Fantastic Info About Balance Sheet Reconciliations What Is A Financial Statement Used For

What are the challenges of financial close?

Balance sheet reconciliations. The more detail and accuracy achieved, the better the overall financial picture of the business. Balance sheet reconciliations should be performed and reviewed on a monthly basis. Identify the accounts to be reconciled.

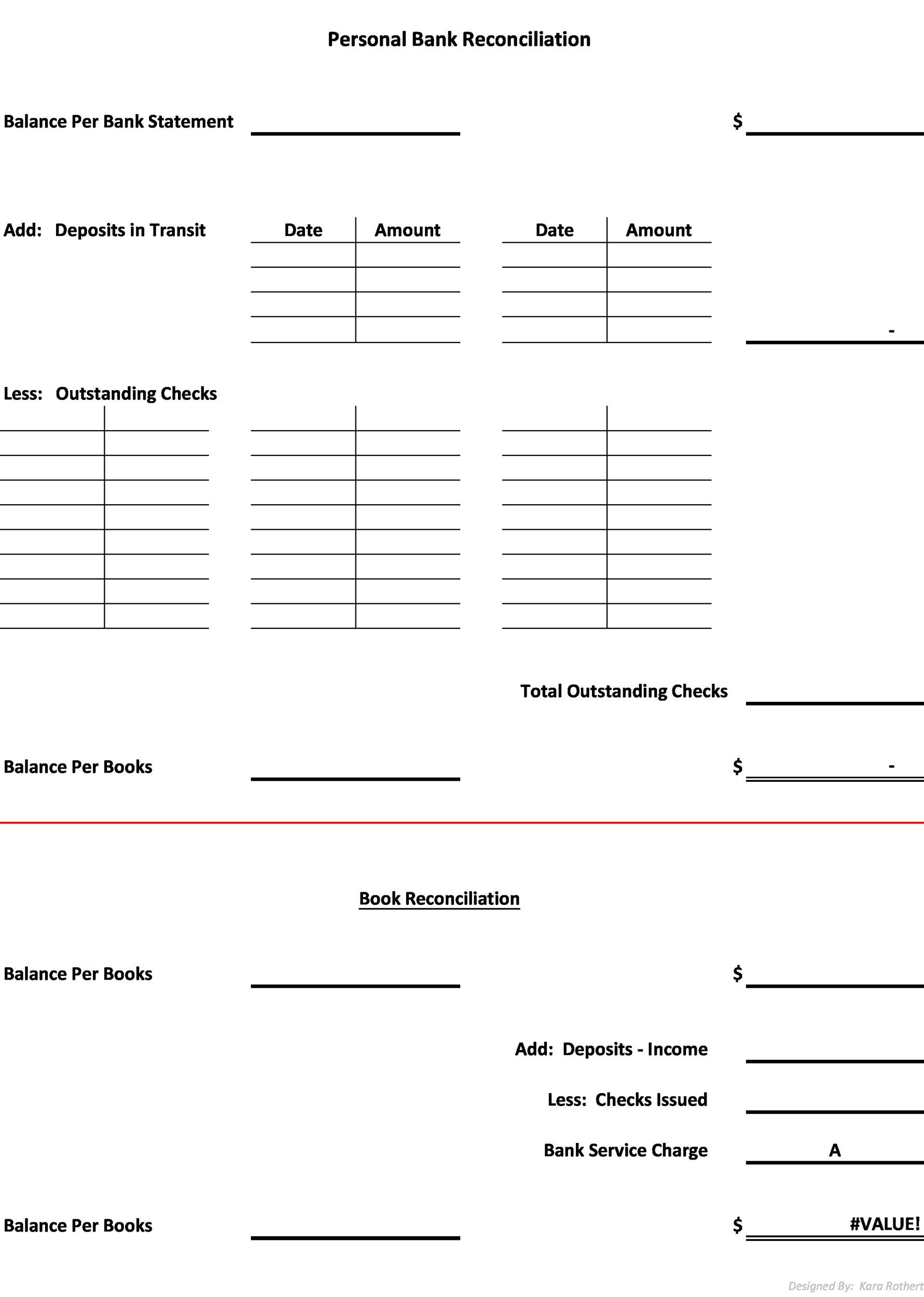

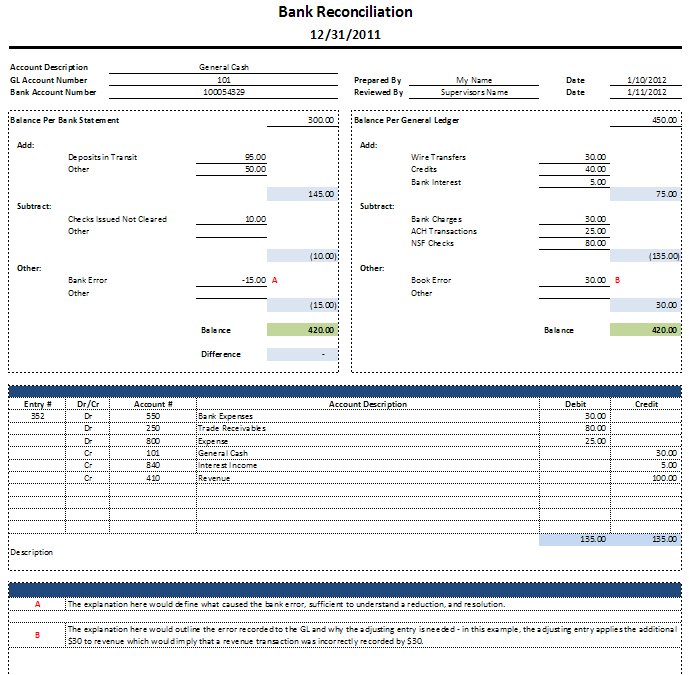

Balance sheet reconciliation can be defined as a process of verifying the accuracy of information presented in the balance sheet. In a qa review, a sample of reconciliations are reviewed to gauge their quality against customizable goals — for example, policy compliance, proper utilization of technology and timely certification. Account reconciliation is the process of matching internal accounting records to ensure they line up with a company’s bank statements.

