Real Info About Balance Sheet Adjustments Preparation Of Ledger Accounts And Trial

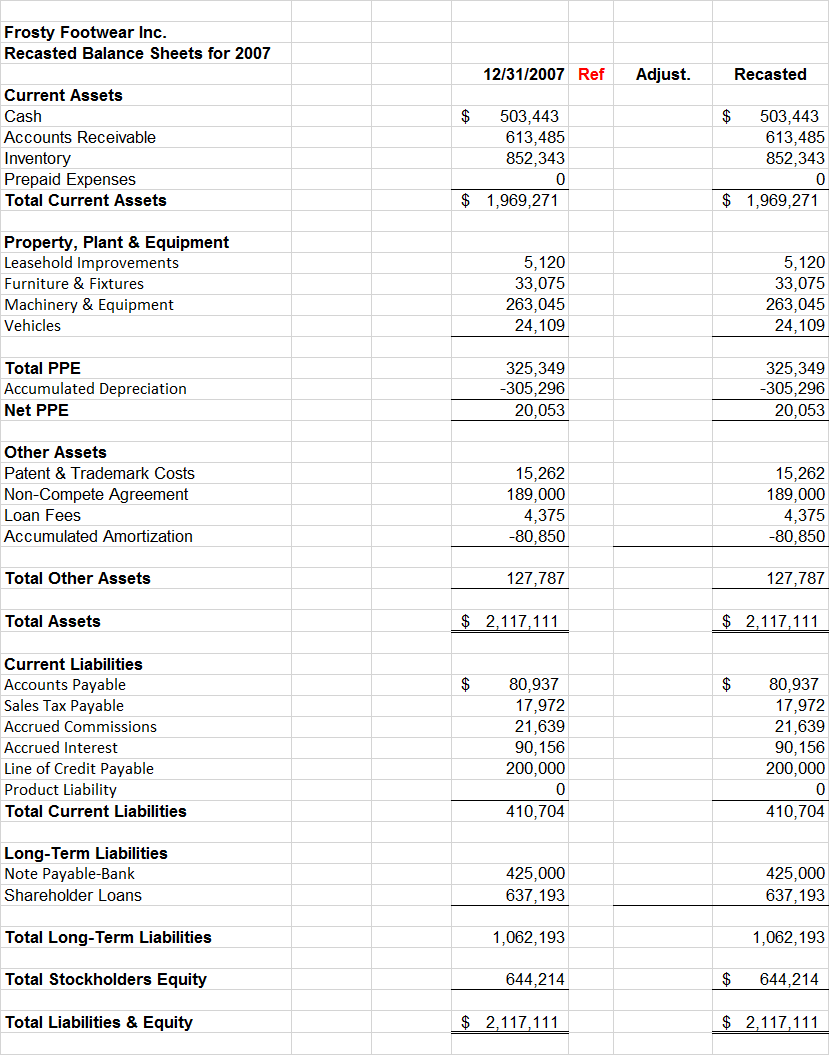

Here are some examples of normalizing.

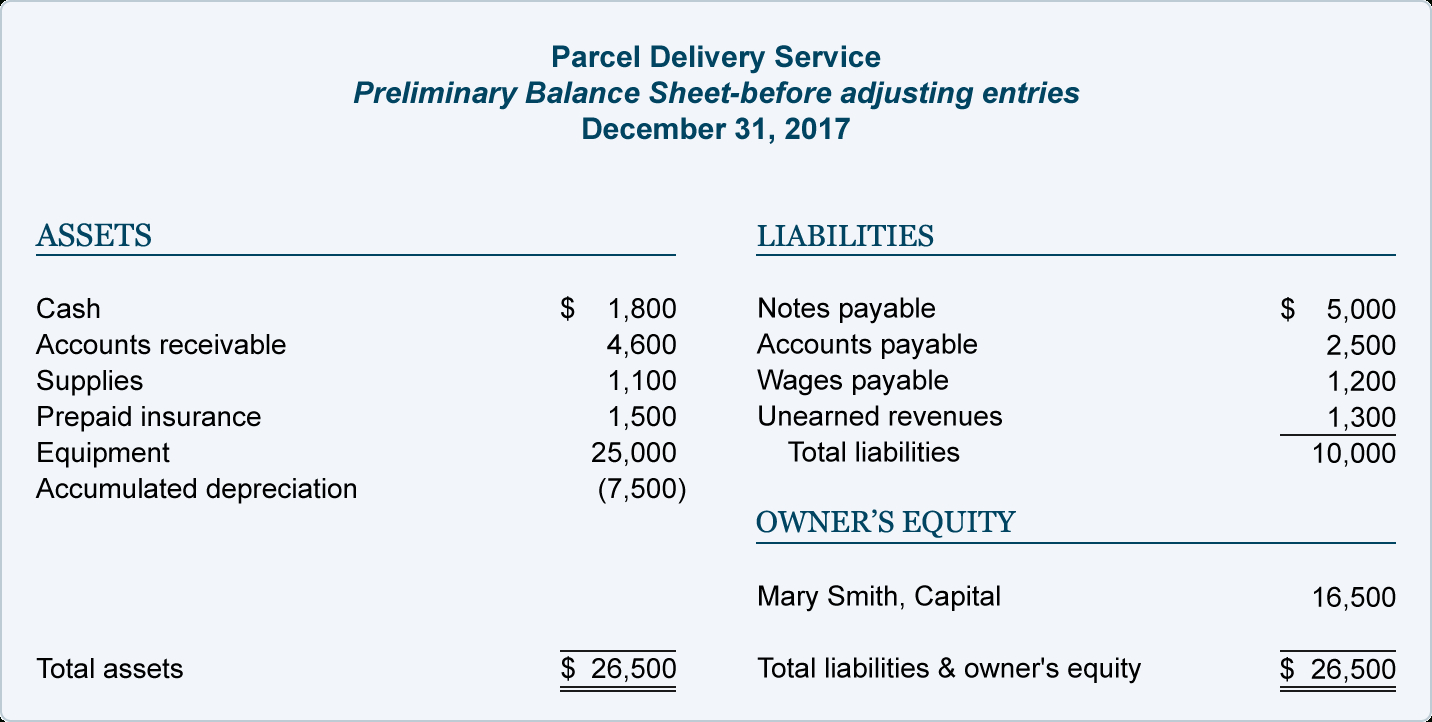

Balance sheet adjustments. Usually, the balance sheet is prepared from a trial balance. The three aspects of a balance sheet are: The fed has been reducing the size of its holdings since 2022.

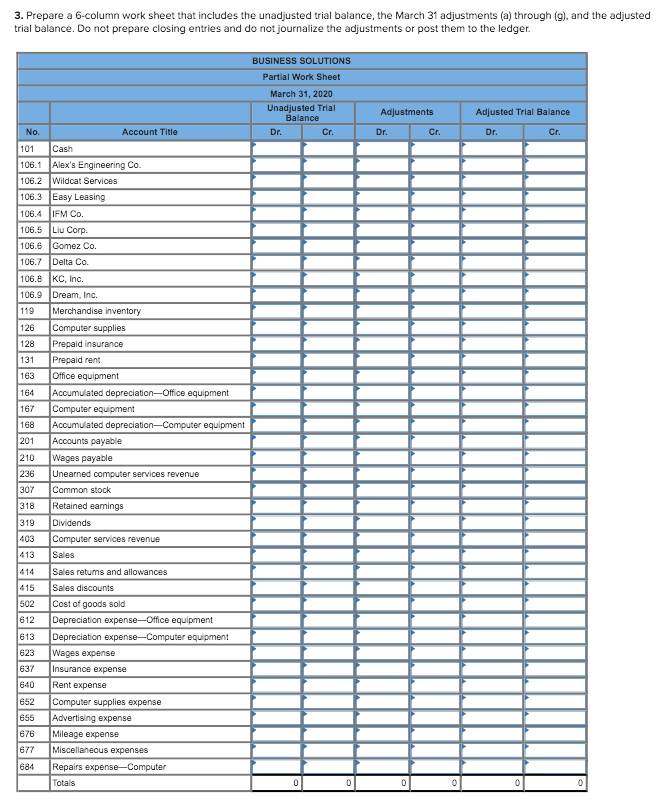

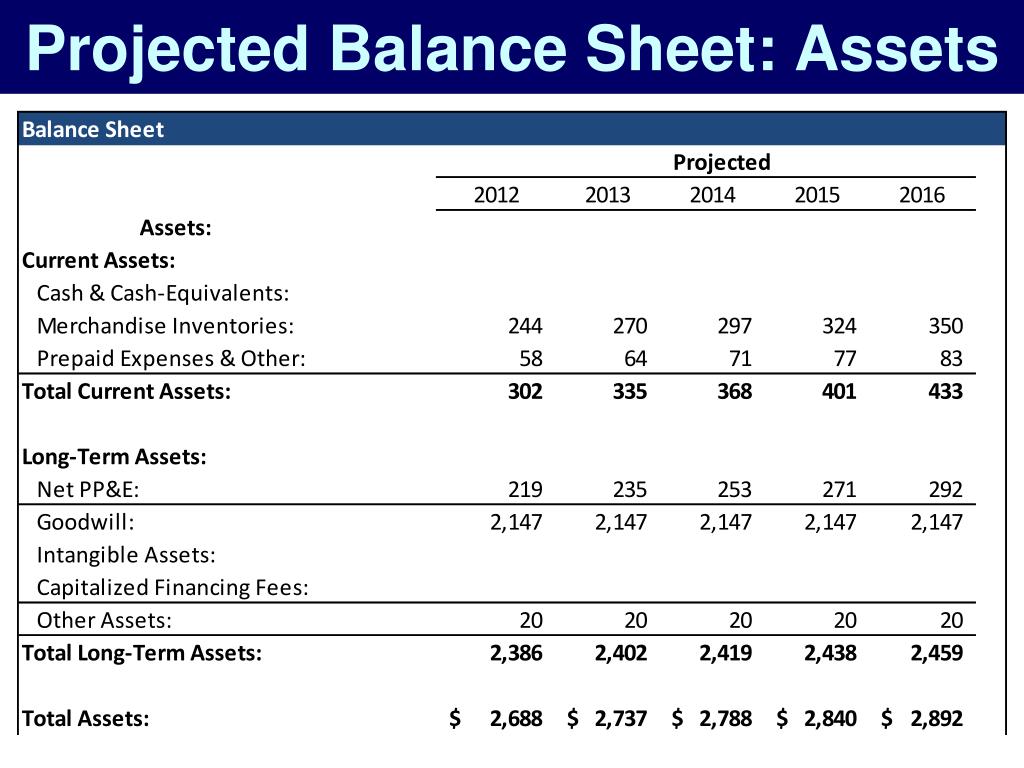

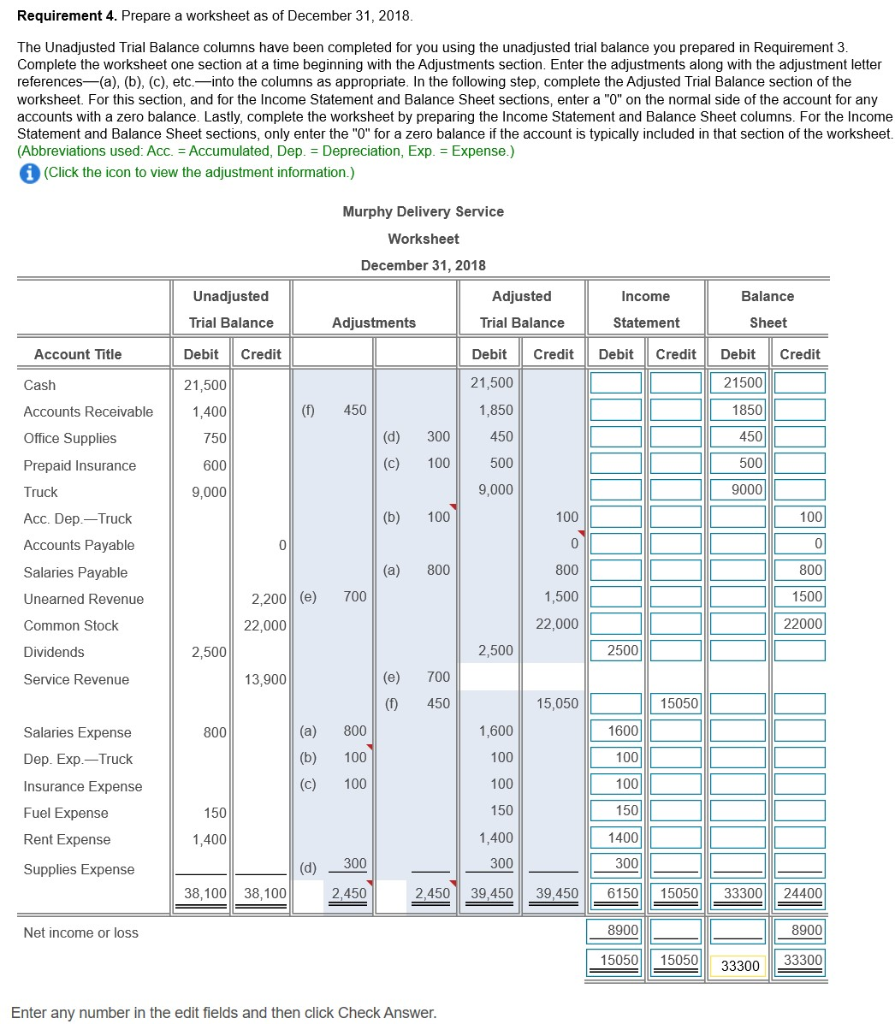

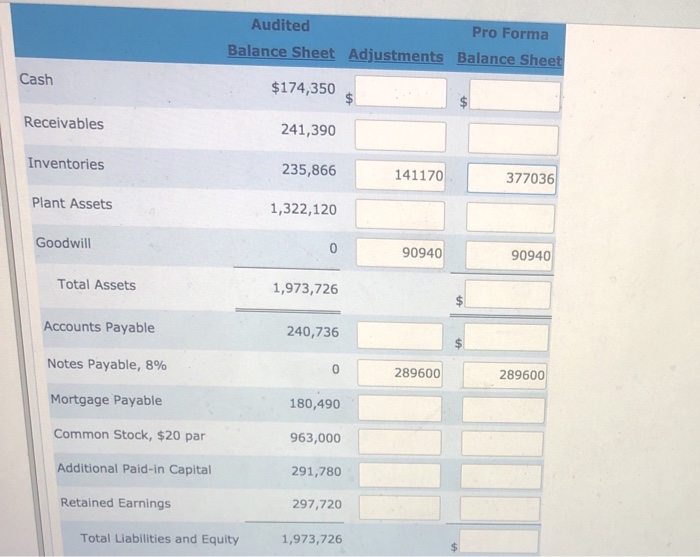

Use real balance sheet as base. Once the trial balance information is on the worksheet, the next step is to fill in the adjusting information from the posted adjusted journal entries. Add total liabilities to total shareholders’ equity and compare to assets.

