Great Tips About Allowance For Doubtful Debt In Balance Sheet Types Of Assets

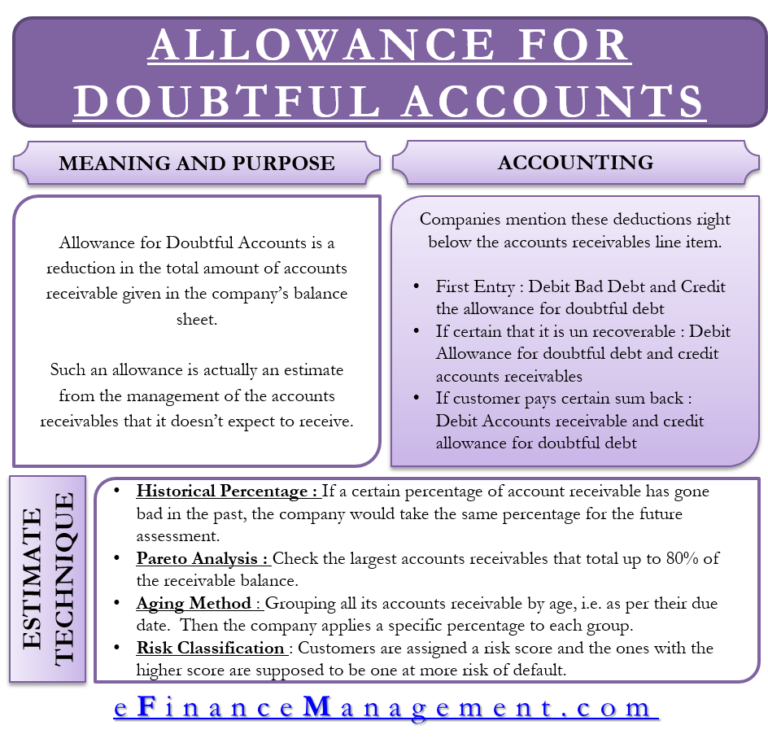

Allowance for doubtful accounts primarily means creating an allowance for the estimated part of the accounts that may be uncollectible and may become bad debt and is shown.

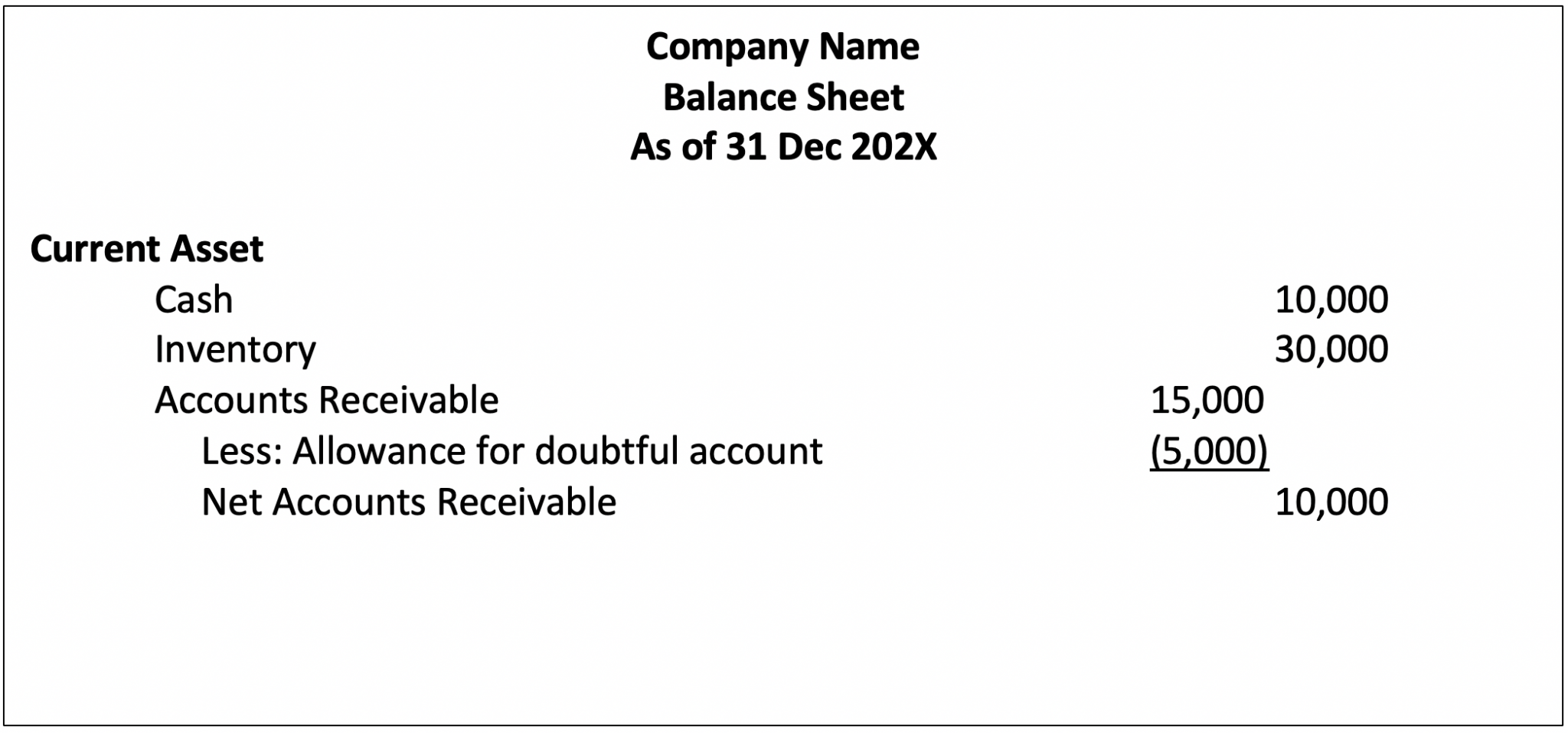

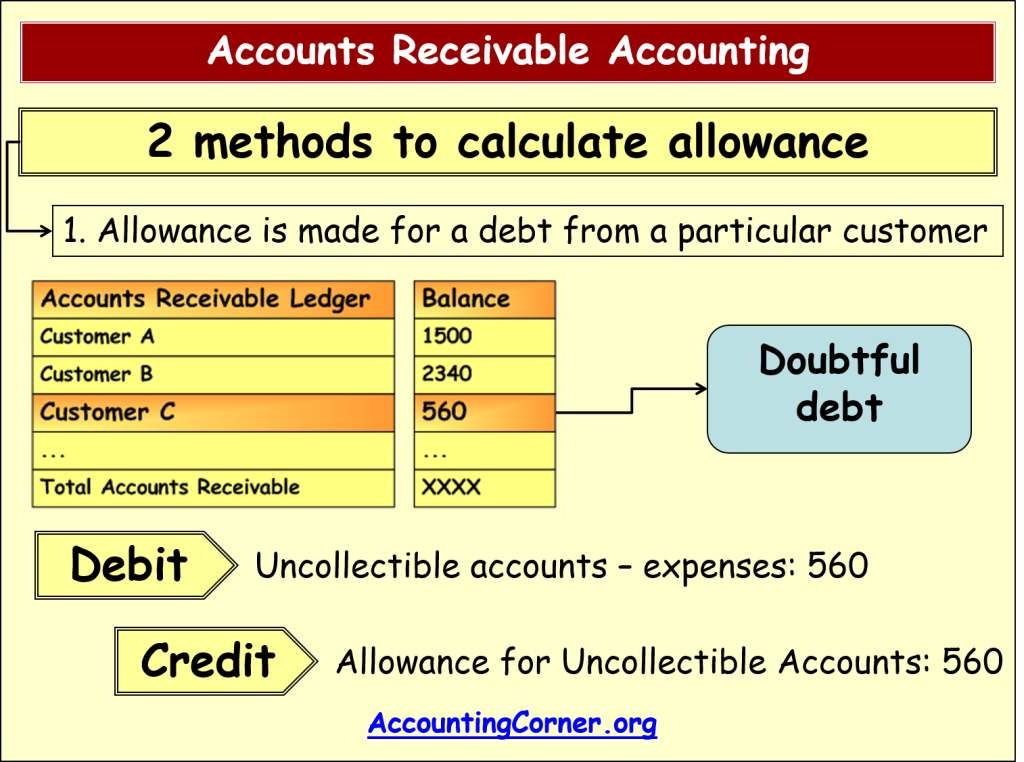

Allowance for doubtful debt in balance sheet. Bad debt expense $3,000 allowance for doubtful accounts $3,000 the allowance account now has a $3,000 credit balance which offsets ar on the balance. Allowance for doubtful accounts (afda) and bad debts expense. An allowance for doubtful accounts (uncollectible accounts) represents a company’s proactive prediction of the percentage of outstanding accounts receivable that.

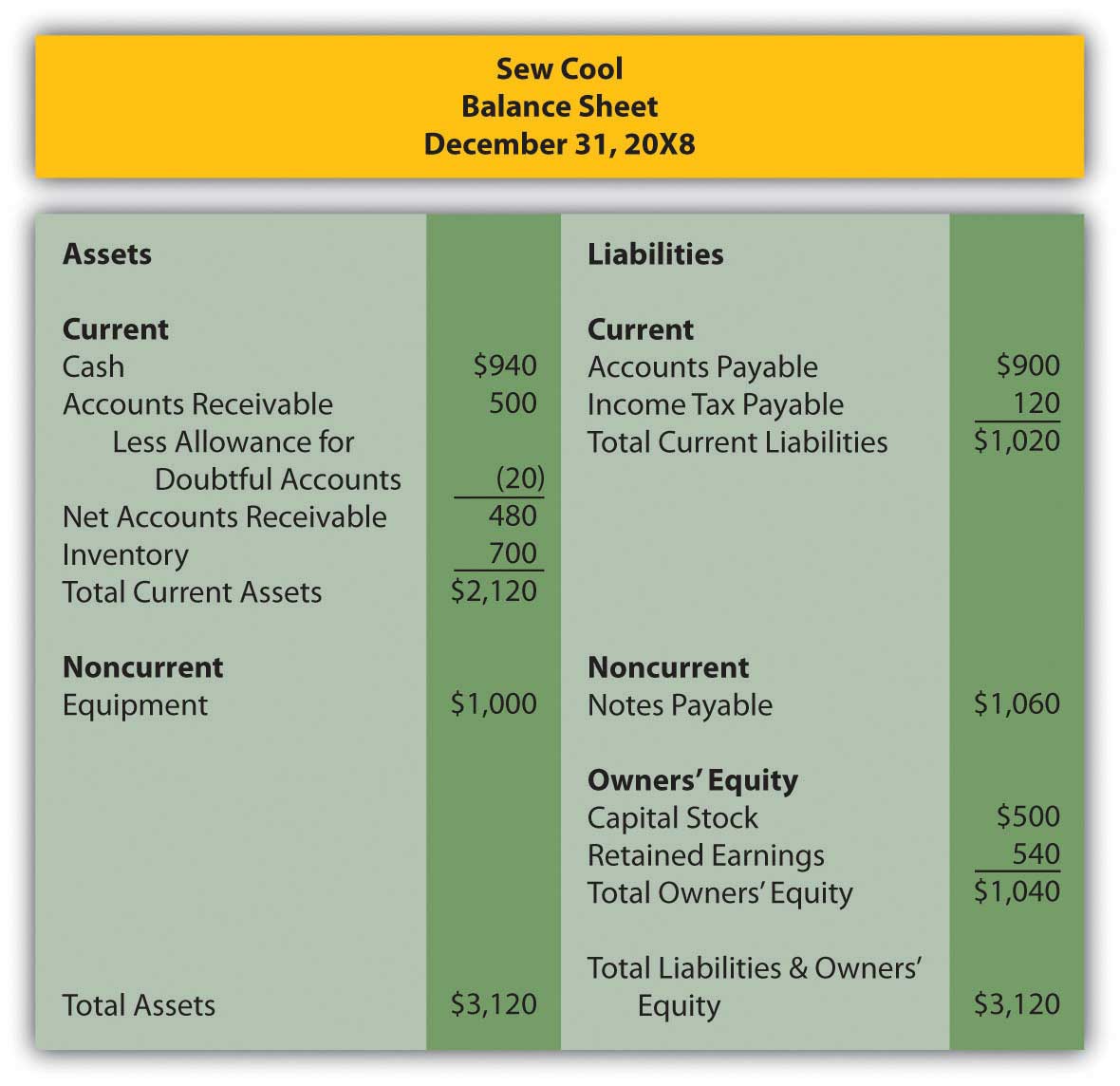

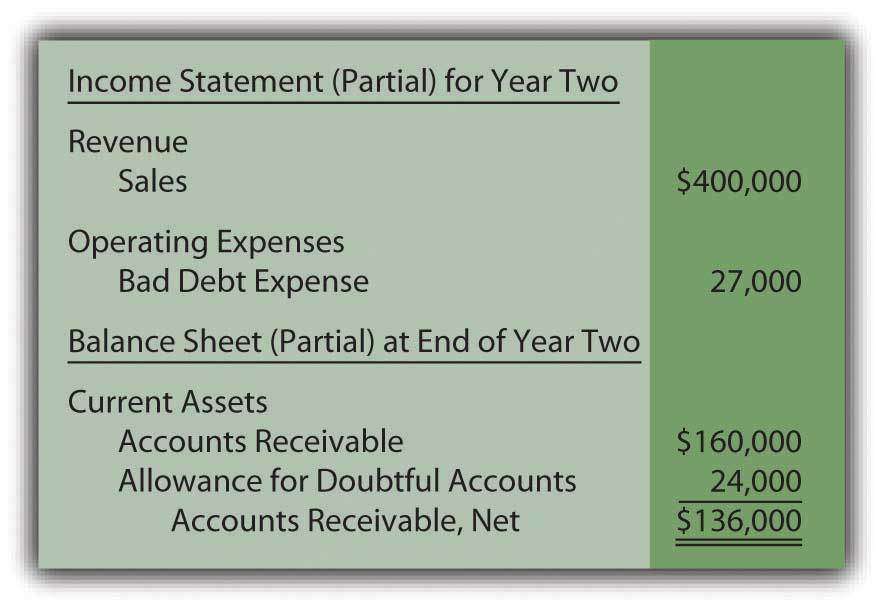

What is an allowance for doubtful debt? To demonstrate the treatment of the allowance for doubtful accounts on the balance sheet, assume that a company has reported an accounts receivable balance of. The discussion also examines the impact of writing off bad debts on the income statement, balance sheet, and statement of changes in financial position.

Allowance for doubtful accounts: Allowance for doubtful accounts is a contra asset that reduces the total amount of accounts receivable. With the account reporting a credit balance of $50,000, the balance sheet will report a net amount of $9,950,000 for accounts receivable.

Allowance for bad debt is a contra account. The allowance for doubtful accounts (or the “bad debt” reserve) appears on the balance. The allowance is the money set aside to handle accounts that go bad.

Bad debt expense (debit balance) will be posted to the company’s income statement as net loss, while the allowance for doubtful accounts will be posted. An allowance for doubtful debt is an estimate of how much of the trade receivables balance of a business will become. We’ll show you how to record ada later on in this post.

Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet. We do this by estimating how much will not be paid:

This item is positioned below accounts receivable, indicating that this is the. Some accountants call this “allowance for bad debt” and put the account directly underneath the a/r on the balance sheet. What is an allowance for doubtful accounts?

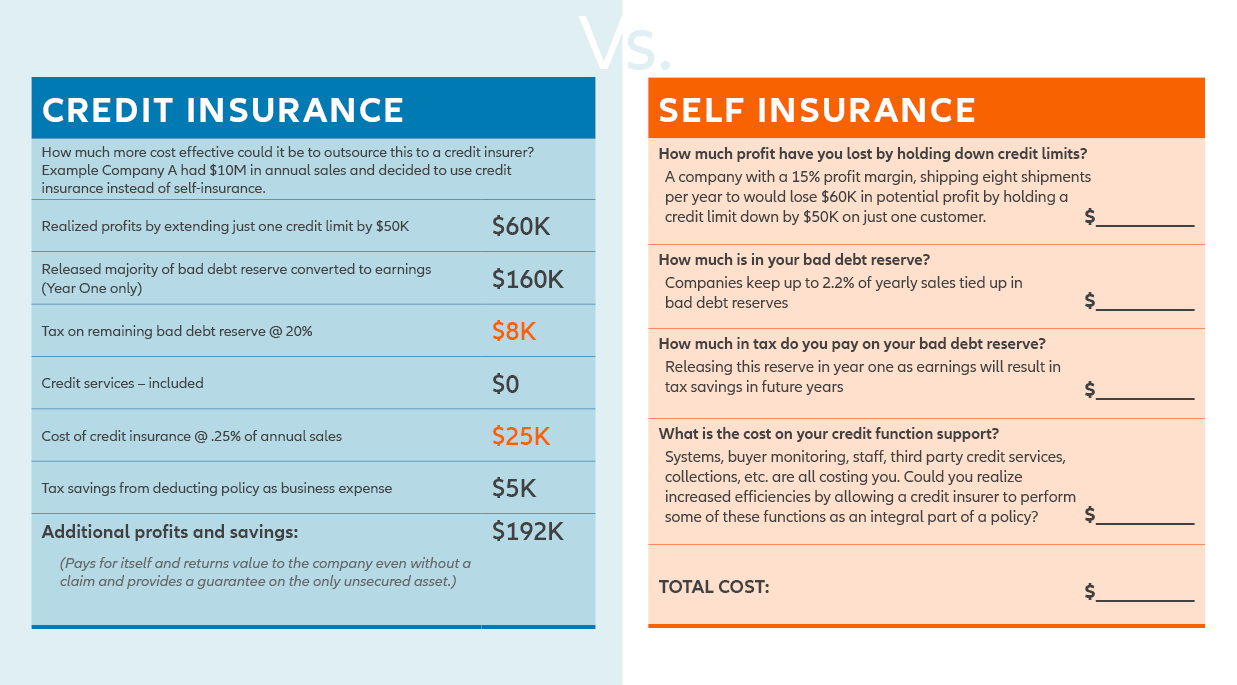

It provides a buffer so that profitability isn’t. An allowance for bad debt is a valuation account used to estimate the amount of a firm's receivables that may ultimately be uncollectible. Companies place the allowance of doubtful accounts under assets in their balance sheets.

Let us take an example where a company has a debit balance of account receivables on its balance sheet to an amount of $500,000. It is important to note that it does not necessarily reflect.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)