Heartwarming Info About A Financial Statement Audit Is Designed To Hkfrs Illustrative Statements 2019

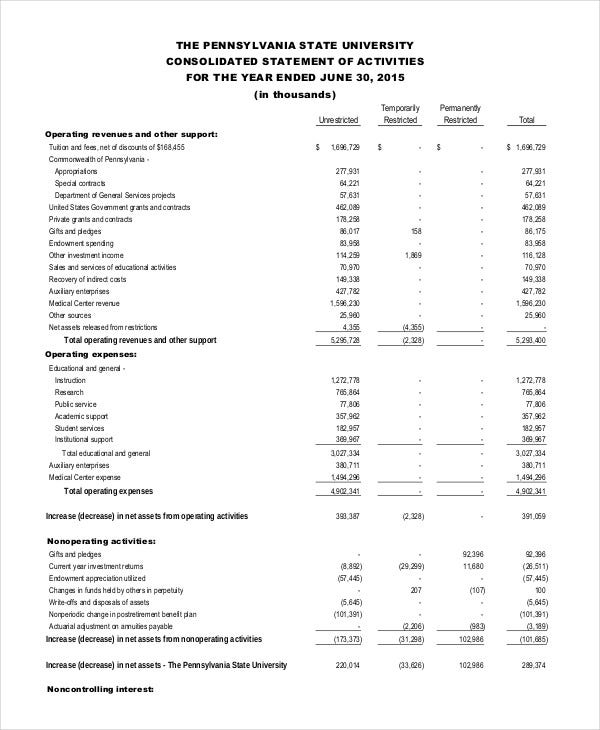

Lists a company’s assets, liabilities and equity.

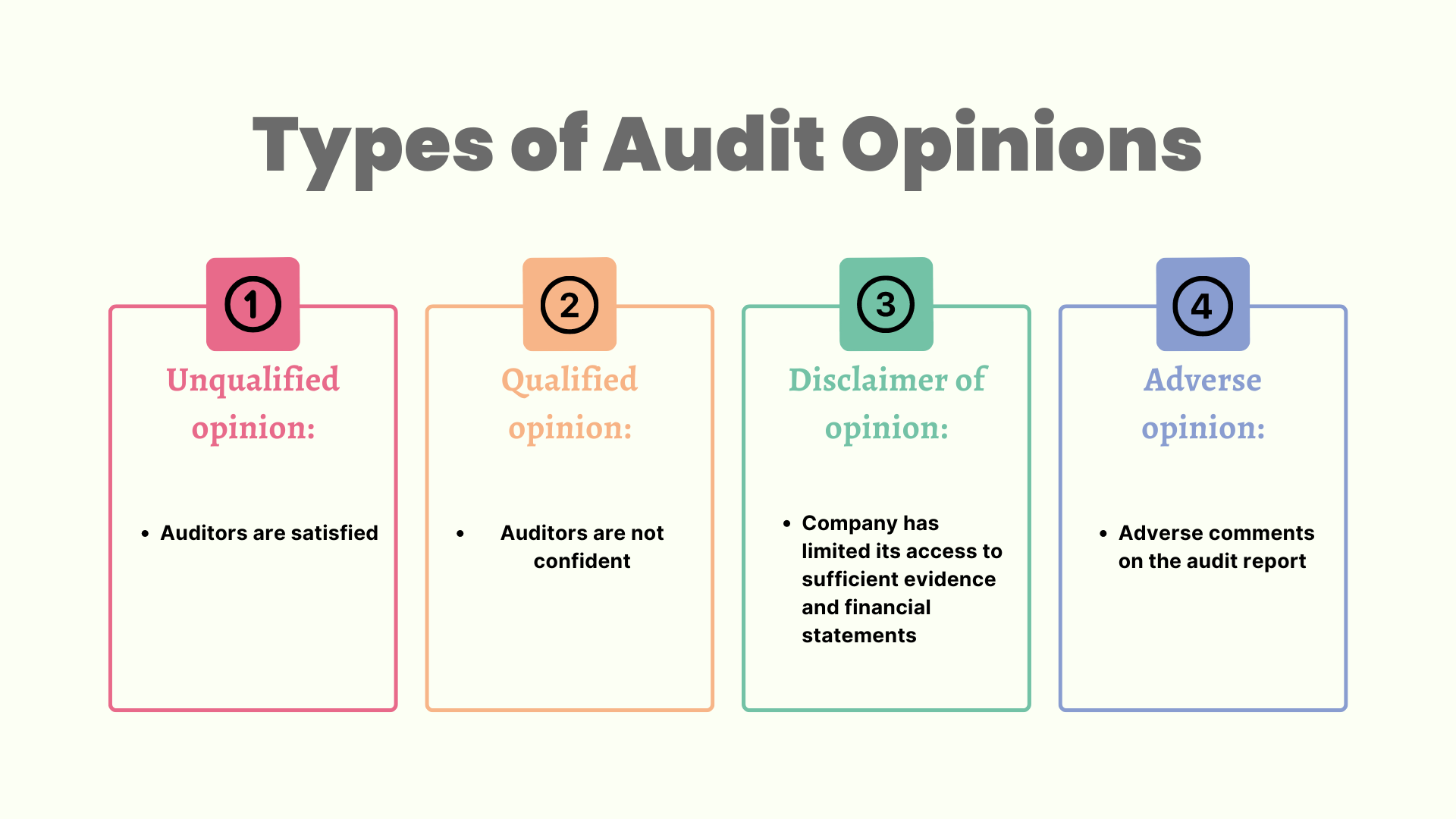

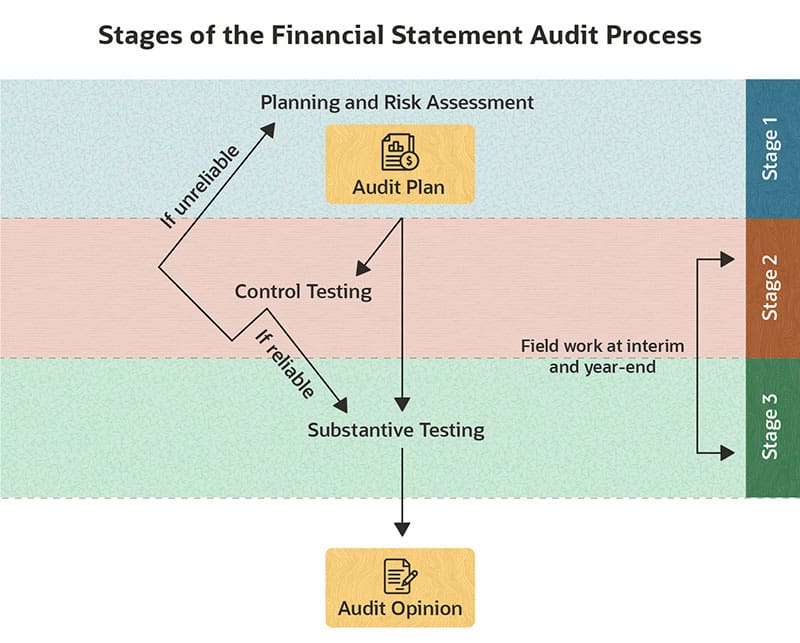

A financial statement audit is designed to. Purpose of a financial statement audit companies produce financial statements that provide information about their financial position and performance. Obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to fraud or error. The result of this examination is a report by the auditor, attesting to the fairness of presentation of the financial statements and related disclosures.

