Amazing Info About Journal Entry Of Impairment Loss Dividends Is On What Financial Statement

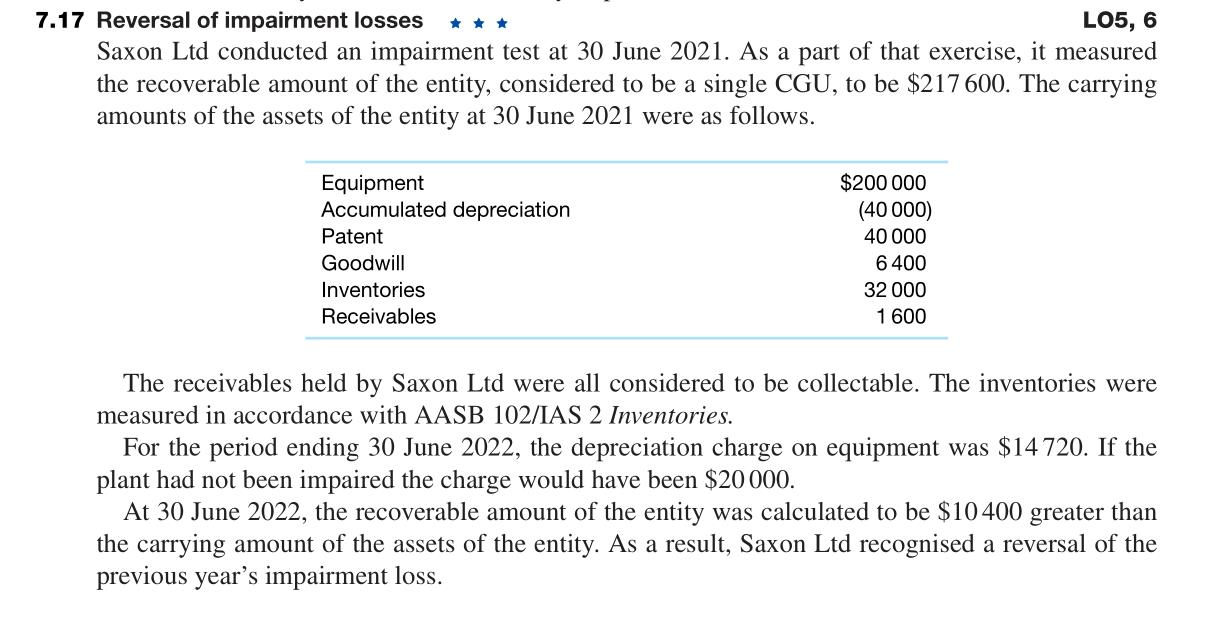

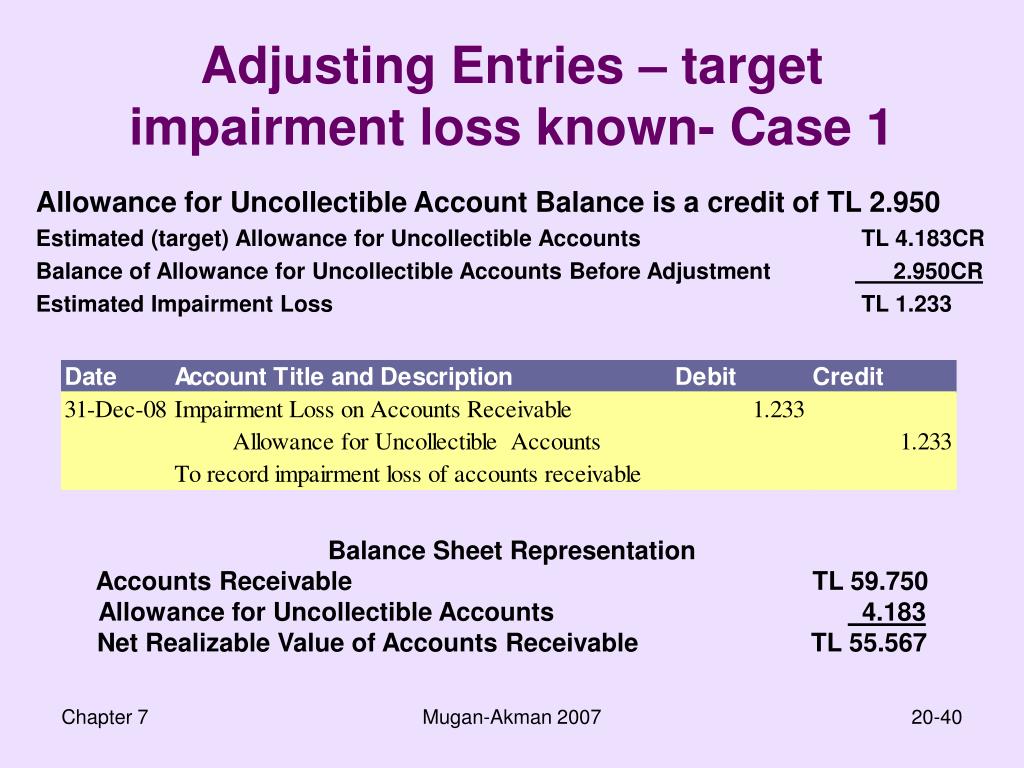

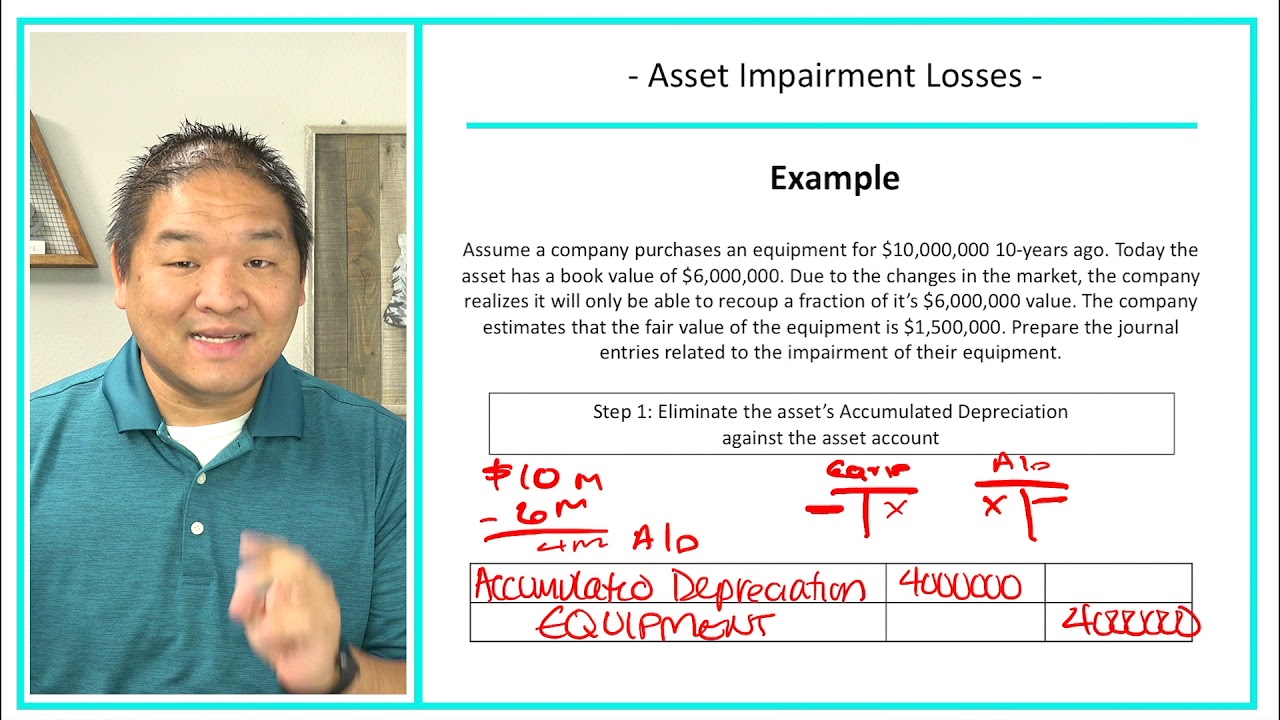

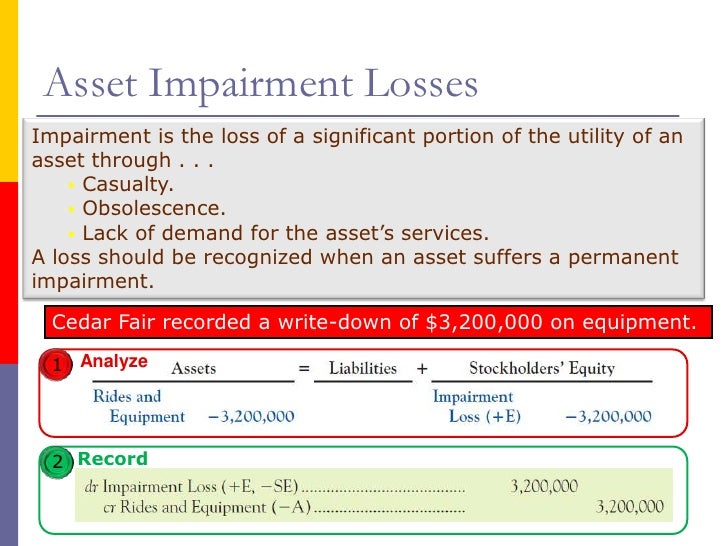

Overall, companies can record impairment loss journal entries as follows.

Journal entry of impairment loss. So we need to reduce the balance of fixed assets (machinery) by $ 50 million and record. An impairment loss is recognised immediately in profit or loss (or in comprehensive income if it is a revaluation decrease under ias 16 or ias 38). The following journal entry must be recorded to account for this condition:

For this example, the journal. Identifying potential goodwill impairment by comparing the fair value of the reporting unit to its carrying amount. An impairment loss is recognized and accrued through a journal entry to record and reevaluate the asset's value.

