Breathtaking Info About Shares In Balance Sheet Petty Cash Statement

Minres said it had $1.4 billion in cash at the end of the first half and net debt of $3.55 billion, up from $1.85.

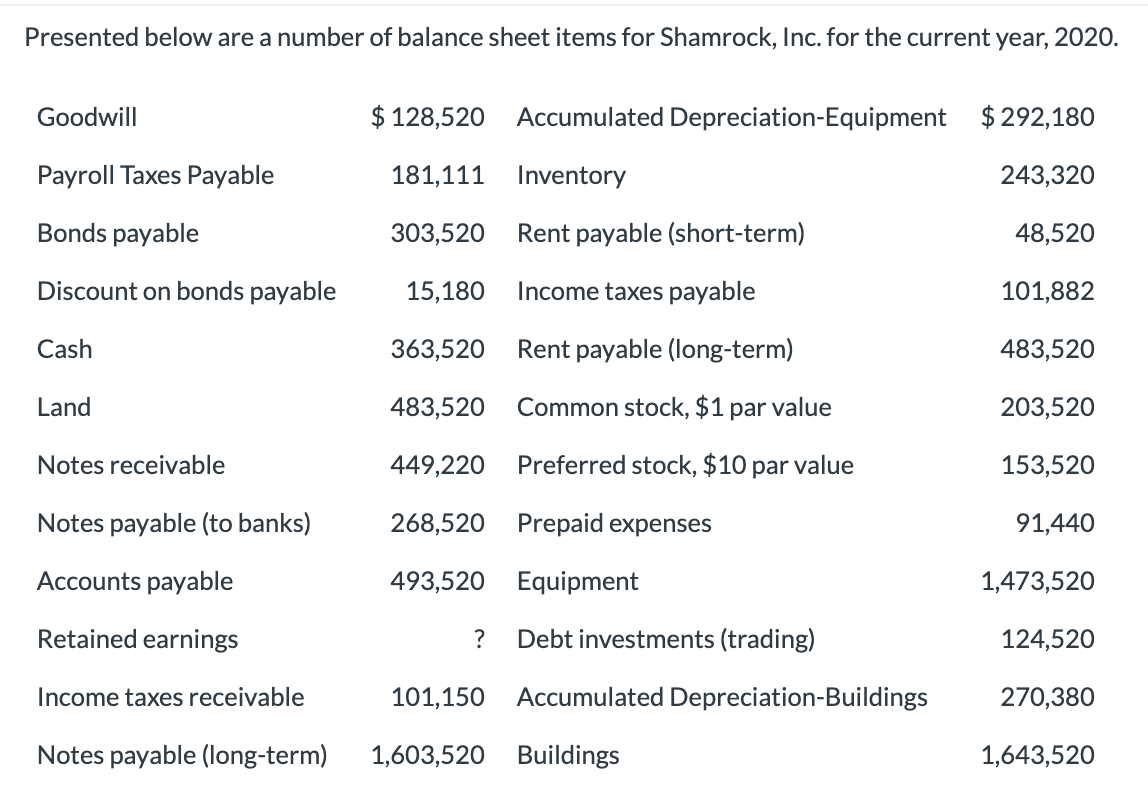

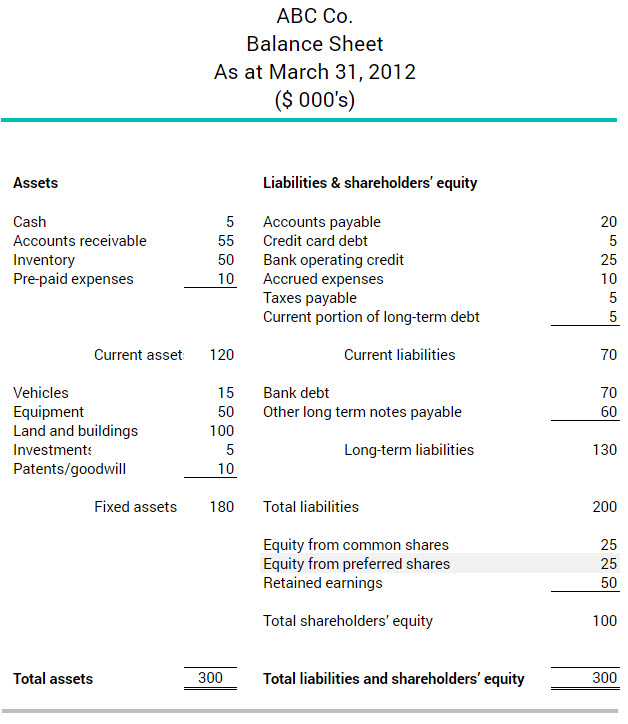

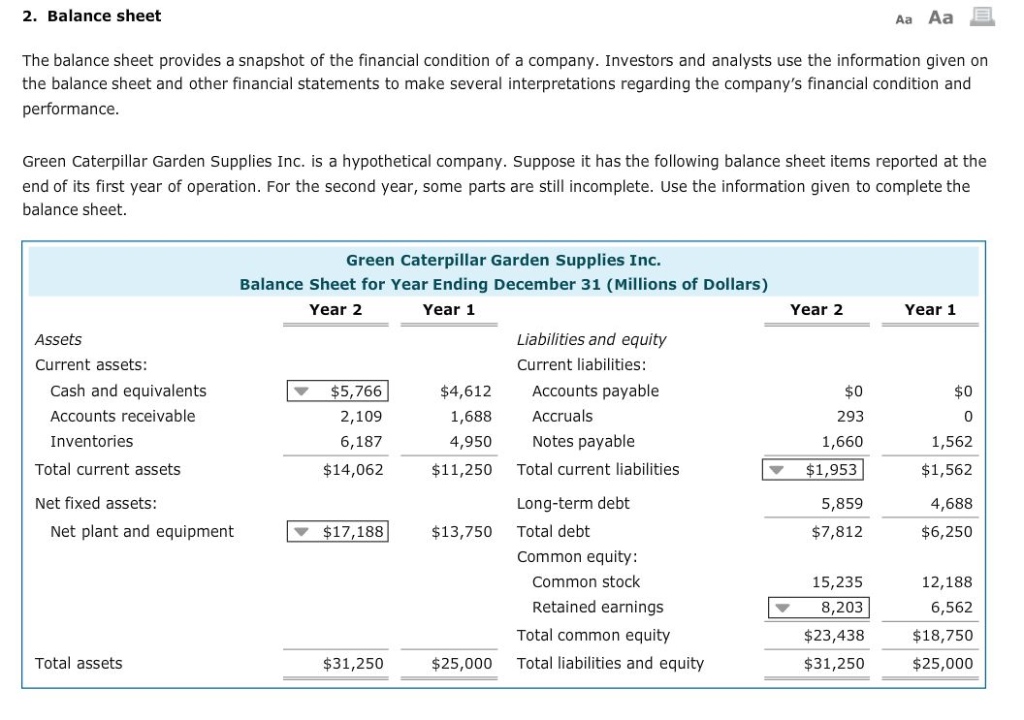

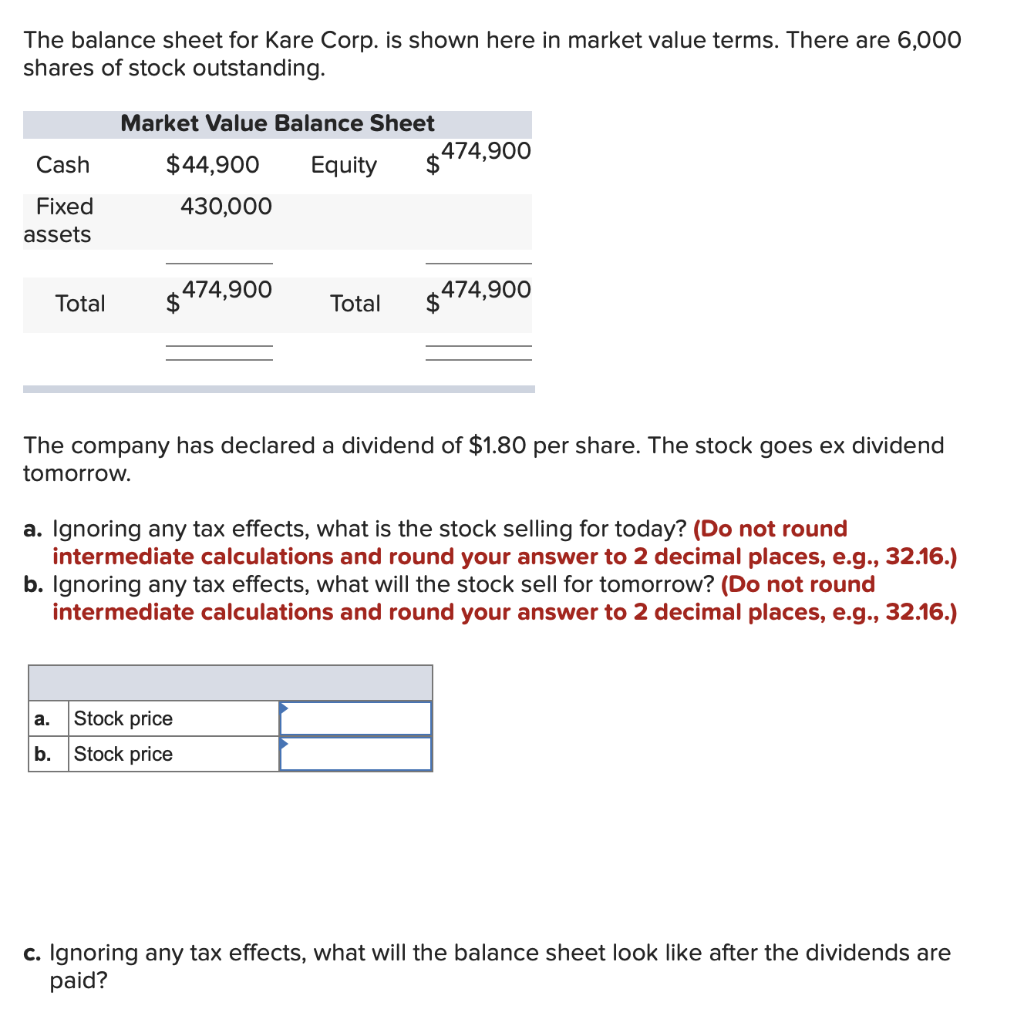

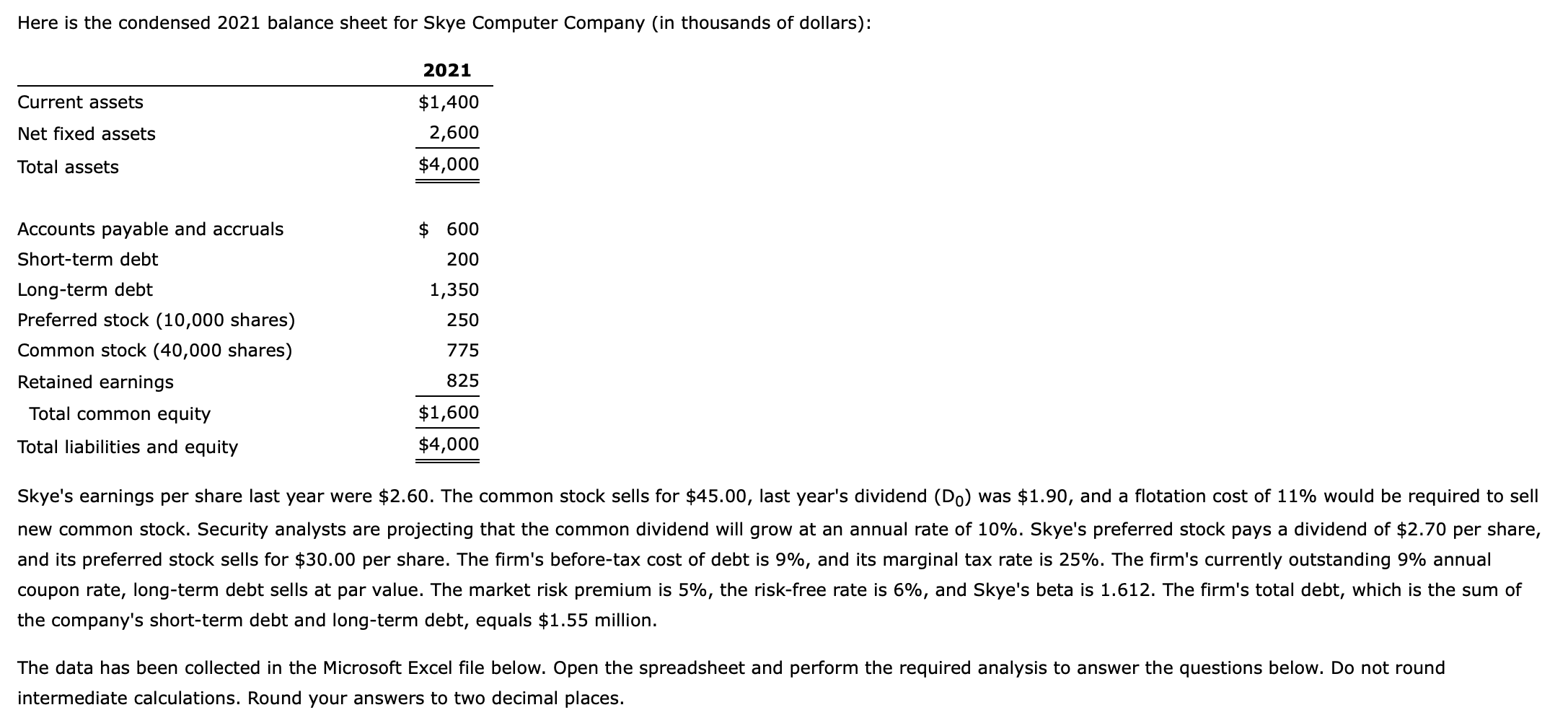

Shares in balance sheet. The information may be listed in separate line items depending on the source of the funds. Initial issue issue of ordinary shares is accounted for by allocating the proceeds between the following accounts: Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

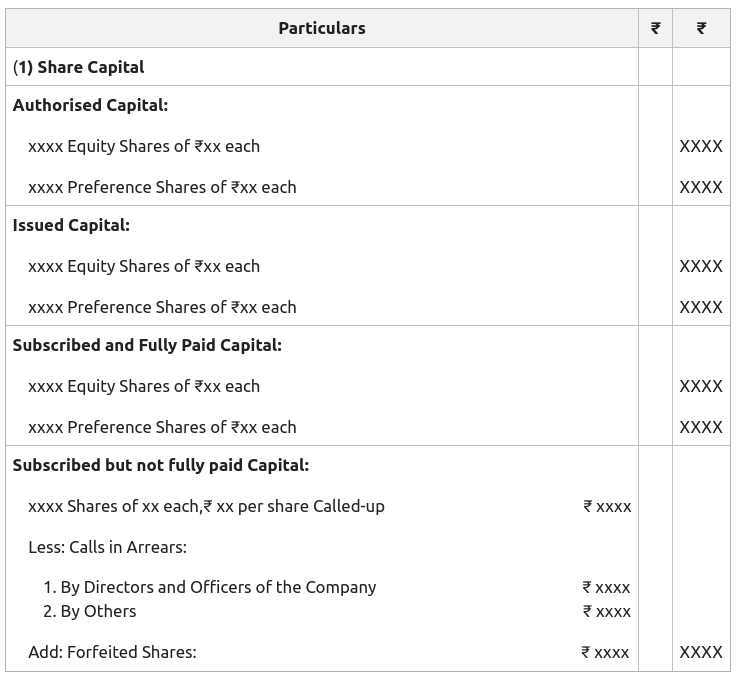

You will understand the concepts and methods of accounting for share capital. Ordinary shares are also known as common stock and equity shares. 2) calls unpaid on shares by others (600 x 20) ₹12,000 illustration 2:

Balance sheets are useful tools. European markets heidelberg materials balance sheet improves as building sector recovers. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

The balance sheet is split into two columns, with each column balancing out the other to net to. Equity represents the shareholders’ stake in the company, identified on a company's balance sheet. That balance sheet also shows that the formula = invested capital + retained earnings.

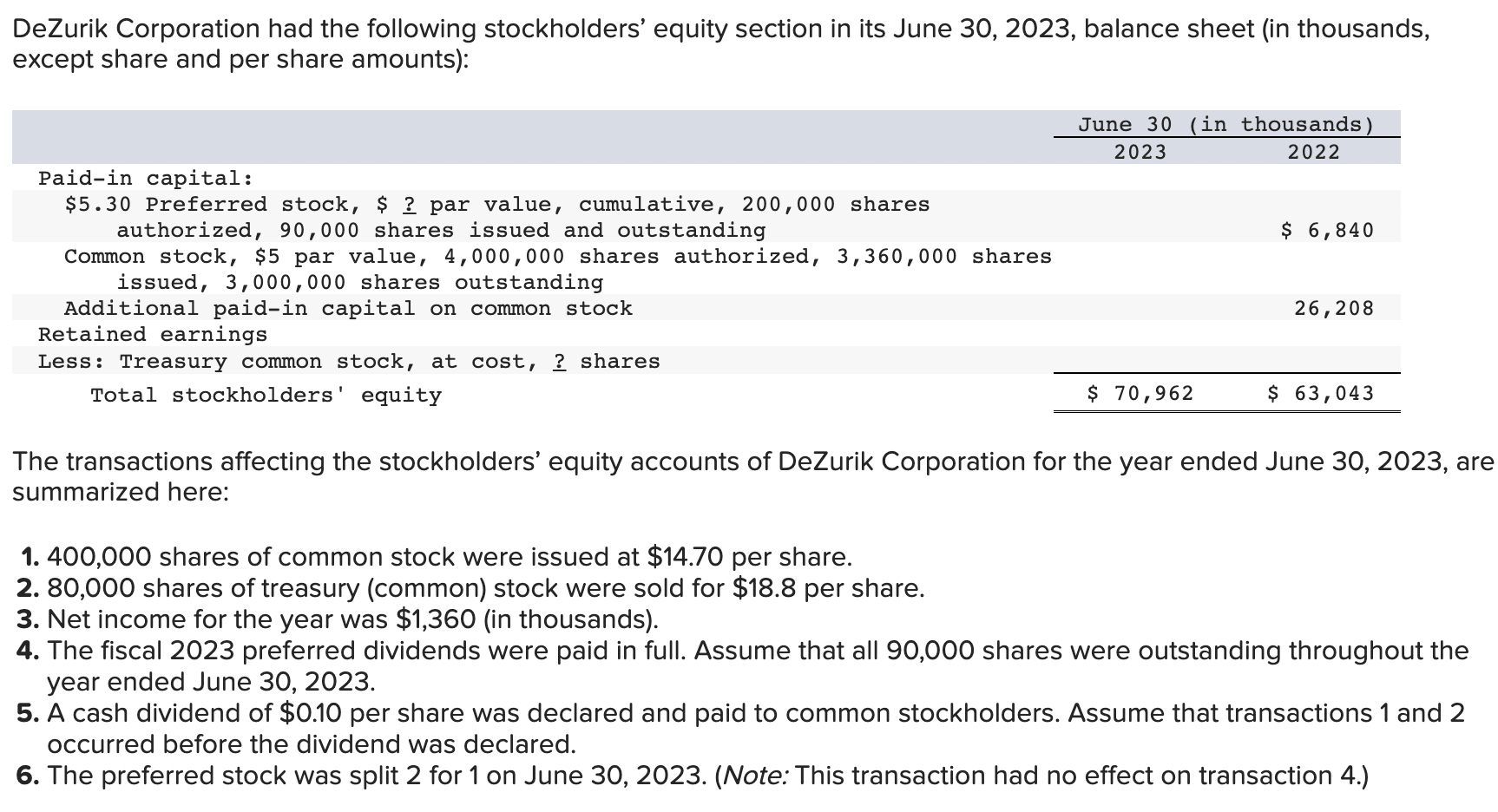

We have transformed the group and delivered consistent execution of our “driving progress 2023” plan, building a strong earnings and capital distribution track record, while maintaining a robust balance sheet.” “today we have an attractive business model, with leading and scaled. Said it’s raising $1 billion in a bought deal shares offering and $1.6 billion from an offering of notes as part of efforts to strengthen its balance sheet. A share premium account shows up in the shareholders’ equity portion of the balance sheet.

When a company is first created, if its only asset is the cash invested by the shareholders, the balance sheet is balanced with cash on the left and share capital on the right side. A publicly traded company’s total number of shares outstanding can usually be found on their investor relations webpage, on stock exchanges’ websites, or in the shareholder’s equity section on a company’s balance sheet as filed with an authorized information service like the u.s. Fact checked by suzanne kvilhaug what are outstanding shares?

Heidelberg materials will buy back more shares after its debt declined significantly, it said on thursday. The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. What is stockholders equity?

Has an authorised capital of ₹80,00,000 divided into 8,00,000 shares of ₹10 each. Summary shareholders’ equity is the shareholders’ claim on assets after all debts owed are paid up. Potentially influenced by the repurchase

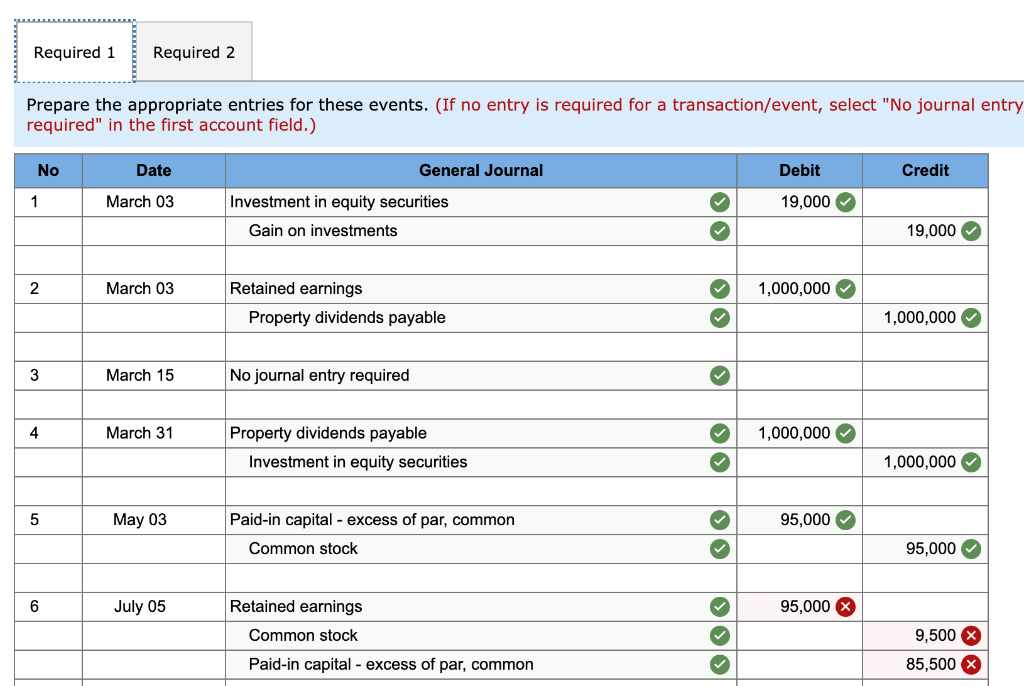

1) 3,000 equity shares of ₹100 each were allotted as fully paid up as a contract without payments being received in cash. Prescribing the accounting for treasury shares (an entity's own repurchased shares) prescribing strict conditions under which assets and liabilities may be offset in the balance sheet; The balance sheet is a key financial statement that provides a snapshot of a company's finances.

In this video ca parag gupta sir (rkg institute) will be discussing presentation of share capital in balance sheet with conceptual important examples.hope yo. The repurchased shares are then recorded as treasury stock on the balance sheet at their repurchase cost. The share premium account represents the difference between the par value of the shares issued.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)