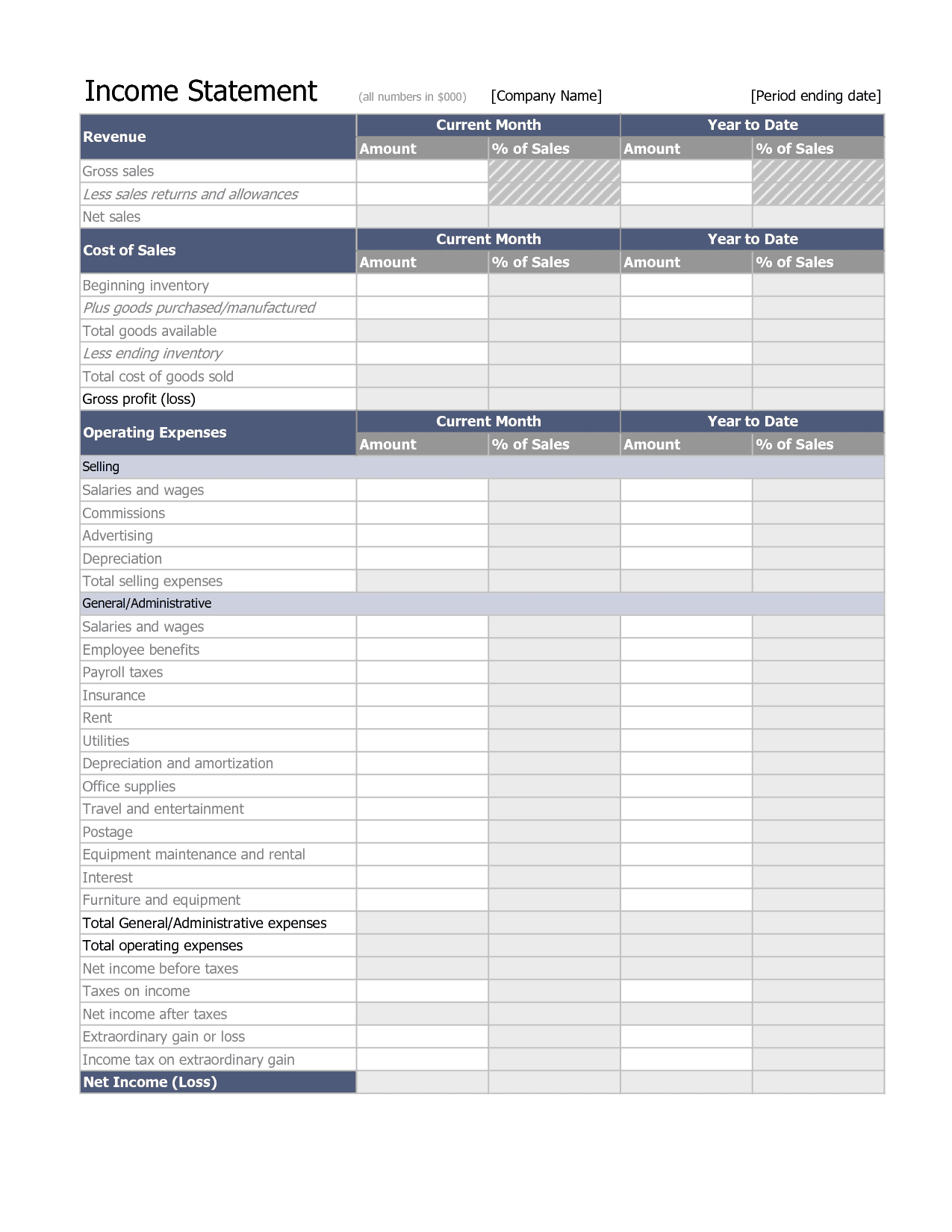

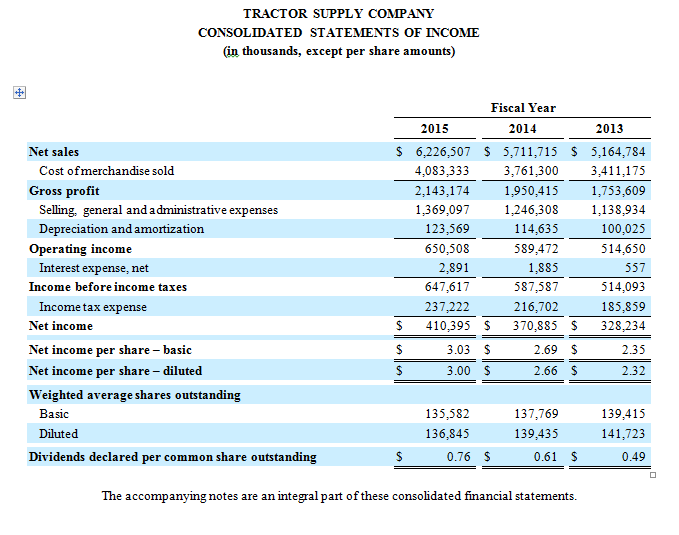

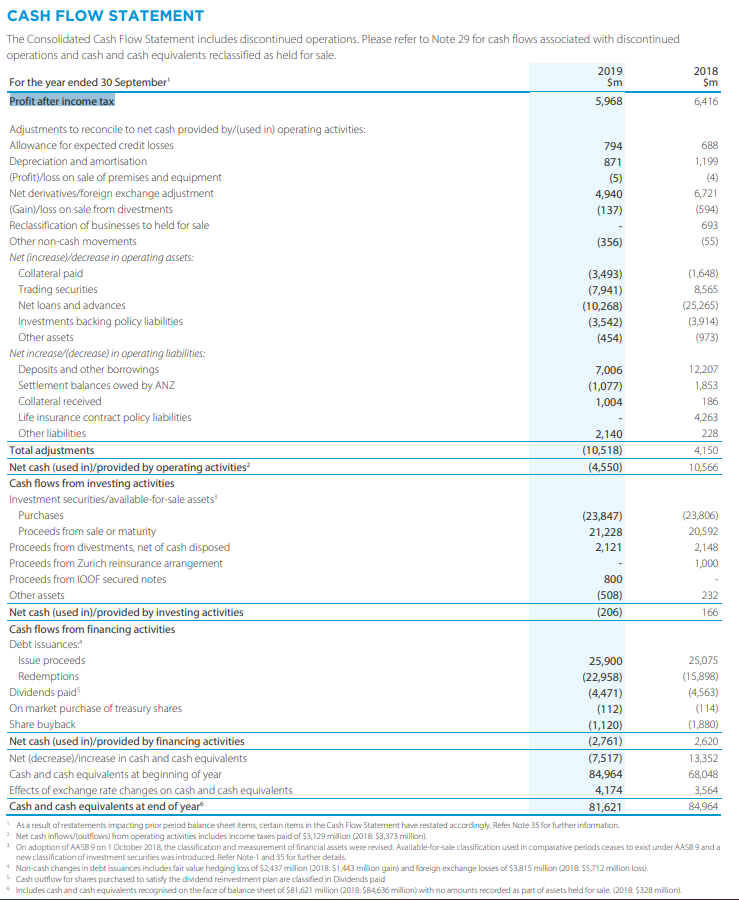

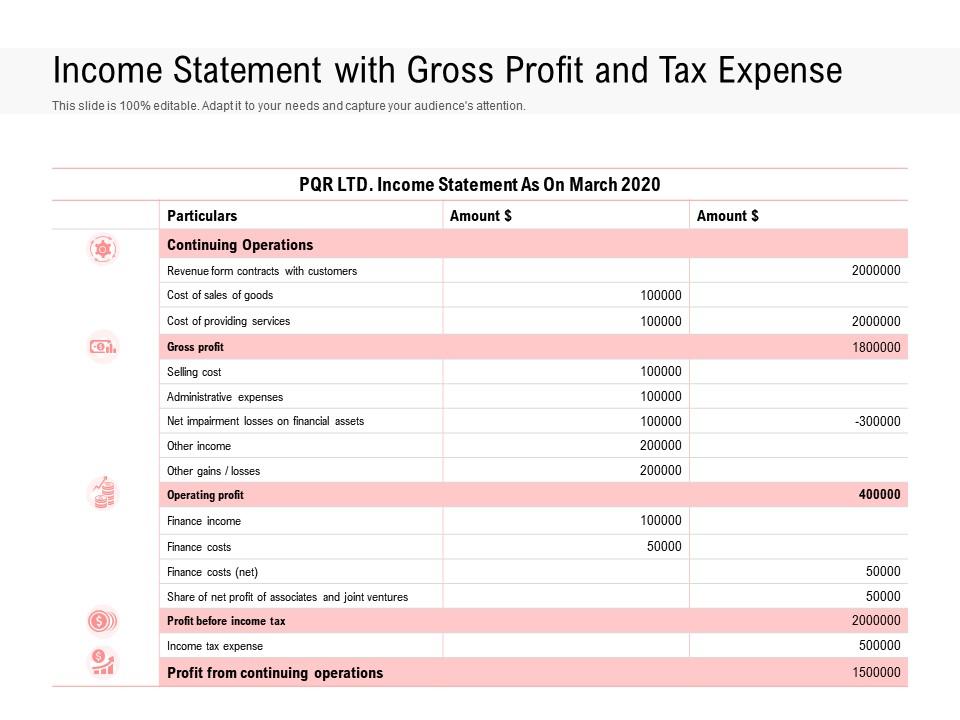

Income tax expense in profit and loss statement. An income statement is a financial statement that reports a company's financial performance over a specific accounting period. Example of a p&l statement. The p&l statement's many monikers include the statement of profit and loss, the statement of operations, the statement of financial results, and the.

