Have A Tips About Advance Tax Treatment In Balance Sheet Statement Of Financial Performance Definition

How to treat advance tax in cash flow statement.?

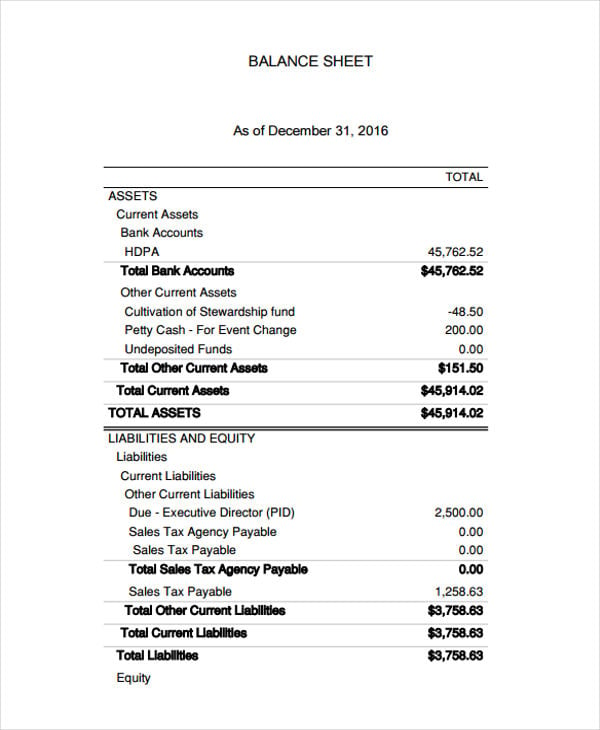

Advance tax treatment in balance sheet. Treatment of tds and advannce tax in balance sheet. Simple interest payable @1% per month for 3 months on the amount of short fall. Accounting entry will be as under:

Treatment in the financial statements. What are the benefit of advance tax? A senior citizen who is a pensioner and also owns a proprietor business deposits advance tax from his.

