Inspirating Tips About Profit And Loss For Sole Proprietor Performance Audit Report

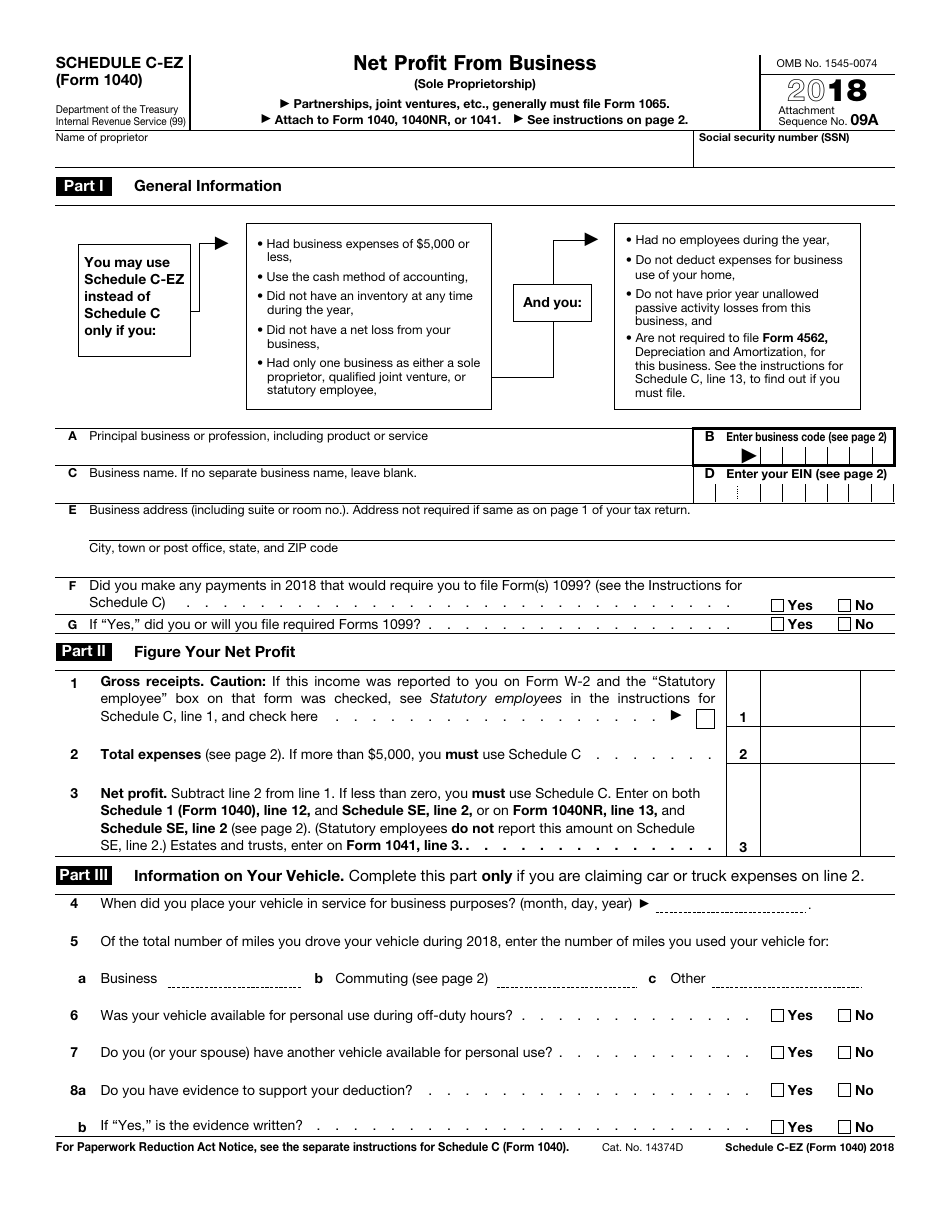

If you run your own business, have an llc, or work as a sole proprietor, it’s likely you’ll need to become familiar with irs schedule c at tax time.

Profit and loss for sole proprietor. Rental property profit and loss template; Daycare profit and loss statement; As a solo practitioner, alex is the sole owner and enjoys complete control over business decisions.

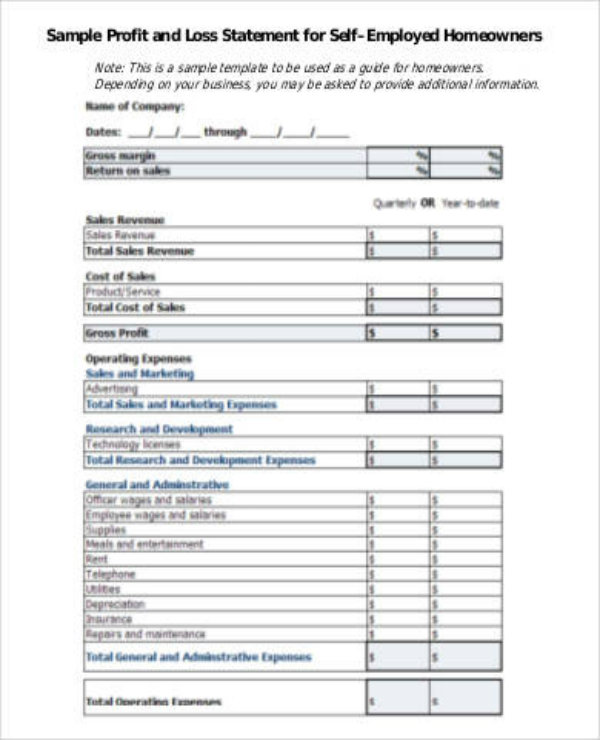

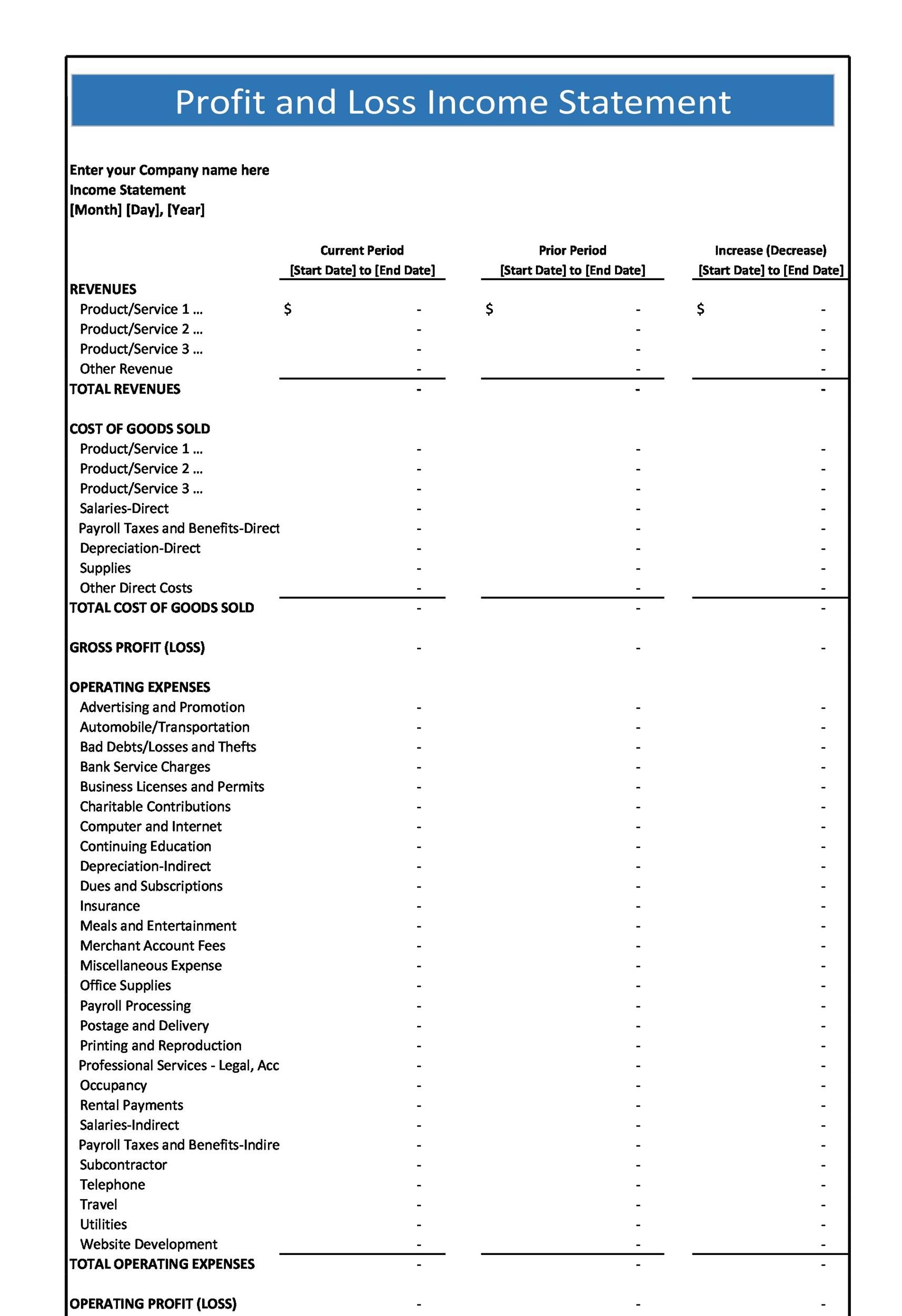

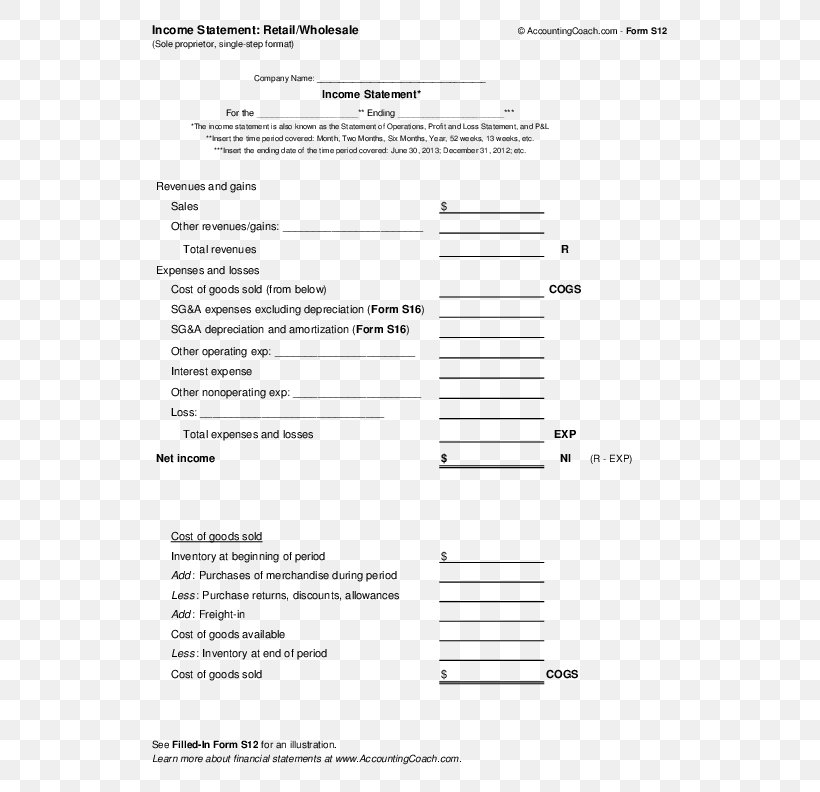

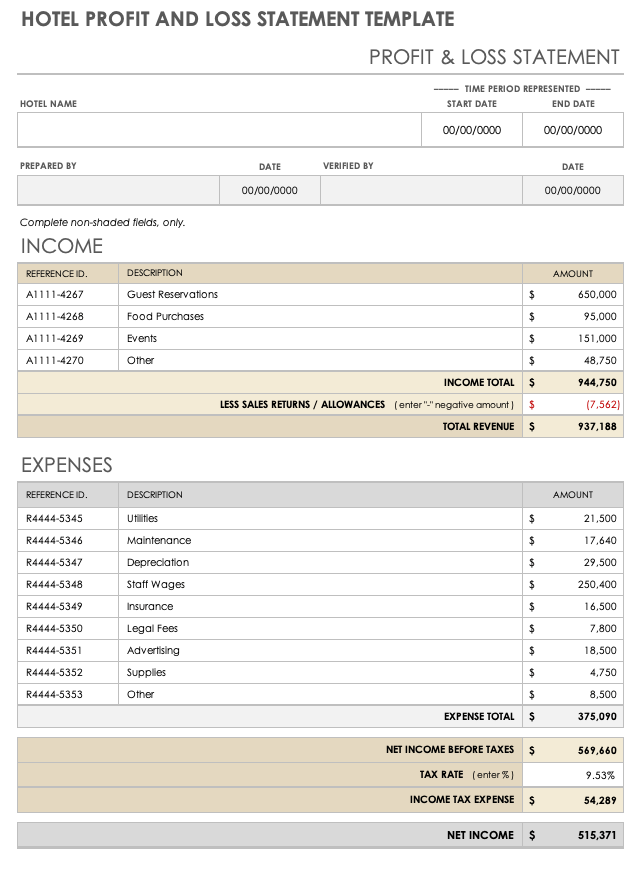

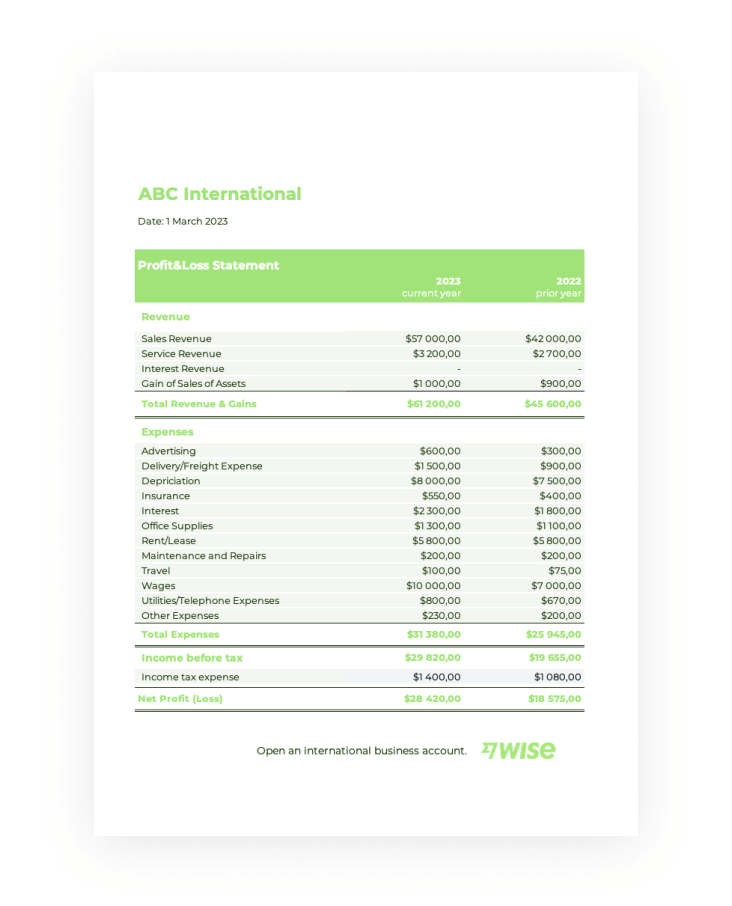

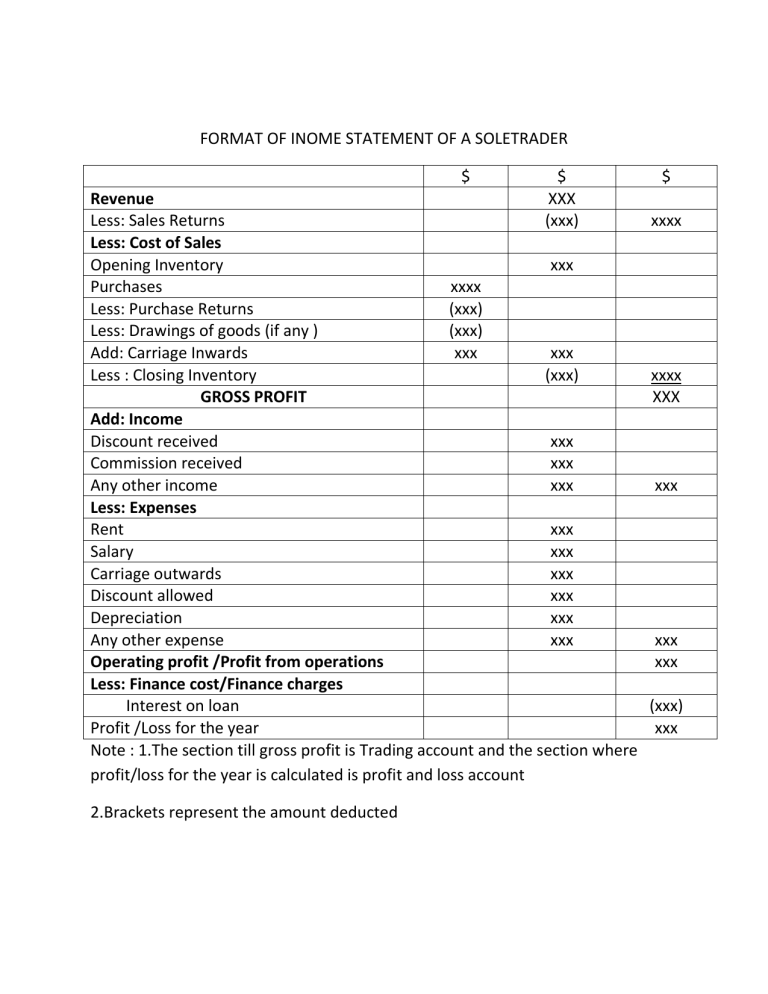

The single step profit and loss statement formula is: Determining profit and losses in a sole proprietorship is important to help you control the business and to properly report taxable income to the government. A p&l statement compares company revenue against expenses to determine the net income of the business.

When it comes time to compute your total income, you subtract the amount of your loss. However, my agi and taxable income for the year were positive, owing to interest, dividends, and capital gains unrelated to the sole proprietorship. Includes recent updates, related forms, and instructions on how to file.

Your sole proprietorship business insurance. We prepare trading account to ascertain the gross profit/ gross loss. Also, use schedule c to report wages and expenses you had as a statutory employee.

Restaurant profit and loss template; Therefore, your sole proprietorship’s taxable income will be close to the “net income” or “net profit” number at the bottom of your profit and loss statement, but with a few adjustments. A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it captures how money flows in and out of your business.

Imagine alex, a professional lawyer, decides to become a sole practitioner lawyer. Partnerships must generally file form 1065. Profit and loss account/statement types of profit and loss.

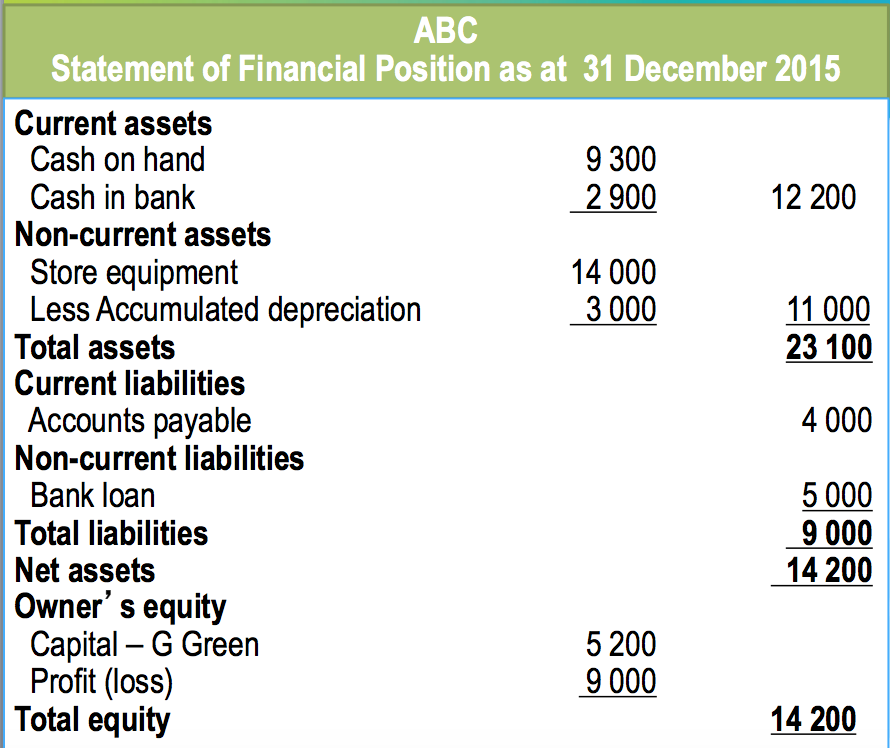

A sole proprietorship is an unincorporated business with only one owner who pays personal income tax on profits earned. Sole proprietor business insurance can help you cover claims against you based on your business. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Sole proprietorships are easy to establish and dismantle due to a lack. In 2022, my sole proprietorship (schedule c) had a net loss for the first time. The primary function of accounting is to accumulate.

Form 941 for quarterly filing of fica (social security and medicare) and withholding taxes). However, this autonomy comes with unlimited personal liability. Subtract operating expenses from business income to see your net profit or loss.

In that case, you will need to file schedule c to report income and expenses with your form 1040. The sole proprietorship had net profits in 2023. It’s usually assessed quarterly and at the end of a business’s accounting year.