Looking Good Info About Unearned Revenue Account Deferred Income Statement

Unearned revenue affects your financial statements,.

Unearned revenue account. There’s no shortage of smart ideas in bethan marlow’s drama of adolescent awakening in rural wales, but they whiz by before they really develop Unearned revenue (s) definition a liability account that reports amounts received in advance of providing goods or services. Go to the gear icon and select chart of accounts.

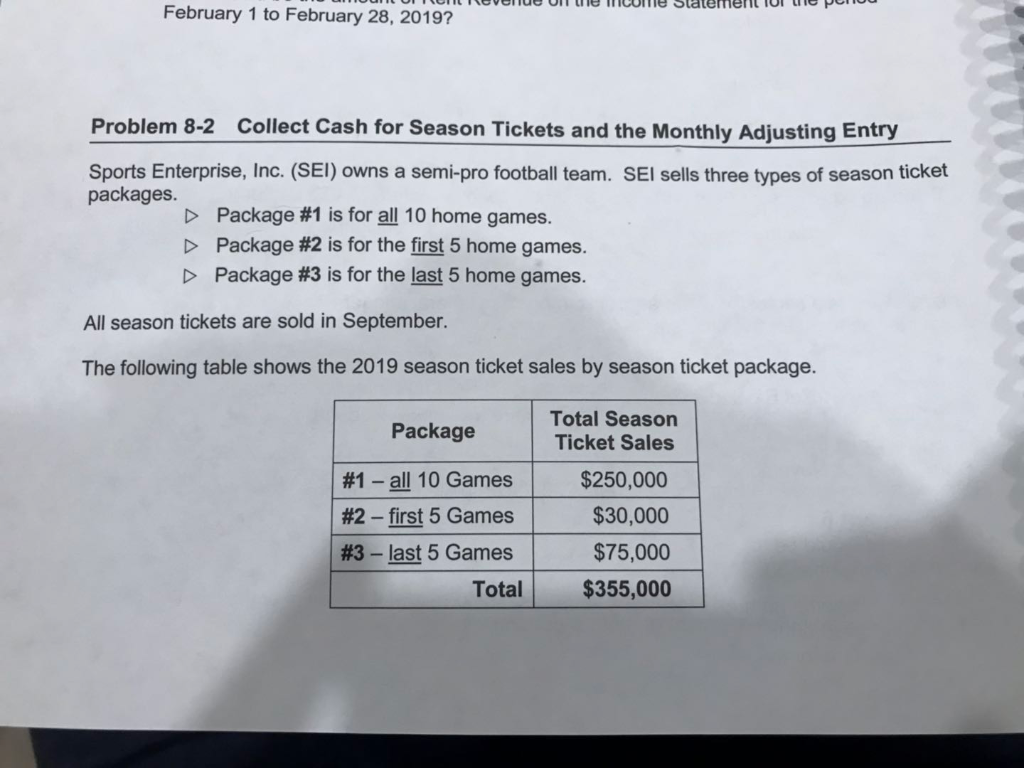

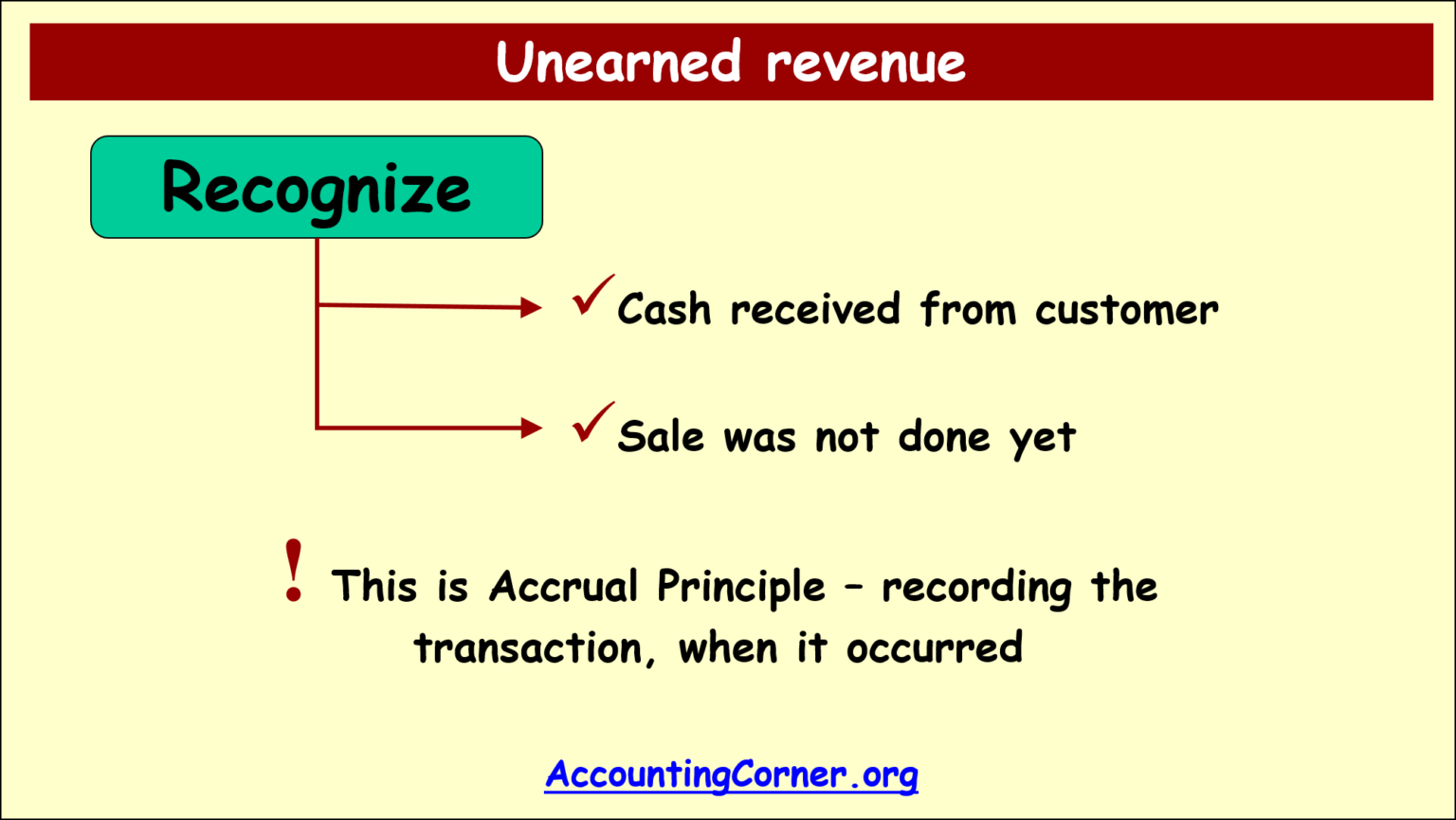

Unearned revenue refers to the money small businesses collect from customers for a or service that has not yet been provided. Unearned revenue is the money a company receives from a customer before the customer receives the product or service they paid for. Unearned revenue defined.

See what you need to know about it. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. Republican lawmakers in arizona have introduced a bill to ban guaranteed basic.

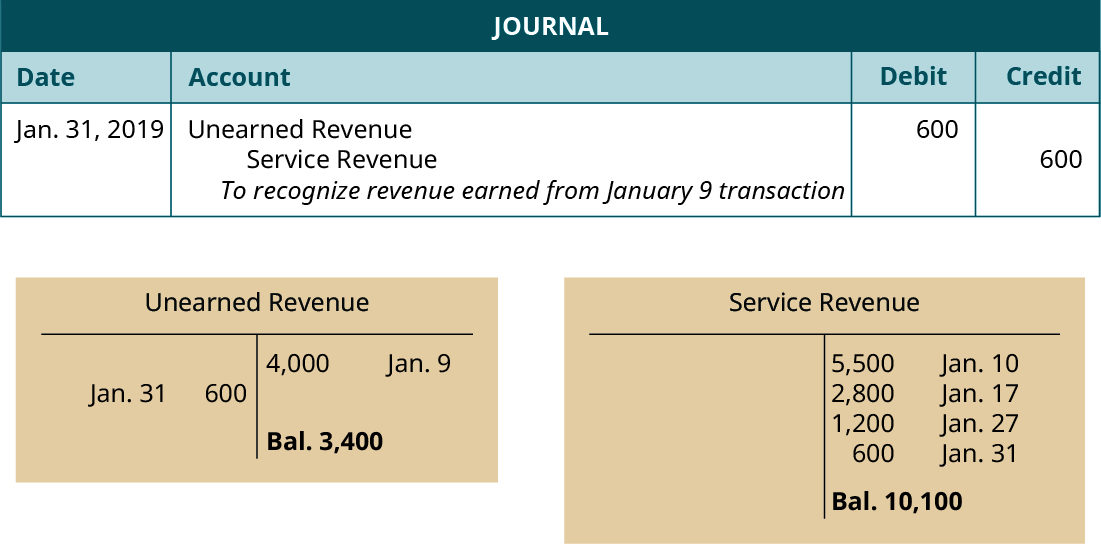

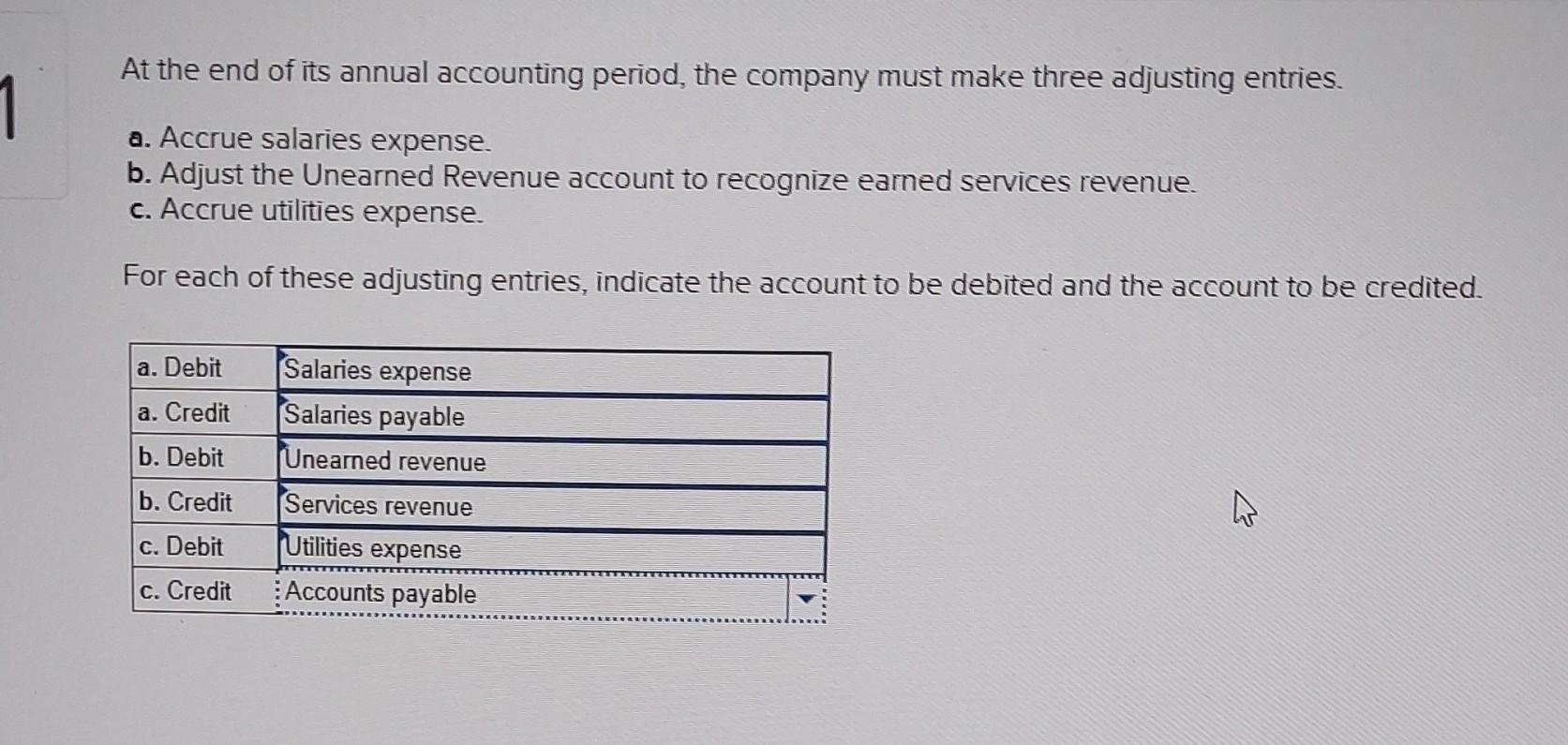

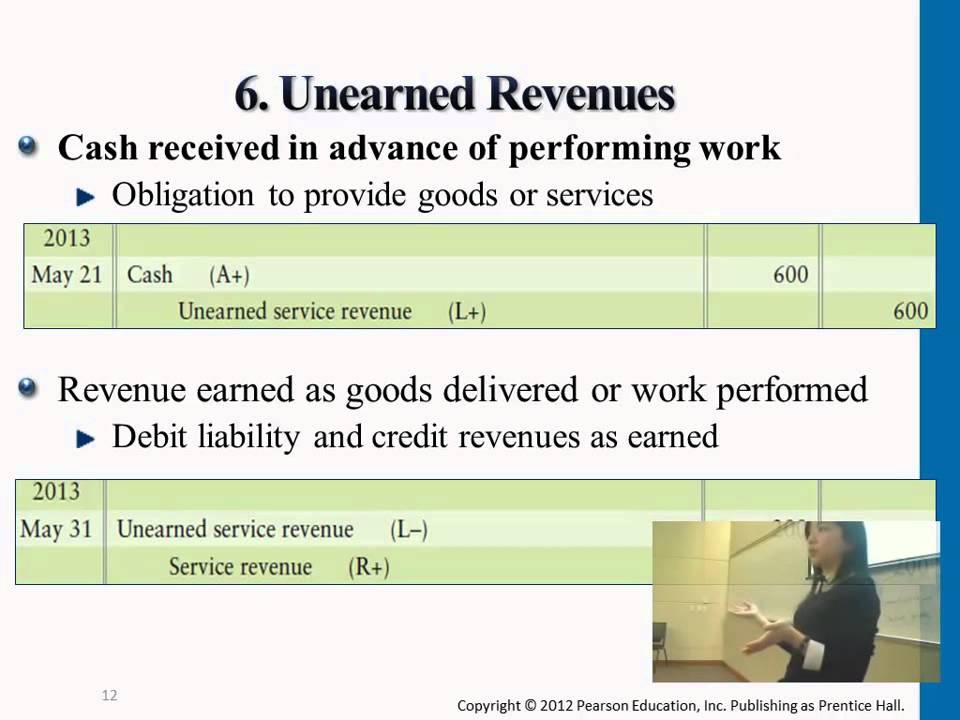

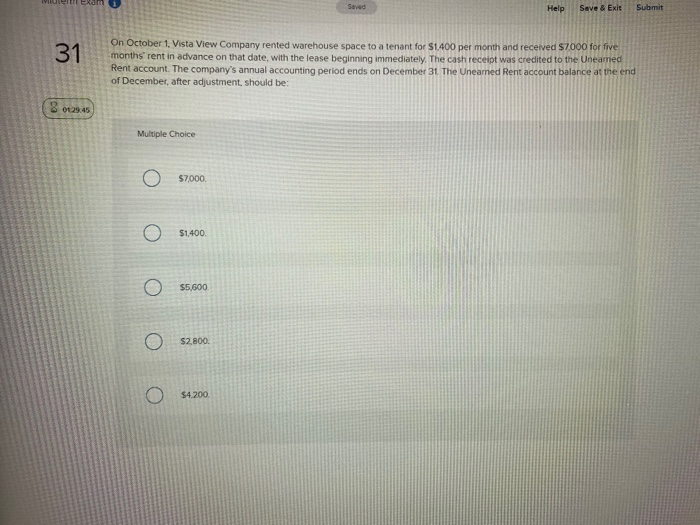

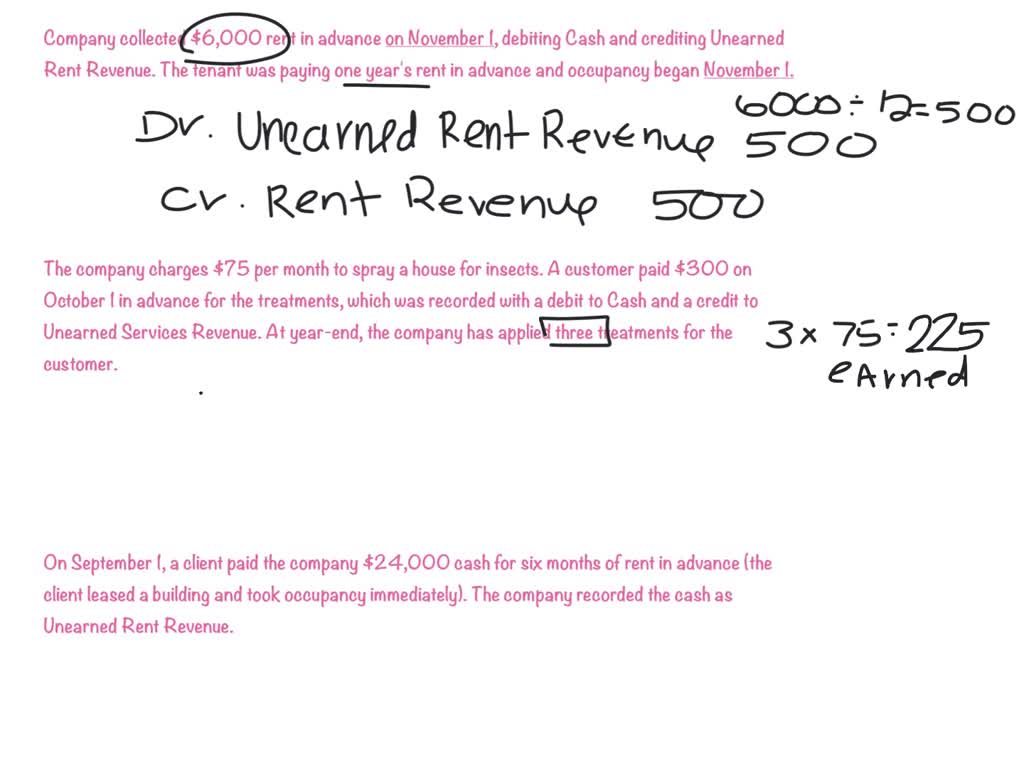

Unearned revenue or deferred revenue is recorded as a liability in journal entries. Another way to look at it is prepaid revenue. Unearned revenue refers to all advance payments for which the company now has an obligation to perform.

It can be thought of as a prepayment for goods or services that a person or company is expected to supply to the purchaser at a later date. So, this profit is labeled as “unearned” since it is. Unearned revenue is the money received by a business from a customer in advance of a good or service being delivered.

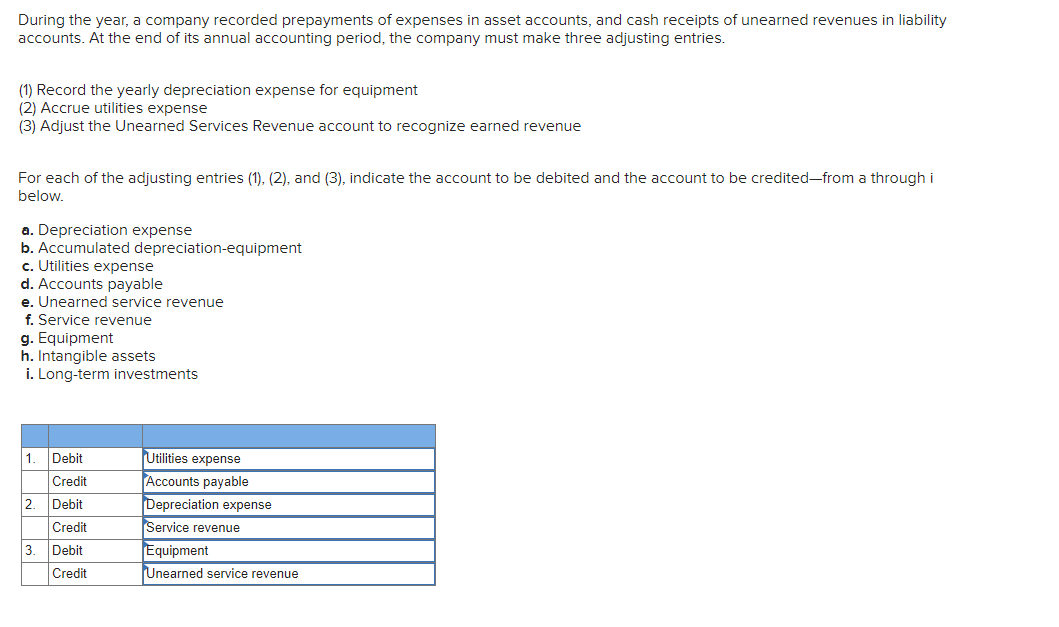

Learn how to adjust unearned revenue accounts under the accrual concept of accounting. Unearned revenue refers to the money small businesses collect from customers for their products or services that have not yet been provided. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the delivery and includes.

By definition, unearned revenue (or deferred revenue) is cash received from a customer for a service that hasn’t been provided yet. Unearned revenue is money that is received by a business before goods or services are provided. As a result of this prepayment, the.

Unearned revenue is a liability that represents an obligation to render services or. The name for the account it uses may be unearned revenues, deferred revenues, advances from customers, or prepaid revenues. All commitments are classified either under short or.

It is the prepayment a business accrues. Unearned revenue journal entry overview.

Therefore, the journal entry to record. Feb 18, 2024, 11:34 am pst. When the goods or services are provided, this.

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/media/Is Unearned Revenue a Liability.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)