Supreme Info About Gross Operating Profit Special Audit Report

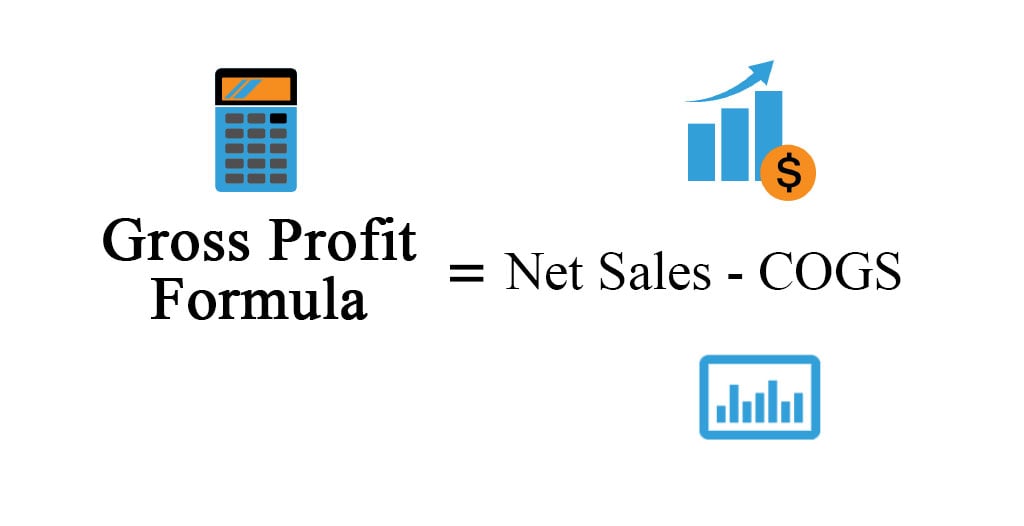

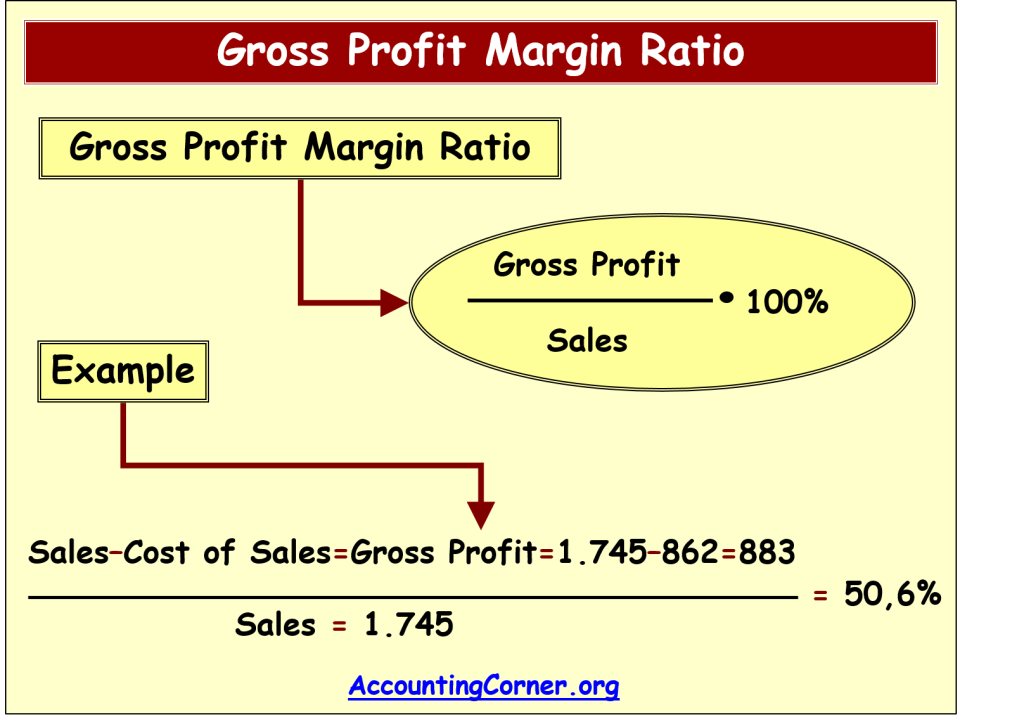

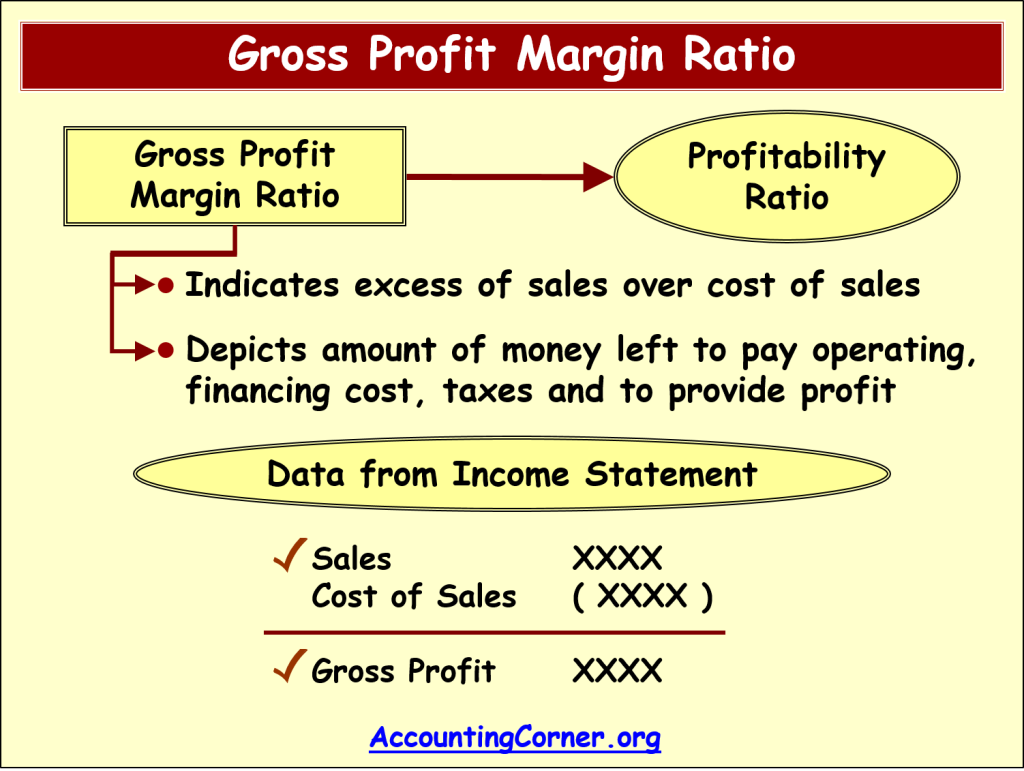

Key takeaways gross profit is total revenue minus the expenses directly related to the production of goods or the cost of goods sold.

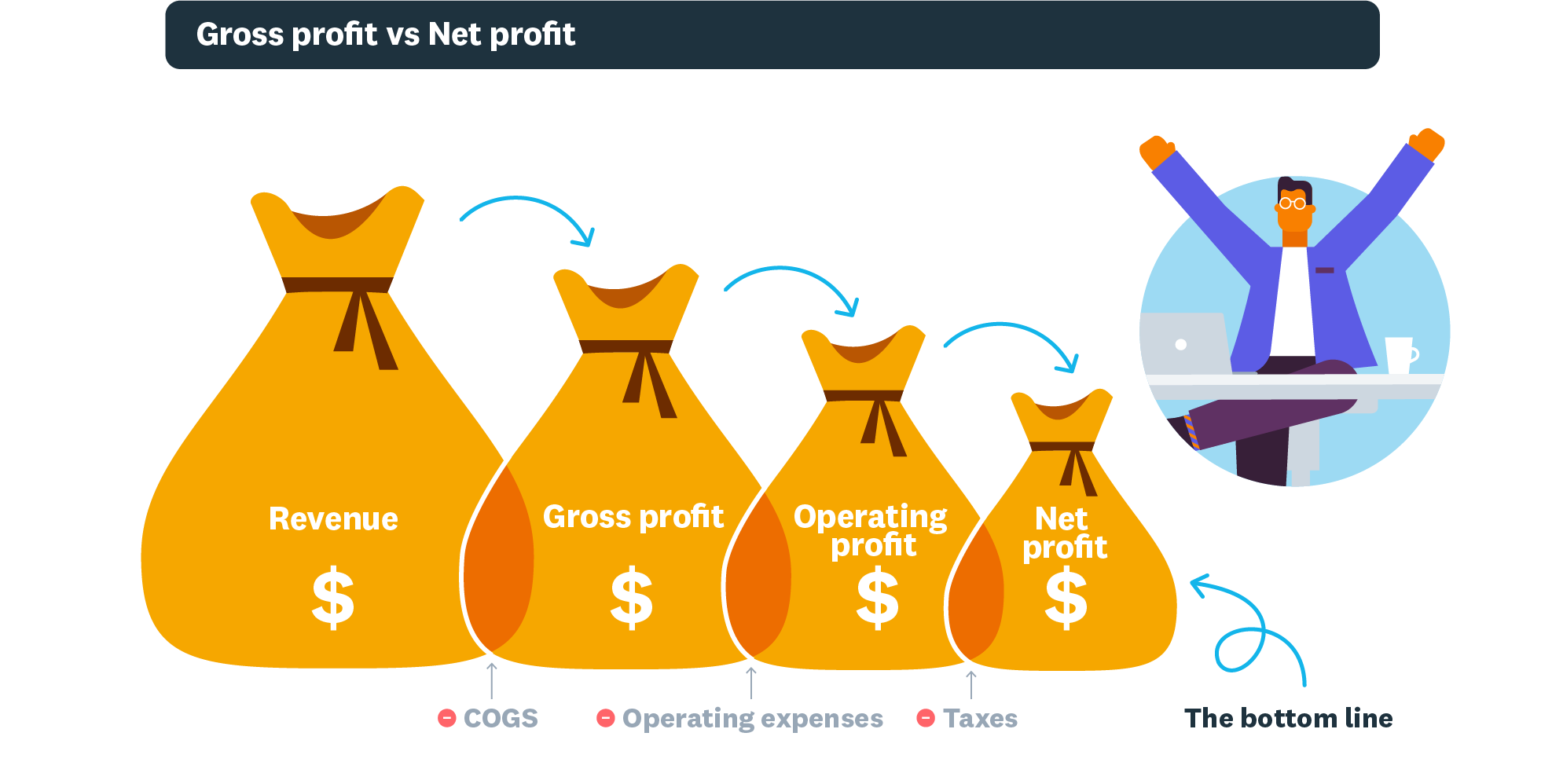

Gross operating profit. Written by masterclass. Net profit is the total amount left over after the business has accounted for all deductions, including interest and taxes. Let’s use the above chart from finmark as an example.

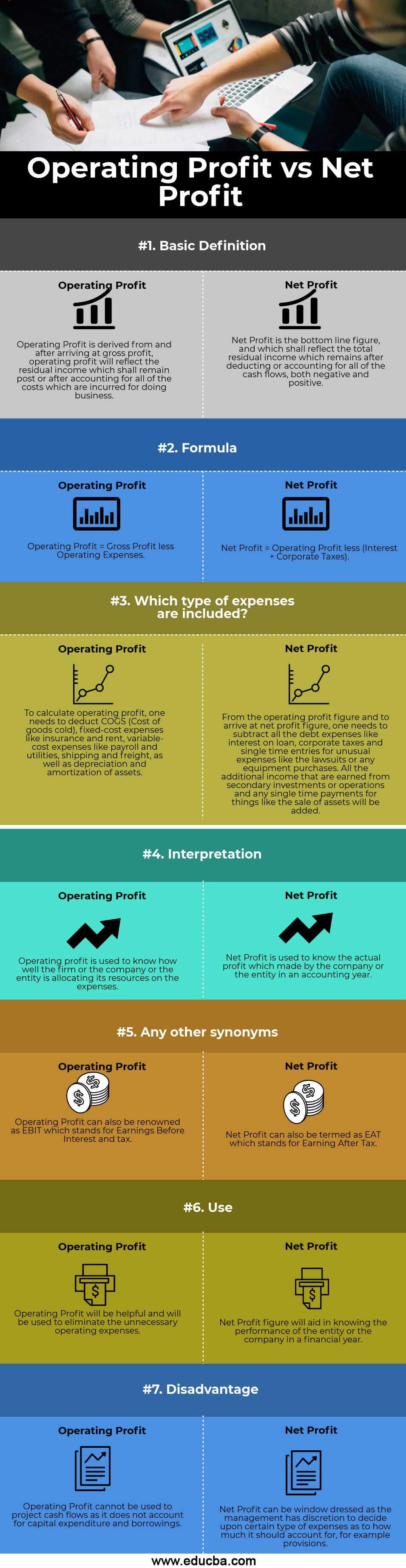

Consider following these steps when determining a company's operating profit over a certain time period: Net income reflects the total residual income after accounting. Just like when calculating the gross.

The first step in calculating a company's operating profit is to determine how much revenue it. Determine the cost of goods sold. Gross profit and operating profit are both important measures of a company's financial health.

Gross profit gross profit is the value that remains after the cost of sales, or cost of goods sold (cogs), has been deducted from sales revenue. Operating income = net earnings + interest expense + taxes. In may 2021, you finished out the month with $18,350 in revenue.

Jun 7, 2021 • 3 min read. Gross profit is the amount a business has earned minus the direct costs of manufacturing or the cost of goods sold. In this video sal mentions that gross profit is the revenue with the cost of goods sold deducted and operating profit is the gross profit with cost of running the business deducted further.

Operating profit is the amount of the gross profit minus operational costs. Derived from gross profit, operating profit is the residual income after accounting for all costs.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)