Awesome Info About T2125 Form 2019 Important Ratios In Balance Sheet

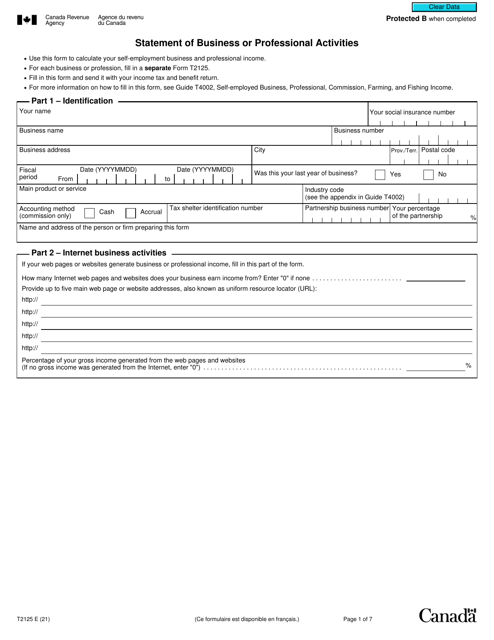

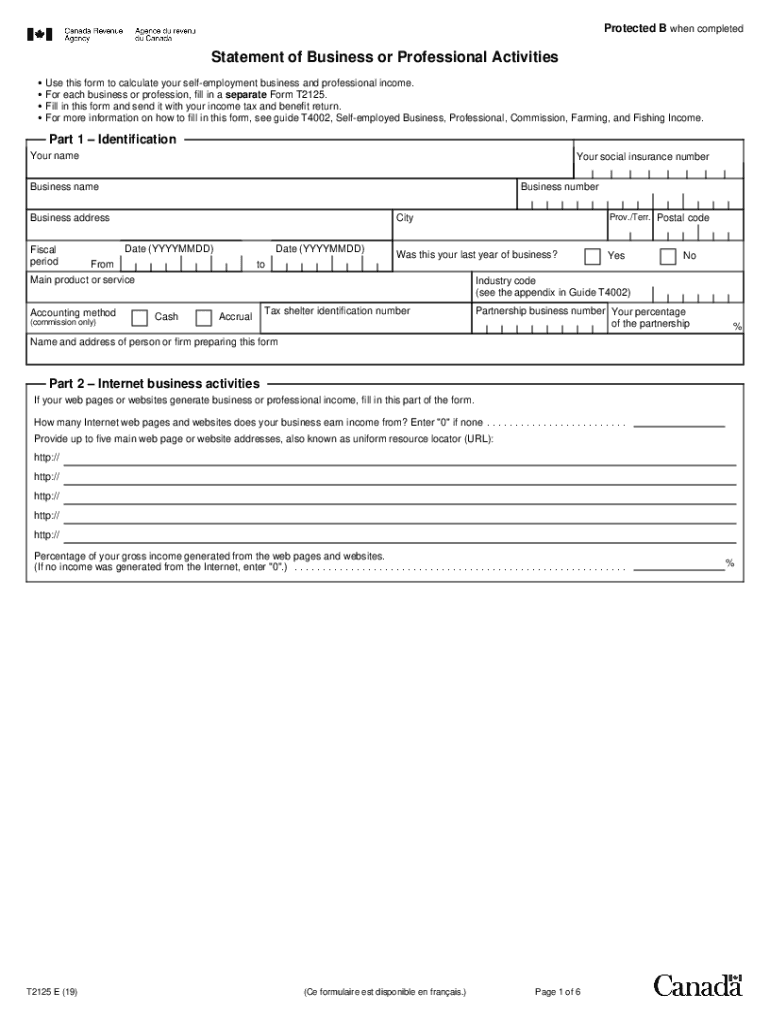

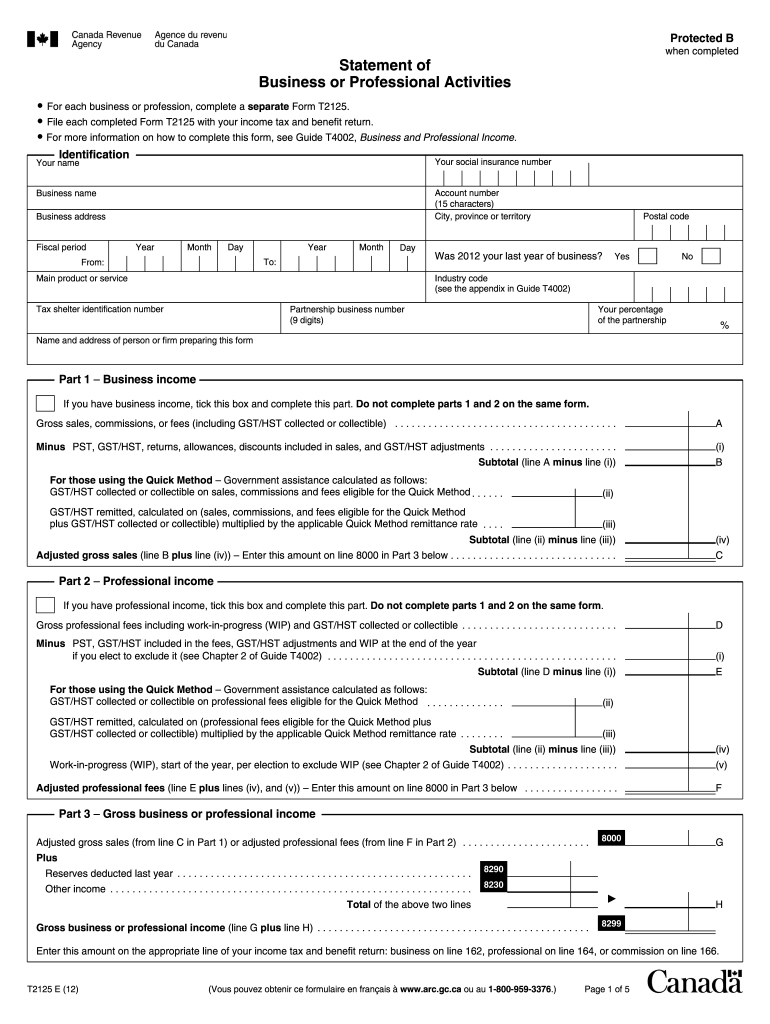

Use the t2125 form to report either business or professional income and expenses.

T2125 form 2019. Clear data protected b when completed statement of business or. Use this form to report either business or professional income and expenses. Get started with the basics of preparing a t2125 business statement in taxcycle t1.

When you want to amend your tax return, you have to wait until you've received your notice of assessment for the year. Create a t2125 form set ; Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

The t2125 form details all revenues and expenses related to the individual’s unincorporated business and professional activities. T2125 statement of business or professional activities t4003 farming and fishing income t4004 fishing income date modified: You can use form t2125, statement of business or professional activities, to report your business and professional income and expenses.

Type of business activity ;. Basic information about the t2125 form. This form can help you calculate your.

This form combines the two previous. You will go page by page and answer the questions then you will see the form t2125. Statement of business or professional activities form to report your income and expenses for the year.

View t2125 statement of business or professional activities 2019.pdf from acct 226 at centennial college. The t2125 form is a versatile reporting tool that allows taxpayers to disclose many facets of their enterprise to the cra including, but not limited to their business. One of the reasons for this is because.

This form combines the two previous forms, t2124, statement of business activities, and t2032,. 7 rows t2125 breakdown. The statement of business or professional activity form must be completed and filed by june 15 each year.

T2125, also called the statement of business or professional activities, is the form that sole proprietors and partnerships use to report the income their business. T2125 statement of business or professional activities.

:max_bytes(150000):strip_icc()/delipaperworktax-56a82fab3df78cf7729ce02e.jpg)