Ideal Tips About Simple Cash Budget Business Financial Projections Template

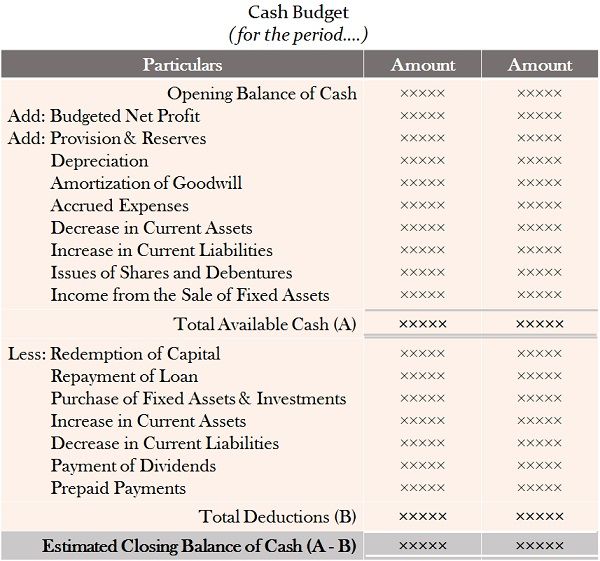

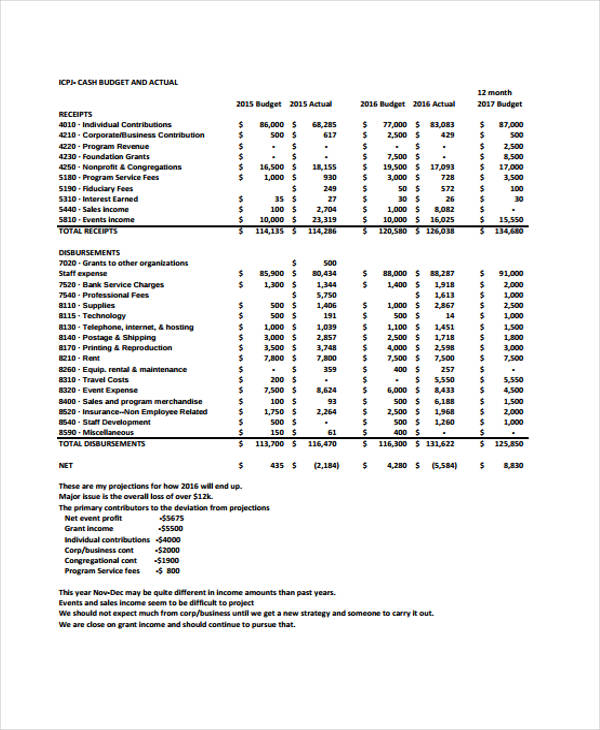

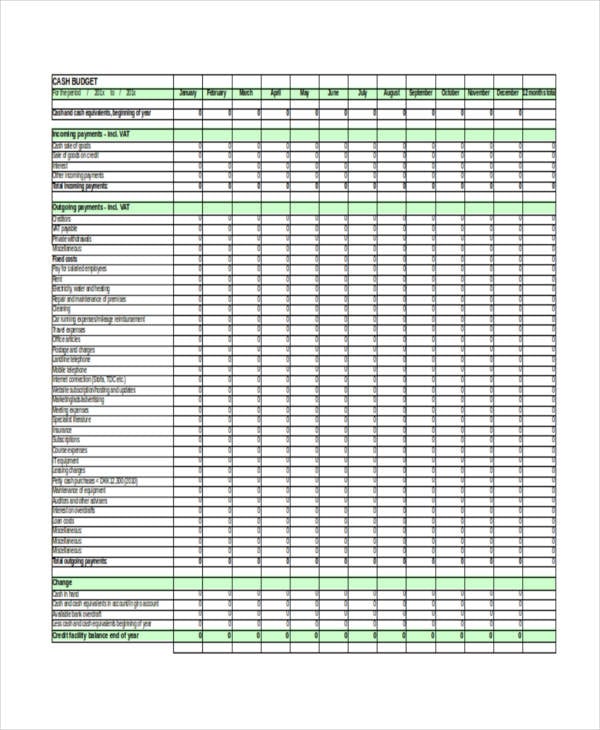

Cash budget is a financial budget prepared to calculate the budgeted cash inflows and outflows during a period and the budgeted cash balance at the end of the.

