Ideal Tips About Accounting For Bonds Ifrs Quickbooks Trial Balance By Month

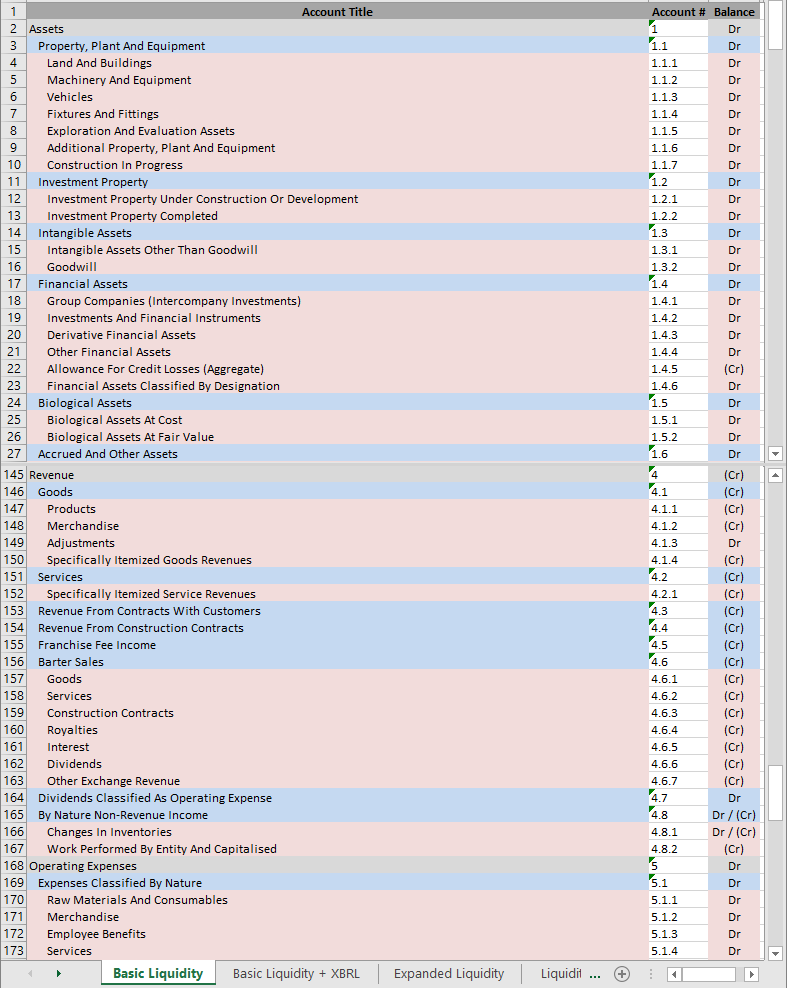

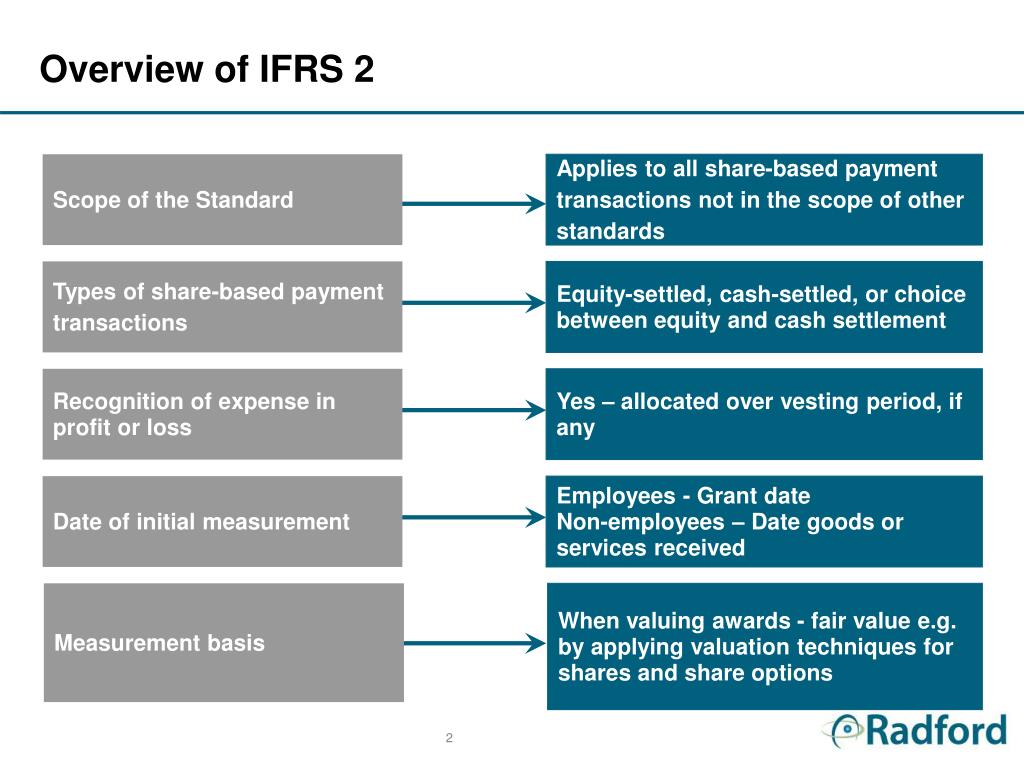

Disclosuresincluding adding disclosures about investments in equity instruments designated as at fvtoci, disclosures on risk management activities and hedge accounting and disclosures on credit risk management and.

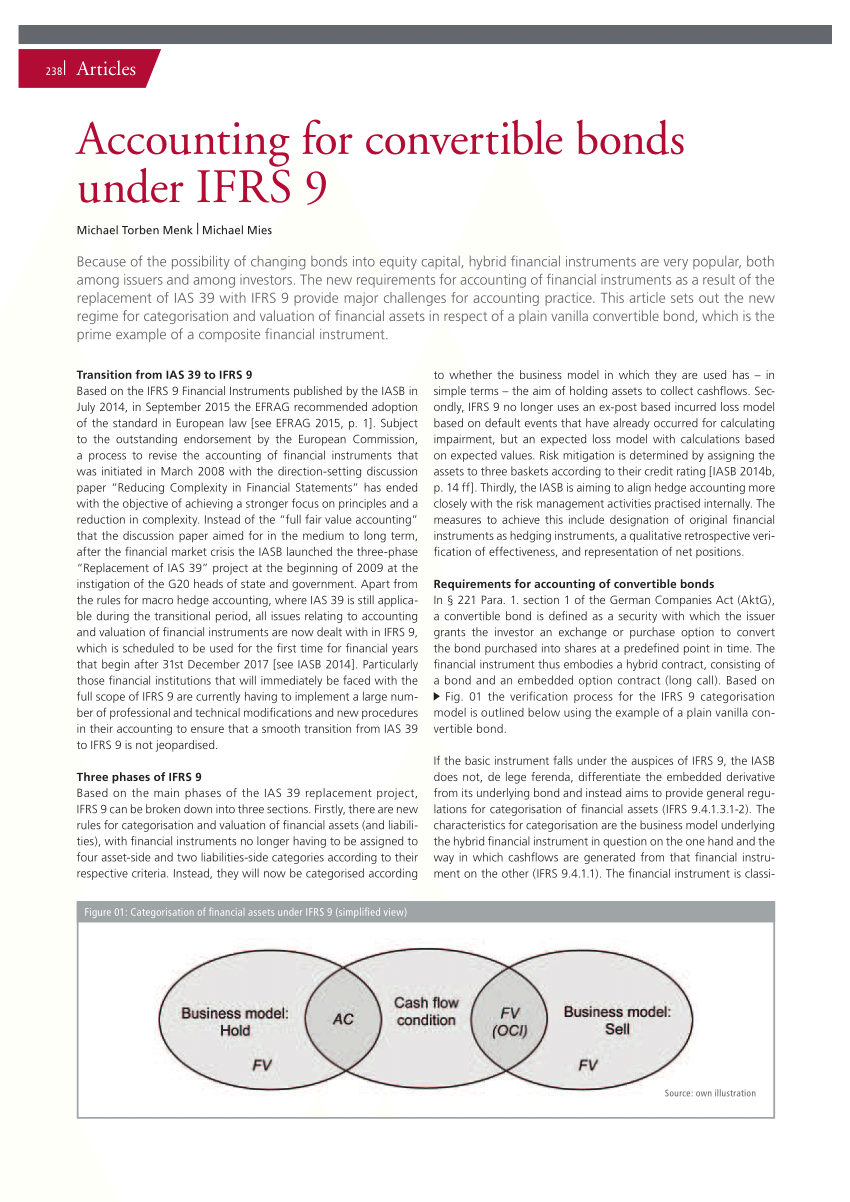

Accounting for bonds ifrs. Lets assume my entity issued a bond of 100m 10% interest, and they incurred transaction costs of 10. Financial instruments with characteristics of equity;. Ccounting for convertible bonds (cbs) have been an obstaclein the path to convergence b etween the generally accepted accounting principles (gaap) issued by the financial.

The accounting treatment of convertible bonds is different under us gaap and ifrs. The conversion can be done at any time before the. Accounting for bonds (ifrs & aspe) the business doctor 4.83k subscribers subscribe subscribed 13 share 837.