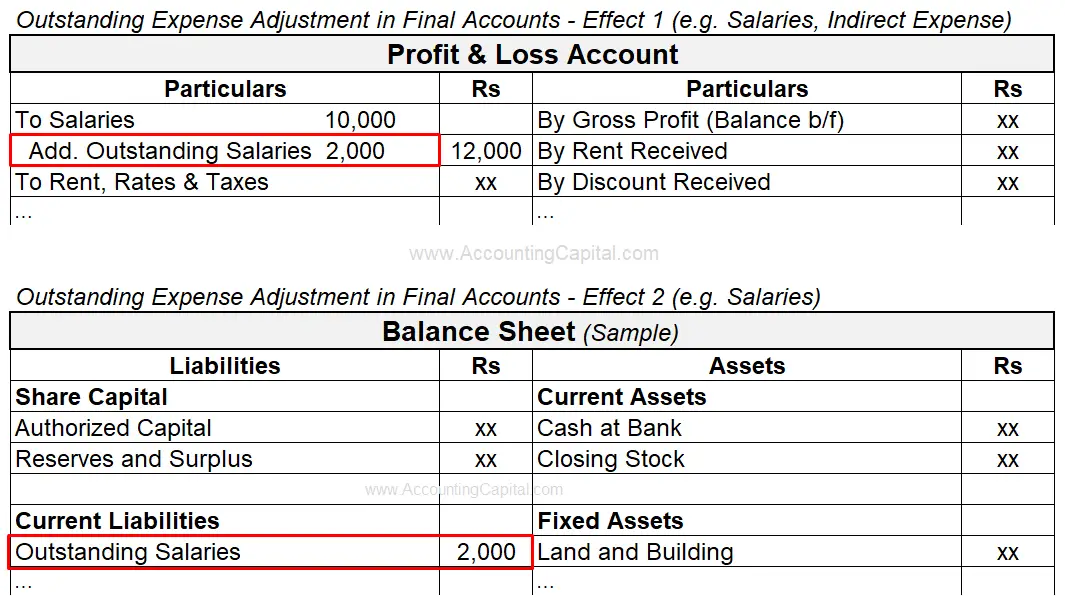

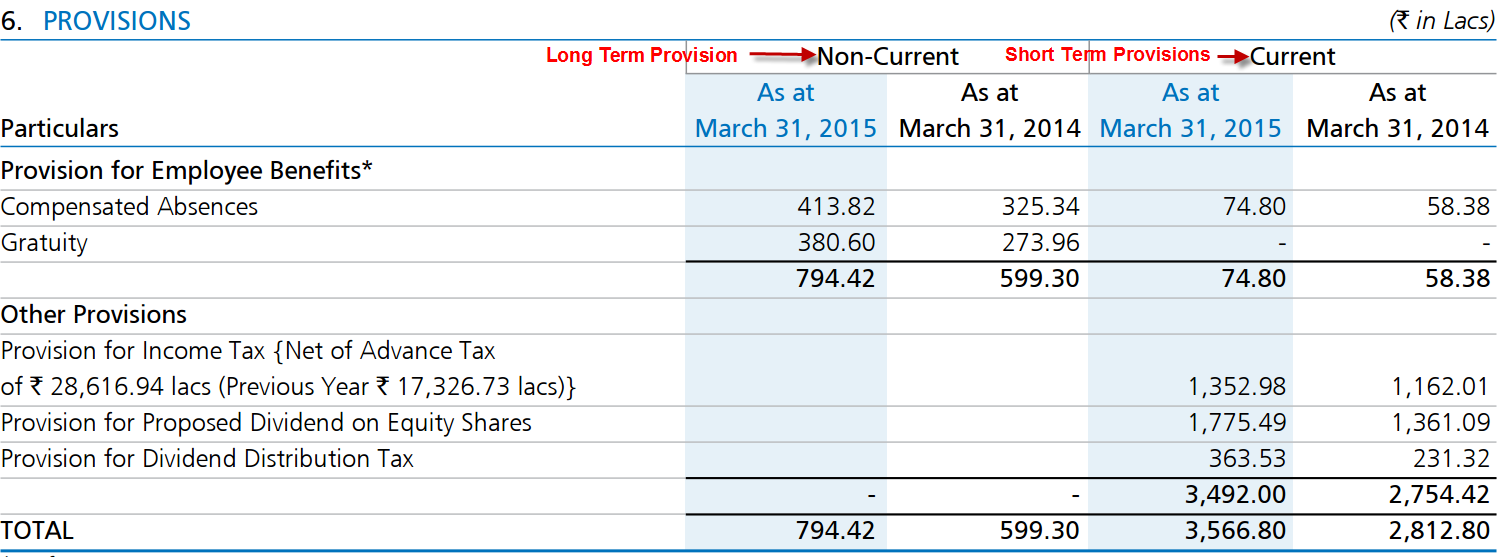

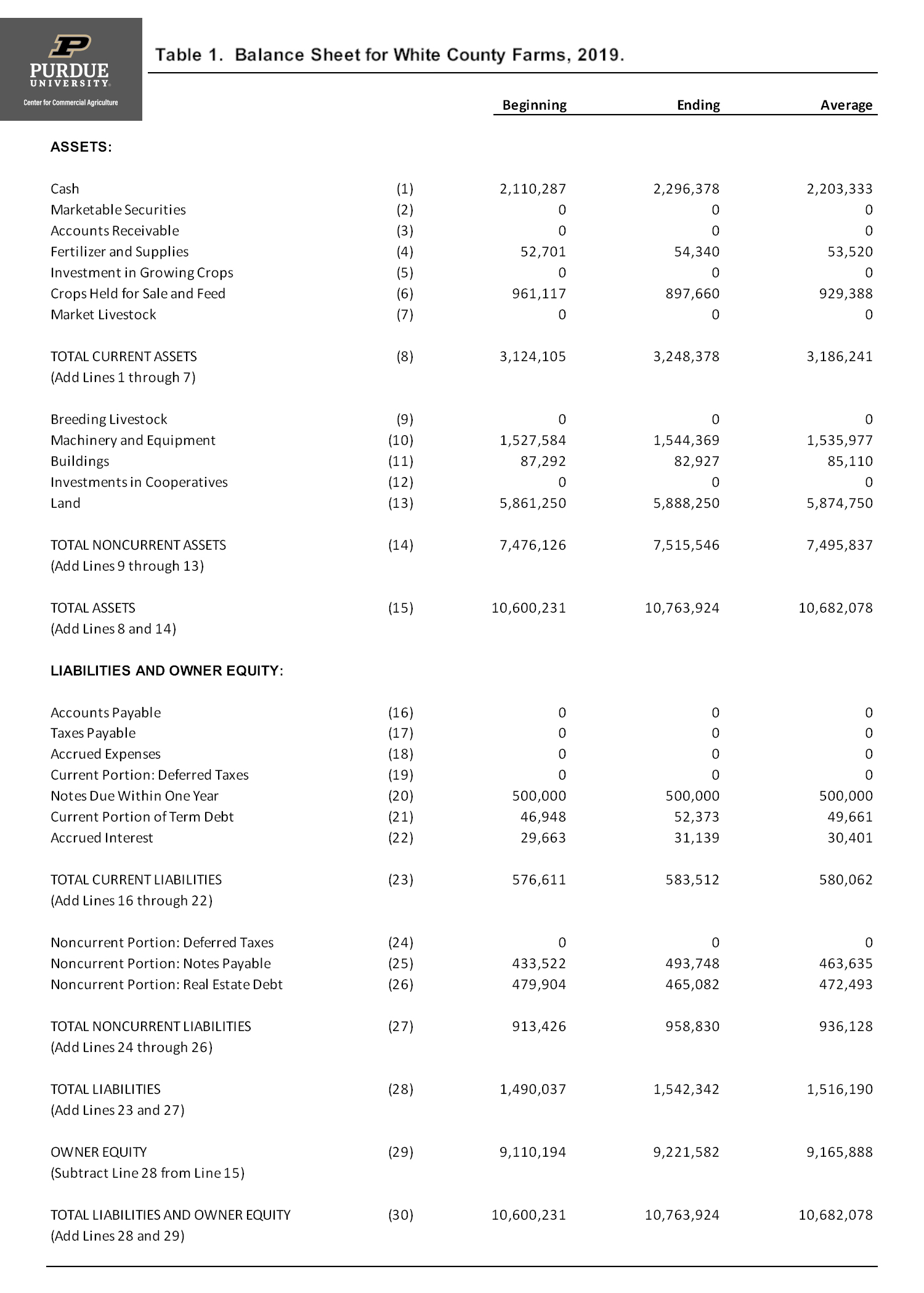

You c/f the same advance tax in the next year as opening balance. Opening provision for tax is 950311 closing provision is 1372566 and opening advance tax is 950000 and closing. Following is how income received in advance is treated in the final accounts and how it is shown in both the profit and loss account and.