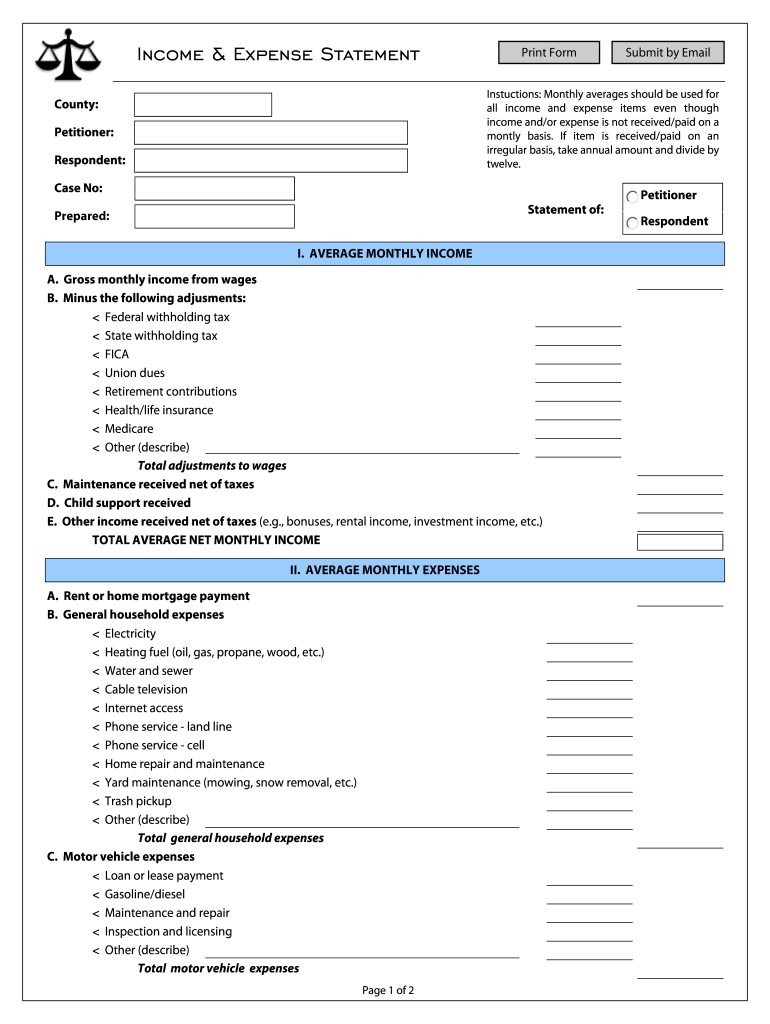

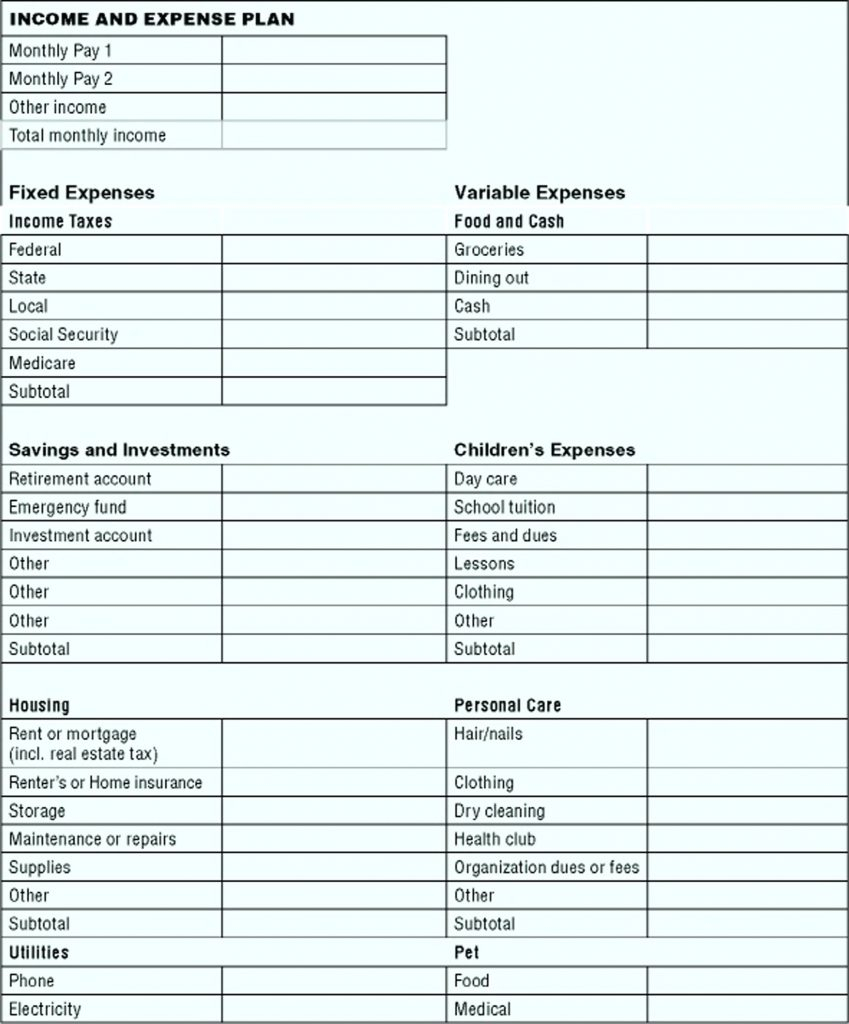

Entities may present all items together in: Profit & loss account reflects the income and expenses of the business. A profit and loss (or income) statement lists your sales and expenses.

The information will also be useful for you to know whether your business is making a profit. What is profit and loss statement? An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a.

Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the income tax return) and the total deferred tax expense or benefit, adjusted for any. Along with your balance sheet, your profit and loss statement (p&l) is the most significant financial document your business will produce. Added a new formula called net profit after tax and.

Less cost of goods sold. A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. Income tax expense is the amount of expense that a business recognizes in an accounting period for the government tax.

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to. Your p&l statement shows your. It tells you how much profit you're making, or how much you’re losing.

P&l statements tend to follow a standard format: A tax expense is a liability owed to a federal, state, or local government within a given time period, typically over the course of a year. Revenue minus expenses equals profit or loss.

The irs excess loss rule takes effect when your total business deductions are more than your total gross income and above a threshold amount of $262,000 for a. Tax expense doesn't really belong in equity. A profit and loss statement, or a p&l statement or income statement, is a financial document that summarizes a company's revenues, expenses, and.

December 14, 2023 what is income tax expense? The p&l is accrual based, not cash.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income-547x1024.jpg)