Build A Info About International Financial Reporting Standard 16 What Is A Statement Of Retained Earnings

The new standard on leases, international financial reporting standard (ifrs) 16, will require the majority of lessees to account for lease.

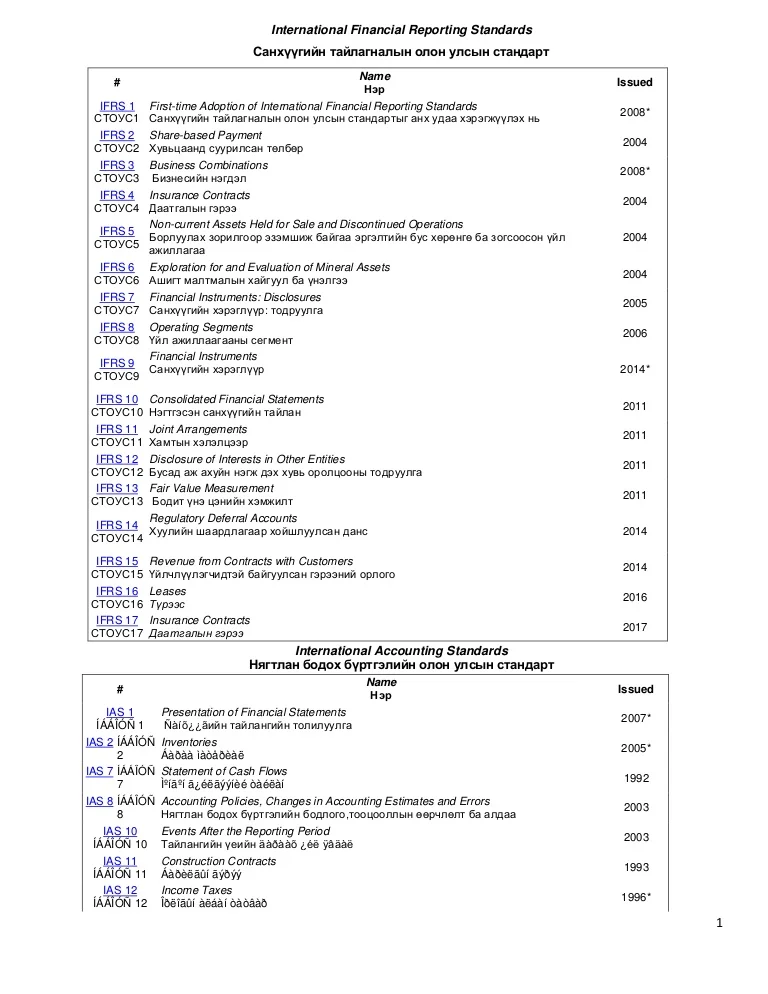

International financial reporting standard 16. The impact of international accounting standards board (iasb)/international financial reporting standard 16 (ifrs 16) article type: Improve the accounting for leases in international financial reporting standards (ifrs) and us generally accepted accounting principles (us gaap). Ifrs 16 leases follow standard 2021 issued about standard news in order to view our standards you need to be a registered user of the site.

International accounting standard 16 property, plant and equipment or ias 16 is an international financial reporting standard adopted by the international accounting. Ifrs 16 leases replaces ias 17. Chapter 10 ias 16 property, plant, and equipment 109 11 ias 40 investment property 123 12 ias 41 agriculture 131 13 ias 38 intangible assets 143.

The new international financial reporting standard no. 18 rows this page contains links to our summaries, analysis, history and resources for international financial reporting standards (ifrs) issued by the. A free 'basic' registration will.

