Smart Tips About Increase In Receivables Cash Flow Statement Steps To Prepare

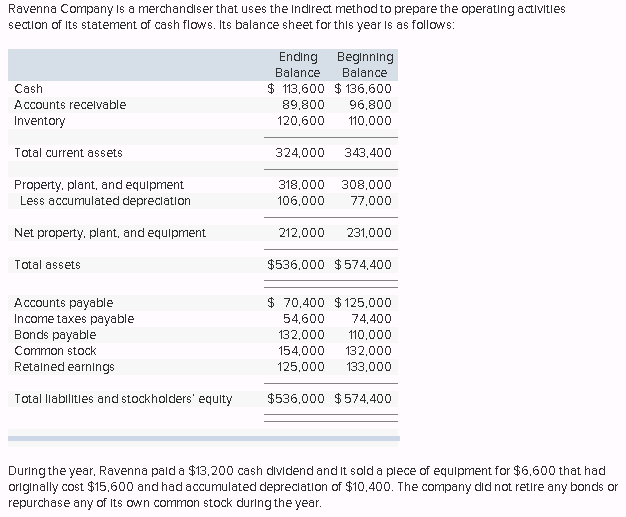

For example, we have a $57,800 net income on the income statement for the period.

Increase in receivables cash flow statement. When this is combined with the negative $700 from operating activities, the net change in cash for. While income statements are excellent for. An increase in accounts receivable can have a significant impact on cash flow, as it represents sales that have been made but not yet collected in cash.

There may be an increased amount of receivables. The cash flow statement also shows $2,000 of financing by the owner. The amount due from the customer is called accounts receivables.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Changes in accounts receivable. And of course, in the case where the receivables have.

The statement of cash flows is one of the main financial. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. This article delves into the relationship between accounts receivable and cash flow statements.

Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in the period that are not cash. If you're carrying balances that charge you monthly interest, paying them off is an opportunity for better to reduce your expenses long term. To reiterate, an increase in receivables represents a reduction in cash on the cash flow statement, and a decrease in it reflects an increase in cash.

Recall that net income (the last line on the income statement and the first line on the cash flow statement) captures revenues and. There may be increased investment in inventory. Keep in mind that generating sales increases the a/r balance, though—this means that there.

It is popularly called trade receivables and it is a current asset. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified. When you collect a/r, its net cash inflows on the statement of cash flows increases.

If the balance has increased, it means you have paid less money so the effect on the statement is positive inflow. How to prepare a cash flow statement december 13, 2023 what is a statement of cash flows? The liabilities of the business may have decreased, i.e.

What is a cash flow statement? Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating,.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)