Have A Tips About Disposal Account In Income Statement Cash Fund Flow

This account is primarily created to.

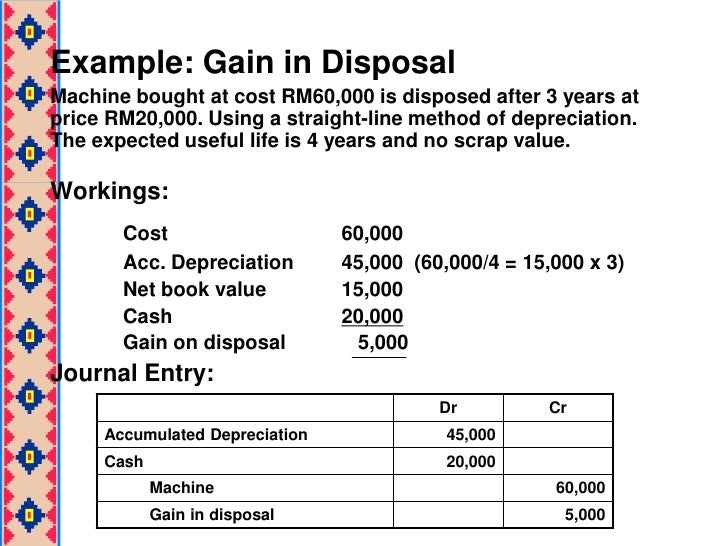

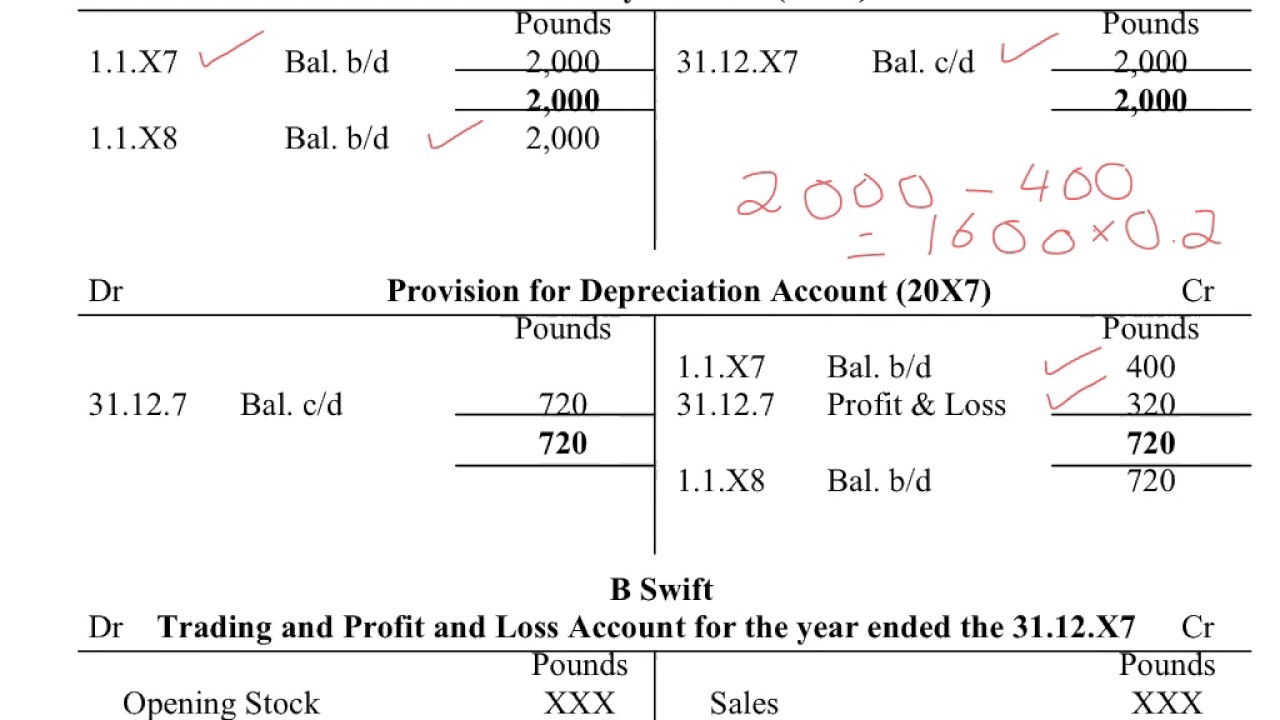

Disposal account in income statement. The asset account and its accumulated depreciation account are removed off the balance sheet when the. 8521 | 33 | 2. Disposal account so, as you can see, you must take into account how much of the cost of the asset you have already written off to determine any subsequent.

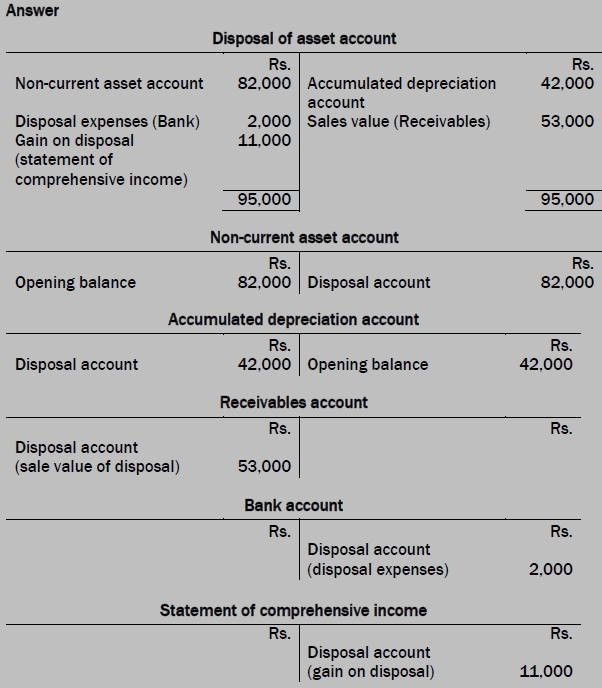

(to write off an assets account on its disposal) 2). Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance. A gain or loss on disposal is recognised as the difference between the disposal proceeds and the carrying value of the asset (using the cost or revaluation model) at the date of.

Step 1 open a disposal account. Record cash receive or the receivable created from the sale: After you're satisfied, make a journal entry for disposal of an asset not fully depreciated.

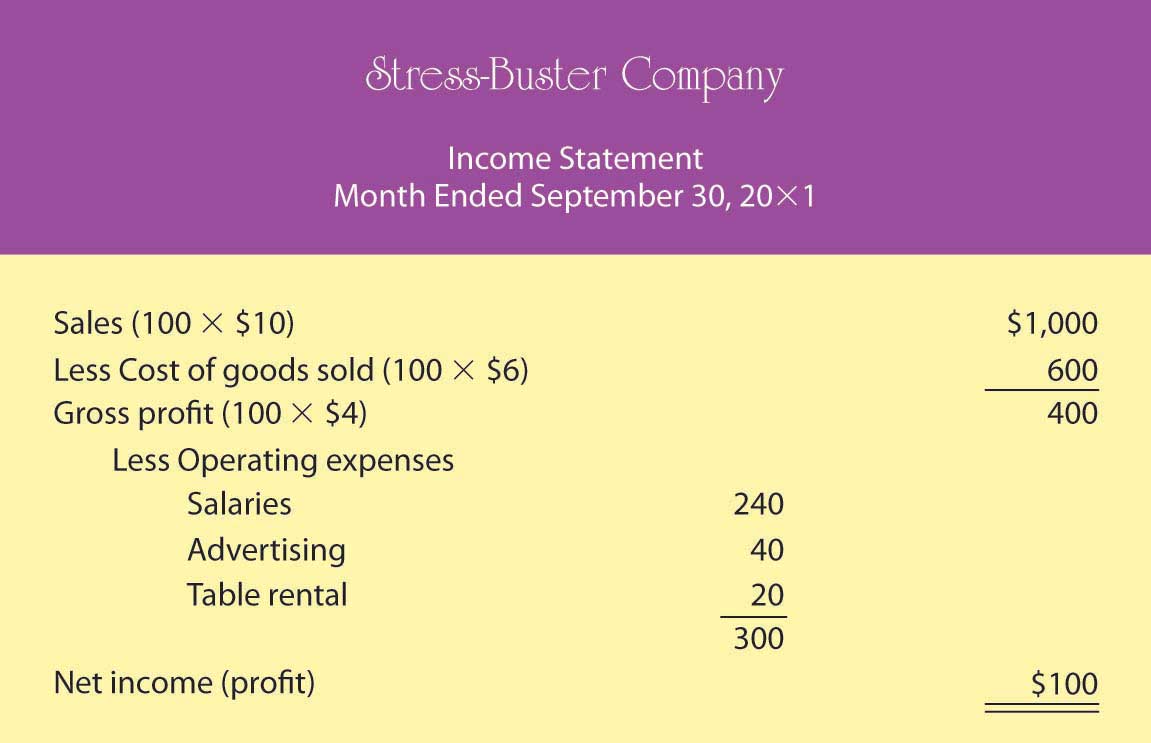

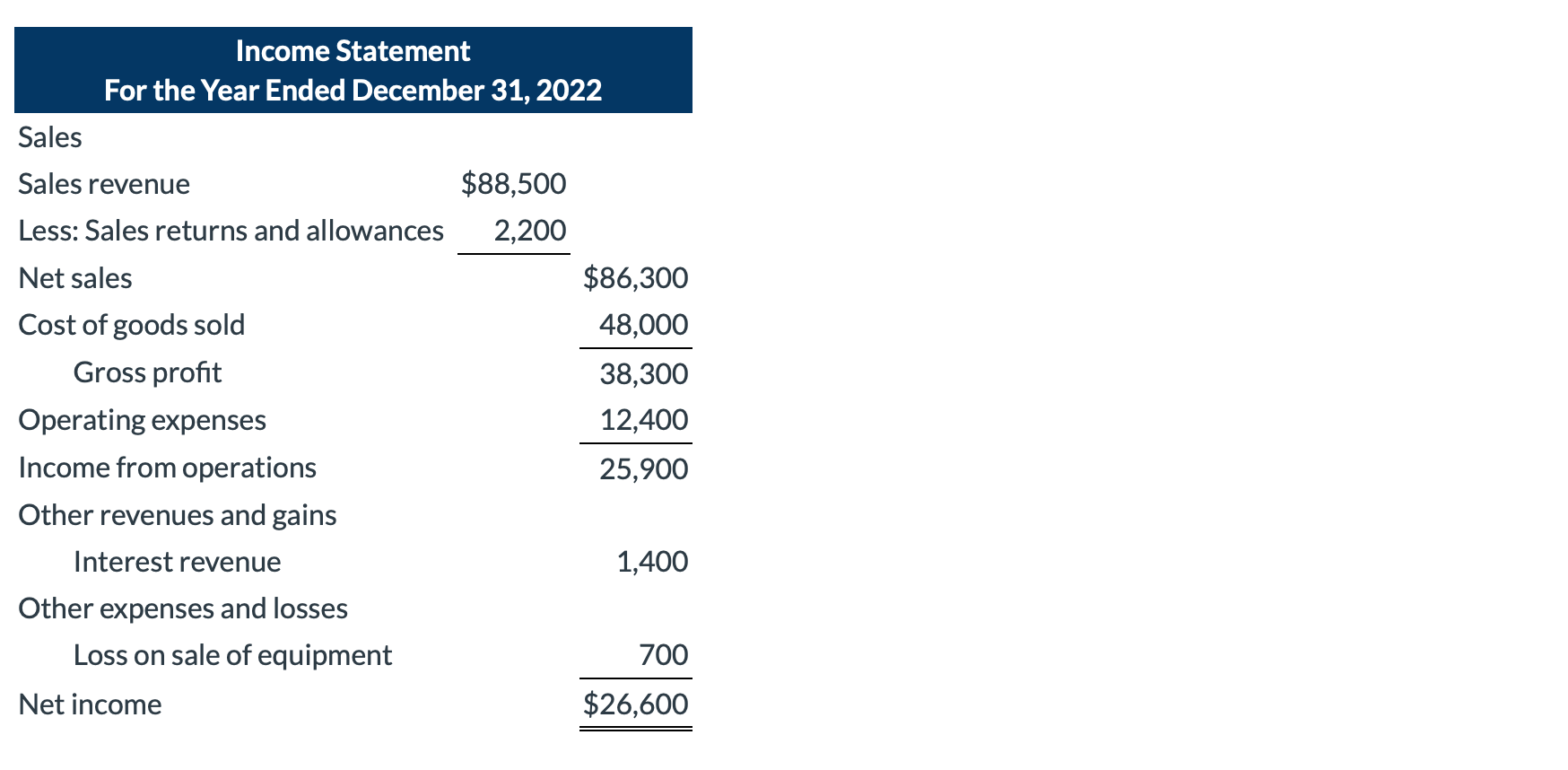

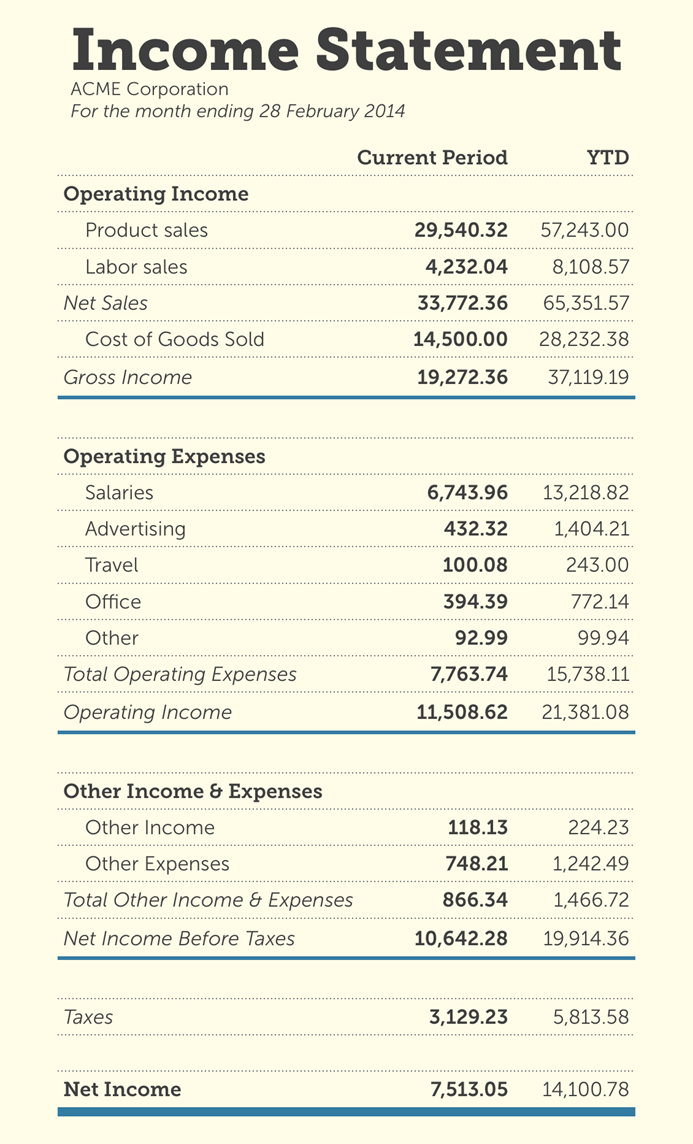

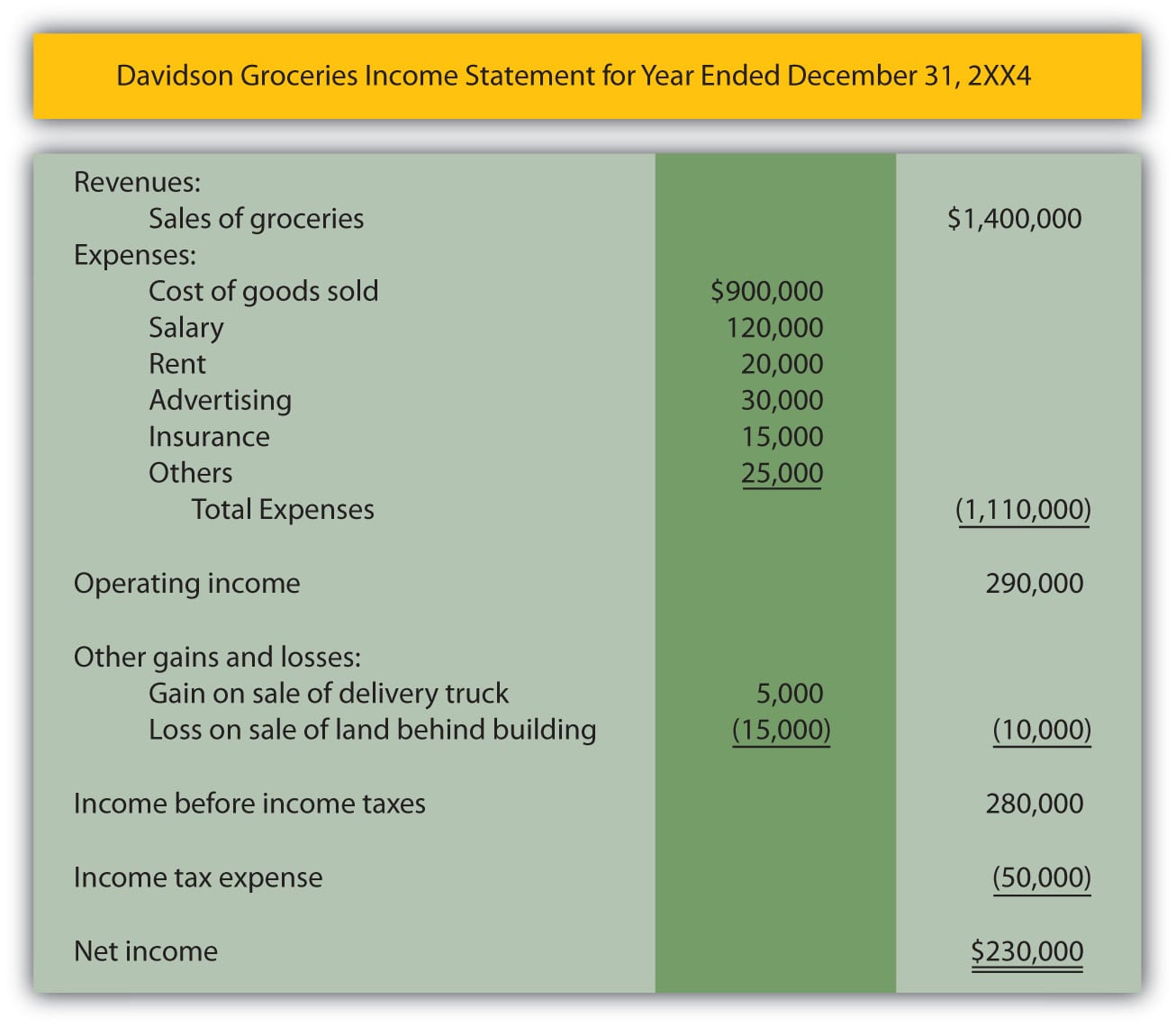

Step 2 transfer the two amounts to the disposal account. In this lesson we focus on income statement. Gains and losses are reported on the income statement.

The gain or loss should be reported on the income statement. The depreciation is, therefore, six months at £10 per month. The account is usually labeled.

How to record the disposal of assets. Consider the $7,000 asset that sold for a $1,000 gain. Asset disposal is accounted for by removing the asset cost and any accumulated depreciation and impairment losses from the balance sheet, recognizing.

Both gains and losses do appear on the income statement, but they are listed under a category called “other revenue and expenses” or similar heading. To record this, you can create a theft expense account on your income statement. When an asset is being sold, a new account in the name of “asset disposal account” is created in the ledger.

The disposal of assets involves eliminating assets from the accounting records. Debit the accumulated depreciation account for the amount of. An disposal bill is one receive or loss account, in which is recorded the difference between the disposal proceeds both which carrying volume is a fixed asset.

After subtracting the asset's accumulated depreciation, you can record the. A disposal account is a gain or loss account that appears in the income statement, and in which is recorded the difference between the disposal proceeds and the net carrying amount of the fixed asset being disposed of.