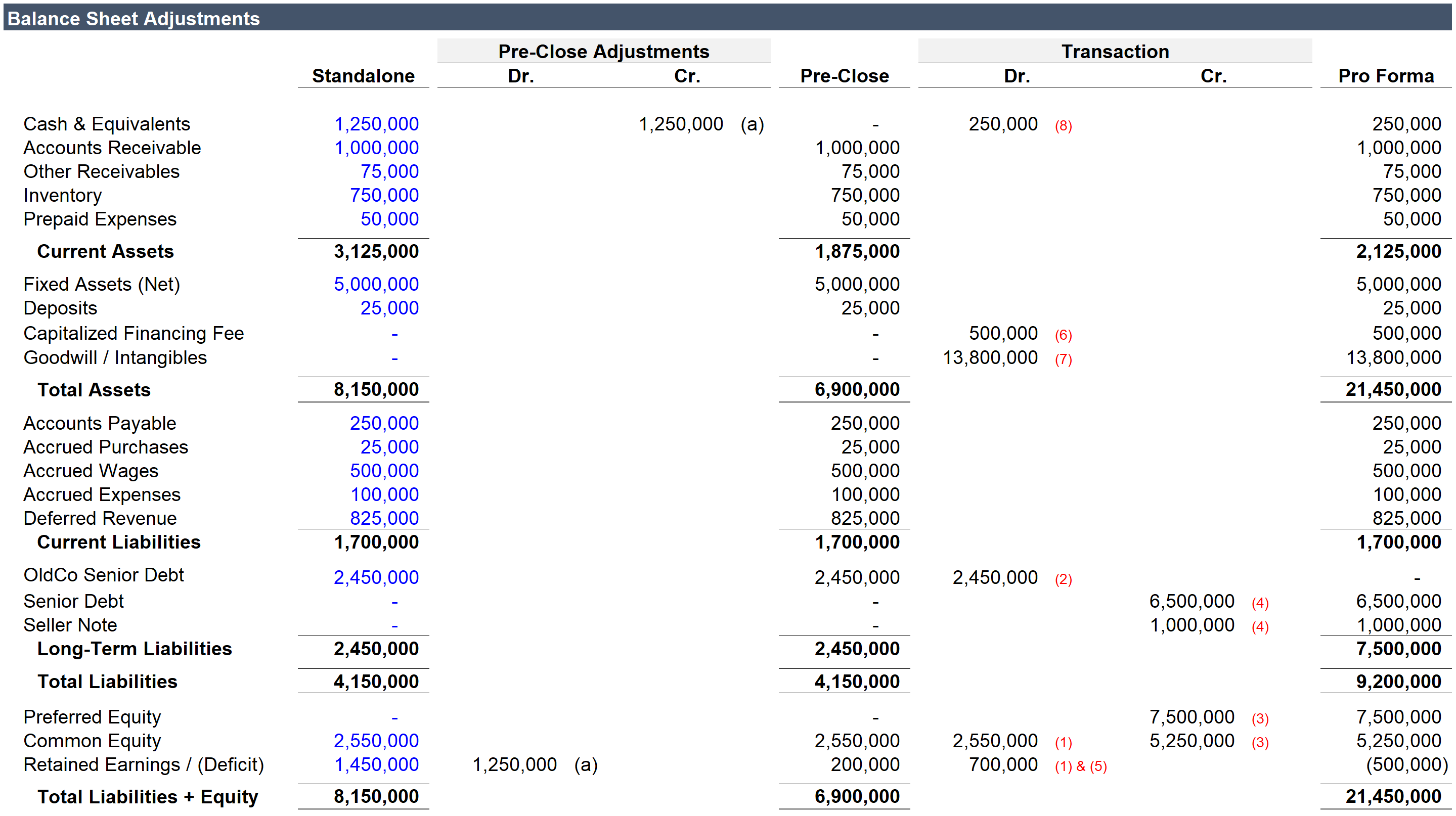

Income statement accounts include revenues and expenses. Lbo pro forma balance sheet adjustments peter lynch the purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control transactions. Determine what the ending balance ought to be for the balance sheet account.

Heidelberg materials will buy back more shares after its debt declined significantly, it said on thursday. To do this, you’ll need to add liabilities and shareholders’ equity together. What are “income statement” and “balance sheet” accounts?

At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data. Your salary and perks family members’ salaries and perks expenses or income that would not be expected to recur or continue after the sale personal expenses, such as personal auto, insurance, cell phone, child care, medical, and travel expenses depreciation amortization Cash will never be in an adjusting entry.

Take the information from maggie's music shop adjusted trial balance and fill out an income statement. Use the financial information from the previous financial statements to create the statement of owner's equity (also known as a statement of retained earnings). Accounting for items given outside the trial balance in adjustments will be carried out twice or at two places or two accounts.

Assets = liabilities + equity the above equation means that at any point in time, a business’s assets should be equal to its liabilities and equity. Budgeted balance sheet and master budget. Adjusting entries must involve two or more accounts and one of those accounts will be a balance sheet account and the other account will be an income statement.

Introduction the purpose of this factsheet is to provide guidance on the accounting for and disclosure of prior period errors and adjustments within statutory financial statements. Depreciation on fixed assets refers to decrease in the value of fixed assets due to their use, wear and tear. Adjustment is done in profit and loss account and balance sheet.

Policymakers said slower qt could ease shift to ample. The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266 million (2022: European markets heidelberg materials balance sheet improves as building sector recovers.

Adjusting entries are made at the end of the accounting period to make your financial statements more accurately reflect your income and expenses, usually — but not always — on an accrual basis. These are the resources owned by an entity, whether tangible or intangible. This made the older, lower.