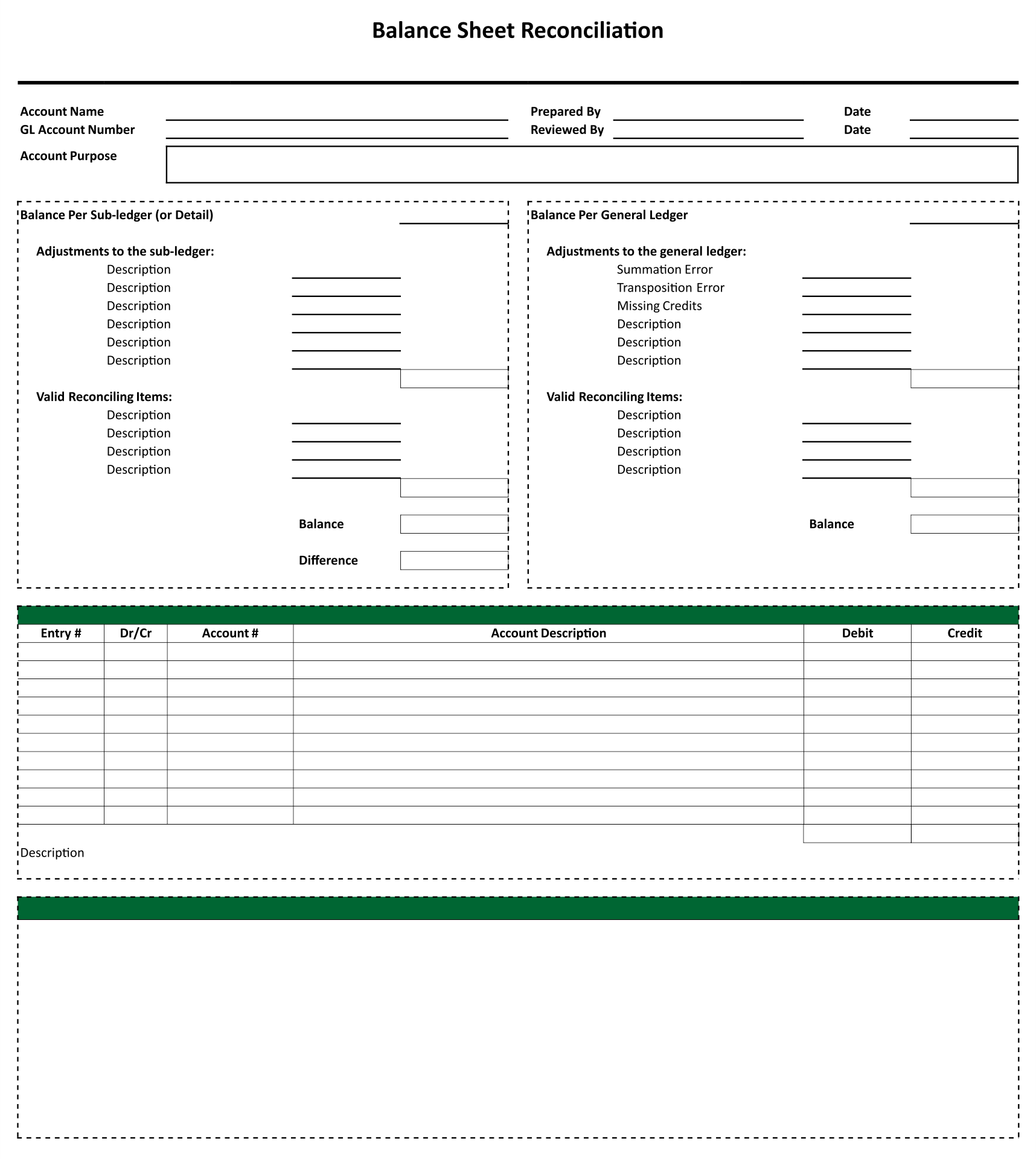

Balance sheet reconciliation checklist: The reconciliation process requires a review of the general ledger with external documentation and supporting information to verify that the general ledger’s balance is correct. It’s more commonly referred to as “closing the books.” balance sheet reconciliation is of utmost importance because it ensures the accuracy of financial statements.

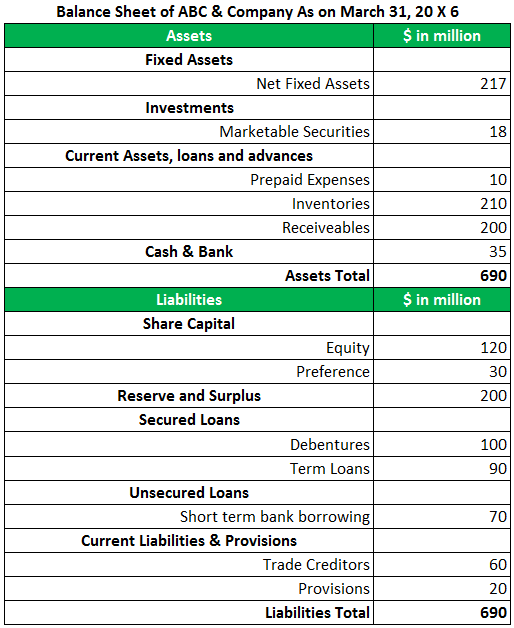

Balance sheet reconciliations are a fundamental control point for accounting. Why use balance sheet reconciliations? Balance sheet account reconciliation is the process of comparing a company’s general ledger, or primary accounting record, with subsidiary ledgers or bank statements in order to identify and resolve discrepancies.

Before you set the balance sheet as final, you want to make sure that every transaction is properly categorised as one or the other. The balance sheet reconciliation process includes reconciling the following accounts, including: Before you can look over your balance sheet and reconcile it, gather the proper.