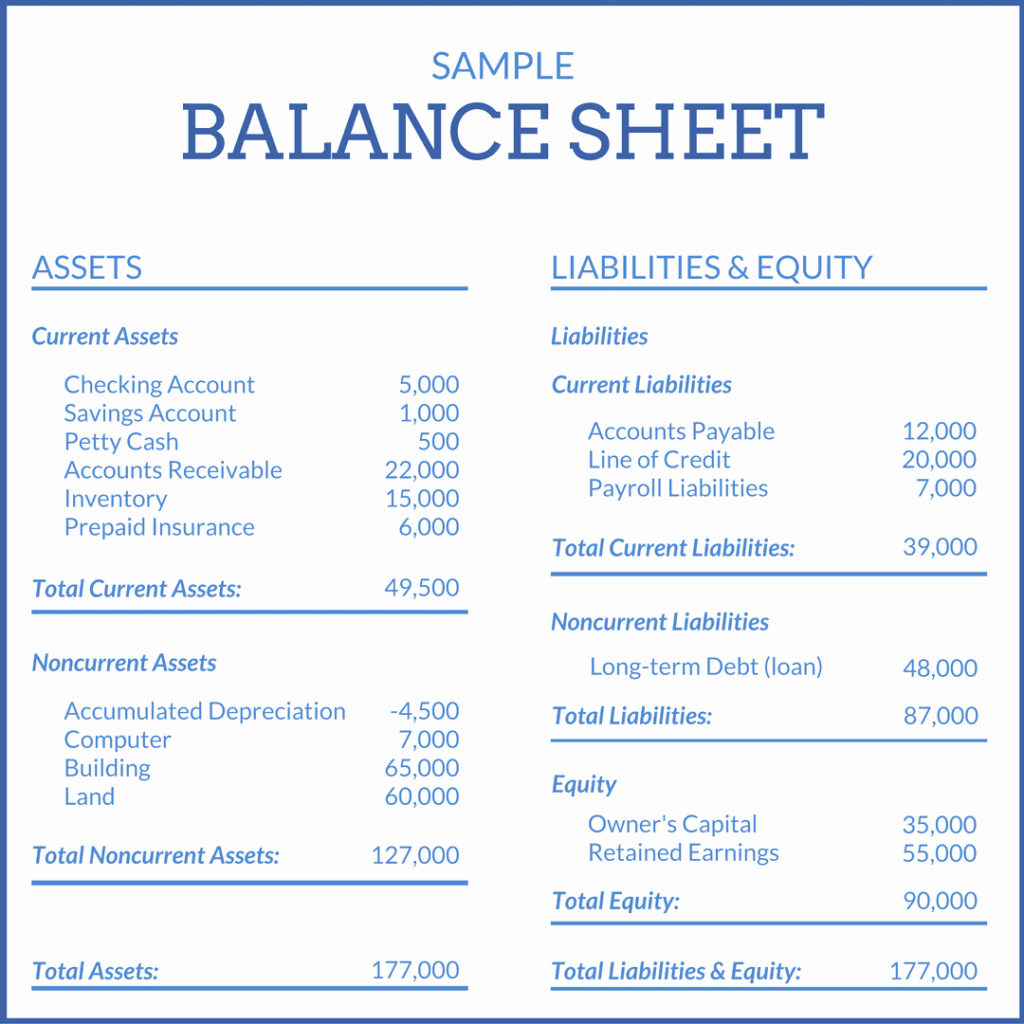

Advance payments are reported as assets on the balance sheet of the company. In another way, we can calculate it by finding a taxable temporary difference, then. Income received in advance these are called timing differences.

