Sensational Info About Is Balance Sheet Same As Financial Statement Lucanet Consolidation

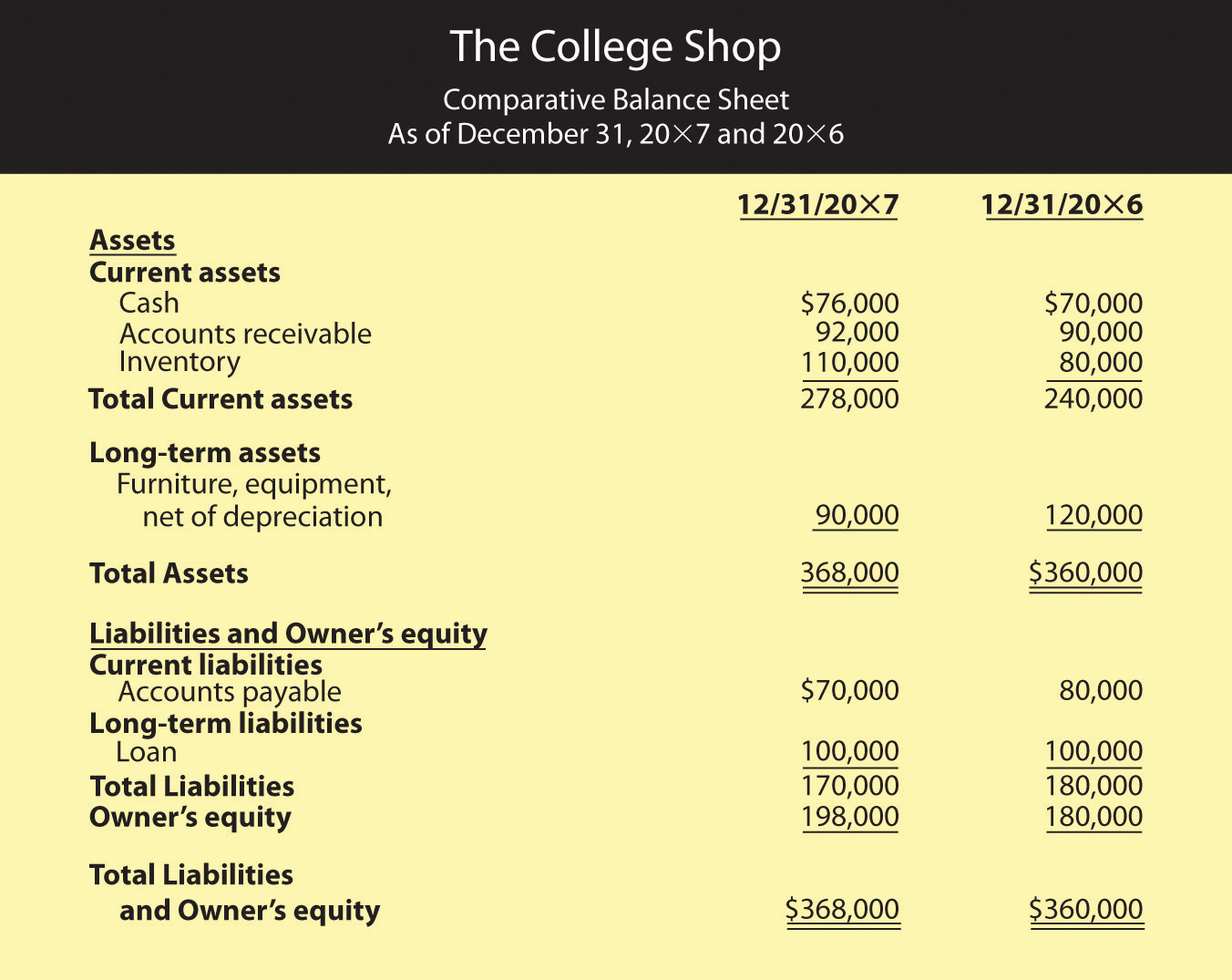

Businesses typically prepare and distribute their balance sheet at the end of a reporting period, such as monthly, quarterly or annually.

Is balance sheet same as financial statement. These three financial statements are intricately linked to one another. The points given below explain the differences between balance sheet and statement of financial position, i.e. These three statements together show the assets and liabilities.

Financial statement describes the financial status of the concern quantitatively. Financial statements are financial reports you can use to monitor your business’s finances and assess its financial health. Let’s start with a quick summary of one of the main financial statements.

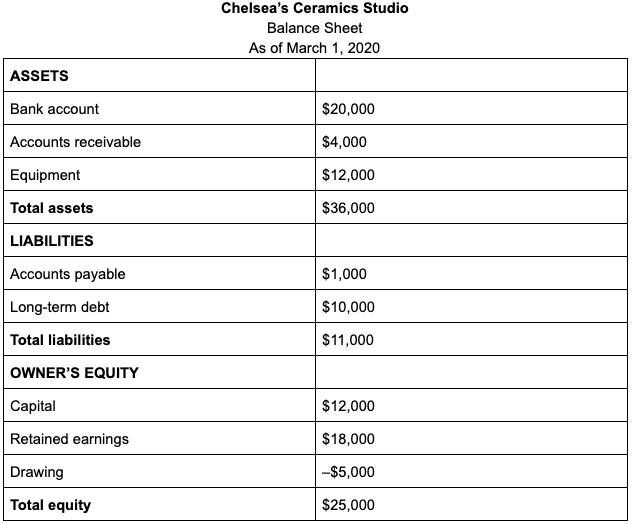

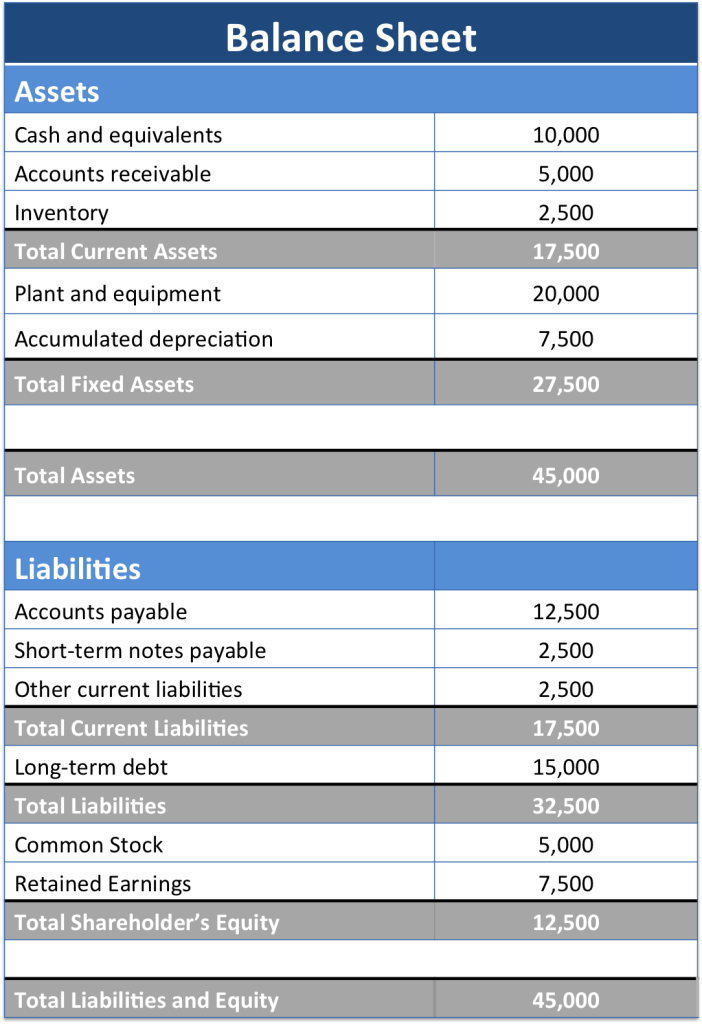

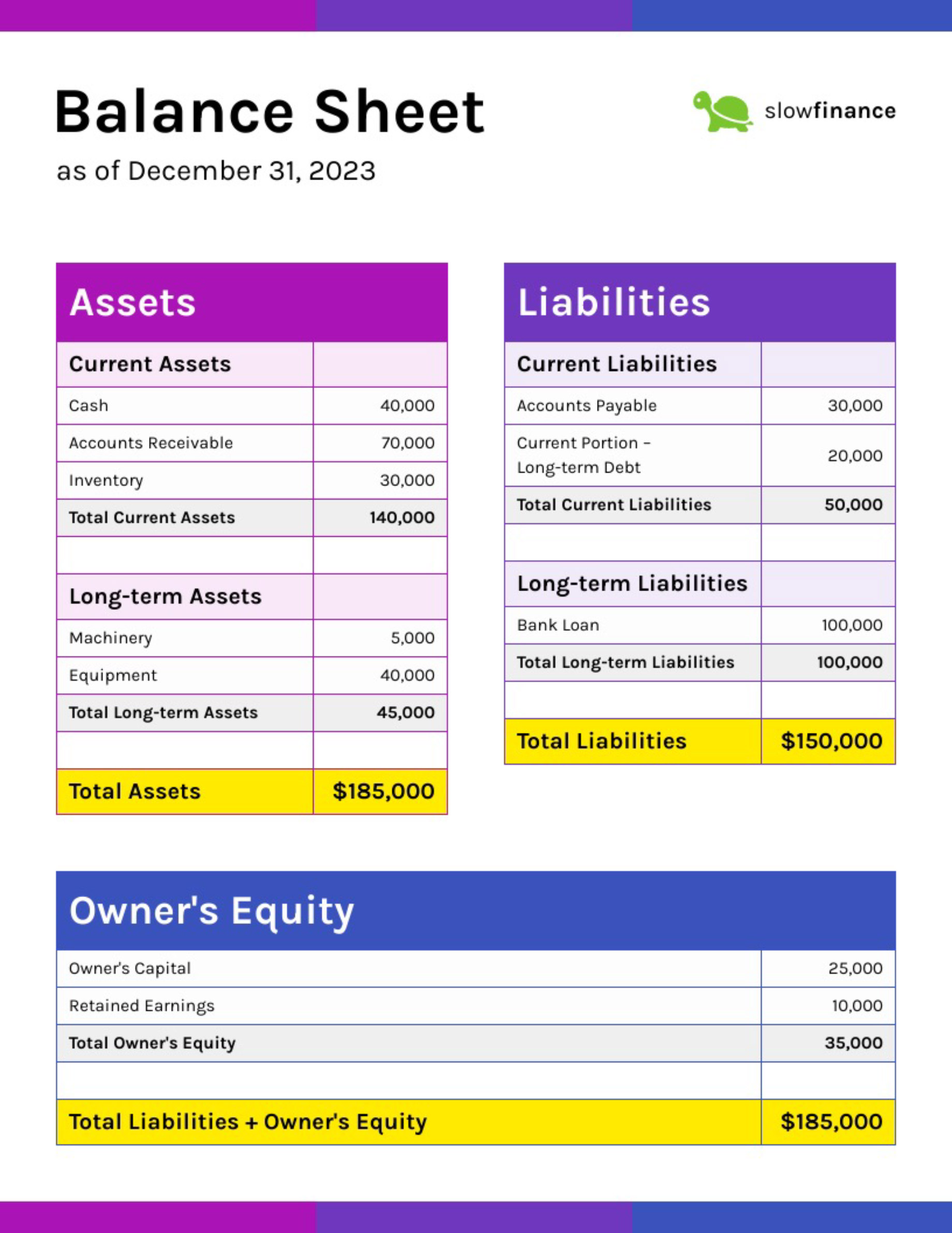

Income statements focus on revenue and expenses. The balance sheet is based on the fundamental equation: It provides useful data for financial ratio.

Using the ‘accounting equation’, the figures in your assets and liabilities columns can be used to calculate. It can also be referred to as a statement of net worth or a statement of financial position. Balances sheets cover assets, liabilities, and investments.

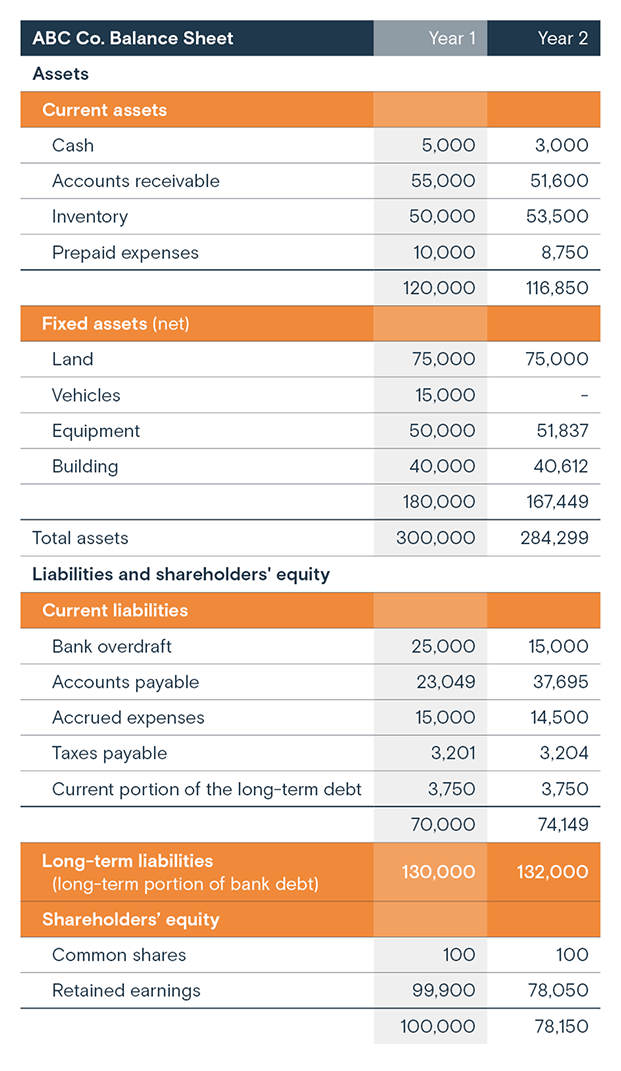

Understanding the balance sheet. Analyzing these three financial statements is one of the key steps when creating a financial model. The balance sheet is one of the three core financial.

They both provide a snapshot of a company's financial position at a specific point in time. As a reminder, the balance sheet provides a snapshot of the company’s liabilities and assets at a given time. Key highlights the three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement.

The income statement was first since net income (or loss) is a required figure in preparing the balance sheet. It’s generally used alongside the other two types of financial statements: Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

A balance sheet shows a company’s financial position at a specific point in time, while an income statement shows its financial performance over a period of time, usually a year or a quarter. Both involve a company’s finances, but their differences are significant by sean ross updated april. A balance sheet represents the financial condition of any entity at a particular date.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. The balance sheet provides a statement of the assets, liabilities, and equity of a business at a particular point in time. The profit and loss account (also known as the profit and loss statement or income statement), and the cash flow statement.

Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for. Overall, a balance sheet is an important statement of your company’s financial health, and it’s important to have accurate balance sheets available regularly. Fundamental analysis balance sheet vs.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)