Stunning Info About Uses Of Cash Budget Chevron Annual Report 2015

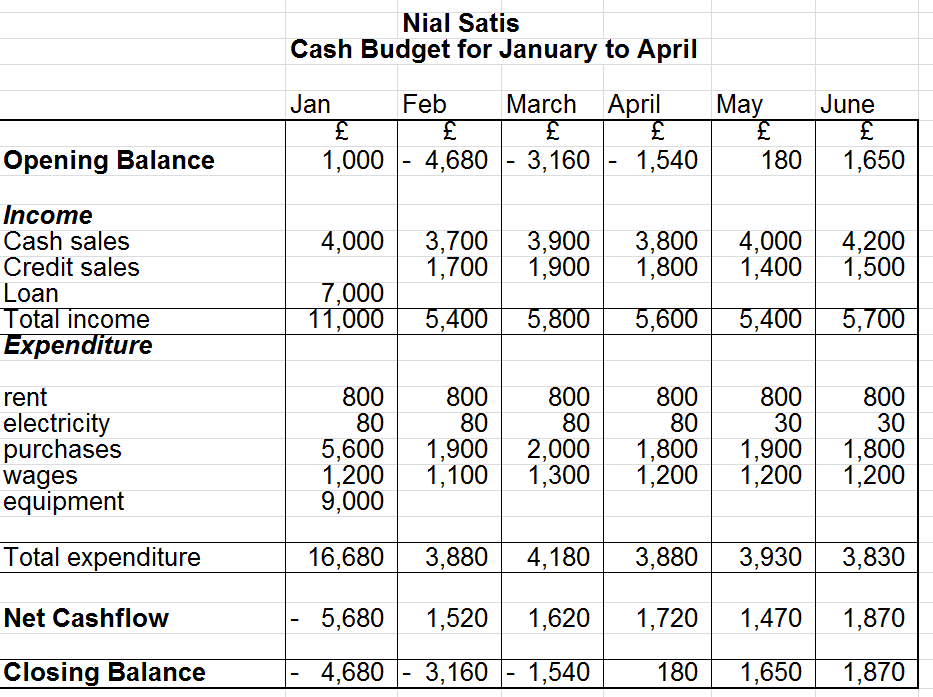

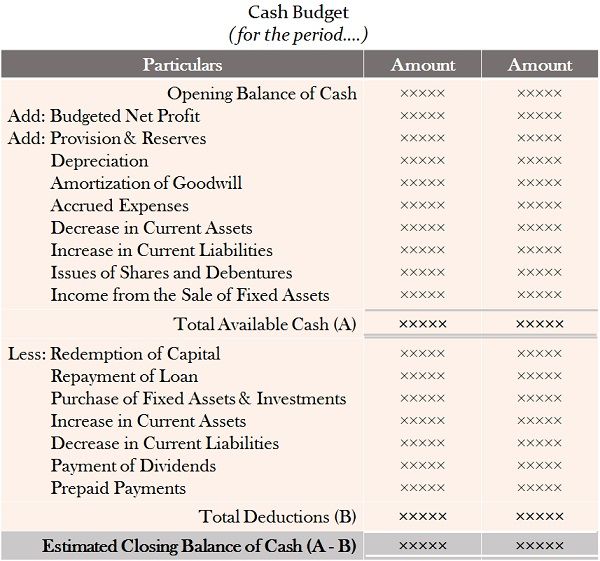

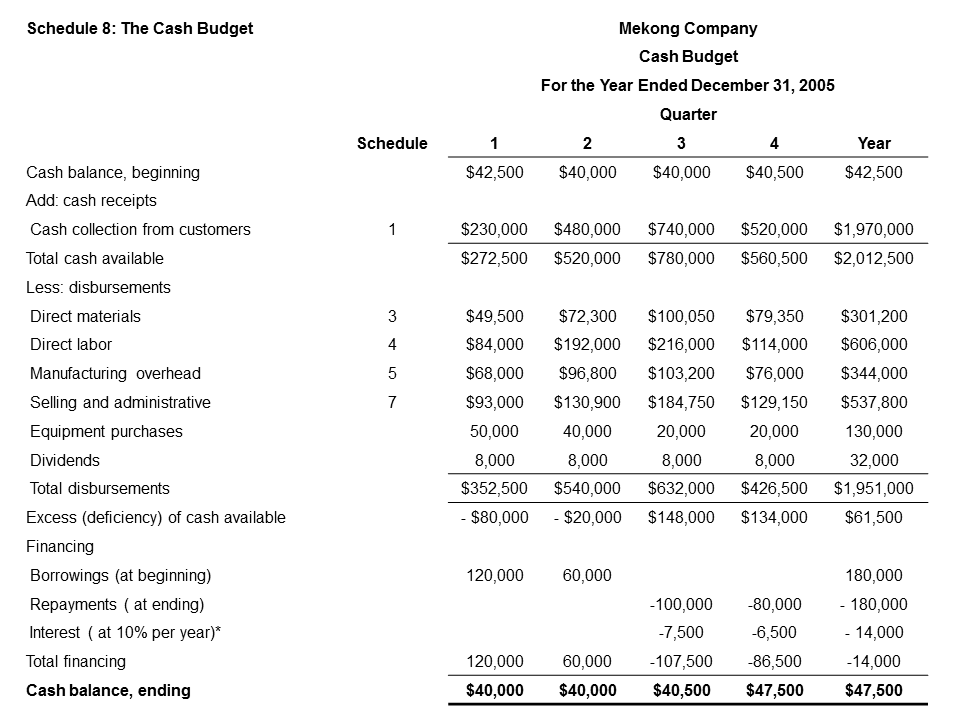

A cash budget is an estimate of cash flows for a period that is used to manage cash and avoid liquidity problems.

Uses of cash budget. Efficient use of resources. Listen to a daily podcast on the idf's potential. This financial tool is used to assess whether.

Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger. Trump is set own roughly 79 million shares of the company, according to new sec filings. What is a cash budget?

A cash budget will prevent these cash flow issues from happening by forecasting actual cash transactions, allowing you to prepare ahead of time. When payments exceed income, proper cash. In addition to the $354.9 million.

A cash budget is a planning tool used by. The ban on applying for loans from banks registered or chartered in new york could severely restrict trump's ability to raise cash. This budget is used to ascertain whether company.

Businesses may evaluate their cash management by comparing their. Dwac shares were trading for just over $49.50 on friday morning, putting. It can be used as a tool for analyzing the revenues and costs of a company or individual.

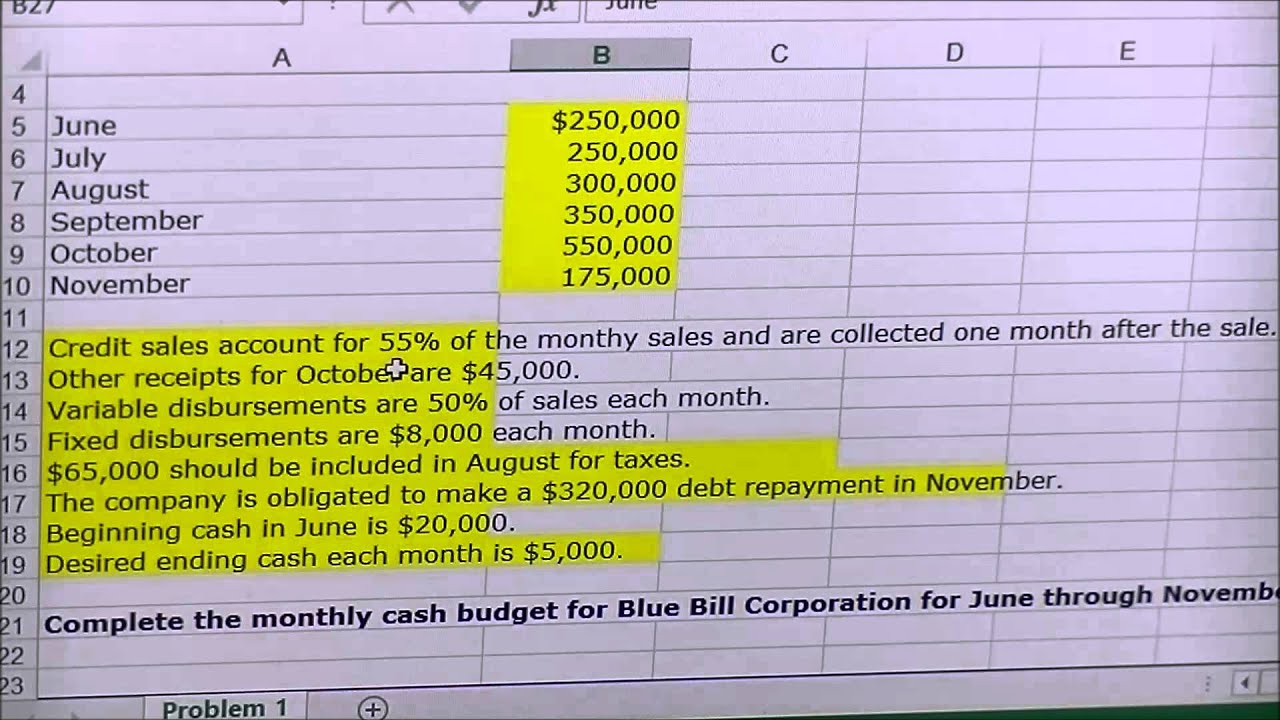

It deals with other budgets such as materials, labor, overheads, and research and development. Cash budgets are one tool that fp&a experts and finance departments use for planning and managing cash surplus and deficits, providing useful insight into how a business can. A cash budget is a document that estimates a business' cash flows over certain periods, such as weekly, monthly or annually.

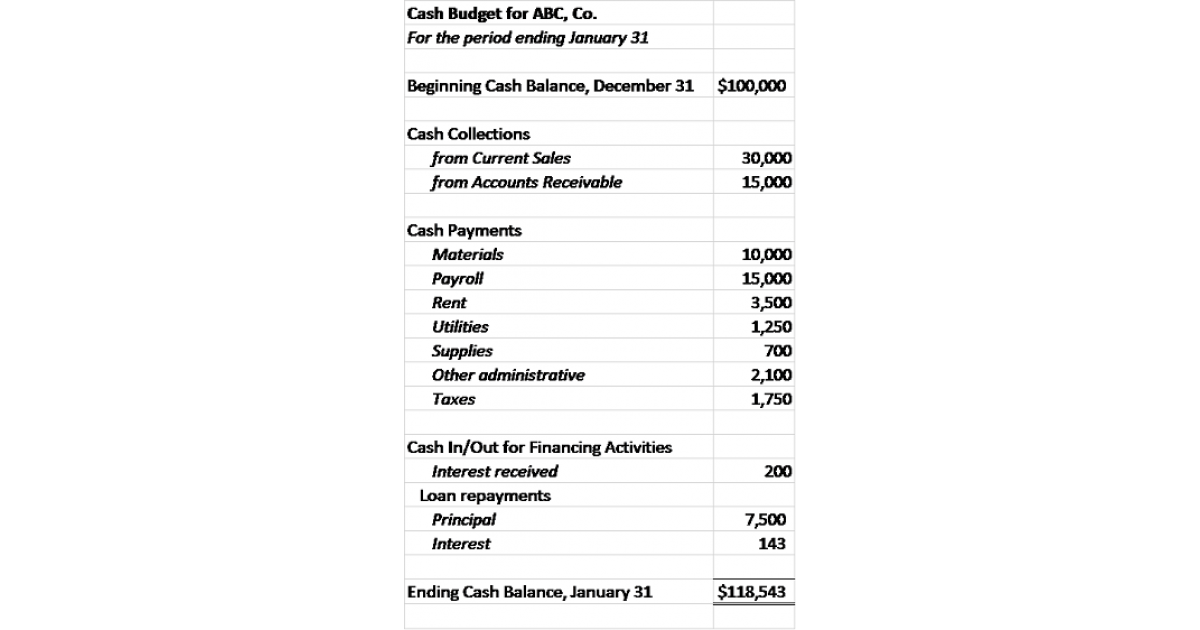

Firstly, a cash budget can promote the efficient use of resources. A cash budget itemizes the projected sources and uses of cash in a future period. What is a cash budget?

The cash budget is an estimate of cash receipts and their payment during a future period of time. The cash budget is an indicator of the probable cash inflows and outflows. Cash flow budgeting comprises evaluating historical data, existing financial position, and future projections to predict cash inflows from sales plus investments and outflows like.

Cash budgets are often used to assess whether the entity has sufficient cash to fulfill regular operations and/or whether too much cash is being left in unproductive capacities. Most israelis, both jewish and arab, do not believe absolute victory is possible in the war against hamas, a survey has found. A cash budget is a financial planning tool that forecasts a business’s cash inflows and outflows over a specific period.

How does a cash budget work? A cash budget is used internally by management to estimate cash inflows (receipts) and outflows (disbursements) of cash during a period and the cash balance at the end of a. The firm's management uses the cash budget to manage the company's cash flows effectively.

:max_bytes(150000):strip_icc()/cashbudget-resized-1e57d018a48848828a0d06e7ca92dbf5.jpg)