What Everybody Ought To Know About Important Income Statement Ratios Google Llc Financial Statements

Ratio #11 days' sales in receivables (average collection period) ratio #12 inventory turnover ratio.

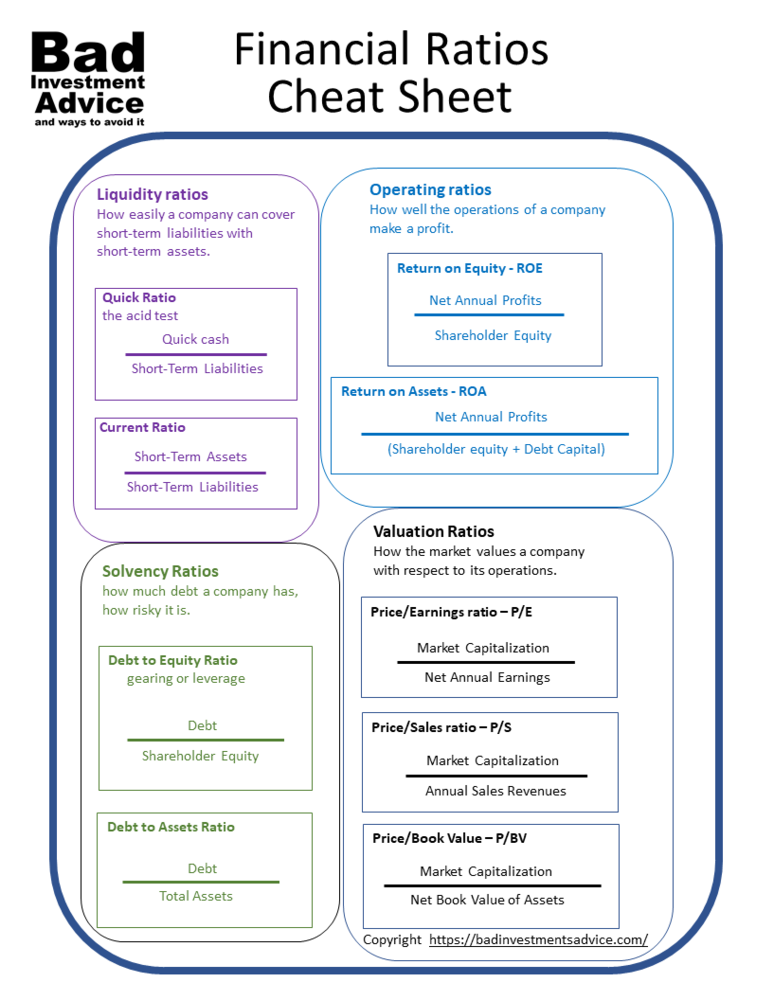

Important income statement ratios. From profitability to liquidity, leverage, market, and activity, these are the 20 most important ratios for financial analysis. The income statement shows a company or individual’s money. 10,000 / 100,000 = 10%.

Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. On 16 feb 2024, dpm and finance minister lawrence wong delivered the budget 2024 statement in parliament. Updated march 17, 2023 reviewed by amy drury fact checked by michael logan what is ratio analysis?

Ratio #6 gross margin (gross profit percentage) ratio #7 profit margin; Helps measure company’s efficiency in using its resources 3. In this section, we will discuss five financial ratios which use an amount from the balance sheet and an amount from the income statement.

They are also useful in determining a company’s quality, efficiency, growth, and financial strength. The income statement ratios formulas are expressions of the various income statement ratios that are useful tools in determining the profitability of a company within a stipulated time frame. Gross profit margin is one of the profitability ratios that use to measure how profitable the entity is after deducting the cost of goods sold from total revenues.

The various formulas included on this financial ratios list offer insight into a company’s profitability, cash flow. Specifically, we will discuss the following: What financial ratios are important to investors?

For example, if a company generates $100,000 in revenue and has $10,000 in net income, their net profit margin would be: Watch budget 2024 statement. Operating margin ratio = operating income / net sales.

Financial ratios are basic calculations using quantitative data from a company’s financial statements.they are used to get insights and important information on the company’s performance, profitability, and financial health. Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions. The income statement for financial ratio analysis analyzing the liquidity ratios the current ratio the quick ratio while it may be more fun to work on marketing efforts, the financial management of a firm is a crucial aspect of owning a business.

Helps measure company’s debt 2. Ratio #8 earnings per share; These ratios usually measure the company’s ability in utilizing its capital and assets in order to generate sales and profit.

Many key fundamental ratios use information from the income statement. When a new york judge delivers a final ruling in donald j. Income statement ratios are the ratios that analyze the company’s performance in the market during a period of time.

Financial ratios using income statement amounts. 5 important income statement financial ratios. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss.