Best Of The Best Tips About Rental Income Profit And Loss Statement Audit Result Report

Download your free copy now.

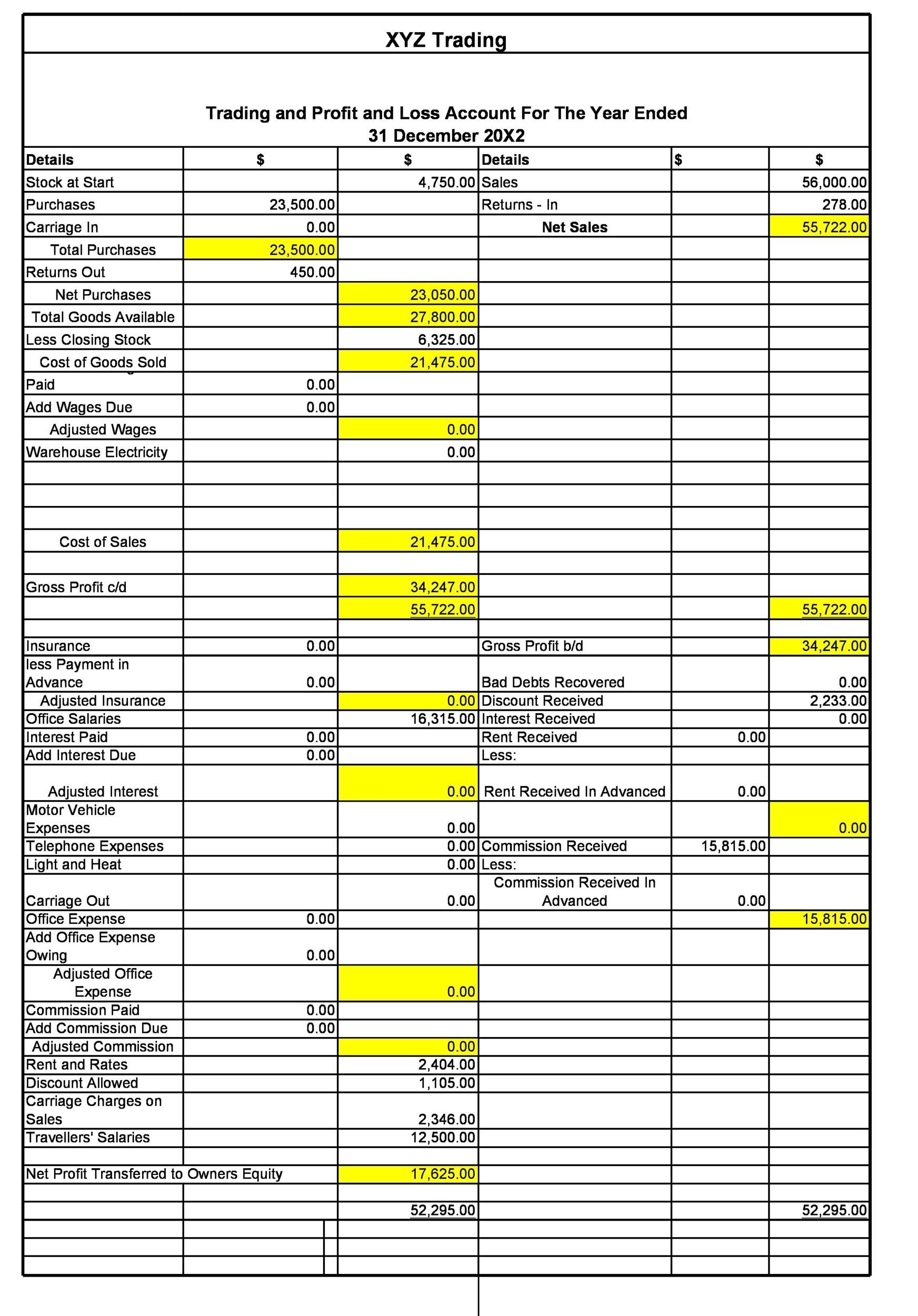

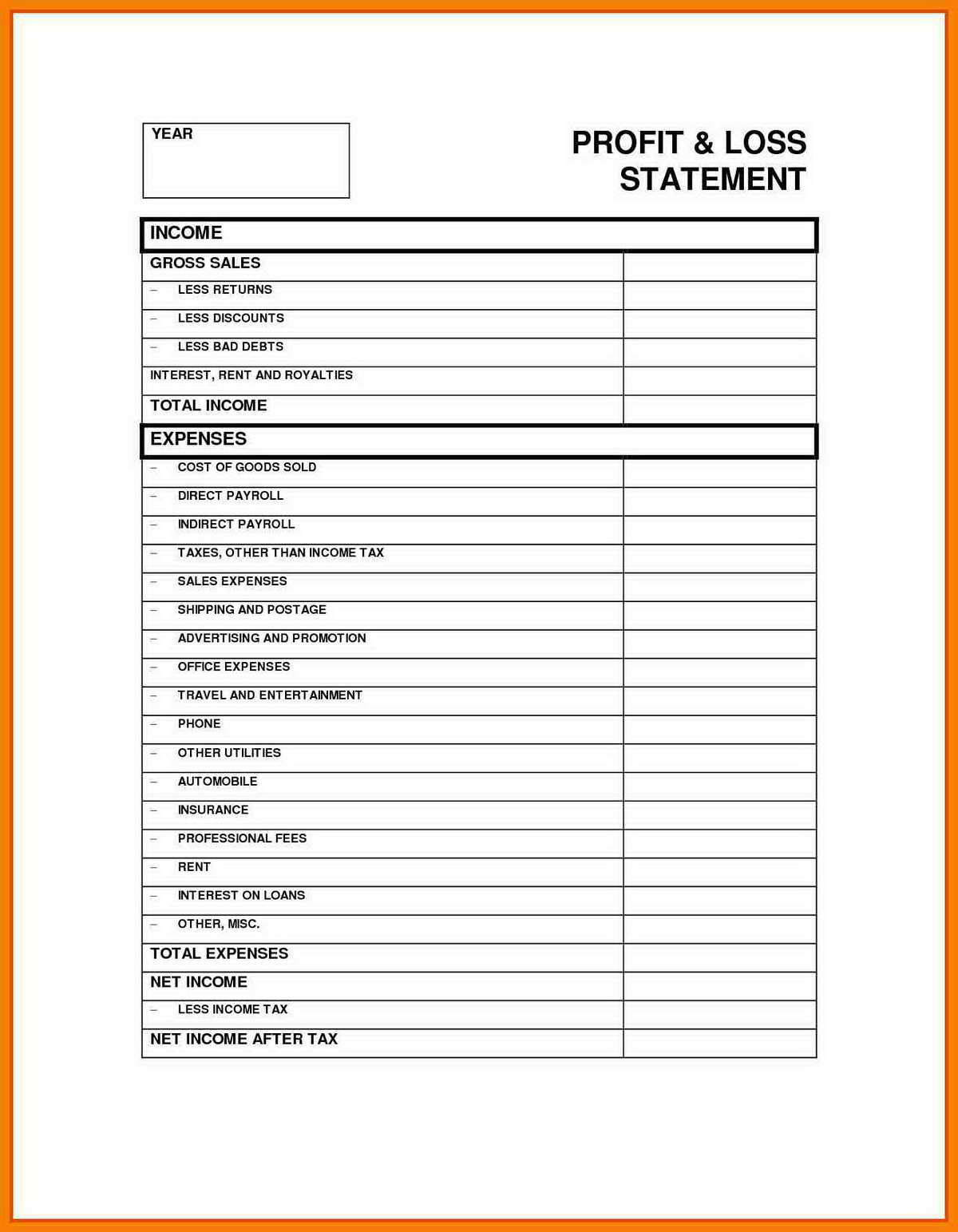

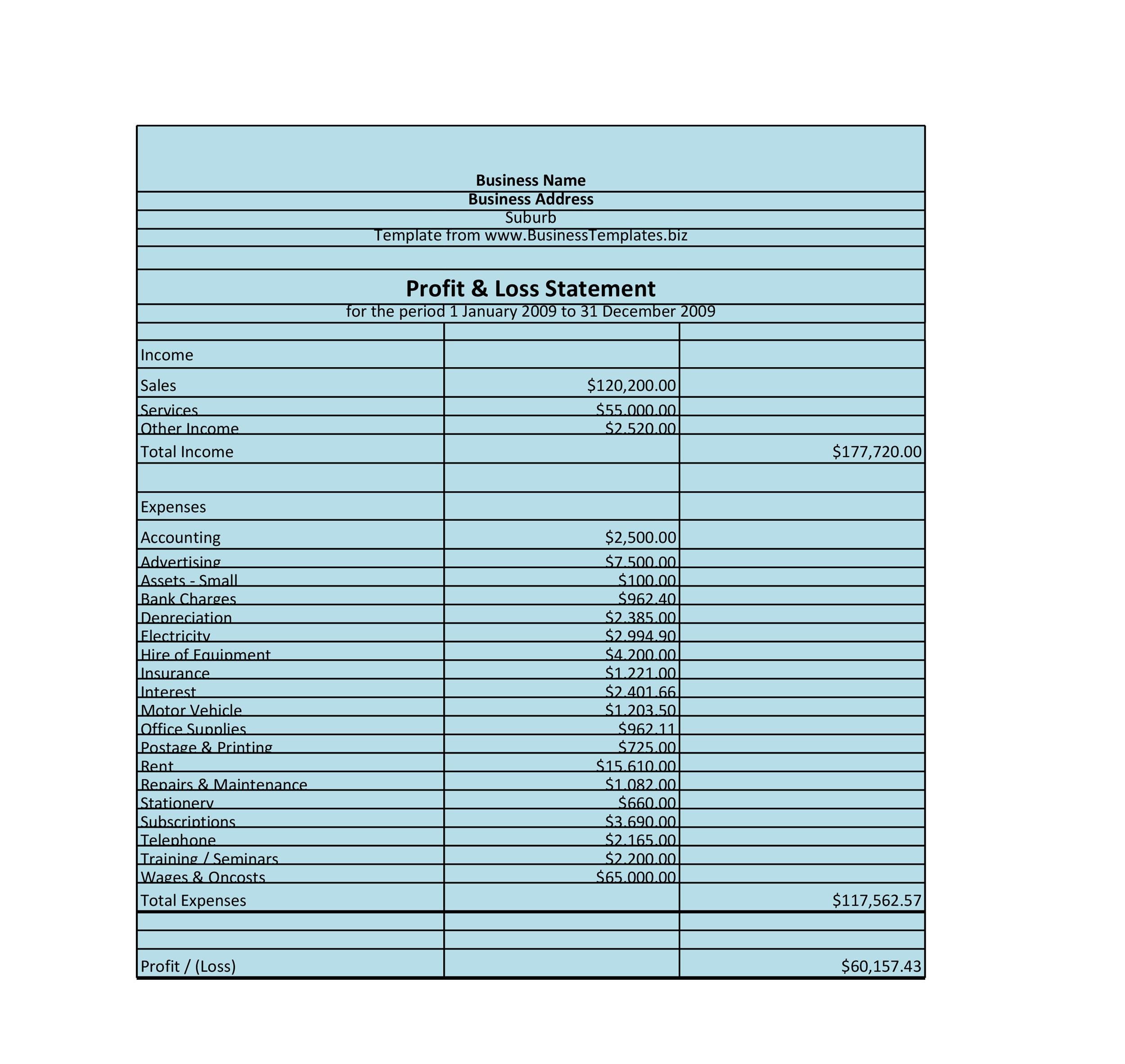

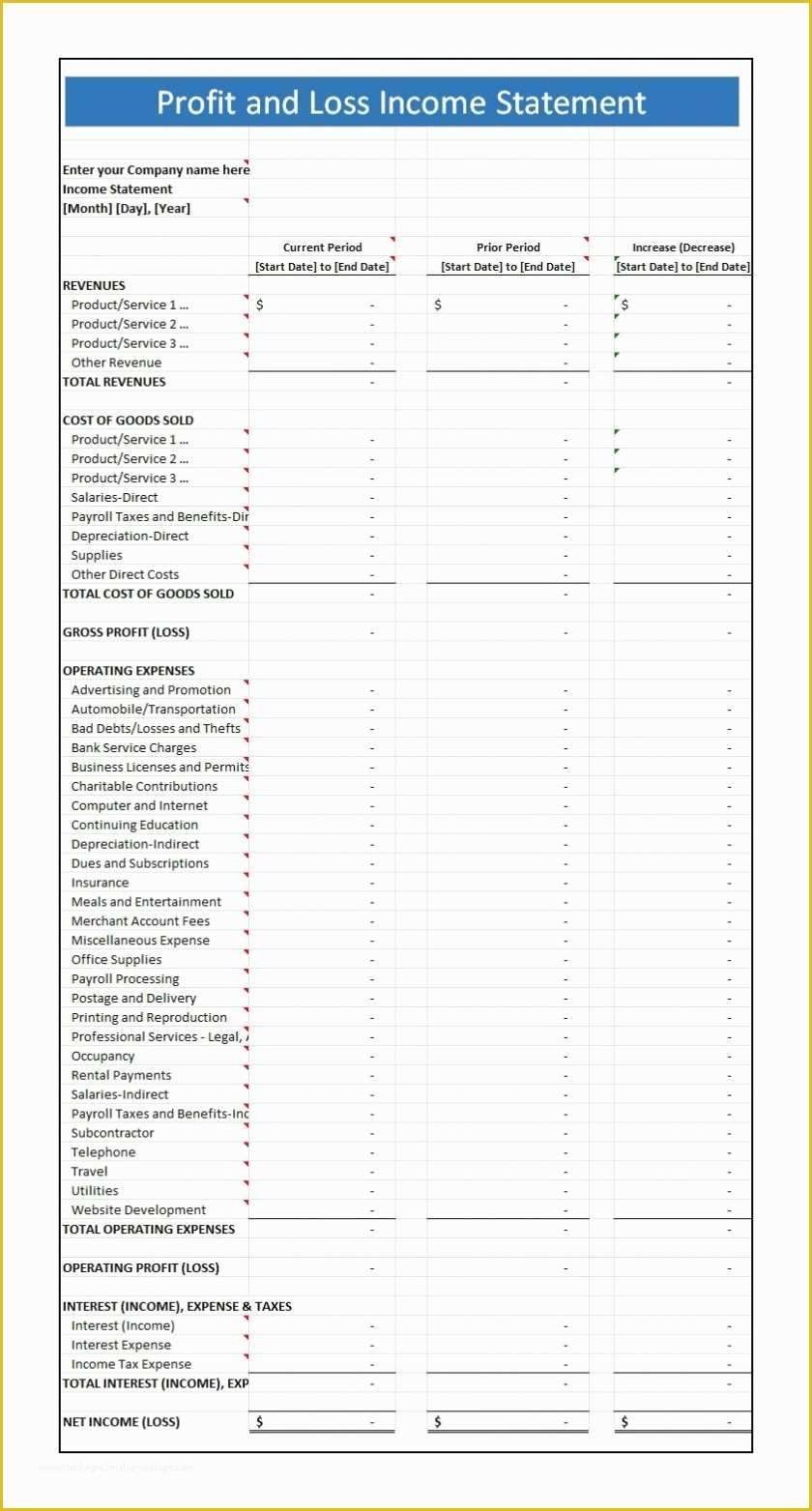

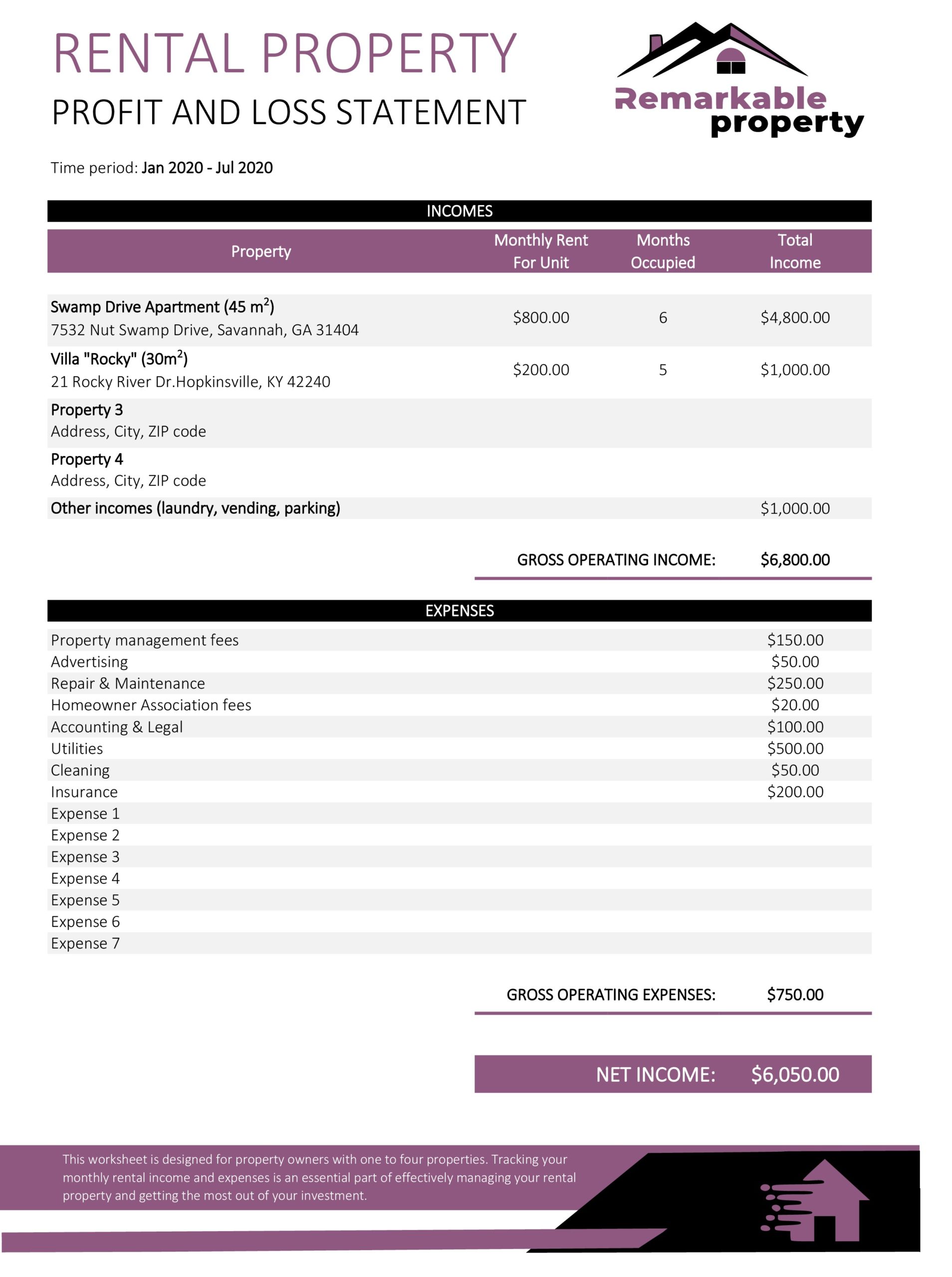

Rental income profit and loss statement. A profit and loss statement belongs a report that summarizes income, expenses, and web operating income over a specific spell of time. Gross income gross income on a profit and loss statement includes revenue from the monthly rent collected. I’ll use this information to complete your tax return.

