Peerless Info About Cash Accounting For Income Tax Ifrs In Practice

No payment was received during the first year,.

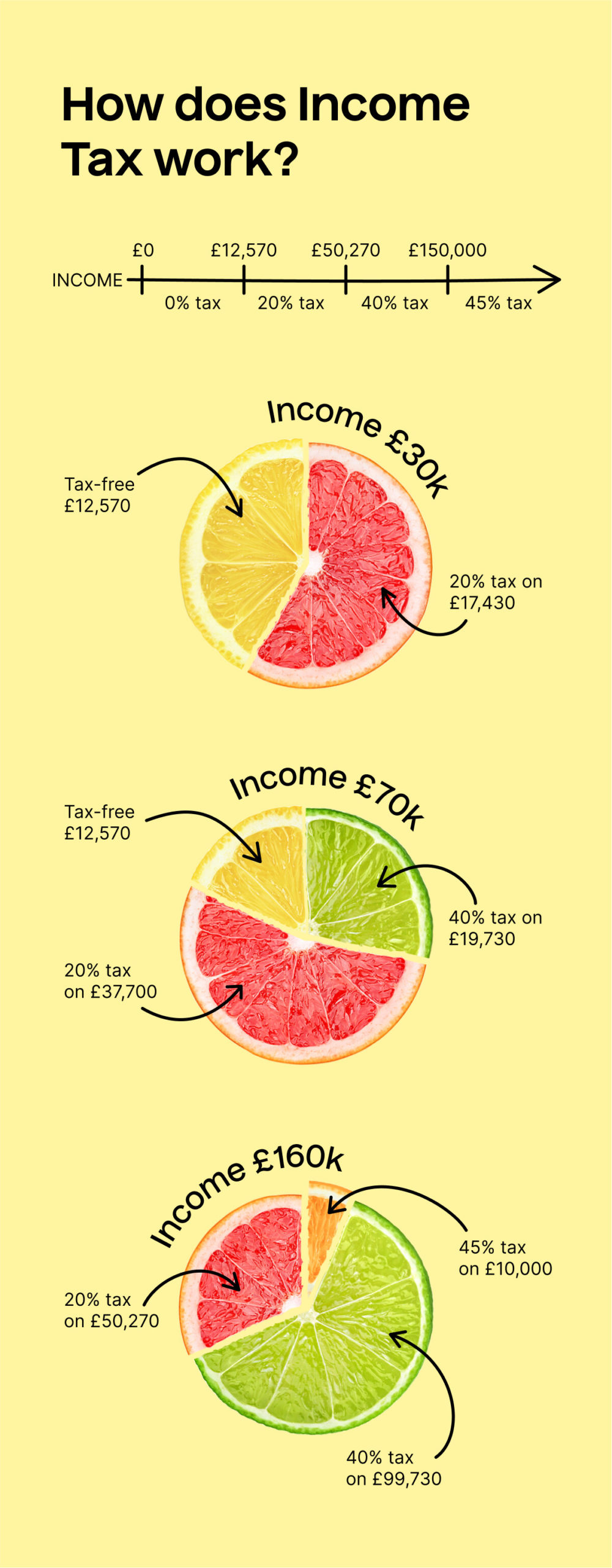

Cash accounting for income tax. Of professional practice, kpmg us. Instead, you calculate your income tax by applying the bands progressively. The cash method is just as the name implies—it records transactions only when cash flows.

When deciding how to report income and expenses, business owners may choose from two accounting methods: Yet, depending on your business model, one. February 22, 2024.

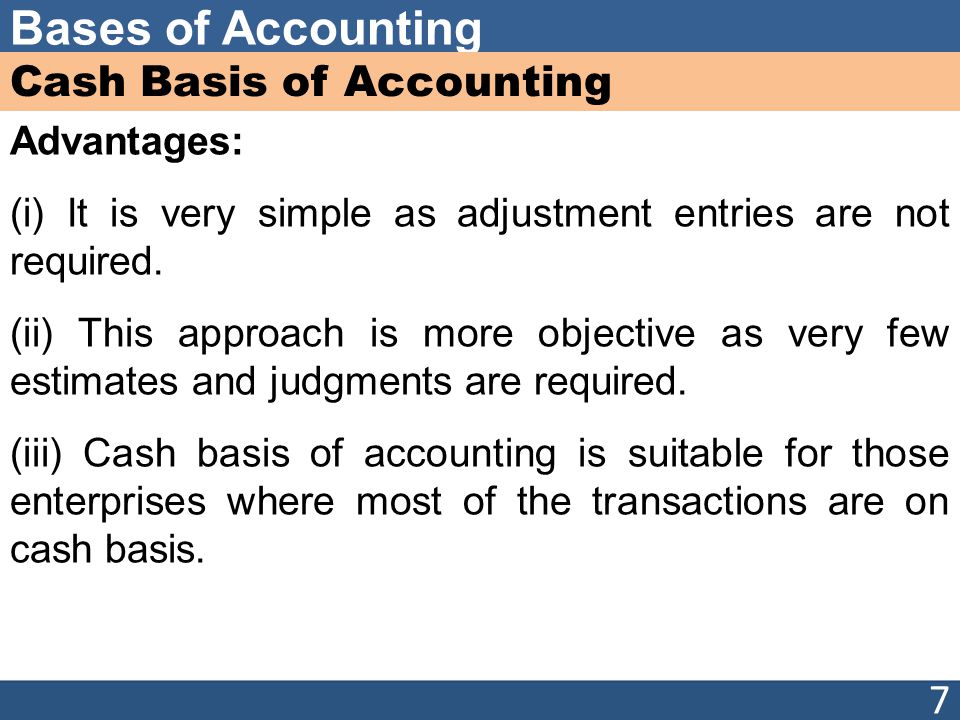

The most commonly used accounting methods are the cash method and the accrual method. This method is most commonly used. Beginning in 2018, more small businesses could elect to use cash accounting.

In 2017, we saw sweeping tax reform unfold in the united states. Accounting methods are the means of recording when income is received and. You can use the cash method if you had average annual gross receipts of $25 million for the preceding three years.

Why use cash basis if you run a small business,. The 2017 tax cuts and jobs act allowed for a change in the option to select cash accounting instead of accrual.