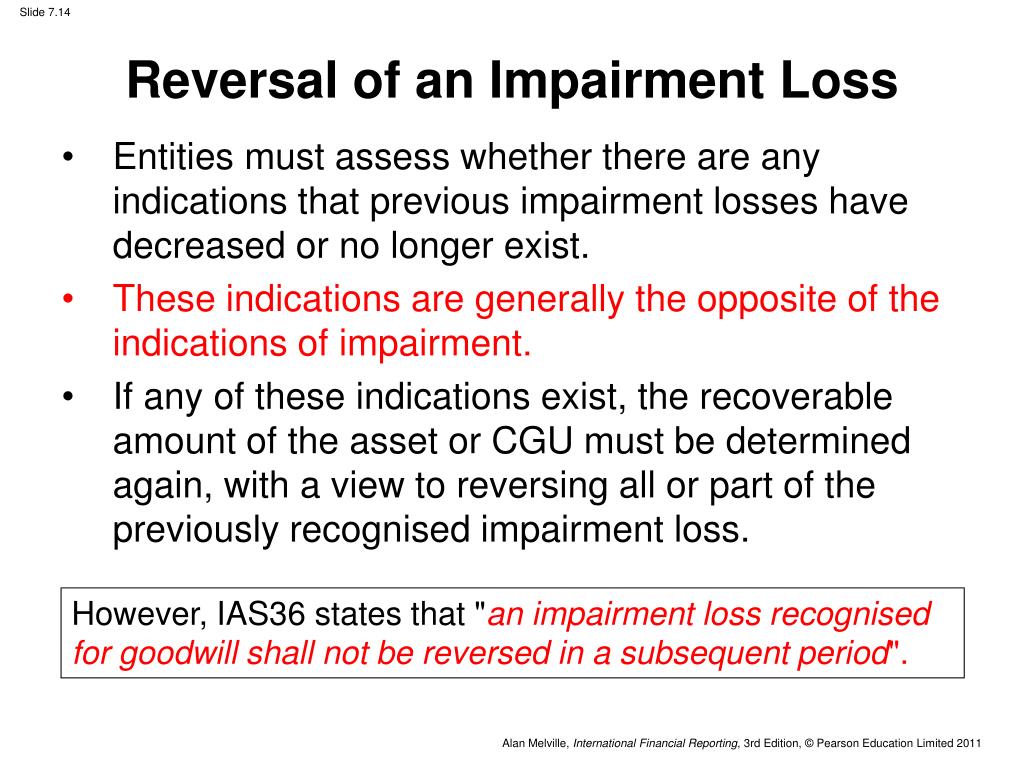

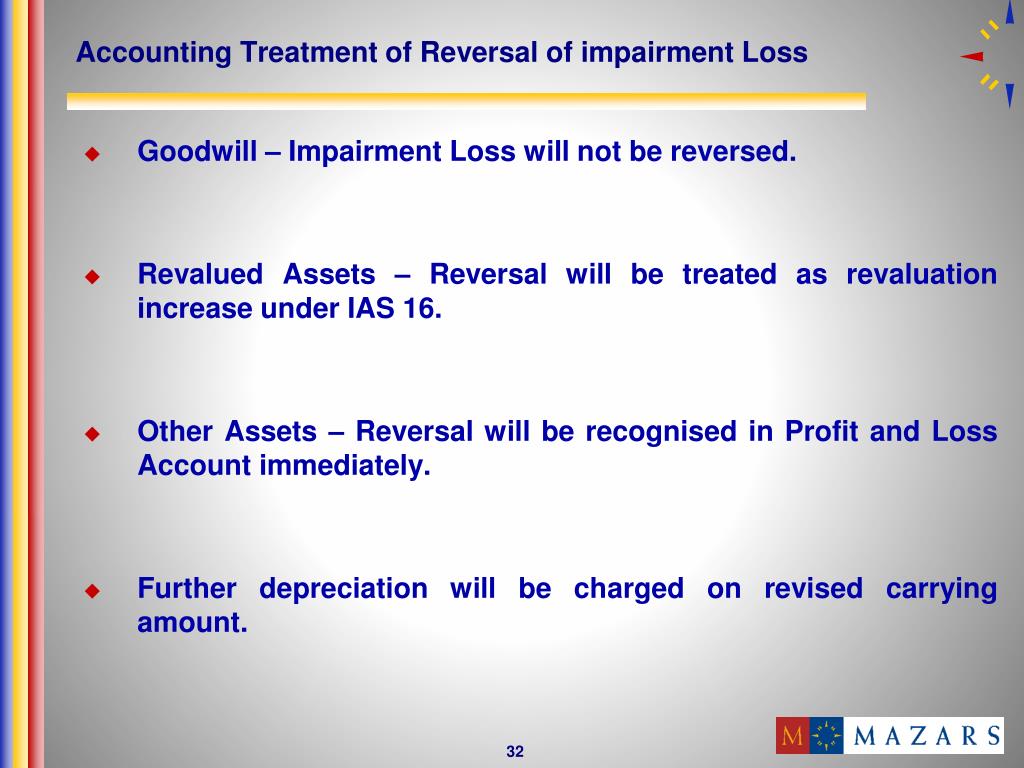

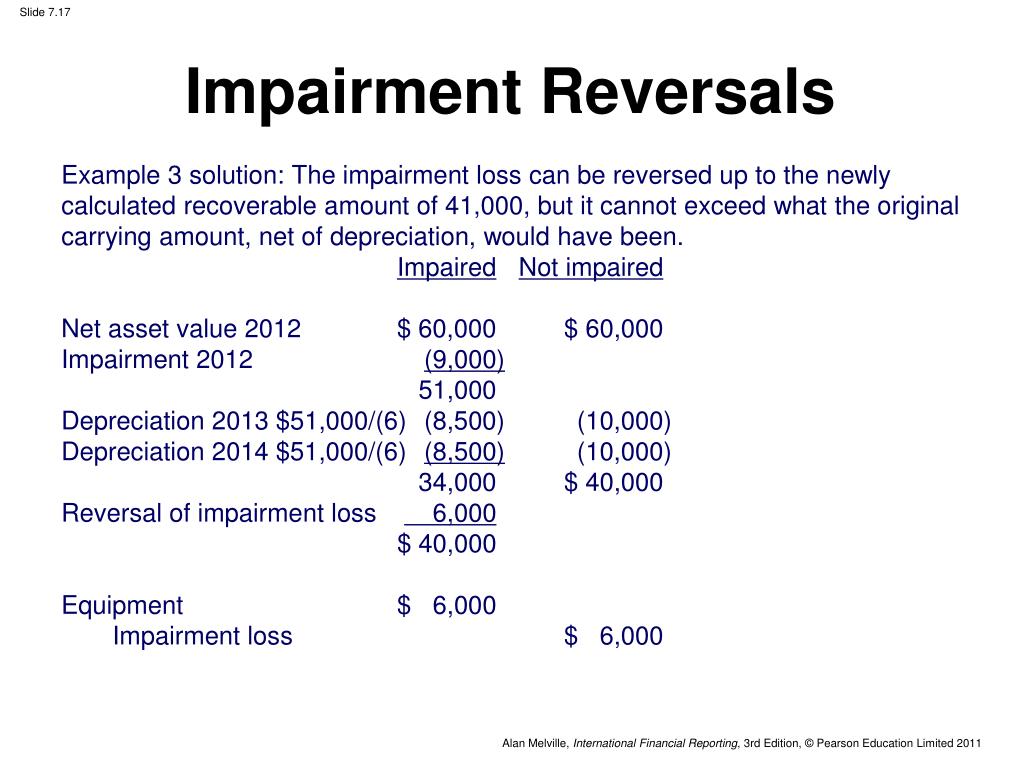

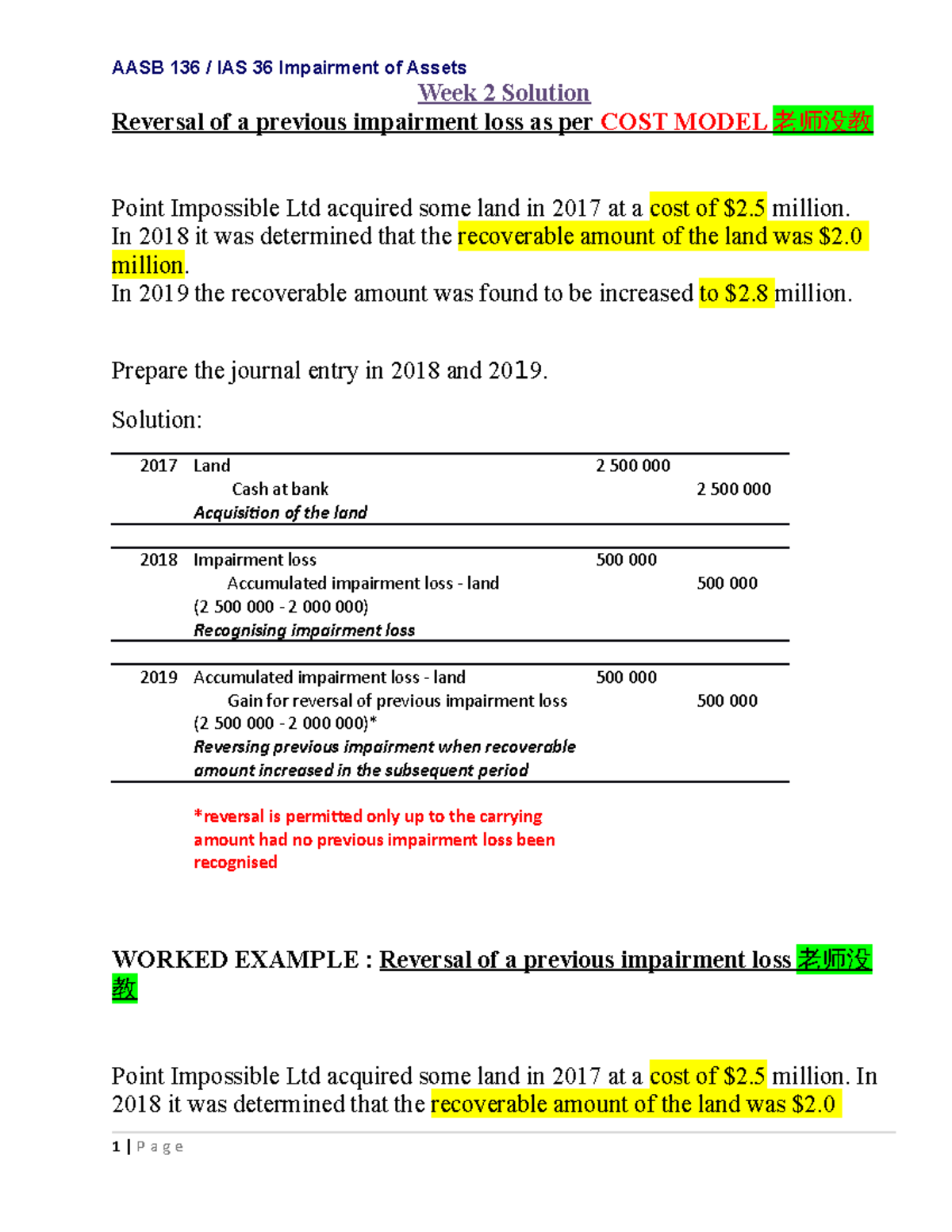

Reversal of impairment loss if due to any event the impaired asset regains its value, the gain is first recorded in income statement. The journal entry would be: The company can make the fixed asset impairment journal entry by debiting the impairment losses account and crediting the accumulated.

It may be a fixed asset or an intangible asset. Impairment occurs when a business asset suffers a depreciation in fair market value in excess of the book value of the asset. When an asset is impaired, a journal entry must be recorded to reflect the loss on the company’s financial statements.

The entity to recognise an impairment loss. Ifrs 9 sets out three distinctive approaches to recognising impairment: Measuring the goodwill impairment loss, if any, by comparing.

As mentioned, the accumulated impairment loss is the contra asset account to reduce the asset’s value. In accounting, impairment is a permanent reduction in the value of a company asset. London— hsbc bet big on china to fuel its growth, a move that has now come back to bite it.

If an asset’s recoverable amount falls below its carrying amount, the difference must be recognised in profit or loss (or oci for revalued assets), known as an. In the journal entry, we debit the impairment loss account or expense account and credit in the corresponding asset. Based on the report from a technical expert, the impairment loss is $ 50 million.

Ias 36 impairment of assets is the accounting standard that describes the requirements for impairment testing of assets if not covered by other specific accounting standards. If there is an indication that an impairment loss has reversed, then a company is required to estimate the recoverable amount of the. When testing an asset for.

The banking giant said it lost $153 million in the final three months. Learning objectives explain how to assess an asset for. As the recoverable amount is less than the carrying value, the asset is impaired.

The standard also specifies when an entity should reverse an impairment loss and prescribes disclosures. This account holds all the impairment losses for. How is impairment loss calculated?