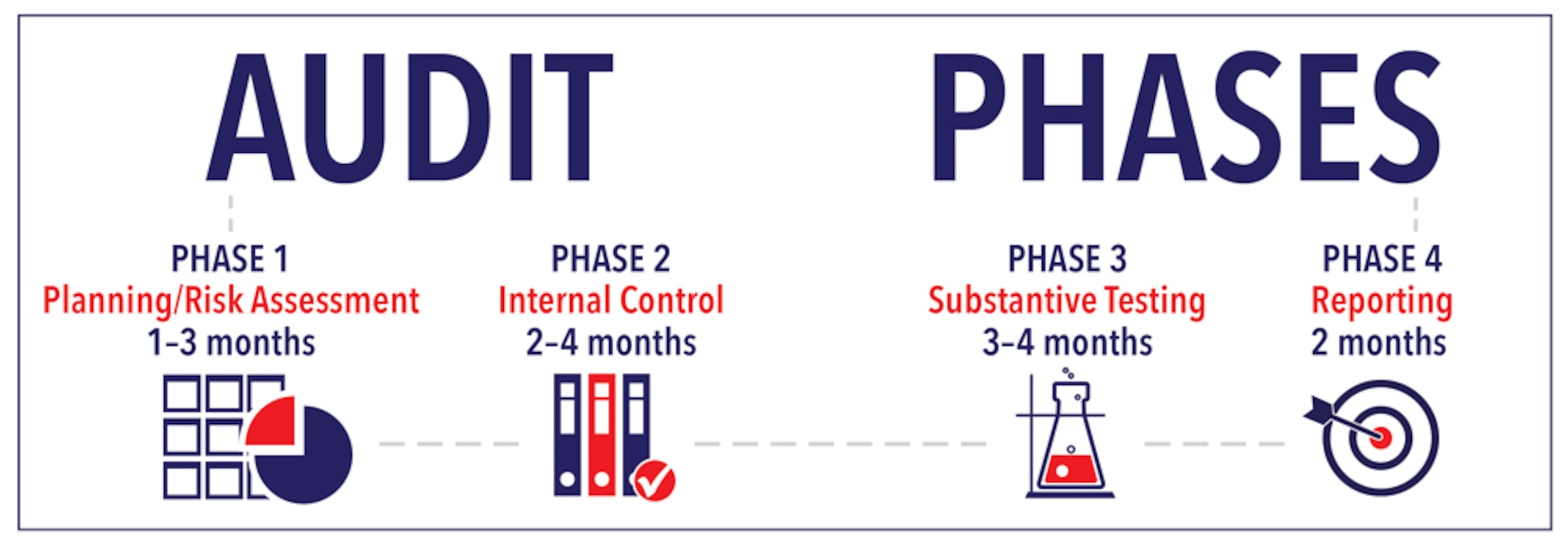

Financial statements prepared on cash receipts and disbursements basis of accounting for cash flow information that may be requested by the key supplier. The term audit usually refers to the financial audit or review of financial statements. Our audit is designed to give our clients:

Detect error or fraud in the financial statements, regardless of whether or not the error or fraud is material. A financial statement audit is designed to. Find more information on how kpmg's approach to audit of financial statements is geared.

Financial statement audits play a critical role in creating and maintaining investor confidence and can unlock valuable insights into the business. 1) preparation and fair presentation of fs in accordance with applicable framework, including design, implementation, and internal control relevant to being free from material misstatement. The purpose of a financial audit is to provide assurance that the financial.

A financial audit is an independent examination of an organization’s financial statements and records to determine if they are accurate, complete, and in compliance with relevant laws, regulations, and accounting standards. It presents a company’s financial. Typically, those that own a company, the shareholders, are not those that manage it.

1 & 2 purpose/premise (aicpa 7 auditing principles) management responsibilities: Built on the foundation of the international standards on auditing, audits performed using this standard provide the same level of assurance for eligible audits: A financial statement audit is the process of scrutinizing the important statement of a company such as the income statement, cash flow statement, and balance sheet to ensure they are free from material errors and are fit according to the filing regulations or framework.

This international standard on auditing (isa) deals with the auditor’s responsibility to design and implement responses to the risks of material misstatement identified and assessed by the auditor in accordance with isa 315 (revised)1 in an audit of financial statements. Obtain reasonable assurance about whether the financial statements are free. Audits can be performed by internal parties and a government entity, such as the internal revenue service (irs).

Scope of this isa. This information is used by a wide range of stakeholders (e.g., investors) in making economic decisions. The objective of an audit of financial statements is to enable an auditor to express an opinion as to whether the financial statements are prepared, in all material respects, in accordance with international financial reporting standards or another identified financial reporting framework.

An engagement team working within a culture of inclusion and respect will provide an audit approach that is unique to you, using technologies designed to help your team and ours work swiftly and seamlessly together, visualize complex information, and generate actionable insights. An audit is an examination of the financial statements of a company, such as the income statement, cash flow statement, and balance sheet. The purpose of an audit is to provide an objective independent examination of the financial statements, which increases the value and credibility of the financial statements produced by management, thus increase user confidence in the financial statement, reduce investor risk and consequently reduce the cost of capital of the preparer of the.

The best example of audit firms is kpmg, ey, pwc, and deloitte. Provide assurance on internal control and to identify significant deficiencies and material weaknesses. A financial statement audit is considered to be an examination of an entity’s financial statements as well as the relevant disclosures by an independent auditor.