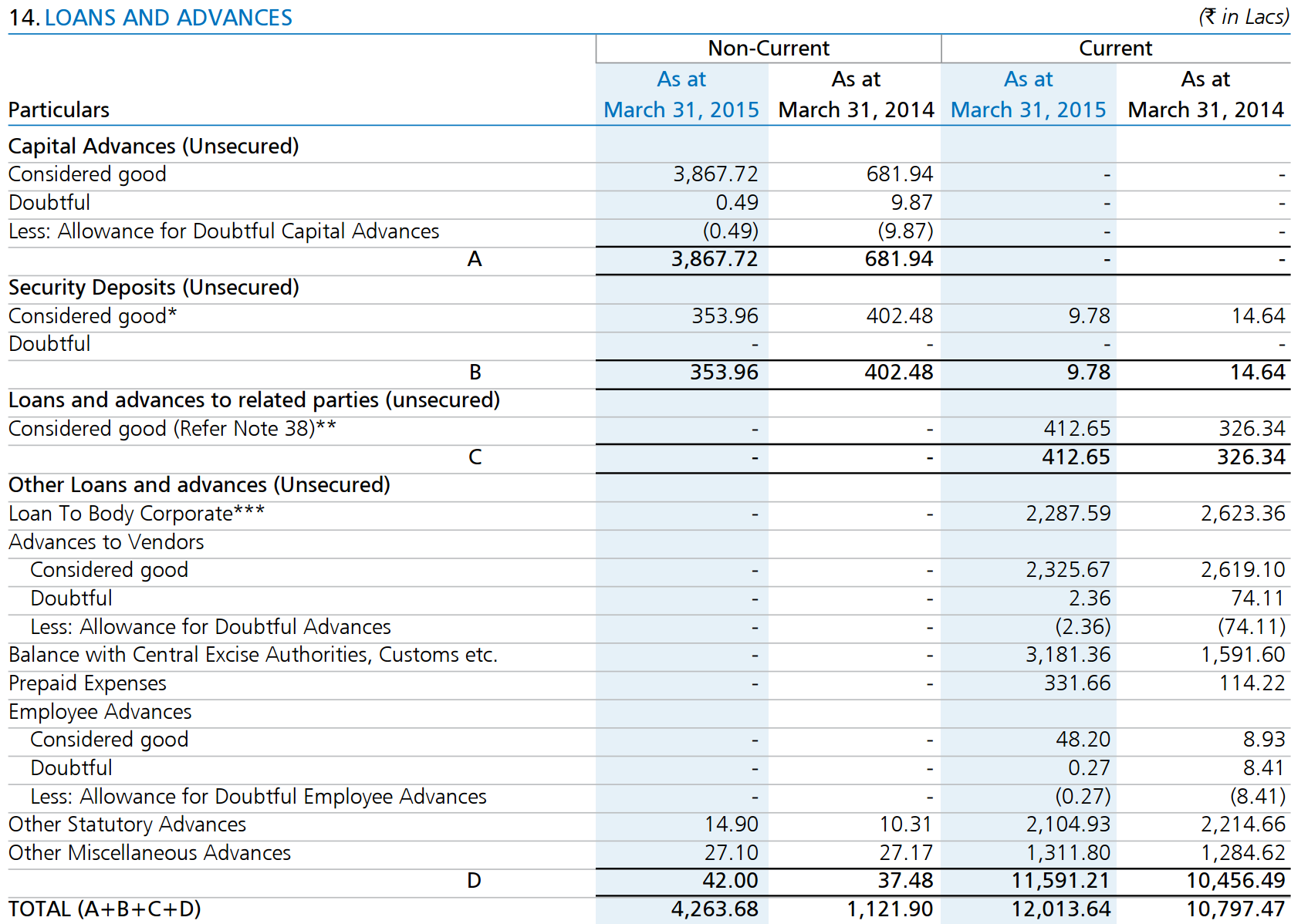

When the us dollar is the functional currency, revaluations of foreign deferred tax balances are reported as either transaction gains and losses or, if. Advance income tax paid a/c dr to bank a/c in case of self assessment tax also this entry is passed but the. The advance tax is piad by the partnership firm show in loan and advances ( assets side) and income tax paid for the previous year deducted from the provision had.

It reduces the burden of tax payment. Definition of revenue received in advance under the accrual basis of accounting, revenues received in. This blog article will take you through an understanding of current tax payable, current tax liability, and its treatment balance sheet.

Where does revenue received in advance go on a balance sheet? When these assets are used, they are spent and reported on the income. Advance tax will be under advances asset side balance sheet.

As per income tax act, we have to pay advance income tax and that is showed at “property & assets” side of balance sheet in the bracket of “other assets”. It helps in mitigating stress that a taxpayer may undergo while making tax payment at the end of fi. 1) what should be the presenation/ treatment of the advance income tax payments done while closing the balance sheet at the end of a financial year?

![[PDF] Tax Computation Format PDF City.in](https://pdfcity.in/wp-content/uploads/2021/10/Income-tax-computation-format.png)