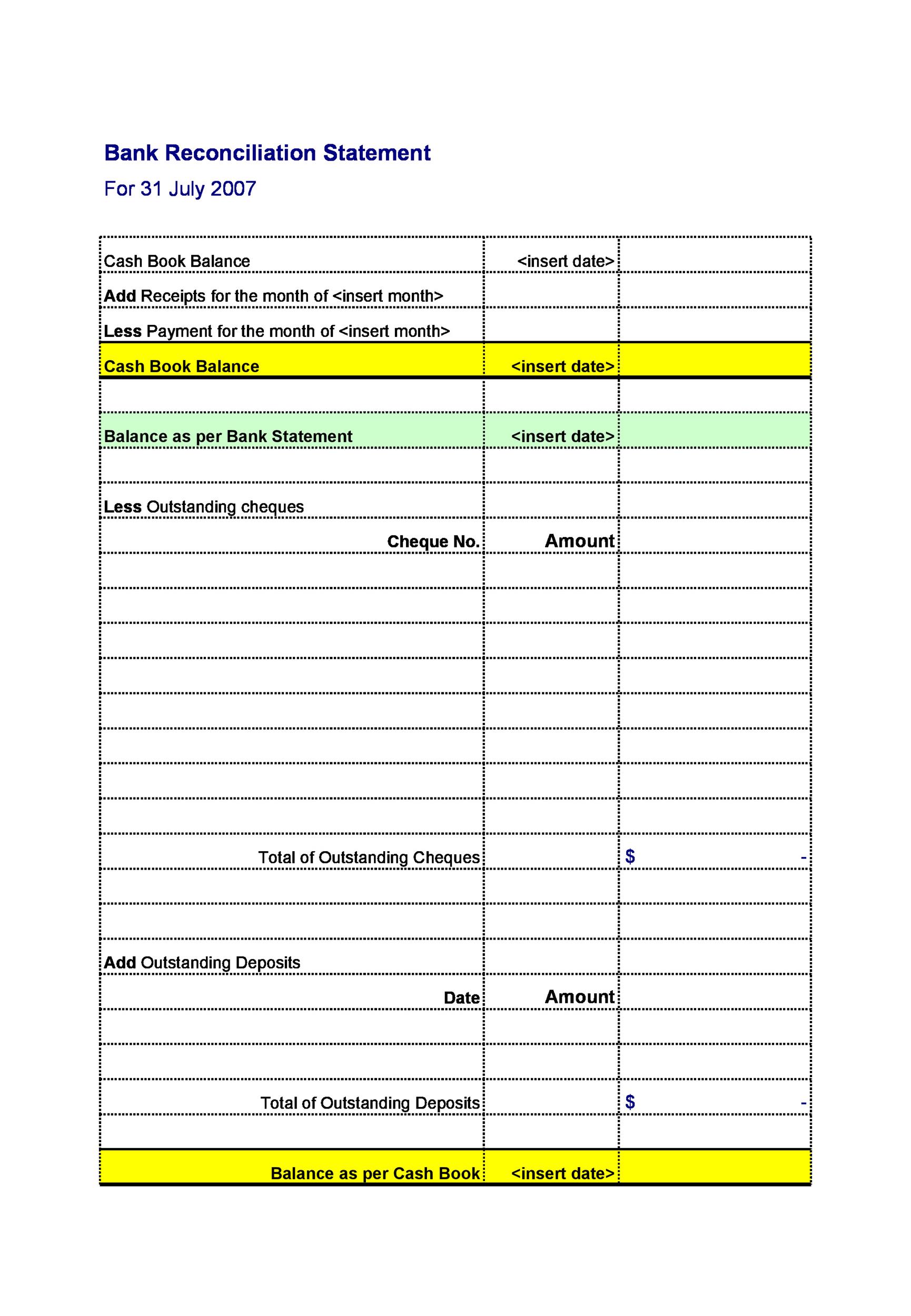

Balance sheet reconciliation is the process of reviewing transactions on your overall balance sheet, while bank reconciliations focus specifically on bank statements and cash accounts. Balance sheet account reconciliation: Account reconciliation is a critical step and key control for finance and accounting.

What are balance sheet reconciliation steps? Balance sheet reconciliations, a vitally important part of a company’s financial reporting process, is where a company compares its financial records to the numbers on its balance sheet to make sure they match. How business management software can help?

Identify the best practices for preparing and reviewing balance sheet reconciliations. Reconciliation also confirms that accounts in a general. Account reconciliation relies on large organisation and the upkeep of invoices, account balances, balance sheet reconciliation and more.

Balance sheet reconciliation is essential for verifying the accuracy of financial data and ensuring that a company’s assets, liabilities, and equity are correctly stated. The balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time, showing its assets, liabilities, and equity. 6 key steps step 1:

Recognize the impact of balanced sheet reconciliations on the accuracy of financial statements. Determine common pitfalls to avoid when conducting reconciliations. The primary purpose of balance sheet reconciliation is to identify and resolve any discrepancies or differences between the recorded balances and the supporting documentation.

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-03.jpg)