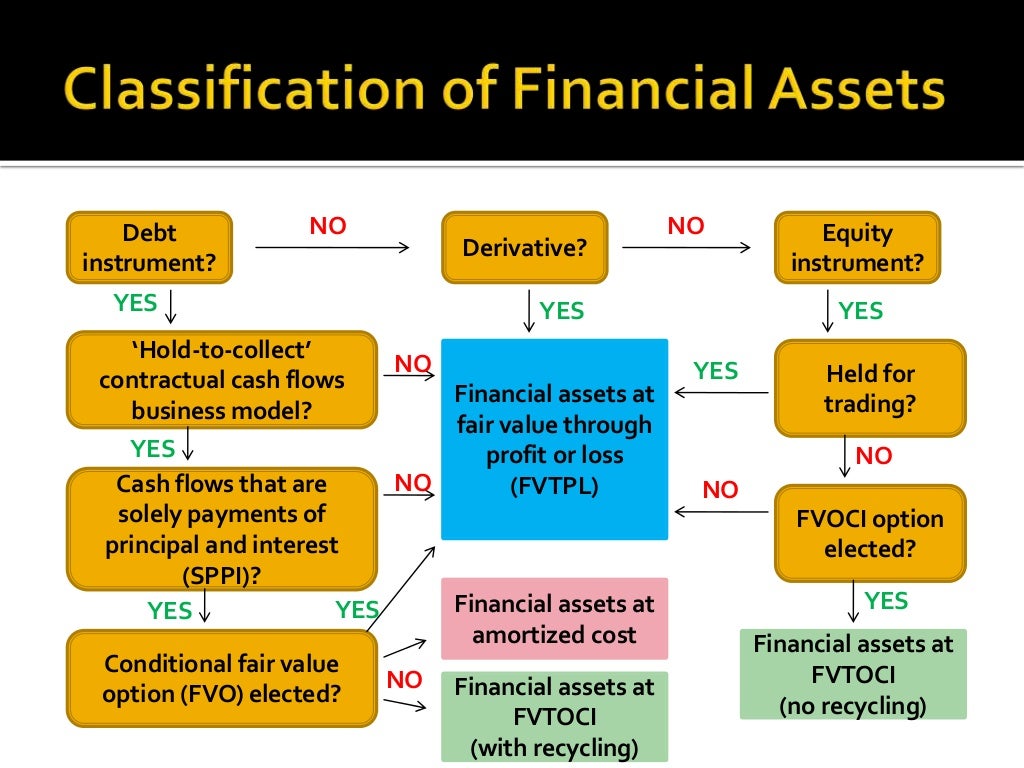

This video illustrates how to account for investments in bonds classified as fair value through net income (aka. Ifrs does not use “premium” or “discount” accounts. Ifrs 9 amends some of the requirements of ifrs 7 financial instruments:

Cumulative gain of $175 million in fccb face. Under us gaap, bonds are recorded at face value and the premium or discount is recorded in a separate account. This article sets out the new regime for categorisation and valuation of financial assets in.