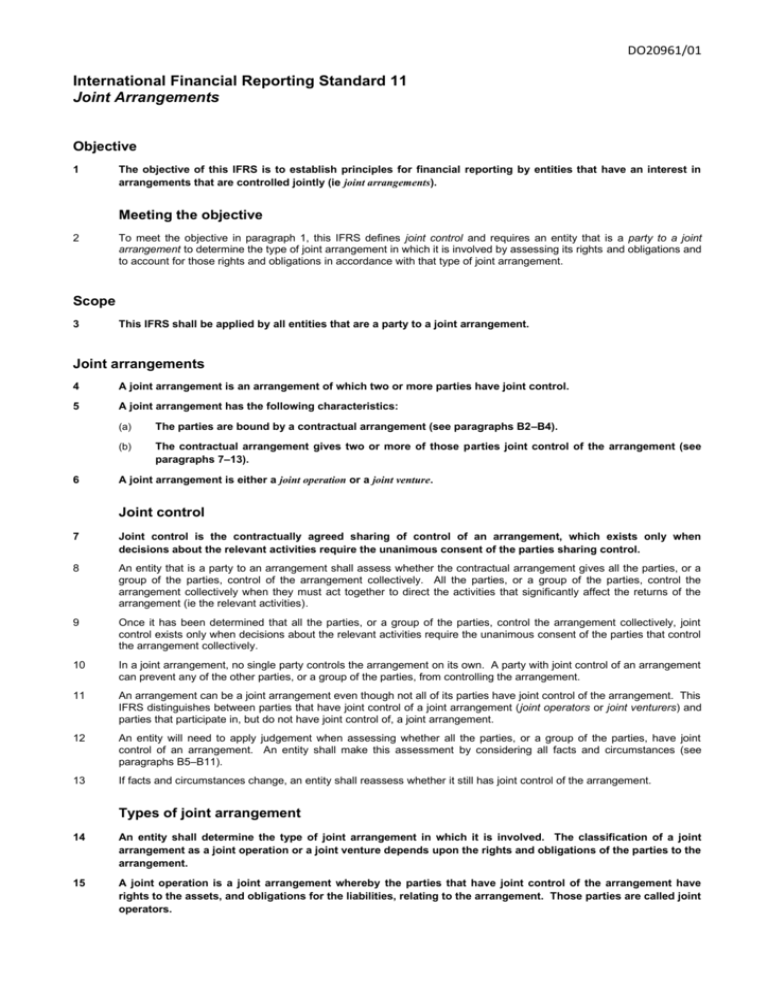

Ifrs 16 is an international financial reporting standard (ifrs) promulgated by the international accounting standards board (iasb) providing guidance on accounting for. Ifrs 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the. Proceeds before intended use (amendments to ias 16) which prohibit a company from deducting from the cost of.

International financial reporting standard 16. Iasb chairman hans hoogervorst introduces the new leases standard. All the paragraphs have equal authority.

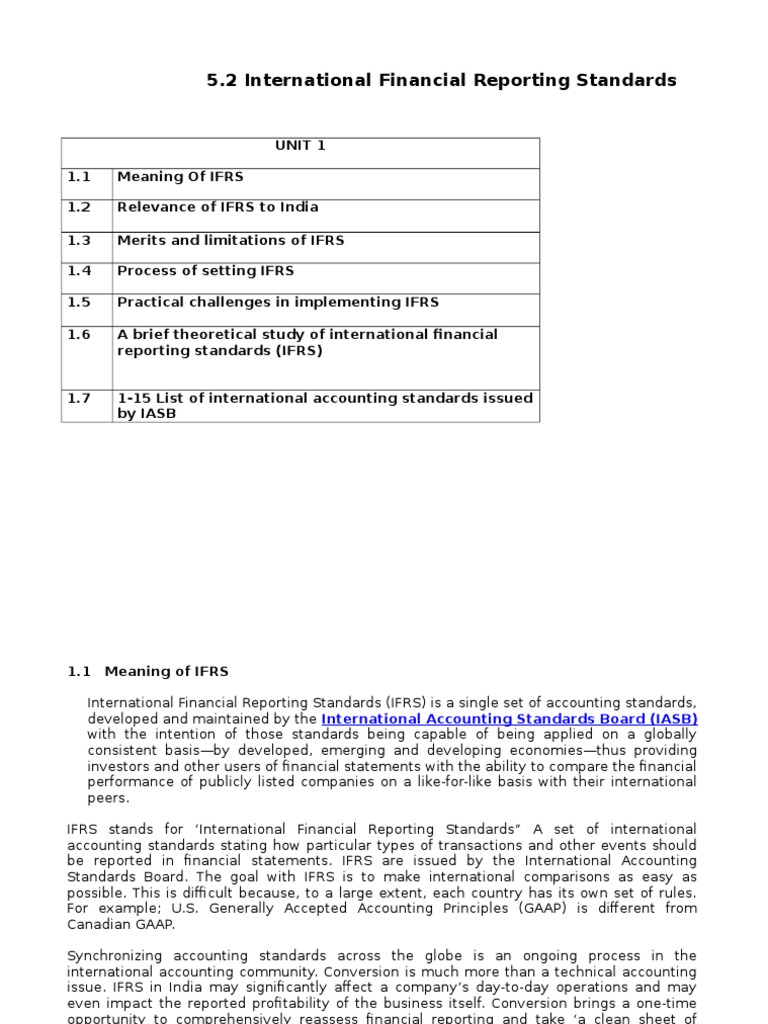

Ifrs is a lease accounting standard published by the international accounting standards board that affects the way companies account for leases in. International financial reporting standards, commonly called ifrs, are accounting standards issued by the ifrs foundation and the international accounting standards. International financial reporting standards (ifrs) are a set of accounting rules for the financial statements of public companies that are intended to.

In january 2016, the international accounting standards board issued a new ifrs ® standard to improve the financial reporting of leases. In accordance with the provisions of the international financial reporting standard ifrs 16 “leases”, as of january 1, 2019, insurance and reinsurance. The new standard on leases, international financial reporting standard (ifrs) 16, will require the majority of lessees to account for lease.

To meet that objective, a lessee should recognise assets and liabilities arising from a lease. In may 2020, the board issued property, plant and equipment: