Exemplary Info About Daily Cash Flow Statement Tally Profit And Loss Account

Utrecht, 22 february 2024 highlights revenue eur 3,324 million;

Daily cash flow statement. Sap s/4hana cloud for finance. This value can be found on the income statement of the same accounting period. Please suggest list of best practices that should be activated to prepare cash flow statement both direct and indirect methods for the purposes of statutory reporting and managerial reporting and planning.

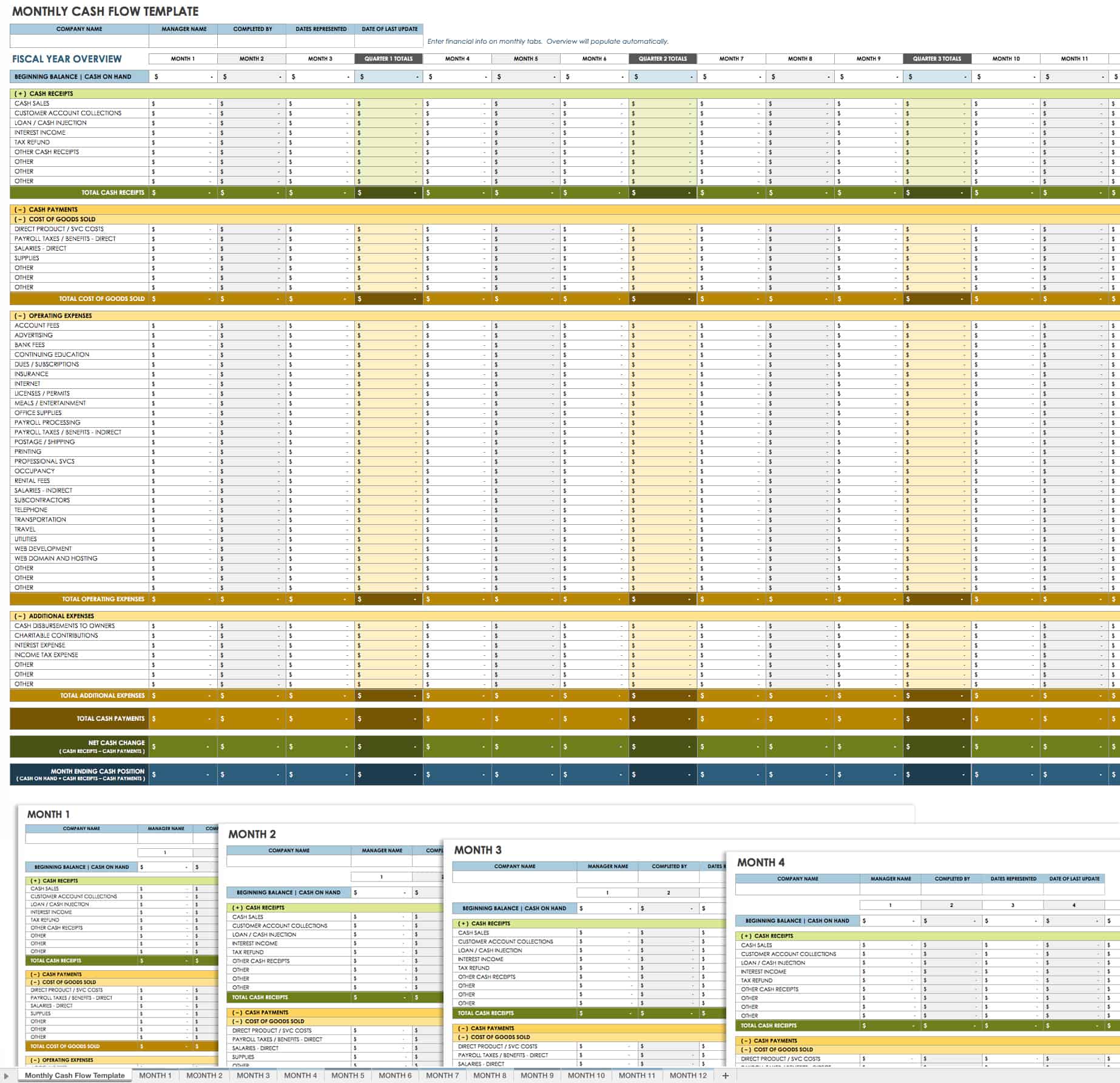

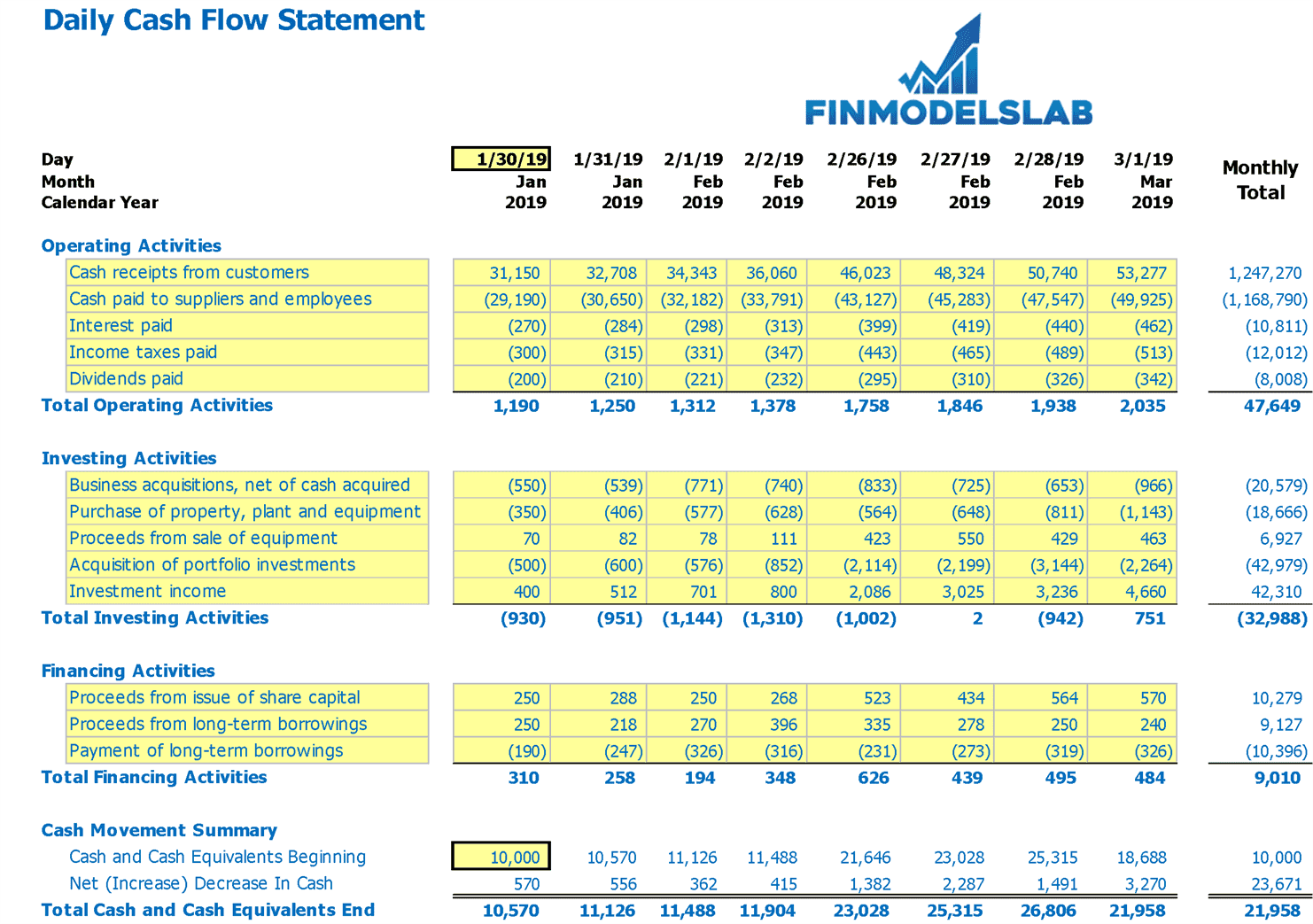

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. A cash flow statement is a financial report that a company drafts at the end of each accounting period that details how much money it made in that period. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. Record adjusted ebitda margin fourth. Jianpu technology cash flow statement.

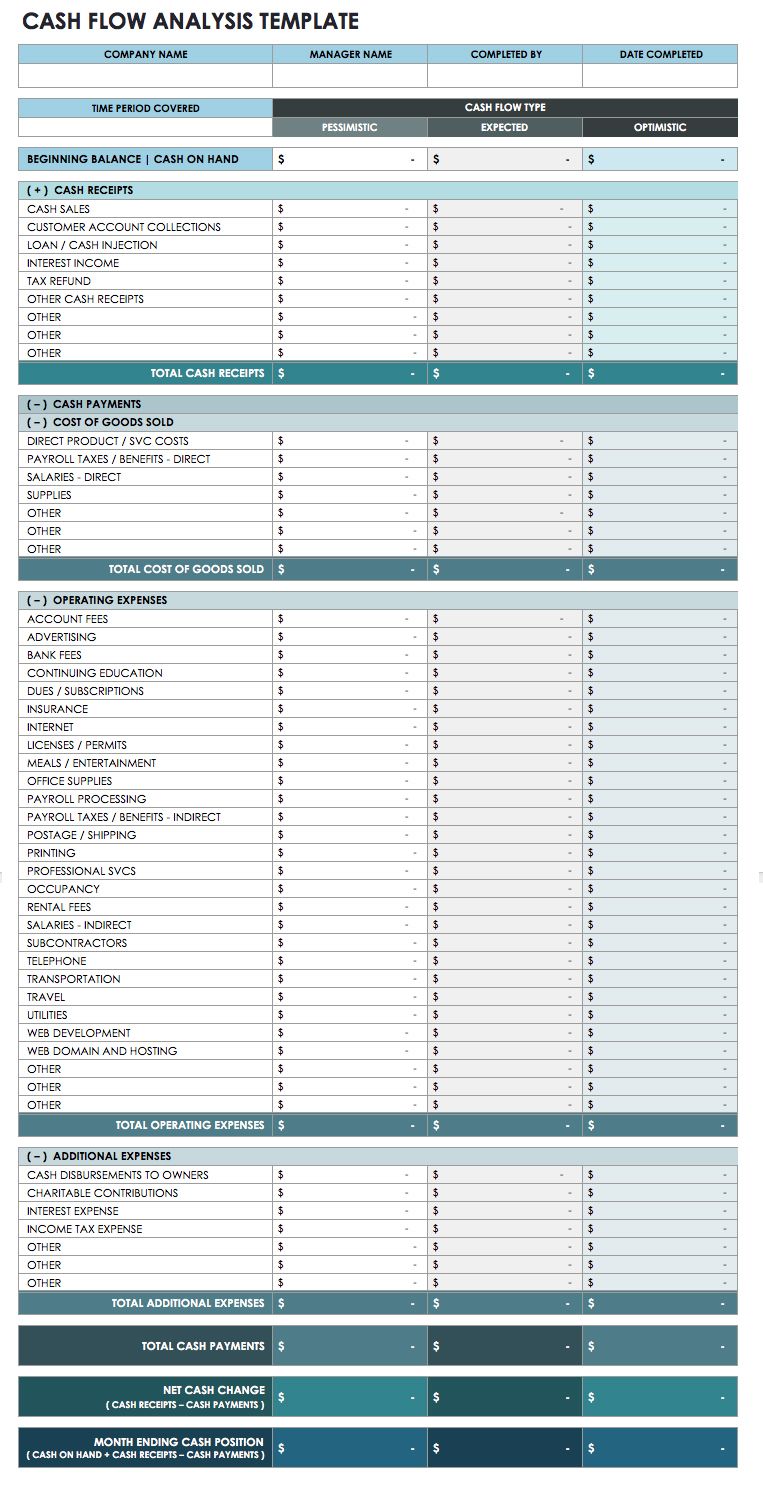

This cash flow statement template is an excellent resource for managing your business finances and ensuring your cash flow remains healthy. The income statement is the most vital information when forecasting cash flow. Gather all financial documents related to income and expenses.

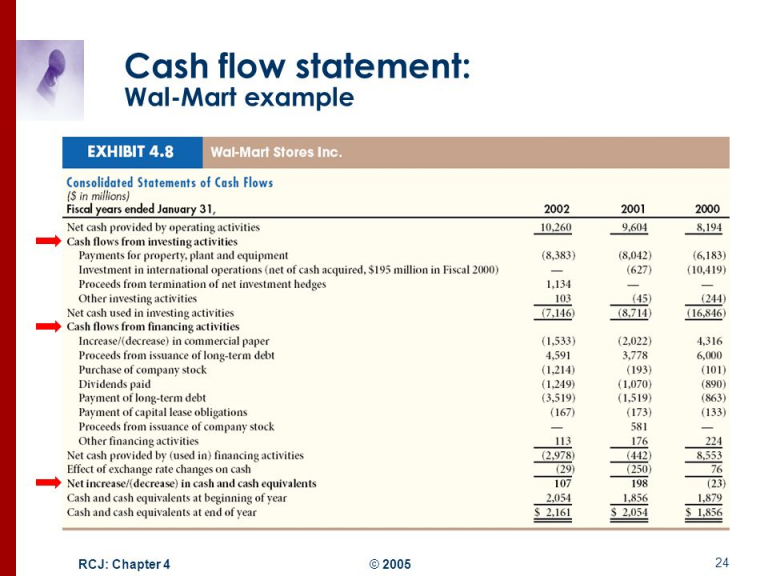

Xyz corp is a clothing manufacturer. To clarify the concept of a cash flow statement, here are two examples: Financials are provided by nasdaq data link and sourced from audited reports submitted to the securities and exchange commission (sec).

A cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

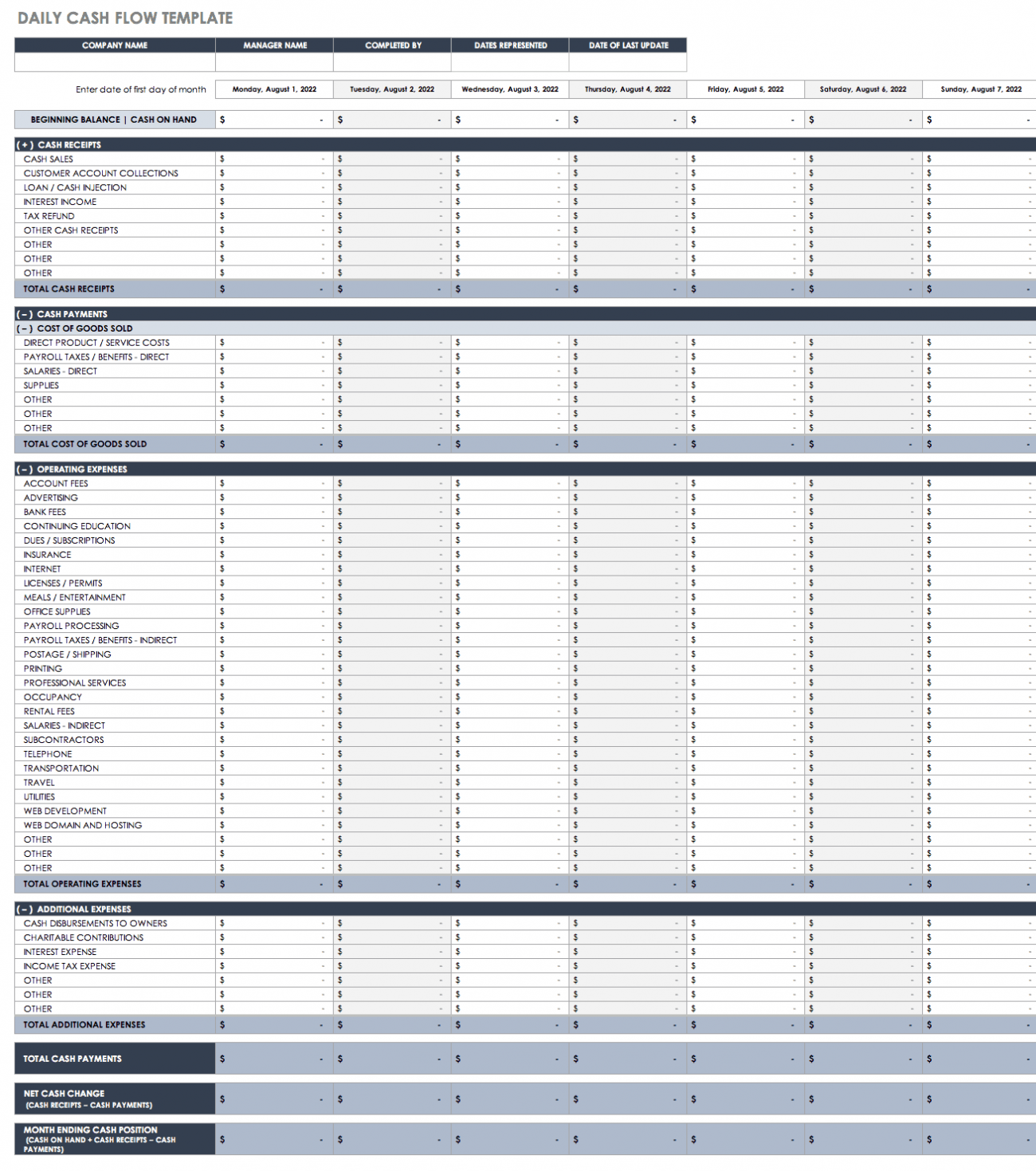

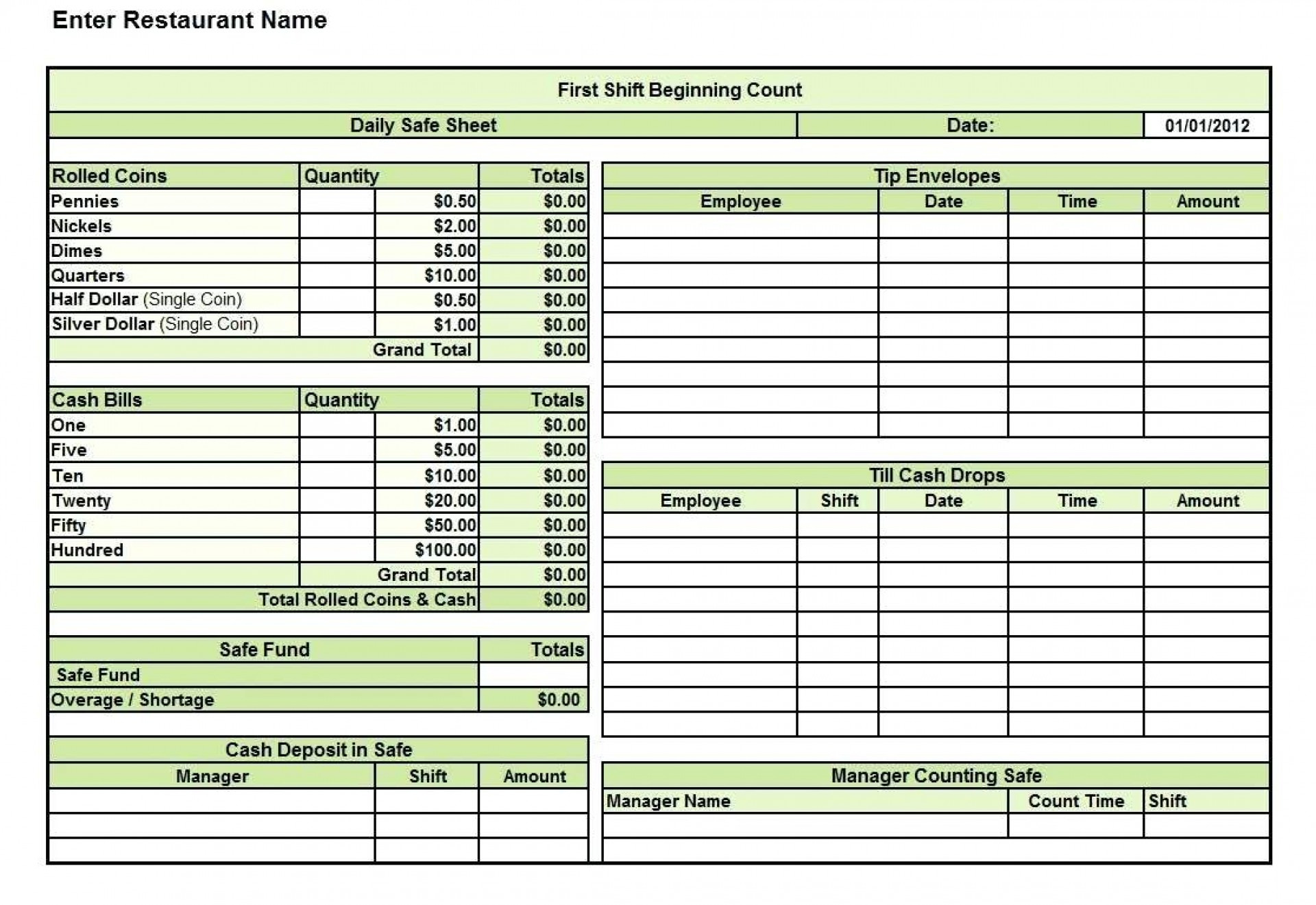

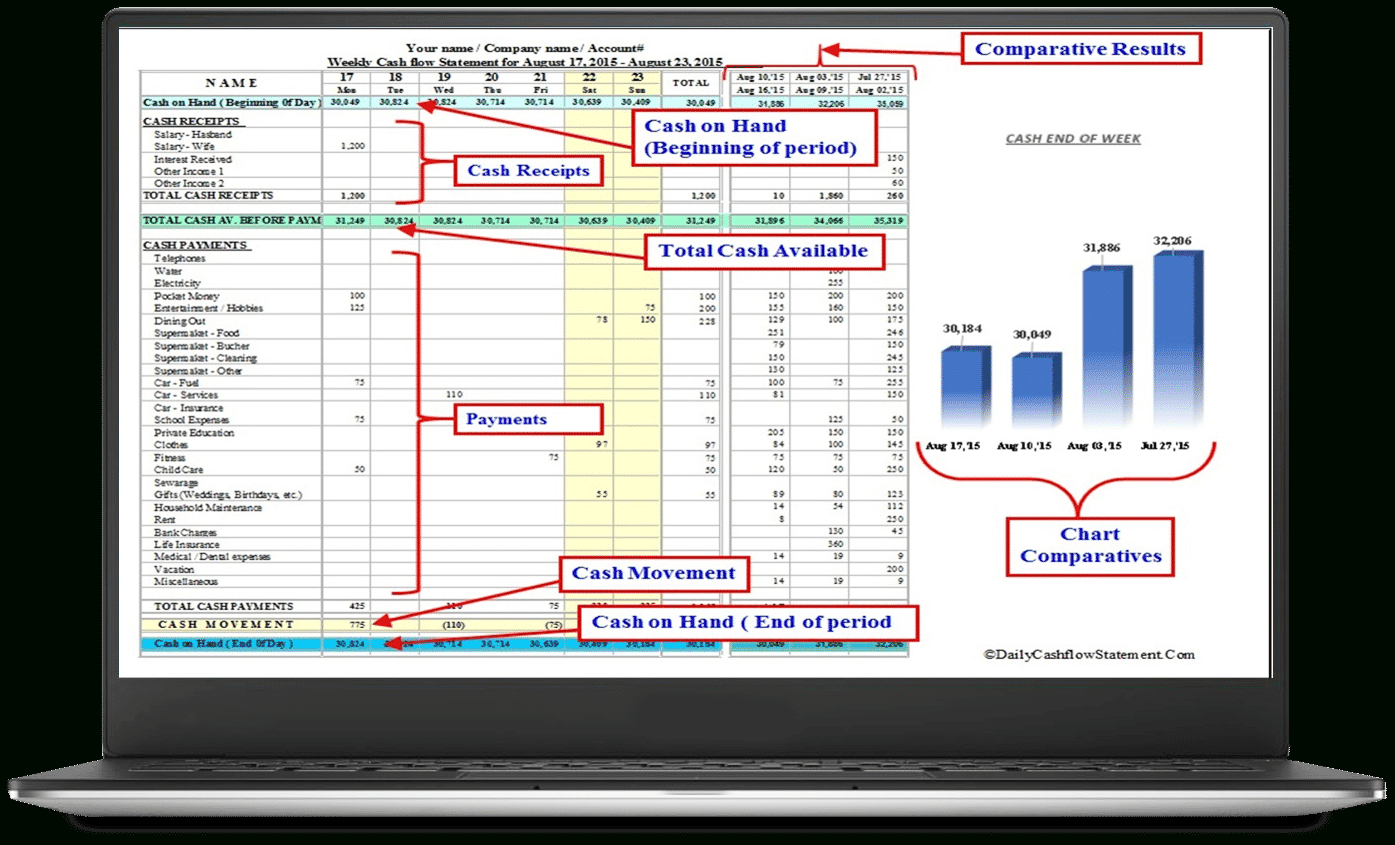

Quickly examine daily costs, income, and profits with this excel document. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Calculate the daily beginning cash balance.

A cash flow statement is comprised of the following three components: The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. Examples of cash flow statement.

This is what the cash flow statement template looks like: The cfs highlights a company's cash management, including how well it generates. What is a cash flow statement?

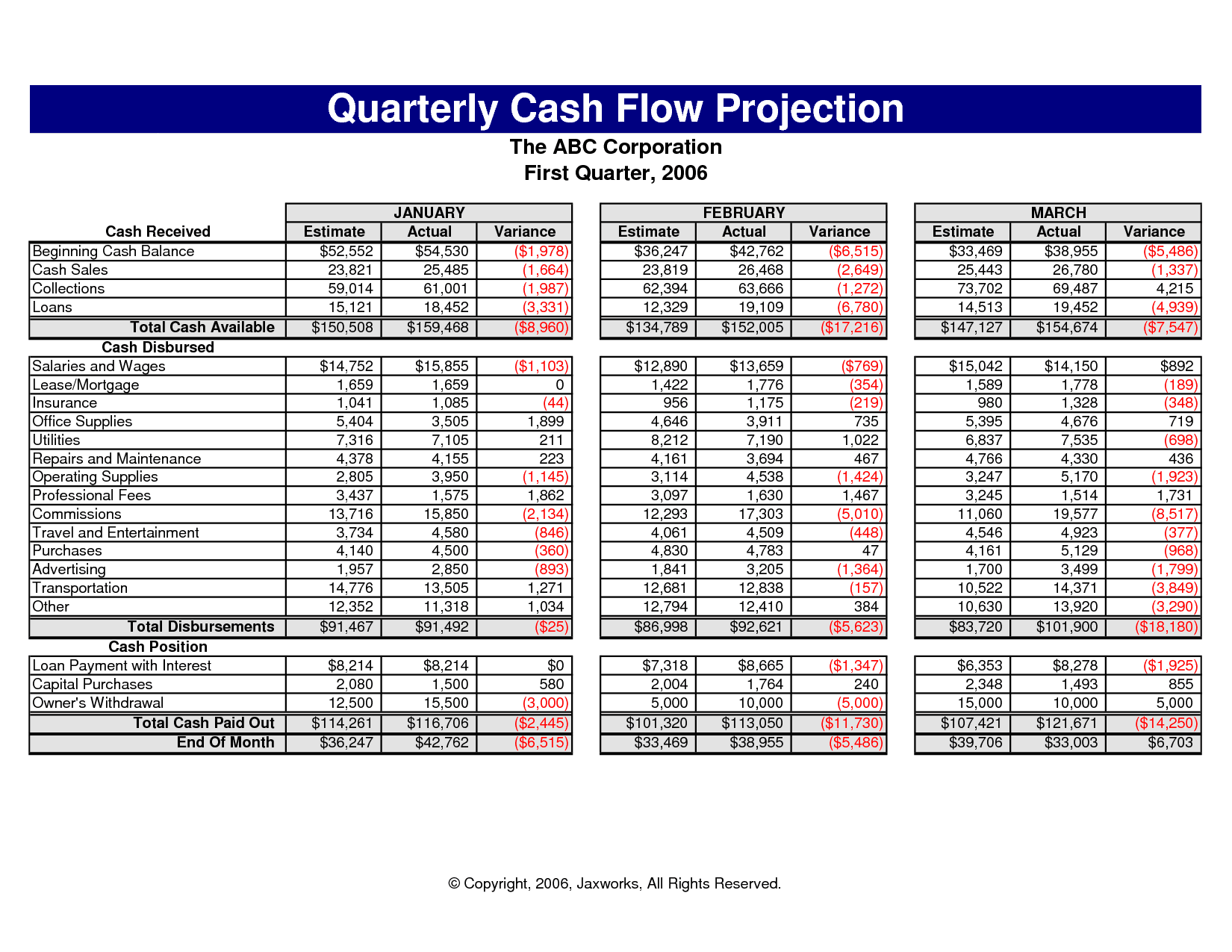

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. Quarterly cash flow projections template; The income statement will tell you how much revenue a company has generated over a period of time, as well as how much the cash paid out for business expenses is.