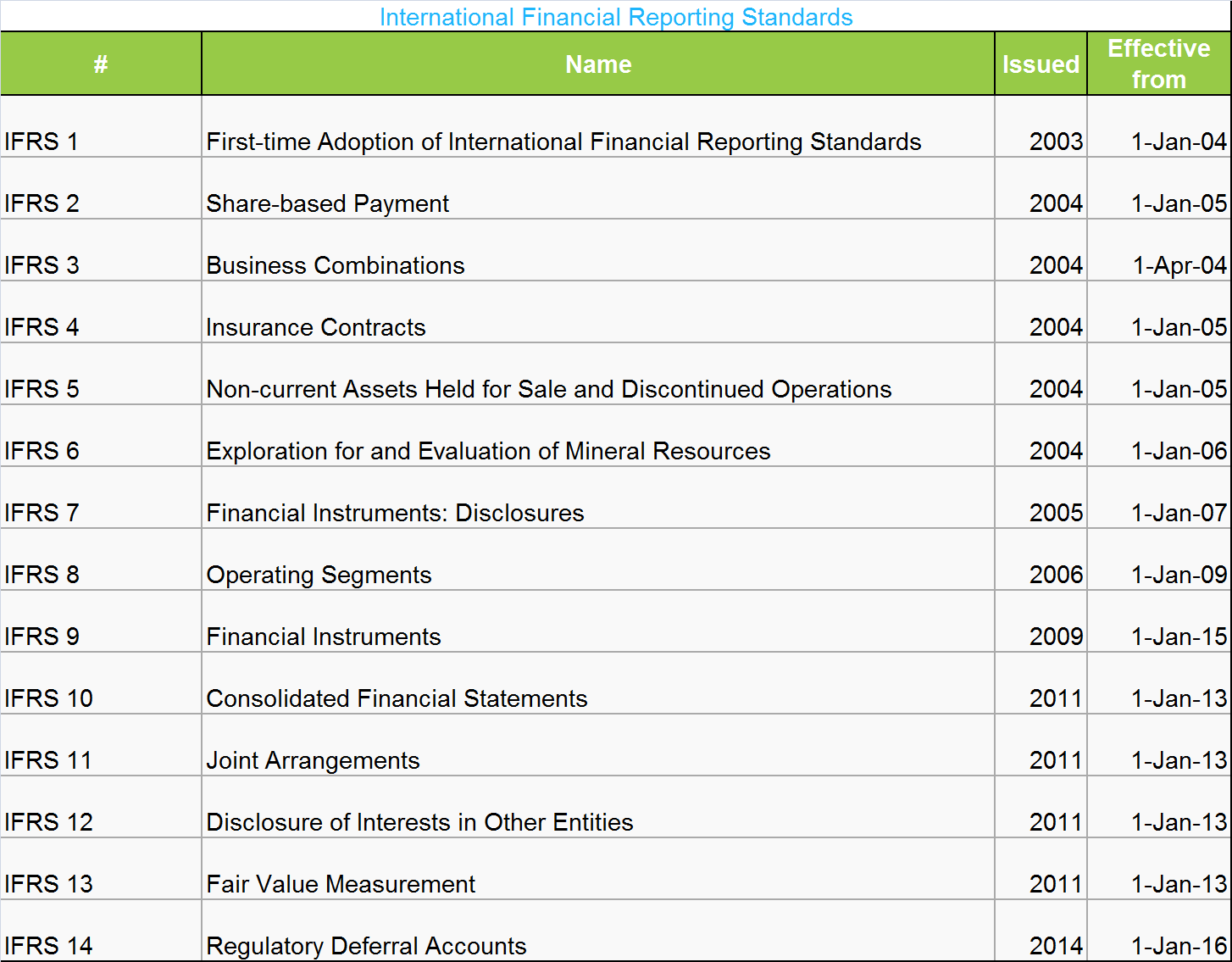

How do accounting standards help? Annual improvements to ifrs accounting standards—transaction price (amendments to ifrs 9) dynamic risk management; Fair value through profit and loss) under.

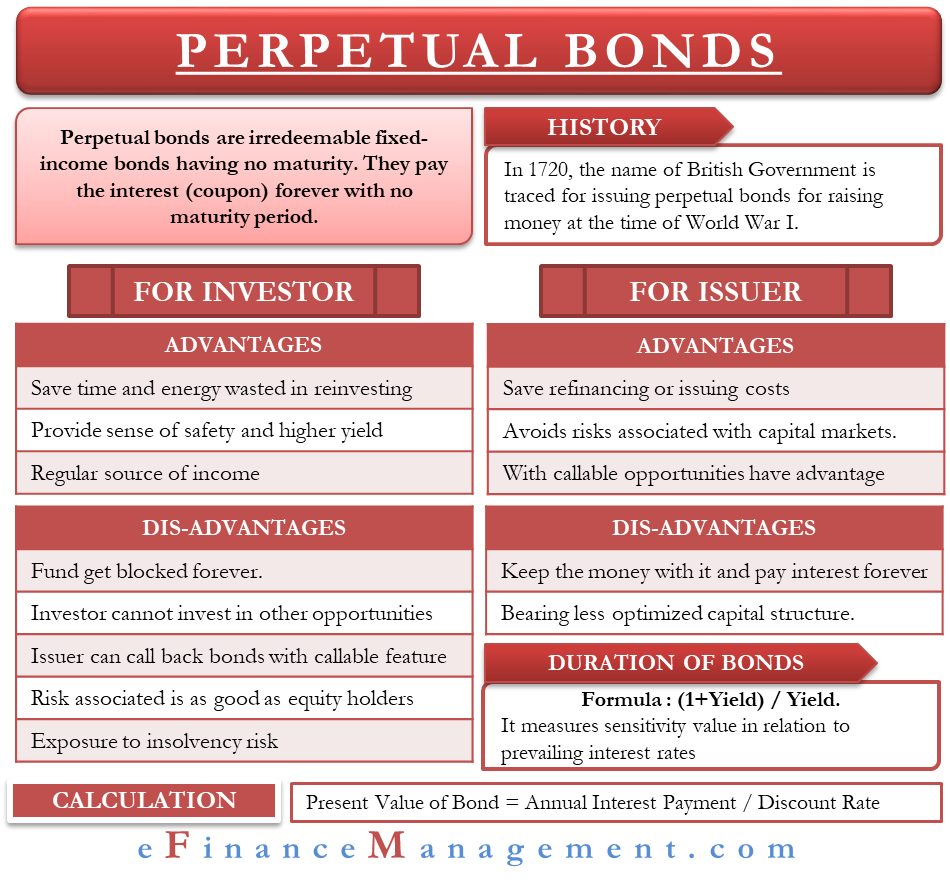

Accounting for convertible bonds. Accounting for convertible bonds. A bond is a fixed obligation to pay that is issued by a corporation or government entity to investors.

Whilst primarily written from the perspectives of banks, many of the aspects discussed will also be relevant to other entities that hold portfolios of securities. Bonds are used to raise cash for operational or. Replacement of ias 39 with ifrs 9 provide major challenges for accounting practice.

Convertible bond is a type of bond which allows the holder to convert to common stock. 13 mar 2018 ifrs 9 financial instruments classification of a particular type of dual currency bonds (agenda paper 8) background. Accounting for investments in esg (environmental, social and governance) bonds.

/ 43:28 intermediate financial accounting ii: