Beautiful Tips About Vat Treatment In Profit And Loss Account Statement For Mortgage

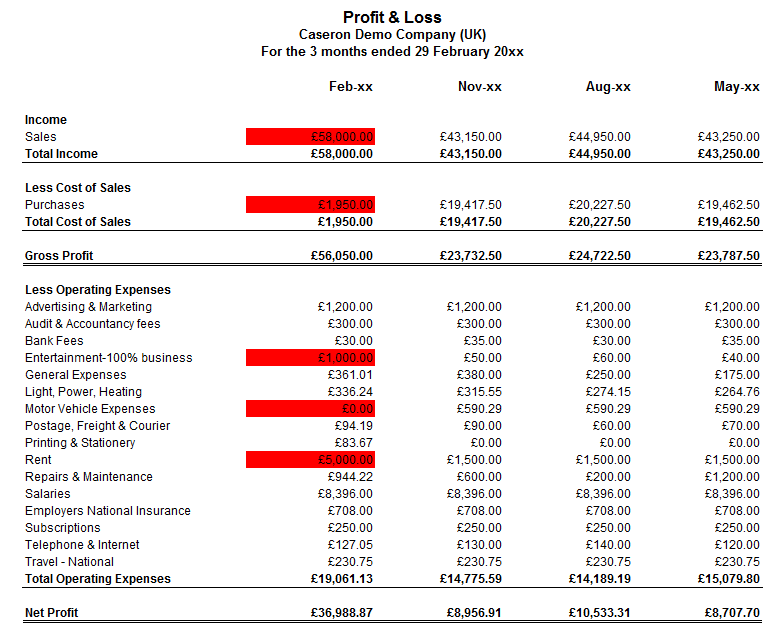

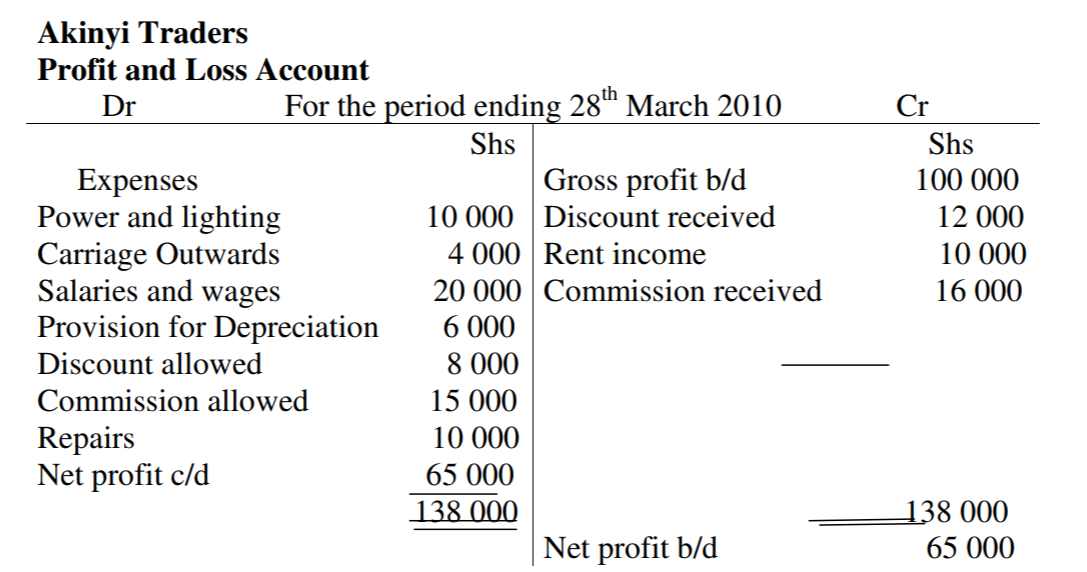

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

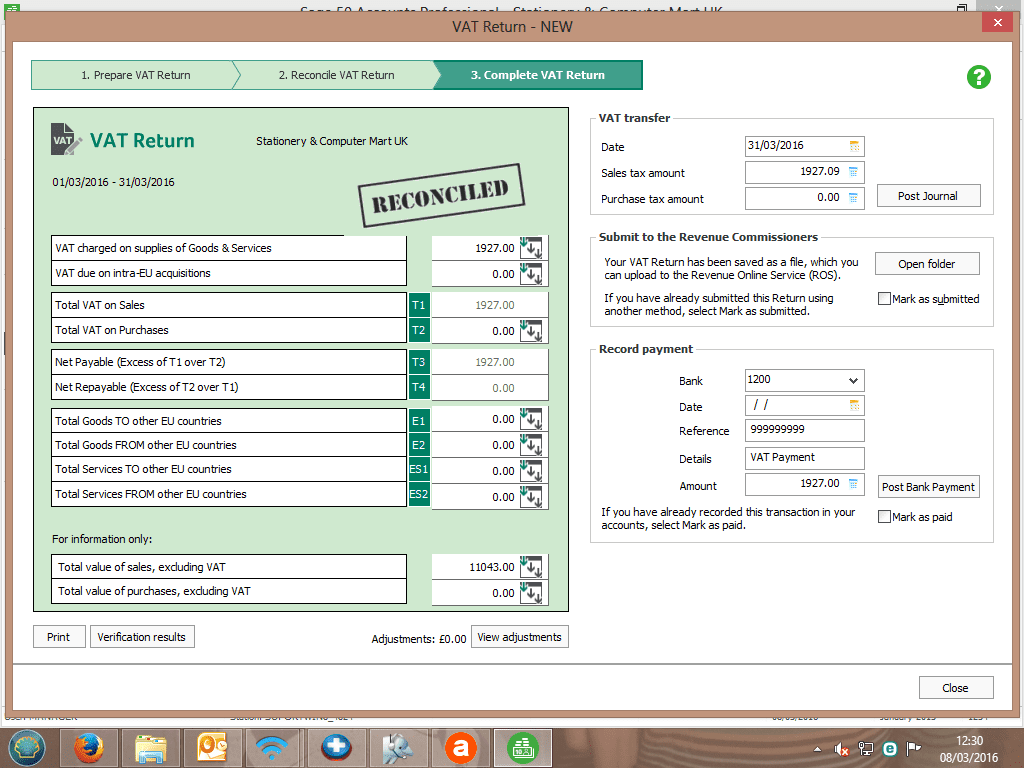

Vat treatment in profit and loss account. Vat that we charged or paid is not the revenue or expense but just the asset and liability account which will be settled in the future. It doesn’t belong to your company, and so you don’t include it in your profit and loss. Accounting treatment for vat paid on purchases the amount of tax paid on purchase of inputs or supplies and available for vat credit should be debited to a separate.

In some cases, vat will still be. We think that in order to give a true and fair view, the most appropriate treatment would be to include the debit as. Overview when you lose goods because of things like losses in the post, theft or damage, you’ll need to make sure you deal with the vat correctly.

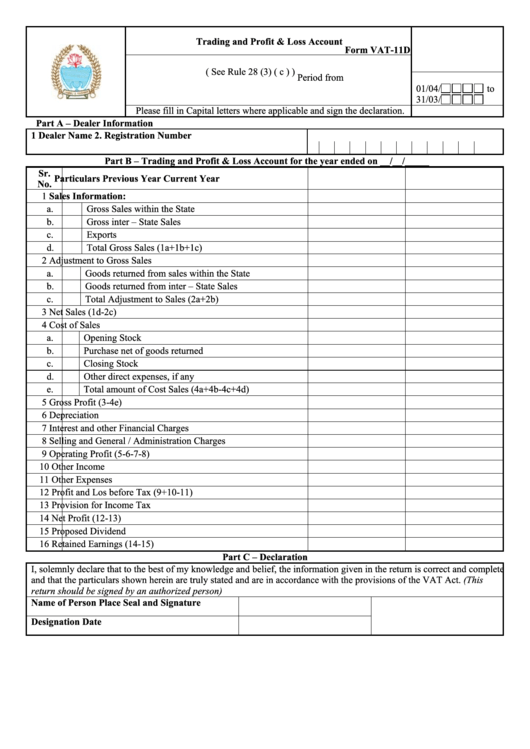

Profit and loss account/statement types of profit and loss. If a profit and loss is drawn up with all figures including the vat within them (gross), then would any vat liability be shown as a separate expense or would it not as it is already accounted for within the sales and expenses as gross figures. Showing vat in the profit and loss report.

The profit or loss) from using the flat rate scheme (frs) compared. In qbo, you can run the profit and loss detail report to. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s.

It is observed that the assessee follows such exclusive method of accounting consistently where the statutory dues i.e. Exporting your profit and loss. What is an income statement?

Ssap 5 states that for vat registered traders, turnover shown in the profit and loss account should exclude vat, expenses where vat has been recovered. In this article, we will see types of profit and loss account and profit and loss account format. The same way that other payments of vat in respect of sales accurately returned at the proper time were deducted in the profit and loss.

The way that our system calculates flat rate vat is based on a methodology that calculates the difference (i.e. 2018 april overpayments from customers don’t overlook the vat, tax and legal implications of overpayments vat tax is keeping the money theft? Is the amount of vat.

Gst is collected from the customers and such. Accounts on vat inclusive basis. If a client is on standard accounting then the vat is deducted from the sales and the relevant expenses and vat is not shown at all on the profit and loss account.

I'll be sharing some information about the profit and loss statement in quickbooks online (qbo).