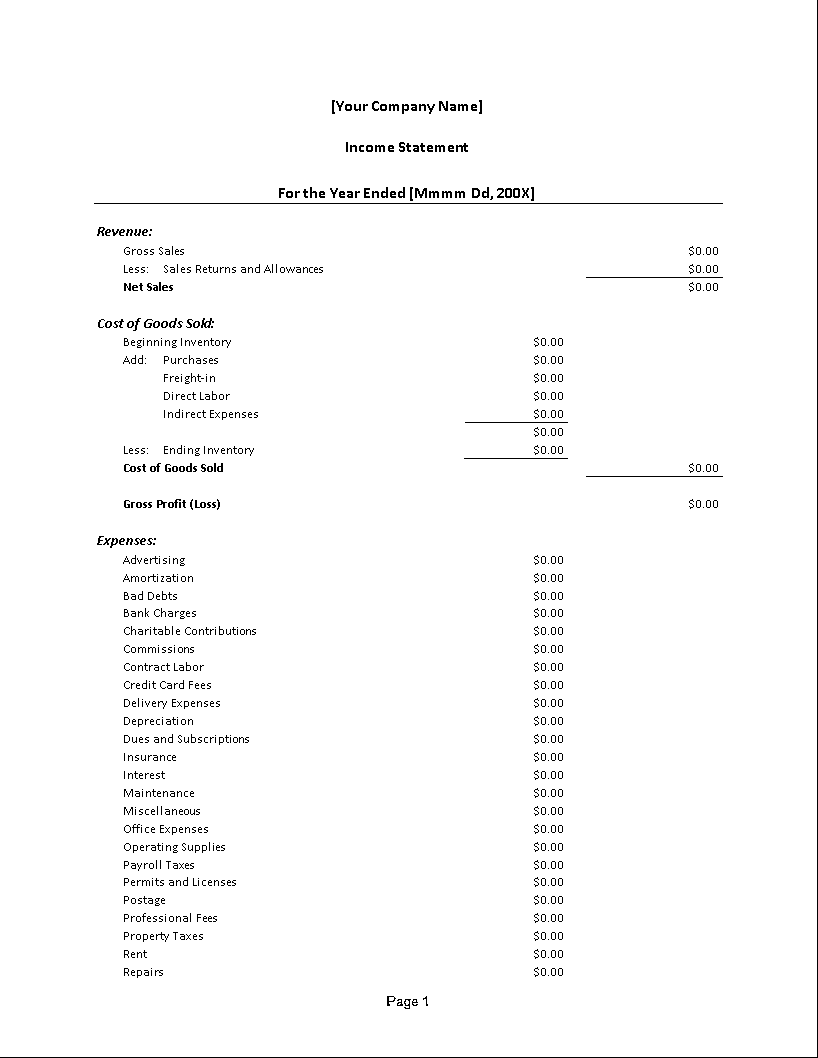

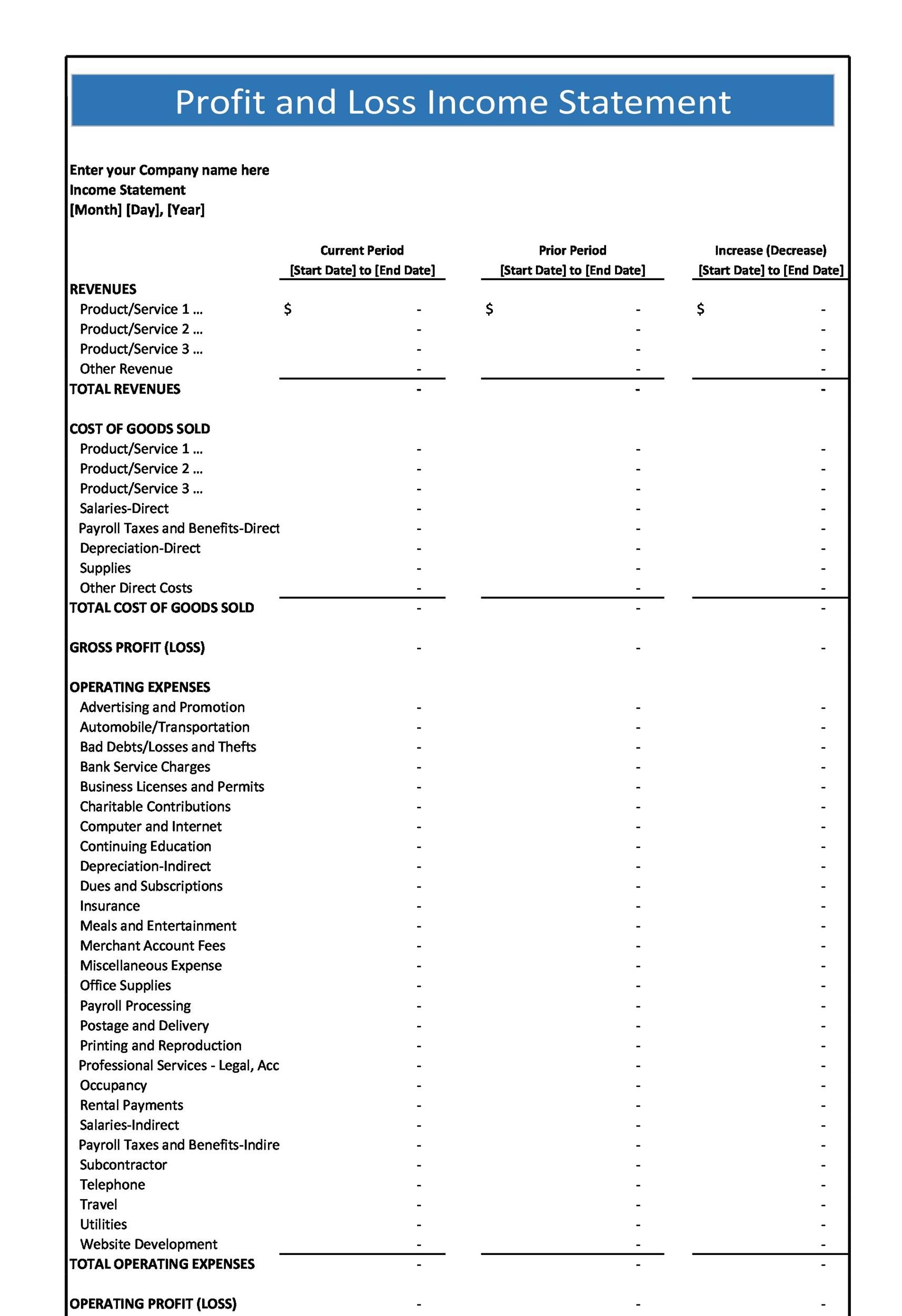

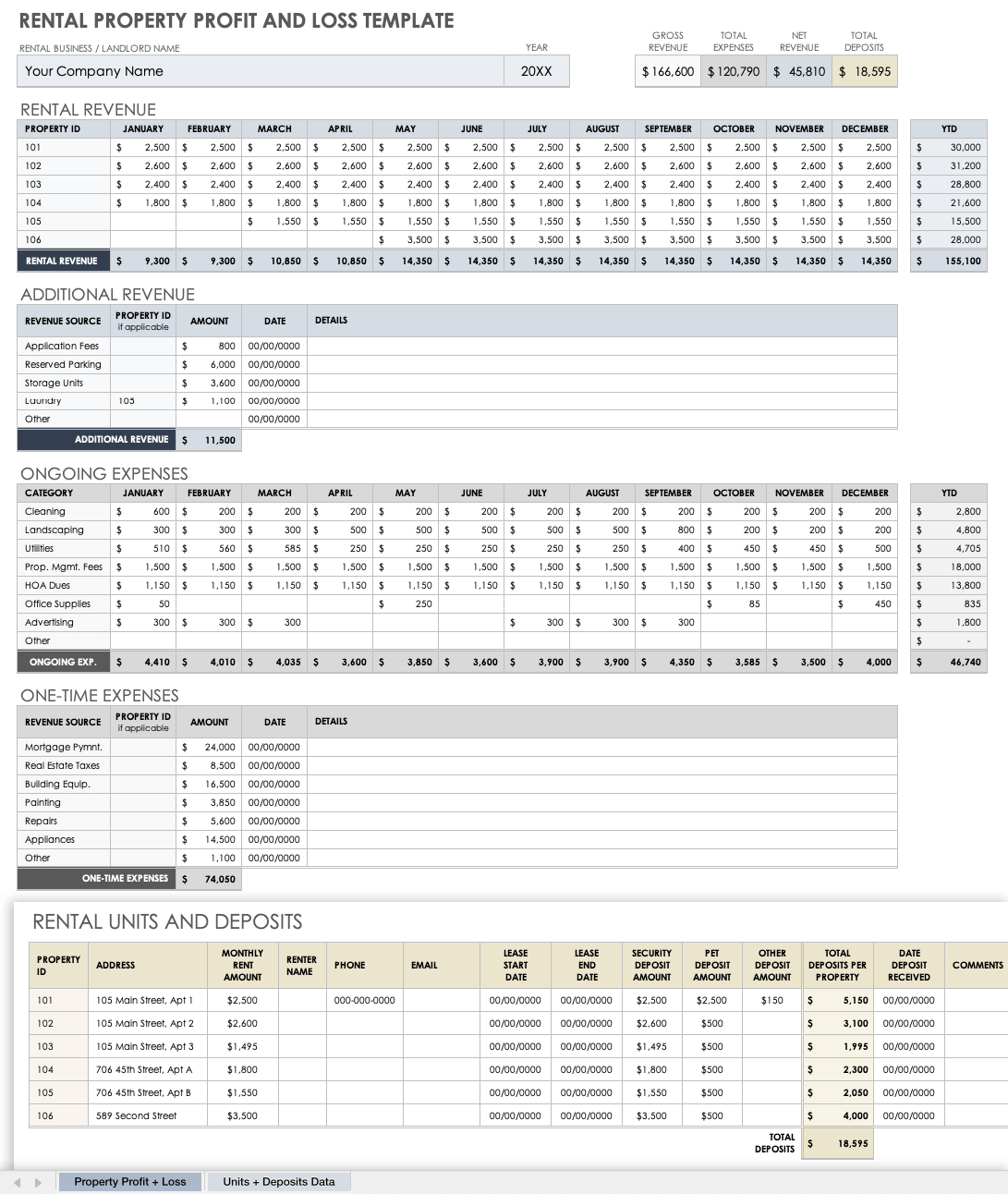

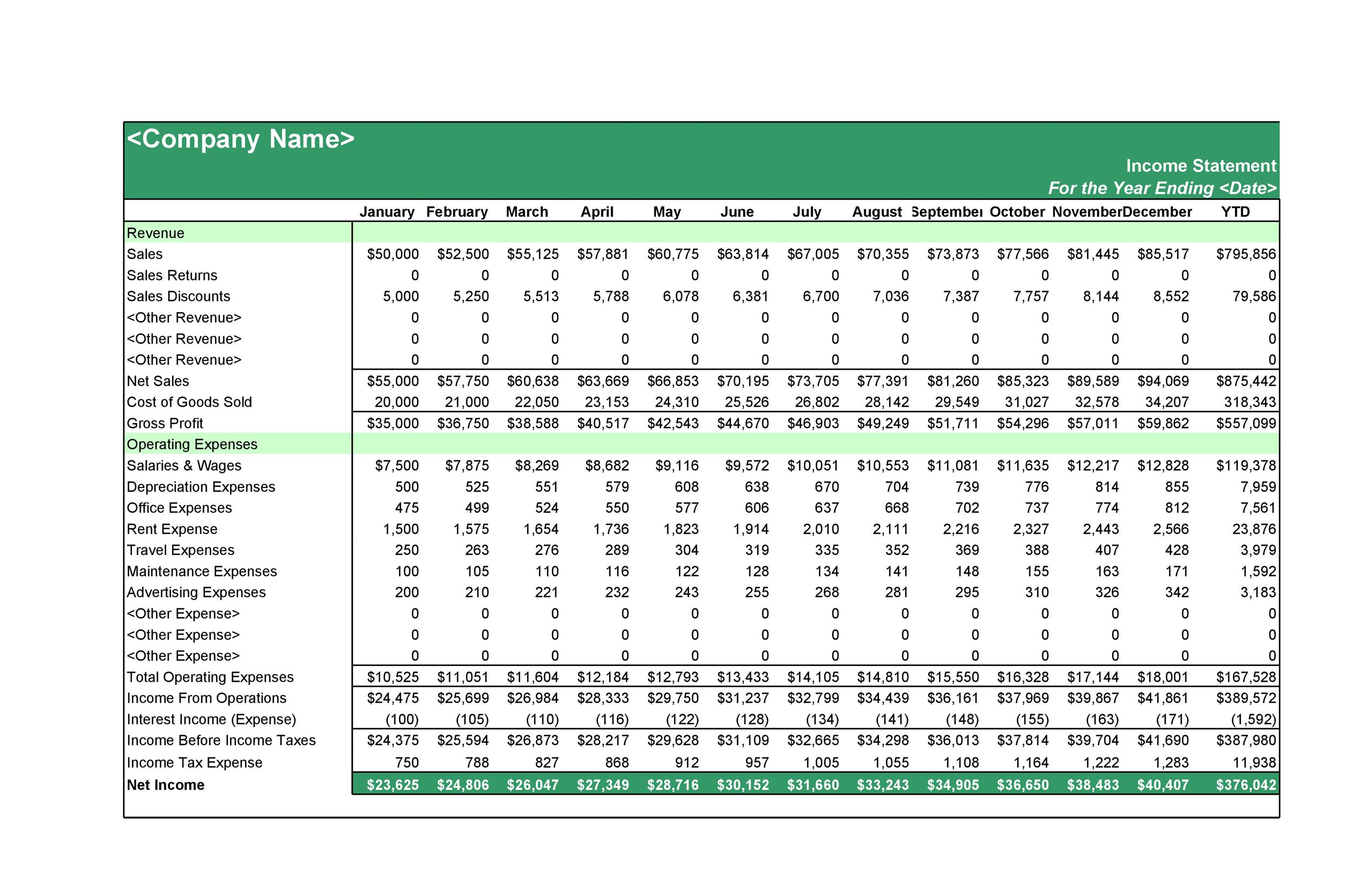

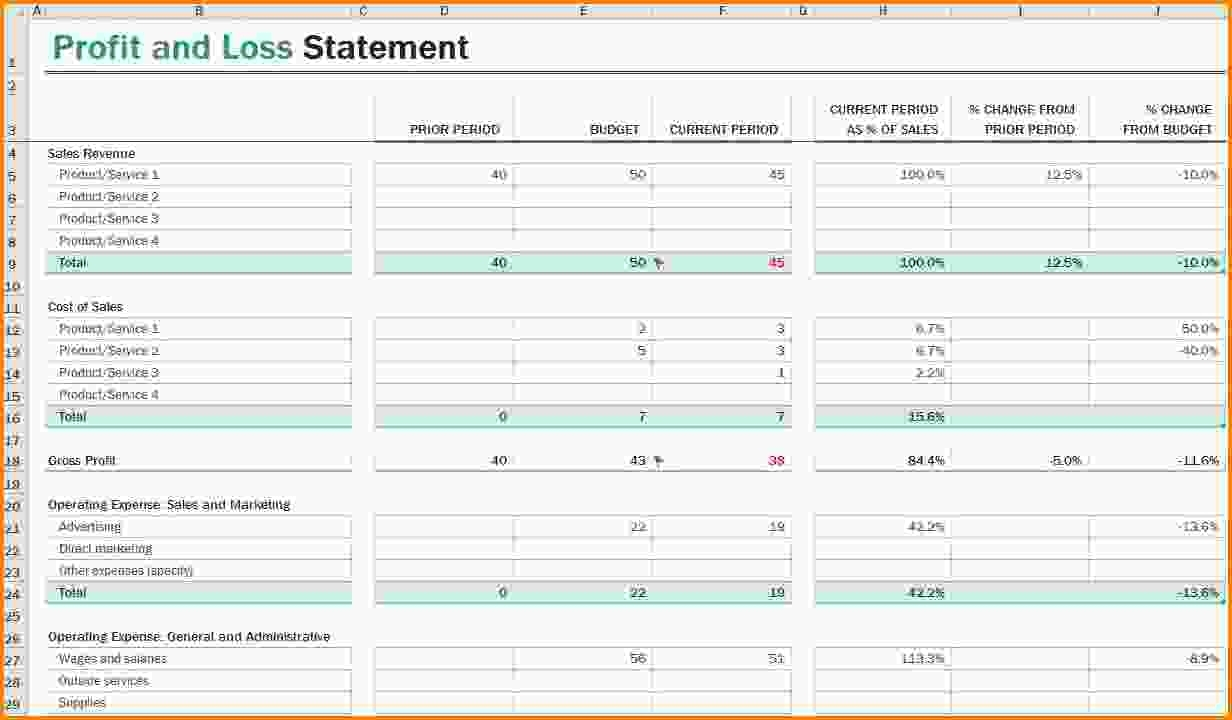

Download annual profit and loss template sample — microsoft excel. By analyzing these components, you can use the p&l statement to evaluate the profitability of your investment monthly, quarterly, or annually — however often you want. Rental costs and income the first two categories summarize the monthly operating income and expenses of the rental properties.

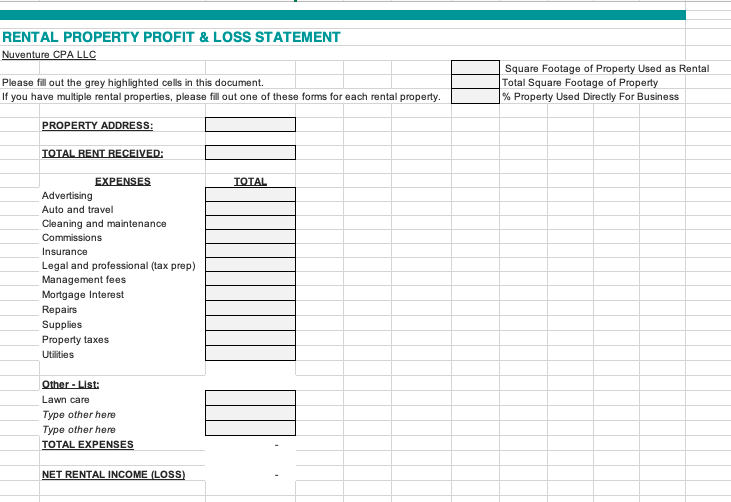

Revenue includes both residential and commercial rental income, laundry and vending income, parking fee, tenant charges such as cleaning, damages, lost keys. It aims to showcase a property’s profitability and typically includes rental income,. A p&l statement is a key financial document that summarizes your rental property income and expenses for the irs (and yourself) for a given period of time, usually one month.

Appropriate sections are broken down by month and by property. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Download template now google sheets more profit and loss templates branded rental p&l template simple rental p&l template year to date profit and loss statement template quarterly p&l template.

Also known as a p&l or income statement, it shows how well or poorly the business is doing by its net income or loss. You cannot claim for items if the expenditure (for example, building insurance or lawn mowing) is already included in body corporate fees and charges. Streamline your financial tracking with our rental property profit and loss statement template for 2024.

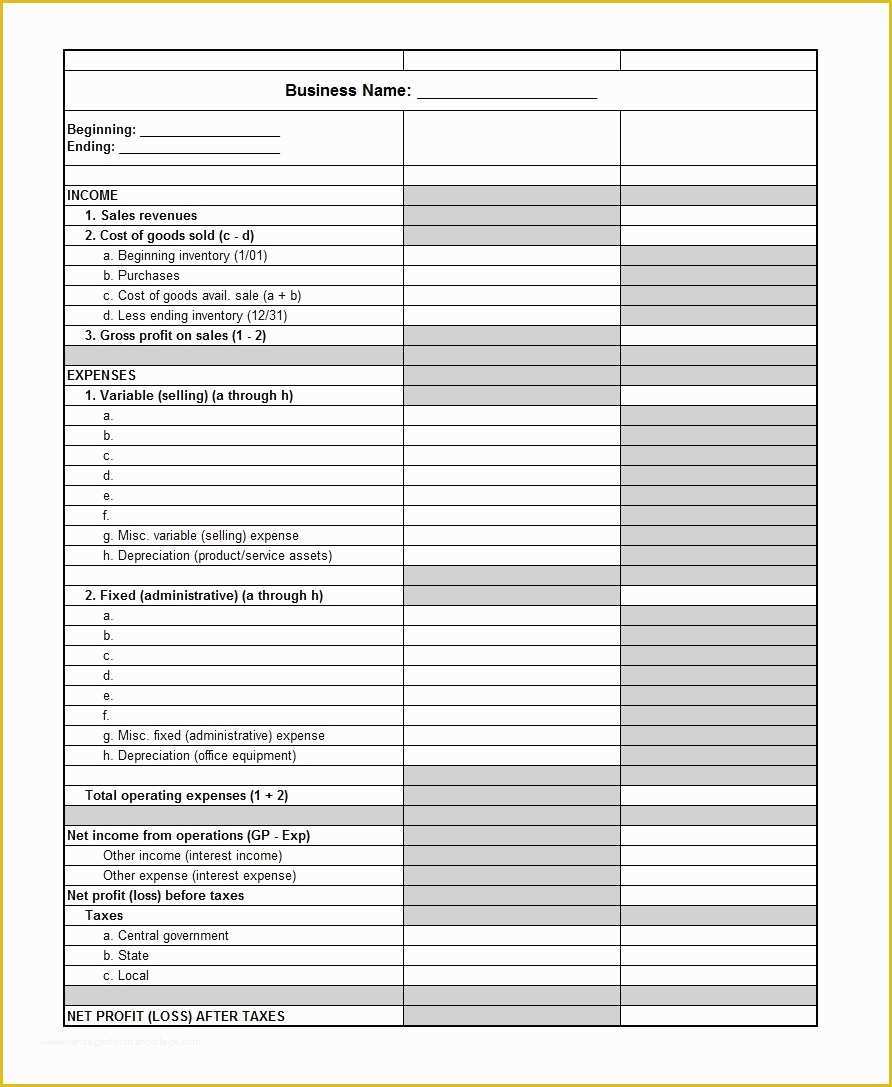

The three main parts to a rental income statment include, gross income, operating expenses, and net operating. You’ll sometimes see profit and loss statements called an income statement, statement of. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

Income statements help determine the economic feasibility of a rental property and its overall value. This is one of the most helpful reports that landlords can use. The collection rate is one of the key factors to drive a.

The rental income statement (also known as a profit and loss or income expense statement) is a financial report used by landlords that shows a breakdown of all income and expenditures and the current noi over a set period of time. A rental property profit and loss statement contains two main details: A good profit and loss account will help investing identify opportunities to increase grossness rental.

It shows your revenue, minus expenses and losses. A profit and loss statement (p&l) is vital for tracking the financial health of a rental property. You can create a statement monthly, quarterly, and annually, and companies use these for tax purposes and budgeting.

Then, it subtracts the costs of making those goods or providing those services, like. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The rental property profit and loss statement template creates a detailed reporting and summary of your income and expenses from four distinct categories: