Out Of This World Info About Bad Debts Treatment In Balance Sheet What Is A Comparative

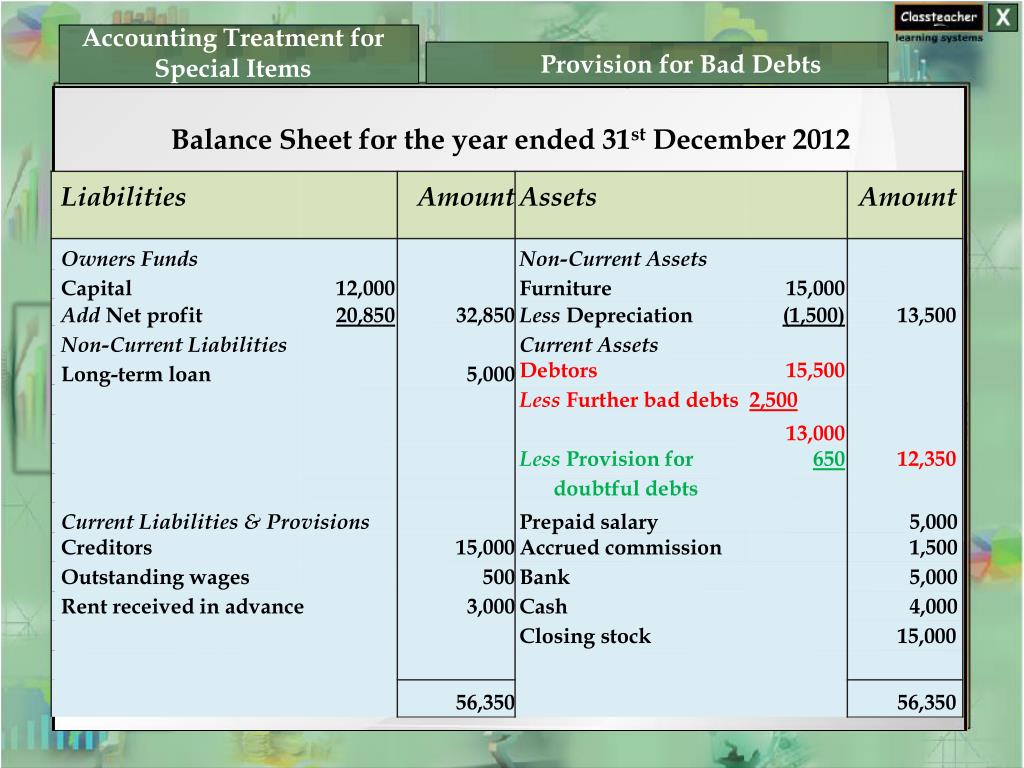

Balance sheet (extract) as on 30 th june 2016

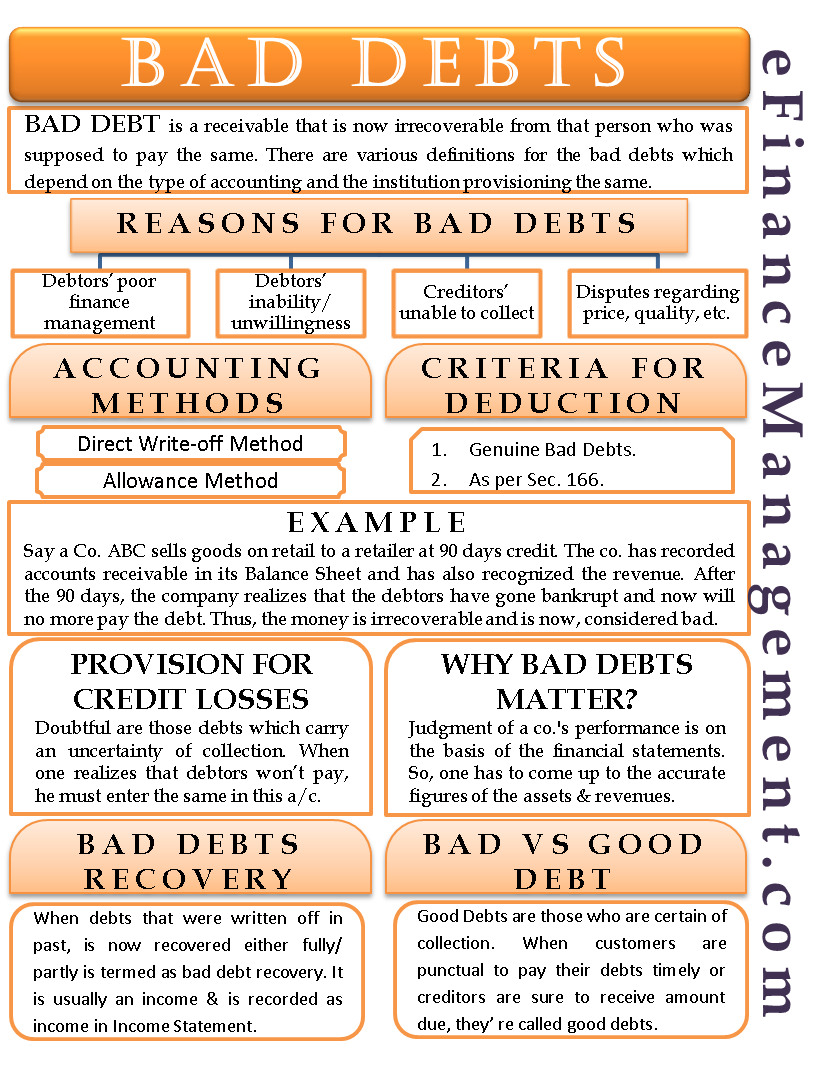

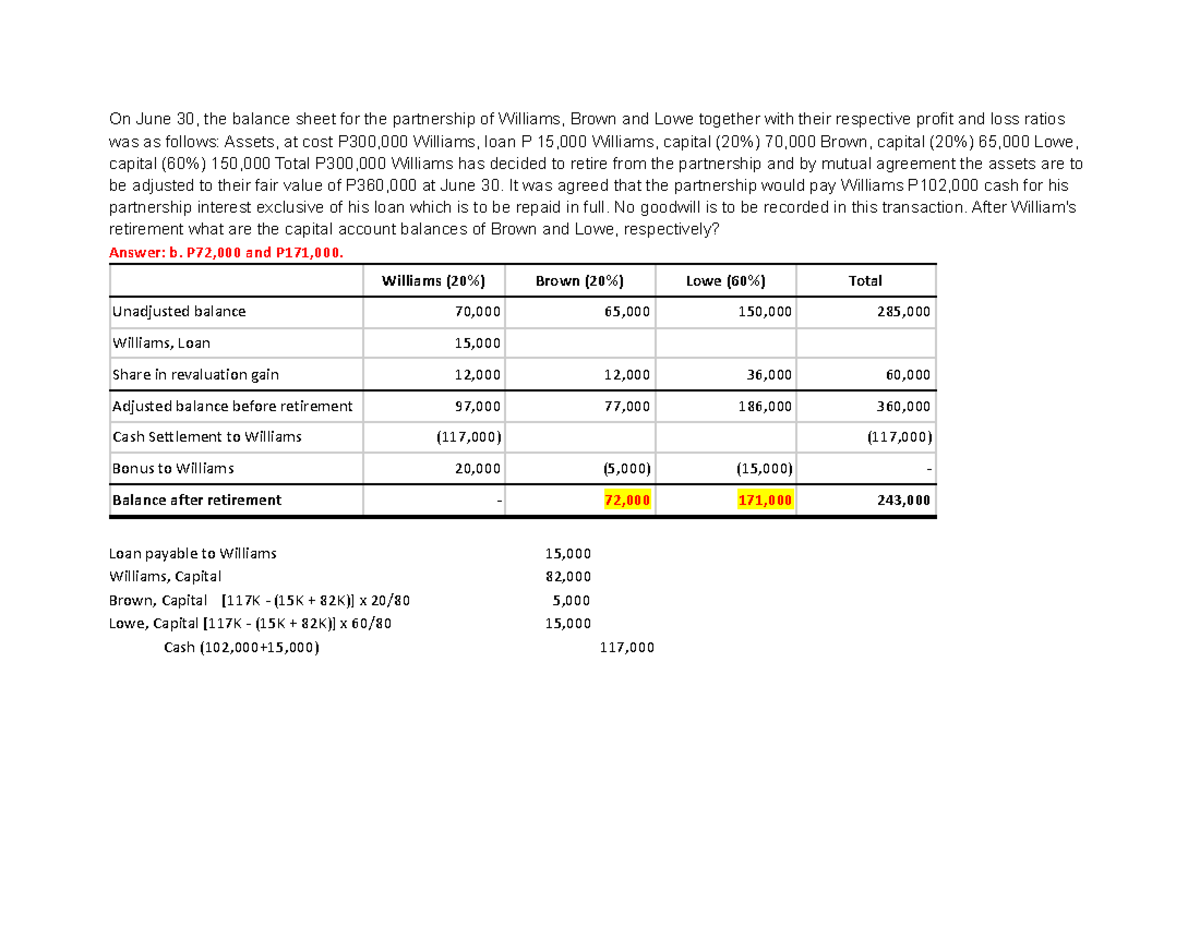

Bad debts treatment in balance sheet. Such an estimate is called a bad debt allowance, a bad debt reserve,. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for.

The following treatment takes place in respect of bad debts: Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as. Incurring bad debt is part of the cost of.

In this method, the bad debt is directly written off to the. Allowance for bad debt: In such a case, two effects will take place:.

4 the accounting equation is like so: Why do businesses need provisions for bad debts?. If bad debts are given outside the trial balance:

There are two methods to calculate bad debt expense: The company credits the accounts receivable account on the balance sheet and debits the bad debt. In a business scenario, amounts which are overdue to a business owner by the debtor (s) and declared irrecoverable are called bad debts.

Table of contents what is bad debt? The provision for doubtful debts is an accounts receivable contra account, so it should always have a credit balance, and is listed in the balance sheet directly below. Updated on march 27, 2023 fact checked why trust finance strategists?

131 1 1 2 add a comment 3 answers sorted by: An allowance for bad debt, also known as an allowance for doubtful accounts, is a valuation account used to estimate the portion of a. Bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off.

Few reasons for debtors to. The bad debts or a provision for bad debt is reduced from debtors and the net figure is shown in the balance sheet. For example, if credit sales are made to a customer who says it’s not recoverable or is partially recoverable then the.

Prepare the journal entry for the. Balance sheet in the balance sheet either it can be shown on the asset side under head current assets by reducing from that specific assets. To record bad debts in the account books, firms must initially estimate their potential losses.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)