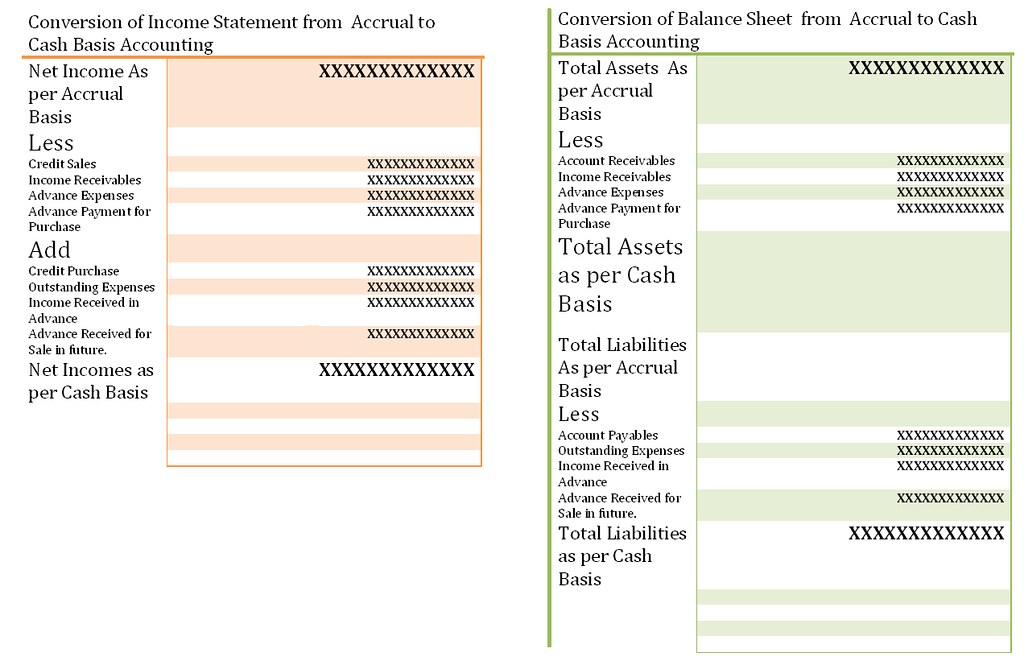

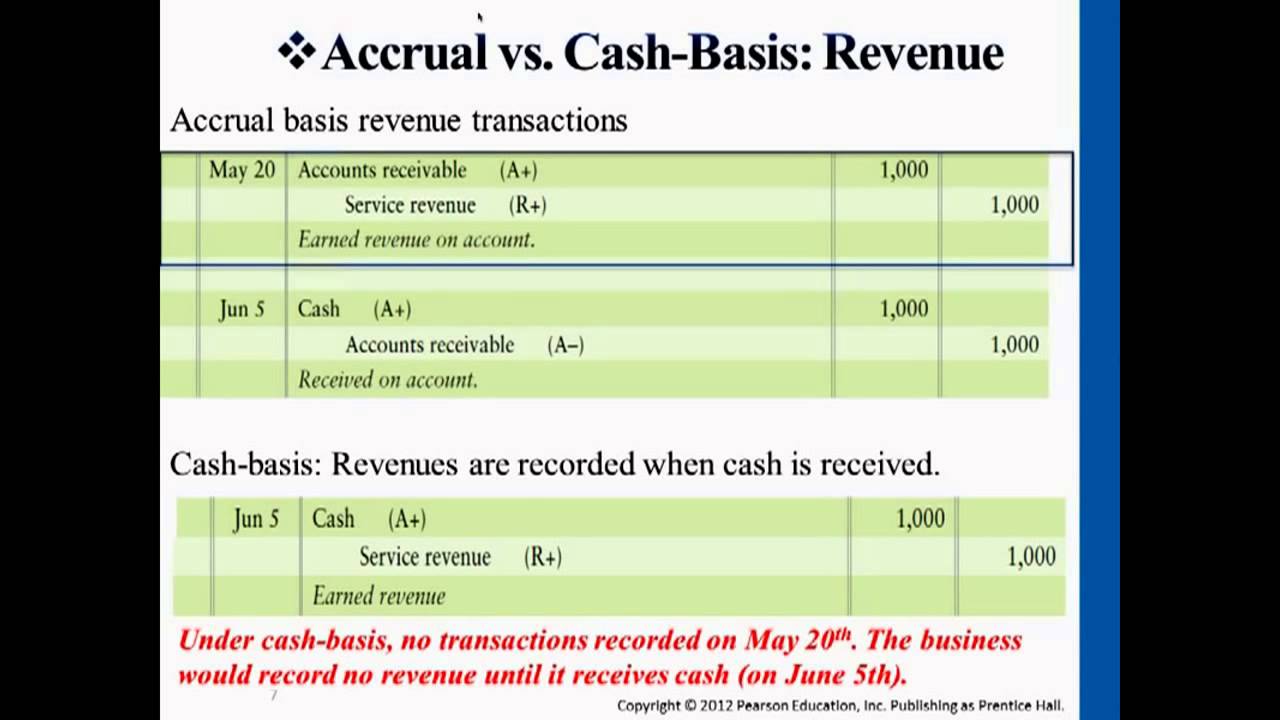

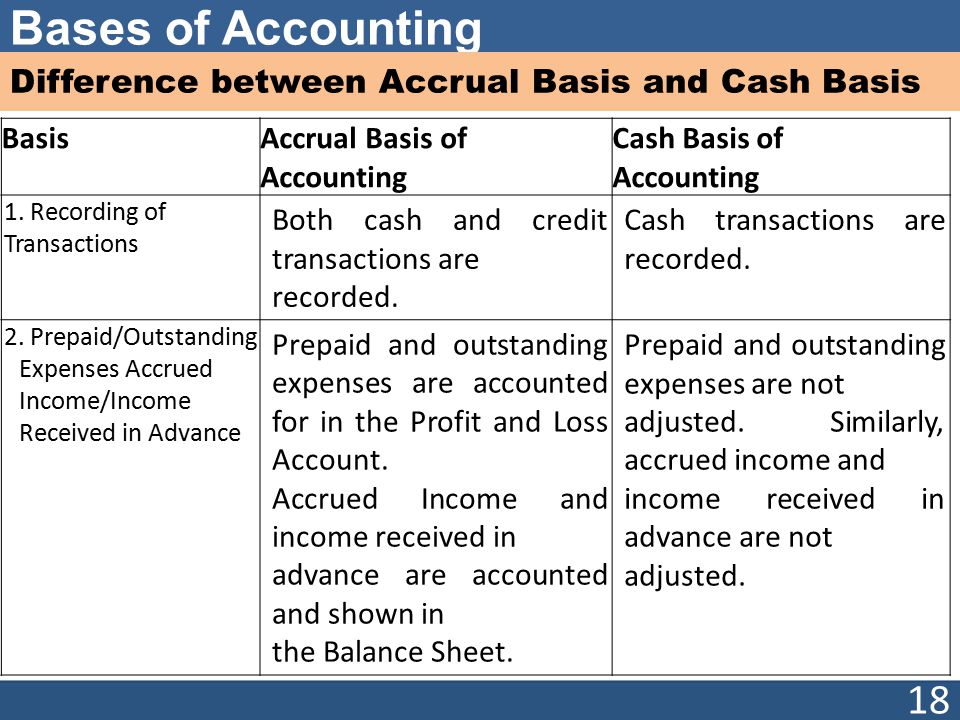

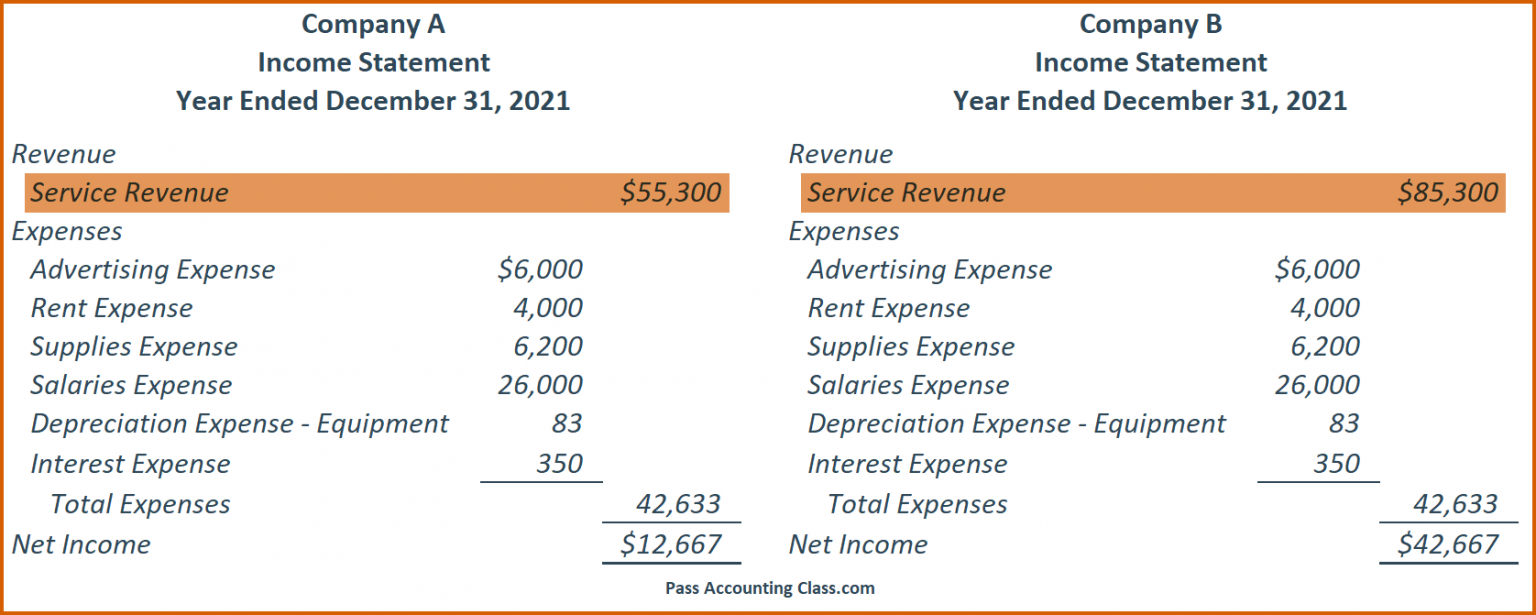

The biggest difference between the two is when those transactions are. Cash and accrual accounting are both methods for recording business transactions. The cash method of accounting often defers recognition of income to a later period, allowing taxpayers to receive the time value of money for deferred tax payments.

Expenses are deductible when the amount. How to account for income taxes. At the end of the tax year the business owners won't have to pay tax on income they haven't yet received.

Under the cash method of accounting, income is recognized when payment has been actually or constructively received. In theory, this is intended to make cashflow easier. First, a company’s income tax accounting should be in line with its operating.

Many businesses have a choice of which. The different accounting methods for including assessable income in an income year. The three main objectives in accounting for income taxes are:

$60 in taxes is paid under accrual basis of accounting in addition to the $600 onss spent to provide the service. For tax year 2023, there have been no changes affecting personal exemptions on maryland returns. Under the cash method of accounting, income is generally recorded when you actually it, and expenses are generally recorded when.