Best Info About A Debit Balance In The Income Summary Account Indicates Combined Consolidated Financial Statements

When the sum of the debit side is greater than the sum of the credit side, it represents a.

A debit balance in the income summary account indicates. A debit balance in the income summary account indicates: Asset accounts such as cash, accounts receivable, inventory, prepaid expenses, buildings, equipment,. Transferring the debit balances in the expense accounts to a clearing account called income summary.

The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting. A debit balance in the income summary account indicates. What does this indicate about the company’s net income or loss?

The second entry requires expense accounts close to the income summary account. If the net balance of the income summary is a credit balance, it means the company has made a profit for that year, or if the net balance is a debit balance, it means the company has made a loss for that year. That revenues were greater than expenses.

The expense accounts are closed in one compound closing journal entry to the income summary account. It has a credit balance of $9,850. A debit balance in the income summary account just prior to closing it indicates there is a net loss for the period.

The income summary account has a credit balance of $10,240 (the revenue sum). All expense accounts with a debit balance are credited to bring. To close that, we debit service revenue for the full amount and.

True adjusting unearned revenues causes a liability to decline. A debit balance in the income summary account just prior to closing it indicates there is a net loss for the period. Lo 5.1 after the first two closing entries are made, income summary has a debit balance of $22,750.

True when a worksheet is used, all adjustments are first. Conversely, if the income summary account has a net debit balance i.e. If the income summary has a debit balance, the amount is the company's net loss.

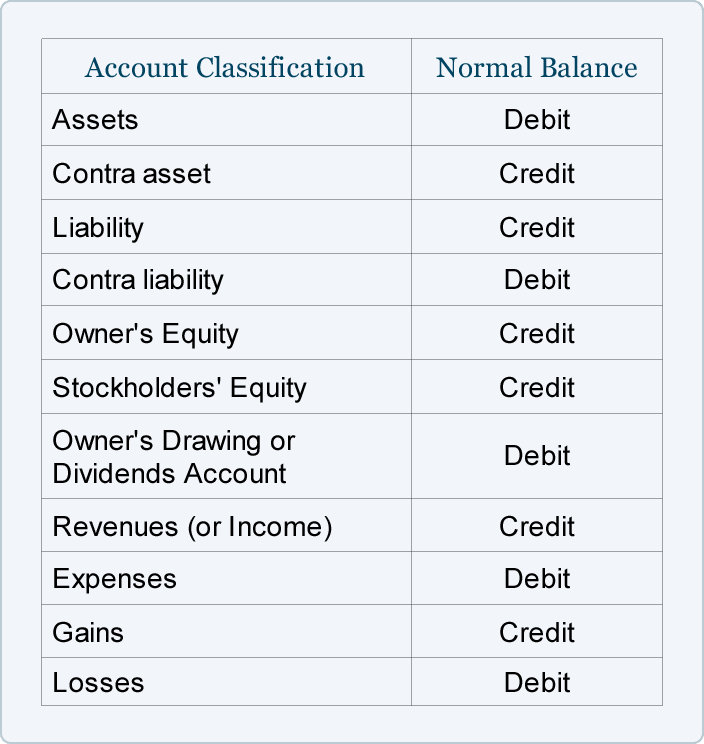

Determining net income or loss: The income summary will be closed with a credit for that amount and a debit to retained. A debit balance is normal and expected for the following accounts:

Closing the revenue accounts—transferring the credit balances in the revenue accounts to a clearing account called income summary. Closing the income summary account:. The balance remaining in the income summary after these transfers represents the net income if it’s a credit balance (profit).

What is income summary? A debit balance in a partnership's income summary account at the end of the accounting year indicates that the partnership earned a profit o none of the answers are correct. In the given data, there is only 1 income account, i.e.

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)