Matchless Info About Liabilities Stockholders Equity Self Employed P&l Statement

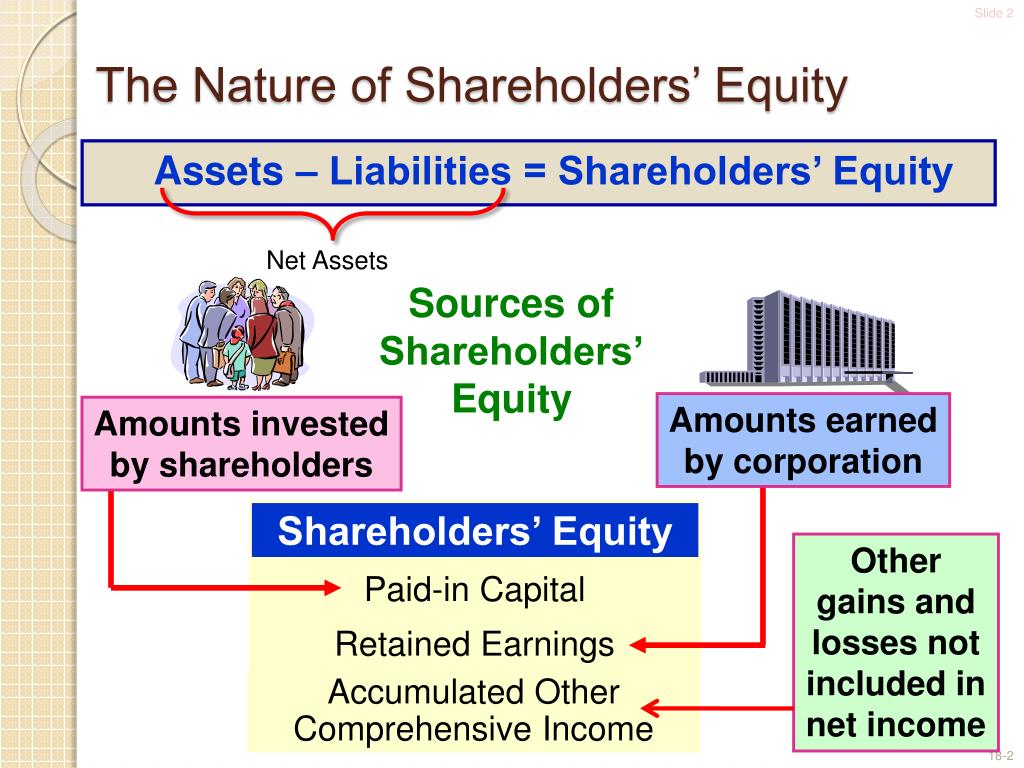

Shareholders’ equity is the owner’s claim when assets are liquidated and debts are paid up.

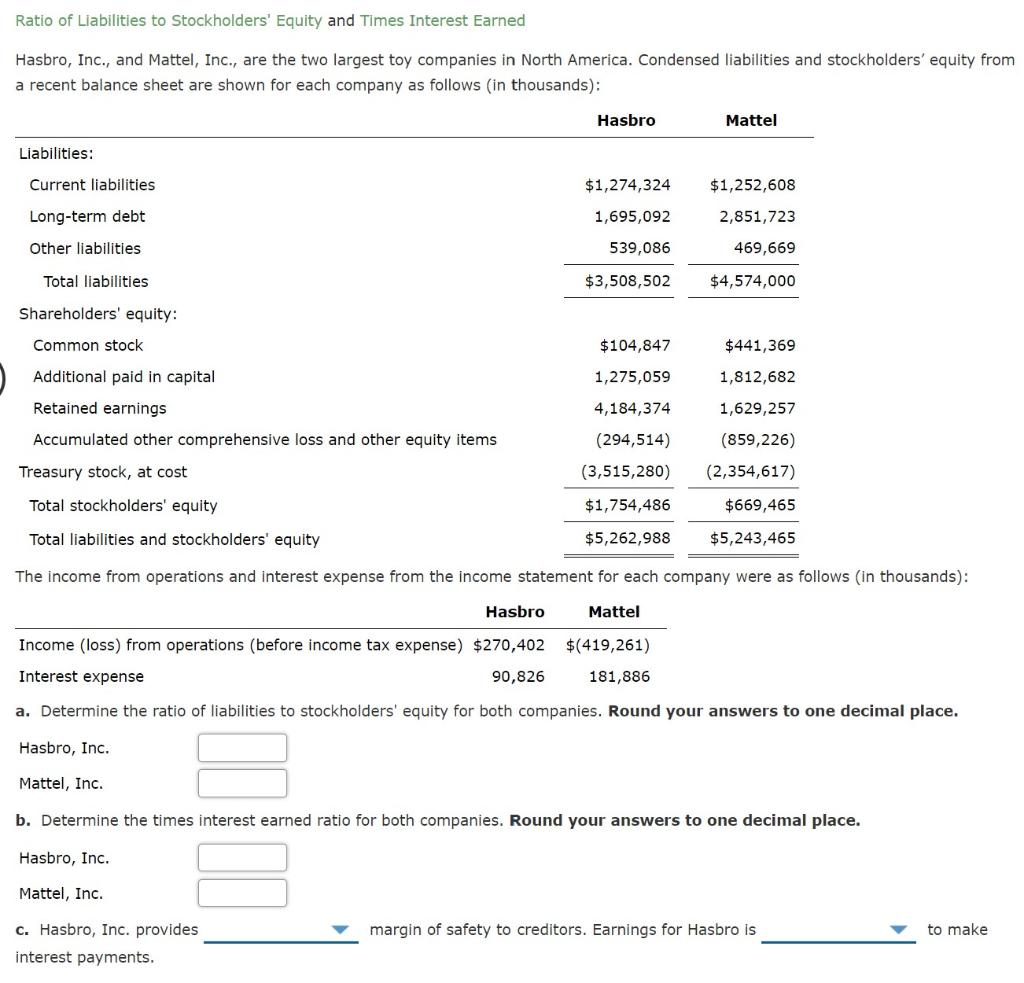

Liabilities stockholders equity. A look at shareholders' equity helps. Stockholders’ equity is calculated as the capital given to a business by its shareholders, plus donated capital and earnings generated by the operation of the business, less any dividends issued. Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of money that would be returned to a company's shareholders if.

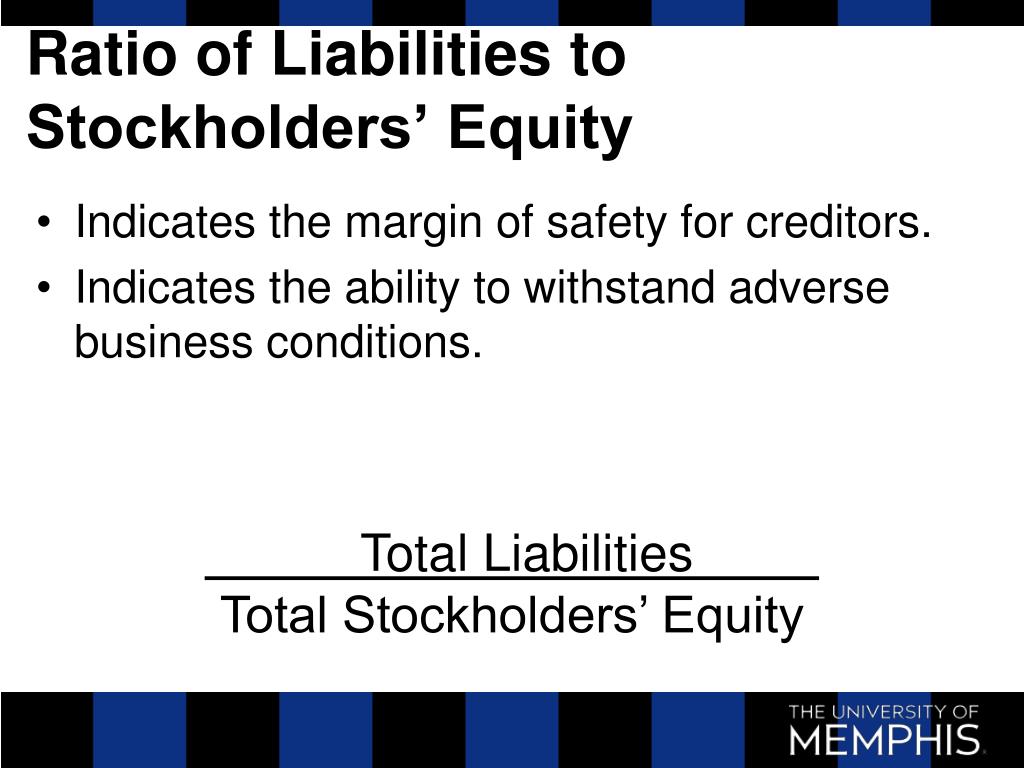

Financing through debt shows as a liability, while financing through issuing equity shares. Stockholders' equity, also known as shareholders' equity or owner's equity, is the total amount of assets left with the company after deducting all liabilities. If shareholders' equity is positive, a company has enough assets to pay its liabilities;

It’s also known as owners’ equity, shareholders’ equity, or a company’s book value. Both liabilities and shareholders' equity represent how the assets of a company are financed. Shareholders' equity may be calculated by subtracting its total liabilities from its total assets —both of which are itemized on a company's balance sheet.

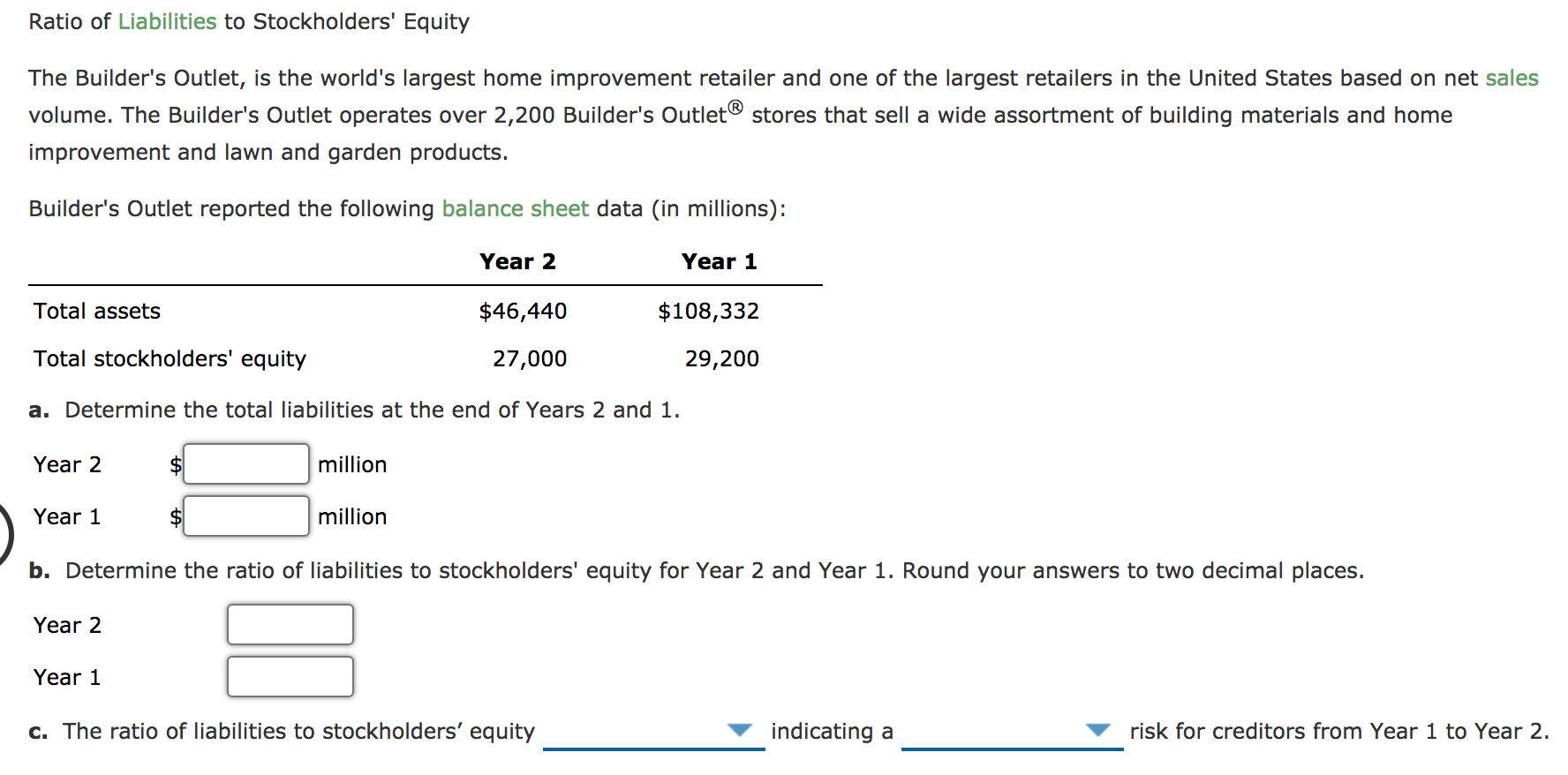

Assets = liabilities + equity. If the company is a corporation, stockholder equity is the third part of the balance sheet. The amount of stockholders' equity is exactly the difference between the asset amounts and the liability amounts.

If it's negative, a company's liabilities exceed its assets. This metric is important in defining a company's financial health and is especially important for shareholders who have invested in the company. Stockholders' equity is also the book value of the corporation.

On the balance sheet, stockholders' equity is calculated as follows: Liabilities and stockholder equity. As a result accountants often refer to stockholders' equity as the difference (or residual) of assets minus liabilities.

But overall, it’s a much less. Stockholders' equity or shareholders equity is the difference between a company's assets and liabilities. Total of all stockholders’ equity (deficit) items, net.

D/e ratios vary by industry and are. Accountants call this the accounting equation (also the “accounting formula,” or the “balance sheet equation”). This includes common stock, retained earnings, and more.

You might think of it as how much a company would have left over in assets if business ceased immediately. You’d need to be able to read a balance sheet to find the company’s total assets and liabilities in order to make these calculations. It is the assets minus the liabilities.

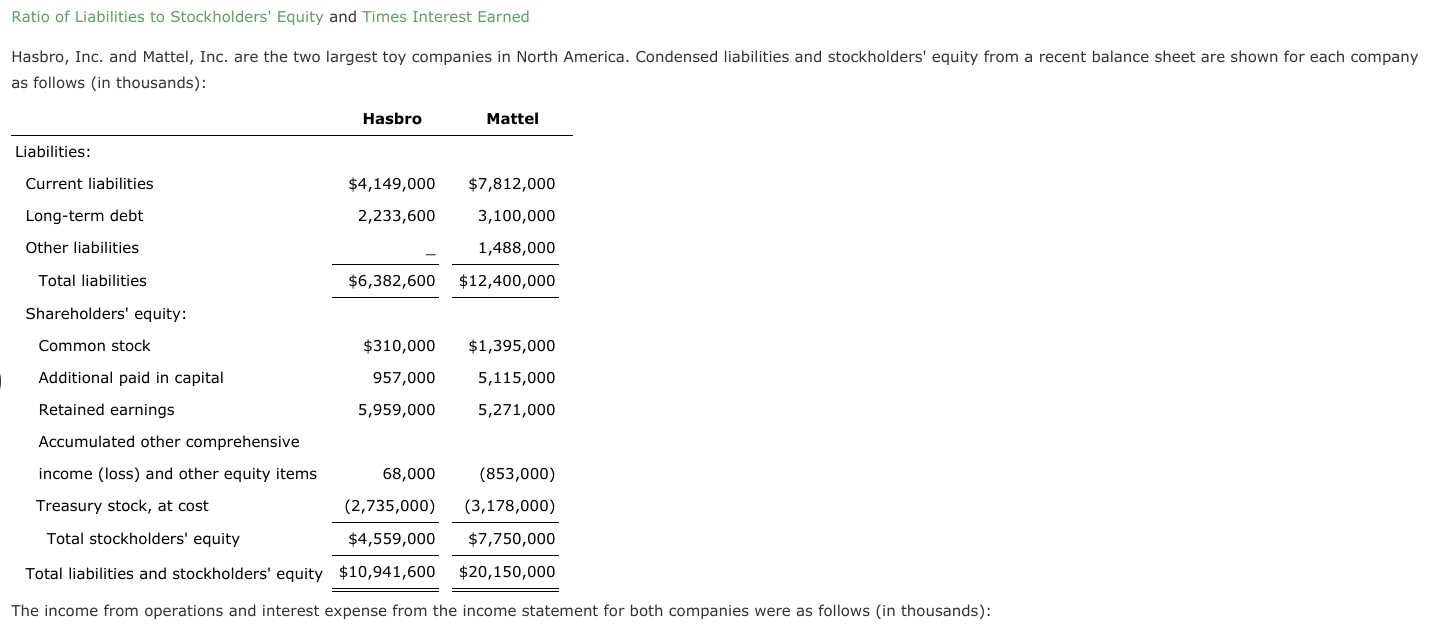

Total stockholders’ equity 394,971 490,151: Shareholders equity is the difference between a company’s assets and liabilities, and represents the remaining value if all assets were liquidated and outstanding debt obligations were settled. Stockholders equity provides highly useful information when.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)