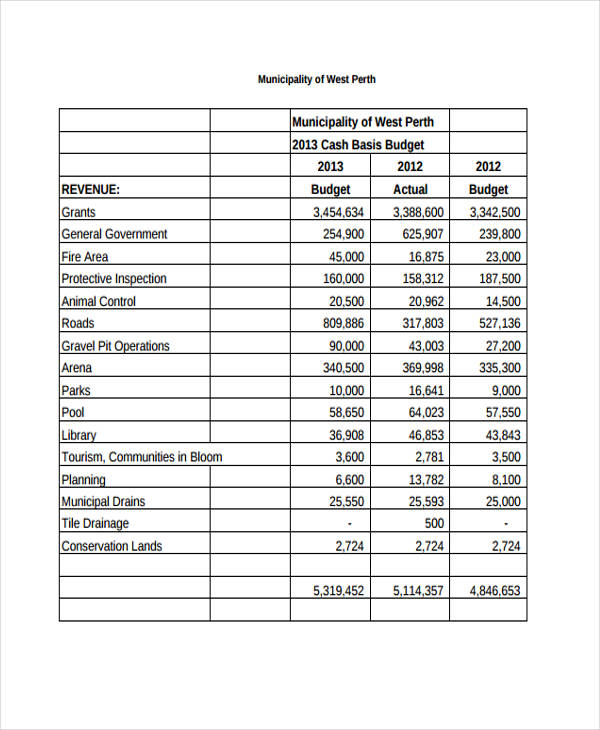

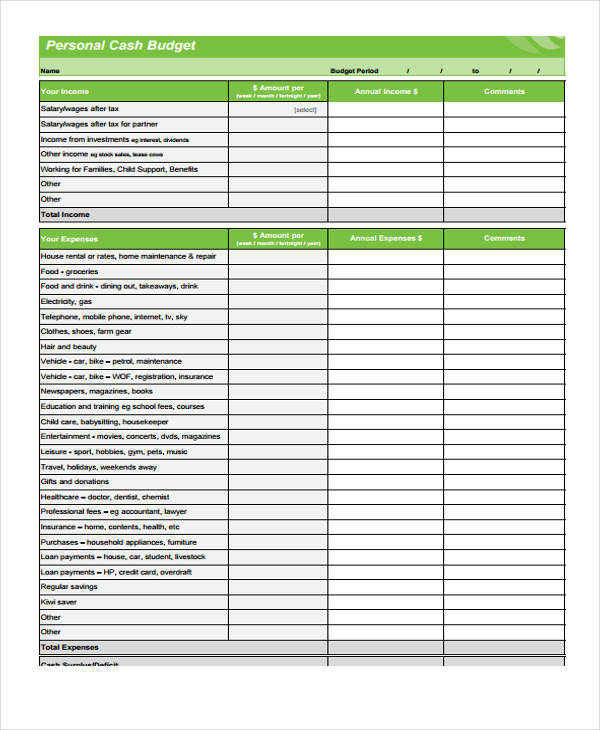

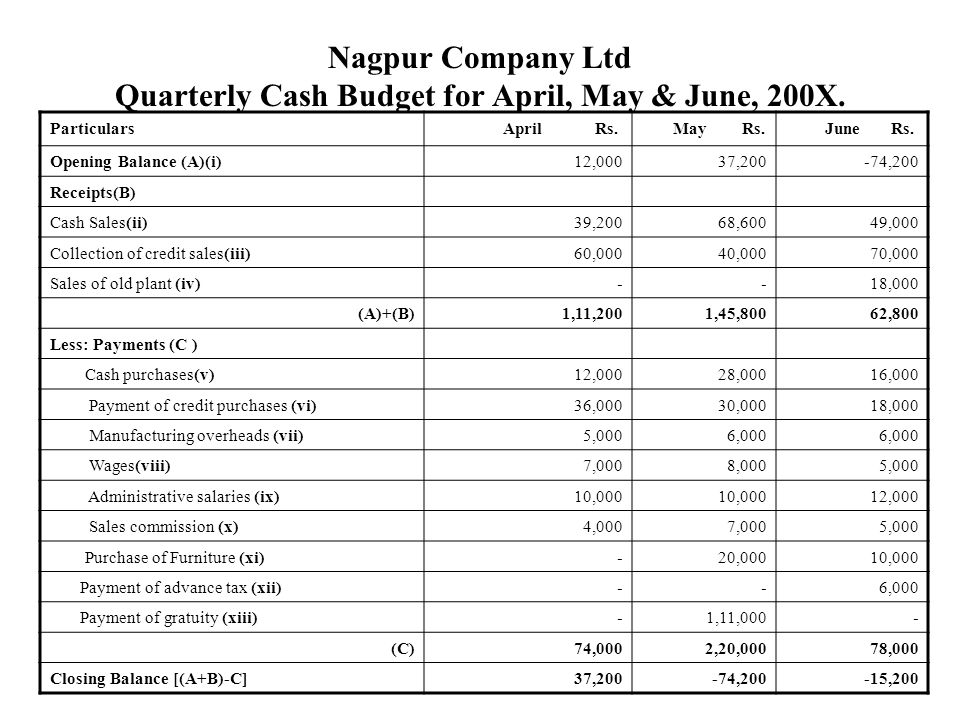

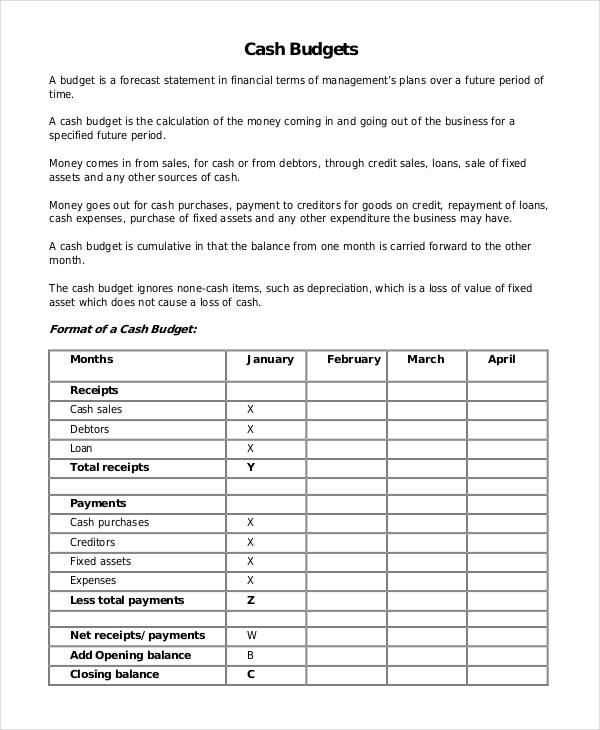

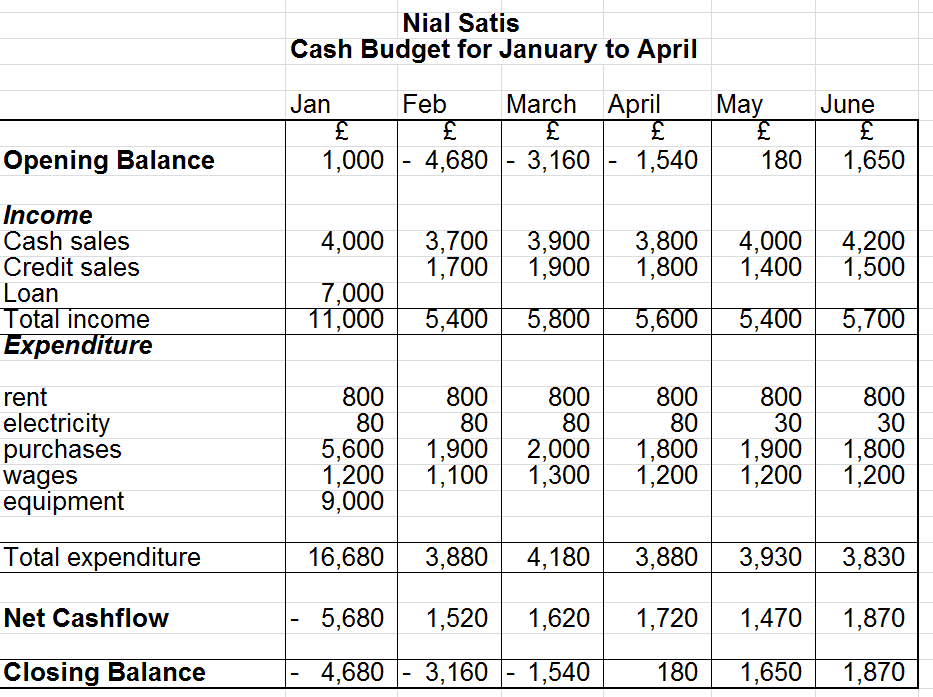

Simple cash budget. This document keeps an eye. Cash budget is a precise statement depicting anticipated projections about the cash receipts and payments for a specific time period. Below is a preview of the cash budget template:.

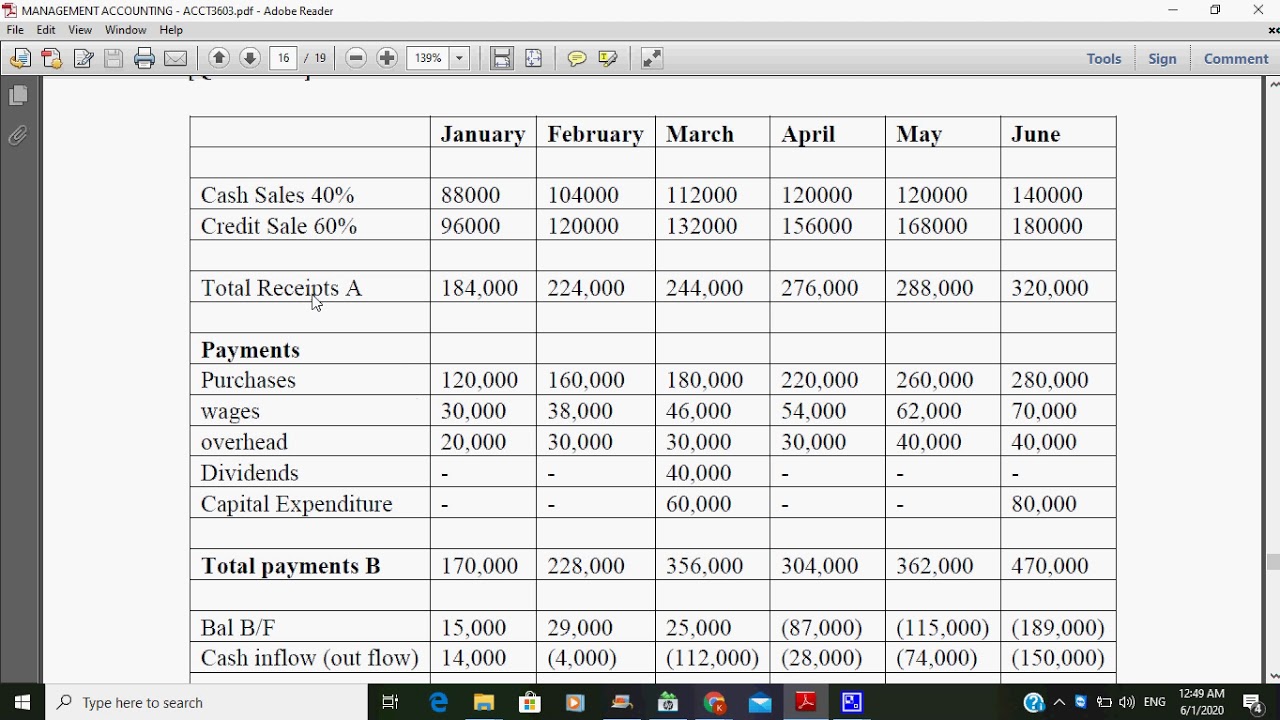

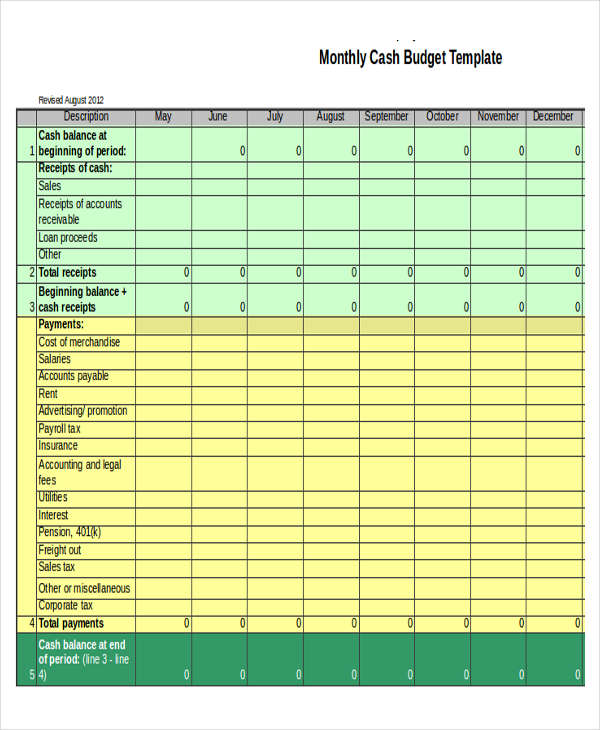

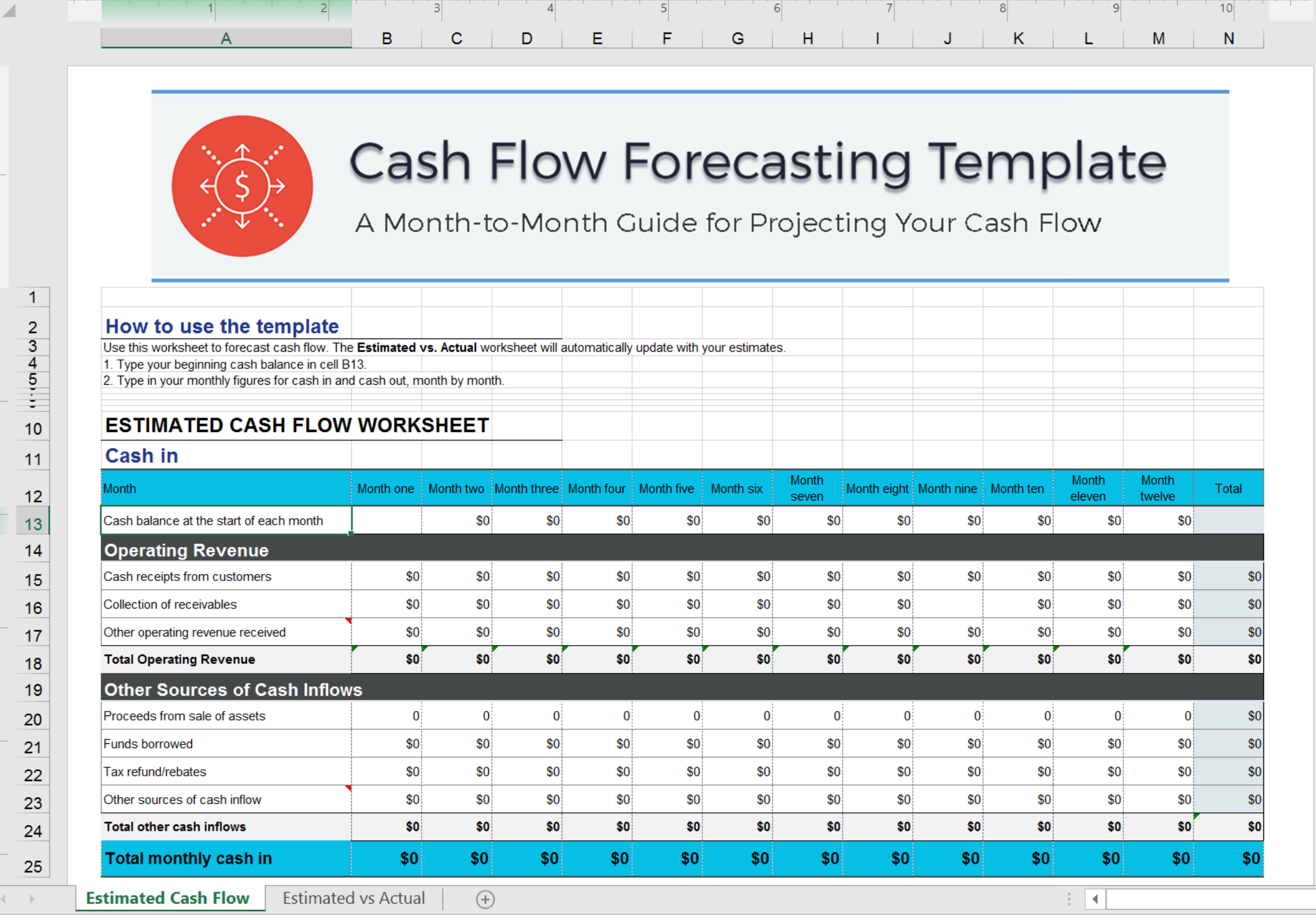

A cash flow budget template is an effective tool that is used to track the flow of cash in an organization over a particular period of time. Solved example what is a cash budget? A cash budget is a statement that helps a business manage its cash flows.

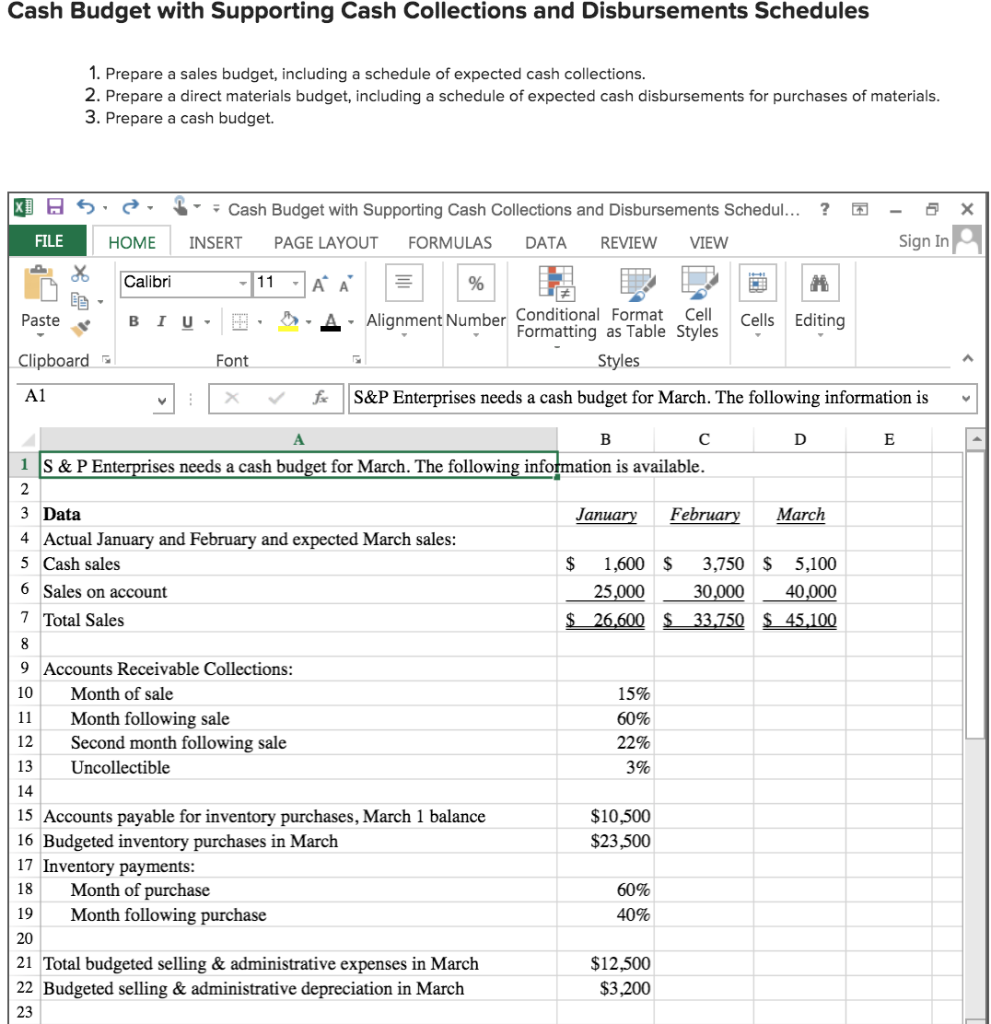

Cash budget example problem with solution what if balance is negative and how to improve. A cash budget is a budget or plan of expected cash receipts and disbursements during the period. For example, if the budget is dated from february 1,.

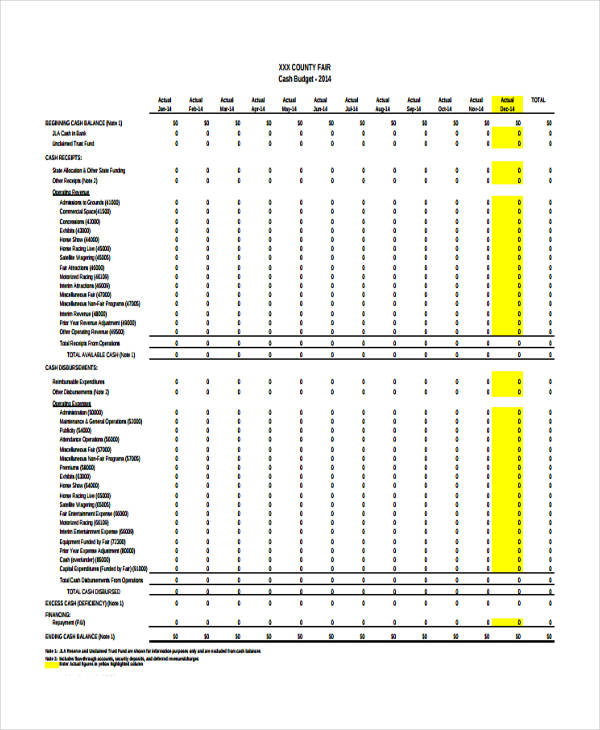

This cash budget template will help you plan your cash inflows and outflows on a monthly basis. Problem 1 from the information below, prepare a cash budget for the period from january to april. The original copy of this receipt is given to the.

A cash budget is the written financial plan made by the business related to their cash receiptscash receiptsa cash receipt is a small document that works as evidence that the amount of cash received during a transaction involves transferring cash or cash equivalent. It is prepared in advance to capture a company’s cash receipts and cash spends. These cash inflows and outflows include revenues collected,.

It is a type of functional budget. A cash budget is an estimate of cash flows for a period that is used to manage cash and avoid liquidity problems. Provides information about future probable receipts and payments 3.

Cash budget format. The company will not be able to operate when the lack of cash. This involves estimates of revenue, costs.

Cash inflows, cash outflows, cash excess or deficiency, and details of. Cash budgets help manage a company's cash flow by simplifying how you track its cash inflow and outflow over time. The cash budget starts with the current cash balance from the date that begins the cash budget statement.

On the other hand, too much cash on hand means that we lose the opportunity to invest them for more profit. The basic format of a cash budget includes four sections: Most israelis, both jewish and arab, do not believe absolute victory is possible in the war against hamas, a survey has found.

How to prepare cash budget? Provides information about various sources of cash receipts and the use of cash 2. The wages to be paid to workers amount to $5,000 each month.